oil prices at 14 month low; oil imports at a 24 week low; commercial crude inventories at a 52 week low; the largest SPR increase since June 2020; natural gas inventory increase smallest on record for end of August

US oil prices finished lower for the eighth time in nine weeks and at the lowest price in fourteen months, on demand concerns following weak economic data from the US and China...after falling 1.7% to $73.55 a barrel last week on OPEC+’s plan to increase output in October, and on a draw from US crude supplies that was less than was expected, the contract price for the benchmark US light sweet crude for October delivery extended last week's losses in overseas markets on Labor Day on expectations for higher OPEC+ production starting in October as signs of sluggish demand in China and the US raised concerns about future consumption growth, then sold off sharply in New York on Tuesday, after reports that a deal was imminent to resolve a dispute that had halted Libyan production and exports, and settled $3.21 lower at a 2024 low of $70.34 a barrel, as downbeat economic data from China and a weak reading on U.S. manufacturing fed worries about a slowdown in energy demand….oil prices continued to trend lower on Wednesday in follow through selling, as bearish sentiment seemed to be dominating the market's narrative, and settled down $1.14 at a nine month low of $69.20 a barrel as traders worried about future demand while crude producers offered mixed signals about supply increases….oil futures edged higher overnight and into Thursday morning, after data from the American Petroleum Institute released late Wednesday showed a larger-than-expected weekly decline in US crude stocks, but then began to slide despite the EIA’s report confirming a huge crude draw which sent US crude inventories to a 2024 low, and settled down 5 cents at another nine month low of $69.20 a barrel, as worries about demand in the U.S. and China and a likely rise in supplies out of Libya offset the big withdrawal from U.S. inventories and a delay to output increases by OPEC+ producers…oil price hovered around $68.60 during the Asian trading hours on Friday due to concerns over demand in both the US and China after manufacturing surveys in both countries indicated that factory activity had contracted, then edged higher ahead of the US jobs report on sketchy communication from OPEC and its allies on a deal to delay production normalization, but tumbled to settle $1.48 lower at a fourteen month low of $67.67 a barrel, as weaker than expected US jobs data exacerbated demand concerns and outweighed price support from an OPEC delay to supply increases, and finished 8.0% lower for the week, the biggest weekly drop in 11 months…

on the other hand, natural gas prices rose for the first time in 3 weeks on an unprecedentedly small storage injection for this time of year.…after falling 2.4% to $2.127 per mmBTU last week on a shift to milder temperature forecasts, the price of the contract for natural gas for October delivery mounted a steady ascent after initial weakness early Tuesday, as steady LNG exports, a decline in production, and higher spot gas prices all provided support, and settled 7.6 cents higher at $2.20 per mmBTU, despite bearish forecasts for less hot weather, on a decline in output and an increase in gas flows to liquefied natural gas export terminals…that front month natural gas contract opened 5 cent higher on Wednesday, but then moved sharply lower as fundamentals became unsupportive, and settled down 5.8 cents at $2.145 per mmBTU on bearish forecasts for less demand this week than had been expected, and an oversupply of fuel still left in storage after last years mild winter….natural gas prices opened 5 cents higher again on Thursday, but this time jumped to the $2.275 level right after a bullish storage report hit the wire, and finished the session 10.9 cents higher at $2.254 per mmBTU on the smaller-than-expected storage build, rising LNG feedgas demand, and a continued decline in output so far this month….natural gas prices drifted between modest gains and losses most of Friday, as weaker weather-related demand butted-up against vestiges of support from Thursday’s extremely bullish storage print, and settled 2.1 cents higher at an eight week high of $2.275 per mmBTU amid falling production estimates and searing summer temperatures across stretches of the South, and thus finished 7.0% higher for the week…

The EIA’s natural gas storage report for the week ending August 30th indicated that the amount of working natural gas held in underground storage rose by 13 billion cubic feet to 3,347 billion cubic feet by the end of the week, the smallest increase on record for the last week of August, which left our natural gas supplies 208 billion cubic feet, or 6.6% above the 3,139 billion cubic feet that were in storage on August 30th of last year, and 323 billion cubic feet, or 10.7% more than the five-year average of 3,024 billion cubic feet of natural gas that had typically been in working storage as of the 30th of August over the most recent five years…the 13 billion cubic foot injection into US natural gas working storage for the cited week was well below the 27 billion cubic foot addition to storage that analysts had forecast in a Reuters poll, and also much less than the 33 billion cubic feet that were added to natural gas storage during the corresponding last in August of 2023, and far less the average 51 billion cubic foot injection into natural gas storage that had been typical for the same late summer week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending August 30th indicated that due to a big decrease in our oil imports, we had to pull oil out of our stored commercial crude supplies for the ninth time in ten weeks, and for the 22nd time in the past 38 weeks, despite an increase in oil supplies that the EIA could not account for...Our imports of crude oil fell by an average of 768,000 barrels per day to a 24 week low of 5,792,000 barrels per day, after falling by an average of 92,000 barrels per day over the prior week, while our exports of crude oil rose by 85,000 barrels per day to 3,756,000 barrels per day, which, when used to offset our imports, meant that the net of our trade of oil worked out to a net import average of 2,036,000 barrels of oil per day during the week ending August 30th, 853,000 fewer barrels per day than the net of our imports minus our exports during the prior week. At the same time, transfers to our oil supply from Alaskan gas liquids, from natural gasoline, from condensate, and from unfinished oils averaged 515,000 barrels per day, while during the same week, production of crude from US wells was unchanged at 13,300,000 barrels per day. Hence our daily supply of oil from the net of our international trade in oil, from transfers, and from domestic well production appears to have averaged a total of 15,851,000 barrels per day during the August 30th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,900,000 barrels of crude per day during the week ending August 30th, an average of 36,000 more barrels per day than the amount of oil that our refineries reported they were processing during the prior week, while over the same period the EIA’s surveys indicated that a net average of 730,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US… So, based on that reported & estimated data, the crude oil figures provided by the EIA appear to indicate that our total working supply of oil from storage, from net imports, from transfers, and from oilfield production during the week ending August 30th averaged a rounded 319,000 barrels per day fewer than what our oil refineries reported they used during the week. To account for that difference between the apparent supply of oil and the apparent disposition of it, the EIA just plugged a [ +319,000 ] barrel per day figure onto line 16 of the weekly U.S. Petroleum Balance Sheet, in order to make the reported data for the supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus indicating there must have been an error or omission of that magnitude in the week’s oil supply & demand figures that we have just transcribed… However, since most oil traders react to these weekly EIA reports as if they were accurate, and since these weekly figures therefore often drive oil pricing and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it’s published, and just as it’s watched & believed to be reasonably reliable by most everyone in the industry…(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” demand, see this EIA explainer….there is also an aging twitter thread from an EIA administrator addressing these ongoing weekly errors, and what they had hoped to do about it)

This week’s net average 730,000 barrel per day decrease in our overall crude oil inventories came as an average of 982,000 barrels per day were being pulled out of our commercially available stocks of crude oil, while an average of 252,000 barrels per day were being added to our Strategic Petroleum Reserve, the thirty-ninth SPR increase in the past forty-six weeks and the largest SPR increase since June 2020, following nearly continuous SPR withdrawals over the prior 39 months… Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to 6,322,000 barrels per day last week, which was 8.0% less than the 6,870,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be unchanged at 13,300,000 barrels per day because the EIA’s rounded estimate of the output from wells in the lower 48 states was unchanged at 12,900,000 barrels per day, while Alaska’s oil production was unchanged at 400,000 barrels per day, and added the same 400,000 barrels per day to the EIA’s rounded national total as it did every week this year….US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 1.5% higher than that of our pre-pandemic production peak, and was also 37.1% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 93.3% of their capacity while processing those 16,900,000 barrels of crude per day during the week ending August 30th, unchanged from their 93.3% utilization rate of a week earlier, but still a bit below normal utilization for late-summer… the 16,900,000 barrels of oil per day that were refined this week were 1.7% more than the 16,623,000 barrels of crude that were being processed daily during week ending September 1st of 2023, but 2.8% less than the 17,381,000 barrels that were being refined during the prepandemic week ending August 30th, 2019, when our refinery utilization rate was at a prepandemic normal 94.8% for late August…

With the increase in the amount of oil being refined this week, gasoline output from our refineries was also higher, increasing by 136,000 barrels per day to 9,748,000 barrels per day during the week ending August 30th, after our refineries’ gasoline output had decreased by 156,000 barrels per day during the prior week.. This week’s gasoline production was 0.4% less than the 9,788,000 barrels of gasoline that were being produced daily over week ending September 1st of last year, and was 5.1% less than the gasoline production of 10,272,000 barrels per day during the prepandemic week ending August 30th, 2019….at the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 167,000 barrels per day to 5,169,000 barrels per day, after our distillates output had increased by 110,000 barrels per day during the prior week. After nineteen production increases in the past twenty-seven weeks, our distillates output was 3.0% more than the 5,017,000 barrels of distillates that were being produced daily during the week ending September 1st of 2023, and a bit more than the 5,154,000 barrels of distillates that were being produced daily during the week ending August 30th, 2019…

With this week’s increase in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the 11th time in thirty-one weeks, increasing by 848,000 barrels to 219,242,000 barrels during the week ending August 30th, after our gasoline inventories had decreased by 2,203,000 barrels to a 39 week low during the prior week. Our gasoline supplies rose this week because the amount of gasoline supplied to US users fell by 369,000 barrels per day to 8,938,000 barrels per day, while our imports of gasoline fell by 212,000 barrels per day to 655,000 barrels per day, and our exports of gasoline rose by 48,000 barrels per day to 865,000 barrels per day.…Even after twenty gasoline inventory withdrawals over the past thirty-one weeks, our gasoline supplies were still 2.1% above last September 1st's gasoline inventories of 214,746,000 barrels, but were also still about 2% below the five year average of our gasoline supplies for this time of the year…

Even with this week’s increase in our distillates production, our supplies of distillate fuels fell for the 19th time in thirty-three weeks, decreasing by 371,000 barrels to 122,715,000 barrels over the week ending August 30th, after our distillates supplies had increased by 275,000 barrels during the prior week. Our distillates supplies fell this week because the amount of distillates supplied to US markets, an indicator of domestic demand, rose by 175,000 barrels per day to 3,997,000 barrels per day, and because our exports of distillates rose by 46,000 barrels per day to 1,407,000 barrels per day, and because our imports of distillates fell by 38,000 barrels per day to 182,000 barrels per day ...Even after 19 inventory withdrawals over the past 33 weeks, our distillates supplies at the end of the week were 3.5% above the 118,602,000 barrels of distillates that we had in storage on September 1st of 2023, but they are still about 10% below the five year average of our distillates inventories for this time of the year…

Finally, after the big drop in our oil imports, our commercial supplies of crude oil in storage fell for the 16th time in twenty-six weeks, and for the 29th time in the past year, decreasing by 6,873,000 barrels over the week, from 425,183,000 barrels on August 23rd to a 52 week low of 418,310,000 barrels on August 30th, after our commercial crude supplies had decreased by 846,000 barrels over the prior week… With this week’s decrease, our commercial crude oil inventories were about 5% below the most recent five-year average of commercial oil supplies for this time of year, while they were still more than 25% above the average of our available crude oil stocks as of the end of August over the 5 years at the beginning of the past decade, with the big difference between those comparisons arising because it wasn’t until early 2015 that our oil inventories had first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns in the Spring of 2020, then jumped again after February 2021’s winter storm Uri froze off US Gulf Coast refining, but then fell sharply due to higher exports relating to the onset of the Ukraine war, only to jump again following the Christmas 2022 refinery freeze offs, our commercial crude supplies as of this August 30th were 0.4% more than the 416,637,000 barrels of oil left in commercial storage on September 1st of 2023, but 2.1% less than the 427,191,000 barrels of oil that we had in storage on September 2nd of 2022, and 1.7% more than the 423,867,000 barrels of oil we had left in commercial storage on August 27th of 2021…

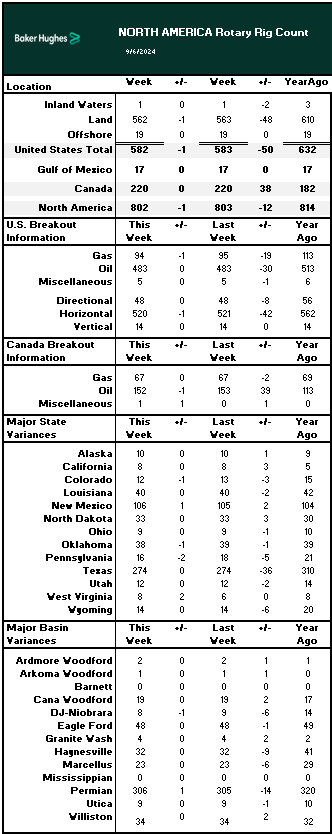

This Week’s Rig Count

In lieu of a detailed report on the rig count, we are again just including a screenshot of the rig count summary from Baker Hughes…in the table below, the first column shows the active rig count as of September 6th, the second column shows the change in the number of working rigs between last week’s count (August 30th) and this week’s (September 6th) count, the third column shows last Friday’s August 30th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting period a year ago, which in this week’s case was the 8th of September, 2023…

++++++++++++++++++++++++++++++++++++++++++++++++++

EOG Resources Eyes Expansion in Ohio's Utica Shale Activity - EOG Resources, Inc. EOG, a leading Houston, TX-based shale producer, is set to significantly expand its activities in the Utica shale play in Ohio, per a Reuters report. Speaking at the Barclays CEO Energy-Power Conference in New York, chief operating officer Jeff Leitzell announced that the company has doubled its activity in Utica over the past year, marking a significant growth in its presence in the region. EOG Resources now operates on 445,000 acres, with an average entry cost of approximately $600 per acre. Leitzell highlighted the strategic significance of the Utica shale for EOG's future growth, noting its potential to become a major asset in the company's portfolio. He indicated that if the company's current success in the region continues, EOG Resources plans to increase its capital investments there. This expansion reflects the company’s confidence in the Utica play as a long-term contributor to its oil and gas production. In addition to its Ohio operations, EOG Resources is making significant strides in the development of its Dorado natural gas play in the Eagle Ford region of southeast Texas. The company has been navigating a period of record-low natural gas prices, choosing to delay several completions until the second half of the year. According to Leitzell, this approach allows EOG to better manage market fluctuations while maintaining profitability. EOG Resources anticipates extended periods of low gas prices with occasional short-term spikes. To navigate these fluctuations and maintain profitability, the company plans to defer completions and allocate resources strategically to maximize returns despite market volatility. With a clear focus on growing its operations in Ohio and Texas, EOG Resources is positioning itself to capitalize on evolving market dynamics, reinforcing its long-term strength in the U.S. shale industry.

EOG to ramp up activity in Utica shale play in Ohio, company says (Reuters) - Houston-based shale producer EOG Resources expects to ramp up operations in the Utica shale play in Ohio, Chief Operating Officer Jeff Leitzell told attendees at the Barclays CEO Energy-Power Conference in New York on Tuesday. EOG Resources has doubled its activity in the Utica year-on-year, operating on 445,000 acres with an average entry cost of around $600 per acre, Leitzell said. "The Utica absolutely has the opportunity to be a foundational play," Leitzell said. "If we continue to have the success that we expect to, you can expect us to go ahead now and put more capital there." EOG is also developing its Dorado natural gas play in the Eagle Ford in southeast Texas. The company has managed record low gas prices in part by deferring a handful of completions to the second half of the year. "There's going to be long periods of low pricing with short duration periods of high pricing, and you've got to be able to make returns and margins all the way through those periods on the gas side," Leitzell said.

EOG set to add to Ohio Utica spending | Oil & Gas Journal - EOG Resources Inc’s budding Ohio Utica shale operation is—barring an ugly surprise in the coming months—in line to get more capital in 2025, one of the company’s top executives told an investor gathering Sept. 3. Speaking to the Barclays CEO Energy-Power Conference, chief operating officer Jeff Leitzell said Houston-based EOG is “seeing outstanding results both through delineation and with our spacing tests in all three areas” of its Utica holdings, which tally 445,000 net acres in the east of the Buckeye State. The company’s early work has focused on about 225,000 net acres that are producing volatile oil. “Everything so far has basically met type curve or exceeded type curve,” Leitzell said. “On that 225,000 acres, we’re just about there […] Everything kind of came in the way we want without any misses.” If development work continues to progress as it has, Leitzell added, EOG’s Utica teams will get more funding in 2025 to add to this year’s 20 net wells, a figure more than triple 2023’s total. And while he didn’t specify dollar details relative to EOG’s total 2024 capex budget of $6.2 billion, it appears likely that Ohio spending will soon be a material part of the company’s outlays. “It absolutely has the opportunity to be a foundational play” on a level with EOG’s core Delaware basin and Eagle Ford assets, Leitzell said. “And it’s on the pathway to be there.” Leitzell’s bullish comments echo those of EOG leaders on the company’s second-quarter earnings call roughly a month ago. (OGJ Online, Aug. 2, 2024) At the time, chief executive officer Ezra Yacob and others praised the consistent production from the company’s delineation work in the Utica and noted its potential to be cost-competitive with parts of the Permian basin. At the Barclays gathering, Leitzell also placed EOG’s Utica work inside its broader strategy, specifically its focus on incrementally amassing acreage to develop rather than following other exploration and production companies into the market for big M&A. Typically, he said, once the EOG team looks at whether the acreage is operated or not, the various contracts that come with a potential target, and the depletion rates at fields in question, it sees more potential value in an organic growth model. “The goal is for it not just to be financially accretive but also accretive on a portfolio level,” Leitzell said. “So when we look at it all, we compare it to our exploration opportunities and we just see a lot more value right now in our exploration opportunities.”

Conservancy district curtails water sales from Atwood Lake to energy company because of drought conditions -- · Drought conditions have lowered the level of the lake from its normal summer pool level by a foot and a half.‒ Due to significant drought conditions in much of Ohio and the Tuscarawas Valley, the Muskingum Watershed Conservancy District is curtailing water sales from Atwood Lake to Encino Energy for oil and gas well operations. As of Wednesday, the conservancy district is reducing water sales to Encino by 75% because Atwood Lake is a foot and a half below its normal summer pool, according to Craig Butler, MWCD executive director. The MWCD had an agreement to sell the company a maximum of 2 million gallons a day from Atwood for a couple of pad operations. Until lake levels stabilize, that number has been reduce to 500,000 gallons per day. Atwood has a storage capacity of 7 billion gallons. "We think it's the right thing to do," he said. The conservancy district receives significant revenue from bonuses and royalties from oil and gas wells around the district. The MWCD has about 100 wells on its property, generating around $200 million in revenue in the past decade or so.

Cecil Twp Proposes Ban on New Shale Drilling via 2500-Ft Setback -- Marcellus Drilling News - The Board of Supervisors for Cecil Township in Washington County, PA, has caved to pressure from radical leftists and is floating a plan to effectively ban all new shale drilling in the township by increasing setbacks from "protected structures" from 500 feet to 2,500 feet (a half a mile!).The supervisors will hold a special meeting tonight to discuss this lunacy. We strongly recommend you attend and voice your opposition.

Pennsylvania Dropped 3 Rigs Last Week, Lowest Count in 2.5 Years - Marcellus Drilling News - The big news (for us) with the weekly Baker Hughes rig count is that last week, Pennsylvania laid down its use of three active drilling rigs, resulting in the lowest rig count in the state in 2 1/2 years. PA now operates 18 active rigs, down from 21 the week prior. The last time PA operated only 18 rigs was, according to our records, in November 2021. Fortunately, West Virginia picked up one of those rigs and improved its count from five to six. Ohio remained the same with nine active rigs. So, the Marcellus/Utica, in total, went from 35 active rigs two weeks ago to 33 active rigs last week. The national rig count (for both oil and gas rigs) dropped by two, now with 583 active rigs.

Biden-Harris Bribe Pa. with Check for $76 Million to Plug Old Wells -- What’s your price, Pennsylvania oil and gas industry? Are you willing to sell yourselves to the Democrats for $152 million (revised down to $114 million) in bribes? How about if Biden-Harris sweetens the pot and rushes a check for $76 million to the state, as they did yesterday? Can you not see through this sleazy attempt to unduly influence the election? In August, Biden-Harris promised (but hasn’t yet delivered a dime of) up to $152 million in “Phase 2” federal money, i.e., your taxpayer dollars, to help plug old conventional oil and gas wells in the Keystone State (see Convenient Timing: Biden-Harris Promise Pa. Another $152 Million). Yesterday, the administration said a check is in the mail for $76 million for “Phase 1” of the same thing. It is grotesquely CORRUPT. It is vote-buying.

Pennsylvania Drillers Defeat Landowner Lawsuit After 9 Years - In 2015, a group of nearly 60 landowners in northeastern Pennsylvania who had leased their land for fracking filed a lawsuit against Chesapeake Energy, Anadarko, Statoil (now Equinor), Mitsui E&P, and Access Midstream (later bought by Williams), alleging the companies had improperly deducted post-production costs (e.g., gas gathering and transportation expenses) from royalties owed to the landowners in breach of their respective leases. The lawsuit also alleged collusion and conspiracy to defraud the landowners. The lawsuit was on hold for many years while other lawsuits played out. Earlier this year, a federal court in Scranton unpaused this lawsuit, and yesterday, the judge ruled, tossing out the landowners’ claims.

UGI Seeks to Store LNG in Trailers in Scranton Suburb During Winter --Marcellus Drilling News --UGI, a diversified energy company with midstream (pipeline) operations in the Marcellus and one of PA’s largest utility companies, wants to store trailers of LNG in the parking lot of a storage facility near Scranton, PA, and is seeking a zoning variance to do so. UGI needs extra supplies of natural gas to inject into its utility system during peak periods in the winter months. The company says it will be a temporary situation.

32 New Shale Well Permits Issued for PA-OH-WV Aug 26 – Sep 1 -- For the week of Aug. 26 – Sept. 1, a total of 32 permits were issued to drill new shale wells in Marcellus/Utica, nearly matching the previous week's 34. It's nice to see the numbers returning to higher levels. The Keystone State (PA) had 18 new permits. PA’s top recipient was EQT (and its subsidiary Rice Drilling), with ten permits in Greene County. Seneca Resources was second, with five new permits issued in Lycoming County. Olympus Energy received three permits in Westmoreland County. Antero Resources | Carroll County | Encino Energy | EOG Resources | EQT Corp | Greene County (PA) | Guernsey County | Lycoming County | Marshall County | Ohio County | Olympus/Huntley & Huntley | Seneca Resources | Southwestern Energy | Westmoreland County | Wetzel County

DC Court Vacates LNG Approval at Port of Brownsville --The D.C. Circuit Court on Tuesday ruled against approval of liquefied natural gas (LNG) export terminal and related pipeline projects at the Port of Brownsville, effectively canceling prior approval of three such projects by the Federal Energy Regulatory Commission.The Sierra Club, in announcing the ruling, said this is the first time a court has vacated FERC approval of an LNG terminal.FERC approved Rio Grande LNG, Texas LNG and the Rio Bravo Pipeline “despite widespread concerns for the harm the projects would cause to the surrounding communities and the climate.”A lawsuit was filed against FERC by the Sierra Club, the city of Port Isabel, Vecinos para el Bienestar de la Comunidad Costera and the Carrizo/Comecrudo Tribe of Texas, a Floreville-based nonprofit organization, claiming that FERC failed to “adequately consider the environmental justice impacts and greenhouse gas emissions of the three projects, as required by the National Environmental Policy Act and the Natural Gas Act.“The D.C. court upheld the petitioners’ arguments, vacating FERC’s approvals, meaning the agency now has to reconsider the impacts of the three projects. This will require a new draft supplemental Environmental Impact Statements and public comment period before FERC decides whether to issue new project permits.The court’s ruling follows two other rulings in July that “call into question the adequacy of FERC reviews,” according to the Sierra Club, which noted that last week the D.C. Circuit Court ruled FERC had failed to consider greenhouse gas emissions as well as market need for expansion of Real Energy Access, a Williams company pipeline project in the Northeast.Also last month, the same court ruled that FERC failed to adequately assess Commonwealth LNG’s air pollution impacts and greenhouse gas emissions, the Sierra Club said, adding that “it is unacceptable for FERC to conduct insufficient environmental justice analysis and to decline to make determinations on the significance of climate-warming emissions.”

US approves gas exports from New Fortress Energy -- The Biden administration on Tuesday granted a gas export terminal the authority to ship fuel abroad after a court blocked its efforts to delay such permissions. The Energy Department approved shipments from a New Fortress Energy facility in Mexico to countries with which the U.S. does not have a free-trade agreement.The gas in question is originally sourced from the U.S.; it then will be transported to Mexico and later to other countries.The administration announced earlier this year that it would pause new approvals for liquified natural gas (LNG) exports like the one it approved on Tuesday, but that pause was halted in court in July. Nevertheless, environmental advocates expressed disappointment in the administration, as some hoped it simply wouldn’t approve major gas projects even without a formal pause in place. “The Department of Energy’s decision to approve the New Fortress LNG Terminal is deeply concerning,” said Allie Rosenbluth, U.S. program manager at advocacy group Oil Change International, in a written statement. “By doing so, it has broken its own commitment to pause LNG export authorizations— a commitment made out of recognition that its current guidance doesn’t adequately consider the risks LNG exports pose to the climate, environment, and public health and safety,” Rosenbluth said. The pause on new LNG export approvals was widely seen as an overture toward the progressive wing of the Democratic Party. And the new export approval comes as Vice President Harris, in her presidential campaign, hasshifted toward the center on other issues, including fracking. A spokesperson for the Energy Department noted that the facility is already constructed and operational. The official added that it does not increase “the total volume of LNG” that the facility can export, but does increase exports to countries without U.S. free trade agreements by about 3 percent. The department’s pause announced earlier this year came in conjunction with a review of its approval practices, including the extent to which factors like climate change are considered. The spokesperson said that the department is continuing to update how it evaluates these projects moving forward. Under the new approval issued on Monday, New Fortress Energy will be allowed to export about 1.4 million tonnes per year of gas for five years.

Venture Global seeks OK to unload first LNG commissioning cargo at Louisiana plant - U.S. liquefied natural gas (LNG) company Venture Global LNG sought authorization on Thursday from U.S. energy regulators by Aug. 30 to unload the first LNG commissioning cargo at the Plaquemines export plant under construction in Louisiana. About a week ago, a tanker (the Qogir) full of LNG docked at Plaquemines, according to Venture Global and data from financial firm LSEG. The tanker came from Norway. Energy analysts and traders said Venture Global would use that LNG to cool down parts of the Plaquemines facility as part of the plant's testing and commissioning process. Earlier in the week, Venture Global said the Qogir docked at Plaquemines but did not provide other information. On Thursday, Venture Global filed with the U.S. Federal Energy Regulatory Commission (FERC) for authorization no later than Aug. 30 to unload the first LNG commissioning cargo on or after Aug. 30. LNG plants under construction, like Plaquemines, use super-cooled fuel to test and cool equipment in preparation for startup. In addition to the Qogir, another LNG vessel, the Venture Gator, which was not fully loaded with LNG, according to data from LSEG, was anchored in the Mississippi River near Plaquemines. Analysts said it was likely the vessel, which was listed as available for orders, would go to Plaquemines. Plaquemines started pulling in small amounts of natural gas from U.S. pipelines in late June, analysts have said the plant could start turning gas into small amounts of LNG in test mode in coming months. Venture Global has said that building the two phases at Plaquemines would entail an investment of about $21 B. Analysts have said they expect Venture Global to complete work on the first 1.8-Bft3d phase of Plaquemines from 2024 to 2026 and the second 1.2- Bft3d phase from 2025 to 2026. The U.S. is already the world's biggest LNG exporter with seven export plants able to turn about 13.8 Bft3d of gas into about 104.6 metric MMtpy of LNG. One Bft3 is enough gas to supply about 5 MM U.S. homes for a day.

NGPL Expansion Could Move Ahead Without Delfin as Delays Continue for LNG Project -Delfin LNG may not be able to accept natural gas supplies on a pipeline expansion that’s expected to enter service in July 2026 as the offshore export project continues working through delays, a Kinder Morgan Inc. subsidiary told federal regulators. Delfin warned Natural Gas Pipeline Co. of America LLC (NGPL) that it might not be able to adhere to the schedule outlined in its long-term transportation agreement for 80 MMcf/d on the Texas-Louisiana Expansion Project, NGPL said in a filing with the Federal Energy Regulatory Commission. Delfin has asked the U.S. Department of Energy (DOE) for an extension to place its first phase online in June 2029. The company cited energy market impacts from the Covid-19 pandemic and global conflicts that made it impossible to reach previous deadlines under its permits.

Harris defends fracking reversal --Vice President Harris in an interview Thursday addressed her reversal on a fracking ban, which she supported during the 2020 Democratic primary but has since come out against. “As vice president, I did not ban fracking. As president, I will not ban fracking,” Harris told CNN’s Dana Bash in a joint interview with her running mate, Minnesota Gov. Tim Walz (D).Bash followed up by citing Harris’s comments at a 2019 town hall in which she said “there’s no question I’m in favor of banning fracking,” and asked why she had since changed her position.“My values have not changed. I believe it is very important that we take seriously what we must do to guard against what is a clear crisis in terms of the climate. And to do that, we can do what we have accomplished thus far,” Harris answered.She went on to cite the recent boom in renewable energy jobs in the U.S., much of it in the wake of the passage of the Inflation Reduction Act in 2022, for which she cast the tiebreaking Senate vote.“That tells me, from my experience as vice president, we can do it without banning fracking,” she said. “What I have seen is that we can grow and we can increase a thriving clean energy economy without banning fracking.”Fracking, the process of extracting natural gas from bedrock by injecting pressurizing fluids, is a major employer in the southwest of Pennsylvania, which is likely to be a pivotal state in the November election.

NFE’s Altamira LNG Granted First Natural Gas Export Permit Since Biden Administration Paused Approvals --The U.S. Department of Energy (DOE) is allowing New Fortress Energy Inc. to export up to 1.4 million metric tons/year of LNG to non-free trade agreement (FTA) countries from its recently commissioned Fast LNG facility in Mexico, marking the first non-FTA permit granted this year. Graph of Commercially Advanced North American LNG Projects impacted by DOE Review. In an order issued over the U.S. Labor Day weekend, DOE staff noted ongoing concerns about U.S. liquefied natural gas development, including an ongoing study into the impacts of gas exports, but ultimately concluded Fast LNG’s shipments to the international market were in the public interest. “DOE is continuing to monitor market developments closely as the impact of successive authorizations of LNG exports and re-exports unfolds,” agency staff wrote in the order. “DOE also acknowledges that proposals to re-export U.S.-sourced natural gas in the form of LNG from Mexico or Canada to non-FTA countries raise public interest considerations that are not present for domestic exports of LNG.”

Three Things to Know About the LNG Market - The Southern Environmental Law Center and the Natural Resources Defense Council have filed a court challenge against FERC’s authorization of the proposed CP2 LNG export project in Cameron Parish, LA. The groups filed the petition for review in the U.S. Court of Appeals for the District of Columbia Circuit (DC Circuit) on behalf of local fishermen and landowners. They allege the Federal Energy Regulatory Commission’s June approval of the 20 million metric tons/year liquefied natural gas project violates the Natural Gas Act and “illustrates FERC’s failure” to review projects in the public interest. The DC Circuit vacated FERC authorizations for the Rio Grande and Texas LNG projects after challenges from other environmental groups.

EOG’s Gassy Dorado Play in South Texas Opening Doors for Multi-Linked LNG Export Pricing, Says COO --Houston-based EOG Resources Inc. has for years remained a top dog among Lower 48 explorers, with a cache of gassy and oily targets from which to pick and choose. The diversified portfolio has provided assurance when prices are high or low, a top executive said. COO Jeffrey R. Leitzell discussed the independent’s marketing strategy Tuesday at the Barclays 38th Annual CEO Energy-Power Conference. The multi-basin explorer has accumulated assets in the Anadarko, Appalachia, Denver-Julesburg, Permian, Powder River and Williston basins, and in the Barnett, Eagle Ford and Utica shales. It also has gas-heavy assets offshore Trinidad and Tobago.'

Texas Waha Hub Gas Prices Plunge to Record Lows, Hit Negative Territory (Reuters) — Natural gas prices in the Permian shale basin in West Texas have turned negative a record number of times in 2024, including an all-time low on Aug. 30, as pipeline and other constraints trap gas in the nation's biggest oil-producing basin. Spot gas prices for Friday at the Waha hub NG-WAH-WTX-SNL in West Texas fell by about 120% to a record low of minus $4.80 per million British thermal units (MMBtu). That was the 21st time Waha prices averaged below zero in August and was lower than the prior record low of minus $4.76 on Aug. 9. Waha prices first averaged below zero in 2019. It happened 17 times in 2019, six times in 2020 and once in 2023. So far in 2024, Waha prices have averaged below zero 32 times. Analysts have said that is a sure sign the region needs more gas pipes, which prompted a coalition of energy firms including privately-held WhiteWater to move forward in July with the Blackcomb pipeline. Other energy firms, including Kinder Morgan and Energy Transfer, have also proposed new projects. There is, however, only one big gas project under construction in Texas that could relieve the severe pipeline constraints in the Permian region this year, the Matterhorn Express Pipeline. In the past, Matterhorn Express projected the 490-mile (789-kilometer) pipe capable of moving up to 2.5 billion cubic feet per day (Bcf/d) of gas from the Permian to the Gulf Coast, could enter service in the third quarter of 2024, but most analysts now expect the project to start in the fourth quarter. Matterhorn Express is a joint venture between units of WhiteWater, EnLink Midstream, Devon Energy and MPLX, according to WhiteWater's website.

US natgas prices climb 4% to 2-week high on lower output, higher LNG feedgas (Reuters) -U.S. natural gas futures climbed about 4% to a two-week high on Tuesday after the long U.S. Labor Day holiday weekend on a decline in output and increase in gas flows to liquefied natural gas export terminals. That price increase came despite bearish forecasts for less hot weather than previously expected, which should reduce the amount of gas power generators burn to keep air conditioners humming. Front-month gas futures for October delivery on the New York Mercantile Exchange rose 7.6 cents, or 3.6%, to settle at $2.203 per million British thermal units (mmBtu), their highest close since Aug. 19. Financial firm LSEG said gas output in the Lower 48 U.S. states slid to an average of 102.3 billion cubic feet per day (bcfd) so far in September, down from 103.2 bcfd in August. Meteorologists forecast weather across the country would remain mostly near normal through Sept. 11 before turning warmer than normal from Sept 12-18. Energy traders, however, noted that warmer-than-normal weather in mid-September would only average around 75 degrees F (23.9 degrees Celsius), down from an average of 79 F (26.1 C) in mid-August. LSEG forecast average gas demand in the Lower 48, including exports, will fall from 102.8 bcfd this week to 101.1 bcfd next week. The forecast for next week was lower than LSEG's outlook on Friday. Gas flows to the seven big U.S. LNG export plants rose to an average of 13.1 bcfd so far in September, up from 12.9 bcfd in August. That compares with a monthly record high of 14.7 bcfd in December 2023. In Mexico, New Fortress Energy's NFE.O Fast LNG export plant in Altamira received authorization from the U.S. Department of Energy to export LNG to non-free trade agreement countries. That should allow the plant, which turns U.S. gas into LNG, to increase exports. Gas prices were trading around $12 per mmBtu at the Dutch Title Transfer Facility (TTF) benchmark in Europe and $14 at the Japan Korea Marker (JKM) benchmark in Asia.

US natural gas prices fall 3% on forecasts for less demand, ample stockpiles (Reuters) -U.S. natural gas futures slid about 3% on Wednesday on bearish forecasts for less demand this week than previously expected. Another factor that has weighed on gas prices for much of this year is the oversupply of fuel left in storage after a mild winter. There was still about 12% more gas in storage than normal, even though injections have been smaller than usual in 15 of the last 16 weeks after low prices early in the year prompted several producers to cut output. Front-month gas futures NGc1 for October delivery on the New York Mercantile Exchange fell 5.8 cents, or 2.6%, to settle at $2.145 per million British thermal units (mmBtu). On Tuesday, the contract closed at its highest price since Aug. 19. The market has seen a drop in output so far this month and forecasts for warmer weather next week than previously expected, which should boost the amount of gas power generators burn to keep air conditioners humming. In the spot market, pipeline constraints caused next-day gas prices at the Waha hub in the Permian Shale in West Texas to fall to an all-time low and average in negative territory for a record 33rd time this year. Waha prices first averaged below zero in 2019. It happened 17 times in 2019, six times in 2020 and once in 2023. In the Atlantic basin, the U.S. National Hurricane Center (NHC) said there was a 30% chance that atropical disturbance in the Caribbean Sea could strengthen into a cyclone as it move into the southern Gulf of Mexico over the next week.

US natgas prices jump 5% to 7-week high on small storage build, rising LNG feedgas (Reuters) -U.S. natural gas futures jumped about 5% to a seven-week high on Thursday on a smaller-than-expected storage build, rising gas flows to liquefied natural gas export plants and a continued decline in output so far this month. That price spike came despite forecasts for less hot weather over the next two weeks than previously expected, which should reduce the amount of gas power generators burn to keep air conditioners humming. The U.S. Energy Information Administration (EIA) said utilities added 13 billion cubic feet (bcf) of gas into storage during the week ended Aug. 30. That was well below the 27-bcf build analysts forecast in a Reuters poll and compares with an increase of 33 bcf in the same week last year and a five-year (2019-2023) average rise of 51 bcf for this time of year. Even though last week's build was smaller than normal for the 16th time in 17 weeks, there was still about 11% more gas in storage than is normal for this time of year. Analysts have said that oversupply of gas left in storage after a mild winter has helped keep prices depressed all year, prompting several producers to cut output. Those output cuts were the reason for the smaller than normal weekly builds seen in recent months. Spot gas prices at the U.S. Henry Hub benchmark NG-W-HH-SNL fell to a 25-year low earlier this year. Front-month gas futures NGc1 for October delivery on the New York Mercantile Exchange rose 10.9 cents, or 5.1%, to settle at $2.254 per million British thermal units, their highest close since July 12. In the spot market, a heat wave in the U.S. West caused power prices to soar over 400% to their highest levels since August 2023 to around $160 per megawatt hour (MWh) at the Palo Verde hub EL-PK-PLVD-SNL in Arizona and $150 at South Path 15 (SP-15) EL-PK-SP15-SNL in Southern California as homes and businesses cranked up their air conditioners. In Texas, the Matterhorn gas pipeline was moving small amounts of gas from the Permian basin in West Texas toward the Gulf Coast, which should relieve the negative prices in the Waha market. Gas flows to the seven big U.S. LNG export plants have risen to an average of 13.2 bcfd so far in September, up from 12.9 bcfd in August. That compares with a monthly record high of 14.7 bcfd in December 2023. On a daily basis, LNG feedgas was on track to rise to a three-month high of 13.3 bcfd on Thursday. Looking ahead, Berkshire Hathaway Energy's 0.8-bcfd Cove Point LNG export plant in Maryland will likely shut for about three weeks of routine annual maintenance around Sept. 20, according to the plant's history and notices to customers.

US natural gas prices rise 1% to 8-week high on higher LNG feedgas, lower output - U.S. natural gas futures edged up about 1% to an eight-week high on Friday as the amount of gas flowing to liquefied natural gas (LNG) export plants rises and producers continue to curtail output. That small price gain occurred despite bearish forecasts for cooler weather over the next two weeks than previously expected, which should reduce the amount of gas power generators burn to keep air conditioners humming. There is still about 10% more gas in storage than normal for this time of year even though injections have been smaller than usual in 16 of the last 17 weeks. Analysts said those small builds happened mostly because several producers cut output this year after spot prices at the U.S. Henry Hub benchmark fell to a 25-year low in the spring and have remained relatively low since. Front-month gas futures for October delivery on the New York Mercantile Exchange rose 2.1 cents, or 0.9%, to settle at $2.275 per million British thermal units (mmBtu), their highest close since July 12 for a second day in a row. For the week, the front-month was up about 7% after gaining about 5% last week. Financial firm LSEG said gas output in the Lower 48 U.S. states has slid to an average of 102.2 billion cubic feet per day (bcfd) so far in September, down from 103.2 bcfd in August. On a daily basis, output was on track to drop by 2.1 bcfd over the last six days to a preliminary 11-week low of 101.7 bcfd on Friday. Analysts, however, noted that preliminary data was often revised later in the day. Meteorologists forecast weather across the U.S. would remain mostly near normal through Sept. 9 before turning warmer than normal in the Sept. 10-21 period. Energy traders, however, noted that warmer-than-normal weather in mid-September would only average around 74 degrees Fahrenheit (23.3 degrees Celsius), down from an average of 79 F (26 C) in mid-August. LSEG forecast average gas demand in the Lower 48, including exports, will fall from 102.5 bcfd this week to 100.5 bcfd for the next two weeks. The forecasts for this week and next were similar to LSEG’s outlook on Thursday. Gas flows to the seven big U.S. LNG export plants have risen to an average of 13.2 bcfd so far in September, up from 12.9 bcfd in August. That compares with a monthly record high of 14.7 bcfd in December 2023. On a daily basis, LNG feedgas was on track to reach a three-month high of 13.4 bcfd on Friday.29dk2902l Gas prices were trading around $12 per mmBtu at the Dutch Title Transfer Facility (TTF) benchmark in Europe and $14 at the Japan Korea Marker (JKM) benchmark in Asia.

‘Molecule-Agnostic’ Equipment Opening Doors Beyond Natural Gas, Says Baker Hughes CEO -Baker Hughes Co. in only a few years has navigated a brief merger with General Electric, an energy-demand-crushing pandemic and an exit from Russia, but it continues to deliver solid results. The secret, said CEO Lorenzo Simonelli, is the oilfield service company’s “differentiated” technology strategy. Pie chart showing 2023 industrial and energy technology revenue. The CEO offered his “roller coaster perspective” on Wednesday at the Barclays 38th Annual CEO Energy-Power Conference. Simonelli took the helm in 2017, shortly after a blockbuster tie-up with General Electric. The deal had soured by 2018, though, and in 2019, it was becoming a standalone company once again.

It's Spreading: America's Top Oil Field Terrorized By Armed Venezuelan Gangs --It's only going to get worse from here, as the Biden-Harris administration's disastrous open border policies have now come to a 'neighborhood near you' (for some of you). In the past week, we saw armed Venezuelan prison gang Tren de Aragua members terrorize the northern Denver suburb of Aurora and other sanctuary cities run by far-left Democrats. New concerns out Thursday afternoon indicate critical infrastructure is now under threat from migrant cartel members. According to Libs of TikTok, a Texas-based oil/gas company issued a memo to employees informing them that police and the FBI havewarned armed Cuba and Venezuela migrant gangs are committing thefts in the Permian Basin (America's highest producing oil field). Here's the memo:Industry peers and law enforcement in West Texas (WTX) are aware of a recent increase in organized criminal activity inclusive of violent crimes, gang activity and oil field thefts in and around WTX operational areas. Specifically, regional law enforcement and the FBI advised that gang members emanating from Cuba and Venezuela are organizing and working in concert to commit thefts within the Permian Basin. These individuals and groups are armed, violent in nature and will not hesitate to use force.Crimes associated with these groups include the theft of oil, diesel fuel, copper wire, and catalyst elements. Recent incidents have also included two assaults by water haulers who were attempting to steal oil from WTX oilfield sites. After the thieves were observed by witnesses who drove up to investigate, the thieves attempted to use their vehicles to run the witnesses off the road. In another incident, a thief, acting as a spotter and following a water hauler who had stolen oil, also attempted to run a witness off the road. There have been numerous reports of second vehicles acting as spotters for water haulers committing oil thefts.An industry peer provided the below snapshot of a video surveillance of an armed thief checking out an area before stealing diesel from the location We highlighted earlier this week that law-abiding Americans must be made well aware of the cities, counties, and states that have laws, ordinances, and policies that obstruct immigration enforcement and shield illegal alien criminals from US Immigration and Customs Enforcement. This is because these areas are increasingly becoming dangerous, with migrant criminals running amok. Aurora is a prime example. It will not matter who wins the election. The flood of illegals have a purpose in the overall plan that has been unfolding. Chaos as far and wide as possible. Massive spread across the nation! https://t.co/qFhElt4NtW

Billionaire Kelcy Warren invests in pipelines — and Trump - Kelcy Warren is good at getting a return on his investments. The billionaire pipeline mogul goes big and moves fast — even if it sometimes looks bad from the outside.That’s how his company, Energy Transfer, built the Dakota Access oil pipeline in spite of bitter tribal protests. And that’s how the company made $2.4 billion from buying and selling natural gas during the deadly Texas blackouts in 2021.This year, he’s invested $5 million in the campaign to elect former President Donald Trump to another term in the White House. The potential return on investment is high.A Department of Energy under a second Trump administration could put Energy Transfer’s natural gas export project in Louisiana back on track. If he retakes power, the former Republican president could end talk of “pausing” federal export permits and dial back President Joe Biden’s heightened scrutiny of the types of mergers and acquisitions Warren uses to expand his company. A second Trump term could also put to rest the continued threats to Dakota Access.“He is a very wealthy guy, and he owns a critical element of U.S. energy infrastructure,” said Cal Jillson, a professor of political science at Southern Methodist University just outside Dallas. “The way he protects it, from his perspective, is to be more of an old-style Republican economic conservative in which he protects his business from over regulation and taxation by face-to-face opportunities to lobby on behalf of his interests.”The oil and gas industry has given Trump more money than all but three other industries, according to the campaign finance tracking site OpenSecrets.org. And Warren is a top giver from the industry, tied with Midland oilman Tim Dunn for first place among oil moguls.The petrodollars oil tycoons are shoveling into Trump’s campaign demonstrate how closely the GOP nominee has aligned himself with an industry respected for its job creation and clout in global energy markets and vilified for its environmental record and its economic power over American consumers.And the prospect of Vice President Kamala Harris winning the White House is even more frightening to many oil and gas executives than was four more years of Biden. Warren himself has said he’s “scared to death” when politicians talk about banning fracking, which is exactly what Harris did during her short-lived campaign for the 2020 Democratic presidential nomination. She has since walked that back but hasn’t made clear how she might be different than Biden on energy issues.“There is a strong sense that Biden, and especially Harris, represent an existential threat to the status quo for the oil and natural gas industry,” said Mark Jones, a political science professor at Rice University in Houston.The $5 million Warren sent to Trump ties him with Dunn for seventh place on the list of top Trump donors compiled by OpenSecrets. The Trump campaign did not respond to requests for comment.According to an analysis of contributions done by OpenSecrets for POLITICO’s E&E News, Warren and his wife, Amy, have contributed nearly $28 million to federal candidates and nearly $7 million to Texas candidates since the end of 2010, almost all of it to Republicans.

North American LNG capacity to more than double by 2028 | Gas Processing & LNG - North America’s LNG export capacity is on track to more than double between 2024 and 2028, from 11.4 billion cubic feet per day (Bcfd) in 2023 to 24.4 Bcfd in 2028, if projects currently under construction begin operations as planned. During this time, we expect developers in Mexico and Canada to place their first LNG export terminals into service and in the United States to add to existing LNG capacity. By the end of 2028, we estimate LNG export capacity will grow by 0.8 Bcfd in Mexico, 2.5 Bcfd in Canada, and 9.7 Bcfd in the United States from a total of 10 new projects that are currently under construction in the three countries.

- Mexico: Developers are currently constructing two projects with a combined LNG export capacity of 0.6 Bcf/d—Fast LNG Altamira offshore on Mexico's east coast and Energía Costa Azul on Mexico's west coast.

- Fast LNG Altamira consists of two Floating LNG production units (FLNG), each with a capacity to liquefy up to 0.199 Bcfd of natural gas, located off the coast of Altamira, in the state of Tamaulipas, Mexico. Natural gas from the United States delivered via the Sur de Texas-Tuxpan pipeline will supply these units. The first LNG cargo from this facility was shipped in August 2024.

- The Energia Costa Azul LNG export terminal (0.4 Bcf/d export capacity) is located at the site of the existing LNG regasification (import) terminal in Baja California in western Mexico. Developers proposed an expansion of this project in Phase 2 by 1.6 Bcf/d. This project will be supplied with natural gas from the Permian Basin in the United States.

- Canada: Currently, three LNG export projects with a combined capacity of 2.5 Bcfd are under construction in British Columbia on Canada’s west coast. Developers of LNG Canada (1.8 Bcfd export capacity) plan to start LNG exports from Train 1 in the summer of 2025. Woodfibre LNG (export capacity 0.3 Bcfd) targets the startup of LNG exports in 2027. Cedar LNG—an FLNG project with capacity to liquefy up to 0.4 Bcfd—made a final investment decision in June 2024 and expects to start LNG exports in 2028. These projects will be supplied with natural gas from western Canada. In addition, the Canada Energy Regulator (CER) has authorized four LNG export projects, including an expansion of LNG Canada, with a combined proposed LNG export capacity of 4.1 Bcfd.

- United States: Five LNG export projects are currently under construction with a combined export capacity of 9.7 Bcfd—Plaquemines (Phase I and Phase II), Corpus Christi Stage III, Golden Pass, Rio Grande (Phase I), and Port Arthur (Phase I). Developers expect to produce the first LNG from Plaquemines LNG and Corpus Christi LNG Stage III and ship first cargoes from these projects by the end of 2024.

U.S. LNG export dominance tested as Europe's demand wilts - The United States has remained the largest exporter of liquefied natural gas (LNG) so far in 2024, but a steep drop in selling prices and a sharp swing in export volumes to key markets is likely testing exporter appetite to stay on top. The U.S. shipped a record 56.9 metric MMt of LNG during the first eight months of 2024, according to Kpler. That surpassed the 54.3 MMt from Australia and 53.7 MMt from Qatar during that period, and marks only the second straight year that U.S. exporters have topped global export rankings. However, a more than 25% drop in average LNG export prices during the first half of 2024 from the first half of 2023 dealt a heavy blow to export revenues, which dropped by $4 B from the opening half of 2023 to $13.2 B, data from the U.S. Energy Information Administration (EIA) shows. That was the lowest half-year revenue total since the first half of 2021, and marks a more than $12-B fall from the second half of 2022 when U.S. export earnings from LNG peaked. U.S. liquefied natural gas (LNG) export volumes, prices and revenues since 2010. The challenge of sharply falling revenues was compounded by a sharp reconfiguration in export volumes to key markets, which saw shipments to relatively close markets in Europe drop by more than 20% while sales to more distant Asia rose by over 40%. Continued muted LNG demand in Europe and further growth in Asia may test the resolve of U.S. exporters to remain the world's largest LNG sellers, as several far-flung Asian markets can be more cheaply supplied by other sellers. Europe's sudden jump in demand for LNG since Russia's invasion of Ukraine in 2022 snarled natural gas pipeline flows to the region has been the main catalyst behind the ascendancy of the U.S. LNG export industry. From 2018 through 2021, U.S. LNG exports to Europe averaged around 15 MMtpy, according to Kpler, but jumped to around 55 MMtpy in 2022 and 2023 as Europe's power firms scrambled to replace lost Russian gas by whatever means necessary. U.S. exports of liquefied natural gas (LNG) by continent since 2018. U.S. exporters were happy to help fill the gas gap, lifting total export volumes by 95% from 2019's total by the end of 2022. Europe's share of the total U.S. LNG traffic also roughly doubled, from around 37% from 2019–2021 to nearly 70% in 2022. A roughly 44% drop in shipments to Asia during 2022 from the year before also allowed U.S. LNG sellers to prioritize Europe over all other customers, and capitalize on the unprecedented supply shock that roiled global gas markets during that period. U.S. LNG shipments to Europe scaled even greater heights in 2023, but the tone has changed in 2024, with shipments from January through August dropping by 22% from the same months in 2023. A key driver behind that slowdown has been a sharp climb in European power generation from renewable energy sources, which remain a priority for Europe's power firms going forward. Solar and wind power's share of electricity generation in Europe jumped from around 16.4% in 2022 to 20.5% so far in 2024, according to Ember. To make way for the higher renewables generation, fossil fuel generation's share dropped from around 44.6% in 2022 to 36.6% so far this year. Coal-fired power has been the main fossil fuel source that has been cut in Europe, but natural gas generation's share has also declined, from around 26% in 2022 to 22% so far this year. Lower gas reliance across Europe is bad news for U.S. LNG exporters. To make up for lower sales into Europe, U.S. exporters may attempt to grow share in Asia, which is a clear bright spot for global gas sellers. However, other major exporters including Qatar and Australia boast far lower shipping distances to key Asian markets, on top of competitive gas liquefaction charges. Shipments to India, for example, can take five times longer from Cove Point in the U.S. than from Ras Laffan in Qatar, LSEG data shows. And Australia can ship LNG to southern China in under nine days, compared to 35 days from the U.S. East Coast.

Mexico Arising as Potential Ally in Southeast Asian Energy Security — Energy demand in Southeast Asia is on a strong upward trajectory, driven by urbanization, industrial growth and the changing energy matrix in the region. Energy policy priorities for governments in the region are to maintain energy security, affordability and sustainability, but their infrastructure gaps make it difficult for them to achieve full connectivity. In this context, liquefied natural gas has emerged as one of the energy sources with the greatest potential. Indonesia and Malaysia play a dual role in both receiving and sending out LNG.

Vista Energy to pump more than $1 billion into growing Argentina shale (Reuters) - In a push to unlock more of the oil riches buried in a massive shale deposit in Argentina, Vista Energy will invest about $1.1 billion this year as it also aims to cut costs there by double digits, the firm's chief executive told Reuters. Miguel Galuccio, Vista Energy's founder and CEO, offered the near-term development plan for the Vaca Muerta shale formation in a Zoom interview from New York , where he was celebrating the company's five-year anniversary on the New York Stock Exchange. Shares have surged more than 460% since the company's initial public offering. The company also trades on the main stock index in Mexico, where it operates an onshore field. But Vaca Muerta, the world's largest shale project in development outside the United States, is by far the company's top project. It is also the Argentine government's main hope for reversing a longstanding energy deficit that has forced it to finance costly imports over decades. Galuccio noted how the project has taken off in just over a decade. "In 2012, Vaca Muerta was for believers. Today Vaca Muerta is for engineers," he said, touting expected production gains. Since last year, output from the deposit has more than doubled to reach 65,000 barrels of oil equivalent per day (boepd) in this year's second quarter. The breakneck growth will likely continue as output in the fourth quarter is seen hitting 85,000 boepd, on its way to reaching 100,000 boepd in 2026 and 150,000 boepd by the end of the decade, said Galuccio. To prime the expansion, Vista will invest in more wells and related transport infrastructure in the area, located in Argentina's western Neuquen province, where it already has 1,150 new well locations identified across more than 200,000 acres, according to company data. The former chief executive of state-owned oil producer YPF, Galuccio said Vista added its third drilling rig to its Vaca Muerta operations earlier this year and will bring on a second fracking crew in the fourth quarter. The technique requires blasting sand, toxic chemicals and large quantities of water into wells, which environmentalists criticize as harmful to aquifers and likely linked to a rise in earthquakes. While Vaca Muerta's lifting costs settled at $4.50 per barrel in the second quarter, the executive sees the extraction costs dipping around 11% to $4 by 2026. He described the expected cost at near the technical limit, from about $18 per barrel when production began. Galuccio flagged that insufficient pipeline capacity was the local industry's biggest bottleneck last year, but pointed to plans to address that by doubling capacity on midstream operator Oldelval's pipeline network, as well as separate expansions on the Vaca Muerta Sur and Norte pipelines. He also stressed that Argentina could use more help developing the massive shale formation, which is about the size of Belgium. "Vaca Muerta needs more Vistas and more investment," he said..

LNG tankers line up at Malaysia's Bintulu complex after maintenance -A backlog of liquefied natural gas (LNG) tankers is waiting to load at Malaysia's Bintulu terminal this week after outages and maintenance work disrupted production, according to industry sources and shiptracking data. The Bintulu facility in Sarawak, controlled by state-owned Petronas, consists of nine LNG production trains run by four different operators with total capacity of nearly 30 metric MMtpy, making it the largest LNG-exporting complex in Asia. Petronas' MLNG joint venture completed planned maintenance on its train 7 in August, while Train 4 had issues that required unplanned maintenance, two sources familiar with the matter said on Tuesday. One of the sources said that Trains 8 and 9 had also undergone unplanned maintenance in August. All four of the affected trains are now back up, the source said, declining to be identified because they were not authorized to speak to media. Petronas had previously requested that buyers defer some LNG loadings from its Bintulu complex due to operational issues at one production train, Reuters reported in August. A Rystad Energy report on Friday said that Trains 7 and 8 at Bintulu, operated by Petronas' Tiga joint venture, were facing issues. "The Petronas-operated Tiga project in Bintulu, Malaysia, is ... facing reduced capacity due to upstream gas issues for Train 7 and a glitch in the heat exchanger for Train 8, likely resulting in delivery delays for the fourth quarter of 2024," analyst Masanori Odaka wrote. At least seven LNG tankers were waiting to load at the Bintulu terminal as of Tuesday, with loading dates for some of them pushed back slightly, shiptracking data showed. Kpler analyst Go Katayama said that typically there would be two to three LNG vessels waiting to load at Bintulu. The LNG tanker Dukhan was scheduled to load on Tuesday, Kpler data showed, but the ship was still waiting off Bintulu as of Tuesday afternoon. LSEG data on Tuesday showed that the loading dates for Dukhan and another tanker, Oceanic Breeze, were pushed back by a day to Sept. 7. Asian spot LNG prices increased last week amid the production issues at Bintulu and an unplanned outage at Australia's Ichthys LNG, rising 20 cents to $14.00/MMBtu on Friday.

Supply Disruptions, Maintenance Not Enough to Sustain Global Natural Gas Price Gains — European and Asian natural gas prices fell again on Tuesday amid weak demand, but the losses could be shortlived as concerns over potential supply disruptions persist. NGI's LNG export flow tracker chart. In Europe, the prompt Dutch Title Transfer Facility (TTF) contract fell 4% Tuesday to finish slightly above $12/MMBtu. It was the second straight session of declines following a period of strong gains in August, when the contract increased by 10% during the month. LNG plant outages, heavy Norwegian maintenance, ongoing geopolitical tensions in Russia, Ukraine and the Middle East, as well as hotter weather, all combined to push prices higher.

Egypt counts on foreign funds to buy gas as power crisis worsens --Saudi Arabia and Libya have financed the purchase of gas cargoes worth at least $200 MM to help Egypt ease its energy crisis this summer amid a steep decline in domestic gas output, two industry sources familiar with the matter said. Egypt needs some $2 B worth of gas to cover summer demand through October, according to one of the two sources familiar with the government's plan, but a hard currency crisis means it lacks funds to fully cover imports of liquefied natural gas (LNG). "Without support from our friends in the Gulf, we won't be able to pay for these shipments," one of the sources said. He added officials were looking to raise more money from allies. The two sources said Saudi Arabia had financed three of the 32 LNG cargoes Cairo has bought so far this year, which according to Reuters calculations are worth around $150 MM at current prices. Libya bought one cargo in July worth around $50 MM with funds of the Libyan National Oil Corporation, the sources added. Egypt’s gas bill and funding from Saudi Arabia and Libya have not been previously reported. A spokesperson for Egypt's petroleum ministry said gas tender details were confidential. The Saudi government, Saudi Arabia's central bank and Libya's state energy firm NOC did not respond to requests for comment. Saudi Arabia and the United Arab Emirates have poured tens of billions of dollars into Egypt to support President Abdel Fattah Al-Sisi, who they view as an important ally. Egypt has had to resort to load-shedding in the last year to keep its grid functioning amid a lack of gas supply and rising demand, and the deepening energy crisis is straining Cairo's budget as it grapples with a heavy subsidies bill. Sisi's government has boosted fuel and food subsidies this summer, but those increases do not offset a 60% devaluation in the Egyptian pound since March 2024, leaving Egypt's growing population struggling with the rising costs of living. Egypt’s foreign debt reached $154 B in May, close to end-2023's all-time high of $168 B. "This financial burden (of the gas bill) comes at a critical time for Egypt as it faces troubles reining in its subsidy bill, which could have an impact on social security and overall stability,"

Russia's Gazprom says H1 net income more than tripled to $10.9 B --Kremlin-owned gas giant Gazprom said on Thursday its first-half net income more than tripled from a year earlier to more than 1 T roubles ($10.9 B), thanks to rising gas exports and cost controls. Gazprom plunged to a net loss of around $7 B in 2023, its first year in the red since 1999, as its gas trade with Europe, once its main sales market, dwindled due to the military conflict in Ukraine. Deputy CEO Famil Sadygov also said on Gazprom's Telegram channel that core earnings in the January to June period rose 19% year on year to 1.459 T roubles due to an improving oil trade and a rise in gas exports, including to China. He added that a rise in Gazprom's stake in the Sakhalin Energy oil and gas project in Russia's Pacific also boosted its financials, while adjusted net profit, the base for the dividend payment, reached 779 B roubles for six months. Gazprom said it swung to a second-quarter net income of 389.7 B roubles from a loss of 18.6 B roubles a year before. Russia has continued to diversify its trade away from the West, which has imposed numerous unprecedented sanctions against Russian business and individuals over the conflict with Ukraine, and cemented its ties with Asia, notably China. Gazprom's CEO Alexei Miller said earlier on Thursday that the group increased natural gas exports to China by 37% in the first eight months of the year.

U.S. Again Sanctions Russia’s LNG Shadow Fleet to Stymie Operations -The U.S. government has imposed additional sanctions to hinder operations at Russia’s Arctic LNG 2 by further targeting a shadow fleet of tankers assembled to move cargoes from the facility. None The United States added the New Energy and Mulan vessels to a list of seven others that were sanctioned late last month. The State Department also sanctioned the vessels’ owner, Gotik Energy Shipping Co., and commercial manager Pilo Energy Cargo Shipping OPC PVT Ltd. Both companies are based in India. The sanctions are part of a broader package first rolled out by U.S. officials last year against the 19.8 million metric tons/year Arctic LNG 2 facility.

LNG entities under U.S. sanctions to curb Russia's Arctic LNG 2 project - The U.S. has imposed sanctions on hundreds of entities and individuals for supporting Russia's war effort in Ukraine, including companies supporting the development of Russia's Arctic LNG 2 project and its shipment of liquefied natural gas (LNG), as well as other future energy projects. The Arctic LNG 2 project by Russia's Novatek is subject to Western sanctions over Russia's conflict with Ukraine. The project had been due to become Russia's largest LNG plant with eventual output of 19.8 million metric tons per year of LNG from three trains. Below are the companies designated by the U.S. state department, as well as the vessels they own or manage, according to data from Equasis and Kpler: The U.S. state department said on Aug. 24 the Pioneer and Asya Energy vessels had entered Russian waters in late July, and had shut off and manipulated their automatic identification system (AIS) to broadcast false locations. While producing a false AIS signature, Pioneer and Asya Energy loaded LNG from the Arctic LNG 2 facility on Aug. 1-3 and 9-11 respectively, said the state department, citing commercial satellite imagery. Ocean Speedstar Solutions and Zara Shipholding did not immediately respond to a request for comment. In another round of sanctions on Sept. 5, the U.S. state department said New Energy used deceptive shipping practices, including shutting off its AIS, to load cargo from Arctic LNG 2 via a ship-to-ship transfer with the Pioneer vessel on Aug. 25. The four vessels have transshipped LNG from Russia's Yamal LNG project despite being originally intended for Arctic LNG 2 use, said the U.S. state department, adding that it is committed to blocking the expansion of Russia's existing LNG fleet. "Further, this transshipment of LNG by vessels with obfuscated ownership could eventually help Russia circumvent EU restrictions prohibiting the transshipment of Russian-origin LNG through European ports," it said. The state department also targeted Novatek China Holdings Co Ltd, a China-based firm established in August 2023 to market LNG from Arctic LNG 2. It also designated Russian construction firm Limited Liability Company Ekropromstroy used as a special purpose vehicle to sell equity stakes in Arctic LNG 2, and UAE-based Waterfall Engineering that provided parts to Arctic LNG 2 in 2023. The United States in addition designated several Russian-based companies involved in the development of the future Yakutia LNG project, one of the largest prospective LNG production projects in Russia. They include LLC Power of Yakutia, LLC Yakutstroiproekt and LLC Liquefied Natural Gas Yakutia.

Turkey Inks 10-Year, 4 Bcm Agreement to Buy U.S. LNG from Shell -Turkey’s state-owned Botaş Petroleum Pipeline Corp. is growing its LNG portfolio and the country’s potential as a natural gas hub with another long-term supply deal with a global market giant. A graph showing the amount of yearly LNG imports to Turkey from 2020 to September 2024. The firm, which controls Turkey’s extensive natural gas and oil pipelines and terminals, inked a 10-year agreement with Shell plc’s Middle East marketing arm for 4 Bcm, or around 2.9 million metric tons/year (mmty). Deliveries of liquefied natural gas from Shell’s U.S. portfolio are expected to begin in 2027.