US oil supplies are at a 13½ year low, but oil exports are at a 8 month high; SPR at a 19½ year low after biggest draw since August 2011; gasoline exports are at a 39 month high; distillate supplies are at a 95 month low; total oil + products supplies also at a 95 month low after across the board drawdowns; DUCs are lowest on record; 4.7 month DUC backlog is lowest in 7 years

oil prices rose this week for the first time in three weeks after a major Russian and Kazakh export pipeline was shut down while Saudi oil facilities were coming under increasing missile attacks...after falling 4.2% $104.70 a barrel last week as China locked down its financial and industrial hubs to control a new Covid outbreak, and as hedge funds reversed their earlier bullish oil bets ahead of a Fed interest rate hike, the contract price for US light sweet crude for April delivery opened higher and jumped $3 early Monday after a Houthi attack on a Saudi facility caused a temporary drop in output at an Aramco refinery and after weekend talks between Ukraine and Russia showed little signs of progress, and then rallied another 4% to settle $7.42 higher at $112.12 a barrel as European Union nations considered joining the US in an embargo of Russian oil...prices rose sharply again early Tuesday on escalating jitters over supply shortages due to the attack on Saudi facilities, coupled with EU talk of an embargo on Russian oil exports, but reversed to settled 36 cents lower at $111.76 a barrel after reports emerged that European Union foreign ministers were split on whether to join the US in banning Russian oil, as trading of the April oil contract expired... with the media now quoting the contract price for US light sweet crude for May delivery, which had been trading 2% lower than April oil and had settled Tuesday down 70 cents at 109.27 a barrel, that new lower oil price jumped in early Wednesday trading, as Russian and Kazakh crude exports via the CPC pipeline to the Black Sea coast were fully halted, raising fears that Moscow would interrupt energy supplies just as Biden arrived in Europe to press for military escalation against them, and then extended those gains after the EIA reported crude oil and fuel stockpiles fell last week as demand jumped to settle $5.66 cents higher at $114.93 a barrel...oil prices stalled while nearing 14-year highs in mixed trading early Thursday, as traders assessed the implications of the disruption of the Caspian Pipeline, which could remove up to 1 million bpd of crude oil from an increasingly tightened global market, but tumbled in afternoon trading to close $2.59 lower at $112.34 a barrel, after the EU failed to agree on a plan to boycott Russian oil, and on reports that exports from Kazakhstan's Caspian Pipeline Consortium terminal might partially resume...oil prices tumbled more than 3% early Friday in reaction to reports suggesting the Caspian Pipeline partially resumed operations at the Black Sea terminal after an inspection revealed limited damage to the loading infrastructure, easing concern that a prolonged disruption of Kazakhstan oil exports would exacerbate a shortfall of available supplies on the global oil market, but then flipped higher after reports of a big fire at the facilities of state-owned Aramco in the Saudi city of Jeddah, following a missile attack claimed by the Houthi rebels, and settled with a $1.56 gain at $13.90 a barrel, thus finishing $9.20 or 8.8% higher for the week, while the May oil contract itself, which had finished last week priced at $103.09 a barrel, logged a 10.5% gain...

natural gas prices also finished higher for the 5th time in six weeks, as forecasts turned cooler and demand from Europe increased....after rising 2.9% to $4.863 per mmBTU last week as near record LNG exports offset the bearish impact of rapidly receding winter weather, the contract price of natural gas for April delivery trended lower much of Monday as gas production increased and forecasts showed light weather-driven demand across most of the Lower 48, but moved higher in late trading to log a 3.7 cent gain at $4.900 per mmBTU, as traders focused more on spiking oil prices than on higher gas output and forecasts for milder weather....natural gas prices then jumped 6% on Tuesday on a shift to cooler weather forecasts and on record demand for US LNG exports and settled 28.7 cents higher at $5.187 per mmBTU, even as European natural gas prices were still six times higher than those in the US....prices inched up another 4.5 cents to a seven week high at $5.232 per mmBTU on Wednesday as forecasts for cooler weather and higher heating demand over the next two weeks continued to firm, and then continued to surge on Thursday even though natural gas in storage dropped by less than was expected in what might have been the final draw of the heating season to settle 16.9 cents higher at $5.401 per mmBTU....natural gas prices spurted 17.0 cents or 3% more to an 8 week high of $5.71 per mmBTU on Friday, after the Biden administration and EU leaders announced a deal to send an additional 15 billion cubic meters of LNG to EU countries in 2022 – about 1.5 Bcf/d — with “expected increases going forward,”....with natural gas prices thus rising every day this week, they thus closed 14.6% higher on Friday than their prior week's close, the biggest jump since January....

The EIA's natural gas storage report for the week ending March 18th indicated that the amount of working natural gas held in underground storage in the US fell by 51 billion cubic feet to 1,389 billion cubic feet by the end of the week, which left our gas supplies 366 billion cubic feet, or 20.9% below the 1,755 billion cubic feet that were in storage on March 18th of last year, and 293 billion cubic feet, or 17.4% below the five-year average of 1,682 billion cubic feet of natural gas that have been in storage as of the 18th of March over the most recent five years....the 51 billion cubic foot withdrawal from US natural gas working storage for the cited week was less than the average forecast for a 62 billion cubic foot withdrawal as expected by an S&P Global Platts survey of analysts, and it was also equally less than the average withdrawal of 62 billion cubic feet of natural gas that have typically been pulled out natural gas storage during the same week over the past 5 years, but it was still more than the 29 billion cubic feet that were pulled from natural gas storage during the corresponding week of 2021...

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending March 18th indicated that after a second straight big increase in our oil exports, we had to pull oil out of our stored commercial crude supplies for the twelfth time in 17 weeks and for the 28th time in the past forty-two weeks, despite another big increase to oil supply that could not be accounted for…our imports of crude oil rose by an average of 92,000 barrels per day to an average of 6,486,000 barrels per day, after rising by an average of 76,000 barrels per day during the prior week, while our exports of crude oil rose by an average of 908,000 barrels per day to an 8 month high of 3,844,000 barrels per day during the week, after our exports had risen 514,000 barrels per day the prior week...applying our oil exports to offset our oil supplies coming from imports, that meant that our effective trade in oil worked out to a net import average of 2,642,000 barrels of per day during the week ending March 18th, 816,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude oil from US wells was reportedly unchanged at 11,600,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 14,242,000 barrels per day during the cited reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,878,000 barrels of crude per day during the week ending March 18th, an average of 276,000 more barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net of 957,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US….so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from storage, from net imports and from oilfield production was 678,000 barrels per day less than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+678,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, essentially a balance sheet fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been a error or omission of that magnitude in this week’s oil supply & demand figures that we have just transcribed....however, since most everyone treats these weekly EIA reports as gospel and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

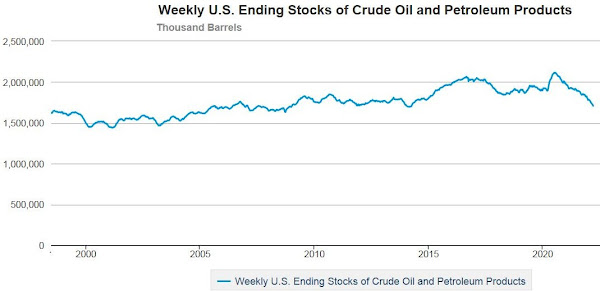

This week's 957,000 barrel per day decrease in our overall crude oil inventories left our total oil supplies at 984,722,000 barrels at the end of the week, the lowest since September 26th, 2008, or virtually a 13 1/2 year low (see graph above)...this week's oil inventory decrease came as 358,000 barrels per day were being pulled our commercially available stocks of crude oil, while 599,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve, which appears to include the first withdrawal under the recently announced 30,000,000 million barrel release from the SPR to address Russian related shortfalls, as well as an ongoing withdrawal under the administration's earlier plan to release 50 million barrels from the SPR to incentivize US gasoline consumption....including other withdrawals from the Strategic Petroleum Reserve under similar recent programs, a total of 84,824,000 barrels have now been removed from the Strategic Petroleum Reserve over the past 20 months, and as a result the 571,323,000 barrels of oil remaining in our Strategic Petroleum Reserve is now the lowest since May 31st, 2002, or at a new 19 1/2 year low, as repeated tapping of our emergency supplies for non-emergencies has already drained those supplies considerably over the past dozen years....based on an estimated average daily oil consumption of 18,000,000 barrels per day, the US will have roughly 28 1/2 days of oil supply left in the Strategic Petroleum Reserve after the current SPR withdrawal programs have run their course...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports slipped to an average of 6,242,000 barrels per day last week, which was still 9.1% more than the 5,723,000 barrel per day average that we were importing over the same four-week period last year….this week’s crude oil production was reported to be unchanged at 11,600,000 barrels per day as the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 11,200,000 barrels per day, while Alaska’s oil production fell by 10,000 barrels per day to 431,000 barrels per day but had no impact on the rounded national total....US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 11.5% below that of our pre-pandemic production peak, but 37.6% above the interim low of 8,428,000 barrels per day that US oil production had fallen to during the last week of June of 2016...

US oil refineries were operating at 91.1% of their capacity while using those 15,878,000 barrels of crude per day during the week ending March 18th, up from a utilization rate of 90.4% the prior week, and ia bit higher than the historical utilization rate for mid March refinery operations, when the need for seasonal maintenance typically causes rotating shutdowns…the 15,878,000 barrels per day of oil that were refined this week were 10.3% more barrels than the 14,389,000 barrels of crude that were being processed daily during week ending March 19th of 2021, when refineries were still recovering from winter storm Uri, and fractionally more than the 15,838,000 barrels of crude that were being processed daily during the week ending March 20th, 2020, when US refineries were operating at what was then a lower than normal 87.3% of capacity at the onset of the pandemic...

With the increase in the amount of oil being refined this week, gasoline output from our refineries was also higher, increasing by 424,000 barrels per day to 9,804,000 barrels per day during the week ending March 18th, after our gasoline output had decreased by 197,000 barrels per day over the prior week.…this week’s gasoline production was 14.3% more than the 8,577,000 barrels of gasoline that were being produced daily over the same week of last year, but 1.7% less than the gasoline production of 9,974,000 barrels per day during the week ending March 13th, 2020, after which gasoline production began to fall in response to the onset of pandemic impacts....meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 24,000 barrels per day to 4,979,000 barrels per day, after our distillates output had increased by 305,000 barrels per day over the prior week…with those increases, our distillates output was 8.2% more than the 4,601,000 barrels of distillates that were being produced daily during the storm impacted week ending March 19th of 2021, and 2.1% more than the 4,838,000 barrels of distillates that were being produced daily during the week ending March 20th, 2020...

Even with the big increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the seventh consecutive week, decreasing by 2,948,000 barrels to 238,043,000 barrels during the week ending March 18th, after our gasoline inventories had decreased by 3,615,000 barrels over the prior week....our gasoline supplies decreased again this week even though the amount of gasoline supplied to US users decreased by 307,000 barrels per day to 8,637,000 barrels per day, and even as our imports of gasoline rose by 190,000 barrels per day to 721,000 barrels per day, because our exports of gasoline rose by 378,000 barrels per day to a 39 month high of 1,058,000 barrels per day.…but even after 7 straight inventory drawdowns, our gasoline supplies were still 2.5% higher than last March 19th's gasoline inventories of 232,297,000 barrels, when shortages in the wake of Winter Storm Uri had resulted in back to back record draws, while they're slightly below the five year average of our gasoline supplies for this time of the year…

Meanwhile, with this week's modest increase in our distillates production, our supplies of distillate fuels decreased for the ninth time in ten weeks and for the 21st time in twenty-nine weeks, falling by 2,071,000 barrels to a 95 month low of 112,135,000 barrels during the week ending March 18th, after our distillates supplies had increased by 332,000 barrels during the prior week…our distillates supplies fell this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, jumped by 812,000 barrels per day to 4,516,000 barrels per day, and because our imports of distillates fell by 50,000 barrels per day to 172,000 barrels per day, while our exports of distillates fell by 484,000 barrels per day to 931,000 barrels per day....after thirty-five inventory decreases over the past fifty weeks, our distillate supplies at the end of the week were 20.8% below the 137,747,000 barrels of distillates that we had in storage on March 19th of 2021, and about 17% below the five year average of distillates inventories for this time of the year…

Meanwhile, after the big jump in our oil exports, our commercial supplies of crude oil in storage fell for the 21st time in 33 weeks and for the 36th time in the past year, decreasing by 2,5008,000 barrels over the week, from 415,907,000 barrels on March 11th to 413,399,000 barrels on March 18th, after our commercial crude supplies had increased by 4,345,000 barrels over the prior week…with this week’s decrease, our commercial crude oil inventories slipped to roughly 13% below the most recent five-year average of crude oil supplies for this time of year, but were still 29.4%% above the average of our crude oil stocks as of the third weekend of March over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels....since our crude oil inventories had jumped to record highs during the Covid lockdowns of spring 2020 and jumped again after last year's winter storm Uri froze off Gulf Coast refining, our commercial crude oil supplies as of this March 11th were 17.8% less than the 502,711,000 barrels of oil we had in commercial storage on March 19th of 2021, and were also 9.2% less than the 455,360,000 barrels of oil that we had in storage on March 20th of 2020, and 6.5% less than the 442,283,000 barrels of oil we had in commercial storage on March 22nd of 2019…

Finally, with our inventory of crude oil and our supplies of all products made from oil remaining near multi year lows, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR....the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 10,889,000 barrels this week, from 1,719,027,000 barrels on March 11th to 1,708,138,000 barrels on March 18th, after our total supply had decreased by 5,567,000 barrels over the prior week, and are now down by 80,295,000 barrels so far this year...that left our total supplies of oil & its products now at the lowest since April 4th, 2014, or at a new 95 month low, after this week's across the board drawdown in crude and product inventories..

This Week's Rig Count

The number of drilling rigs running in the US rose for the 66th time over the prior 78 weeks during the week ending March 25th, but it still remained 15.5% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US increased by seven to 670 rigs this past week, which was also 253 more rigs than the pandemic hit 417 rigs that were in use as of the March 26th report of 2021, but was still 1,259 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil was up by 7 to 531 oil rigs during this week, after rigs targeting oil had decreased by 3 during the prior week, and there are now 207 more oil rigs active now than were running a year ago, even as they still amount to just 33.0% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are still down 22.3% from the prepandemic oil rig count….meanwhile, the number of drilling rigs targeting natural gas bearing formations was unchanged at 137 natural gas rigs, while they were still up by 45 natural gas rigs from the 92 natural gas rigs that were drilling during the same week a year ago, and while they were still only 8.5% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…in addition to rigs targeting oil and gas, Baker Hughes lists two active "miscellaneous" rigs; one is a rig drilling vertically for a well intended to store CO2 emissions in Mercer county North Dakota, and the other is also a vertical rig, drilling 5,000 to 10,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track...the "miscellaneous" directional rig that had been set up to target the Marcellus shale in Schuyler County, New York last week appears to have already been shut down this week...

The offshore rig count in the Gulf of Mexico was up by two to fourteen rigs this week, with thirteen of this week's Gulf rigs drilling for oil in Louisiana waters and another rig drilling for oil in Alaminos Canyon, offshore from Texas....that's two more than the 12 offshore rigs that were active in the Gulf a year ago, when 10 Gulf rigs were drilling for oil offshore from Louisiana and two were deployed for oil in Texas waters…since there is not any drilling off our other coasts at this time, nor was there a year ago, those Gulf of Mexico rig counts are equal to the national offshore totals for both years....

In addition to those rigs offshore, we continue to have 3 water based rigs drilling inland again this week; one is a horizontal rig targeting oil at a depth of between 5000 and 10,000 feet, drilling from inland waters in Plaquemines Parish, Louisiana, near the mouth of the Mississippi, another is a directional rig drilling for oil at a depth of over 15,000 feet in the Galveston Bay area, while the third inland waters rig is a directional rig targeting oil at a depth of between 10,000 and 15,000 feet in St. Mary Parish, Louisiana...during the same week of a year ago, there were no inland waters rigs deployed..

The count of active horizontal drilling rigs was up by 4 to 610 horizontal rigs this week, which was also 230 more rigs than the 380 horizontal rigs that were in use in the US on March 26th of last year, but still 55.6% less than the record 1,374 horizontal rigs that were drilling on November 21st of 2014...at the same time, the vertical rig count was also up by four rigs to 25 vertical rigs this week, and those were also up by 3 from the 22 vertical rigs that were operating during the same week a year ago….on the other hand, the directional rig count was down by one to 35 directional rigs this week, while those were still up by 20 from the 15 directional rig that were in use on March 26th of 2021….

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of March 25th, the second column shows the change in the number of working rigs between last week’s count (March 18th) and this week’s (March 25th) count, the third column shows last week’s March 18th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 26th of March, 2021...

With the six rig increase in Texas and the three rig increase in the Permian basin, we'll start by checking the Rigs by State file at Baker Hughes for the Texas changes in that basin...there we find that four rigs were added in Texas Oil District 8, which encompasses the core Permian Delaware, and that another new rig was set up in Texas Oil District 7C, which includes those Texas counties in the southern part of the Permian Midland, but that a rig was pulled out of Texas Oil District 8A, which includes the counties of the northern part of the Permian Midland, at the same time...since the Texas Permian thus shows a net four rig increase while the national Permian basin count was up by three, we have to figure that the rig that was pulled out of New Mexico this week had been drilling in the far western Permian Delaware, in the southeast corner of that state, for the national Permian total to balance...

elsewhere in Texas, we find that a rig was added Texas Oil District 1, another rig was added in Texas Oil District 3, and another rig was added in Texas Oil District 4; any one of those three could have accounted for the rig added in the Eagle Ford shale, which stretches in a narrow band through the southeast quadrant of that state...finally, Texas also saw a rig pulled out of Texas Oil District 10, or the panhandle region...since that was probably a Granite Wash rig, and since the Granite Wash basin count was up by one rig, that strongly suggests that two rigs were added in the portion of the Granite Wash basin that lies in Oklahoma, to the east of the Texas panhandle...that would still leave two Oklahoma rigs unaccounted for by Baker Hughes, since all four of the rigs removed from the Cana Woodford necessarily had been drilling in the center of that state...

Among the other states showing changes this week, the two rig increase in Louisiana was due to the two new oil rigs set up to drill in the state's offshore Gulf of Mexico waters, and North Dakota had a rig added in the Williston shale, while a North Slope oil rig, not tracked by Baker Hughes, was pulled out of Alaska...meanwhile, while we know there was an oil rig added in the Haynesville shale, there is no indication of a change in either northern Louisiana or Texas Oil District 6, where the Haynesville shale is located....that could have only have happened if a rig in the same region that was not targeting the Haynesville had been pulled out at the same time, which would be unusual but not uncommon...note, for instance, that the Marcellus shale shows no change despite the addition of a natural gas rig in the Pennsylvania Marcellus because that PA rig was offset by the removal of the "miscellaneous" Marcellus rig, targeting neither oil nor gas, from Schuyler County, New York at the same time....the natural gas rig count change was then reduced to zero nationally because a natural gas rig was pulled out of Ohio's Utica shale at the same time...

DUC well report for February

Last week saw the release of the EIA's Drilling Productivity Report for March, which included the EIA's February data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions (under the report's tab 3)....that data showed a decrease in uncompleted wells nationally for the 21st consecutive month in February, as both completions of drilled wells and drilling of new wells increased in February, but remained well below average pre-pandemic levels...for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 156 wells, falling from 4,528 DUC wells in January to 4,372 DUC wells in February, which was the lowest number of US wells left uncompleted on record, and also 40.0% fewer DUCs than the 7,295 wells that had been drilled but remained uncompleted as of the end of February of a year ago...this month's DUC decrease occurred as 775 wells were drilled in the 7 regions that this report covers (representing 87% of all U.S. onshore drilling operations) during February, up from the 728 wells that were drilled in January, while 931 wells were completed and brought into production by fracking them, up by 20 from the 911 well completions seen in January, and up by 387 from the winter storm impacted 544 completions seen in February of last year....at the February completion rate, the 4,372 drilled but uncompleted wells left at the end of the month represents a 4.7 month backlog of wells that have been drilled but are not yet fracked, down from the 5.0 month DUC well backlog of a month ago, and the lowest backlog since December 2014, despite a completion rate that is still more than 20% below 2019's pre-pandemic average...

once again, both oil producing regions and natural gas producing regions saw DUC well decreases in February, while none of the major basins covered by this report reported a DUC well increase....the number of uncompleted wells remaining in the Permian basin of west Texas and New Mexico decreased by 86, from 1,482 DUC wells at the end of January to 1,396 DUCs at the end of February, as 343 new wells were drilled into the Permian basin during January, while 429 wells in the region were being fracked...meanwhile, DUCs in the Eagle Ford shale of south Texas decreased by 19, from 683 DUC wells at the end of January to a record low of 664 DUCs at the end of February, as 81 wells were drilled in the Eagle Ford during February, while 100 already drilled Eagle Ford wells were completed....in addition, DUC wells in the Niobrara chalk of the Rockies' front range decreased by 14, falling from 343 at the end of January to a record low of 329 DUC wells at the end of February, as 89 wells were drilled into the Niobrara chalk during February, while 103 Niobrara wells were being fracked....at the same time, there was also a decrease of 13 DUC wells in the Bakken of North Dakota, where DUC wells fell from 436 at the end of January to a record low of 423 DUCs at the end of February, as 62 wells were drilled into the Bakken during February, while 75 of the drilled wells in the Bakken were being fracked....meanwhile, the number of uncompleted wells remaining in Oklahoma's Anadarko basin decreased by 10, falling from 773 at the end of January to 761 DUC wells at the end of February, as 57 wells were drilled into the Anadarko basin during February, while 67 Anadarko wells were completed.....

among the natural gas producing regions, the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, fell by 14 wells, from 457 DUCs at the end of January to a record low of 443 DUCs at the end of February, as 84 wells were drilled into the Marcellus and Utica shales during the month, while 98 of the already drilled wells in the region were fracked....meanwhile, the uncompleted well inventory in the natural gas producing Haynesville shale of the northern Louisiana-Texas border region remained unchanged at 369 DUCs, as 59 wells were drilled into the Haynesville during February, while 59 of the already drilled Haynesville wells were fracked during the same period....thus, for the month of February, DUCs in the five major oil-producing basins tracked by this report (ie., the Anadarko, Bakken, Niobrara, Permian, and Eagle Ford) decreased by a total of 142 wells to 3,560 DUC wells, while the uncompleted well count in the major natural gas basins (the Marcellus, the Utica, and the Haynesville) decreased by 14 wells to 812 wells, although as this report notes, once into production, more than half the wells drilled nationally will produce both oil and gas...

+++++++++++++++++++++++++++

Cuyahoga County has more than 300 orphan oil and gas wells that may need plugging - The Ohio Department of Natural Resources has been busy letting contracts to plug orphan oil and gas wells across the state in recent years, including a number in Cuyahoga County, and business should pick up even more with a shot of federal money on the way. The wells aren’t just found in the countryside, but in backyards, beneath parking lots, near schools and under roads. “We’ve plugged them on the banks of Lake Erie,” said Jason Simmerman, well program engineer with the ODNR’s Division of Oil and Gas Resources Management. One of the wells, plugged in late 2017, was located 5 feet from a home in Westlake. It was discovered during landscaping of the front yard and after methane was smelled in the basement, Simmerman said. It’s not clear when the well was dug as is the case with most of the 330 documented orphan wells in Cuyahoga County that have yet to be plugged. An orphan well is one that is not only inactive but has no owner of record to assume responsibility. In most cases, the wells were abandoned before 1965, which is when the state created the Division of Oil and Gas Resources Management and started regulating the industry. Many of the wells go back to the days of John D. Rockefeller and Standard Oil. They could have been used for industrial or agricultural purposes or perhaps just to heat a home. Many are in rural areas, perhaps discovered by a farmer working his fields or a hunter traipsing through the forest, said division spokesman Adam Schroeder. “We really do rely on Ohio citizens to help us find these wells,” he said. But orphan wells are also found in populated areas, such as Westlake or Cleveland, although those wells may have been drilled when the area around them was more rural, and then only to go unnoticed or ignored when construction went up around them. Elsewhere in Greater Cleveland, the state has documented 423 orphan wells in Medina County, 389 in Lorain County, 121 in Summit County, 95 in Lake County, 29 in Portage County and eight in Geauga County. The state created its orphan well program in 1976 and it has since been funded by a severance tax on the extraction of oil and gas. Activity has picked up considerably since 2018 with passage of House Bill 225, which provided more money to plug orphan wells. Of the nearly 20,000 orphan wells documented by the state, it is ready to plug 1,053 of them. The pace of work is expected to pick up considerably now that the state has a huge influx of funding heading its way. Plugging the wells is “good from both a climate and a public health perspective,” said Nolan Rutschilling interim managing director of energy policy for the Ohio Environmental Council. Even if a well is buried or partially buried it still could be leaking methane, which is a far more potent greenhouse gas than carbon dioxide, he said, although it doesn’t remain in the atmosphere as long. “In addition to methane, benzene leaks out from the wells and that is really bad for folks with asthma and has negative effects on lung development in children,” Rutschilling said. If a well presents an immediate risk, perhaps due to a strong leak of oil and gas, it will be plugged on an emergency basis, Schroeder said. Otherwise, the wells are graded and prioritized, with some in close proximity to each other lumped together in a single contract.

Ohio's fracking industry - boon as promised or something less? - — A Cleveland State University report in 2012 predicted that Ohio’s then-growing fracking industry would add 66,000 direct and indirect jobs and $5 billion a year to the state’s economy by the end of 2014.Predictions only grew from there. A decade later with operations spread out across the eastern side of the state to cash in on shale drilling’s economic potential, many numbers are in. But they are fuzzy and tell different stories from different viewpoints. And like many things perceived political, the industry’s successes and failures depend largely on who is doing the explaining.There are more than 3,600 permits to operate such wells in Ohio. One estimate tied more than 200,000 jobs to the industry, directly or indirectly, though the state acknowledges that count is exaggerated. And Ohio ranks sixth in the country for natural gas production and 13th for oil production. Yet environmental concerns remain. For people who live there, the industry did bring jobs and money.. “There was an influx into the economy that would have never happened. But some opponents of the industry’s proliferation in Ohio and surrounding states have said any job growth would likely be short-lived. Sean O’Leary, a senior researcher at the environmental and public policy think tank Ohio River Valley Institute, said that after drilling is completed, it takes fewer workers to extract gas and oil. “And so as the industry gets more mature, it requires fewer and fewer employees,” O’Leary said.Ohio has 81 wells permitted for the Marcellus shale and 3,591 permits for the Utica shale as of March 12. Most are listed as active and producing, according to the Ohio Department of Natural Resources.There are also 226 active underground injection wells that companies use to store brine, the liquid waste produced after blasting underground shale with water, according to 2020 numbers from ODNR.Wells produced 180.2 million barrels of oil and 12.5 billion thousand cubic feet of gas from 2010 to 2020, according to ODNR. Companies also injected at least 142.5 million barrels of brine.During that time, the amount of severance tax – 10 cents per barrel of oil and 2.5 cents per thousand cubic feet of natural gas – grew nearly every year. In fiscal year 2011, the state collected $11.6 million from that tax, which also includes payments for coal and other mining operations. Last year, that number was more than five times higher – at $63 million – with all but about $5 million coming from natural gas, according to the Ohio Department of Taxation.Backers of such operations also like to boast that the industry directly and indirectly supports 208,000 jobs. And a study by researchers at CSU’s Maxine Goodman Levin College of Urban Affairs, done at the behest of the state’s economic development arm JobsOhio – said the industry directly and indirectly involving shale pumped $90.6 billion into the economy between 2012 and the first half of 2020. The state, by comparison, had a $695 billion total economy in 2020.But take some of the numbers that backers push with a grain of salt, say detractors. For example, the 208,000 jobs number was pulled out of a Department of Jobs and Family Services report from 2019. It counts every person the U.S. Census Bureau codes in its surveys as working both in the drilling field and the sectors supporting it.That includes, say, truck drivers, who haul a lot more than fracking materials. So there are more workers in that number than just those tied to oil and gas.

Gulfport Energy Discusses Merger With Rival Ascent Resources - Gulfport Energy Corp. has discussed merging with rival oil and gas explorer Ascent Resources, according to people familiar with the matter, as U.S. energy companies consider pairing up amid rebounding commodity prices. Gulfport and Ascent have discussed a transaction that would value the combined company at about $8 billion, said one of the people, who asked to not be identified because the matter isn’t public. Ascent management would run the company under one structure they’ve discussed, this person said. No deal is imminent and the companies could opt to not proceed with a merger, the people added. Gulfport rose 4% to close at $87.08 in New York trading Friday, giving the Oklahoma City-based company a market value of about $1.9 billion. Closely held Ascent Resources is backed by private equity firm First Reserve. Oil and gas explorers are increasingly looking to pair up as oil prices surge. PDC Energy Inc. agreed to buy Great Western Petroleum for $1.3 billion in February while Oasis Petroleum Inc. agreed to a $6 billion combination with Whiting Petroleum Corp. this month. Gulfport and Ascent are both active in the natural-gas rich Utica Shale of Ohio. Gulfport emerged from bankruptcy last year.

'Drill, buddy, drill!!!!' Inside FERC's $40M Rover fine - Tunneling under the Tuscarawas River was not going well. It was early April 2017, and construction on the Rover pipeline across Ohio had just begun. At a worksite near Canton, Ohio, a drilling device was stuck, probably caked with mud. And drilling fluid that should circulate back to the surface was instead disappearing underground.So the night foreman of a contractor crew started adding diesel fuel to the mix to lubricate the drill and get it unstuck, according to an enforcement report from the Federal Energy Regulatory Commission. Other workers followed his lead.It’s an old trick. It was also against the law.The drilling fluid — about 2 million gallons of it — later surfaced in a pristine wetland across the river. The mud was at least a foot and laced with the toxic fuel.Now, FERC is seeking a $40 million fine from Rover’s developer, Energy Transfer LP (Energywire, Dec. 17, 2021). In its report issued late last year, agency enforcement staff said the company fostered a speed-justifies-the-means attitude and passed it on to its roughly 12,000 contract employees, all the way to the laborers in the mud pits.“These violations were the product of a corporate culture that favored speed and construction progress over regulatory compliance that Rover pressed upon its contractors,” FERC’s enforcement staff wrote.Energy Transfer has blamed “a rogue employee” of a contractor for adding the diesel. In a filing this week, the company argued it cannot be held liable for the actions of its contractor.“What the Report does reveal,” company attorney William Scherman wrote in the filing this week, “is a stunning rush to judgment in a desperate attempt to blame the innocent for the alleged deliberate misdeeds of third parties multiple steps removed from those who stand charged.”Rather than pressure to speed up drilling, the filing suggested the contract crew was in disarray because of interpersonal problems, including rumors that another foreman was “having an affair with the wife” of one of his workers.Either way, critics say, the failures laid out by FERC investigators show the agency has little ability to prevent environmental damage once it approves a project.It took four years of investigation before the agency sought the $40 million fine last December. That case appears likely to be tied up in litigation for months or longer. Meanwhile, the pipeline has been pumping gas for more than three years, netting at least $1.4 billion. For Energy Transfer, critics say, the $40 million fine will simply be the cost of doing business.

Cleanup continues for oil spill at Oswego Harbor — Oil spill cleanup operations at Oswego Harbor have “greatly diminished signs” of the polluting agent, according to Oswego Harbor Generating Station officials. Cleanup efforts are still ongoing at Oswego Harbor after an underground oil pipe coming from the Oswego Harbor Power Station spilled “No. 6 fuel oil” into Lake Ontario earlier this month. Plant personnel — alongside officials from Mayor Billy Barlow’s office and the Oswego Fire Department, members of the U.S. Coast Guard, and State Department of Environmental Conservation (DEC) officials — continue to assess the source of the leak, as well as the volume of oil that spilled into the harbor, an Oswego Harbor Generating Station spokesperson said. So far, cleanup crews have deployed booms to contain the spread of the contaminant, as well as remove any visible traces of oil utilizing special sponges, the spokesperson said. No. 6 fuel oil, according to the National Oceanic and Atmospheric Administration (NOAA), is a “ dense, viscous oil produced by blending heavy residual oils with a lighter oil (often No. 2 fuel oil) to meet specifications for viscosity and pour point.” Information materials on oil spills provided by NOAA indicate that the fuel usually spreads into thick, dark, colored slicks that can contain large amounts of oil. An investigation is underway to determine the amount of fuel spilled, DEC officials said.

Eastern Shore Natural Gas pipeline expansion approved by Sussex County Council - The expansion of a natural gas facility in Sussex County clears its final hurdle in Delaware. The Sussex County Council voted 4 to 1 this week to approve a pipeline capacity expansion at Eastern Shore Natural Gas’ (ESNG) Bridgeville facility. Councilman John Rieley cast the lone “no” vote citing the pipelines’ location, “I love natural gas. I absolutely think it’s the right thing to do - to expand the plant. I just wish it wasn’t there - in that particular location. I’ve often used the example of - you don’t want to put a leather tanning factory in the middle of a residential neighborhood, which seems pretty intuitive. I have to be honest, this strikes me a little bit too close to that type of scenario. And I’m going to vote “no.” The plan has faced criticism by community members and environmental advocates. But Matt Parker - ESNG’s engineering manager - says the proposed facility and trucks involved will be 1,300 feet away from Phillis Wheatley Elementary School, and almost 1,100 feet away from the schools’ playground, “There’s no gas processing that takes place at this facility. So truck offloading and above grade piping are approximately 800 feet from the nearest residence, it’s over 1,000 feet from the playground at Phillis Wheatley Elementary School and 1,300 feet away from the school structure itself.” ESNG claims those distances are safe since the gas is only offloaded and not treated or processed. Parker noted that the proposed facility has three offload points with an approximate 18 trucks coming and going on a daily basis. The project still needs approval from the Federal Energy Regulatory Commission.

Plans for Gibbstown LNG terminal on hold - Plans to build New Jersey’s first terminal to export liquefied natural gas took a step back when the developer of a plant where natural gas would be turned into liquid agreed not to build it under a current permit. Bradford County Real Estate Partners said it wouldn’t have time to build the plant at Wyalusing, Pennsylvania before its air-quality permit expires in July. As part of a court settlement last week, the company will let that permit expire and apply for a new one if it decides to revive the project. That settlement came after three environmental groups in Pennsylvania challenged the project which would export liquefied natural gas from a new terminal on the Delaware River at Gibbstown in Gloucester County to overseas markets where the price of natural gas is much higher than in the U.S. Gas would be pumped from the abundant Marcellus Shale field in northeastern Pennsylvania to the Wyalusing plant. It would then be shipped via train or truck about 175 miles to a former DuPont explosives-manufacturing site at Gibbstown where it would be loaded onto ocean-going tankers. Construction of the dock has been approved by the Delaware River Basin Commission but is on hold from March 15 to Sept. 15 to protect migratory fish, including the endangered Atlantic sturgeon, to comply with permit conditions set by the Army Corps of Engineers. The project also faces a possible study of its environmental impacts by the federal government if the Federal Energy Regulatory Commission decides in a current review that it has jurisdiction. Any such review would add another delay. The project is fiercely opposed by environmentalists who say it would encourage more production of climate-warming natural gas by fracking, expose residents along the route to the risk of catastrophic explosions, and subject residents near the terminal to round-the-clock truck and train traffic. “This is a great victory for the environment and people’s health because the liquefaction plant is highly polluting and would spur new fracking to feed the LNG trains to Gibbstown, causing more pollution and health harms,” said Tracy Carluccio, deputy director of the environmental group Delaware Riverkeeper Network. While the project appears to be on hold at both ends of the route, it has not been abandoned by New Fortress Energy, parent of the Bradford County group, and of Delaware River Partners, which heads construction of the Gibbstown terminal. New Fortress told the Federal Energy Regulatory Commission that it plans to ship the liquefied gas to Gibbstown from the proposed Wyalusing plant, or from unspecified “third-party liquefaction facilities.”

Ohio Chamber wants Michigan pipeline to remain open – The Ohio Chamber of Commerce has joined the legal fight to keep a Michigan pipeline open, urging a U.S. district court to rule against Gov. Gretchen Whitmer as gas prices continue to rise across the country. The Ohio Chamber, along with five other business organizations that include the U.S. and Canadian chambers of commerce, filed a friend of the court brief in federal court supporting Enbridge’s ongoing attempt to keep the Line 5 pipeline open. U.S. District Court Judge Janet Neff is expected to rule any day on whether the case will be heard in state or federal court. The Ohio Chamber believes closing the pipeline under the Straits of Mackinac could be disastrous for consumers and developing U.S. oil production, rather than limiting it, should be the focus. “At a time when the national average for gas is over $4.30 per gallon, policymakers need to look for ways to drive up oil production domestically and in North America. That is why the Ohio Chamber continued our legal efforts to stop Michigan’s governor from single-handedly stifling oil production in our state,” Ohio Chamber President and CEO Steve Stivers said. “The Line 5 pipeline is a critical part of reducing America’s demand for Russian oil because it accounts for 43 percent of the Great Lakes’ refinery capacity and transports half a million barrels of crude oil per day.” Whitmer revoked a land use agreement in 2020 that allowed Enbridge to operate the pipeline, which has been stuck in legal disputes since then. Refineries in Toledo produce 30% of the gasoline and 35% of the diesel used in Ohio, according to the chamber, which added limiting production at the state’s refineries could drive up fuel prices by 10%. Ohio officials said closing the line would cause a significant disruption in the supply chain, which serves as a source of jet fuel for several regional and international airports, particularly in Cleveland and Detroit. It also could affect 20,000 Ohio jobs. Ohio lawmakers, Gov. Mike DeWine and Lt. Gov. Jon Husted also have pressured Michigan to allow the pipeline to remain open. Consumers throughout the Midwest may face up to a combined $5.9 billion annual spike in gas and diesel costs if Whitmer is successful in shuttering the Enbridge Line 5. Over the next five years, the cost could exceed $23.7 billion in additional transportation costs across the region. The estimates come from a study conducted by Consumers Energy Alliance.

Republicans Renew Criticism Of Efforts To Shut Key Oil Pipeline Amid Energy Crisis -Republicans have renewed pressure on the State of Michigan to reverse course on its attempts to shut down Line 5, an operational oil pipeline that supplies much of the Midwest with energy.The GOP leaders argued that Democratic Michigan Gov. Gretchen Whitmer should halt her effort to shutter the pipeline in light of the Ukraine crisis which has threatened a “global oil supply shock.” Since Russia invaded neighboring Ukraine, oil prices skyrocketed above $100 per barrel, touching $120 per barrel at one point, and gasoline prices have hit record levels nationwide.“Let’s get real, the last thing this nation needs is to choke off even more domestic energy production which will push gas prices even higher,” Michigan Rep. Fred Upton, the top Republican on the House Energy and Commerce Subcommittee on Energy, told the Daily Caller News Foundation. “Yes, Line 5 needs to be replaced. Shutting it down, however, would cause real economic havoc.”“Proceeding with replacement rather than shutting it down is the proper safe approach to protect the Great Lakes and our consumers,” he continued. Line 5, which was built in 1953, carries about 540,000 barrels of oil and gas per day from Canada to Michigan, according to the pipeline’s operator, Enbridge. The pipeline provides energy to several Midwestern states, including Michigan, Pennsylvania, Ohio and Indiana. The pipeline transports 4.2-7.8 million gallons of refined products to Michigan per day, including the majority of the state’s propane supply. Shutting Line 5 would lead to refineries in Michigan, Ohio and Pennsylvania receiving about 45% less crude oil leading to a 14.7-million-gallon-per-day shortage of gas, diesel and jet fuel in the region, according to Enbridge. But in late 2020, Whitmer revoked a 1953 easement allowing Enbridge to operate pipelines in the state after asking the company to halt operations over environmental concerns. Enbridge then filed a federal lawsuit against Whitmer, arguing that the authority to regulate international pipelines was given to the federal government.“Line 5 is absolutely essential for not only northern Ohio, but also for Michigan,” Republican Ohio Rep. Bob Latta, a member of the House Energy and Commerce Committee, told the DCNF in an interview. “When you look at it, it’s over 540,000 barrels of product that goes through it a day and it has a $5 billion economic impact into our area.”

Ohio Lt. Gov blasts Michigan Gov. Whitmer for 'unreasonable, irresponsible' effort to shut down oil pipeline - Republican Ohio Lt. Gov. Jon Husted is calling out Michigan Gov. Gretchen Whitmer for her efforts to shut down a major oil pipeline that carries Canadian oil across the Midwest. Whitmer, a Democrat, contends that Enbridge Energy’s Line 5 poses a risk of a "catastrophic" oil spill in the Great Lakes. She and Michigan Attorney General Dana Nessel have launched legal challenges to close the pipeline built in 1953 that moves oil through northern Wisconsin and Michigan to refineries in Ontario.The ongoing Line 5 dispute is getting renewed focus at a time of high gas prices, a ban on Russian oil imports and efforts to boost oil and gas supplies domestically. Husted said Michigan needs to end its legal effort to shut off a friendly source of energy from the Canadian pipeline. Whitmer's actions threaten Ohio's economy and could deliver more pain at the gas pump, the Republican said."With what’s going on with Russia and Ukraine, I think the world is learning right now that we can't be dependent on other nations for the supply of our oil and gas who are adversarial to us," Husted told Fox News Digital in an interview. "We can work with nations who are allies — in this case, with Canada and Line 5 — but Michigan is being unreasonable and irresponsible with their actions."Ohio Lt. Gov. Jon Husted is calling out Michigan Gov. Gretchen Whitmer for her efforts to shut down the Line 5 oil pipeline that supplies crude oil to Ohio refineries. (Governor Jon Husted's office)The Russia-Ukraine war, however, hasn’t prompted the Whitmer administration to end its pipeline fight. Nessel, the Michigan AG, recently said she hopes the Biden administration would be more "vocal" on shutting down the pipeline and contends that the impact on Michigan gas prices would be "incredibly minimal.""I do wish that the Biden administration would be even a fraction as vocal about the importance of shutting down Line 5 as Justin Trudeau and his government have been about, you know, maintaining a pipeline that has outlasted its lifespan by, you know, two times," Nessel reportedly told the Royal Oak Area Democratic Club in March. The increased consumer energy prices have signaled to Whitmer a need to develop alternatives to oil, rather than become more dependent on fossil fuels, her office claimed.

Pro-Line 5 businesses, critics argue whether legal fight should be in federal court - Dueling court filings in recent days pit certain business interests against others in the legal fight between Michigan’s governor and Enbridge over the Canadian company’s Line 5 pipeline. Amicus briefs filed a few days apart last week in federal court by the Great Lakes Business Network and a group of six large chambers of commerce argue opposing sides of the battle between Gov. Gretchen Whitmer and the energy transportation company. The governor wants Enbridge’s countersuit tossed out of federal court after she dropped her case to halt the flow of Line 5. Whitmer opted to instead support the pending case state Attorney General Dana Nessel filed against the company, also meant to halt the pipeline’s use. Representatives from the chambers argued to keep Enbridge’s case in federal court as a matter of national energy policy, while the business network officials want state authorities to shut down Line 5 because of the oil spill risk it poses to freshwater in the Great Lakes. “At a time of geopolitical uncertainty, energy security has taken on a renewed importance. Given the current disruptions to energy supplies and rapid increases in prices at the pump, we need to be firing on all cylinders to provide consumers with safe and reliable access to a menu of energy sources,” said Mark Agnew, Canadian Chamber of Commerce senior vice president of policy and government relations. The U.S. Chamber joined Canada’s in the brief filing, along with state chambers from Michigan, Ohio, Pennsylvania, and Wisconsin. The briefs are the latest blows in the bout over the fate of the section of Enbridge’s Line 5 pipeline that runs beneath the waters of the Straits of Mackinac between the Upper and Lower peninsulas as a shortcut for the Canadian company. The segment is a section of the pipeline that daily moves about 23 million gallons of crude oil and natural gas from Alberta oil fields to petrochemical refineries in Sarnia, Ontario, picking up some fuel from northern Michigan along the way. The chambers argue only the federal government can make interstate oil pipeline decisions, but that’s just not true, said Bentley Johnson, federal government affairs director for the Michigan League of Conservation Voters. He said the location of the disputed section of pipeline in the water is what makes it inherently unsafe and as a result, a state matter. “Enbridge could put every pipeline safety measure available to the industry on Line 5 and it would still be an unacceptable threat to our state to have it sitting on the bottom of the Great Lakes, vulnerable to ship anchors and other threats. The State of Michigan has the legal and moral duty and obligation to protect these water resources that they manage in the public trust, and so the case belongs in state court, to be decided by state judges and decision-makers,” he said. The brief filed by the business network – a collection of tourism and freshwater-dependent companies across Michigan – argues any underwater Line 5 rupture would devastate the economy across the Great Lakes Basin. Further, it contends such an ecological disaster would have far larger negative effects than any economic hardship Enbridge would experience should it lose its shortcut through Michigan.

Big Oil in the Mackinac Straits Is a Disaster Waiting to Happen --“Native American sovereignty supersedes Big Oil’s authority.” This was the thought that occurred to me as I made my way home from Lansing, through the Mackinac Straits, the body of water that connects Lake Michigan to Lake Huron, last month. I had just made a presentation to the Mackinac Straits Corridor Authority (MSCA) as part of the Indigenous community’s ongoing battle to shut down a 1950s-era oil pipeline built and operated by the Canadian company Enbridge. Given the volume of water that passes through the straits and the direction of the currents in the area, the University of Michigan Water Center has determined that the Mackinac Straits are the very worst place in the Great Lakes for an oil spill to happen. The pipeline should not be there at all, but now Enbridge wants to go even further, blasting a new underground tunnel beneath the straits to replace the existing underwater pipeline. A broad coalition of Michiganders have come together to oppose Line 5, including Michigan Governor Gretchen Whitmer and Attorney General Dana Nessel.The MSCA was created by the state’s former Republican Governor Rick Snyder during his last days in office as a rubber-stamp organization to legitimize Enbridge’s interests. So we were not surprised when the authority granted Enbridge permission to move forward on the project. But a storm is coming. An elder woman from my tribe once recounted an Anishinaabek prophecy to me: A black snake would come to our land and try to poison our waters—but would end up uniting our people as never before. This has come to pass. In an unprecedented action, all 12 federally recognized tribes in Michigan came together to write a joint letter to President Joe Biden, arguing that Enbridge’s black snake under the straits violates treaties that the United States made with us, as sovereign nations, when it forced us to cede our land. The Standing Rock movement woke me up—as it did so many Native people of my generation. The following year, I returned to Michigan, and worked as a visual artist and musician in Detroit. I soon became increasingly interested in the water that surrounds us in the Great Lakes region. After all, the Anishinaabek first migrated here from the east hundreds of years ago because of a prophecy that requires us to protect the water.

Enviros say GOP, oil industry are using high gas prices to fearmonger about pipeline shutdowns ⋆ Gas prices have soared in recent weeks amid inflation and the Russian invasion of Ukraine, with some Democrats raising concerns about price gouging.Although they’re starting to drop, many Republicans and oil companies are still using gas prices to criticize Democrats President Joe Biden and Gov. Gretchen Whitmer for efforts to shut down oil pipeline projects.This is not the first time GOP lawmakers have focused on gas prices to make the case against the decommissioning of Line 5 and other pipelines. But when gas prices reached a record average high of $4.33 per gallon on March 11, the highest since 2008, that argument has ramped up.On his first day in office, Biden revoked the Keystone XL pipeline extension permit, which would have transported tar sands oil across three states — Montana, South Dakota and Nebraska. In Michigan, Whitmer and Attorney General Dana Nessel have been working to stop the Canadian-owned Line 5 pipeline in the Straits of Mackinac.Right-wing media has been a key place for pro-pipeline arguments. In the fall, as Line 5 lawsuits between Enbridge and the state of Michigan played out, GOP lawmakers, conservative figures and media ramped up the pro-pipeline rhetoric and put a highly politicized lens on the debate, as the Advance previously reported.Those include a tweet from GOP gubernatorial candidate Ryan Kelley, claiming that “Biden and his progressive leftist agenda [are] taking aim at Line 5” (despite Biden still not taking a public stance on the pipeline); and remarks from groups and lawmakers in office slamming both Biden and Whitmer over Line 5. That rhetoric has reemerged as gas prices took off. “Whitmer wants higher gas prices,” is the title of a Wall Street Journal editorial last week. Arguing that a Line 5 shutdown would raise costs at the pump for Midwesterners, the editorial heavily cites a newstudy from Consumers Energy Alliance (CEA) that claims Midwesterners will spend “at least $23.7 billion more on gasoline and diesel” in the five years following a shutdown.The nonprofit Consumers Energy Alliance is a front group for the energy industry that pushes pro-oil and gas messaging in the United States, according to SourceWatch.Enbridge spokesperson Ryan Duffy, referring to the CEA report, said it is “clear that a shut-down of Line 5 would only add to the current disruption of the energy market, and would hurt small businesses and the hard-working families in Michigan and throughout the region, at a time when they can least afford it.” But environmentalists say the attempt to connect currently high gas prices with these pipeline shutdowns is nothing more than empty rhetoric.“What’s been alarming to me is how that report is being picked up as fact,” said Beth Wallace, National Wildlife Federation (NWF) Great Lakes campaign manager, “whereas several other reports that use sourcing and facts and regional dynamics are being brushed off.”

Illinois AG files suit against Marathon over crude oil spill | ksdk.com— The Illinois Attorney General is suing an oil company after more than 160,000 gallons of crude oil leaked into Cahokia Creek. When a leak was identified in the Marathon Pipe Line near Edwardsville, Illinois, Virginia Woulfe-Beiley was initially satisfied with the response. "Illinois regulators took really swift action containing and determining the cause of the leak,” said Virginia Woulfe-Beiley. However, the Sierra Club-Piasa Palisades member said she was shocked when she found out more than 160,000 of crude were spilled into Cahokia Creek. "My first thoughts really went to public safety, clean air, clean water, and the wildlife in our area,” said Woulfe-Bailey. "Unfortunately, we have seen a number of animals that have had to be treated for exposure to the pipeline release,” said Andrew Armstrong, Chief of the Environmental Bureau of the Illinois Attorney General’s Office. That's why the Illinois Attorney General's Office is stepping in. "It's a very serious case in terms of the amount of the release,” said Armstrong. “That's why our office is acting so quickly." A lawsuit filed against Marathon Pipe Line in Madison County Court alleges multiple violations of the Illinois Environmental Protection Act. "This amount of oil can create fumes that can threaten public health,” said Armstrong. “Certainly it has already impacted the environment and the surrounding river and wetlands." A Marathon spokesman says the company has already removed more than 5,300 cubic yards of contaminated soil along with more than 11,000 barrels of oil and water. "We need to see a complete and total cleanup of the release,” said Armstrong. “We need to make sure that Marathon is taking all actions it can to prevent all future releases in our state." "We're hoping that it's a long time before we see anything else like this,” said Woulfe-Beiley. “We have to stay vigilant." As part of its lawsuit, the state of Illinois is seeking civil penalties of $50,000 for each violation of the Illinois Environmental Protection Act and Illinois Pollution Control Board regulations, as well as an additional penalty of $10,000 for each day of each violation

Cleanup of big Edwardsville oil spill continues, but pipeline concerns persist - An oil spill in Edwardsville unleashed an estimated 165,000 gallons of crude oil into Madison County waterways earlier this month. It’s among the largest local spills on record — but for residents near the spill site, it wasn’t clear at first that anything was wrong. The first local observation started with a smell. On March 11, the Edwardsville Fire Department alerted residents on Facebook to “multiple calls this morning for an odor of natural gas in the air.” But it wasn’t natural gas. Instead, it was an oil spill from Marathon Petroleum, which maintains a 75-mile pipeline that runs for part of its length parallel to Cahokia Creek. On Wednesday’s St. Louis on the Air, Edwardsville resident Toni Oplt recalled detecting the smell but not knowing what it meant: One of her neighbors believed that a work crew was tarring a road. Days later, another complained the smell was giving her headaches. Oplt is an environmental activist, a member of the Sierra Club and chairperson for the Metro East Green Alliance. She argues Edwardsville could have done more to alert residents to the environmental disaster taking place inside its borders. Although the city did share the alert and updates from its Fire Department to its main Facebook group, officials didn’t reach out to those directly affected. Said Oplt, “For people like myself, for community members, it becomes a long series of questions that don't get answered.” Cahokia Creek and the bike trail alongside it are frequented by nature lovers and young people during the warmer months, Oplt said. She’s concerned about health effects. On March 12, one day after the spill was first reported, Oplt snapped a photo from the trail where it passes over the creek — the picture shows a sheen of oil sliding across the water’s surface. In a statement to St. Louis on the Air, Marathon Petroleum said that its crews are continuing to work along the area of the spill near the Cahokia Creek. The statement added that the spill is being “monitored 24 hours a day for impacted wildlife and audible deterrent is being used to keep any animals from entering the affected area.” In an earlier statement, the company claimed it had already recovered between 2,200 and 3,000 barrels of oil that had spilled from the pipeline, KMOV reported. Hannah Flath, communications coordinator for Sierra Club Illinois, cautioned that Marathon’s recent actions appear limited to the short-term problems raised by the spill. “The Metro East area, and really Illinois more broadly, is unfortunately at risk for these incidents because of the network of pipelines underneath the ground,” she said. “We are of course at the center of the country, which makes us home to more miles of fossil fuel pipelines and most other states, putting our communities at risk.” On Monday, the St. Louis Post-Dispatch reported on “the web of pipelines that crisscross the St. Louis region” — and the prevalence of oil spills. Reporters Bryce Gray and Janelle O’Dea revealed the numbers behind the incidents: 432 combined spills in Missouri and Illinois since 2020, 72 resulting in spills of 1,000 gallons or more; 36 spills exceeded 10,000 gallons, while 13 — not including the recent Edwardsville spill — exceeded 100,000 gallons. Flath said those numbers raise a bigger issue about the pipelines running beneath our feet. It’s not just about keeping them well-maintained and less likely to spill, she said, “but also to ultimately do whatever we can to end our reliance on these pipelines.” “Down the road, we need to think about not just this spill,” Oplt said. “We need to think about the next one.”

Amazon's NKY cargo hub spills 1,700 gallons of jet fuel — The Kentucky Energy and Environment Cabinet says a mechanical failure caused a jet fuel spill at Amazon Inc.’s air cargo hub at CVG Airport in Hebron, Ky., but the March 15 spill was contained before it caused environmental damage. An incident report from the Cincinnati/Northern Kentucky International Fire Department said Amazon mechanics initially estimated the spill at between 15,000 and 16,000 gallons of jet fuel. But Amazon later informed the airport that the spill was 1,700 gallons, or 13% of the fuel tank that had a defective valve. “The incident was handled in accordance with our approved environmental containment and remediation plans and at no point did it present any safety concerns to personnel or operations at our facility,” said Amazon spokeswoman Alisa Carroll. John Mura, spokesman for the environmental cabinet, said the spill was contained. “The fire department flushed the material into the drainage system that leads to an oil-water separator,” Mura said. “An environmental contractor pumped out the spillage and there is no indication that water ways were impacted.” James McCloud, environmental inspector on Kentucky’s emergency response team, said it was one of the largest fuel spills he could recall at CVG in the last several years.

Jury boosts landowners' compensation for Bent Mountain property taken by Mountain Valley Pipeline - A jury ordered Mountain Valley Pipeline to pay $523,327 Thursday for a prime piece of Bent Mountain real estate that it took, against the owners’ wishes, using its power of eminent domain. The company building a natural gas pipeline first offered about $119,000 for an eight-acre easement through the 560-acre tract. After the Terry family refused to sell, Mountain Valley took possession of a 125-foot-wide right of way and quickly began cutting trees on land that includes old-growth forests, meadows and the headwaters of Bottom Creek. Four years later, company attorneys argued this week that the Terrys deserved $151,850 for their loss. The jury saw it differently, awarding most of the $570,000 the family had sought. The verdict in Roanoke’s federal court came after four days of often conflicting testimony from appraisers who were asked to put a price on land that has been with the Terry family for seven generations. “I think it was a great thing for the jury to do,” said Frank Terry, who lives in a circa-1890 farmhouse on property that he jointly owns with his brother and sister, John Coles Terry and Elizabeth Terry Reynolds. “I don’t want them on my property, and if I could I’d keep them off,” Terry said of construction crews building the deeply controversial project that slices through the rural heart of the New River and Roanoke valleys. Joe Sherman, a Norfolk attorney who represented the family, told the jury that the only measure of justice would be to award just compensation, or the difference between the fair market value of the land before and after it was condemned for the pipeline. “The Terrys can’t stop this project,” he said. “That’s been decided. So their only remedy is money.” Jurors were asked to sort through the work of four different appraisers, who offered widely different values and accounting methods in testimony that was both dry and sometimes contentious. Joseph Thompson, a Roanoke appraiser hired by Mountain Valley, said he found the property to be worth $1.2 million before the taking. The pipeline easement reduced the value by 12%, he testified, which worked out to a just compensation figure of about $150,000. The Terrys countered with an initial assessment of $1.9 million and a diminution of 30%. That put just compensation at $570,000, Sherman told the jury. In 2017, after proposing a 303-mile pipeline that would run through West Virginia and Southwest Virginia, Mountain Valley began to approach landowners in its path. About 85% of the property owners agreed to sell their land, the company says. Those who did not – including the owners of about 300 parcels in Southwest Virginia – were sued by Mountain Valley, which had the power of eminent domain on its side. Over the years, eminent domain has traditionally been used for government projects to take private land for a public good, such as the construction of highways. But the Natural Gas Act gives private companies like Mountain Valley the authority to condemn land for pipelines when there is a determination of public necessity, which the Federal Energy Regulatory Commission found in 2017. U.S. District Judge Elizabeth Dillon ruled the company had the right to immediate possession of the land in early 2018. Tree cutting began shortly afterward, and Mountain Valley was allowed to work out just compensation for the owners in the years that followed.

With construction at a standstill, Mountain Valley Pipeline looks for solutions -Adding a splash of yellow to the drab winter landscape, dozens of excavators and bulldozers sit in rows on a gravel lot, idled by the latest stop in construction of the Mountain Valley Pipeline. Developers had hoped the equipment would be in the field by now, finishing work on a natural gas pipeline that was supposed to be done four years ago. But on a mild afternoon last week, crews loaded one of the excavators onto a tractor-trailer bound for a different construction job, one with more promise. Mountain Valley — which lost two permits this year to a federal appeals court that has repeatedly struck down its government-issued approvals — is facing the greatest danger of collapse since the $6.2 billion infrastructure project was authorized in 2017. While construction remains at a standstill, efforts to revive the pipeline continue on several fronts: Attorneys for Mountain Valley have asked the full 4th U.S. Circuit Court of Appeals to reconsider decisions by a three-judge panel, which in late January struck down a permit allowing the pipeline to pass through the Jefferson National Forest and the following week invalidated an opinion from the U.S. Fish and Wildlife Service that work would not jeopardize endangered species. U.S. Sen. Joe Manchin of West Virginia is calling for legislative or executive action to advance the project. The 303-mile pipeline will start in the Mountain State before passing through the Roanoke and New River valleys. And with Russia’s invasion of Ukraine tightening the global energy market, supporters of Mountain Valley say it’s needed more than ever for a steady supply of natural gas. Seeking legal relief A federal appellate court based in Richmond — and in particular, three judges on the 15-member court — has been perhaps the sharpest thorn in the side of a joint venture of five energy companies that make up Mountain Valley Pipeline LLC. Chief Judge Roger Gregory and judges Stephanie Thacker and James Wynn have presided over 12 cases in which environmental groups challenged permits issued to Mountain Valley and the Atlantic Coast Pipeline, a similar project that was canceled in 2020 as legal problems mounted. “That panel’s record speaks for itself,” pipeline attorneys wrote in a recent court filing, stating that all but two of the 12 contested permits have been vacated or stayed over the past four years. On March 11, a petition filed by Mountain Valley asked the full Fourth Circuit to consider the decisions of the three-judge panel in a rare proceeding known as an en banc hearing. “The consequences of the panel’s actions are grave,” the petition states. “Its errors have trapped Mountain Valley and the agencies in a perpetual loop, ordered to redo work that was neither arbitrary nor capricious, knowing that revised analysis will yet again be subject to inappropriately aggressive review.”