US oil exports rose to a record high, even with US oil supplies at a 20½ year low, the Strategic Petroleum Reserve at a new 38 year low, & total oil + oil products supplies at a 17½ year low..

US oil prices finished higher for the first time in three weeks as US oil & fuel inventories shrunk and our oil exports rose to a record high....after rising 0.5% to $85.05 a barrel last week (even as the quoted price of oil ended lower due to the expiration of the higher priced November contract), the contract price for the benchmark US light sweet crude for December delivery fell in Asian trading on Monday as traders feared weak oil demand and a global economic downturn after Chinese data showed a 2% drop in their oil imports, and slumped lower in New York as the bearish Chinese data was compounded when Xi Jinping was given a third five-year term, dashing hopes that Beijing would pivot away from Xi's demand-sapping zero-COVID policy, but partly recovered to settle 47 cents lower at $84.58 a barrel as traders tried to gauge what might happen to supply and demand after the US midterms, and whether U.S. and global economic recessions could be avoided...oil prices fell more than 1 percent again early on Tuesday, reflecting lingering concerns about the outlook for global demand, particularly in China, but then followed Wall Street prices higher, as the dollar tumbled and energized markets, while traders continued to evaluated the potential for slowing commodities demand against near-term supply tightness. and settled with a 74 cent gain at $85.32 a barrel after Saudi Energy Minister Abdulaziz bin Salman warned that using emergency oil supplies to manipulate oil prices now might be painful in the months to come....oil prices pushed even higher early Wednesday, finding additional support from acute and widening diesel shortages along the East Coast that are heightening concern over historically low inventory levels heading into the heating season, and then surged nearly 3% to settled $2.59 higher at $87.91 after the EIA reported record U.S. crude exports and that refiners operated at higher-than-usual levels for this time of year, with the dollar's weakness adding support....oil prices continued to rise in early Asian trade on Thursday, driven by record US crude exports and a weaker dollar, and then spiked after the BEA reported that U.S. gross domestic product had expanded more than expected in the third quarter, and hung on to settle $1.17 higher at a two week high of $89.08 a barrel, on the expectation that a US economic rebound would bolster demand for oil, even if the possibility of interest rate hikes weighed on other markets...however, oil prices turned lower in Asia on Friday, after Chinese cities had ramped up Covid-19 curbs late on Thursday, sealing up buildings and locking down districts in a scramble to halt widening outbreaks, and gave back all of Thursday's gains to settle $1.18 lower at $87.90 a barrel as China widened its Covid-19 curbs, though losses were limited by the strong rebound in U.S. and German economies...hence, US oil prices finished the week with a 3.35% gain, as US fuel stockpiles dropped and exports rose to a record high, signaling robust demand despite recent bearish economic trends...

meanwhile, natural gas prices also finished the week higher for the first time in 10 weeks, boosted by the shift of price quotes to the higher priced December contract....[NB: while oil contract prices are presently lower in the future months, natural gas contract prices are higher for the winter months...hence, recent contract expirations have been lowering oil price quotes, but raising natural gas price quotes] after falling 23.2% to a seven-month low at $4.959 per million BTU last week on mild weather forecasts, expectations of easing demand, and rapidly rising inventories, the contract price of US natural gas for November delivery slid to a fresh seven-month low early in the Monday session, but quickly reversed as traders found value in the oversold contract and pushed it 24.0 cents higher to settle at $5.199 per mmBTU, the first increase in 7 trading sessions, on a technical rebound and on expectations that demand would rise once LNG export plants finish maintenance in the coming weeks...natural gas prices advanced for a second straight session on Tuesday amid forecasts for colder weather patterns, production interruptions and the looming expiration of the November contract, and settled 41.1 cents higher at $5.613 per mmBTU....however, natural gas prices reversed lower in early trading Wednesday amid a continued lack of early winter heating demand, but steadied as traders balanced expectations that demand would rise once LNG export plants exit maintenance outages against forecasts that demand will remain low through at least early November, and settled just seven-tenths of a cent lower at $5.606 per mmBTU...natural gas prices then fell on Thursday after the weekly storage report came in below already modest market expectations, and trading in the November contract ended 42.0 cents lower on the day at $5.186 per mmBTU, while the December contract, which would be the front month on Friday, fell 24.4 cents to $5.875 per mmBTU...thus, with the contract price of US natural gas for December delivery being quoted on Friday, prices slid from that level and settled down 19.1 cents at $5.684 per mmBTU amid light demand, strong production and forecasts for large storage injections, but still ended 14.6% higher on the week, with most of that due to the contract shift, while the December contract, which had finished last week priced at $5.472 per mmBTU, finished just 3.9% higher...

The EIA's natural gas storage report for the week ending October 21st indicated that the amount of working natural gas held in underground storage in the US rose by 52 billion cubic feet to 3,394 billion cubic feet by the end of the week, which still left our gas supplies 142 billion cubic feet, or 4.0% below the 3,536 billion cubic feet that were in storage on October 21st of last year, and 197 billion cubic feet, or 5.5% below the five-year average of 3,591 billion cubic feet of natural gas that were in storage as of the 21st of October over the most recent five years....the 52 billion cubic foot injection into US natural gas working storage for the cited week was lower than the average forecast for an injection of 59 billion cubic feet from a Reuters poll of analysts, and was much less than the 88 billion cubic feet that were added to natural gas storage during the corresponding week of 2021, and also less than the average injection of 66 billion cubic feet of natural gas that had typically been added to our natural gas storage during the same week over the past 5 years...

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending October 21st indicated that due to two and a quarter million barrels per day of extra US oil supplies that could not be accounted for, we had oil left to add to our stored commercial crude supplies for the 5th time time in 8 weeks, and for the 21st time in the past 48 weeks, despite record shipments of crude oil exports....Our imports of crude oil rose by an average of 273,000 barrels per day to average 6,180,000 barrels per day, after falling by an average of 156,000 barrels per day during the prior week, while our exports of crude oil rose by 991,000 barrels per day to a record of 5,129,000 barrels per day, which together meant that the net of our trade in oil worked out to an import average of 1,051,000 barrels of oil per day during the week ending October 21st, 718,000 fewer barrels per day than the net of our imports minus our exports during the prior week. Over the same period, production of crude from US wells was reportedly unchanged at 12,000,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have averaged a total of 13,051,000 barrels per day during the October 21st reporting week…

With our oil exports at a record high, we'll include a historical graph of them below, where you can see that prior to the end of 2014, US oil exports, except for those allowed under NAFTA, had been negligible because they had been banned 40 years earlier, in the wake of the Arab oil embargo. The ban on US oil exports was lifted in a spending bill that Congress passed during the last week of 2015, part of a compromise that Obama agreed to in order to avoid a government shutdown...as you can see, the recent export spikes clearly beat the previous oil export highs by a large margin...

Meanwhile, US oil refineries reported they were processing an average of 15,436,000 barrels of crude per day during the week ending October 21st, an average of 114,000 fewer barrels per day than the amount of oil that our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 118,000 barrels of oil per day were being pulled out of the varied supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures from the EIA for the week ending October 21st appear to indicate that our total working supply of oil from net imports, from oilfield production, and from storage was 2,266,000 barrels per day less than what our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+2,266,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed....moreover, since last week’s EIA fudge factor was at (+1,025,000) barrels per day, that means there was a 1,241,000 barrel per day difference between this week's balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the changes to supply and demand from that week to this one that are indicated by this week's report are off by that much, rendering those comparisons complete nonsense...however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 118,000 barrel per day decrease in our overall crude oil inventories left our oil supplies at 841,663,000 barrels at the end of the week, which was our lowest total oil inventory level since December 14th, 2001, and therefore at a 20 1/2 year low.….Our oil inventories decreased this week as an average of 370,000 barrels per day were being added to our commercially available stocks of crude oil, while 488,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve. That draw on the SPR was another installment of the emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump" (sic), that was intended to supply 1,000,000 barrels of oil per day to commercial interests over a six month period from its inception to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising until that time, and has been fluctuating in recent weeks because the administration has been attempting to use the Strategic Petroleum Reserve to manipulate prices on a weekly basis; moreover, last week Biden announced a final 15,000,000 barrel release from the Strategic Petroleum Reserve while simultaneously announcing he'd buy crude to replenish the SPR if prices fall to or below the $67-72 a barrel range, effectively putting a floor under oil at that price.....Including the administration's initial 50,000,000 million barrel SPR release earlier this year, their subsequent 30,000,000 barrel release, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 251,014,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 27 months, and as a result the 401,718,000 barrels of oil that still remain in our Strategic Petroleum Reserve is now the lowest since May 25, 1984, or at a new 38 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's SPR releases. The total 180,000,000 barrel drawdown of the current release program, now scheduled to run through December, will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to an average of 6,025,000 barrels per day last week, which was 4.0% less than the 6,277,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be unchanged at 12,000,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 11,600,000 barrels per day, while Alaska’s oil production was 23,000 barrels per day higher at 431,000 barrels per day, but had no impact on the final rounded national total. US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 8.4% below that of our pre-pandemic production peak, but was 23.7% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021...

US oil refineries were operating at 88.9% of their capacity while using those 15,436,000 barrels of crude per day during the week ending October 21st, down from their 89.5% utilization rate during the prior week, but within the historical utilization rate range for mid October. The 15,436,000 barrels per day of oil that were refined this week were still 2.6% more than the 15,048,000 barrels of crude that were being processed daily during week ending October 22nd of 2021, but 3.5% less than the 15,998,000 barrels that were being refined during the prepandemic week ending October 25th, 2019, when our refinery utilization was at 87.7%, also within the normal range for mid October...

Even with the decrease in the amount of oil being refined this week, the gasoline output from our refineries was a bit higher, increasing by 58,000 barrels per day to 9,437,000 barrels per day during the week ending October 21st, after our gasoline output had increased by 213,000 barrels per day during the prior week. This week’s gasoline production was still 6.3% less than the 10,072,000 barrels of gasoline that were being produced daily over the same week of last year, and 7.3% below the gasoline production of 10,184,000 barrels per day during the week ending October 25th, 2019. At the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 45,000 barrels per day to 4,978,000 barrels per day, after our distillates output had increased by 160,000 barrels per day during the prior week. With that, our distillates output was 8.7% more than the 4,581,000 barrels of distillates that were being produced daily during the week ending October 22nd of 2021, and 0.2% more than the 4,970,000 barrels of distillates that were being produced daily during the week ending October 25th 2019...

Even with the increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the 9th time in 12 weeks; and for the 29th time out of the past thirty-eight weeks, decreasing by 1,478,000 barrels to 207,890,000 barrels during the week ending October 21st, after our gasoline inventories had decreased by 114,000 barrels during the prior week. Our gasoline supplies fell by more this week because the amount of gasoline supplied to US users rose by 252,000 barrels per day to 8,930,000 barrels per day, while our imports of gasoline rose by 180,000 barrels per day to 655,000 barrels per day, and while our exports of gasoline rose by 95,000 barrels per day to 876,000 barrels per day. And after 29 gasoline inventory drawdowns over the past 38 weeks, our gasoline supplies were 4.2% lower than last October 22nd's gasoline inventories of 9,323,000 barrels, and about 6% below the five year average of our gasoline supplies for this time of the year…

Meanwhile, with the decrease in our distillates production, our supplies of distillate fuels increased for the 14th time in 23 weeks and for the 23rd time in the past year, rising by 170,000 barrels to 106,357,000 barrels during the week ending October 21st, after our distillates supplies had increased by 124,000 barrels during the prior week. Our distillates supplies rose again this week as the amount of distillates supplied to US markets, an indicator of our domestic demand, decreased by 194,000 barrels per day to 3,878,000 barrels per day, while our exports of distillates rose by 171,000 barrels per day to 1,215,000 barrels per day, and while our imports of distillates rose by 28,000 barrels per day to 139,000 barrels per day.. But after fifty-one larger inventory withdrawals over the past seventy-nine weeks, our distillate supplies at the end of the week were were 14.9% below the 124,962,000 barrels of distillates that we had in storage on October 22nd of 2021, and about 20% below the five year average of distillates inventories for this time of the year...

Meanwhile, despite the increase in our oil exports, our commercial supplies of crude oil in storage rose for the 14th time in 27 weeks and for the 21st time in the past year, increasing by 2,588,000 barrels over the week, from 437,357,000 barrels on October 14th to 439,945,000 barrels on October 21st, after our commercial crude supplies had decreased by 1,725,000 barrels over the prior week. After this week's increase, our commercial crude oil inventories remained to 2% below the most recent five-year average of crude oil supplies for this time of year, but were over 30% more than the average of our crude oil stocks after three full weeks of October over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. And even though our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this October 21st were 2.1% more than the 430,812,000 barrels of oil we had in commercial storage on October 22nd of 2021, while 10.7% less than the 492,427,000 barrels of oil that we had in storage on October 23rd of 2020, and 0.2% more than the 438,853,000 barrels of oil we had in commercial storage on October 25th of 2019…

Finally, with our inventories of crude oil and our supplies of all products made from oil near multi-year lows over the most recent months, we are also continuing to watch the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR. With the modest inventory decreases we've already noted for this week, the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 5,070,000 barrels this week, from 1,631,600,000 barrels on October 14th to 1,626,530,000 barrels on October 21st, after our total inventories had decreased by 6,097,000 barrels during the prior week. This week's decrease left our total liquids inventories down by 161,903,000 barrels over the first 42 weeks of this year, and at the lowest level since March 25th, 2005, or at a new 17 1/2 year low... ...

This Week's Rig Count

The number of drilling rigs running in the US fell for the seventh time in thirteenth weeks, and only for the 14th time over the past 109 weeks during the week ending October 28th, but even so, they're now 3.2% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US decreased by 2 rigs to 768 rigs this past week, which was still 224 more rigs than the 544 rigs that were in use as of the October 29th report of 2021, but was 1,161 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil decreased by 2 to 610 oil rigs during the past week, after the number of rigs targeting oil had increased by 2 during the prior week, while there are still 166 more oil rigs active now than were running a year ago, even as they amount to just 37.9% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are still down 10.7% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations was down by one to 156 natural gas rigs, which was still up by 56 natural gas rigs from the 100 natural gas rigs that were drilling during the same week a year ago, even as they were only 9.7% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008….

Other than those rigs targeting oil and natural gas, Baker Hughes also reports that two "miscellaneous" rigs continued drilling this week: one was a directional rig drilling to between 5,000 and 10,000 feet on the big island of Hawaii, while the other was a vertical rig drilling more than 15,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track....While we have seen no details on either of those, in the past we've identified various "miscellaneous" rigs as being exploratory, for carbon dioxide storage, and for utility scale geothermal projects...a year ago, there were were also two such "miscellaneous" rigs running...

The offshore rig count in the Gulf of Mexico was down by 1 to 13 rigs this week, with 11 of this week's Gulf rigs drilling for oil in Louisiana's offshore waters, and two rigs drilling for oil offshore from Texas....the Gulf rig count is now unchanged from the 13 Gulf rigs running a year ago, when 12 of rigs were drilling for oil offshore from Louisiana and one was deployed for oil offshore from Texas...in addition to rigs drilling in the Gulf, we still have an offshore directional rig drilling to between 5,000 and 10,000 feet for natural gas in the Cook Inlet of Alaska, while a year ago, drilling offshore from Alaska had shut down for the winter...

In addition to rigs running offshore, there are still two water based rigs drilling through inland bodies of water this week; those include a directional rig drilling to between 10,000 and 15,000 feet, inland in St Mary Parish, Louisiana, and a directional rig drilling for oil at a depth greater than 15,000 feet in Terrebonne Parish, Louisiana; the inland waters rig that had been drilling for oil in Cameron Parish, Louisiana was shut down this past week...a year ago, there were two rigs drilling on inland waters...

The count of active horizontal drilling rigs was down by 5 to 703 horizontal rigs this week, which was still 220 more rigs than the 483 horizontal rigs that were in use in the US on October 29th of last year, but just 51.2% of the record 1,374 horizontal rigs that were drilling on November 21st of 2014....on the other hand, the directional rig count was up by 2 to 43 directional rigs this week, and those were up by 11 from the 32 directional rigs that were operating during the same week a year ago…meanwhile, the vertical rig count was unchanged at 22 vertical rigs this week, which was down by 7 from the 29 vertical rigs that were in use on October 29th of 2021….

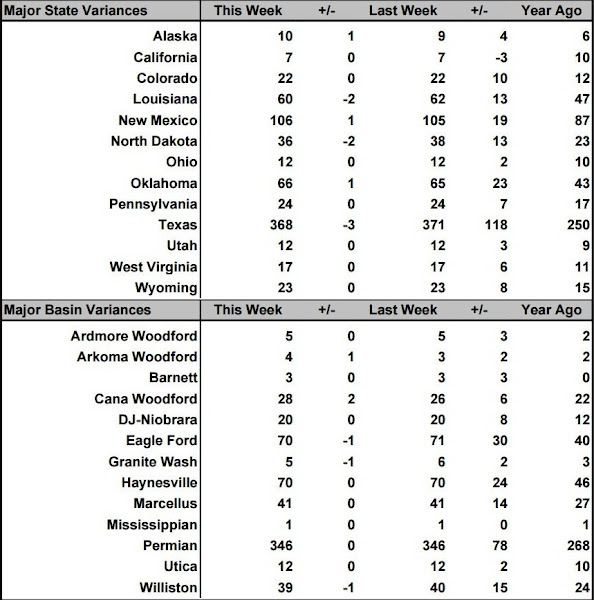

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of October 21st, the second column shows the change in the number of working rigs between last week’s count (October 21st) and this week’s (October 28th) count, the third column shows last week’s October 14th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 29th of October, 2021...

we'll again start by checking the Rigs by State file at Baker Hughes for changes in Texas, where the count was down 3 rigs this week; first, there was a rig pulled out of Texas Oil District 1, which accounts for the decrease in the Eagle Ford shale; there was also a natural gas rig pulled out of Texas Oil District 8, which is the core Permian Delaware, but since that indicates a rig decrease in the Texas Permian, and since the national Permian basin count was unchanged, we can conclude that rig added in New Mexico was set up to drill in the far west Permian Delaware...however, since the Permian basin count for this week shows an increase of two, to 343, oil rigs and a decrease of two natural gas rigs to three, we can also conclude that the new New Mexico rig was targeting oil, and that in some other area of the Permian, a natural gas rig was pulled out while an oil rig was added that thus doesn't show up in our details...in addition, there was also a rig pulled out of Texas Oil District 10, which accounts for the decrease in the Granite Wash basin..

elsewhere, the Louisiana rig count was down by two with the removal of an oil rig from the adjacent Gulf of Mexico and the removal of the inland waters rig that had been drilling for oil in Cameron Parish; the North Dakota rig count was down by two with the removal of two oil rigs from the Williston basin, but the Williston basin was only down by one because an oil rig was added in the Williston in Montana, this time in Fallon county, at the same time...meanwhile, the rig added in Alaska was on the North Slope, where all Alaskan land drilling is now taking place, and even though the Oklahoma rig count was only up by 1, there were two oil rigs added in the state's Cana Woodford, and another oil rig added in the Arkoma Woodford; that means two rigs were removed from a basin or basins elsewhere in the state that Baker Hughes doesn't track...moreover, those basins that Baker Hughes doesn't track also account for the removal of four oil rigs and the addition of a natural gas rig, partly offsetting the Permian basin gas rig decrease...

++++++++++++++++++++++++++++++

Ohio Energy Leaders Agree – Energy Future is Not an “Either/Or” Moment, but an “And” Moment - Ohio’s natural gas and oil industry is committed to a dual track of lowering the industry’s carbon footprint while maintaining reliability and affordability, according to panelists at the Ohio Chamber of Commerce’s recent energy conference. Participants were confident that this is achievable through an all-of-the-above energy portfolio that unleashes domestic oil and natural gas while capitalizing on renewable innovation. On Thursday, energy leaders from across the value chain gathered for the Ohio Chamber’s “Energy Supply Chain: Present & Future” conference. Participants included oil and natural gas producers, pipeline operators, policymakers, renewable companies, and more, with questions largely centering on the energy transition and how various resources fit into the sustainable future.A key point reiterated was how Ohio – and the larger Appalachian region – is blessed with an abundance of natural gas resources by sitting on top of the Marcellus and Utica shales.The region’s Shale Revolution has provided enormous direct and indirect economic benefits for the state including new markets, jobs, wage-growth, and more. Jackie Stewart with Encino Energy, one of Ohio’s largest oil and natural gas producers, emphasized this point:“The majority of our oil produced here in Ohio are going to Ohio refineries. Ohio made natural gas is running through these pipes…that means huge economic benefits.” Adam Parker from pipeline company Enbridge added: “We [the energy industry] exist to fuel our quality of life…from charging our cell photos to heating our homes. All of us working together are a key enabler for Ohio’s economy.”

Ohio Drillers Say They are Ready to “Unleash American Energy” | Marcellus Drilling News - Yesterday, the Ohio Chamber of Commerce held its “Energy Supply Chain: Present & Future” conference at the Ohio Statehouse Atrium in Columbus. Participants and speakers included oil and natural gas producers, pipeline operators, policymakers, renewable companies, and more. Questions largely centered on the energy transition and how various resources fit into a so-called sustainable future. The upshot was that Ohio’s natural gas (mostly Utica, some Marcellus) is front and center as a driving force for Ohio energy, and the Ohio economy.

Ohio Senate Contest Features Two Candidates Who Profess Love for Natural Gas - InsideClimate News - In the race for Ohio’s open U.S. Senate seat, Rep. Tim Ryan, a Democrat, fought off a debate attack by talking about his fondness for natural gas. “In the Inflation Reduction Act, we’re going all in on natural gas,” Ryan said in an Oct. 11 debate in Cleveland. “I’ve been a natural gas proponent since I’ve been in Congress and we have to get this right. We need to increase our production of natural gas.” He is running against J.D. Vance, the investor and author, who also wants to see an increase in production of gas, a fossil fuel that contributes to climate change. It’s not difficult to see why some environmental advocates are leery of some of Ryan’s views. But Ryan’s voting record shows him to be firmly within his party’s mainstream, despite his emphasis on positions that appeal to the political center. Meanwhile, Vance casts himself as an outsider in the tradition of former President Donald Trump and has adopted much of Trump’s approach to energy and the environment, downplaying the risks of climate change and criticizing the transition to renewable energy and electric vehicles. The race shows how energy gets discussed in a state that ranks sixth in the country in natural gas production and where Democrats, with the exception of Sen. Sherrod Brown and Ohio Supreme Court justices, are on an extended losing streak in statewide races. With polls showing a dead heat, the race is surprisingly close, considering that Trump easily won Ohio’s electoral votes in 2016 and 2020. If Ryan were to win, it would be an upset that would help to tilt the Senate, now divided 50-50 between the parties, in Democrats’ favor. “I don’t think Democratic enthusiasm is functionally going to be a problem for Ryan,” said Kyle Kondik, managing editor of Sabato’s Crystal Ball at the University of Virginia Center for Politics, and an Ohio native. Inside Climate News contacted both candidates’ campaign offices and neither responded.

ODNR issues permit for injection well in Little Hocking amidst pollution fears - (WTAP) - The Ohio Department of Natural Resources has issued a permit for an injection well in Little Hocking. Some locals and the Little Hocking Water Association fear the project could pollute their drinking water.Linda Aller, a hydrogeologist with Bennett and Williams who works with the Little Hocking Water Association, explained, “They’re using these wells to dispose of all those unwanted liquids from drilling and fracking.”It will be owned by Arrowhead Road Services LLC, which already has another injection well in the area.There have been several local meetings held about the project. Click the links below to learn more about those meetings.The Little Hocking Water Association General Manager John Smith said the injection site is only about a mile away from their well field.Aller said the new Arrowhead injection well could interfere with improperly plugged orphan wells that might be in the area.“..., there’s a lot of wells that were drilled in the old days where no one knows where they really are that weren’t correctly plugged,” she explained.The consequences of that would be contaminated drinking water and environmental pollution, according to Aller. She explained that injection wells inject fluid into the ground, which creates pressure, which could force the fluid back up if there’s a hole from an orphan well underground.“If it comes back up, it can then move into the shallower formations, which are where you get your water supply from,” she said. The Ohio Department of Natural Resources said it cannot calculate the risk orphan wells pose but acknowledged that the risk is there.

EQT CEO Toby Rice sees opportunity for Appachian hydrogen hub - One of the leaders in the Pittsburgh region’s push toward a regional hydrogen and carbon capture storage hub said Appalachia is the perfect spot when it comes to the expected next step in the energy transition. “Appalachia is ideally suited to lead the charge in clean hydrogen production in the United States, given abundant, low-cost, low-emissions natural gas, interconnected infrastructure and storage, existing transportation networks and proximity to major end-use markets,” said Toby Z. Rice, president and CEO of Pittsburgh-based EQT Corp. (NYSE: EQT). Rice and EQT have been among the leading voices for the region’s move to build a hydrogen/carbon capture hub, a multibillion-dollar initiative to reduce and eliminate the emissions linked to climate change by revamping manufacturing, power and other energy uses to hydrogen. EQT is a founding member of Appalachian Energy Future, a group of companies that are working to build up awareness among policymakers and the public on the wisdom of hydrogen and carbon capture. It’s also joined the Appalachian Regional Clean Hydrogen Hub, also known as ARCH2, a consortium of EQT, the state of West Virginia, Battelle and others that want to build a hydrogen production facility in West Virginia and infrastructure in Ohio and Pennsylvania. ARCH 2 will be one of the groups seeking funding from an $8 billion opportunity from the federal government. Proposals are due in early November and full applications in February; a decision on the first stage of funding between eight and 10 burgeoning hydrogen hubs nationwide is expected in the second half of 2023. EQT is among the companies that would like to see hydrogen, which has a low emissions profile in an end use, created from Marcellus and Utica shale natural gas. That would ensure a future for natural gas, especially paired with technology that would capture any carbon emissions and then turn it into a solid that would either be repurposed into another product or transported as a liquid to be stored permanently underground. In a conference call with analysts, Rice said he was excited about the potential for the technology to decarbonize and at an attractive price. It’s not clear, he said, when that would happen and that EQT would temper its spending in the short term. “Before we would put any dollars, significant dollars, there, we need to understand the profitability of those,” Rice said. Cost is a major issue. But so is demand because, for the time being, natural gas is far cheaper than hydrogen. The hydrogen hub “is going to allow us to get past that chicken and the egg issue, and I think it’s going to be a really good example of the collaboration necessary to make these exciting zero carbon solutions a reality,” he said. “More to come.”

EQT 3Q Completed Wells & Production Drops, but Profits Rise | Marcellus Drilling News - EQT faced some strong headwinds during the third quarter of 2022, but the company still came out on top. The headwinds included third-party (mainly pipeline) outages beyond EQT’s control, as well as droughts that decreased the volume of water the company could lay hands on for fracking. As a result, the company brought online to sales just 16 new wells instead of the 22 to 32 forecasted. Production slipped too, to 488 Bcfe (billion cubic feet equivalent), down 7% from last year’s 3Q. That 488 Bcfe calculates out to be 5.30 Bcfe/d. On the plus side, the company generated net income of $684 million in 3Q22 vs. losing $1.98 billion in 3Q21, and it generated free cash flow of $591 million.

Sinkholes Attributed to Gas Drilling Underline the Stakes in Pennsylvania’s Governor’s Race - The Allegheny Front —Standing in her granddaughter’s yard in Carlisle, Pennsylvania, on a recent fall day, Lynde Blymier pointed to a patch of ground where the grass was sparse. On this foot-wide spot, dead leaves were scattered over what looked like freshly overturned earth, the color of red clay.According to Blymier, it was a sinkhole, and although this one was filled in, it was only one of a series of such holes that stretched behind her granddaughter’s home, past her great-grandson’s swing set and toys, in a surprisingly neat line that marched toward the edge of the property. One of the craters had a chair positioned over it to prevent tripping. “Everything starts as a little hole, a perfect circle,” said Blymier, 70, “and then starts to get deeper and bigger and bigger. They expand over time. Blymier has lived in this mobile home park for more than 30 years and works as its property manager, so she has extensive knowledge of the utilities connected to the site and of its construction in 1987. She first noticed changes on the property after Sunoco, the Texas-based oil and gas company, began construction of a section of the Mariner East II pipeline in 2017 that cuts through the property. Since then, she said, engineers who surveyed the area have estimated that Sunoco has lost over 300,000 gallons of drilling fluid in the site, which includes the mobile home park, storage units, an office building and a parking lot and is bordered by the Appalachian Trail, the Pennsylvania Turnpike and Interstate Highway 81. Earlier this year, Blymier and her neighbors thought they had finally found someone in government who could help them: the current state attorney general, Josh Shapiro. Now the Democratic candidate for governor, Shapiro has earned a reputation as the rare Pennsylvania politician who was willing to openly challenge oil and gas companies, often citing the state’s constitutional right to clean air and pure water.

As Nov. 8 election approaches, Wolf and Pa. lawmakers look to push through massive tax incentives for natural gas · Democratic Gov. Tom Wolf and top state lawmakers are hurriedly negotiating a massive economic development package that would encourage natural gas development in Pennsylvania. The proposed credits, totaling $180 million a year, are aimed at different industries including hydrogen production, milk processing, and biomedical research, according to draft bill language viewed by Spotlight PA. The incentives would sunset in 2045, putting the potential price tag of foregone state taxes at roughly $3.6 billion if the credits are claimed in full.Taken as a whole, the package would be even bigger than the record-setting $1.65 billion incentive Pennsylvania gave Shell for its plastic factory in Beaver County.With the Nov. 8 election fast approaching, such a deal — rumored since September — could appeal to both major parties and their allies in business and organized labor. But Wolf and lawmakers are running out of time to push it through before voters head to the polls.The legislature is scheduled to adjourn this week until late next month, and the two-year session ends on Nov. 30.It’s unclear if legislative leaders will be able to rally support for the package, but it is a priority. Both state Senate Majority Leader Kim Ward (R., Westmoreland) and state House Appropriations Committee Chair Stan Saylor (R., York) acknowledged ongoing talks last week.“The governor wants some things, we want some things,” Saylor said.A Wolf spokesperson did not immediately reply to a request for comment.The keystone of the proposed deal is an annual $50 million tax credit to incentivize hydrogen production in Pennsylvania, according to the draft language.The package would also set aside $50 million each in annual tax breaks for milk processing and medical research, and expand an existing tax credit for companies using fracked methane in manufacturing.Wolf signed the latter in 2020, which created $26 million a year in tax incentives over 26 years. The new proposed tax deal would expand that credit by $30 million but cut its timeline short.

Could a new LNG export terminal be coming to the Marcellus / Utica's backyard? - Without a doubt, the two biggest changes to U.S. natural gas markets in the last 15 years have been the Shale Revolution and the development of LNG exports. These completely upended the way gas flowed in this country, with the Northeast now home to the largest gas-producing basin and the Gulf Coast — including its fleet of LNG export terminals — now the U.S.’s largest demand center. Production growth in the Marcellus/Utica has stalled, however, largely due to the regulatory and legal challenges associated with building new pipeline takeaway capacity. One possible fix would be a new East Coast LNG terminal, which in addition to having easy access to cheap, almost-local gas would also be close to gas-hungry European markets. But just how likely is such a project? In today’s RBN blog, we discuss the advantages and hurdles of developing LNG export capacity on the East Coast.The Mid-Atlantic region already has one LNG terminal, of course — Cove Point LNG, on the Chesapeake Bay in Maryland (yellow diamond in Figure 1) — and we should look at that facility in depth before we discuss the potential for a second LNG export terminal close to the Marcellus/Utica. Cove Point is a single-train, 5.25-MMtpa (700 MMcf/d) liquefaction-and-export facility owned by Berkshire Hathaway. All of its feedgas comes from the Marcellus/Utica via contracts with two area upstream producers, Coterra Energy in Northeast Pennsylvania and Antero Resources in Southwest Pennsylvania and West Virginia. The producers also manage gas transmission from the production area to Dominion Cove Pipeline (purple line), which feeds into the LNG terminal. [….] Cove Point has shown itself to be a viable and highly competitive LNG exporter. Could the same be said for a second export terminal in the Mid-Atlantic region? First, it’s clear that there would be ample gas production available — the Marcellus/Utica has extraordinarily large proven reserves of gas that would be economic to produce even at much lower prices. There’s also decent in-region pipeline capacity in place to move gas around. Depending on the exact terminal location, it’s likely that only a “last-mile” pipeline would be needed to connect to a new LNG terminal.Are any plans in the works? Well, New Fortress Energy had been planning a floating LNG project on the New Jersey side of the Delaware River but it put that project on hold because of local opposition. For now, all eyes are on Penn American Energy, which has been developing Penn LNG (see artist’s rendering below), a proposed 7.2-MMtpa (950 MMcf/d, requiring about 1.2 Bcf/d of feedgas) facility that could be built at one of four locations along the Delaware River near Philadelphia. Although the final site has not been selected, many think it could be at the Marcus Hook Industrial Complex (green diamond in Figure 1), which is already an export point for the area’s NGLs. Marcus Hook (and the three other locations under consideration) could receive gas from Texas Eastern and Transco pipelines. Feedgas could be purchased from the nearby Transco Zone 6 Non-NY or TETCO M3 pricing hubs in Southeast Pennsylvania, both of which trade at a discount to Henry Hub for most of the year. Far more likely, however, is that deals will be made directly with upstream producers to supply the terminal, cutting the producers in on the sale of LNG, thereby giving producers exposure to premium export markets in exchange for feedgas supply. It’s an attractive option for Marcellus/Utica producers who are all too familiar with low in-basin prices and constraints to get their supply out.

Range Resources CEO Says Marcellus, Utica Shales Vital to Stabilize Natural Gas Markets - Fort Worth, TX-based Range Resources Corp is among the country’s largest natural gas producers, with nearly one million net acres in Pennsylvania targeting the Marcellus, Utica and Upper Devonian shale formations. “As we continue to witness a global energy crisis, it’s apparent that the world desperately needs access to abundant, safe, reliable and ethical fuel sources,” CEO Jeff Ventura told analysts during a call to discuss Range’s second-quarter earnings. “Families in Europe are facing real challenges that may not be solved this winter…a stark reminder that evolving energy policy will need to be thoughtful, prioritizing security, affordability, availability and reliability.” Ventura cautioned that certain regions of the United States “are not insulated from these challenges, as large population centers on the East Coast and New England could be faced with limited supplies this winter due to a lack of pipeline infrastructure.” He added, “As the U.S. and the world look for reliable, safe and affordable long-term energy solutions, we believe Appalachian natural gas, and particularly Range, is well-suited to meet the call…” Range believes that “increased Appalachian supplies will be critical” to meet projected growth in U.S. gas demand, particularly for LNG exports, Ventura said. “But in order for that to happen in a meaningful way, additional infrastructure…is necessary.” He noted that “permitting delays and cancellations of critical infrastructure projects have obviously been a challenge, resulting in inflated energy costs in the U.S. and abroad. But in the long run, we believe that common-sense policy and economics will win the day, and allow this great resource to provide life-sustaining fuel to the people who need it.”Within Pennsylvania, “the good news is that the natural gas industry polls well,” Ventura said, citing that candidates on both sides of the aisle support it. He highlighted a proposed liquefied natural gas export terminal envisioned for the Delaware River near Philadelphia that would connect Appalachian gas supply with global demand.

New England Utility Urges Biden to Declare Emergency to Avoid Fuel Shortage - New England’s largest utility is imploring President Joe Biden to start preparing emergency measures to prevent a potential wintertime natural gas shortage.The Federal Energy Regulatory Commission has “acknowledged for many months that New England will not have sufficient natural gas to meet power supply needs for the region in the event of a severe cold spell this winter,” Joseph Nolan, chief executive officer of Springfield, Massachusetts-based Eversource Energy, wrote in a letter to Biden. “This represents a serious public health and safety threat.”The White House didn’t immediately respond to a request for comment.Eversource’s appeal comes amid growing worries about widespread energy shortages in some of the most populated parts of the US. Heating oil already is being rationed in the New York City area as the coldest months of the year approach -- and diesel supplies essential to trucking are precariously low in the Northeast. Federal energy officials have warned that fuel availability in New England is “a primary concern.” Among the reasons: soaring global demand for US exports and limited pipeline capacity in the six-state region.In its letter Thursday, Eversource asked the White House to consider emergency authorities including use of the Defense Production Act as well as provide a waiver of the Jones Act, a century-old law that can raise shipping costs.Eversource provides electricity and natural gas service to about 4 million homes and businesses in Connecticut, Massachusetts and New Hampshire.

Mountain Valley Pipeline's permit to cross streams in West Virginia faces legal challenge --A state permit that allows the Mountain Valley Pipeline to cross streams and wetlands is muddied by the company’s past violations of water quality standards, environmental groups asserted Tuesday. In oral arguments to the 4th U.S. Circuit Court of Appeals, an attorney for the Sierra Club and other organizations asked that a certification granted last year by the West Virginia Department of Environmental Protection be struck down. Derek Teaney told a three-judge panel of the court — which has consistently ruled against Mountain Valley in the past — that the West Virginia state agency should have taken more care to prevent a possible recurrence of muddy runoff from construction sites along the pipeline’s path. The department’s determination that there was a reasonable assurance that future problems with erosion and sedimentation would not occur, while at the same time downplaying the nearly 140 citations it has issued against the company in the past, is “entirely implausible and internally inconsistent,” Teaney said. A ruling by the 4th Circuit is expected later in what is the third round of ligation involving stream crossings for the project. The Sierra Club also has filed a lawsuit against Virginia’s State Water Control Board, which awarded a similar water quality certification for the portion of the pipeline that passes through Southwest Virginia. Oral arguments in that case are scheduled for December. Teaney, an attorney for the nonprofit law firm Appalachian Mountain Advocates, began an 87-page filing with the following line: “West Virginia has long resisted the requirements of the Clean Water Act,” which he quoted from a 2018 opinion by the 4th Circuit. “We would submit that this is just the latest incarnation of DEP’s resistance,” he said of the state environmental agency’s most recent decision that favored a 303-mile natural gas pipeline that begins in West Virginia. During arguments to the Richmond-based appeals court, questions and comments from the three judges hearing the case suggested they were sympathetic to Teaney’s position, at least in some respects. “You have to look at the past as a predictor of the future,” Judge Stephanie Thacker said of Mountain Valley’s record of environmental noncompliance since construction of the pipeline began in 2018. The West Virginia agency has fined Mountain Valley a combined $569,000 for failing to maintain erosion and sedimentation control measures in 2019 and 2021. But in evaluating those cases in light of the company’s application for a new water quality certification, Department of Environmental Protection attorney Lindsay See said, the agency did not consider the 140-some violations surprising. An “overwhelming majority” of the infractions did not involve water quality, See said. In Virginia, the Department of Environmental Quality has cited the company more than 350 times. Mountain Valley agreed to pay a fine of $2.15 million in 2019. More recently, a construction site in Wetzel County, West Virginia, was written up in August by state regulators for discharging sediment-laden water that flowed downhill and into a tributary of Stout Run.

Court poised to block key Mountain Valley pipeline permit - A three-judge panel with a history of tossing out permits for the Mountain Valley pipeline appeared ready Tuesday to reject yet another approval for the natural gas project. During oral arguments, the 4th U.S. Circuit Court of Appeals analyzed a water permit certification for the pipeline and questioned whether the West Virginia Department of Environmental Protection had done enough to protect the state’s waterways from sedimentation. But the judges seemed to stop short of overturning the permit entirely. “Maybe I’ve just been here too long,” said the judge, an Obama pick. “[We] send this back; they go into a room and then enter these additional things in the record — does it cure it?” The embattled Mountain Valley pipeline has been the subject of a litany of lawsuits over its federal permits and has become a political symbol in Washington of the need to overhaul how major federal projects are approved and litigated. The pipeline, designed to carry gas 300 miles through West Virginia and Virginia, recently announced plans to pull back on an extension of the project into North Carolina. Appalachian Mountain Advocates attorney Derek Teaney, who represented the Sierra Club and other environmental challengers, said Tuesday that their complaint about the state water certification for Mountain Valley was not about a harmless agency error and called for the permit to be scrapped instead of sent back to state regulators. “We need to know what they are going to do so these violations don’t happen again,” he said. The environmental groups sued West Virginia DEP over its December 2021 certification that the Mountain Valley pipeline complied with state water quality standards under Section 401 of the Clean Water Act. The challenge to the approval comes after the 4th Circuit had previously blocked the pipeline developer from using a general water permit called Nationwide Permit 12 to conduct dredge-and-fill activities across waterways in the path of the pipeline. Teaney told the 4th Circuit on Tuesday that the West Virginia DEP had improperly relied on Mountain Valley’s compliance with a separate oil and gas construction stormwater permit to ensure that the project met water quality standards, but the state agency had not made stormwater permit compliance a condition of 401 certification. Meanwhile, Mountain Valley had violated the state stormwater permit 139 times and state water quality standards dozens of times, Teaney said.

Mountain Valley Pipeline halts eminent domain actions for Southgate extension - Mountain Valley Pipeline has decided to withdraw eminent domain actions against land in North Carolina the company sought for its Southgate extension, a 75-mile offshoot of the main pipeline that would carry gas from Pittsylvania south to Rockingham and Alamance counties. “As the timing, design, and scope of this project continue to be evaluated, MVP has elected to dismiss this action, believing that to be the appropriate course of action for the time being and a demonstration of its desire to work cooperatively and in good faith with landowners and communities along the pipeline’s route,” said the motion filed Friday in U.S. District Court for the Middle District of North Carolina. But the company asked for the dismissal without prejudice, which would allow it to pursue eminent domain actions against the properties again. Mountain Valley “has not abandoned this project,” the pipeline wrote. Shawn Day, a spokesperson for the MVP Southgate project, reiterated the motion’s language, adding, “Mountain Valley remains committed to the MVP Southgate project, which is needed to help North Carolina achieve its lower-carbon energy goals and meet current and future residential and commercial demand for natural gas in the region.” “Proceedings currently remain under way with respect to a small number of tracts” along the proposed Southgate route in Virginia, Day added. A condition of the Federal Energy Regulatory Commission’s approval of the Southgate project in 2020 was that construction of the extension would not begin until the company received the required federal permits for the mainline system and the Director of the Office of Energy Projects, or its designee, lifted a stop-work order and authorized the project. The pipeline regained life in August after FERC extended its October 2022 completion deadline by four years. Regulators said their decision was an administrative one and that the proceedings were not the proper time to revisit the project’s approval. At that time, a company spokesperson said the company remains committed to securing federal and state permits to bring the project into service in the second half of 2023. Mountain Valley has said the main line is 94% complete, although some opponents dispute the company’s numbers. However, Mountain Valley still lacks necessary permits to complete the pipeline. An effort by U.S. Sen. Joe Manchin, D-West Virginia, to force approval and completion of the project through federal legislation on permitting reform stalled this fall.

FERC taking comment on proposed pipeline expansion project targeting Wetzel County ...A subsidiary of the Mountain Valley Pipeline’s lead developer is planning a project that would include constructing roughly 4.5 miles of pipeline in Wetzel County to help transport gas to mid-continent and Gulf Coast markets. Equitrans LP, subsidiary of Canonsburg, Pennsylvania-based Mountain Valley Pipeline lead developer Equitrans Midstream Corp., has proposed the construction as part of the Ohio Valley Connector Expansion project. The project includes natural gas transmission pipeline and aboveground facilities in Wetzel County, Greene County, Pennsylvania and Monroe County, Ohio.

Study reveals soil moisture plays the biggest role in underground spread of natural gas leaking from pipelines - Soil moisture content is the main factor that controls how far and at what concentration natural gas spreads from a leaked pipeline underground, a new study has found. Pipeline operators need to factor how the amount of water found in surrounding soil affects gas movement when trying to determine the potential hazards posed by a pipeline leak, said SMU's Kathleen M. Smits, who led the study recently published in the journal Elementa that examined soil properties from 77 locations around the country where a gas leakage had occurred. "We don't need to look any further than Dallas or Georgetown, Texas to see where underground pipeline leaks have the potential to result in catastrophic outcomes," "We often see that such incidents are the result of a lack of clear protocols to detect the leaks or assess damage. That's why there should be more focus on the importance of environmental factors such as soil moisture and how to properly account for them in leak scenarios." In general the team found that methane gas leaking from a pipeline does not spread as far when the soil moisture content increases. That results in a higher concentration of methane gas close to the leak site in more moist soil, the study revealed. The opposite was true with drier soil. But Smits stressed that simply knowing how wet the ground is at the time of the leak is not enough to make conclusions about how soil moisture content impacts gas movement. The moistness of the soil -- or lack thereof -- at the time of leak triggers different complex behaviors in the soil when methane gas seeps into the same spaces as water and oxygen in the pores of the soil. Soil moisture content can also change over time because of weather and other factors such as seasonal water table levels. "You have to understand how the moisture controls both the movement and concentration together," Smits said. "This is something we can assist [pipeline owners] with going forward in addressing leak incidents." The research team looked at more than 300 soil samples from leak sites around the country. The samples -- which were taken at the time of the leak and again after the leak was repaired -- were weighed when they were wet. They were also weighed a second time after they had been dried out in an oven. "The difference in the dry and wet weights, linked with knowledge of the volume of the soil sample, allowed us to calculate the soil moisture," Smits explained. Other soil qualities like its texture and permeability were also examined by the team, but did not demonstrate as much impact on how natural gas moved belowground. In another study aimed at improving gas leak detection, Smits and researchers from CSU's Energy Institute found that there are instances where operating a mobile detection unit from the front or roof of a car were not as effective as walkers carrying a handheld detection instrument. "For example, if you just isolated the speed of travel -- comparing a person walking at 2 to 3 miles per hour versus a car driving at a slow speed of 20 to 30 mph -- the probability of detecting a leak drops from 85 percent for a walking survey to 25 percent for a car," Smits said. The study, published in the journal Environmental Pollution, showed that atmospheric stability also had an effect on mobile surveys. Atmospheric stability essentially determines whether air will rise, sink, or do nothing. Warm, less dense air rises (unstable), while cooler, more dense air sinks (stable). Air staying at the same altitude is considered neutral. Researchers found that mobile surveys conducted at speeds between 2 to 11 miles per hour got progressively less effective (from 85 percent to 60 percent) at finding a leak as the atmospheric stability went from extremely unstable conditions to extremely stable. Walking surveys conducted under these same conditions did not reflect variability. "Walking surveys find the most leaks, by far, but they are labor intensive and cost a lot of money," Smits noted. "This study shows that if operators want to use another method such as a mobile survey, they need to thoughtfully choose a suitable survey speed under different weather conditions to achieve a detection probability equivalent to the traditional walking survey."

Future of pipelines, Black school hinge on court NEPA fight - An upcoming federal appeals court battle could reset the rules for environmental reviews of major projects like power plants and highways — and determine the fate of a historic Virginia school built to educate Black children during the Jim Crow era. As the Army Corps of Engineers weighs a permit for a “mega landfill” to be constructed within 1,000 feet of the former Pine Grove Elementary School in Cumberland County, Va., the agency’s consideration of more data on the project’s health and cultural impacts could hinge on its adherence to a 2020 Trump-era rule that overhauled — critics would say gutted — requirements for National Environmental Policy Act reviews dating back to 1978. The Trump NEPA rule will come under scrutiny Wednesday when Wild Virginia and other environmental groups challenge the White House Council on Environmental Quality regulation before the 4th U.S. Circuit Court of Appeals. Advertisement “The changing landscape of the CEQ regulations and how the Army Corps of Engineers should or shouldn’t implement that makes it hard for the Pine Grove project to monitor what is going on,” said Cale Jaffe, a law professor at the University of Virginia. Former Pine Grove students and their descendants are working to preserve the two-room school as a cultural center and are urging the Army Corps in public comments to conduct a more thorough analysis of the impacts of the landfill, which would accept 5,000 tons of waste per day, six days a week. “We are adhering to the current NEPA regulations,” said Army Corps spokesperson Breeana Harris in an email. Under the Trump rules — which the Biden administration has not yet fully revised — the agency could decide to conduct an environmental assessment of the proposed landfill near the Pine Grove school, instead of a more robust and detailed environmental impact statement. NEPA analysis is “sort of like a radar screen,” said Jaffe, who penned a “friend of the court” brief from Pine Grove school supporters backing the appeal from environmental groups to keep their challenge to the Trump NEPA rules alive. “It shows us what’s coming in and what’s happening,” he said. “And when you eviscerate the regulations under NEPA, the radar screen goes dark.”

US natural gas production and exports set new records - In 2021, both US natural gas marketed production and natural gas exports established new records, according to the US Energy Information Administration (EIA).Marketed, or wet, natural gas production (which includes both dry natural gas and natural gas plant liquids (NGPLs) such as ethane and propane) grew 3% in 2021 after declining in 2020. US natural gas exports, which have more than doubled since 2017, increased 26% in 2021.Natural gas production in the US has generally increased over the past decade because of the widespread adoption of horizontal drilling and hydraulic fracturing techniques that allow operators to increase the efficiency of natural gas production from shale formations. In 2021, natural gas from shale formations accounted for 79% of all US natural gas production. The increase in dry natural gas production was accompanied by an almost 4% increase in NGPL production in 2021, which has grown every year since 2005, averaging just under 8 billion ft3/d in 2021. The expansion of infrastructure needed to process growing volumes of marketed natural gas has resulted in more recovered NGPLs, leading to both greater domestic consumption and increased export volumes of ethane and propane.US natural gas exports have grown substantially over the past decade. In 2017, US natural gas exports surpassed imports for the first time since 1957. Major growth in natural gas exports in the second half of the decade was driven by growth in LNG, which the US began shipping overseas in 2016 from the Lower 48 states. In 2021, LNG exports grew to 54% of total US natural gas exports, up from 45% in 2020. Almost all other US natural gas exports were by pipeline to Canada and Mexico.So far in 2022, both natural gas marketed production and natural gas exports have continued to grow. In the EIA’s ‘Short-Term Energy Outlook’, it forecasts both marketed production and exports will continue to grow to record-high levels in 2023.

U.S. natgas gains 5% on technical move, forecast LNG export rise (Reuters) - U.S. natural gas futures jumped about 5% after sliding to a fresh seven-month low earlier in the session on a technical rebound and expectations demand would rise as liquefied natural gas (LNG) exports increase once export plants exit maintenance outages in coming weeks. Analysts at energy consulting firm Gelber & Associates said the price spike was largely due to technical factors, noting, "Prices have tumbled too far, too fast ... before rebounding amid oversold conditions." Before Monday's gain, futures plunged almost 60% over the past nine weeks - a move that could help cut U.S. consumer heating costs this winter - due to a combination of mild weather, record output and low LNG exports that allowed utilities to inject lots of gas into storage. Major LNG outages include Berkshire Hathaway Energy's shutdown on Oct. 1 of its 0.8 billion-cubic-feet-per-day (bcfd) Cove Point LNG export plant in Maryland for about three weeks of planned maintenance and the shutdown of Freeport LNG's 2.0-bcfd plant in Texas for unplanned work after an explosion on June 8. Freeport expects the facility to return to at least partial service in early to mid-November. Front-month gas futures rose 24.0 cents, or 4.8%, to settle at $5.199 per million British thermal units (mmBtu). On Friday, the contract closed below the psychologically significant $5 mark for the first time since March. Despite Monday's price increase, the front-month remained in technically oversold territory with a relative strength index (RSI) below 30 for a sixth day in a row for the first time since January 2020. Even after nine weeks of losses, U.S. gas futures were still up about 40% so far this year as soaring global gas prices feed demand for U.S. exports due to supply disruptions and sanctions linked to Russia's Feb. 24 invasion of Ukraine. Gas was trading at $28 per mmBtu at the Dutch Title Transfer Facility (TTF) in Europe and $31 at the Japan Korea Marker (JKM) in Asia. That put European forwards down about 16% for the day and on track to for their lowest close since June 13 as mild weather and strong LNG imports allowed utilities to boost the amount of gas in storage in Northwest Europe to healthy levels over 90% of capacity. TTF settled at a record high of $90.91 on Aug. 25. During the first nine months of 2022, roughly 60%, or 6.3 bcfd, of U.S. LNG exports went to Europe, as shippers diverted cargoes from Asia to fetch higher prices. Last year, just 29%, or about 2.8 bcfd, of U.S. LNG exports went to Europe. Data provider Refinitiv said average gas output in the U.S. Lower 48 states has risen to 99.5 bcfd so far in October, up from a monthly record of 99.4 bcfd in September. With the coming of seasonally cooler weather, Refinitiv projected average U.S. gas demand, including exports, would rise from 93.9 bcfd this week to 97.1 bcfd next week. The forecast for this week was lower than Refinitiv's outlook on Friday.

U.S. natural gas steady on mild weather ahead of expected LNG export gain -U.S. natural gas futures were little changed on Tuesday as the market waits for demand to rise once liquefied natural gas (LNG) export plants start to exit maintenance outages in coming weeks. That expected demand increase was offset by record output, mild weather and low LNG exports in the past month or so, allowing utilities to boost the amount of gas in storage ahead of winter. Major LNG outages include Berkshire Hathaway Energy’s shutdown of its 0.8 billion cubic feet per day (bcfd) Cove Point LNG export plant in Maryland on Oct. 1 for about three weeks of planned maintenance and the shutdown of Freeport LNG’s 2.0 bcfd plant in Texas for unplanned work after an explosion on June 8. Freeport expects the facility to return to at least partial service in early to mid-November. At least three vessels were heading to Freeport, Refinitiv data showed, including Prism Brilliance (currently off the coast from the plant), Prism Diversity (expected to arrive Oct. 28) and Prism Courage (Nov. 1). Some traders expect Freeport to return to service in November while others believe the return will be delayed. Officials at Freeport have said the plant remains on track to return in November. Front-month gas futures for November delivery rose 1.8 cents, or 0.4%, to $5.217 per million British thermal units (mmBtu) at 8:18 a.m. EDT (1218 GMT). Despite the small gain, the contract remained technically oversold with a relative strength index (RSI) below 30 for a seventh day in a row for the first time since April 2019. With the front month down about 60% over the past nine weeks as the market gave up on cold weather in November, the premiums on futures for December 2022 over November 2022 and November 2023 over October 2023 have hit several record highs over the past few days. Traders use the October-November and November-December spreads to bet on winter weather. Despite weeks of declines, U.S. gas futures were still up about 39% this year as soaring global gas prices feed demand for U.S. exports due to supply disruptions and sanctions linked to Russia’s Feb. 24 invasion of Ukraine.

Bargain Buyers Sustain Natural Gas Futures Rally; West Texas Cash Prices Flip Negative - Natural gas futures on Tuesday advanced a second-straight session amid calls for colder weather patterns, production interruptions and the looming expiration of the prompt month contract. After a steep sell-off last week, traders also stepped back into the market to buy gas at a discount ahead of winter. Following a 24.0-cent rally in the previous session, the November Nymex gas futures contract, which rolls off the board Thursday, settled at $5.613, up 41.4 cents day/day. December rose 41.3 cents to $6.166. At its low in intraday trading this month, the front month had dipped below the $5.00 handle. Prices this year, however, have tended to rise heading into expiry. NGI’s Spot Gas National Avg., meanwhile, gained 36.5 cents to $4.545, despite West Texas spot prices going negative for the first time this year amid a production surge and temporary pipeline constraints. Prices at the Waha hub in West Texas, for example, dropped $1.745 day/day to average negative $1.165. Waha prices on Monday fell $2.020 from Friday’s levels. A “surge in production is now being compounded by capacity constraints from scheduled maintenance,” said analysts at The Schork Report. That said, the Schork analysts added Waha prices have printed negative about 40 times since 2019 before rebounding. “Owing to robust associated gas production and pipeline constraints throughout the market area, Waha negative prices are not unheard of,” they said. Following losses last week, cash prices in every other region of the Lower 48 advanced Tuesday, offsetting the West Texas losses.

U.S. natgas steady as mild weather offsets planned LNG export rise -(Reuters) - U.S. natural gas futures held steady on Wednesday as the market balanced expectations demand would rise once liquefied natural gas (LNG) export plants exit maintenance outages against forecasts that demand will remain low with the weather staying mild through at least early November. Traders also noted that the combination of record output, mild weather and low LNG exports has already allowed utilities to inject much more gas into storage than usual over the past month or so, boosting inventories to healthy levels for the winter. In the spot market, meanwhile, gas prices at the Waha hub in the Permian Shale in West Texas fell into negative territory in intraday trade this week as pipeline maintenance prevented gas from leaving the basin. Prices closed at a positive 2 cents per million British thermal units (mmBtu) for Wednesday, their lowest since settling in negative territory in October 2020. Traders, however, noted futures prices would soon jump higher once December becomes the front-month after the market close on Thursday, in part because LNG exports were expected to rise to record levels after a couple of liquefaction plants return to service. Major LNG outages include Berkshire Hathaway Energy's shutdown of its 0.8 billion cubic feet per day (bcfd) Cove Point LNG export plant in Maryland on Oct. 1 for a few weeks of planned maintenance and the shutdown of Freeport LNG's 2.0 bcfd plant in Texas for unplanned work after an explosion on June 8. At least three vessels were heading to Freeport, Refinitiv data showed. Prism Brilliance was off the coast from the plant, Prism Diversity was expected to arrive Oct. 28 and Prism Courage Nov. 1. While some traders expect Freeport to delay its return to service, company officials have said the plant remains on track to return in November. On its second-to-last day as the front-month, gas futures for November delivery fell 0.7 cent, or 0.1%, to settle at $5.606 per million British thermal units (mmBtu). Futures for December, which will soon be the front-month, were trading around $6.14 per mmBtu. Gas futures have been extremely volatile in recent weeks with prices up about 14% so far this week after crashing about 59% to a seven-month low over the prior nine weeks as utilities boosted the amount of gas in storage to healthy levels. Despite weeks of declines, U.S. gas futures were still up about 52% this year as soaring global gas prices feed demand for U.S. exports due to supply disruptions and sanctions linked to Russia's Feb. 24 invasion of Ukraine. Gas was trading at $29 per mmBtu at the Dutch Title Transfer Facility (TTF) in Europe and $30 at the Japan Korea Marker (JKM) in Asia.

U.S. natgas drop 8% on contract expiration, milder weather forecasts (Reuters) - U.S. natural gas futures dropped about 8% on Thursday as the market focused on near record output and forecasts for milder weather next week than previously expected that should allow utilities to add more gas to storage than usual in coming weeks. Traders noted that big price drop came on the last day the November contract will be the front-month on the New York Mercantile Exchange, which has traditionally been a day of low volume and extreme volatility. The price drop also came despite a smaller-than-expected storage build last week, expectations demand will rise in the near future as liquefied natural gas (LNG) export plants return to service, and renewed concerns about a possible rail strike. A rail strike could boost demand for gas by threatening coal supplies to power plants. The Brotherhood of Railroad Signalmen union, representing more than 6,000 members, said workers voted against ratifying a national tentative agreement reached in mid-September, the second union not to approve the deal. The U.S. Energy Information Administration (EIA) said utilities added 52 billion cubic feet (bcf) of gas to storage during the week ended Oct. 21. That was lower than the 59-bcf build analysts forecast in a Reuters poll and compares with an increase of 88 bcf in the same week last year and a five-year (2017-2021) average increase of 66 bcf. On its last day as the front-month, gas futures for November delivery fell 42.0 cents, or 7.5%, to settle at $5.186 per million British thermal units (mmBtu). Futures for December, which will be the front-month, were trading around $5.91 per mmBtu. In the spot market, gas prices at the Waha hub in the Permian Shale in West Texas fell into negative territory in intraday trade this week as pipeline maintenance prevented some gas from leaving the basin. Waha prices closed at a positive 1 cent per mmBtu for Thursday, their lowest since settling in negative territory in October 2020 for a second day in a row. U.S. gas futures are up about 49% so far this year as soaring global gas prices feed demand for U.S. exports due to supply disruptions and sanctions linked to Russia's Feb. 24 invasion of Ukraine. Gas was trading at $31 per mmBtu at the Dutch Title Transfer Facility (TTF) in Europe and $30 at the Japan Korea Marker (JKM) in Asia. Data provider Refinitiv said average gas output in the U.S. Lower 48 states held at 99.4 bcfd so far in October, tying the monthly record in September. With seasonally cooler weather coming, Refinitiv projected average U.S. gas demand, including exports, would rise from 94.8 bcfd this week to 96.6 bcfd next week. The forecast for this week was higher than Refinitiv's outlook on Wednesday, while its forecast for next week was lower.