US oil imports at a 2 year high; distillates exports at all time high, US oil supplies at an 18 year low, Strategic Petroleum Reserve at a 37 year low; oil rigs fall by most in 25 months, natural gas rigs at a 35 month high..

oil prices fell for the fifth time in six weeks on weak economic reports from China and Europe and lower US demand for fuel...after rising 4.1% to $98.62 a barrel last week on falling Russian oil exports and on a larger than expected drop in U.S. crude inventories, the contract price for the benchmark US light sweet crude for September delivery fell in Asian trading early on Monday as a surprise contraction in Chinese factory data added to concerns that a global slowdown might sap demand, while an increase in Libyan output eased supply concerns, and then tumbled more than 4% in New York trading to settle down $4.73 at $93.89 a barrel after European manufacturing data indicated a deeper contraction at the start of the third quarter, with Germany, France, Italy, and Spain all recording sub-50 readings in their respective PMIs...oil prices dropped again in early trading on Tuesday as traders absorbed the bleak outlook for fuel demand amid data pointing to a global manufacturing downturn, but recovered to settle 53 cents higher at $94.42 a barrel ahead of an OPEC+ producers meeting wherein a further boost in crude supply was uncertain amid concerns that a possible global recession could limit energy demand...oil prices dipped in overnight trading after the American Petroleum Institute reported a surprise build of crude inventories against analysts' predictions of a modest draw, but rallied early Wednesday despite the API data after OPEC+ ministers signaled the coalition might raise oil production in September, despite signs of decelerating demand growth in Asia and European Union, before turning lower after the EIA confirmed that US crude and gasoline stockpiles had unexpectedly surged higher last week, and after OPEC+ said it would raise its oil output target by only 100,000 barrels per day in September, and settled $3.76 or nearly 4% lower at a six month low of $90.66 a barrel, as the EIA data also showed an unseasonal drop in gasoline consumption, underscoring concerns that spiking fuel prices had undermined usually strong summer driving demand...oil prices steadied above those levels early Thursday, as traders weighed tight supply against demand fears, but then dropped to their lowest levels since the Ukrainian war began, as traders fretted over the possibility that an economic recession later this year could torpedo energy demand, settling $2.12 lower at $88.54 a barrel as traders refocused on global recession fears, rising inflation, and building crude oil inventories in the US...oil prices eroded further in overnight trading into Friday as traders awaited the release of July employment data in the United States, which was expected to show a slowing pace of new hires amid softer economic growth and tightening monetary policy, but reversed to settle 47 cents higher at $89.01 a barrel, after a surprisingly strong U.S. jobs report painted a picture of a U.S. economy that was not slowing down...nonetheless, oil prices still finished 9.7% lower on the week, the biggest weekly decline since early April, amid growing signs that a global economic slowdown was curbing demand....

meanwhile, natural gas prices also finished lower for the week, on milder forecasts and on an inventory increase that exceeded expectations....after rising 0.4% to $8.229 per mmBTU last week, but closing 0.8% lower than the prior week's July contract closing price, the contract price of natural gas for September delivery retreated in early trading Monday as weekend weather models had moderated, but bounced off the bottom to finish 5.4 cents higher at $8.283 per mmBTU, after midday weather models showed more heat on the East Coast...however, natural gas prices dropped about 7% to a two-week low on Tuesday on record output from US wells and on forecasts for less demand over the next two weeks than was previously expected, and settled 57.7 cents lower at $7.706 per mmBTU....but that drop almost was completely reversed on Wednesday, when prices rose 56.0 cents or 7% to $8.266 per mmBTU, after Freeport LNG said that its LNG export plant in Texas remained on track to return to service in early October...natural gas prices then slid on Thursday after the storage report showed a bigger-than-expected injection into storage, and on forecasts for cooler weather that could reduce air-conditioning demand but partially recovered from steeper losses to settle 14.4 cents, or 1.7% lower, at $8.122 per mmBTU...natural gas prices gave up another 5.8 cents on Friday to settle at $8.064 per mmBTU, as gas output from wells neared record highs and forecasts for hot weather were revised slightly lower and thus finished 2.0% lower on the week...

The EIA's natural gas storage report for the week ending July 29th indicated that the amount of working natural gas held in underground storage in the US rose by 41 billion cubic feet to 2,457 billion cubic feet by the end of the week, which left our gas supplies 268 billion cubic feet, or 9.8% below the 2,725 billion cubic feet that were in storage on July 29th of last year, and 337 billion cubic feet, or 12.1% below the five-year average of 2,794 billion cubic feet of natural gas that have been in storage as of the 29th of July over the most recent five years....the 41 billion cubic foot injection into US natural gas working storage for the cited week topped even the highest of estimates ahead of the report, and was quite a bit more than the 16 billion cubic feet that were added to natural gas storage during the corresponding week of 2021, and also more than the average injection of 33 billion cubic feet of natural gas that has typically been added to our natural gas storage during the same week over the past 5 years....

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending July 29th indicated that after a jump in our oil imports, a drop in our oil exports, and another big withdrawal of crude from the SPR, we were able to add oil to our stored commercial crude supplies for the 3rd time in 7 weeks, and for the 15th time in the past 36 weeks. Our imports of crude oil rose by an average of 1,178,000 barrels per day to a 2 year high of 7,342,000 barrels per day, after falling by an average of 355,000 barrels per day during the prior week, while our exports of crude oil fell by 1,036,000 barrels per day to 3,512,000 barrels per day, which meant that our trade in oil worked out to a net import average of 3,830,000 barrels of oil per day during the week ending July 29th, 2,214,000 more barrels per day than the net of our imports minus our exports during the prior week. Over the same period, production of crude from US wells was reportedly unchanged at 12,100,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 15,930,000 barrels per day during the July 29th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,853,000 barrels of crude per day during the week ending July 29th, an average of 174,000 fewer barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 32,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures from the EIA for the week ending July 29th appear to indicate that our total working supply of oil from net imports, from oilfield production, and from storage was 109,000 barrels per day more than what our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (-109,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed...moreover, since last week’s EIA fudge factor was at (+864,000) barrels per day, that means there was a 973,000 barrel per day difference between this week's balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the week over week supply and demand changes indicated by this week's report are completely worthless....however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's modest 32,000 barrel per day decrease in our overall crude oil inventories left our oil supplies at 896,408,000 barrels at the end of the week, which was again our lowest total oil inventory level since February 6th, 2004, and therefore at a new 18 year low (see graph below)….our oil inventories decreased this week even as 638,000 barrels per day were being added to our commercially available stocks of crude oil, because 670,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve at the same time.. This week's draw on the SPR was part of the emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump" (sic), that was expected to supply 1,000,000 barrels of oil per day to commercial interests over a six month period up to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising further, at least up until that time. The administration's previous 30,000,000 million barrel release from the SPR to address Russian supply related shortfalls wrapped up in June, and his earlier release of 50 million barrels from the SPR to incentivize US gasoline consumption was completed in May. Including those, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 186,292,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 24 months, and as a result the 469,855,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since May 24th, 1985, or at a new 37 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's SPR releases. Now the total 180,000,000 barrel drawdown expected during the current six month release program to November will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,675,000 barrels per day last week, which was 1.7% more than the 6,564,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be unchanged at 12,100,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 11,700,000 barrels per day, while Alaska’s oil production was 3,000 barrels per day higher at 438,000 barrels per day but had no impact on the final rounded national total. US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 7.6% below that of our pre-pandemic production peak, but was 24.7% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021...

US oil refineries were operating at 91.0% of their capacity while using those 15,853,000 barrels of crude per day during the week ending July 29th, down from their 92.2% utilization rate during the prior week, and a refinery utilization rate that's below normal for mid summer. The 15,853,027,000 barrels per day of oil that were refined this week were 0.4% less than the 15,920,000 barrels of crude that were being processed daily during week ending July 30th of 2021, and 10.8% less than the 17,777,000 barrels that were being refined during the prepandemic week ending August 2nd, 2019, when our refinery utilization was at 96.4%, the highest of that summer...

With the decrease in the amount of oil being refined this week, gasoline output from our refineries was also lower, decreasing by 366,000 barrels per day to 9,292,000 barrels per day during the week ending July 29th, after our gasoline output had increased by 290,000 barrels per day during the prior week. This week’s gasoline production was also 8.5% less than the 10,151,000 barrels of gasoline that were being produced daily over the same week of last year, and 10.8% less than our gasoline production of 10,421,000 barrels per day during the week ending August 2nd, 2019, ie, a comparable week during the year before the pandemic impacted US gasoline output. Meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 76,000 barrels per day to 4,933,000 barrels per day, after our distillates output had decreased by 22,000 barrels per day during the prior week. But even after those decreases, our distillates output was still 1.1% more than the 4,877,000 barrels of distillates that were being produced daily during the week ending July 30th of 2021, while 6.3% less than the 5,286,000 barrels of distillates that were being produced daily during the week ending August 2nd 2019...

Even with the decrease in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the 5th time in seven weeks; but for just the 6th time out of the past twenty-six weeks, increasing by 163,000 barrels to 225,294,000 barrels during the week ending July 29th, after our gasoline inventories had decreased by 3,304,000 barrels during the prior week. Our gasoline supplies increased this week because the amount of gasoline supplied to US users decreased by 704,000 barrels per day to 8,541,000 barrels per day, while our imports of gasoline rose by 10,000 barrels per day to 609,000 barrels per day, and while our exports of gasoline rose by 72,000 barrels per day to 768,000 barrels per day. But after 20 inventory drawdowns over the past 26 weeks, our gasoline supplies were 1.6% lower than last July 30th's gasoline inventories of 228,870,000 barrels, and about 3% below the five year average of our gasoline supplies for this time of the year…

Following a series of decreases in our distillates production, our supplies of distillate fuels decreased for the 4th time in 5 weeks and for the 30th time in forty-eight weeks, falling by 2,400,000 barrels to 109,324,000 barrels during the week ending July 29th, after our distillates supplies had decreased by 784,000 barrels during the prior week. Our distillates supplies fell by more this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, increased by 127,000 barrels per day to 3,750,000 barrels per day, and because our exports of distillates rose by 139,000 barrels per day to 1,634,000 barrels per day, while our imports of distillates rose by 110,000 barrels per day to 234,000 barrels per day.. But after forty-six inventory withdrawals over the past sixty-eight weeks, our distillate supplies at the end of the week were 21.2% below the 138,744,000 barrels of distillates that we had in storage on July 30th of 2021, and about 25% below the five year average of distillates inventories for this time of the year…

For imports and exports, citing the four week average gives us a better picture of the trend, since it ameliorates the weekly volatility inherent in the different sizes of vessels and the timing of the ship loadings and unloadings from week to week...With this week's increase in our exports of distillates, the four week average of our distillates exports rose from last week's 47 month high of 1,485,000 barrels per day to an all time high of 1,573,000 barrels per day....with that record topping earlier highs in 2017 and 2019, we'll include a chart below to show you what it looks like...

Meanwhile, with this week's big increase in our oil imports and decrease in our exports, our commercial supplies of crude oil in storage rose for the 5th time in 12 weeks and for the 21st time in the past year, increasing by 4,467,000 barrels over the week, from 422,086,000 barrels on July 22nd to 426,553,000 barrels on July 29th, after our commercial crude supplies had decreased by 4,523,000 barrels over the prior week. After this week's increase, our commercial crude oil inventories were still about 7% below the most recent five-year average of crude oil supplies for this time of year, but roughly 26% above the average of our crude oil stocks as of the end of July over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. Since our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this July 29th were still 2.9% less than the 439,225,000 barrels of oil we had in commercial storage on July 30th of 2021, and were 17.7% less than the 518,596,000 barrels of oil that we had in storage on July 31st of 2020, and 2.8% less than the 438,930,000 barrels of oil we had in commercial storage on August 2nd of 2019…

Finally, with our inventories of crude oil and our supplies of all products made from oil near multi-year lows in recent months, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR. The EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 1,164,000 barrels this week, from 1,679,939,000 barrels on July 22nd to 1,678,775,000 barrels on July 29th, after our total inventories had fallen by 8,857,000 barrels during the prior week. That left our total liquids inventories down by 109,658,000 barrels over the first 29 weeks of this year, and only one million barrels from hitting a new 13 1/2 year low...

This Week's Rig Count

The number of drilling rigs running in the US decreased for only the 8th time over the previous 97 weeks during the week ending August 5th, but were still 3.7% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US decreased by 3 to 764 rigs this past week, which was still 273 more rigs than the 491 rigs that were in use as of the August 6th report of 2021, and was 1,165 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil fell by 7 to 598 oil rigs during the past week, the biggest oil rig drop in 25 months, after the number of rigs targeting oil had increased by 6 during the prior week, but there are still 211 more oil rigs active now than were running a year ago, even as they now amount to just 37.2% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are also down 12.4% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations increased by 4 to 161 natural gas rigs, the most natural gas rig activity since August 30, 2019, which was also up by 58 natural gas rigs from the 103 natural gas rigs that were drilling during the same week a year ago, even as they were still only 10.0% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…

In addition to rigs targeting oil and natural gas, Baker Hughes is still reporting five "miscellaneous" rigs active; those include a horizontal rig drilling to between 5,000 and 10,000 feet into the Permian basin in Dawson county Texas, a directional rig drilling to between 5,000 and 10,000 feet on the big island of Hawaii, a rig drilling vertically to between 10,000 and 15,000 feet for a well or wells intended to store CO2 emissions in Mercer county North Dakota, a vertical rig drilling more than 15,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track, and another vertical rig, targeting the Marcellus shale at a depth of between 5,000 and 10,000 feet in Tompkins County, New York...that one might be a exploratory geothermal well now being drilled on the Cornell University campus....a year ago, there were was only one such "miscellaneous" rig running...

The offshore rig count in the Gulf of Mexico was down by 1 to 14 rigs this week, with all of this week's Gulf rigs drilling for oil in Louisiana's offshore waters....that now matches the number of offshore rigs that were active in the Gulf a year ago, when 13 Gulf rigs were drilling for oil offshore from Louisiana and one rig was deployed for oil offshore from Texas...in addition to rigs drilling in the Gulf, we still have two offshore directional rigs drilling for natural gas in the Cook Inlet of Alaska; one is indicated to be drilling to between 10,000 and 15,000 feet, while the other one is indicated to be drilling to between 5,000 and 10,000 feet...a year ago, there were no offshore rigs other than those deployed in the Gulf of Mexico....

in addition to rigs running offshore, there are still 2 water based rigs drilling through inland bodies of water...one is a directional rig targeting oil at at a depth greater than 15,000 feet drilling through a lake on Grand Isle, Louisiana, and the other is directional rig drilling for oil in Terrebonne Parish, Louisiana, also at a depth greater than 15,000 feet...the other inland waters rig that had been drilling in Terrebonne Parish, and the one drilling in Cameron parish, Louisiana, were shut down this week, while during the same week of a year ago, there was just one such "inland waters" rig deployed...

The count of active horizontal drilling rigs was up by one to 698 horizontal rigs this week, which was also 255 more rigs than the 442 horizontal rigs that were in use in the US on August 6th of last year, but still just over half of the record 1,374 horizontal rigs that were drilling on November 21st of 2014....on the other hand, the vertical rig count was down by 3 to 29 vertical rigs this week, but those were still up by 14 from the 15 vertical rigs that were operating during the same week a year ago…at the same time, the directional rig count was down by 1 to 37 directional rigs this week, while those were still up by 10 from the 27 directional rigs that were in use on August 6th of 2021….

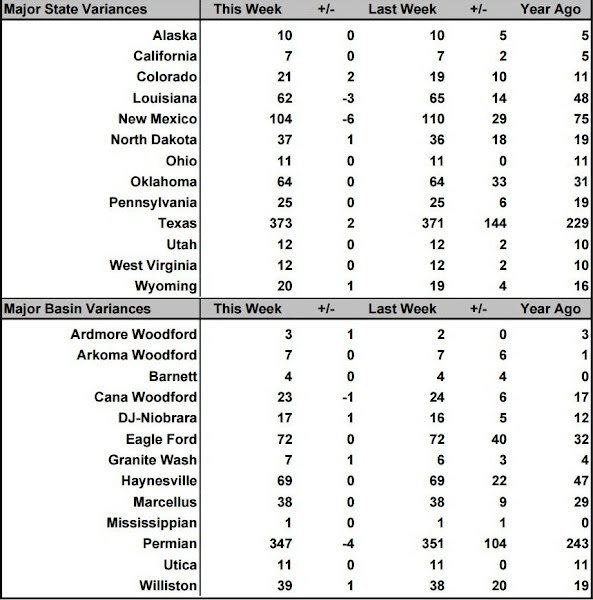

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of August 5th, the second column shows the change in the number of working rigs between last week’s count (July 29th) and this week’s (August 5th) count, the third column shows last week’s July 29th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 6th of August, 2021...

checking the Rigs by State file at Baker Hughes for the changes in the Texas Permian, we find there were 3 oil rigs added in Texas Oil District 8, which covers the core Permian Delaware, and there was another oil rig added in Texas Oil District 8A, which includes the northernmost counties over the Permian Midland, but that there were two oil rigs pulled out of Texas Oil District 8A, which includes the southern counties of the Permian Midland...since that indicates that the Texas Permian rig count increased by 2, we have to conclude that all 6 of the rigs that were pulled out of New Mexico had been drilling in the far west Permian Delaware, in order for the national Permian rig count to have fallen by four...& since there were no other changes apparent in Texas, that Texas Permian increase also accounts for the Texas increase...

elsewhere, the three rig decrease in Louisiana included the oil rig pulled out of the state's offshore waters, and the two inland waters oil rigs that were shut down in the southern tier of the state at the same time...meanwhile, the two rigs added in Colorado include one in the DJ Niobrara chalk and one in a basin that Baker Hughes doesn't track, the rig added in North Dakota was in the Williston basin, and the rig added in Wyoming was in a basin that Baker Hughes doesn't track...in Oklahoma, an oil rig was pulled out of the Cana Woodford, while oil rigs were added in the Ardmore Woodford and the Granite Wash at the same time...since the Oklahoma rig count was unchanged, that means there was at least one rig pulled out of an Oklahoma basin that Baker Hughes doesn't track..i say "at least" because most of this week's net changes occured in basins that Baker Hughes doesn't track, including the increase of 4 natural gas rigs and the decrease of six oil rigs...since i see no other changes in the state totals to account for those rigs, most of them must have occurred in states like Oklahoma that host both oil and natural gas rigs, such that the loss of one and the gain of the other wouldn't show up in the state totals...if you really need to know where those changes occured, Baker Hughes offers the North America Rotary Rig Count Pivot Table (xls) which shows the individual well drilling records by state and county since February 2011, including all those in basins that Baker Hughes doesn't track in their other summaries...

++++++++++++++++++++++++++++++++++++++++++++++++

Oil and gas production expected to increase in Guernsey County - The Daily Jeffersonian - Industry experts expect to see an increase in oil and gas production in the Utica Shale region including Guernsey County this year due to a rising demand resulting from global issues and domestic usage. Guernsey County currently has 300 Utica shale well permits and the most active producers in the county are Ascent Resources with 130 permits, Southwestern Energy with 69 and Utica Resources with 31. The Ohio Department of Natural Resources reports 24 wells — 23 productive and 1 exploratory — were drilled in Guernsey County in 2019, the latest year for which statistics are available. The average well depth was 19,918 feet with an estimated footage drilled of 478,029. The most recent horizontal shale production statistics for Guernsey County from 2019 totaled 13,556,178 barrels of oil and 91,078,704 Mcf of gas. "The industry in Guernsey County is strong, and it's active," "Some of the opportunities and challenges happening right now are allowing us to put (drilling) units together...get leases together and go out and drill to lift that commodity out of the ground. You will see increased activity here in Guernsey County this year, and beyond this year." There are 12 drilling rigs currently in operation in the Utica region across southeast Ohio. According to the Ohio Department of Natural Resources, more than 275,000 gas wells had been drilled statewide as of 2019 with 2.6 trillion cubic feet of natural gas production. The most recent statistics available also show 55,921 oil wells have produced 27 million barrels of crude oil. "Ohio has done smart things to be a welcoming state when it comes to energy, and there's good reason for that. All you need to do is look to Europe right now." "Shutting off Russia's oil supply, you are going to have to make that up somewhere and that's where you are seeing some renewed interest in the western part of the Utica shale formation because it's more rich in oil deposits," said George Brown of OOGEEP. "The great thing about Guernsey County is the entire natural gas ecosystem that goes along with it (oil)." Ohio is home to four oil refineries, which can produce nearly 600,000 barrels of crude oil daily, according to the Ohio Oil & Gas Energy Education Program. That's enough oil to produce 11.4 millions gallons of gasoline per day. The rate at which oil and gas production will increase in Guernsey County this year will depend on several variables, according to local officials. "It will probably depended producer to producer based on what their plans are...their access to capital and what their drilling units look like, but I would say we will see increased activity this year," said Chadsey. "Our people can't turn on a dime. You do have to get a permit, get your hands on a rig, a crew and all that stuff, so it will probably be a slow ramp up but I think we will continue to see more activity and excitement about that activity here in Guernsey County." The county continues to be on the western edge of the Utica shale play in what is referred to as the oil window. Brown said there are two-overlaying issues that will slow production in Guernsey and other counties nearby when it come to oil and gas. "One is the certainty in the planning that needs to go into the preparation process for exploration," he said. "It takes time. It can take up to a year, if not more, to get a rig in place and get it in the process of exploration." "And two, building out the critical energy infrastructure to get that product to meet its market. There are currently five pipeline proposals that have either been canceled or opposed that would haven taken the gas and oil coming from Ohio and other parts of the basin to end users either on the east coast of the United State or down south to meet the needs.

Ohio lawmakers want to create tax breaks for energy development - – Saying communities in Ohio have been denied economic development and job growth opportunities because of energy issues, two Ohio lawmakers announced legislation Friday that would provide taxpayer incentives to grow energy infrastructure in the state.Reps. Jon Cross, R-Kenton, and Jay Edwards, R-Nelsonville, called areas of the state “energy deserts,” and want House Bill 685 to promote the use of the state’s natural gas energy resource.“We’ve been hearing from communities that are locked out of future job growth because of the high cost of energy infrastructure in the state,” Cross said. “These ‘energy deserts’ see limited job growth because there just isn’t the infrastructure in place to deliver energy at a reasonable price. House Bill 685 is a step in the right direction to address the problem and bring jobs and affordable energy to every corner of the state.” The bill, which has yet to be assigned to a committee, would call for the creation of local “ENERGIZEOhio Zones” that would be designated as areas in need of investment. The designation would allow natural gas infrastructure projects to receive tax abatements and speed up depreciation to lower the over cost of development, the sponsors said. Also, the bill would allow the state to offer low-cost financing for projects and create a revolving loan fund that would allow local officials to facilitate pipeline easements. The bill also calls for financial incentives to gas companies developing natural gas pipelines in the zones. “I’ve heard from communities that are really suffering because they don’t have the energy they need, even though there is robust supply in the state and strong local demand,” Edwards said. “Energy infrastructure construction costs have just gone through the roof due to inflation. We can’t wait for Washington to solve our problems. The General Assembly needs to pass this legislation to help deal with these increases in costs.” There are more than 26,000 natural gas producing wells across Ohio and 24 natural gas storage sites. There is also nearly 10,000 miles of gas pipelines in the state, according to the Natural Gas Solution. “Too much of Ohio’s energy is being shipped out of state,” Cross said. “We need to keep it here in Ohio to ensure our businesses and citizens have access to affordable, abundant local energy.”

Gulfport 2Q Update – Turns Profitable $216M, No Talk of Selling | Marcellus Drilling News - Gulfport Energy, the third-largest driller in the Ohio Utica Shale (by the number of wells drilled), emerged from bankruptcy in May 2021 with a new board and new top management. By September of last year, the rumors began circulating that the company was shopping itself for sale (see Big News: OH Utica Driller Gulfport Energy Looking to Sell Itself). The two largest drillers in the Ohio Utica (Ascent Resources and Encino Energy) have been reported to be in talks to buy Gulfport. Yet, in Gulfport’s 2Q22 update issued earlier this week, there wasn’t even a whisper about a potential sale or merger.

Study: Drilling wastewater on Pa. roads dangerous to human health, environment - A long-anticipated health study commissioned by Pennsylvania environmental officials examined the practice of spreading wastewater from conventional gas – and oil drilling on thousands of miles of rural dirt roads in the state. Researchers concluded that the practice doesn’t control dust effectively and poses dangers to the environment and human health. The state Department of Environmental Protection has not yet acted based on those findings but said that the study’s impact will be “immediate, large and intense.” After a legal challenge to the practice in 2018 arising from environmental and health concerns, DEP temporarily banned most spreading of wastewater from conventional oil and gas drilling on the approximately 25,000 miles of dirt and gravel roads in the state. Spreading has never been allowed with wastewater from wells employing hydraulic fracturing, commonly known as fracking. But for more than a half-century, spreading salty wastewater from conventional oil and gas wells was a cheap way for the industry to get rid of a byproduct, while reducing municipal costs for dust control in summer and road de-icing in winter. Twenty-one of the state’s 67 counties allowed wastewater to be spread on rural roads before the temporary ban. Nationally, 12 states have permitted the practice. According to DEP records, approximately 240 million gallons of drilling wastewater were spread on Pennsylvania roads from 1991–2017. Industry officials have long maintained the spreading did not have any adverse consequences. For the independent study commissioned by DEP, Penn State researchers conducted a series of laboratory experiments to test dust generation and suppression. They also measured the chemical makeup of wastewater and explored its runoff effects. The wastewater samples came from conventional drilling operations obtained in confidence from western Pennsylvania oil service companies.The results showed that wastewater was essentially no more effective than rainwater in controlling dust because its high sodium content does not allow road dust to bond to the material. In fact, the study noted, “sodium can destabilize gravel roads and increase long-term road maintenance costs.” The investigation also revealed health and environmental concerns. Elevated levels of contaminants could pollute nearby water sources, the study concluded. In addition to increasing the salinity of fresh water, the water in some simulations contained heavy metals — such as barium, strontium, lithium, iron and manganese — at levels exceeding human health standards. Some tests also found radioactive radium, a carcinogen, though often in low concentrations.

Pipeline Co. Convicted of Criminal Charges The companies behind the construction of a controversial natural gas pipeline that crosses through the Mon-Yough area have been convicted of criminal charges related to the project. On Friday, Pennsylvania Attorney General Josh Shapiro announced that Sunoco Pipeline LP and ETC Northeast Pipeline LLC have pleaded no contest to charges related to contamination of lakes, rivers, streams and groundwater during the construction of the Mariner East 2 pipeline.The Mariner East 2 pipeline, which goes through 17 southern Pennsylvania counties, crosses Forward Twp. and passes near communities such as Sutersville, West Newton and Finleyville. It parallels an older gasoline pipeline built in the 1930s.Homeowners who live in the pipeline’s path and want to have their water tested have until Aug. 19 to file a request.Shapiro and state regulators have alleged that the companies — both subsidiaries of a larger Texas-based company known as Energy Transfer LP — failed to report environmental damage and criminal use of unapproved additives in drilling fluid.Prosecutors allege that more than 150 families have had their drinking water contaminated by construction of the Mariner East 2 pipeline, which carries liquified natural gas from Ohio and West Virginia to processing facilities elsewhere in Pennsylvania.“We have a constitutional right in Pennsylvania to clean air and pure water,” Shapiro said in a prepared statement. “It’s a right that was enshrined in our state constitution at a time when the people of Pennsylvania learned a tough lesson first-hand — the health of our children, and our economic future, depended on protecting our environment from reckless profit and unchecked corporate interests.“Today we’re upholding our oath to our constitution and holding Energy Transfer accountable for their crimes against our natural resources,” he said.Sunoco Pipeline LP pleaded no contest to 14 counts of clean streams violations for incidents related to the construction of the Mariner East 2 Pipeline, Shapiro said.The plea agreement also covers allegations leveled against ETC Northeast in connection with the construction of the Revolution Pipeline, a 42.5-mile pipeline that starts in Butler County and connects to a gas processing plant in Washington County, passing through Beaver and Allegheny counties.As part of the agreement, Shapiro’s office said, Energy Transfer will pay for independent evaluations of potential water quality impacts for homeowners from the construction of the Mariner East 2 Pipeline and offer approved mechanisms for restoring or replacing the impacted private water supplies.An independent, professional geologist will review water testing and advise homeowners on water quality and impact, Shapiro’s office said.Energy Transfer also will pay $10 million towards projects that improve the health and safety of water sources along the routes of the pipelines.In October 2021, 48 charges were filed against the two companies after a statewide grand jury investigation.According to testimony before the grand jury, Sunoco Pipeline repeatedly allowed thousands of gallons of drilling fluid to escape underground, which sometimes surfaced in fields, backyards, streams, lakes and wetlands. The company then failed to report the losses of fluid to the Pennsylvania Department of Environmental Protection numerous times, despite legal requirements to do so, the state alleged.

Pipeline developer pleads no contest in pollution cases - The developer of a major pipeline system that connects the Marcellus Shale gas field in western Pennsylvania to an export terminal near Philadelphia pleaded no contest Friday to criminal charges that it systematically polluted waterways and residential water wells across hundreds of miles. Dallas-based Energy Transfer Operating agreed to independent testing of homeowners' water and promised to remediate contamination in a settlement of two separate criminal cases brought by the Pennsylvania attorney general. Under a plea deal, the company will also pay $10 million to restore watersheds and streams along the route of its Mariner East pipeline network. "We are holding Energy Transfer accountable for their crimes against our natural resources," Attorney General Josh Shapiro said at a news conference after the hearing in Harrisburg. An Energy Transfer spokeswoman called the $10 million fund “not a fine or penalty of any kind but the product of a voluntary collaboration” with the state. “While we understand Mr. Shapiro is running for office, it remains disappointing that he would mischaracterize the facts of this voluntary agreement to his political advantage rather than acknowledge the good faith efforts of Energy Transfer to resolve this dispute,” the spokeswoman, Laura Atchley, said in an email. The company’s Mariner East 1, Mariner East 2 and Mariner East 2X pipelines carry propane, ethane and butane from the Marcellus and Utica shale gas fields to a refinery processing center and export terminal in Marcus Hook, a suburb of Philadelphia. Construction wrapped in February. Mariner East has been one of the most penalized projects in state history. The owner has racked up tens of millions of dollars in civil penalties, and state regulators repeatedly halted construction over contamination. The attorney general stepped in last October, charging Energy Transfer with releasing industrial waste at 22 sites in 11 counties and failing to report spills to regulators. The company fouled the drinking water of at least 150 families, prosecutors have said.

Energy Transfer reaches plea deal with the state in criminal case over Mariner East and Revolution pipelines -The Pennsylvania Attorney General’s office announced that it reached a plea deal with Texas-based pipeline company Energy Transfer, concluding a criminal case brought against the firm for its Mariner East and Revolution pipelines. Energy Transfer pleaded “no contest” to 23 criminal charges on Friday, without admitting guilt or wrongdoing while accepting a conviction in the case.The plea deal includes a water grievance process where qualified landowners who believe their water may have been impacted by Energy Transfer’s Mariner East pipeline construction will receive a free evaluation from an independent geologist. If it is determined that the company was indeed the cause of the water issue, Energy Transfer will have to restore or replace the landowners’ water supply.It also includes $57,500 in fines to be paid to the Department of Environmental Protection, and $10 million that will be distributed through grants towards water improvement projects. Attorney General Josh Shapiro, speaking at a press conference on Friday, said the plea deal secures what Pennsylvania citizens impacted by Energy Transfer’s pipeline construction wanted most — a voice and a remedy.The settlement caps a multi-year investigation and follows more than $32 million in penalties that Energy Transfer has already been assessed by state environmental and pipeline regulators.The attorney general first filed 48 criminal charges against Energy Transfer in October — 47 misdemeanors and 1 felony charge — alleging that the company leaked thousands of gallons of drilling fluid during underground drilling operations when building the Mariner East pipelines. Those spills showed up in people’s backyards, caused sinkholes, and polluted waterways, a grand jury convened to hear the evidence concluded. It also found that Energy Transfer kept some of this damage from environmental regulators despite requirements to report it.The twin Mariner East pipelines now carry natural gas liquids from Ohio and Western Pennsylvania to a processing plant near Philadelphia.In February, Mr. Shapiro added nine more charges to the case. These stemmed from an investigation into the company’s 2018 Revolution Pipeline explosion in Beaver County. There, an early-morning landslide cause the newly-activated natural gas pipeline to slip, rupture and ignite. The grand jury that looked into the blast found that Energy Transfer failed to secure the ground along its right of way, which led to landslides.But most of the charges in the state’s case against Energy Transfer, filed in the Daughin County Court of Common Pleas, and most of the emphasis of the investigation was about water pollution, Mr. Shapiro said during the press conference.“That is the heart of this case,” he said.As part of the deal Energy Transfer pleaded “no contest” to 23 charges with the remaining 34 dropped, including the felony charge.In a statement that implied Mr. Shapiro was grandstanding to benefit his gubernatorial campaign, Energy Transfer nevertheless said it was pleased to put this matter to bed.To those who wonder why his office accepted a plea deal instead of taking the case to trial, the attorney general said: “even if we won, Energy Transfer would have walked away paying pocket change. The residents would have been screwed.”He said the $10 million payment stipulated in this plea deal is more than six times the maximum criminal penalty that could have been assessed under state law.

CNX Increases Spending to Stay Ahead of Inflation - CNX Resources Corp. will increase this year’s capital expenditures (capex) as it battles through inflationary pressures and works to keep its operations stable heading into next year. The Appalachian pure-play is now guiding for a 2022 capex range of $550-590 million, up $70 million at the midpoint from its previous forecast. “We are planning to run a second rig for almost the entirety of the second half of the year to ensure there are no delays to our 2023 schedule, and we are pre-buying and locking in key tangible goods and services,” said CFO Alan Shepard during a recent call to discuss the company’s second quarter results. [Want today’s Henry Hub, Houston Ship Channel and Chicago Citygate prices? Check out NGI’s daily natural gas price snapshot now.] Plans to keep a second rig running and accelerate three well turn-in-lines are forecast to cost $25 million, while $15 million has been allocated for innovation and emissions reductions, and another $30 million has been earmarked for rising costs related to inflation. While other independent producers across the country have shared ambitions to gain more exposure to international markets through LNG exports, CNX management continues to stress a more local approach. “CNX is going to continue to advocate for natural gas and the Appalachian region,” said CEO Nicholas Deluliis. He noted during the Pittsburgh-based company’s first quarter earnings call in April that the basin has a limited ability to ramp up production to help meet overseas natural gas demand due to pipeline constraints. The company has been pursuing local projects for what management said have been marginal costs. CNX recently expanded a partnership with the Pittsburgh International Airport, where it operates shale gas wells. The company plans to develop more wells at the airport to produce liquefied natural gas and compressed natural gas for use in ground transportation and aviation.

Biden, Manchin back deal to advance Mountain Valley pipeline - The Biden administration has agreed to advance the controversial Mountain Valley pipeline project as part of a broader permitting reform plan in Congress, a spokesperson for Energy and Natural Resources Chair Joe Manchin (D-W.Va.) said yesterday.Senate Majority Leader Chuck Schumer (D-N.Y.), House Speaker Nancy Pelosi (D-Calif.) and President Joe Biden agreed to pursue permitting reform legislation this year so Manchin would support a budget reconciliation package on climate, taxes and health care.Legislation in the works would require federal agencies to take “all necessary actions” to permit the natural gas project slated to run through Virginia and West Virginia, according to a summary shared with E&E News. It also would grant jurisdiction to the U.S. Court of Appeals for the District of Columbia Circuit over litigation associated with the pipeline.In addition to advancing the pipeline, which is being developed as a joint venture by Equitrans Midstream Corp. and other energy companies, the permitting deal would direct the president to “designate and periodically update” 25 energy infrastructure projects considered to be of high priority. It would also establish a two-year timeline for federal environmental reviews associated with “major projects” and a one-year timeline for “lower-impact projects” (E&E Daily, Aug. 2).Unlike the reconciliation bill, the new agreement with the Mountain Valley pipeline measures would need backing from Republicans and at least 60 members of the Senate to pass (E&E Daily, July 29).Initially approved by the Federal Energy Regulatory Commission in October 2017, the 303-mile Mountain Valley pipeline has faced years of legal challenges and prolonged opposition from environmental and conservation groups, who say the project is nonviable. Manchin has repeatedly backed the $6.6 billion project, describing it as necessary for maintaining a reliable and affordable energy system (Energywire, July 21).In a research note yesterday, ClearView Energy Partners LLC described the plan to move legal challenges to the D.C. Circuit as an “unusual directive,” noting that project opponents have succeeded in vacating some of the project’s permits at the 4th U.S. Circuit Court of Appeals. In May, project developers unsuccessfully asked for new judges to hear a challenge to a state water permit (Energywire, June 23). “We view this Congressional directive (if enacted) as materially changing the prospects for MVP and its planned timeline,” Clearview wrote about the accord. The plan could affect several federal agencies if it enacted. Mountain Valley still has permits pending from the Bureau of Land Management, the Forest Service and Fish and Wildlife Service. Two state water permits from Virginia and West Virginia are also still being litigated.

Manchin Trades Climate Support for Massive WV Pipeline — From his Summers County, West Virginia, farmhouse, Mark Jarrell can see the Greenbrier River and, beyond it, the ridge that marks the Virginia border. He and many others along the path of the partially finished Mountain Valley Pipeline through West Virginia and Virginia fear that it may contaminate rural streams and cause erosion or even landslides. By filing lawsuits over the potential impacts on water, endangered species and public forests, they have exposed flaws in the project’s permit applications and pushed its completion well beyond the original target of 2018. The delays have helped balloon the pipeline’s cost from the original estimate of $3.5 billion to $6.6 billion. But now, in the name of combating climate change, the administration of President Joe Biden and the Democratic leadership in Congress are poised to vanquish Jarrell and other pipeline opponents. For months, the nation has wondered what price Democratic West Virginia Sen. Joe Manchin would extract to allow a major climate change bill. Part of that price turns out to be clearing the way for the Mountain Valley Pipeline. “It’s a hard pill to swallow,” said Jarrell, a former golf course manager who has devoted much of his retirement to writing protest letters, filing complaints with regulatory agencies and attending public hearings about the pipeline. “We’re once again a sacrifice zone.” The White House and congressional leaders have agreed to step in and ensure final approval of all permits that the Mountain Valley Pipeline needs, according to a summary released by Manchin’s office Monday evening. The agreement, which would require separate legislation, would also strip jurisdiction over any further legal challenges to those permits from a federal appeals court that has repeatedly ruled that the project violated the law. The provisions, according to the summary, will “require the relevant agencies to take all necessary actions to permit the construction and operation of the Mountain Valley Pipeline” and would shift jurisdiction “over any further litigation” to a different court, the D.C. Circuit Court of Appeals. In essence, the Democratic leadership accepted a 303-mile, two-state pipeline fostering continued use of fossil fuels in exchange for cleaner energy and reduced greenhouse emissions nationwide. Manchin has been pushing publicly for the pipeline to be completed, arguing it would move much needed energy supplies to market, promote the growth of West Virginia’s natural gas industry and create well-paid construction jobs.

Manchin agreement smooths way for Mountain Valley Pipeline - Pittsburgh Business Times -- Equitrans Midstream Corp. CEO Thomas Karam on Tuesday hailed proposed legislation that he said would smooth the way for the approval of its long-delayed pipeline for Marcellus and Utica shale natural gas.The long-delayed and over-budget $6.6 billion pipeline, caught up in legal hurdles and resubmitted permits, was one of the top of priorities for U.S. Sen.Joe Manchin, D-West Virginia when he negotiated a wider package on the Biden administration's domestic priorities on prescription drugs and climate change last week. It emerged Monday that part of the deal was an agreement to lighten the permitting process of a number of energy infrastructure projects, including MVP. MVP, a project of Canonsburg-based Equitrans (NYSE: ETRN), is a 303-mile pipeline that will take southwestern Pennsylvania natural gas from West Virginia to Virginia. But it's been mired in legal battles and permits that it has had to resubmit, some more than once. Karam called MVP "collateral damage" in the fight between energy companies and environmental advocates.Karam, citing Manchin's work and the agreement on proposed legislation on federal permitting, said the proposed legislation would allow the pipeline to complete its revised timeline of being operational in the second half of 2024.The proposed permitting legislation "includes direct treatment for MVP," Karam said. He had referred to it as the Federal Permitting Reform and Jobs Act, but Equitrans later in the day issued a correction to say that the bill by that name was not the same and had been introduced last year. The proposed energy permitting provisions discussed on the call, and part of which was released Monday, directly mentioned MVP.Manchin's office told reporters that the pipeline was one of several that would benefit from the changes in permitting processes, which would provide the certainty that oil and gas companies have craved and have not received in recent years with court action and fierce opposition. MVP, which was initially to be completed in 2018, has been a poster child for those delays. Karam had two messages Tuesday in the company's second-quarter earnings call: That the legislation was going to help MVP and other energy infrastructure projects, and that even without it, Equitrans was confident that it could clear the legal hurdles that have been brought up in recent months. Equitrans through the decision of the Fourth Circuit Court of Appeals, have lost a previously approved biological impact statement as well as approval to cross a federally owned forest.

Republican Senators, Manchin Revive Trump-Era Energy Reform - The Senate voted to reinstate rules helping expedite the construction of energy infrastructure that persisted under former President Donald Trump, eliminating a final rule that was previously imposed by the Biden administration. Senate Energy and Natural Resources Chair Joe Manchin of West Virginia joined a united Republican caucus to pass a Resolution of Disapproval in a 50-47 vote by using the Congressional Review Act (CRA) to nullify the Biden administration’s National Environmental Policy Act (NEPA) regulations, according to Senate logs. The move will accelerate federal permitting for the development of crucial future energy, mining, and infrastructure projects.The vote will return the NEPA process to the 2020 Trump-era provisions that curtailed regulations, making sure that fossil fuel projects were only studied for their individual environmental impact and not for the eventual effects of the energy that would be produced by the infrastructure, according to documents. The Biden administration, which often prioritizes climate and environmental issues, found Trump’s reforms objectionable and finalized a new rule that neutralized them in April 2022. Despite the 2020 rule’s ability to expedite oil and gas pipelines, the removal of NEPA regulation applies to all infrastructure on federal lands and can also help green energy infrastructure or rare earth mineral mines, essentially for the production of EVs to be built faster, according to CEI. Republican Sen. Dan Sullivan of Alaska originally proposed the vote that will also prevent the reissuing of a similar rule in the future unless Congress authorizes it. Republicans unanimously voted to overturn Biden’s permitting regulations, while Manchin was the only Democrat to support the move. The vote comes after President Joe Biden and Sen. Chuck Schumer of New York promised Manchin that they would help pass permitting reform on Monday. The president can still use his powers to veto the effort.

U.S. Natural Gas Production Hit An All-Time High In 2021 - This article is the fourth in a series on the BP Statistical Review of World Energy 2022. The Review provides a comprehensive picture of supply and demand for major energy sources on a country-level basis. Previous articles covered overall energy consumption, carbon dioxide emissions, and petroleum supply and demand. Today, I want to cover the production and consumption of natural gas. In 2021, global natural gas consumption reached a new all-time high, surpassing the previous record set in 2019 by 3.3%. Natural gas is the cleanest-burning of the fossil fuels. It is also the fastest-growing fossil fuel, with a global 2.2% average annual growth rate over the past decade.In comparison, oil grew at a rate of 0.7% globally over the past decade, and coal grew globally at 0.1%. Looking ahead, natural gas is projected to be the only fossil fuel that will see substantial demand growth over the next two decades.Over the past decade, the U.S. shale gas boom propelled the U.S. into the global lead among natural producers. In 2021, the U.S. set a new all-time high for natural gas production. For the year, the U.S. held a commanding 23.1% share of global natural gas production, ahead of Russia (17.4%) and even the entire Middle East (17.7%).The Top 10 producers of natural gas accounted for 72.6% of the world’s natural gas supply in 2021. U.S. production grew 2.3% last year to surpass 90 billion cubic feet (BCF) per day for the first time. U.S. production in 2021 was 91% higher than in 2005, when the shale gas boom was just getting started.The U.S. is also the world’s top consumer of natural gas. In fact, most of the leading producers are also the world’s leading consumers.The surge of natural gas production in the U.S. has also launched the U.S. into first place globally in natural gas liquids (NGL) production. The U.S. has a 44.8% global share of NGL production, with most of the NGLs destined for refineries or petrochemical production.However, because the U.S. consumes most of the natural gas it produces, it lags behind two other countries in the export of liquefied natural gas (LNG), which is different than NGL. In 2021 Australia was in first place globally with a 20.9% share of LNG exports, followed by Qatar (20.7%), the U.S. (18.4%), Russia (7.7%), and Malaysia (6.5%).But the U.S. is the world’s fastest-growing LNG exporter, with a 49.1% average annual growth rate over the past decade (and a 100% increase in LNG exports from 2019 to 2021). The U.S. is on a pace to become the world’s largest LNG exporter this year.

Fracking offers New York enormous potential — if only politicians would get out of the way - Way back in 2019, before anyone had heard of COVID, the national economy was enjoying record levels of success while New York’s was struggling. President Donald Trump was well-positioned for reelection, while Gov. Andrew Cuomo was trying to explain his state’s stagnation.The previous year, 190,000 New Yorkers had fled to other states. Once-booming upstate cities like Buffalo, Rochester and Binghamton led the state’s population loss. Cuomo blamed it on the weather, saying people departed for “climate-based” reasons. And Cuomo blamed Trump (no surprise there) for the discontinuation of state and local tax (SALT) deductions that he claimed created a $2 billion shortfall. Then-political-newcomer Rep. Alexandria Ocasio-Cortez had scuttled Cuomo’s hard-fought Amazon deal, canceling 25,000 jobs and billions in tax revenue. New York state was in a rut.And New York’s greatest economic opportunity still lies buried under its feet today.Geological formations below ground hold tens of trillions of cubic feet of natural gas. The US Geological Survey estimates the Marcellus Shale formation contains 84 trillion cubic feet and the Utica Shale another 38 trillion. Large portions of these formations are in New York, where they sit untapped — because of Cuomo’s fracking ban, which he persuaded the Legislature to pass.Cuomo couldn’t have known that the price of natural gas would more than quadruple after 2020, nor that Russia would cut liquefied-natural-gas exports to Europe, prompting rationing and fear for the winter. But he did know that natural gas — and the fracking necessary to retrieve it — would mean jobs, economic prosperity and opportunity for New Yorkers upstate. He ignored all that in the name of green science. My organization, Power The Future, compared Pennsylvania’s economy with New York’s. Natural gas generated $1.7 billion in new tax revenue for the Keystone State from 2012 to 2019. Wages for oil and gas employees had increased 36% between 2007 and 2012. In fact, from the great recession of 2008 to 2012, when Pennsylvania was losing jobs overall, natural gas and fracking jobs increased 259%.The natural-gas industry is so crucial to Pennsylvania that the Bernie Sanders-backed Senate candidate John Fetterman has magically reversed his opposition to fracking. The Democratic gubernatorial candidate, Josh Shapiro, who has been on the record as anti-fossil fuel and anti-fracking — and even sued the industry as attorney general — hides all this on his campaign website, saying he wants Pennsylvania to “remain an energy hub.” So even Pennsylvania’s liberal Democrats are pro-natural-gas. Or at least claim to be. Then there is New York, today with an even worse economic climate and greater population decline (not to mention skyrocketing crime). Cuomo is long gone. But New York’s anti-fossil fuel, anti-fracking, anti-commonsense policies remain.

DC Moves To Ban Natural Gas In Most New Buildings -By 2026, all new buildings and substantial renovations in D.C. will have to be net-zero construction, meaning they produce as much energy as they consume, under legislation passed unanimously by the D.C. Council. The legislation, which also bans most natural gas use in new buildings, has now been signed by Mayor Muriel Bowser. Separate climate legislation, also signed by Bowser, commits to making the entire city carbon neutral by 2045. “Buildings account for close to 75% of the District’s emissions,” said Councilmember Mary Cheh, who introduced the bills, during discussion of the legislation. “So making our buildings more efficient and ensuring that they use clean energy, is probably one of the most important steps we can take to achieve carbon neutrality.” Building emissions come from the electricity and natural gas used for heating, air conditioning, hot water, cooking, and everything else that requires power. Earlier this year, a study found that ample natural gas leaks around the District are a contributor to climate change. Mike Tidwell, executive director of the Chesapeake Climate Action Network, said the District had “raised the bar on climate action, not only in the nation’s capital, but for the whole country.”

Natural Gas Futures See Late Bounce as August Forecast Turns Hotter; Rain Dampens Cash -Armed with a cooling weather forecast and a new production high over the weekend, natural gas traders initially sent September futures lower as the calendar flipped to August. However, midday weather models showing more heat for the East Coast quickly reversed the course for September Nymex gas futures. The prompt month settled 5.4 cents higher at $8.283/MMBtu. October futures moved up 5.2 cents to $8.260. Spot gas prices extended their losses from late last week amid showers tracking across the Midwest and eastern United States, which kept a lid on temperatures. NGI’s Spot Gas National Avg. fell 19.0 cents to $8.140. Futures action was fast and furious Monday, with September prices down sharply out of the gate as weather forecasts cooled a bit for the first half of this month. The prompt month plunged to a $7.753 intraday low before recovering midday. Bespoke Weather Services said near-record heat is still expected this week, with every day in the 15-day outlook forecast to be hotter than normal. But, models have tended to overshoot the level of projected heat throughout the summer, and heading into the middle of August, some cooler trends are likely to emerge. “As we head into the middle part of the month, the focus of strongest anomalous heat looks set to slosh back into the middle of the nation, with some relaxation expected in the eastern part of the U.S.,” Bespoke said. Nevertheless, the midday Global Forecast System model gained back four of the nine cooling degree days (CDD) it lost over the weekend. Overall, it remained “impressively hot and bullish” most of the next 15 days, while remaining more than 15 CDDs hotter than the European model. Meanwhile, production continues to tease new highs. NatGasWeather pointed out that output hit 97 Bcf late last week and held at that level through the weekend. However, with the start of the new month, early data on Monday reflected a 1.5 Bcf day/day decline in production. Revisions are likely, though. With the recent heat and the near-term outlook reflecting more of the same, U.S. storage deficits are set to swell in the coming weeks, according to the firm. It sees overall stocks, currently 345 Bcf below the five-year average, slipping to slightly more than 360 Bcf behind those levels. On the bright side, NatGasWeather noted deficits may have ballooned to near 450 Bcf if not for the outage at the Freeport LNG terminal.

U.S. natgas futures drop 7% on record output, lower demand (Reuters) - U.S. natural gas futures dropped about 7% to a two-week low on Tuesday on record output and forecasts for less demand over the next two weeks than previously expected. That price drop came despite a 5% jump in European gas prices on concerns about Russian supplies and forecasts for temperatures across much of the Untied States to remain hotter than normal through at least mid August. So far this summer, electric companies have already burned record amounts of gas to meet soaring power use to keep air conditioners humming. Power demand in Texas was expected to break records again this week. Gas-fired plants have provided over 40% of U.S. power in recent weeks, according to federal energy data, even though gas futures soared about 52% in July. That is partially because coal prices keep hitting fresh record highs, making it uneconomical for some generators to use their coal-fired plants. Front-month gas futures fell 57.7 cents, or 7.0%, to settle at $7.706 per million British thermal units (mmBtu), its lowest close since July 19. That was the biggest one-day percentage decline since late June when the contract fell about 17%. So far this year, the front-month was up about 105% as much higher prices in Europe and Asia keep demand for U.S. LNG exports strong, especially since the amount of gas from Russia to Europe has dropped following Moscow's invasion of Ukraine on Feb. 24. Gas was trading around $62 per mmBtu in Europe and $45 in Asia. Data provider Refinitiv said average gas output in the U.S. Lower 48 states rose to 97.4 bcfd so far in August from a record 96.7 bcfd in July. On a daily basis, however, output was on track to drop 1.4 bcfd to a preliminary 96.7 bcfd on Tuesday after soaring 2.4 bcfd to a daily record high of 98.4 bcfd on Friday. Preliminary data is often changed later in the day. With hotter weather expected, Refinitiv projected that average U.S. gas demand including exports would rise from 99.6 bcfd this week to 100.2 bcfd next week. Those forecasts were lower than Refinitiv's outlook on Monday. The average amount of gas flowing to U.S. LNG export plants rose to 11.1 bcfd so far in August from 10.9 bcfd in July. That compares with a monthly record of 12.9 bcfd in March. The seven big U.S. export plants can turn about 13.8 bcfd of gas into LNG.

USA Gas Prices Hit 14 Year Seasonal High -U.S. gas prices hit at a 14-year seasonal high as the country battles persistent high temperatures and resultant soaring cooling demand for gas. That’s what Rystad Energy Analyst Karolina Siemieniuk highlighted in a market note sent to Rigzone late Tuesday, which outlined that Henry Hub gas prices rose to $8.99 per MMBtu on July 26, before falling to $8.283 per MMBtu on August 1. At the time of writing, Henry Hub gas prices were hovering just under $8 per MMBtu. The commodity closed above $9 per MMBtu in June but dipped to under $6 per MMBtu in July. In the note, the Rystad analyst pointed out that, in the west, prolonged droughts and reduced hydro-electric generation had contributed to elevated gas use. “At the same time, the U.S. has become the largest LNG exporter, with 42 million tons of LNG exported in the first six months of 2022, about six million tons more compared with the same period last year,” Siemienik stated in the note. “The U.S. has since mid-June not been exporting at its full capacity due to the ongoing outage at the Freeport LNG facility in Texas, which has affected 15.3 million tons per annum of capacity. Despite this outage … current U.S. gas inventories are below the five-year average and last year’s number,” the analyst added. “U.S. underground storage as of week 29 (July 22) was at 2.416 trillion cubic feet, which is 260 billion cubic feet below last year’s level. In the absence of the Freeport LNG outage, gas inventories could have been even lower and prices in the U.S. even higher,” Siemieniuk continued. The analyst also warned in the note that, “with Europe still scrambling for LNG, prices are likely to stay elevated for the near future”.

U.S. natgas jump 7% with Freeport LNG seen back in October (Reuters) - U.S. natural gas futures jumped 7% on Wednesday after Freeport LNG said its liquefied natural gas (LNG) export plant in Texas remains on track to return to service in early October. Freeport said in a release that it entered into a consent agreement with the U.S. Pipeline Hazardous Materials Safety Administration (PHMSA) that should allow the plant "to resume initial operations in early October." The shutdown of Freeport on June 8 left a lot of gas in the United States for utilities to inject into what are extremely low stockpiles. Freeport is the second-biggest LNG export plant in the United States. It was consuming about 2 billion cubic feet per day (bcfd) of gas before it shut. Freeport has long estimated the facility will return to at least partial service in October. Some analysts, however, have projected the outage would last longer. In addition to the Freeport news, prices were also up on forecasts for hotter weather and more air conditioning demand next week than previously expected. Front-month gas futures rose 56.0 cents, or 7.3%, to settle at $8.266 per million British thermal units (mmBtu). In what has already been an extremely volatile year, that increase was only the biggest one-day percentage gain since July 20 when the contract rose about 10%. On Tuesday, the front-month fell about 7%. So far this year, the front-month was up about 118% as much higher prices in Europe and Asia keep demand for U.S. LNG exports strong, especially since the amount of gas from Russia to Europe has dropped following Moscow's invasion of Ukraine on Feb. 24. Gas was trading around $59 per mmBtu in Europe and $46 in Asia. The United States became the world's top LNG exporter during the first half of 2022. But no matter how high global gas prices rise, the United States cannot export any more LNG because its plants were already operating at full capacity. Russian gas exports on the three main lines into Germany - Nord Stream 1 (Russia-Germany), Yamal (Russia-Belarus-Poland-Germany) and the Russia-Ukraine-Slovakia-Czech Republic-Germany route - held at 2.5 bcfd on Tuesday, the same as Monday. That compares with an average of 2.8 bcfd in July and 10.4 bcfd in August 2021. . With hotter weather expected, Refinitiv projected that average U.S. gas demand including exports would rise from 99.5 bcfd this week to 101.3 bcfd next week. The forecast for next week was higher than Refinitiv's outlook on Tuesday. The average amount of gas flowing to U.S. LNG export plants rose to 11.0 bcfd so far in August from 10.9 bcfd in July. That compares with a monthly record of 12.9 bcfd in March. The seven big U.S. export plants can turn about 13.8 bcfd of gas into LNG.

Natural Gas Futures Plunge, but Quickly Recover from EIA’s Plump Storage Report -The Energy Information Administration (EIA) reported a much larger-than-expected 41 Bcf injection into natural gas storage inventories for the week ending July 29. The EIA figure topped even the highest of estimates ahead of the report, and seemingly eased some concerns about supply, given the possibility of Freeport LNG’s return in October. The Nymex September gas futures contract was down about 24 cents day/day at around $8.020/MMBtu in the minutes leading up to the inventory report. They quickly plunged to $7.880 as the EIA print crossed trading desks. By 11 a.m. ET, though, the prompt month was back at $8.112, off 15.4 cents from Wednesday’s close. “After a few tight numbers, I see this one 1.5 Bcf/d loose versus last year,” said managing director Het Shah of The Desk’s online chat Enelyst. “Most of my miss was in the South Central salt. I was expecting salt to draw” but it “came in flat.” South Central salt stocks ended the period unchanged at 195 Bcf, while nonsalts added 4 Bcf to lift stocks to 671 Bcf, according to EIA. Midwest inventories rose by 18 Bcf, while East stocks increased by 17 Bcf. Mountain storage levels were up 3 Bcf, and the Pacific region stayed flat on the week. The 41 Bcf injection compares with the year-earlier injection of 16 Bcf. The five-year average for the week is a build of 35 Bcf, according to EIA. Enelyst participants questioned whether production was higher than the 97 Bcf/d levels recently observed in the market. In particular, there were questions about whether Appalachia producers were ramping up amid the bursts of heat sweeping through the region. In addition, one of the trains at the Sabine Pass liquefied natural gas terminal was out of commission most of last week, which made more gas available for injection. Total working gas in storage as of July 29 was 2,457 Bcf, which is 268 Bcf below year-ago levels and 337 Bcf below the five-year average, EIA said.

U.S. natgas futures ease 1% on record output, milder forecasts (Reuters) - U.S. natural gas futures eased about 1% on Friday as output neared record highs and forecasts for hot weather were revised slightly lower, which would mean lower demand for air conditioning. Also weighing on prices was the ongoing outage at the Freeport liquefied natural gas (LNG) export plant in Texas, which has left more gas in the United States for utilities to inject into stockpiles for next winter. Forecasts called for weather to remain hotter than normal through at least mid August. Gas-fired generators have provided more than 40% of U.S. power in recent weeks, according to federal energy data. Even with gas futures soaring about 52% in July, gas remained an attractive option because coal prices kept hitting record highs. Freeport, the second-biggest LNG export plant in the United States, was consuming about 2 billion cubic feet per day (bcfd) of gas before it shut on June 8. Freeport expects to return the facility to at least partial service in early October. Front-month gas futures fell 5.8 cents, or 0.7%, to settle at $8.064 per million British thermal units (mmBtu). For the week, the contract slid about 2% after easing about 1% last week. So far this year, the front-month was up about 116%, as much higher prices in Europe and Asia fed strong demand for U.S. LNG exports. Gas flows to Europe from Russia dropped following Moscow's Feb. 24 invasion of Ukraine. Gas was trading around $58 per mmBtu in Europe and $45 in Asia. Data provider Refinitiv said average gas output in the U.S. Lower 48 states rose to 97.8 bcfd so far in August from a record 96.7 bcfd in July. With hotter weather expected, Refinitiv projected that average U.S. gas demand including exports would rise from 98.9 bcfd this week to 100.8 bcfd next week before sliding to 99.2 bcfd in two weeks as heat starts to ease. Refinitiv's forecasts for this week and next were lower than on Thursday.