US gasoline supplies fell 2.3% on return of demand and gasoline exports at 3 1/2 year high; Strategic Petroleum Reserve at new 37 year low; 670,000 barrels per day of excess oil were produced worldwide in July, even with OPEC output 1,231,000 barrels per day short of quota

oil prices rose for the second week in three this week, supported by weak US inflation data, suggesting that monetary policy might not need to be as economically restrictive going forward...after falling 9.7% to $89.01 a barrel last week on weak economic reports from China and Europe and lower US demand for fuel, the contract price for the benchmark US light sweet crude for September delivery edged up from last week's 6 month lows in early trading on Monday, as positive economic data from China and the US fed hopes for rising demand, despite nagging fears of a recession, and then further rallied after China surprised markets by reporting a greater-than-expected growth in oil purchases over the last month to settle $1.75 higher at $90.76 a barrel, as the drawdown of U.S. Strategic Petroleum Reserves to a fresh 37-year low underscored tight market fundamentals....oil's rally extended into early trading on Tuesday, following reports that Russia's Transneft had suspended oil exports to Hungary, the Czech Republic, and Slovakia due to transit payment issues, but then dropped over $1 a barrel following reports on progress in talks to revive the Iran nuclear accord, which would allow Tehran to boost oil exports, and settled 26 cents lower at $90.50 a barrel after the U.S. EIA revised lower its world oil demand forecast for the fourth consecutive month, citing protracted economic weakness and rising inflation across the wealthy industrialized OECD countries...oil prices dipped in evening trading after the API reported a bigger than expected build of US crude inventories, and then edged lower early Wednesday on expectations that the Druzhba pipeline flows to central Europe would resume shortly as traders took to the sidelines ahead of US inflation and oil inventory data, but then rebounded on renewed gasoline demand and higher crude inventories, and as lower-than-expected U.S. inflation data drove investors into riskier assets, and finished $1.43 higher at $91.93 a barrel, supported by a sharp drop in the U.S. dollar after inflation data for July surprised markets to the downside, with the first month-on-month decrease since April 2020...oil prices moved 1% higher early Thursday, after the International Energy Agency boosted its forecast for global demand growth this year, and accelerated in afternoon trading to close $2.41 higher at $94.34 a barrel, as high natural gas prices in Europe were forcing power generators to switch to oil for electricity production....however, oil prices moved lower in Asian trading amid mild profit taking early Friday, and then tumbled in early New York trading on a stronger dollar following cautious comments from key Federal Reserve officials that softer U.S. inflation data wouldn't necessarily slow the aggressiveness of further rate increases, and settled $2.25 lower at $92.09 a barrel on easing worries about a supply disruption in the U.S. Gulf of Mexico, and lower oil demand forecasts from OPEC...but oil prices still finished 3.5% higher on the week, as better-than-expected inflation data reset expectations of how aggressively the Fed would have to raise interest rates...

natural gas prices also finished higher on the week, on weaker well output and on signs that Freeport LNG was on track to resume exports by early October... after falling 2.0% to $8.064 per mmBTU last week on milder forecasts and on an inventory increase that exceeded expectations, the contract price of natural gas for September delivery opened 5% lower on Monday on weekend forecasts for lighter cooling demand in the coming weeks, and settled 47.5 cents, or 5.9% lower at $7.589 per mmBTU, their lowest close since mid-July, on record output and on forecasts for cooler weather and lower air conditioning demand over the next two weeks than had been expected...however, natural gas prices opened 20 cents higher on Tuesday and recovered more than half of their Monday drop to settle 24.4 cents higher at $7.833 per mmBTU, as well production took a tumble and drove a swift rebound for natural gas futures...continued lower output and a warmer shift in the forecast drove prices higher Wednesday, as they finished with a 36.9 cent gain at $8.202 per mmBTU, and then they jumped 67.2 cents or 8% to $8.874 on Thursday on talk of increased gas flows to the Freeport LNG export plant in Texas, another drop in gas output, and forecasts for more demand over the next two weeks than had been expected...after an initial 5% drop on Friday on forecasts for cooler weather and lower demand for next week, natural gas prices clawed back from the day's lows to settle at $8.768 per mmBTU, down 10.6 cents on the day, but still 8.7% higher on the week...

The EIA's natural gas storage report for the week ending August 5th indicated that the amount of working natural gas held in underground storage in the US rose by 44 billion cubic feet to 2,501 billion cubic feet by the end of the week, which still left our gas supplies 268 billion cubic feet, or 9.7% below the 2,769 billion cubic feet that were in storage on August 5th of last year, and 338 billion cubic feet, or 11.9% below the five-year average of 2,839 billion cubic feet of natural gas that have been in storage as of the 5th of August over the most recent five years....the 44 billion cubic foot injection into US natural gas working storage for the cited week was higher than the average 40 billion cubic foot injection forecast from both Bloomberg's and Reuters' surveys of analysts, but matched the 44 billion cubic feet that were added to natural gas storage during the corresponding week of 2021, and almost matched the average injection of 45 billion cubic feet of natural gas that had typically been added to our natural gas storage during the same week over the past 5 years....

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending August 5th indicated that after another big drop in our oil exports, another big withdrawal of crude from the SPR, and a shift from oil demand that could not be accounted for to oil supplies that could not be accounted for, we were able to add oil to our stored commercial crude supplies for the 4th time in 8 weeks, and for the 16th time in the past 37 weeks....Our imports of crude oil fell by an average of 1,171,000 barrels per day to average 6,171,000 barrels per day, after rising by 1,178,000 barrels per day to a 2 year high during the prior week, while our exports of crude oil fell by 1,402,000 barrels per day to 2,110,000 barrels per day, which meant that our trade in oil worked out to a net import average of 4,061,000 barrels of oil per day during the week ending August 5th, 231,000 more barrels per day than the net of our imports minus our exports during the prior week. Over the same period, production of crude from US wells was reportedly 100,000 barrels per day higher at 12,200,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 16,261,000 barrels per day during the August 5th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,581,000 barrels of crude per day during the week ending August 5th, an average of 728,000 more barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 23,000 barrels of oil per day were being added to the supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures from the EIA for the week ending August 5th appear to indicate that our total working supply of oil from net imports and from oilfield production was 343,000 barrels per day less than what what was added to storage plus what our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+343,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed...moreover, since last week’s EIA fudge factor was at (-109,000) barrels per day, that means there was a 452,000 barrel per day difference between this week's balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the net of the week over week supply and demand changes indicated by this week's report are Inaccurate by that much....however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's rounded 32,000 barrel per day increase in our overall crude oil inventories came as 780,000 barrels per day were being added to our commercially available stocks of crude oil, while 757,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve at the same time.. That draw on the SPR was part of the emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump" (sic), that was expected to supply 1,000,000 barrels of oil per day to commercial interests over a six month period up to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising further, at least up until that time. The administration's previous 30,000,000 million barrel release from the SPR to address Russian supply related shortfalls wrapped up in June, and his earlier release of 50 million barrels from the SPR to incentivize US gasoline consumption was completed in May...Including those, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 191,589,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 24 months, and as a result the 464,558,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since April 26th, 1985, or at a new 37 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's SPR releases. Now the total 180,000,000 barrel drawdown expected during the current six month release program to November will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to an average of 6,549,000 barrels per day last week, which was 0.9% less than the 6,608,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be 100,000 barrels per day higher at 12,200,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day at 11,800,000 barrels per day, while Alaska’s oil production was 4,000 barrels per day lower at 433,000 barrels per day but had no impact on the final rounded national total. US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 6.9% below that of our pre-pandemic production peak, but was 25.8% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021...

US oil refineries were operating at 94.3% of their capacity while using those 16,581,000 barrels of crude per day during the week ending August 5th, up from their 91.0% utilization rate during the prior week, and back to a refinery utilization rate that's now near normal for mid summer. The 16,581,000 barrels per day of oil that were refined this week were 2.4% more than the 16,197,000 barrels of crude that were being processed daily during week ending August 30th of 2021, but 4.2% less than the 17,302,000 barrels that were being refined during the prepandemic week ending August 9th, 2019, when our refinery utilization was at 94.8%, typical for mid summer...

With the big increase in the amount of oil being refined this week, gasoline output from our refineries was also much higher, increasing by 858,000 barrels per day to 10,150,000 barrels per day during the week ending August 5th, after our gasoline output had decreased by 366,000 barrels per day during the prior week. This week’s gasoline production was 1.9% more than the 9,961,000 barrels of gasoline that were being produced daily over the same week of last year, but 0.5% less than our gasoline production of 10,203,000 barrels per day during the week ending August 9th, 2019, ie, a comparable week during the year before the pandemic impacted US gasoline output. Meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 189,000 barrels per day to 5,122,000 barrels per day, after our distillates output had decreased by 76,000 barrels per day during the prior week. With that increase, our distillates output was 4.9% more than the 4,885,000 barrels of distillates that were being produced daily during the week ending July 30th of 2021, and 0.9% more than the 5,077,000 barrels of distillates that were being produced daily during the week ending August 9th 2019...

Even with the big increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the 3rd time in eight weeks; but for the 21st time out of the past twenty-seven weeks, decreasing by 4,978,000 barrels to 220,316,000 barrels during the week ending August 5th, after our gasoline inventories had increased by 163,000 barrels during the prior week. Our gasoline supplies decreased this week because the amount of gasoline supplied to US users increased by 582,000 barrels per day to 9,123,000 barrels per day, and because our exports of gasoline rose by 286,000 barrels per day to 3 1/2 yr high of 1,126,000 barrels per day, while our imports of gasoline fell by 14,000 barrels per day to 595,000 barrels per day. After 21 inventory drawdowns over the past 27 weeks, our gasoline supplies were 3.1% lower than last August 6th's gasoline inventories of 227,469,000 barrels, and about 6% below the five year average of our gasoline supplies for this time of the year…

After the increase in our distillates production, our supplies of distillate fuels increased for the 2nd time in 9 weeks and for the 19th time in forty-nine weeks, rising by 2,166,000 barrels to 111,490,000 barrels during the week ending August 5th, after our distillates supplies had decreased by 2,400,000 barrels during the prior week. Our distillates supplies rose this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, decreased by 153,000 barrels per day to 3,724,000 barrels per day, and because our exports of distillates fell by 341,000 barrels per day to 1,293,000 barrels per day, while our imports of distillates fell by 30,000 barrels per day to 204,000 barrels per day.. After forty-six inventory withdrawals over the past sixty-nine weeks, our distillate supplies at the end of the week were 20.7% below the 140,511,000 barrels of distillates that we had in storage on August 6th of 2021, and about 24% below the five year average of distillates inventories for this time of the year...

Meanwhile, after this week's big decrease in our oil exports, our commercial supplies of crude oil in storage rose for the 6th time in 13 weeks and for the 22nd time in the past year, increasing by 5,457,000 barrels over the week, from 426,553,000 barrels on July 29th to 432,010,000 barrels on August 5th, after our commercial crude supplies had increased by 4,467,000 barrels over the prior week. After those increases, our commercial crude oil inventories were still about 5% below the most recent five-year average of crude oil supplies for this time of year, but roughly 24% above the average of our crude oil stocks as of the first week of August over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. Since our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this August 5th were still 1.5% less than the 438,777,000 barrels of oil we had in commercial storage on August 6th of 2021, and were 16.0% less than the 514,084,000 barrels of oil that we had in storage on August 7th of 2020, and 1.9% less than the 440,510,000 barrels of oil we had in commercial storage on August 9th of 2019…

Finally, with our inventories of crude oil and our supplies of all products made from oil near multi-year lows in recent months, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR. The EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, rose by 7,709,000 barrels this week, from 1,678,775,000 barrels on July 29th to 1,686,484,000 barrels on August 5th, after our total inventories had fallen by 1,164,000 barrels during the prior week. That still left our total liquids inventories down by 101,949,000 barrels over the first 30 weeks of this year, and less than nine million barrels from a 13 1/2 year low...

OPEC's Report on Global Oil for July

Thursday of this week saw the release of OPEC's August Oil Market Report, which includes details on OPEC & global oil data for July, and hence it gives us a picture of the global oil supply & demand situation at a time when China was reopening from its most restrictive Covid lockdowns, and when global refining actively was picking up with the summer driving season, while at the same time the supply of Russian oil was still curtailed by sanctions imposed by the West....in light of those circumstances, OPEC and aligned oil producers agreed to increase their output by the usual 400,000* barrels per day for a twelfth consecutive month, ie the 12th such increase from the previously agreed to July 2021 level, and to also increment that increase with half of the production increase they had originally scheduled for September...that was the sixth production quota policy reset that they had made over the past twenty-six months, all by way of responding to the pandemic-related demand slowdown and subsequent irregular recovery....note that with the course and impact of the Ukraine war and the future course of the pandemic largely unknown, the demand projections made in this report will have a much greater degree of uncertainty than they would have during normal, more stable times..

The first table from this month's report that we'll review is from the page numbered 48 of this month's report (pdf page 58), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC has used an average of production estimates by six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures....with the June report, the consultancy Wood Mackenzie and the research and intelligence firm Rystad Energy were also added to OPEC's secondary sources.....

As we can see on the bottom line of the above table, OPEC's oil output increased by 234,000 barrels per day to 28,716,000 barrels per day during July, up from their revised June production total that averaged 28,482,000 barrels per day....however, that June output figure was originally reported as 28,716,000 barrels per day, which therefore means that OPEC's June production was revised 36,000 barrels per day lower with this report, and hence OPEC's July production was, in effect, just 180,000 barrels per day higher than the previously reported OPEC production figure (for your reference, here is a copy of the table of the official June OPEC output figures as reported a month ago, before this month's revision)...

According to the agreement reached between OPEC and the other oil producers at their Ministerial Meeting on July 18th, 2021, the oil producers party to that agreement were to raise their output by a total of 400,000 barrels per day each month through December 2021, (later bumped up to 432,000 bpd) which was subsequently renewed at monthly meetings to include further 400,000+ barrel per day production increases in January, February, March, April, May, and June of 2022, and which would indicate an increase of 254,000 barrels per day each month from the OPEC members listed above, (later bumped up to 286,000 barrels per day) with the rest of the current 432,000 barrel per day cartel increase to supplied by other aligned oil producers. including Russia...with the OPEC agreement reached on June 3rd, they agreed to further increase their July output by half of the 432,000 barrels per day they had scheduled as an increase in September...hence, the July production increase for the extended cartel was to expected to be 648,000 barrels per day, with 429,000 barrels of that coming from OPEC...hence, OPEC's actual July increase of 216,000 barrels per day was barely half of the increase they had commited to....and while the production decreases in Venezuela, Angola, Iran and in Libya contributed to their July production shortfall, several other OPEC members continued to be well short of what they were expected to produce, as we'll see in the next table..

The adjacent table was originally included as a downloadable attachment to the press release following the 29th OPEC and non-OPEC Ministerial Meeting on June 2nd, 2022, which set OPEC's and other aligned oil producers' production quotas for July... since war torn Libya and US sanctioned producers Iran and Venezuela are exempt from the production cuts imposed by the joint agreement that governs the output of the other OPEC producers, they are not shown in this list, and OPEC's quota excluding them is aggregated under the total listed for the 'OPEC 10', which you can see was expected to be at 26,276,000 barrels per day in July....therefore, the 25,045,000 barrels those 10 OPEC members actually produced in June were 1,231,000 barrels per day short of what they were expected to produce during the month, with Nigeria and Angola accounting for a large part of this month's shortfall, while only Kuwait, the UAE and Gabon were able to produce what was expected of them...

+ + +

* Recall that the original 2020 oil producer's agreement was to jointly cut their oil production by 23%, or by 9.7 million barrels per day, from an October 2018 baseline for just two months early in the pandemic, during May and June of 2020, but that initial 9.7 million bpd production cut agreement was extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020....then, in a subsequent meeting in early July of that year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August 2020 and subsequent months, which thus became the agreement that governed OPEC's output for the rest of 2020...the OPEC+ agreement for their January 2021 production, which was later extended to include February and March and then April's output, was to further ease their supply cuts by 500,000 barrels per day to a reduction of 7.2 million barrels per day from that original October 2018 baseline...then, during a difficult meeting on April 1st of last year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher each month by a pre-set amount for each country over the following three months, thus extending their joint output cut agreement through July 2021....production levels for August and the following months of last year were to be determined by a July 1st OPEC meeting, but that meeting was adjourned on July 2nd due to a dispute between the UAE and the Saudis over the 2018 reference production levels on which the cuts are based, and a subsequent attempt to restart that meeting on July 5th was called off....so it wasn't until July 18th 2021 that a tentative compromise addressing August 2021's output quotas was worked out, allowing oil producers in aggregate to increase their production by 400,000 barrels per day in August, and again by that amount in each of the following months, and also to boost reference production levels for the UAE, the Saudis, Iraq and Kuwait beginning in April 2022, and which made the cartel's effective monthly production increase 432,000 barrels per day since that time....OPEC and other producers then agreed to increase their production in January 2022 by a further 400,000 barrels per day in a meeting concluded on the 2nd of December, 2021, and reaffirmed their intention to continue that policy with another 400,000 barrel per day increase in February at a meeting concluded January 4, 2022, and then agreed to stick to that 400,000 bpd oil output increase in March, despite pressure from the US to raise output more quickly, at a meeting on February 2nd....then, at a meeting on March 2nd, OPEC and its oil-producing allies, which included Russia, decided to hold their production increase at that level thru April in an OPEC+ meeting that only lasted 13 minutes, their shortest meeting ever...then on March 31, OPEC and aligned producers agreed to reaffirm the decisions of the prior Ministerial meetings and again limit their production increase for May to the agreed 400,000 barrels per day, because "the current [oil market]volatility is not caused by fundamentals, but by ongoing geopolitical developments"...following that, in an OPEC and non-OPEC Ministerial Meeting held on May 5th, they again "reaffirmed, reconfirmed, and reinterated" the decision of the July 18th 2021 meeting to increase production by 432,000 barrels per day in June...however, in a meeting held on June 2nd, they agreed to bring forward the 432,000 barrel per day increase they had already scheduled for September, with that increase to be split evenly between July and August...hence, the production quota increase for both July and August was set at 648,000 barrels per day, which should then leave each member's production back to the October 2018 baseline...

Hence OPEC arrived at the production quotas for August 2021 through July & Augst of this year after repeatedly readjusting the original 23%, or 9.7 million barrel per day production cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day output reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was subsequently raised to an 8.2 million barrel per day oil output reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during the Covid surge of February, March, and then later during April of last year....under the agreement prior to the July 18th 2021 pact affecting the recent months since then, OPEC's production cut in April 2021 was set at 4,564,000 barrels per day below the October 2018 baseline, which was lowered to a cut of 3,650,000 barrels per day from the baseline with the subsequent comprehensive agreement, which thus set the July 2021 production quota for the "OPEC 10" at 23,033,000 barrels per day, with war torn Libya and US sanctioned producers Iran and Venezuela exempt from the production cuts imposed by that agreement....for OPEC and the other producers to increase their output by 400,000 barrels per day from that July 2021 level, each producer would be need to initially increase their production by just over 1% per month since that time...for OPEC alone, that meant a 254,000 barrel per day increase for each month from July 2021 to April 2022, at which time the incremental 32,000 barrels per day adjustment they arrived at in July 2021 kicked in....adding together those monthly quota increases since last July, when the quota was at 23,033,000 barrels per day, and then adding the 216,000 barrel per days brought forward from September's increase, is how they arrived at the 26,276,000 barrels per day quota for OPEC for July that you see on the table above..

The next graphic from this month's report that we'll look at shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from August 2020 to July 2022, and it comes from page 49 (pdf page 59) of OPEC's August Oil Market Report....on this graph, the cerulean blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

After this month's 216,000 barrel per day increase in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate is that total global liquids production increased by a rounded 1,700,000 barrels per day to average 100.6 million barrels per day in July, a reported increase which came after June's total global output figure was apparently revised down by 920,000 barrels per day from the 99.82 million barrels per day of global oil output that was estimated for June a month ago, as non-OPEC oil production rose by a rounded 1,500,000 barrels per day in July after that downward revision, with 1.100,000 barrels per day of July's production growth coming from the OECD Europe, "Other Eurasia", and Latin America...

After that 1.7 million barrel per day increase in July's global output, the 100.6 million barrels of oil per day that were produced globally during the month were 4.88 million barrels per day, or 5.1% more than the revised 95.72 million barrels of oil per day that were being produced globally in July a year ago, which was the third month after OPEC and their allied producers began their program of monthly production increases from the 7.2 million barrels per day production cut that had governed their output over the first four months of last year (see the August 2021 OPEC report (online pdf) for the originally reported July 2021 details)...with this month's increase in OPEC's output fairly modest compared to the big global increase, their June oil production of 28,896,000 barrels per day amounted to 28.7% of what was produced globally during the month, down from their revised 29.0% share of the global total in June....OPEC's July 2021 production was reported at 26,657,000 barrels per day, which means that the 13 OPEC members who were part of OPEC last year produced 2,239,000 barrels per day, or 8.4% more barrels per day of oil this July than what they produced last July, when they accounted for 27.9% of global output...

With the increases in both OPECs and global oil output that we've seen in this report, the amount of oil being produced globally during the month was significantly more than the expected global demand, as this next table from the OPEC report will show us....

The above table came from page 26 of the August Oil Market Report (pdf page 36), and it shows regional and total oil demand estimates in millions of barrels per day for 2021 in the first column, and then OPEC's estimate of oil demand by region and globally quarterly over 2022 over the rest of the table...on the "Total world" line in the fourth column, we've circled in blue the figure that's relevant for July, which is their estimate of global oil demand during the third quarter of 2022....OPEC is estimating that during the 3rd quarter of this year, all oil consuming regions of the globe will be using an average of 99.93 million barrels of oil per day, which is an downward revision of 720,000 barrels per day from their estimate 100.65 million barrels per day for 3rd quarter demand of a month ago (that revision is circled in green)...but as OPEC showed us in the oil supply section of this report and the summary supply graph above, OPEC and the rest of the world's oil producers were producing 100.6 million barrels per day during July, which would imply that there was a surplus of around 670,000 barrels per day of global oil production in July, when compared to the demand estimated for the month...

Note that in green we have circled an upward revision of 220,000 barrels per day to OPEC's previous estimates of second quarter demand...so, in addition to figuring July's global oil supply shortfall that's evident in this report, that upward revision of 220,000 barrels per day to second quarter demand, combined with the 920,000 barrel per day downward revision to June's total global supply figure that's implied in this report, means that the 1,490,000 barrels per day global oil surplus we had previously figured for June would now be revised to a surplus of just 350,000 barrels per day...in addition, the 160,000 barrels per day global oil output surplus we had previously figured for May, in light of the 220,000 barrels per day upward revision to second quarter demand, would now be revised to a shortage of 60,000 barrels per day...in like manner, the 560,000 barrels per day global oil output previously figured for April would now be revised to a surplus of 340,000 barrels per day....

note that in green we have also circled an upward revision of 30,000 barrels per day to OPEC's previous estimates of first quarter demand....for March, that means that the global oil output surplus of 170,000 barrels per day we had previously figured for March would be revised to a surplus of 140,000 barrels per day, and that the 50,000 barrels per day global oil output shortage we had previously figured for February would now be revised to a shortage of 80,000 barrels per day, and that the global oil output shortage of 800,000 barrels per day we had previously figured for January would now be revised to a shortage of 830,000 barrels per day, in light of that 30,000 barrel per day upward revision to first quarter demand...

This Week's Rig Count

The number of drilling rigs running in the US decreased for only the 9th time over the previous 98 weeks during the week ending August 13th, and decreased for 2 weeks in a row for the only time in that 23 month span; however, the rig count was still 3.8% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US decreased by 1 to 763 rigs this past week, which was still 262 more rigs than the 501 rigs that were in use as of the August 13th report of 2021, and was 1,166 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil increased by 3 to 601 oil rigs during the past week, after the number of rigs targeting oil had decreased by 7 during the prior week, but there are still 203 more oil rigs active now than were running a year ago, even as they now amount to just 37.4% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are also down 12.0% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations decreased by 1 to 160 natural gas rigs, which was still up by 58 natural gas rigs from the 102 natural gas rigs that were drilling during the same week a year ago, even as they were still only 10.0% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…

Other than those rigs targeting oil and natural gas, Baker Hughes reports that three of the five "miscellaneous" rigs that were active the prior week were shut down this week; those idled this week included a horizontal rig drilling into the Permian basin in Dawson county Texas, the vertical rig drilling a well or wells intended to store CO2 emissions in Mercer county North Dakota, and the vertical rig targeting the Marcellus shale at a depth of between 5,000 and 10,000 feet in Tompkins County, New York..."miscellaneous" rigs that remain active this week include a directional rig drilling to between 5,000 and 10,000 feet on the big island of Hawaii, and a vertical rig drilling more than 15,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track....a year ago, there were was only one such "miscellaneous" rig running...

The offshore rig count in the Gulf of Mexico was up by 2 to 16 rigs this week, with all of this week's Gulf rigs drilling for oil in Louisiana's offshore waters....that's now three more than the number of offshore rigs that were active in the Gulf a year ago, when 12 Gulf rigs were drilling for oil offshore from Louisiana and one rig was deployed for oil offshore from Texas...in addition to rigs drilling in the Gulf, we still have two offshore directional rigs drilling for natural gas in the Cook Inlet of Alaska; one is indicated to be drilling to between 10,000 and 15,000 feet, while the other one is indicated to be drilling to between 5,000 and 10,000 feet...a year ago, there were was only one rig drilling offshore from Alaska...

In addition to rigs running offshore, there are now 3 water based rigs drilling through inland bodies of water...the one added this week was a directional rig drilling to between 10,000 and 15,000 feet, inland in Galveston Bay. Texas; legacy inland waters rigs include a directional rig targeting oil at a depth greater than 15,000 feet drilling through a lake on Grand Isle, Louisiana, and a directional rig drilling for oil in Terrebonne Parish, Louisiana, also at a depth greater than 15,000 feet...

The count of active horizontal drilling rigs was down by 5 to 693 horizontal rigs this week, which was still 237 more rigs than the 442 horizontal rigs that were in use in the US on August 13th of last year, but barely over half of the record 1,374 horizontal rigs that were drilling on November 21st of 2014....on the other hand, the vertical rig count was up by 2 to 31 vertical rigs this week, and those were also up by 13 from the 18 vertical rigs that were operating during the same week a year ago…at the same time, the directional rig count was also up by 2 to 39 directional rigs this week, while those were also up by 12 from the 27 directional rigs that were in use on August 13th of 2021….

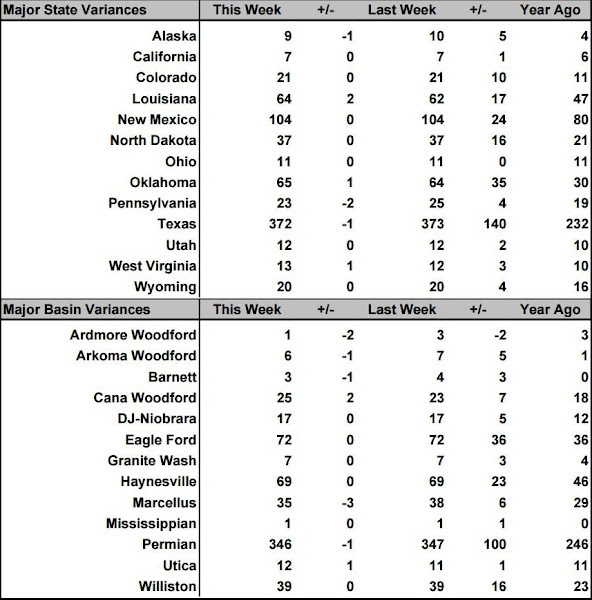

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of August 12th, the second column shows the change in the number of working rigs between last week’s count (August 5th) and this week’s (August 12th) count, the third column shows last week’s August 5th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 13th of August, 2021....

checking the Rigs by State file at Baker Hughes for the changes in Texas Permian, we first find there was one rig pulled out of Texas Oil District 1, while there was a rig added in Texas Oil District 2 at the same time, which were most likely offsetting changes in the Eagle Ford shale...checking next for changes in the Texas Permian, we find there were 7 rigs added in Texas Oil District 7C, which covers the southern counties of the Permian Midland, but that there were six rigs pulled out of Texas Oil District 8, which covers the core Permian Delaware, and that there were two oil rigs pulled out of Texas Oil District 8A, which includes the northern counties of the Permian Midland...one of the Permian rig additions was a natural gas rig, while the removals include the miscellaneous rig that was pulled out of Dawson county, leaving the Permian basin with 343 oil rigs and 3 natural gas rigs...also in Texas, there was a rig pulled out of Texas Oil District 5, which would account for the oil rig removed from the Barnett shale...

in Oklahoma, there were two oil rigs added in the Cana Woodford, but there were two oil rigs pulled out of the Ardmore Woodford at the same time...there was also a natural gas rig removed from the Arkoma Woodford, and since the state count was up by one, that also means two rigs were added in an Oklahoma basin that Baker Hughes doesn't track....in Louisiana, the two oil rigs added offshore account for all the state's changes; everything onshore remained unchanged...in Alaska, we find that the rig that was removed had been drilling for oil in Sagavanirktok, in the North Slope Borough...

in Appalachia, there were three natural gas rigs pulled out of the Marcellus shale in Pennsylvania, but a natural gas rig added in the Utica shale in the state at the same time....there was also a miscellaneous rig pulled out of the Marcellus shale in New York state, but a natural gas rig added in the Marcellus in West Virginia at the same time...hence, natural rigs netted down by one in the Marcellus, and down by one in the Arkoma Woodford, but up by one in the Permian, and hence down by just one nationally...

+++++++++++++++++++++++++++++++++++

Ohio Bill Creates Tax Breaks for Natural Gas Infrastructure Projects | Marcellus Drilling News -Last week two Ohio state House members, Reps. Jon Cross, R-Kenton, and Jay Edwards, R-Nelsonville, introduced House Bill (HB) 685 to promote the use of the state’s natural gas energy resource. The bill would create “ENERGIZEOhio Zones” to attract new investment in areas that are disadvantaged due to lack of energy resources. The designation allows natural gas infrastructure projects (like pipelines) to receive tax abatements and speed up depreciation to lower the overall cost of development.

Legislation on Additional Infrastructure to Address 'Energy Deserts' – State Representatives Jon Cross (R-Kenton) and Jay Edwards (R-Nelsonville) have introduced House Bill 685, the ENERGIZEOhio bill, to promote the use of Ohio’s abundant natural gas energy resource. Ohio is a leader in the production of natural gas. Unfortunately, too many communities across the state have been locked out of future job growth and economic development opportunities due to limited energy infrastructure to deliver Ohio’s natural gas to them. Modeled after successful economic development programs already used in Ohio, ENERGIZEOhio will create a series of programs and incentives geared toward lowering energy costs and growing energy infrastructure in the state. “We’ve been hearing from communities that are locked out of future job growth because of the high cost of energy infrastructure in the state,” Cross said. “These ‘energy deserts’ see limited job growth because there just isn’t the infrastructure in place to deliver energy at a reasonable price. House Bill 685 is a step in the right direction to address the problem and bring jobs and affordable energy to every corner of the state.” “I’ve heard from communities that are really suffering because they don’t have the energy they need, even though there is robust supply in the state and strong local demand,” Edwards said. “Energy infrastructure construction costs have just gone through the roof due to inflation. We can’t wait for Washington to solve our problems. The General Assembly needs to pass this legislation to help deal with these increases in costs.” House Bill 685 would permit the creation of locally led “ENERGIZEOhio Zones,” which will serve as designated areas in need of investment. Within the ENERGIZEOhio Zone, natural gas infrastructure projects would receive tax abatements and accelerated depreciation to lower the overall cost of the development. In addition, House Bill 685 would permit the State of Ohio to offer low-cost financing to support projects and provide a revolving loan fund to allow local officials to facilitate pipeline easements. Finally, the bill provides financial incentives to gas companies to encourage the development of natural gas pipelines in ENERGIZEOhio zones..

Hilcorp Seeks New Utica Permits in Columbiana County - Business Journal Daily – Houston-based Hilcorp Energy Co. has applied for four new permits to enhance its exploration efforts in Columbiana County, according to the Ohio Department of Natural Resources. Hilcorp has applied for three permits to deepen existing wells and a single permit to drill a new horizontal well along Fairmount Road in Elk Run Township, records show. According to the most recent data, energy companies have drilled 97 wells across the county that target the Utica/Point Pleasant shale formation. Hilcorp’s wells in Elk Run Township are some of the most productive in the county, according to oil and gas production data that energy companies provide to ODNR. During the first quarter of 2022, Hilcorp’s Elk Run Baker 7H well produced the most natural gas among wells drilled in Columbiana. Over a period of 90 days, the well yielded a total of 697.9 million cubic feet of gas, according to data. Other nearby wells on the Elk Run Baker pad also proved strong gas and oil producers. The Baker 4H produced 578.5 million cubic feet, records show, while the Baker 2H yielded 500 million cubic feet of gas for the quarter. The Baker 3H produced 466.9 million cubic feet of gas during the quarter. None of the wells produced significant amounts of oil. Data show that Hilcorp has drilled 27 wells across Columbiana County targeting the Utica/Point Pleasant formation. EAP Ohio, also based in Houston with local offices in Louisville, Ohio, has 58 active wells in the county. Wells in Mahoning and Trumbull counties produced little oil and gas during the quarter, data show. The most productive gas well in Mahoning County was Hilcorp’s Poland CLL2 6H well with 56.9 million cubic feet produced over 90 days. Pin Oak Energy Partners’ Kibler 2-3H well in Lordstown, Trumbull County, yielded the most gas in that county with 80.6 million cubic feet. These results pale in comparison to the strong oil and gas wells found in the southeastern portion of the state, according to ODNR. Gulfport Appalachia boasted the most productive gas well in Ohio during the first quarter – the Angleo well in Jefferson County, which produced more than four billion cubic feet of gas during the quarter. Ascent Resources’ Betts 7H well in Guernsey County yielded the most oil during the three-month period, with 103,438 barrels produced.

Ascent Resources Turns Profitable, Drills 22 New Wells in 2Q | Marcellus Drilling News - Ascent Resources, originally founded as American Energy Partners by gas legend Aubrey McClendon, is a privately-held company that focuses 100% on the Ohio Utica Shale. Ascent is Ohio’s largest natural gas producer (337,000 leased acres) and the 8th largest natural gas producer in the U.S. The company issued its second quarter update yesterday. Ascent averaged production of 2.0 Bcfe/d for the quarter, the same as 1Q22 and virtually the same as 2Q21. By the end of June, Ascent was producing 2.2 Bcfe/d. Nearly all of Ascent’s production (93%) was natural gas, while the rest was oil and NGLs.

Ascent Closes on 27K Utica Acres for $270M – Finally Names Seller -- Marcellus Drilling News - On July 1, just as everyone was heading out the door for summer vacation, Ascent Resources announced it is buying another 26,800 acres in the Ohio Utica for $270 million (see Ascent Resources Buys Another 27K Utica Acres for $270 Million). The announcement withheld the identity of the seller but did say Ascent was buying *all* of the seller’s Ohio Utica shale assets, which touched off speculation about who is doing the selling. We now know. On Friday, Ascent announced it has closed on the deal. The seller was XTO Energy, an ExxonMobil subsidiary…

Why Ascent Resources moved up some of next year's fracking to this year - Inflationary pressures and higher gas prices are leading a Utica Shale driller to move up some of the hydraulic fracturing and well completions that it was planning for next year.Ascent Resources Utica Holdings LLC, one of the biggest privately held natural gas producers in the United States, said it was adding a frack crew late in this quarter to finish pads and turn on the gas spigot instead of in 2023 like previously scheduled. Ascent has production of about 2 billion cubic feet per day and 708 wells in the Utica in Ohio. The move doesn't mean that Ascent will veer from the industry's strategy of so-called maintenance capital, which is the amount of drilling and hydraulic fracturing that leads to a steady state of gas production and the corresponding, so far this year, higher free cash flow. Utica and Marcellus Shale producers say that even with the higher prices for natural gas, until pipelines are built to carry away gas outside the region, production isn't likely to skyrocket. Gas was $8.01 per million British Thermal Unit on the Henry Hub spot market as of Aug. 2, compared to $3.74 per million BTU at the beginning of the year,according to the Energy Information Administration. Instead, it's all about inflation and a tight market for service providers, particularly hydraulic fracturing, as the demand for oil and natural gas in the U.S. and around the world skyrockets. "We think it's a prudent decision given commodity prices and more importantly the relative scarcity of goods and services in the field," said EVP/COO Keith Yankowsky. The crews will be working to complete bigger and more complex well pads that have already been drilled.CEO Jeff Fisher told investors in a conference call Thursday that the company was moving the money it would have spent next year into this year's capital expenditures amid higher expected costs and tight market for service providers next year. "This is simply an acceleration of capital from 2023 and is not a permanent increase to our development plan," Fisher said. In fact, the four drilling crews that Ascent has working right now is expected to drop to three by the fourth quarter and will remain that way in 2023. Executives said they weren't providing any further details about their drilling plans for 2023 but said that it was likely going to continue to be maintenance capital level. Ascent is planning to start drilling between 80 and 85 wells for the full year, about the same it forecast. But it will turn inline — bring into full production — between 85 and 90 wells in 2022, compared to the 75-80 it had expected it would in January. It turned inline 31 wells in the second quarter, half in June alone. The move will bump up Ascent's capital spending from $710 million to $770 million forecast in January 2022 to between $920 million and $950 million now foreseen. Most of that is in drilling and completions operations and also includes the impact of inflation in places like fuel costs, tubular steel and labor and service-related expenses.Fisher said that production in 2022 will end up at the higher end of the previous guidance of 2 billion to 2.1 billion cubic feet of production a day.

BP to shed interest in Toledo refinery - Cenovus Energy Inc. has agreed to purchase partner bp PLC’s 50% ownership interest in jointly held BP-Husky Refining LLC’s 160,000-b/d refinery in Toledo, Ohio.As part the proposed deal, Cenovus will pay $300 million in cash for bp’s stake in the refinery, plus the value of inventory, bp and Cenovus said in separate releases on Aug. 8.Upon finalizing the transaction, Cenovus—which has held the other 50% interest in the BP-Husky Refining partnership since merging with Husky Energy Inc. in 2021—will take 100% ownership of the venture, as well as assume operatorship of the refinery from bp (OGJ Online, Oct. 26, 2020).In addition to the refinery sale, the parties confirmed signing a multi-year product supply agreement, further details of which were not revealed.Pending customary closing conditions, the companies said they expect to complete the deal by yearend 2022.bp said it expects more than 580 bp employees currently employed at the Toldeo refinery to become Cenovus employees upon the deal’s closing.For Cenovus, the proposed acquisition will provide an additional 80,000 b/d of downstream throughput capacity, including 45,000 b/d of heavy oil refining capacity, enabling the operator to further optimize its heavy oil value chain through integration with its upstream assets, particularly the ability to run advantaged Canadian crude feedstock, the company said in an Aug. 8 presentation to investors.“Fully owning the Toledo refinery provides a unique opportunity to further integrate our heavy oil production and refining capabilities,” said Alex Pourbaix, Cenovus’ president and chief executive officer.“Operating the refinery will open up additional synergies and capital efficiency opportunities, including connectivity with our nearby [175,000-b/d refinery in Lima, Ohio]. This transaction solidifies our refining footprint in the US Midwest and increases our ability to capture margin throughout the value chain,” Pourbaix added.The company is also eyeing potential turnaround efficiencies via sequencing maintenance events between the Lima and Toledo refineries, the latter of which completed a major turnaround and feedstock optimization project this year to increase the site’s capacity to run high-TAN crude volumes to about 55,000 b/d from 28,000 b/d, Cenovus told investors.Regarding divestment of its stake in the bp-Husky Toledo refinery, bp said the sale will support the operator’s strategy to instead focus investment on its remaining two US refineries—including the fully owned 152,000-b/d refinery in Whiting, Ind., and 238,450-b/d Cherry Point refinery in Blaine, Wash.—both of which are strategically positioned to serve customers in the US Midwest and Pacific Northwest. Including the Toledo refinery, bp presently operates seven refineries that include 800,000 b/d of net capacity in the US and 1.6 million b/d internationally.

Energy Transfer held criminally responsible for damage from Mariner East pipeline construction -- The state attorney general says Texas-based pipeline builder Energy Transfer is “accepting criminal responsibility” for dozens of charges related to construction of its Mariner East pipeline project and the 2018 explosion of the Revolution pipeline in Beaver County.Pennsylvania Attorney General Josh Shapiro announced the company waived its preliminary hearing scheduled for Friday. Energy Transfer pleaded no contest to the charges, meaning the company will have a permanent criminal record for causing damage to drinking water, wetlands and waterways across the state during five years of construction on the liquified natural gas pipeline system.“Every time Energy Transfer bids for a new project here in the Commonwealth of Pennsylvania or somewhere across this country their criminal conduct will stick with them forever,” Shapiro said at a news conference announcing the plea.Energy Transfer did not contest the evidence, and Shapiro said the company agreed their case would lead to a conviction. In October 2021, the Attorney General released a grand jury presentment dozens of pages long that detailed sinkholes, drilling mud spills, and drinking water contamination at 22 sites in 11 counties across Pennsylvania. Those 48 charges included a felony count of failing to report pollution. In February, the AG charged the company with nine additional criminal charges related to the 2018 explosion of the Revolution Pipeline in Beaver County.The plea includes the charges related to the Revolution pipeline. It does not include the felony count related to Mariner East. The AG’s office did not say why that charge was not included in the plea.From the outset, the Mariner East project faced roadblocks when its initial permit applications to the Department of Environmental Protection weredeemed deficient and challenged by environmental groups. Almost immediately after the construction began, it created damage and further galvanized communities who had initially opposed the eminent domain takings required to build the 350-mile pipeline project that contains two new lines and a reconfigured third line.Construction caused dozens of drilling mud spills into wetlands and waterways across the state, led to dangerous sinkholes in Chester County, and polluted drinking water supplies across the length of the project. The company purchased at least five homes in Chester County after its work damaged the aquifer and left gaping holes in resident’s backyards.“After many years of deceiving the public, Energy Transfer is finally being brought to justice for criminal conduct,” said Clean Air Council executive director Joe Minott, whose organization led litigation efforts challenging pipeline permits issued by the DEP. “A pipeline that has had so many criminal violations of the law should not even be allowed to operate.”Shapiro acknowledged that much of the damage would not have been known without documentation by local residents. “We have reached this achievement in large part because of citizens, because of the good people of Pennsylvania,” he said. “The women and men who served on these grand juries and the many neighbors who brought us evidence from their backyards and from nearby streams. To every member of the public who helped us bring about this conviction I want to truly say ‘Thank you.'”

Energy Transfer Affiliates Convicted of Environmental Crimes for Pennsylvania Pipeline Incidents - Energy Transfer LP (ET) affiliates have reached a plea deal and accepted criminal charges related to the Mariner East 2 (ME2) and Revolution pipeline projects in Pennsylvania, resolving cases brought by state Attorney General (AG) Josh Shapiro since last year. ET affiliates pleaded no contest to 23 counts against both pipelines without admitting guilt. Another 34 counts were dropped. Under the plea deal, ET agreed to pay for independent evaluations of potential water quality impacts for homeowners affected by ME 2 construction. The company has also offered to restore or replace private water supplies. Shapiro, a Democratic candidate for governor, said Friday ET would pay an additional $10 million to improve “the health and safety” of water sources along the pipeline routes. ET said in a statement that the $10 million fund was a voluntary collaboration with the state, noting that the fines levied against it related to the cases were limited to $57,500. The AG’s office last October filed 48 counts of environmental crimes for misconduct during construction of the ME 2 natural gas liquids pipeline, which crosses the entire state. Earlier this year, Shapiro filed nine counts of environmental crimes against the company for failing to properly oversee construction of the Revolution natural gas pipeline in Western Pennsylvania, which ruptured and exploded in 2018. A statewide grand jury investigation determined that ET repeatedly allowed thousands of gallons of drilling fluid to escape underground during ME 2 construction. The project was completed earlier this year, five years after work started. It was stymied by regulatory, legal and construction delays. Sinkholes, leaks and water well problems disrupted neighborhoods and prompted state regulators to periodically halt work on the project. The company paid millions in fines. The grand jury investigation also found that an ET affiliate allegedly ignored environmental protocols and custom plans that were created to minimize erosion and the possibility of a landslide, which ultimately led to the Revolution explosion. The incident in Beaver County’s Center Township scorched nearby forests, destroyed a home, barn and vehicles, and caused six high voltage electric transmission towers to collapse. There were no injuries. The pipeline returned to service last year.

Williams, PennEnergy Move Certified Appalachian Natural Gas to Growing Domestic, LNG Markets - Williams is partnering with PennEnergy Resources LLC to market and deliver certified natural gas from the Appalachian Basin to meet growing demand in the United States and beyond. Through its Sequent business unit, purchased from Southern Co. in 2021, Williams is building a marketing portfolio to sell the low-carbon natural gas to utilities, LNG export facilities and other clean energy users. Sequent was among North America’s largest natural gas marketers by sales volumes, and now Williams secures a top spot. It ranked No. 7 on NGI’s first-quarter ranking of top North America natural gas marketers. The PennEnergy gas supplies included in the agreement would come from the company’s 378 production wells in southwest Pennsylvania that have achieved Project Canary’s TrustWell certification. Every well pad inspected achieved platinum status, the highest rating available, according to PennEnergy. The certification covers operational, environmental, social, and governance data points on a per-well and midstream asset basis.Earlier this year, the Appalachia-based exploration and production (E&P) company said it had deployed monitoring units to detect and measure methane and other emissions in real time. Focused on the Marcellus and Utica shales and Upper Devonian formation, PennEnergy’s operations span three Southwest Pennsylvania counties. Williams’ Chad Zamarin, senior vice president of Corporate Strategic Development, said the partnership with PennEnergy builds on its multifaceted strategy to grow the delivery of “next-gen gas” to markets across the United States and overseas.“With our large-scale gathering and processing footprint in the best U.S. production basins, our connectivity to the nation’s biggest natural gas customers and our industry-leading Sequent marketing platform, we are extremely well-positioned to facilitate the efficient gathering, marketing and transportation of responsibly sourced natural gas,” he said. PennEnergy CEO Rich Weber added, “PennEnergy welcomes higher standards in the marketplace, which play to our strengths, highlighting our dedication and investments made over many years to ensure the safety of our employees, the community and the environment.”The E&P is one of several that have pursued gas production certification, including Chesapeake Energy Corp., PureWest Energy LLC, Vermilion Energy Inc. and EQT Corp. and Seneca Resources Corp.

Marcellus Activity Slows as U.S. Drilling Total Falls in Latest Baker Count - Driven in part by a slowdown in Marcellus Shale activity, the U.S. rig count eased one unit lower to finish at 763 for the week ended Friday (Aug. 12), according to updated figures from oilfield services provider Baker Hughes Co. (BKR). Net changes domestically for the week included a three-rig increase in oil-directed drilling. However, declines of one natural gas-directed rig and three miscellaneous units drove the overall domestic tally lower, according to the BKR numbers, which are based partly on data from Enverus. The 763 active U.S. rig count as of Friday is up from 501 rigs active in the year-earlier period. Land drilling declined by four rigs for the week, partially offset by a two-rig increase in the Gulf of Mexico and the addition of one rig operating in inland waters. Horizontal rigs fell by five overall, while directional and vertical rigs each increased by two. The Canadian rig count dropped two units to end the week at 201, versus 164 in the year-ago period. Net changes there included a decline of three oil-directed rigs, partially offset by a one-rig increase in natural gas-directed drilling. Broken down by major drilling region, the Marcellus dropped three rigs from its total week/week, ending with 35 active rigs. That’s up from 29 in the year-earlier period. Elsewhere among plays, the Ardmore Woodford dropped two rigs week/week, while one-rig declines were recorded in the Arkoma Woodford, the Barnett Shale and the Permian Basin. Two rigs were added in the Cana Woodford, while the Utica Shale picked up one rig week/week, the BKR data show. In the state-by-state count, Louisiana added two rigs for the period, while Oklahoma and West Virginia each added one. Pennsylvania saw a two-rig decrease week/week, while Alaska and Texas each dropped one from their respective totals, according to BKR.

With Seneca Resources Shift, NFG Foresees Appalachian Natural Gas Growth - A sizable boost in quarterly output from the exploration arm, as well as stronger midstream volumes, have helped fuel Appalachian Basin-focused National Fuel Gas Co. (NFG) as it shifts focus to undeveloped acreage in the Marcellus and Utica shales. Management told investors during a third quarter conference call the firm’s performance reflected its approach to balanced spending. That approach is helping the company maintain momentum as it prepares for the energy environment of the future, management said. New York-based NFG operates across four different segments: exploration and production through its Seneca Resource Co. subsidiary, pipeline and storage, gathering and utility services in western New York and northwestern Pennsylvania. NFG combined production for the quarter was 92 Bcfe, compared with 83 Bcfe year/year. Midpoint production guidance has been increased for the year by 2.5 Bcfe to a range of 350-355 Bcfe. NFG attributed most of the growth to Seneca’s development program in the Appalachian Basin, boosting natural gas volumes. NFG’s natural gas production totaled 89,293 MMcf for 3Q2022 from 79,745 MMcf in the year-ago period. Seneca is running two rigs in the Appalachian. NFG CEO Dave Bauer said that plan will largely continue, but the activity is shifting in 2023 to Tioga County, PA, acreage in the Utica. “We’ve had great success on the initial development of the acreage we acquired there, so it makes sense to overweight that area,” Bauer said. The strategy change wouldn’t substantially increase upstream spending levels, Bauer said, but would be an emphasis of its capital plan for the next two years as NFG builds out infrastructure to the interstate pipeline system. Bauer said NFG’s midpoint guidance for Fiscal Year 2023 capital spending was $830-940 million, a 10% increase year/year. Oil production volumes dropped slightly when compared year/year, which the firm attributed to a “natural production decline in California.” Oil volumes totaled 526,000 bbl in 3Q2022, compared with 558,000 in 3Q2021. NFG recently closed the sale of Seneca’s California assets, reportedly netting $241 million.

Southwestern Energy Boosts Spending to Fight Inflation, Prepare for 2023 - Southwestern Energy Co. said Friday it would increase both production and spending this year in response to inflation. The company also plans for a 2023 maintenance program, and free cash flow would be strengthened by the move. COO Clay Carrell said a second company-operated fracture fleet would be added in Appalachia by the end of September, displacing a third-party crew. It also plans to reposition a Southwestern-owned rig to the Haynesville later this year, “which we expect to further improve performance, compress cycle times and reduce costs,” he said. The company-owned fleet and equipment are expected to help control ballooning oilfield costs. Southwestern is now guiding for 1.715-1.745 Tcfe of production this year, up from its previous range of 1.683-1.723 Tcfe. Spending for the full year was increased toto $2.1-2.2 billion from a previous range of $1.9-2.0 billion. The company is spending about 55% of this year’s capital in the Haynesville Shale and 45% in the Appalachian Basin, a split that isn’t likely to change much next year, said CEO Bill Way. Longer-term the company is continuing efforts to gain more exposure to growing U.S. LNG exports. “The U.S. natural gas market continues to move from structural oversupply to a more balanced market, with the potential for further excess demand, especially in the Gulf Coast region,” Way said. Southwestern is among the nation’s largest natural gas and natural gas liquids producers. It is the largest producer in the Haynesville, and “with complimentary firm transportation from Appalachia,” around 65% of the company’s production reaches the Gulf Coast market, he added. The company produced 438 Bcfe in the second quarter, well above the 276 Bcfe for the same period last year. The jump came after the company acquired GEP Haynesville and Indigo Natural Resources LLC last year, boosting its assets significantly in Louisiana.

R.I. reaches $1.8m settlement with gas companies over contamination - – Three energy giants will pay a combined $1.8 million to Rhode Island to resolve the state’s lawsuit over soil and groundwater pollution caused by a gasoline additive, Attorney General Peter Neronha announced Thursday.The settlement from Chevron, Irving, and Valero will go toward emergency response and ongoing remediation of contamination by methyl tertiary-butyl ether, or MTBE. Rhode Island settled with other energy companies earlier this year for $17 million. “MBTE contamination of public water supplies poses a significant public health and safety risk, one which oil and gas companies knew about well before the public did,” Neronha said in a news release announcing the settlements, which were entered in Rhode Island federal court. “The work to remediate contaminated water supplies continues, and the funds recovered to date, including today, will be exclusively dedicated to doing that work. In the meantime, this Office remains strongly committed to ensuring that the remaining oil and gas defendants are held responsible for the damage they have caused to the people of Rhode Island and the environment.”

Why Is Inflation Reduction Act a Big Deal for Natural Gas, Oil Industries? - The U.S. Senate on Sunday passed a massive spending bill that would invest hundreds of billions of dollars to reshape the energy sector and try to slow climate change, creating far-reaching implications for oil and natural gas, as well as the economy broadly. The bill moves to the Democrat-controlled House, which convenes on Friday, and “looks to be on track for passage,” policy analysts at ClearView Energy Partners LLC said Monday. Tax credits in the bill include $30 billion to hasten the production of solar panels and wind turbines, among other renewable energy infrastructure. It would spend another $10 billion on facilities to manufacture electric cars and future innovations. The legislation also calls for $60 billion to develop clean energy sources in poor communities. The bill would also roll back former President Trump’s 10-year moratorium on offshore wind leasing. Tax incentives in the bill would enable consumers to receive subsidies for energy-efficient products, as well as a $7,500 tax credit to buy electric vehicles. Notably, the legislation would reward natural gas and oil companies that address methane leaks and penalize with fines those that do not. In addition to a new minimum 15% corporate tax, it also establishes a 1% excise tax on company stock buybacks. Energy companies have rewarded shareholders with multiple rounds of buybacks over the past several quarters. That noted, Democrats allowed key fossil fuel provisions to win the support of West Virginia Sen. Joe Manchin, whose state’s economy is driven in large part by natural gas and coal production. The bill ensures oil and gas drilling leases in the Gulf of Mexico and Alaska’s Cook Inlet. It also would require that the federal government continue to hold regular auctions for oil and gas leases alongside any new plans for wind or solar projects on federal land. Companies also would be rewarded for investing in carbon capture technology with tax credits. In doing so, the legislation would enable plants that burn gas or coal to remain open if they use the evolving technology. It also encourages alternative forms of energy such as hydrogen. The American Petroleum Institute (API) said the package falls short of addressing U.S. energy needs. “While we’re encouraged that the bill will likely open the door to more federal onshore and offshore lease sales and will expand and extend tax credits for carbon capture, we remain opposed to policies that raise taxes and discourage investment in U.S. oil and natural gas,” CEO Mike Sommers said Monday.

Manchin’s Donors Include Pipeline Giants That Win in His Climate Deal - The New York Times— After years of spirited opposition from environmental activists, the Mountain Valley Pipeline — a 304-mile gas pipeline cutting through the Appalachian Mountains — was behind schedule, over budget and beset with lawsuits. As recently as February, one of its developers, NextEra Energy, warned that the many legal and regulatory obstacles meant there was “a very low probability of pipeline completion.”Then came Senator Joe Manchin III of West Virginia and his hold on the Democrats’ climate agenda.Mr. Manchin’s recent surprise agreement to back the Biden administration’s historic climate legislation came about in part because the senator was promised something in return: not onlysupport for the pipeline in his home state, but also expedited approval for pipelines and other infrastructure nationwide, as part of a wider set of concessions to fossil fuels.It was a big win for a pipeline industry that, in recent years, has quietly become one of Mr. Manchin’s biggest financial supporters.Natural gas pipeline companies have dramatically increased their contributions to Mr. Manchin, from just $20,000 in 2020 to more than $331,000 so far this election cycle, according to campaign finance disclosures filed with the Federal Election Commission and tallied by the Center for Responsive Politics. Mr. Manchin has been by far Congress’s largest recipient of money from natural gas pipeline companies this cycle, raising three times as much from the industry than any other lawmaker.NextEra Energy, a utility giant and stakeholder in the Mountain Valley Pipeline, is a top donor to both Mr. Manchin and Senator Chuck Schumer, Democrat of New York, who negotiated the pipeline side deal with Mr. Manchin. Mr. Schumer has received more than $281,000 from NextEra this election cycle, the data shows. Equitrans Midstream, which owns the largest stake in the pipeline, has given more than $10,000 to Mr. Manchin. The pipeline and its owners have also spent heavily to lobby Congress.The disclosures point to the extraordinary behind-the-scenes spending and deal-making by the fossil fuel industry that have shaped a climate bill that nevertheless stands to be transformational. The final reconciliation package, which cleared the Senate on Sunday, would allocate more than $370 billion to climate and energy policies, including support for cleaner technologies like wind turbines, solar panels and electric vehicles, and put the United States on track to reduce its emissions of planet-warming gases by roughly 40 percent below 2005 levels by the decade’s end.