US natural gas price falls 21.5% on export plant outage; US oil supplies at new 17½ year low, SPR at a 35 year low after the largest SPR release on record; gasoline supplies at a 6 month low; global oil surplus at 560,000 barrels per day in May, 4th straight surplus, even as OPEC output dropped to 1.049 million bpd below quota; natural gas rigs at a 33 month high....

.oil prices fell for the first time in 8 weeks after the Fed raised interest rates three-quarters of a percent and Russian oil output returned to pre-war levels...after rising 1.5% to a 13 year high weekly close of $120.67 last week as record high fuel prices showed no signs of dampening demand, the contract price for US light sweet crude for July delivery fell nearly 1.5% in Asian trading early Monday as pandemic-related concerns in China and higher-than-expected US inflation weighed on sentiment, and was off by $2 a barrel in trading trading in New York on worries that fresh COVID-19 outbreaks in China could lead to further lockdowns, but later spiked higher on reports that Libya had shut down nearly all Its oil fields and settled 26 cents higher at $120.93 per barrel, even as gasoline contracts plunged 3.3% and diesel contracts fell 1.9% at the same time, on concerns over the lost demand growth expected this summer as the US economy slowed in response to Fed inflation fighting policy...oil prices rose again early on Tuesday after credit rating agency Fitch Ratings increased its short- and medium-term oil price forecasts and after OPEC reported its oil production actually decreased in May, as tight global supplies outweighed worries that fuel demand would be hit by a possible US recession and fresh COVID-19 curbs in China, but the rally evaporated amid signs that Democrats were considering more energy legislation as they and the White House faced increasing pressure to curb US energy costs, and oil settled $2 lower at $118.93 per barrel, as traders repositioned ahead of the weekly inventory data release and the interest rate announcement from the Fed, where a 75-basis point hike was being considered...oil prices fell further in early morning trading Wednesday after the International Energy Agency (IEA) forecast that the global oil market was likely to rebalance in the second half of the year, driven by slowing demand growth and accelerated gains in non-OPEC oil supplies that would partially offset the loss of Russian barrels. and then extended its losses after the EIA reported an unexpected crude inventory build and a slowing of gasoline demand, and then fell sharply to settle $3.62 lower at $115.31 a barrel as traders worried about a fall in demand after the Fed hiked interest rates by three-quarters of a percentage point...oil prices erased early gains to fall to a two-week low on Thursday on inflation concerns highlighted by interest rate hikes in the US,Britain and Switzerland, though tight oil supply limited losses, and recovered from the day's lows to turn positive again, supported by tight oil supply and peak summer consumption, and advanced $2.28 to settle at $117.59 a barrel, supported by a sharp drop in the U.S. Dollar Index after a number of European central banks raised their interest rates....but global markets wobbled and oil prices sank on Friday over growing fears that inflation-fighting interest rate hikes by central banks could trigger a recession and was down roughly 5% to a three-week low by midday, led by a slump in US gasoline futures, as the US dollar rose to its highest since December 2002, and settled $8.03, or 6.8% lower at $109.56 a barrel, as traders worried that interest rate hikes from major central banks could slow the global economy and cut demand for energy...with that selloff, oil prices notched a 9.2% decrease for the week, with all petroleum contracts posting their first weekly loss since April, amid signs of a tentative rebound in Russian oil production supported by strong demand from Asian and European buyers..

natural gas prices also fell sharply this week, on the news that the Freeport LNG export terminal would be down for months, thus adding 2 billion cubic feet per day to domestic supplies,,,,after rising 3.8% to $8.850 per mmBTU last week as a rally to a 13 year high on record high temperatures was cut off after the explosion at Freeport, the contract price of natural gas for July delivery slid 24.1 cents, or almost 3% to a one-week low of $8.609 per mmBTU on Monday, as the shutdown of the Freeport export plant cut demand for gas, even though power demand in Texas hit an all-time high....natural gas prices then crashed early on Tuesday after representatives from Freeport reported that the company did not expect the export facility to be fully repaired for months, sending gas prices tumbling $1.42, or 17%, to $7.189 per mmBTU, the third largest drop on record, as a prolonged outage would leave more gas to refill low U.S. stockpiles before next winter...prices recovered a bit on Wednesday, regaining 23.1 cents to settle at $7.420 per mmBTU, as traders' focus returned to soaring demand amid countrywide heat waves....natural gas prices edged up again on Thursday, on forecasts for record power demand in Texas, soaring global gas prices and a small decline in U.S. daily gas output, and settled 4.4 cents higher at $7.464 per mmBTU, despite a bigger-than-usual stockpile build, a revised increase in the amount of gas in storage, and a decline in forecast U.S. gas demand...but prices tumbled again on Friday on forecasts for lower demand for the next two weeks, and on expectations that the extended shutdown of the Freeport plant would allow utilities to quickly rebuild low U.S. gas stockpiles, and settled 52 cents or 7% lower at a seven week low of $6.944 per mmBTU, and thus finished with a 21.5% loss on the week...

The EIA's natural gas storage report for the week ending June 10th indicated that the amount of working natural gas held in underground storage in the US rose by 92 billion cubic feet to 2,095 billion cubic feet by the end of the week, after gas in storage at the end of the prior week was revised from 1,999 billion cubic feet to 2,003 billion cubic feet to reflect resubmissions of data during the prior three-week period....that still left our gas supplies 330 billion cubic feet, or 13.6% below the 2,425 billion cubic feet that were in storage on June 10th of last year, and 323 billion cubic feet, or 13.4% below the five-year average of 2,418 billion cubic feet of natural gas that have been in storage as of the 10th of June over the most recent five years....the 92 billion cubic foot injection into US natural gas working storage for the cited week was more than average forecast for a 89 billion cubic foot injection from an S&P Global Platts survey of analysts, and more than the average injection of 79 billion cubic feet of natural gas that had typically been added to our natural gas storage during the same week over the past 5 years, and more than triple the 28 billion cubic feet that were added to natural gas storage during the corresponding week of 2021...

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending June 10th showed that after a big increae in our oil imports, another big oil withdrawal from the SPR, and an increase in oil supplies that could not be accounted for more than covered a near record jump in our oil exports, we had oil left to add our stored commercial crude supplies for the 7th time in 11 weeks, and for the 22nd time in the past 50 weeks…our imports of crude oil rose by an average of 831,000 barrels per day to an average of 6,985,000 barrels per day, after falling by an average of 64,000 barrels per day during the prior week, while our exports of crude oil rose by 1,493,000 barrels per day to 3,725,000 barrels per day, after falling by 1,758,000 barrels per day during the prior week, which meant that our trade in oil worked out to a net import average of 3,260,000 barrels of oil per day during the week ending June 10th, 622,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude from US wells reportedly rose by 100,000 barrels per day to 12,000,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 15,260,000 barrels per day during the cited reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,320,000 barrels of crude per day during the week ending June 10th, an average of 67,000 fewer barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net of 822,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US....so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from storage, from net imports and from oilfield production was 238,000 barrels per day less than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+238,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an error or omission of that magnitude in this week’s oil supply & demand figures that we have just transcribed....even so, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

week's 822,000 barrel per day decrease from our overall crude oil inventories left our total oil supplies at 930,326,000 barrels at the end of the week, our lowest oil inventory level since October 1st, 2004, and therefore a 17 1/2 year low….our oil inventory decreased this week even though 279,000 barrels per day were being added to our commercially available stocks of crude oil, because 1,102,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve, the largest SPR withdrawal on record, at the same time....that draw on the SPR would now include the initial emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump", that is expected to supply 1,000,000 barrels of oil per day to commercial interests from now up to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising further at least up until that time, as well as the previous 30,000,000 million barrel release from the SPR to address the initial Russian supply related shortfalls....the administration's earlier plan to release 50 million barrels from the SPR to incentivize US gasoline consumption wrapped up in May.... including that, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 144,535,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 22 months, and as a result the 511,612,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since Januar 2nd, 1987, or at a 35 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's releases....so now, the total 180,000,000 barrel drawdown expected over the six months to November will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,641,000 barrels per day last week, which was 2.2% more than the 6,322,000 barrel per day average that we were importing over the same four-week period last year….this week’s crude oil production was reported to be 100,000 barrels per day higher at 12,000,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day higher at 11,600,000 barrels per day, even as Alaska’s oil production was 10,000 barrels per day lower at 435,000 barrels per day andand and has no impact on the final rounded national total...US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was still 8.4% below that of our pre-pandemic production peak, but was 42.4% above the interim low of 8,428,000 barrels per day that US oil production had fallen to during the last week of June of 2016...

US oil refineries were operating at 93.7% of their capacity while using those 16,320,000 barrels of crude per day during the week ending June 10th, down from the 94.2% utilization rate of the prior week, but still a typical refinery utilization rate for early summer…but the 16,320,000 barrels per day of oil that were refined this week were a bit less than the 16,337,000 barrels of crude that were being processed daily during week ending June 11th of 2021, and 5.5% less than the 17,264,000 barrels that were being refined during the prepandemic week ending June 14th, 2019, when refinery utilization was also at a fairly normal 93.9% for the second weekend of June...

With the decrease in the amount of oil being refined this week, gasoline output from our refineries was also lower, decreasing by 21,000 barrels per day to 10,019,000 barrels per day during the week ending June 10th, after our gasoline output had increased by 73,000 barrels per day over the prior week.…this week’s gasoline production was 0.9% more than the 9,926,000 barrels of gasoline that were being produced daily over the same week of last year, but 4.1% below our gasoline production of 10,451,000 barrels per day during the week ending June 14th, 2019, ie, during the year before the pandemic impacted US gasoline output....at the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 57,000 barrels per day to 5,944,000 barrels per day, after our distillates output had increased by 17,000 barrels per day over the prior week…and our distillates output was 2.2% less than the 5,056,000 barrels of distillates that were being produced daily during the week ending June 11th of 2021, and 8.0% less than the 5,371,000 barrels of distillates that were being produced daily during the week ending June 14th, 2019...

Even with the recent increases in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the eighteenth time in nineteen weeks, decreasing by 710,000 barrels to a six month low of 217,474,000 barrels during the week ending June 10th, after our gasoline inventories had decreased by 812,000 barrels over the prior week....our gasoline supplies decreased again this week even though the amount of gasoline supplied to US users decreased by 106,000 barrels per day to 9,093,000 barrels per day, because our imports of gasoline fell by 526,000 barrels per day to 650,000 barrels per day while our exports of gasoline fell by 31,000 barrels per day to 926,000 barrels per day ...and after 18 inventory drawdowns over the past 19 weeks, our gasoline supplies were 10.5% lower than last June 11th's gasoline inventories of 242,980,000 barrels, and 11% below the five year average of our gasoline supplies for this time of the year…

Even with the decrease in our distillates production, our supplies of distillate fuels increased for the 7th time in twenty-two weeks and for the 14th time in forty-one weeks, rising by 725,000 barrels to 109,709,000 barrels during the week ending June 10th, after our distillates supplies had increased by 2,592,000 barrels during the prior week….our distillates supplies rose by less this week even though the amount of distillates supplied to US markets, an indicator of our domestic demand, fell by 31,000 barrels per day to 3,619,000 barrels per day because our exports of distillates rose by 178,000 barrels per day to 1,379,000 barrels per day, and because our imports of distillates fell by 62,000 barrels per day to 158,000 barrels per day....but after forty-two inventory withdrawals over the past sixty-one weeks, our distillate supplies at the end of the week were 19.4% below the 136,191,000 barrels of distillates that we had in storage on June 11th of 2021, and still about 23% below the five year average of distillates inventories for this time of the year…

Meanwhile, after this week's big release of crude from our Strategic Petroleum Reserve, our commercial supplies of crude oil in storage rose for the 12th time in 29 weeks and for the 20th time in the past year, increasing by 1,956,000 barrels over the week, from 416,758,000 barrels on June 3rd to 418,714,000 barrels on June 10th, after our commercial crude supplies had increased by 2,025,000 barrels over the prior week…after this week’s increase, our commercial crude oil inventories rose to 14% below the most recent five-year average of crude oil supplies for this time of year, and to about 18% above the average of our crude oil stocks as of the second weekend of June over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels....since our crude oil inventories had jumped to record highs during the Covid lockdowns of spring 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude oil supplies as of this June 3rd were 10.3% less than the 466,674,000 barrels of oil we had in commercial storage on June 11th of 2021, and were 22.4% less than the 539,280,000 barrels of oil that we had in storage on June 12th of 2020, and 13.2% less than the 482,364,000 barrels of oil we had in commercial storage on June 14th of 2019…

Finally, with our inventories of crude oil and our supplies of all products made from oil remaining near multi year lows, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR....the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 2,764,000 barrels this week, from 1,684,943,000 barrels on June 3rd to 1,682,179,000 barrels on June 10th, after our total inventories had risen by 3,682,000 barrels during the prior week....that left our total liquids inventories down by 106,254,000 barrels over the first 23 weeks of this year, and less than one million barrels from a 13 1/2 year low..

OPEC's Report on Global Oil for May

Tuesday of this week saw the release of OPEC's June Oil Market Report, which includes details on OPEC & global oil data for May, and hence it gives us a picture of the global oil supply & demand situation at a time when major cities in China were under restrictive Covid lockdowns, while at the same time exports of Russian oil were curtailed by sanctions imposed by the West....in light of those offsetting circumstances, OPEC and aligned oil producers had again agreed to increase their output by 400,000 barrels per day for a tenth consecutive month, ie the 10th such increase from the previously agreed to July 2021 level, which was in turn part of the fifth production quota policy reset that they've made over the past twenty-three months, all in response to the pandemic-related slowdown and subsequent irregular recovery....note that with the course and impact of the Ukraine war and the pandemic still uncertain, we consider the demand projections made herein to be pretty speculative, and hence will not address any projections beyond the May estimates..

The first table from this month's report that we'll review is from the page numbered 47 of this month's report (pdf page 57), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC uses an average of production estimates by six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures...

As we can see on the bottom line of the above table, OPEC's oil output decreased by 176,000 barrels per day to 28,508,000 barrels per day during May, down from their revised April production total that averaged 28,684,000 barrels per day....however, that April output figure was originally reported as 28,648,000 barrels per day, which therefore means that OPEC's April production was revised 36,000 barrels per day higher with this report, and hence OPEC's May production was, in effect, just 140,000 barrels per day lower than the previously reported OPEC production figure (for your reference,here is the table of the official April OPEC output figures as reported a month ago, before this month's revision)...

As we can see from that table, the primary reason for the decrease in OPEC's output in May was the 186,000 barrel per day drop in oil production from Libya, where demonstrations against the prime minister had further curtailed production in a country already impacted by repeated bouts of civil strife...but Libya wasn't the cartel's only problem; production fell in more than half its members, and left a deficit that the Saudis and the Emirates, the two OPEC members with surplus capacity, couldn't make up..

According to the agreement reached between OPEC and the other oil producers at their Ministerial Meeting on July 18th, 2021, the oil producers party to that agreement were to raise their output by a total of 400,000 barrels per day each month through December 2021, which was subsequently renewed at monthly meetings to include further 400,000 barrel per day production increases in January, February, March, April, May and June of 2022, and which would indicate an increase of 254,000 barrels per day each month from the OPEC members listed above, with the rest of the 400,000 bpd supplied by other producers. including Russia....but OPEC's decrease of 176,000 barrels per day nearly reversed their expected increase....and while the production decreases in Libya and Nigeria, which has ongoing pipeline theft and leakage problems, were obviously the major reason for the May decrease. several other OPEC members continue to be short of what they were expected to produce, as we'll see in the next table..

The adjacent table was originally included as a downloadable attachment to the press release following the 27th OPEC and non-OPEC Ministerial Meeting on March 31st, 2022, which set OPEC's and other aligned producers' production quotas for May... since war torn Libya and US sanctioned producers Iran and Venezuela are exempt from the production cuts imposed by the joint agreement that governs the output of the other OPEC producers, they are not shown here, and OPEC's quota is aggregated under the total listed for the 'OPEC 10', which you can see was expected to be at 25,589,000 barrels per day in May....therefore, the 24,540,000 barrels those 10 OPEC members actually produced in May were 1,049,000 barrels per day short of what they were expected to produce during the month, with Nigeria and Angola accounting for most of this month's shortfall, while only the UAE was able to produce what was expected of them...

The adjacent table was originally included as a downloadable attachment to the press release following the 27th OPEC and non-OPEC Ministerial Meeting on March 31st, 2022, which set OPEC's and other aligned producers' production quotas for May... since war torn Libya and US sanctioned producers Iran and Venezuela are exempt from the production cuts imposed by the joint agreement that governs the output of the other OPEC producers, they are not shown here, and OPEC's quota is aggregated under the total listed for the 'OPEC 10', which you can see was expected to be at 25,589,000 barrels per day in May....therefore, the 24,540,000 barrels those 10 OPEC members actually produced in May were 1,049,000 barrels per day short of what they were expected to produce during the month, with Nigeria and Angola accounting for most of this month's shortfall, while only the UAE was able to produce what was expected of them...

* * *

Recall that the original 2020 oil producer's agreement was to jointly cut their oil production by 23%, or by 9.7 million barrels per day, from an October 2018 baseline for just two months early in the pandemic, during May and June of 2020, but that initial 9.7 million bpd production cut agreement was extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020....then, in a subsequent meeting in July of that year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August 2020 and subsequent months, which thus became the agreement that governed OPEC's output for the rest of 2020...the OPEC+ agreement for their January 2021 production, which was later extended to include February and March and then April's output, was to further ease their supply cuts by 500,000 barrels per day to a reduction of 7.2 million barrels per day from that original 2018 baseline...then, during a difficult meeting on April 1st of last year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher each month by a pre-set amount for each country over the following three months, thus extending their joint output cut agreement through July....production levels for August and the following months of last year were to be determined by a July 1st OPEC meeting, but that meeting was adjourned on July 2nd due to a dispute between the UAE and the Saudis over the 2018 reference production levels, and a subsequent attempt to restart that meeting on July 5th was called off....so it wasn't until July 18th 2021 that a tentative compromise addressing August 2021's output quotas was worked out, allowing oil producers in aggregate to increase their production by 400,000 barrels per day in August, and again by that amount in each of the following months, and also to boost reference production levels for the UAE, the Saudis, Iraq and Kuwait beginning in April 2022, which is now reflected in the OPEC production quota table you see above, and which now makes the effective monthly production increase 432,000 barrels per day....OPEC and other producers then agreed to increase their production in January 2022 by a further 400,000 barrels per day in a meeting concluded on the 2nd of December, 2021, and reaffirmed their intention to continue that policy with another 400,000 barrel per day increase in February at a meeting concluded January 4, 2022, and then agreed to stick to that 400,000 bpd oil output increase in March, despite pressure from the US to raise output more quickly, at a meeting on February 2nd....then, at a meeting on March 2nd, OPEC and its oil-producing allies, which included Russia, decided to hold their production increase at that level thru April in an OPEC+ meeting that only lasted 13 minutes, their shortest meeting ever...then on March 31, OPEC and aligned producers agreed to reaffirm the decisions of the prior Ministerial meetings and again limit their production increase for May to the agreed 400,000 barrels per day, because "the current [oil market]volatility is not caused by fundamentals, but by ongoing geopolitical developments"...then again, in an OPEC and non-OPEC Ministerial Meeting held on May 5th, they again reaffirmed the decision of the July18th 2021 meeting to increase production by 432,000 barrels per day in June of this year...most recently, however, in a meeting held June 2nd, they agreed to advance the 432,000 barrel per day increase scheduled for September, with that increase to be split evenly between July and August...hence, the production increase now scheduled for those two months is 648,000 barrels per day...

Hence OPEC arrived at the production quotas for August 2021 through MAY of this year by repeatedly readjusting the original 23%, or 9.7 million barrel per day production cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day output reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was subsequently raised to an 8.2 million barrel per day oil output reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during the Covid surge of February, March, and then later during April of last year....under the agreement prior to the current one affecting this month, OPEC's production cut in April 2021 was set at 4,564,000 barrels per day below the October 2018 baseline, which was lowered to a cut of 3,650,000 barrels per day from the baseline with the prior comprehensive agreement, which thus set the July production quota for the "OPEC 10" at 23,033,000 barrels per day, with war torn Libya and US sanctioned producers Iran and Venezuela exempt from the production cuts imposed by that agreement....for OPEC and the other producers to increase their output by 400,000 barrels per day from that July 2021 level, each producer would be allowed to initially increase their production by just over 1% per month since that time...for OPEC alone, that meant a 254,000 barrel per day increase for each month from July 2021 to April 2022, at which time the incremental 32,000 barrels per day adjustment they arrived at in July 2021 kicked iN...adding together those monthly increases since last July, when the quota was at 23,033,000 barrels per day, is how they arrived at the 25,589,000 barrels per day quota for OPEC for May that you see on the table above..

The next graphic from this month's report that we'll look at shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from June 2020 to May 2022, and it comes from page 48 (pdf page 58) of OPEC's June Oil Market Report....on this graph, the cerulean blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

after this month's 176,000 barrel per day decrease in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate is that total global liquids production decreased by a rounded 150,000 barrels per day to average 98.75 million barrels per day in May, a reported decrease which came after April's total global output figure was apparently revised up by 160,000 barrels per day from the 99.74 million barrels per day of global oil output that was estimated for April a month ago, as non-OPEC oil production inched up by 23,000 barrels per day in May after that upward revision, as 400,000 barrels per day production growth in non-OPEC Eurasia and Latin American countries was offset by output decreases totaling 400,000 barrels per day by Canada and the UK...

Even after that decrease in May's global output, the 98.75 million barrels of oil per day that were produced globally during the month were still 5.82 million barrels per day, or 6.2% more than the revised 93.93 million barrels of oil per day that were being produced globally in May a year ago, which was the first month that OPEC and their allied producers began their program of monthly production increases from the 7.2 million barrels per day production cut that had governed the production of the prior four months (see the June 2021 OPEC report (online pdf) for the originally reported May 2021 details)...with this month's decrease in OPEC's output greater than the global decrease, their May oil production of 28,508,000 barrels per day amounted to 28.9% of what was produced globally during the month, down from their revised 29.0% share of the global total in April....OPEC's May 2021 production was reported at 25,463,000 barrels per day, which means that the 13 OPEC members who were part of OPEC last year produced 3,045,000 barrels per day, or 14.2% more barrels per day of oil this April than what they produced a year earlier, when they accounted for 27.2% of global output...

Even after the decrease in both OPECs and global oil output that we've seen in this report, the amount of oil being produced globally during the month was still more than the expected global demand, as this next table from the OPEC report will show us....

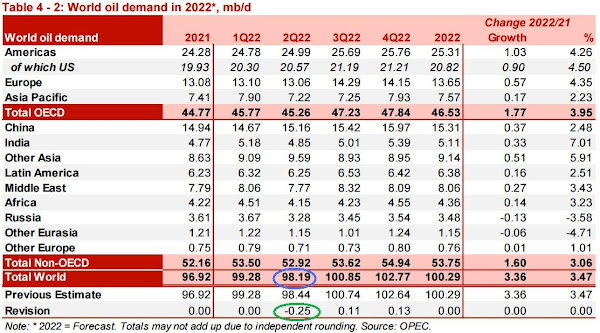

The above table came from page 28 of the June Oil Market Report (pdf page 38), and it shows regional and total oil demand estimates in millions of barrels per day for 2021 in the first column, and then OPEC's estimate of oil demand by region and globally quarterly over 2022 over the rest of the table...on the "Total world" line in the third column, we've circled in blue the figure that's relevant for May, which is their estimate of global oil demand during the second quarter of 2022....OPEC has estimated that during the 2nd quarter of this year, all oil consuming regions of the globe have been using an average of 98.19 million barrels of oil per day, which is a downward revision of 250,000 barrels per day from their estimate for 2nd quarter demand of a month ago (that revision is circled in green)...but as OPEC showed us in the oil supply section of this report and the summary supply graph above, OPEC and the rest of the world's oil producers were producing 98.75 million barrels per day during May, which would imply that there was a surplus of around 560,000 barrels per day of global oil production in May, when compared to the demand estimated for the month...

In addition to figuring May's global oil supply surplus that's evident in this report, the downward revision of 250,000 barrels per day to second quarter demand that's shown circled in green above, combined with the 160,000 barrel per day upward revision to April's global oil supplies that's implied in this report, means that the 300,000 barrels per day global oil output surplus we had previously figured for April would now be revised to a surplus of 710,000 barrels per day...those daily surpluses would follow the 230,000 barrels per day surplus we had figured for March, and the 10,000 barrels per day surplus we had figured for February...so despite the oil shortage concerns that have driven oil prices over $100 a barrel since the war began, the world's oil producers have managed to produce more barrels of oil each day than anyone wanted over that entire span...

This Week's Rig Count

The number of drilling rigs running in the US rose for the 76th time over the prior 90 weeks during the week ending June 17th, but still remained 6.7% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US increased by 7 to 740 rigs this past week, which was also 270 more rigs than 470 rigs that were in use as of the June 18th report of 2021, but was also 1,189 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil increased by 4 to 584 oil rigs during this week, after rigs targeting oil rose by 6 during the prior week, and there are 211 more oil rigs active now than were running a year ago, even as they still amount to just 36.3% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are still down 14.5% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations rose by 3 to 154 natural gas rigs, which was the most natural gas rigs deployed since September 6th, 2019, and up by 57 natural gas rigs from the 97 natural gas rigs that were drilling during the same week a year ago, even as they were still only 9.6% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…in addition to rigs targeting oil and gas, Baker Hughes continues to show two "miscellaneous" rigs still active; one is a rig drilling vertically for a well or wells intended to store CO2 emissions in Mercer county North Dakota, and the other is also a vertical rig, drilling 5,000 to 10,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track...a year ago, there were no such "miscellaneous" rigs running...

The offshore rig count in the Gulf of Mexico was up by one to fifteen rigs this week, with all of this week's Gulf rigs drilling for oil in Louisiana waters....that's two more than the count of offshore rigs that were active in the Gulf a year ago, when all 13 Gulf rigs were drilling for oil offshore from Louisiana…in addition to rigs drilling in the Gulf, we also have an offshore rig drilling in the Cook Inlet of Alaska, where natural gas is being targeted at a depth greater than 15,000 feet, while year ago, there were no offshore rigs other than those deployed in the Gulf of Mexico....

in addition to rigs offshore, we continue to have 3 water based rigs drilling through inland bodies of water this week, including a directional rig drilling for oil at a depth between 10,000 and 15,000 feet, inland in the Galveston Bay area, and two directional inland water rigs drilling for oil in Terrebonne Parish, Louisiana, one of which is targeting a formation greater than 15,000 feet in depth, while the other is shown drilling to between 10,000 and 15,000 feet... during the same week of a year ago, there was just one such "inland waters" rig deployed...

The count of active horizontal drilling rigs was up by six to 676 horizontal rigs this week, which was 248 more rigs than the 420 horizontal rigs that were in use in the US on June 11th of last year, but still 50.9% below the record 1,374 horizontal rigs that were drilling on November 21st of 2014....at the same time, the directional rig count was up by one to 39 directional rigs this week, and those were up by 14 from the 25 directional rigs that were operating during the same week a year ago…meanwhile, the vertical rig count was unchanged at 27 vertical rigs this week, while those were up by 7 from the 20 vertical rigs that were in use on June 11th of 2021….

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of June 17th, the second column shows the change in the number of working rigs between last week’s count (June 10th) and this week’s (June 17th) count, the third column shows last week’s June 10th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 18th of June, 2021..

to determine where the 7 rigs added in New Mexico were located, we first check the Rigs by State file at Baker Hughes for the changes in the Texas Permian basin...there we find that there were three rigs pulled out of Texas Oil District 8, which is the core Permian Delaware, and that there were 4 rigs pulled out of Texas Oil District 7C, which includes the southern counties of the Permian Midland....since that means that the Texas Permian rig count was down by 7 rigs, then all 7 New Mexico rigs must have been added in the western Permian Delaware in the southeast corner of that state for the national Permian count to remain unchanged...

elsewhere in Texas, we find that two rigs were added in Texas Oil District 1, that one rig was added in Texas Oil District 3, and that another rig was added in Texas Oil District 4 but that one rig was pulled out of Texas Oil District 2....one of those four rig additions was in the Eagle Ford, and it's possible another one could have been, if the rig pulled out of District 2 had been targeting that basin...Texas also had a rig added in Texas Oil District 5, apparently targeting a basin that Baker Hughes doesn't track, and two rigs added in Texas Oil District 6, both of which were likely targeting natural gas in the Haynesville shale, because the Haynesville shale region of northwest Louisiana had a rig pulled out at the same...there was also a rig added in Texas Oil District 10, which would have been in the Granite Wash, thus suggesting that two rigs were pulled out of the Granite Wash in Oklahoma at the same time....note that Oklahoma's count remained unchanged as two oil rigs were added in the Cana Woodford and another oil rig was added in the Ardmore Woodford in the state at the same time...likewise, Louisiana's rig count remained unchanged because an oil rig was added in the state's offshore waters, while the natural gas rig was pulled out of the northwest corner of the state...however, the natural gas rig count was up by 3 because two natural gas rigs were added in a basin or basin that Baker Hughes doesn't track..

++++++++++++++++++++++++++++++++++++++++++++

Riverbend Energy Sells Non-Operated Wells in Ohio Utica, Elsewhere - Riverbend Energy Group invests in oil and gas wells. The company mainly invests in non-operated oil and gas wells, although it also has some operated wells in its portfolio (and investments in renewables too). In May we told you that Riverbend was, according to sources speaking with Reuters, working with an unnamed investment bank to shop three portfolios of non-operated oil and gas assets for $2 billion–with one of the packages containing Utica Shale assets (see Riverbend Energy Shops Non-Operated Wells in Ohio Utica, Elsewhere). Reuters was right, as usual. The properties produce about 47,000 boe/d from 11,000 wells, the company said. A spokesperson would not comment on the name of the buyer. The transaction is expected to close during the third quarter.

EIA DPR: MU July NatGas Set to Increase More than Any Other Play ---Once again the number crunchers at the U.S. Energy Information Administration overestimated natural gas production in the Marcellus/Utica in the agency’s monthly Drilling Productivity Report (DPR). This is a pattern. Perhaps making such revisions is inevitable, but we find it disconcerting. Last month the EIA predicted total production in the Marcellus/Utica region (which they call Appalachia in the report) would be 35.67 billion cubic feet per day (Bcf/d). In the monthly DPR issued yesterday, EIA revised the June number down to 35.16 Bcf/d. Not a huge difference. It translates to 515 million cubic feet per day (MMcf/d) less in production–roughly 1/2 Bcf/d.

Pa. DEP splits up long-stalled oil and gas air pollution rule - Pennsylvania environmental regulators are moving forward with just half of a long overdue rule designed to limit air pollution from oil and gas well sites after objections from legislators and advocates for the state’s conventional oil and gas industry caused the proposed rule to be split in two. The state Environmental Quality Board voted Tuesday to advance a rule that only covers air pollution from unconventional, or shale gas, well sites and related equipment. The revised rule loses roughly 80% of the pollution reduction benefit that had been expected when the rule covered both the state’s shale and traditional well site infrastructure. Officials from the state Department of Environmental Protection said they are working to finish a second rule to address air pollution sources in the conventional oil and gas industry as soon as possible, likely by September. The agency is racing to salvage the rules to avoid sanctions by the U.S. Environmental Protection Agency that could threaten billions of dollars in federal highway funds. Sanctions that will require major new air pollution sources throughout Pennsylvania to offset double their emissions are set to take effect on Thursday, but the deadline to avoid federal highway sanctions is in mid-December, DEP officials said. DEP has currently identified four facilities that will be subject to the offset sanctions on June 16. Both types of sanctions are automatic under the federal Clean Air Act and the U.S. EPA does not have discretion over whether and when to impose them, an EPA spokesman said. Pennsylvania is more than three years past the deadline when it was required to implement the oil and gas air pollution controls, which are based on federal guidelines. They are designed to cut releases of a smog-forming group of chemicals called volatile organic compounds from the state’s existing oil and gas well sites while cutting emissions of methane, a potent greenhouse gas, as a side benefit. DEP contends it was not required to split the rule in two, but decided to do so after a Republican-led state House committee objected to the combined rule, which triggered a legislative review process that could stretch past the sanction deadline and into next year. Trade groups for the state’s conventional oil and gas industry also sued to block the rule from applying to their well sites, arguing that a 2016 state law requires conventional oil and gas wells to be regulated independently from Marcellus and Utica shale wells.

Major export terminal pitched in Chester sets up clash between Biden's LNG, environmental justice goals - Plans for a massive liquefied natural gas facility and export terminal in Chester along the Delaware River have quietly been shopped around to current and former elected officials and their representatives from Chester City Hall to the governor’s office in Harrisburg.WHYY News obtained details of the plan, as well as the company’s lobbying efforts, through Right-to-Know requests.Penn America Energy LLC, the New York-based company behind the estimated $4 billion-to-$8 billion project, wants to build on a 100-acre brownfield site along the Chester waterfront with the goal of exporting 7 million metric tonnes of LNG each year to countries in South America, Europe, and Asia, according to the documents.For comparison, six current LNG export terminals in the U.S. shipped 7.6 million metric tonnes of LNG overseas in March, according to the Energy Information Administration. Franc James, Penn America’s CEO, told WHYY News the project has been in the works for five years, and is “sourcing the cleanest environmentally responsible natural gas possible.”“As an environmentalist, I want to set a new standard for being the most environmentally responsible and sustainable project ever developed,” Franc said in an email. “Natural gas from the Marcellus is the cleanest natural gas in the world now and working to be even cleaner. That greatly appeals to us and in support of a new standard worldwide.”In response to questions about the relative cleanliness of Marcellus Shale, Penn America LNG provided a chart by the Clean Air Task Force, which says due to regulations and efforts by producers, natural gas production in the Appalachian Basin emits the least amount of methane worldwide.While James did not provide details or a timeline for the project, a February 2021 report by Penn LNG, obtained by WHYY News, describes the project. James said the site has not yet been secured, but others briefed on the plan say the company is eyeing the former Ford factory. James told WHYY News that anticipating a shipping date is premature. But a project overview in the report says the engineering firm Bechtel and Air Products would build a gasification plant that could freeze one billion cubic feet of Marcellus and Utica shale gas a day with a target to start shipping overseas in 2027 or 2028.

Louisiana is bracing for an LNG boom. The projects will emit millions of tons of greenhouse gases. - A report outlining the environmental impact of the United States’ roaring liquefied natural gas export industry says 25 impending LNG projects could spew out up to 90 million tons of greenhouse gases annually — more than would be generated in a year by all of the cars, trucks, buses and motorcycles in Florida. The majority of those 90 million tons — which will be added to the sector's existing 12.3 million tons — will originate in Louisiana. In all, 12 of the 25 projects are set to call Louisiana home, joining three of the nation’s seven operational export terminals. The projects include both new terminals and expansions of existing facilities. If they approach their permitted totals, the 12 Louisiana projects could produce a combined 56.9 million tons of greenhouse gases each year, according to a report from the Environmental Integrity Project, an environmental law nonprofit that tracks permit enforcement. That would account for about 63% of the 90 million new tons. The 90 million total is equivalent to 18 million passenger vehicles running for a year, the report said. For comparison, Florida has nearly 17 million registered motor vehicles, according to federal data. Louisiana has about 3.9 million. However, the Louisiana emissions figures are incomplete. G2 Net Zero LNG, a proposed Cameron Parish facility, has not revealed its projected emissions totals because it has not filed for a federal air permit. There’s one other caveat: the LNG facilities don’t always reach their limits. Sabine Pass LNG in Cameron Parish hit 42% of its allowed emissions in 2020. But it led the way for all U.S. export terminals with 4.5 million tons of greenhouse gases. Second was Cameron LNG in Hackberry with 3.7 million tons. Calcasieu Pass, which began production in January, is permitted for about 4 million tons per year. Of the four U.S. terminals under construction, Driftwood LNG in Calcasieu Parish and Plaquemines LNG in Plaquemines Parish have the two highest permitted thresholds at 9.5 million and 8.1 million tons, respectively. Louisiana’s 10 other LNG projects are either awaiting environmental permits or have made little progress since being announced..

U.S. natgas drops 3% as Freeport LNG outage cuts demand (Reuters) - U.S. natural gas futures slid about 3% to a one-week low on Monday as the shutdown of the Freeport liquefied natural gas (LNG) export plant last week cut U.S. demand for gas, leaving more of the fuel available to refill low stockpiles. That gas price decline came even though power demand in Texas hit an all-time high on Sunday and will likely break that record on Monday as economic growth boosts usage and homes and businesses keep air conditioners cranked up to escape a lingering heatwave. Freeport shut on June 8 after a pipe burst, according to energy research firm IIR Energy and others. Freeport LNG, the plant owner, has said the plant would be down for at least three weeks of maintenance. Analysts projected that the Freeport shutdown would reduce the gas available to the rest of the world, especially in Europe where most U.S. LNG has gone in recent months as countries look to wean themselves off Russian supplies after Moscow's invasion of Ukraine. But leaving more gas in the United States should give utilities a chance to rebuild extremely low stockpiles more quickly. Freeport, the second-biggest U.S. LNG export plant, consumes about 2 billion cubic feet per day (bcfd) of gas, so a three-week shutdown would result in about 42 billion cubic feet (bcf) more gas being available to the U.S. market. U.S. storage is currently about 15%, or 340 bcf, below normal levels for this time of year, its lowest since April 2019. Front-month gas futures for July delivery on the New York Mercantile Exchange (NYMEX) fell 24.1 cents, or 2.7%, to settle at $8.609 per million British thermal units (mmBtu), their lowest since June 3. With the U.S. Federal Reserve expected to keep raising interest rates in coming months to reduce inflation, open interest in NYMEX futures fell to its lowest since September 2016 for a second day in a row on Friday as investors cut back on risky assets like commodities. U.S. gas futures were up about 126% so far this year as much higher prices in Europe and Asia keep demand for U.S. liquefied natural gas (LNG) exports strong, especially since Russia's Feb. 24 invasion of Ukraine stoked fears Moscow might cut gas supplies to Europe. Gas was trading around $25 per mmBtu in Europe and $23 in Asia.

Freeport LNG Out for Months, Stranding 2 Bcf/d and Rattling Global Markets - Representatives with the liquefied natural gas (LNG) facility in Texas that suffered an explosion last week, Freeport LNG, said early Tuesday that the company does not expect the export facility to be fully repaired for months. The company is now targeting late 2022 for a return to full service instead of the initial guidance of three weeks. Given that the explosion and fire that knocked the plant offline were contained to a small area, partial operations could begin in 90 days, said Freeport LNG Development LP. The announcement sent U.S. natural gas futures tumbling. The July New York Mercantile Exchange gas futures contract plunged by $1.42 to close at $7.189/MMBtu on Tuesday. It hit an intraday low of $7.008. The European benchmark Title Transfer Facility prompt contract surged more than $4 to finish Tuesday near $30. [Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.] An explosion last Wednesday at the terminal left market participants contemplating potential demand destruction of 2.0 Bcf/d through at least June. The much longer repair period could free up gas for domestic use and ease a feared supply crunch that had sent U.S. futures to a 14-year high this spring. Meanwhile, competition for LNG cargoes is poised to heat up between Asia and Europe given the potential lack of supplies through year’s end. “At this time, completion of all necessary repairs and a return to full plant operations is not expected until late 2022,” Freeport stated. A “resumption of partial operations is targeted to be achieved in approximately 90 days, once the safety and security of doing so can be assured, and all regulatory clearances are obtained.” The cause of the accident remains unclear and an investigation is underway. The company said Tuesday the incident occurred in pipe racks that support the transfer of LNG from the facility’s LNG storage tank area to the dock facilities. None of the liquefaction trains, LNG storage tanks, marine facilities or LNG process areas were impacted, the company said. Preliminary observations suggest the incident resulted from the overpressure and rupture of a segment of an LNG transfer line, “leading to the rapid flashing of LNG and the release and ignition of the natural gas vapor cloud,” Freeport said. The vapor cloud was contained within the facility’s fence line, the company said. The explosion lasted about 10 seconds. The fire and smoke that followed the blast were from materials that burned where it occurred, including pipeline insulation and cabling. The fire was extinguished in 40 minutes. No injuries were reported.

Natural gas plummets as Freeport delays facility restart following explosion -- Natural gas prices plunged on Tuesday, after Freeport LNG said its facility that had a fire last week likely won't be back up and running soon. "[C]ompletion of all necessary repairs and a return to full plant operations is not expected until late 2022," the company said Tuesday in a statement. The facility, located in Quintana Island, Texas, had an explosion last Wednesday."Given the relatively contained area of the facility physically impacted by the incident, a resumption of partial operations is targeted to be achieved in approximately 90 days," Freeport LNG said.U.S. natural gas fell about 16% to $7.22 per million British thermal units (MMBtu)."The U.S. natural gas market will now be temporarily oversupplied as 2 bcf/d or a little over 2% of demand for U.S. natural gas has been abruptly eliminated," ."U.S. natural gas supply will likely remain at current levels as producers won't reduce production by 2 bcf/d. The result is an oversupplied U.S. natural gas market," he added.Freeport's operation is roughly 17% of the U.S.' LNG processing capacity.Despite Tuesday's drop, natural gas prices are still up 93% since the start of the year. Demand has rebounded as worldwide economies emerge from the pandemic, while supply has remained constrained.Russia's invasion of Ukraine upended a market that was already tight. As Europe looks to move away from Russian energy, record amounts of U.S. LNG are now heading to the continent.Surging prices are adding to inflationary pressures across the economy. Drivers are already grappling with record prices at the pump with the national average for a gallon of gas topping $5 over the weekend, and now utility bills are also set to rise.Natural gas prices surged above $9 per MMBtu in May, hitting the highest level since August 2008.After the explosion at Freeport's facility last week, the company initially said the plant would be shut for several weeks."The incident occurred in pipe racks that support the transfer of LNG from the facility's LNG storage tank area to the terminal's dock facilities," the company said Tuesday. "None of the liquefaction trains, LNG storage tanks, dock facilities, or LNG process areas were impacted," the company added.

U.S. natgas plunges 17% on long Texas Freeport LNG outage - (Reuters) - U.S. natural gas futures plunged about 17% to a five-week low on Tuesday on expectations an extended outage at the Freeport liquefied natural gas (LNG) export plant in Texas would leave more gas to refill low U.S. stockpiles. In addition, news that the Freeport restart could take 90 days rather than the initial three-week estimate, following an explosion last week, exacerbated concerns over gas shortages in Europe. Gas prices at the Title Transfer Facility in the Netherlands soared by 15%. Freeport shut on June 8 after a pipe burst, according to energy research firm IIR Energy and others. Freeport, the second-biggest U.S. LNG export plant, consumes about 2 billion cubic feet per day (bcfd) of gas, so a 90-day shutdown would result in about 180 billion cubic feet (bcf) more gas being available to the U.S. market. "Freeport's outages will place a ceiling on demand, providing additional power behind expected storage injections in the near term," U.S. storage is currently about 15%, or 340 bcf, below normal levels for this time of year, its lowest since April 2019. Front-month gas futures for July delivery fell $1.42, or 17%, to settle at $7.189 per million British thermal units (mmBtu), their lowest close since May 9. That was the biggest daily percentage drop since a 26% fall in late January in what has already been an extremely volatile year for gas trade. The price drop came despite record power demand in Texas, forecasts for more gas demand over the next two weeks than previously expected, a reduction in daily gas output and low wind power. Power demand in Texas failed to hit a new all-time high on Monday due to less hot weather, but will likely break peak use records on Tuesday and later this week as homes and businesses keep air conditioners cranked up to escape a lingering heatwave. Low wind power forces generators, including those in Texas - the state with the most wind power - to burn more gas to keep the lights on. U.S. gas futures were still up about 96% this year as much higher prices in Europe and Asia keep demand for U.S. LNG exports strong, especially since Russia's Feb. 24 invasion of Ukraine stoked fears Moscow might cut gas supplies to Europe. Gas was trading around $30 per mmBtu in Europe and $23 in Asia. The average amount of gas flowing to U.S. LNG export plants fell from 12.5 bcfd in May to 11.8 bcfd so far in June, with the Freeport outage, according to data from Refinitiv. That compares with a monthly record of 12.9 bcfd in March. The seven big U.S. export plants can turn about 13.6 bcfd of gas into LNG.

U.S. Natural Gas Rises Over 4.5% Amid Pre-Summer Heat Wave - After plunging to a 5-week-low on Tuesday, natural gas prices in the U.S. have ramped up again, gaining 4% on Wednesday on excessive temperatures expected to last through next week. By 3:05 p.m CT, Henry Hub natural gas prices were at $7.514, up 4.52%, up over 109% year-to-date.July Nymex natural gas (NGN22) on Wednesday closed up +0.231 (+3.21%).Demand for natural gas to power air-conditioners is expected to rise significantly as one-third of the United States is witnessing extreme heat warnings. Over the next few days, heat indexes are expected to break records, putting additional pressure on electricity providers. Heat waves are also spreading across Europe, where natural gas prices surged more than 20% on Wednesday. Gas prices in Europe continue to spike not only on temperature but on Russia’s move this week to curb gas supplies via Nord Stream. On Tuesday, Gazprom said it would cut gas flows to Germany via Nord Stream by 40%, citing equipment repairs, prompting German officials to accuse Moscow of further weaponizing natural gas. On Wednesday, Gazprom said it had reduced the flow of gas to Italy, as well. In the United States, Tuesday saw natural gas prices plunge on news of a 90-day shutdown of the Freeport, Texas, LNG export terminal following an explosion last week. ″[C]ompletion of all necessary repairs and a return to full plant operations is not expected until late 2022,” the company said Tuesday in a statement. Freeport’s delayed restart takes approximately 2% of demand off the market, suggesting potential oversupply of natural gas. As of Wednesday, potential oversupply, ahead of the Energy Information Administration's (EIA) release of natural gas inventory data on Thursday, was being counterbalanced by a heat wave that suggests an uptick in demand.

Natural Gas Futures Bounce Back After Third-Largest Drop on Record - After slumping $1.420 in Tuesday’s session in the wake of news that the liquefied natural gas (LNG) export project on Quintana Island, TX, Freeport LNG, won’t see a return to full service until late this year, the July Nymex gas futures contract on Wednesday regained 23.1 cents day/day and closed at $7.420. August rose 22.6 cents to $7.406. Cash prices recovered from a slump of their own. NGI’s Spot Gas National Avg. gained 27.5 cents to $7.540 on Wednesday following a $1.370 loss a day earlier. The Freeport outage, caused by an explosion and brief fire last week, translates into a loss of about 2.0 Bcf/d of LNG feed gas for at least three months, not three weeks, as initially telegraphed by the company. What’s more, with full service delayed until near the end of 2022, export volumes at the facility will likely remain below capacity at a time when global demand supports maximum volumes. As such, feed gas that would have found its way to Freeport for export likely will now be used domestically, including for injections into storage. Other American LNG facilities are maxed already and cannot absorb more. That means low supplies in the United States relative to overall demand – as the summer nears – are bound to get a boost, helping to balance the market. Prices had skyrocketed to 14-year highs this spring on supply worries. The Freeport news and expected impact on storage eased those concerns and dragged prices down Tuesday. Prompt month prices plunged as low as $7.008 intraday. The Schork Report’s analysts noted that, from peak to trough, Tuesday’s drop marked the seventh-largest decline on record. The settlement represented the third-largest day/day decline in Nymex records dating to 1990, they said. “The second-largest exporter of U.S. LNG just went offline on the cusp of the peak cooling season,” the analysts said. The Energy Information Administration (EIA) printed a 97 Bcf injection into Lower 48 storage during the week ended June 3. The build lifted stocks to 1,999 Bcf, but supplies in storage remained 14.5% below the five-year average. [Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.] With an extended outage for the Freeport terminal, deficits are likely to shrink and the odds of summer natural gas prices surpassing the $10 mark have “materially lessened,”

US natural gas storage levels increase by 92 Bcf, slimming deficit: EIA -US natural gas working stocks rose by 92 Bcf during the week ended June 10, reducing the deficit to the five-year average and slowing the momentum of a two-day recovery for gas futures. Storage inventories rose to 2.095 Tcf for the week ended June 10, the US Energy Information Administration reported June 16. The build was slightly higher than an S&P Global Commodity Insights' survey of analysts calling for an 89 Bcf net injection. The weekly injection was more than triple the 28 Bcf build reported during the corresponding week in 2021, and 13 Bcf more than the five-year average build of 79 Bcf, according to EIA data. The above-average build reduced storage's deficit to the five-year average to 323 Bcf, or 13.4% from 336 Bcf, or 14.4%, the previous week. The NYMEX Henry Hub July contract's settlement came in far lower than that was observed in early morning trading, suggesting that the above-average build into storage helped stymie a fledgling futures rally. In June 16 trading, before the weekly gas storage report was published at 10:30 am ET, the July contract was on a path toward retracing its steps back toward $8/MMBtu. The Henry Hub prompt traded around $7.87/MMBtu in the minutes before the report was released, up more than 40 cents from the June 15 settlement of $7.42/MMBtu. Within an hour of the report's launch, the contract had dropped to $7.70/MMBtu and fell further as the trading session went on. The NYMEX Henry Hub July contract settled at $7.464/MMBtu June 16, up 4.40 cents from the prior day, preliminary settlement data from CME Group shows. Looking ahead to the week in progress, a forecast by S&P Global's supply and demand model calls for a much smaller draw of 52 Bcf for the week ending June 17, which would erase this week's gains against the deficit. While the Freeport LNG outage is expected to loosen supply-demand balances in the South Central region, heightened cooling demand from record-high temperatures in the Midwest, Southeast, and Texas has soaked up some of the excess supply, leaving less gas available to flow into storage in the near term. S&P Global data shows that gas-fired power demand in Texas and the Southeast has come in 1.5 Bcf/d, or 9%, higher month to date than year-ago levels. Similarly, gas demand in the Midwest and Midcontinent has come in nearly 800 MMcf/d, or 6%, higher so far this June compared with last.

U.S. natgas drops 7% to 7-wk low on demand decline, oil price plunge - -- U.S. natural gas futures dropped about 7% to a seven-week low on Friday on forecasts for lower demand this week and next and expectations the extended shutdown of the Freeport liquefied natural gas (LNG) export plant in Texas would allow utilities to quickly rebuild low U.S. gas stockpiles. Traders also noted gas futures were following a collapse in oil prices due to concerns interest rate rises could cause a recession that reduces demand for energy. Prices declined despite record power demand in Texas, forecasts for hotter weather and much higher U.S. gas demand in two weeks, and small declines in U.S. gas output in recent days. The Freeport shutdown on June 8 reduced the amount of U.S. gas available to the rest of the world, especially in Europe where most U.S. LNG has gone as countries there wean themselves off Russian energy after Moscow invaded Ukraine. Freeport, which said the plant will remain out of service for about 90 days, declared force majeure on LNG shipments until September, according to a Bloomberg report. Gas prices at the European benchmark Title Transfer Facility in the Netherlands were up about 4% on Friday after Russia reduced pipeline exports to Europe. Analysts said leaving more gas in the United States should give utilities a chance to rebuild extremely low stockpiles more quickly. The Freeport facility, the second-biggest U.S. LNG export plant, consumes about 2 billion cubic feet per day (bcfd) of gas, so a 90-day shutdown would make about 180 billion cubic feet (bcf) more gas available to the U.S. market. Front-month gas futures for July delivery on the New York Mercantile Exchange (NYMEX) fell 52.0 cents, or 7.0%, to settle at $6.944 per million British thermal units (mmBtu), their lowest close since April 28. For the week, the contract was down about 22% after rising 4% last week. That was the biggest weekly decline since early December when it dropped 24%. With the Federal Reserve expected to keep raising interest rates, open interest in NYMEX futures fell on Thursday to the lowest level since September 2016 for a sixth day in a row as investors continued to cut back on risky assets. U.S. gas futures are still up about 88% so far this year as much higher prices in Europe and Asia keep demand for U.S. LNG exports strong, especially since Russia's Feb. 24 invasion of Ukraine stoked fears Moscow might cut gas supplies to Europe. Gas was trading around $38 per mmBtu in Europe and $34 in Asia. Russia cut pipeline exports to Europe to 3.8 bcfd on Thursday from 4.7 bcfd on Wednesday on the three mainlines into Germany: North Stream 1 (Russia-Germany), Yamal (Russia-Belarus-Poland-Germany) and the Russia-Ukraine-Slovakia-Czech Republic-Germany route. That compares with an average of 11.6 bcfd in June 2021.

LNG plant had history of safety issues before explosion - The explosion and fire in Texas last week that shut down about one-fifth of the country’s liquefied natural gas export capacity wasn’t the first time flames have bedeviled the Freeport LNG facility.When an electrical fire broke out in an enclosure at the terminal in 2020, the company’s call for help was routed to Houston, more than 60 miles away.After that delay, local firefighters responded. But they couldn’t find their way into the facility. Federal regulators would later say there weren’t enough Freeport personnel helping direct them. The mix-up is part of a record of safety lapses at Freeport, a massive facility that handles a product that currently is crucial to meeting the world’s energy needs. The terminal has had a string of incidents in recent years, and federal regulators have hit it with more enforcement actions than any of its competitors along the Gulf of Mexico.“The question is, what’s going on here? Is it something systemic?” said Richard Kuprewicz, a chemical engineer who worked for years in the oil and gas industry and now consults on safety. “Is there a recurring theme coming up?”Freeport LNG announced yesterday that the facility would be shut down for about three months (Greenwire, June 14). That’s a dramatic increase from the estimate, on the day of the explosion, that it would be at least three weeks. Considering the facility’s size and the current gas crunch, the development has been wreaking havoc on gas prices.But the three-month estimate is for only partial operations. The company’s statement said it did not expect a return to full operations “until late 2022.” The shutdown deals a blow to President Joe Biden’s efforts to help Europe wean itself quickly from Russian gas by expanding LNG exports from the United States. The U.S. oil and gas industry has also promoted its role in supplying gas to Europe before and after the invasion. But a significant portion of that supply is now unavailable.Before last week’s blast, federal inspectors had conducted six “failure investigations” of the operation since the beginning of 2015, according to federal records reviewed by E&E News. One opened just last month when, according to a National Response Center report, a spill of 100 gallons of triethylene glycol sent an employee to the hospital. Freeport has been hit with 11 enforcement actions from the federal Pipeline and Hazardous Materials Safety Administration (PHMSA) since early 2015, agency records show, more than any other Gulf Coast LNG facility.Problems at the facility have affected shipments and customers, as well. Last year, industry media reported that persistent concerns about the quality of gas going into the plant and loading issues caused Freeport to reduce the number of cargoes available for export.The explosion last week was the fourth incident reported to PHMSA since mid-2019 at the plant, which began operations in 2008 as an import terminal. The site began exporting gas in 2019.A safety expert called the frequency of incidents “alarming,” and possibly a sign of poor planning.“LNG is a beast when it comes to hazard and particularly fire and explosion,” said Faisal Khan, director of the Mary Kay O’Connor Process Safety Center at Texas A&M University. “It can easily escalate.”

Several thousands of gallons of oily material in Flint River (AP) — Several thousands of gallons of an oil-based, dark black material with a petroleum smell spilled into the Flint River in Flint, authorities said Wednesday. The spilled appeared to be 5 miles (8 kilometers) miles long, Jill Greenberg, a spokeswoman for Michigan's environmental agency, told MLive.com. “Booms are being deployed and investigators are working to determine a source,” the agency said on Twitter. Officials said drinking water was not threatened. Flint used the river for drinking water in 2014-15 before lead contamination caused the city to return to a regional water supplier. The U.S. Environmental Protection Agency is sending two on-scene coordinators to Flint in response, an EPA spokeswoman said. Agencies from the city of Flint, Genesee County and the state of Michigan were among those that responded initially to what the state has said was a spill of several thousands of gallons of an oil-based, dark black material with a petroleum smell. They’ve said the spilled material, located within a 10-mile stretch of the river, looks similar to motor oil. Representatives of the state agency took samples from the affected area of the river Wednesday, but Greenberg said results were not immediately available. “We’re still in emergency response mode ...,” said Jill Greenberg, an EGLE spokeswoman. “We’ve identified a potential source, but we are still investigating.”

Biden ready to use "emergency authorities" to boost fuel output, lower gas prices --President Biden will warn CEOs of the nation's largest oil companies on Wednesday that he's considering invoking emergency powers to boost U.S. refinery output, according to a letter obtained by Axios. Biden's direct engagement with the oil giants is part of an ongoing White House effort to tame fuel prices despite limited options — and cast oil companies as responsible for consumers' higher bills.The letter, which calls on the companies to boost output, signals how gasoline and diesel prices have become both an economic and political shock reaching the highest levels of the administration. Biden tells seven big refiners and fuel companies that he's "prepared to use all reasonable and appropriate Federal Government tools and emergency authorities to increase refinery capacity and output in the near term.""I understand that many factors contributed to the business decisions to reduce refinery capacity, which occurred before I took office," he writes. "But at a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable."Adding an olive branch, the letter — sent to the heads of ExxonMobil, Chevron, BP America, Shell USA, Phillips 66, Marathon and Valero — calls for them to offer "concrete, near-term solutions."Biden says he wants ideas to address inventory, price and refinery capacity issues in the coming months, as well as transportation measures to bring fuel to market. "The crunch that families are facing deserves immediate action," Biden writes. : In seeking help from the oil industry, Biden is walking a political tightrope, eager to lower the cost at the pump without alienating his base, which backs policies to combat climate change.: Biden said Energy Secretary Jennifer Granholm will convene an "emergency meeting on this topic." Biden's letter focuses on the drop in U.S. refinery capacity in recent years. It has dropped by about 1 million barrels per day compared to pre-COVID levels, according to the industry and federal data.