natural gas prices at a new 13 year high as heating season ends with supplies lowest in 3 years; Strategic Petroleum Reserve at a 20 year low; US distillates exports at a 45 month high leaves domestic distillates supplies at an 8 year low; oil product exports at an all time high; global oil surplus hits 710,000 barrels per day in March despite 821,000 barrel per day OPEC shortfall; natural gas drilling at a 30 month high

oil prices recovered from early losses to end higher for the first time in three weeks after Ukrainian peace talks failed and the EU considered a ban on Russian oil imports...after falling more than 1% to $98.26 a barrel last week after the IEA countries joined the US in an unprecedented release of emergency oil reserves, the contract price for US light sweet crude for May delivery tumbled 3% in mid-morning trading on Monday on growing concerns over China's Covid-19 surge and the big oil reserve release from consuming nations and never recovered, settling $3.97 or 4% lower at $94.29 a barrel, with sharp losses spearheaded by tightening lockdowns of China's largest cities as the World Bank slashed China's 2022 growth forecast on the back of their largest Covid-19 outbreak since beginning of the pandemic....but oil prices rebounded on Tuesday, as Shanghai eased lockdown restrictions in some areas and OPEC told the European Union it wouldn’t be possible to replace the Russian supply loss, and then rallied in afternoon trading after both OPEC and the EIA downgraded the global supply outlook through 2023, driven by sharp downward revisions to Russian oil production, which had already been hammered by Western sanctions, and finished $6.31 higher at $100.60 a barrel....oil prices extended their gains in midmorning trading on Wednesday, after Moscow said peace talks with Ukraine had reached a dead end, feeding worries about tight supplies, and closed $3.65 higher at $104.25 a barrel, even after the EIA reported that U.S. crude stocks rose by more than 9 million barrels in the most recent week....but oil prices slid more than 2% early Thursday as Chinese refiners appeared ready to cut crude throughput this month by about 6%, a pullback not seensince the early days of the pandemic, but bounced back as traders covered short positions ahead of the long weekend on news that the European Union might phase in a ban on Russian oil imports, with US May oil closing $2.70 higher at $106.95 a barrel, thus finishing the week 8.8% higher, as traders weighed a global supply deficit, a potential ban on Russian oil from the European Union, and and China’s latest virus lockdowns

Meanwhile, natural gas prices rose for the eighth time in nine weeks and set a new thirteen year high each day this week, as the heating season ended with natural gas supplies at a 3 year low, 24% below their year earlier level....after rising 9.8% to $6.278 per mmBTU last week on falling US gas output and on a bigger than expected decline in gas inventories, the contract price of natural gas for May delivery opened 2% higher on Monday and rallied to gain 36.5 cents to $6.643 per mmBTU, as a bump in production did little to assuage growing concerns about dwindling supplies, especially in light of chilly forecasts for most of this month...prices edged higher again on Tuesday on expectations that a freezing air mass in Canada would boost heating demand as it moved into the US next week. and settled 3.7 cents higher at $6.680 per mmBTU, and then surged 31.7 cents to $6.997 on Wednesday, on forecasts for unusual cold in the Upper Midwest and unusual heat in the Mid-Atlantic states....finally, natural gas prices finished off the short holiday week with another big jump on Thursday, after the latest EIA inventory data confirmed a sluggish start to the injection season, and on expectations that freezing weather in Canada would boost heating demand as it moves into the United States next week. and settled 30.3 cents higher at $7.300 per mmBTU, thus finishing with a 16.3% increase for the week..

the above is a screenshot of the interactive natural gas price chart from barchart.com, which i have set to show front month natural gas prices monthly over the past 10 years, which means you're seeing the range of natural gas prices over that time as they were quoted by the media...this same chart can be reset to show prices of front month or individual monthly natural gas futures contracts over time periods ranging from 1 day to 30 years, as the menu bar on the top indicates, and also to show natural gas prices by the minute, hour, day, week or month for each...each bar in the graph above represents the range of natural gas prices for a single month, with months when prices rose indicated in green, and months when prices fell indicated in red, with the small sticks above or below each monthly bar representing the extent of the price change above or below the opening and closing price for the month in question....likewise, the bars across the bottom show trading volume for the months in question, again with up months indicated by green bars and down months indicated in red...what's noteworthy in this monthly price view is that natural gas prices have already risen more in the first 15 days of April than they did over any full month in the previous ten years, something you can easily tell from the length of the green bar representing the current month..

The EIA's natural gas storage report for the week ending April 8th showed that the amount of working natural gas held in underground storage in the US rose by 15 billion cubic feet to 1,382 billion cubic feet by the end of the week, which still left our gas supplies 439 billion cubic feet, or 23.9% below the 1,836 billion cubic feet that were in storage on April 8th of last year, and 303 billion cubic feet, or 17.8% below the five-year average of 1,700 billion cubic feet of natural gas that have been in storage as of the 8th of April over the most recent five years....the 15 billion cubic foot injection into US natural gas working storage for the cited week was more than the average forecast for a 10 billion cubic foot injection from an S&P Global Platts survey of analysts, but it was less than the average injection of 33 billion cubic feet of natural gas that have typically been added to our natural gas storage during the same week over the past 5 years, and far kess than the 55 billion cubic feet that were added to natural gas storage during the corresponding week of 2021... assuming there will be no further withdrawals from storage until fall, the 1,382 billion cubic feet we ended this year's heating season with would have been the lowest natural gas inventory level since April 2019...

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending April 8th indicated that after a near record decrease in our oil exports, we were able to add surplus oil to our stored commercial crude supplies for the 7th time in 20 weeks and for the 16th time in the past forty-five weeks…our imports of crude oil fell by an average of 305,000 barrels per day to an average of 5,995,000 barrels per day, after rising by an average of 41,000 barrels per day during the prior week, while our exports of crude oil fell by an average of 1,513,000 barrels per day to 2,180,000 barrels per day during the week, after our exports had risen by an average of 705,000 barrels per day during the prior week...applying our oil exports to offset oil supplies from imports to get our effective trade in oil, we find there was a net import average of 3,815,000 barrels of per day during the week ending April 8th, 1,208,000 more barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude oil from US wells was reportedly unchanged at 11,800,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 15,615,000 barrels per day during the cited reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,523,000 barrels of crude per day during the week ending April 8th, an average of 424,000 fewer barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net of 783,000 barrels of oil per day were being added to the supplies of oil stored in the US….so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from net imports and from oilfield production was 691,000 barrels per day less than what was added to storage plus what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+691,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an error or omission of that magnitude in this week’s oil supply & demand figures that we have just transcribed.... moreover, since last week’s EIA fudge factor was at (+1,352,000) barrels per day, that means there was a 661,000 barrel per day difference between this week's balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the week over week supply and demand changes indicated by this week's report are completely useless....however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 783,000 barrel per day increase in our overall crude oil inventories came as 1,340,000 barrels per day were being added to commercially available stocks of crude oil, while 557,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve at the same time....that draw on the SPR included a withdrawal under the initial 30,000,000 million barrel release from the SPR to address Russian supply related shortfalls, as well as an earlier ongoing withdrawal under the administration's plan to release 50 million barrels from the SPR to incentivize US gasoline consumption....including other withdrawals from the Strategic Petroleum Reserve under similar recent programs, a total of 95,468,000 barrels have now been removed from the Strategic Petroleum Reserve over the past 21 months, and as a result the 560,681,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since March 8th, 2002, or at a 20 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs has already drained those supplies considerably over the past dozen years...with Biden's recent announcement, an additional and unprecedented million barrels per day will be released from the SPR daily starting in May and running up to the midterm elections in November, in the hope of keeping gasoline and diesel prices lower up until that time....that total 180,000,000 barrel drawdown will remove almost a third of what remains in the SPR at this time, as the following graph illustrates...

The above graph comes from a post by oil and gas researcher Rory Johnston at Substack, wherein he discusses the implications of the planned SPR release, and it shows the historical quantity of oil held in our Strategic Petroleum Reserve, beginning from its inception following the Arab Oil Embargo of 1973-74 to the present day...the graph is further annotated to indicate the reasons for major additions to and withdrawals from the SPR, most of which were due to disruptions to oil supplies following hurricanes in the Gulf (you can get a better view of that by clicking on the graph, or even better yet, the enlarged version at substack.com....on the far right, Rory has projected where the strategic petroleum Reserve will end up after the Biden withdrawals are complete, which will take the SPR back to its level of 1983, while it was still being filled...based on an estimated average daily US oil consumption of 18,000,000 barrels per day, the US will have roughly 18 1/2 days of oil supply left in the Strategic Petroleum Reserve this November, after all three of the Biden administration's SPR withdrawal programs have run their course ...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to an average of 6,260,000 barrels per day last week, which was still 4.9% more than the 5,971,000 barrel per day average that we were importing over the same four-week period last year….this week’s crude oil production was reported to be unchanged at 11,800,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 11,400,000 barrels per day, while Alaska’s oil production fell by 5,000 barrels per day to 443,000 barrels per day but had no impact on the final rounded national total....US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was still 9.9% below that of our pre-pandemic production peak, but 40.0% above the interim low of 8,428,000 barrels per day that US oil production had fallen to during the last week of June of 2016...

US oil refineries were operating at 90.0% of their capacity while using those 15,523,000 barrels of crude per day during the week ending April 8th, down from the 92.1% utilization rate of the prior week, but still close to the historical utilization rate for early April refinery operations, when spring refinery maintenance programs have just about finished up…the 15,523,000 barrels per day of oil that were refined this week were 3.1% more barrels than the 15,051,000 barrels of crude that were being processed daily during week ending April 9th of 2021, when refineries were still recovering from winter storm Uri, and 22.6% more than the 12,665,000 barrels of crude that were being processed daily during the week ending April 10th, 2020, when US refineries were operating at what was then a much lower than normal 69.1% of capacity at the onset of the pandemic, but 3.5% less than the 16,078,000 barrels that were being refined during the week ending April 12th 2019, when refinery utilization had slipped to an 8 year low of 87.7% for the same week of April...

Even with the decrease in the amount of oil being refined this week, gasoline output from our refineries was still higher, increasing by 377,000 barrels per day to 9,501,000 barrels per day during the week ending April 8th, after our gasoline output had increased by 70,000 barrels per day over the prior week.…but this week’s gasoline production was still 1.2% less than the 9,615,000 barrels of gasoline that were being produced daily over the same week of last year, and 4.2% less than the gasoline production of 9,917,000 barrels per day during the week ending April 12th, 2019, ie, the year before the pandemic impacted output....on the other hand, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 388,000 barrels per day to 4,654,000 barrels per day, after our distillates output had decreased by 49,000 barrels per day over the prior week…even with those decreases, our distillates output was 10.1% more than the 4,228,000 barrels of distillates that were being produced daily during the week ending April 9th of 2021, but 3.5% less that the 5,038,000 barrels of distillates that were being produced daily during the week ending April 12th, 2019...

Even with the increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the ninth time in ten weeks, decreasing by 3,648,000 barrels to 233,139,000 barrels during the week ending April 8th, after our gasoline inventories had decreased by 2,041,000 barrels over the prior week....our gasoline supplies decreased again this week because the amount of gasoline supplied to US users increased by 174,000 barrels per day to 8,736,000 barrels per day, and because our imports of gasoline fell by 45,000 barrels per day to 439,000 barrels per day while our exports of gasoline fell by 94,000 barrels per day to 886,000 barrels per day,.…and even with 9 inventory drawdowns over the past 10 weeks, our gasoline supplies were still only 0.7% lower than last April 9th's gasoline inventories of 234,897,000 barrels, and 3% below the five year average of our gasoline supplies for this time of the year…

Meanwhile, with this week's big decrease in our distillates production, our supplies of distillate fuels decreased for the tenth time in thirteen weeks and for the 22nd time in thirty-two weeks, falling by 2,902,000 barrels to an eight year low of 111,399,000 barrels during the week ending April 8th, after our distillates supplies had increased by 771,000 barrels during the prior week…our distillates supplies fell this week even though the amount of distillates supplied to US markets, an indicator of our domestic demand, fell by 163,000 barrels per day to 3,484,000 barrels per day, because our exports of distillates rose by 366,000 barrels per day to a 45 month high of 1,739,000 barrels per day, while our imports of distillates rose by 66,000 barrels per day to 154,000 barrels per day.....after thirty-six inventory decreases over the past fifty-two weeks, our distillate supplies at the end of the week were 22.3% below the 143,464,000 barrels of distillates that we had in storage on April 9th of 2021, and about 17% below the five year average of distillates inventories for this time of the year…

This week's spike in distillates exports, combined with elevated exports of other petroleum products, meant that our total exports of all such refinery products were at an all time high, rising from 5,938,000 barrels per day during the week ending April 1st to 6,807,000 barrels per day during the week ending April 8th, easily topping the prior export record of 6,432000 barrels per day set last August 6th; that record export total includes everything our refineries produce, from gasoline and distillates to kerosene type jet fuels, residual fuels, and propane/propylene...

Meanwhile, with the near record drop in our oil exports, our commercial supplies of crude oil in storage rose for the 14th time in 37 weeks and for the 20th time in the past year, increasing by 9,382,000 barrels over the week, from 412,371,000 barrels on April 1st to 421,753,000 barrels on April 8th, after our commercial crude supplies had increased by 2,421,000 barrels over the prior week…with this week’s increase, our commercial crude oil inventories were about 13% below the most recent five-year average of crude oil supplies for this time of year, but were nearly 30% above the average of our crude oil stocks as of the second weekend of April over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels....since our crude oil inventories had jumped to record highs during the Covid lockdowns of spring 2020, and then jumped again after last year's winter storm Uri froze off Gulf Coast refining, our commercial crude oil supplies as of this April 8th were 14.4% less than the 492,423,000 barrels of oil we had in commercial storage on April 9th of 2021, and were also 16.3% less than the 503,618,000 barrels of oil that we had in storage on April 10th of 2020, and 7.3% less than the 455,154,000 barrels of oil we had in commercial storage on April 12th of 2019…

Finally, with our inventory of crude oil and our supplies of all products made from oil remaining near multi year lows, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR....the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, rose by 3,465,000 barrels this week, from 1,708,416,000 barrels on April 1st to 1,711,881,000 barrels on April 8th, the second increase after our total supplies had decreased by 81,461,000 barrels over the first twelve weeks of this year...hence that increase still left our total supplies of oil & its products less than 5 million barrels higher than what would be an 8 year low dating back to April 4th, 2014.

OPEC's Report on Global Oil for March

Tuesday of the past week saw the release of OPEC's April Oil Market Report, which includes details on OPEC & global oil data for March, and hence it gives us a picture of the global oil supply & demand situation after OPEC and aligned oil producers agreed to increase their output by 400,000 barrels per day for an eighth consecutive month, ie from the previously agreed to July 2021 level, which was in turn part of the fifth production quota policy reset that they've made over the past twenty-two months, all in response to the pandemic-related slowdown and subsequent irregular recovery....note that now with the course and impact of the Ukraine war uncertain, we consider the demand projections made herein, which are only modestly lower than in the prior report, to be purely speculative, and hence will not address any projections beyond the March estimates..

The first table from this monthly report that we'll review is from the page numbered 45 of this month's report (pdf page 55), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC uses an average of production estimates by six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures...

According to the agreement reached between OPEC and the other oil producers at their Ministerial Meeting on July 18th, 2021, the oil producers party to that agreement were to raise their output by a total of 400,000 barrels per day each month through December 2021, which was subsequently renewed to include further monthly 400,000 barrel per day production increases in January, February, March and April 2022, and which would indicate an increase of 254,000 barrels per day each month from the OPEC members listed above, with the rest supplied by other producers. including Russia..but as we can see from the above table, OPEC's increase of 57,000 barrels per day fell far short of that...the production decreases in Nigeria, which has ongoing pipeline theft and leakage problems, and Libya, with their repeated bouts of civil strife, are obviously part of the reason for the March shortfall, but even Saudi Arabia fell 50,000 barrels per day short of what they were expected to produce, as we'll see in the next table...

The adjacent table was originally included as a downloadable attachment to the press release following the 25th OPEC and non-OPEC Ministerial Meeting on February 2nd, 2022, which set OPEC's and other aligned producers production quotas for March... since war torn Libya and US sanctioned producers Iran and Venezuela are exempt from the production cuts imposed by the joint agreement that governs the output of the other OPEC producers, they are not shown here, and OPEC's quota is aggregated under the total listed for the 'OPEC 10', which you can see was to be at 25,061,000 barrels per day in March....therefore, the 24,240,000 barrels those 10 OPEC members actually produced in March were 821,000 barrels per day short of what they were expected to produce during the month, with Nigeria and Angola accounting for most of this month's shortfall, while only Kuwait and the UAE were able to produce what was expected of them.....

* * *

Recall that the original 2020 oil producer's agreement was to jointly cut their oil production by 23%, or by 9.7 million barrels per day, from an October 2018 baseline for just two months early in the pandemic, during May and June of 2020, but that initial 9.7 million bpd production cut agreement was extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020....then, in a subsequent meeting in July of that year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August 2020 and subsequent months, which thus became the agreement that governed OPEC's output for the rest of 2020...the OPEC+ agreement for their January 2021 production, which was later extended to include February and March and then April's output, was to further ease their supply cuts by 500,000 barrels per day to a cut of 7.2 million barrels per day from that original 2018 baseline...then, during a difficult meeting on April 1st of last year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher each month by a pre-set amount for each country over the following three months, thus extending their joint output cut agreement through July....production levels for August and the following months of last year were to be determined by a July 1st OPEC meeting, but that meeting was adjourned on July 2nd due to a dispute between the UAE and the Saudis over the 2018 reference production levels, and a subsequent attempt to restart that meeting on July 5th was called off....so it wasn't until July 18th 2021 that a tentative compromise addressing August 2021's output quotas was worked out, allowing oil producers in aggregate to increase their production by 400,000 barrels per day in August, and again by that amount in each of the following months, and also to boost reference production levels for the UAE, the Saudis, Iraq and Kuwait beginning in April 2022....OPEC and other producers then agreed to increase their production in January 2022 by a further 400,000 barrels per day in a meeting concluded on the 2nd of December, 2021, and reaffirmed their intention to continue that policy with another 400,000 barrel per day increase in February at a meeting concluded January 4, 2022, and then agreed to stick to that 400,000 bpd oil output increase in March, despite pressure from the US to raise output more quickly, at a meeting on February 2nd....then, at a meeting on March 2nd, OPEC and its oil-producing allies, which included Russia, decided to hold their production increase at that level thru April in an OPEC+ meeting that only lasted 13 minutes, their shortest meeting ever...finally, on March 31, OPEC and aligned producers agreed to reaffirm the decisions of the prior Ministerial meetings and again limit their production increase to 400,000 barrels per day, because "the current [oil market] volatility is not caused by fundamentals, but by ongoing geopolitical developments"

Hence OPEC arrived at the production quotas for August 2021 through April of this year by repeatedly readjusting the original 23%, or 9.7 million barrel per day production cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day output reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was subsequently raised to an 8.2 million barrel per day oil output reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during the Covid surge of February, March, and then later during April of last year....under the agreement prior to the current one affecting this month, OPEC's production cut in April 2021 was set at 4,564,000 barrels per day below the October 2018 baseline, which was lowered to a cut of 3,650,000 barrels per day from the baseline with the prior comprehensive agreement, which thus set the July production quota for the "OPEC 10" at 23,033,000 barrels per day, with war torn Libya and US sanctioned producers Iran and Venezuela exempt from the production cuts imposed by thiat agreement....for OPEC and the other producers to increase their output by 400,000 barrels per day from that July 2021 level, each producer would be allowed to initially increase their production by just over 1% per month since that time...for OPEC alone, a 254,000 barrel per day increase each month since, begining with the July 2021 quota of 23,033,000 barrels per day, is how they arrived at the 25,061,000 barrels per day quota for OPEC for March that you see on the table above..

The next graphic from this month's report that we'll look at shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from April 2020 to March 2022, and it comes from page 46 (pdf page 56) of OPEC's April Oil Market Report....on this graph, the cerulean blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

Including this month's 57,000 barrel per day increase in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate is that total global liquids production increased by a rounded 370,000 barrels per day to average 99.66 million barrels per day in March, a reported increase which came after February's total global output figure was apparently revised down by 210,000 barrels per day from the 99.50 million barrels per day of global oil output that was estimated for February a month ago, as non-OPEC oil production rose by a rounded 320,000 barrels per day in March after that downward revision, with 260,000 barrels per day of the increase coming from the US and Norway, due to the resolution of weather related outages and a shale oil production increase in March...

After that increase in March's global output, the 99.66 million barrels of oil per day that were produced globally during the month were 6.45 million barrels per day, or 6.9% more than the revised 93.21 million barrels of oil per day that were being produced globally in March a year ago, which was the third month that OPEC and their allied producers had reduced their output cuts by 500,000 barrels per day from the 7.7 million barrels per day production cut that they applied to the last 5 months of 2020, but also the second month that the Saudis had unilaterally decreased their own production by a million barrels per day in response to the pandemic's hit to demand (see the April 2021 OPEC report (online pdf) for the originally reported March 2021 details)...with this month's modest increase in OPEC's output, their March oil production of 28,557,000 barrels per day amounted to 28.7% of what was produced globally during the month, down from their revised 28.8% share of the global total in February....OPEC's March 2021 production was reported at 25,042,000 barrels per day, which means that the 13 OPEC members who were part of OPEC last year produced 3,515,000 barrels per day, or 14.0% more barrels per day of oil this March than what they produced a year earlier, when they accounted for 26.9% of global output...

After the increases in OPEC's and global oil output that we've seen in this report, the amount of oil being produced globally during the month was a bit more than the expected global demand, as this next table from the OPEC report will show us....

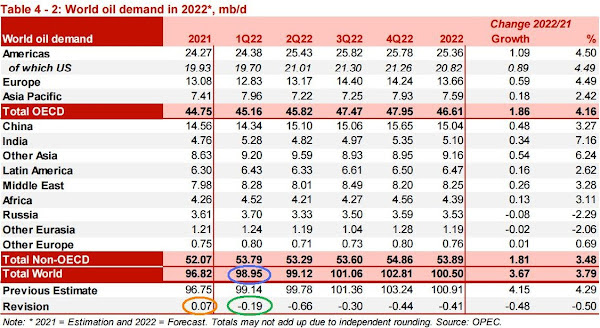

The above table came from page 26 of the April Oil Market Report (pdf page 36), and it shows regional and total oil demand estimates in millions of barrels per day for 2021 in the first column, and then OPEC's estimate of oil demand by region and globally quarterly over 2022 over the rest of the table...on the "Total world" line in the second column, we've circled in blue the figure that's relevant for March, which is their estimate of global oil demand during the first quarter of 2022....OPEC is estimating that during the 1st quarter of this year, all oil consuming regions of the globe were using an average of 98.95 million barrels of oil per day, which is a downward revision of 19,000 barrels per day from their estimate for 1st quarter demand of a month ago (that revision is circled in green)...but as OPEC showed us in the oil supply section of this report and the summary supply graph above, OPEC and the rest of the world's oil producers were producing 99.66 million barrels million barrels per day during March, which would imply that there was a surplus of around 710,000 barrels per day of global oil production in March, when compared to the demand estimated for the month...

In addition to figuring the March global oil supply shortfall that's evident in this report, the downward revision of 210,000 barrels per day to February's global oil output that's implied in this report, which is mostly offset the 190,000 barrels per day downward revision to first quarter demand noted above, means that the 360,000 barrels per day global oil output surplus we had previously figured for February would now be revised to a surplus of 340,000 barrels per day...similarly, the oil shortage of 600,000 barrels per day we had previously figured for January would be revised to a shortage of 410,000 barrels per day in light of the 190,000 barrel per day downward revision to first quarter demand...

Also note that in orange we've also circled an upward revision of 70,000 barrels per day to 2021's demand, which also means that the supply shortfalls that we previously reported for last year would have to be revised....a separate table on page 25 of the March Oil Market Report (pdf page 35) indicates the revisions to 2021 demand included an an upward revision of 20,000 barrels per day to 4th quarter demand, an upward revision of 90,000 barrels per day to 3rd quarter demand, an upward revision of 80,000 barrels per day to 2nd quarter demand. and an upward revision of 140,000 barrels per day to 1st quarter demand...we're not inclined to go back and recompute the shortages for each month of 2021, but we do have adequate totals for the year from our prior reports such that we can estimate an aggregate revision...

With the release of OPEC's January Oil Market Report three months ago, we had complete and revised data for all of 2021, and found that the world was short 527,910,000 barrels of oil during the year, which worked out to a shortage of 1,446,300 barrels of oil per day....OPEC's February Oil Market Report then revised aggregate global demand for 2021 higher by 10,000 barrels per day, OPEC's March Oil Market Report revised 2021 demand higher by 90,000 barrels per day, and now this month's report has revised that demand higher by another 70,000 barrels per day....that means our original estimate of 2021's oil shortage now needs to be revised a total 170,000 barrels per day higher, or to 1,616,300 barrels per day...that would therefore revise the total shortage total shortage of oil for last year up to 534,115,000 barrels....we're still far from running out, however, because the quantities of oil being produced globally during the pandemic of 2020 still averaged over 1.1 trillion barrels, or over 3 million barrels per day more than anyone wanted...

This Week's Rig Count

The number of drilling rigs running in the US rose for the 69th time over the prior 81 weeks during the period ending April 14th, but it still remained 12.6% below the prepandemic rig count (note that this week's tally only counts 6 days due to Good Friday)......Baker Hughes reported that the total count of rotary rigs drilling in the US increased by four to 693 rigs this past week, which was also 254 more rigs than the pandemic hit 439 rigs that were in use as of the April 16th report of 2021, but was still 1,236 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil was up by 2 to 548 oil rigs during this week, after rigs targeting oil had increased by 13 during the prior week, and there are now 204 more oil rigs active now than were running a year ago, even as they still amount to just 34.1% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are still down 19.8% from the prepandemic oil rig count….meanwhile, the number of drilling rigs targeting natural gas bearing formations was up by 2 to 143 natural gas rigs, the most since October 11th, 2019, and up by 49 natural gas rigs from the 94 natural gas rigs that were drilling during the same week a year ago, even as they were still only 8.9% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…in addition to rigs targeting oil and gas, Baker Hughes continues to show two active "miscellaneous" rigs; one is a rig drilling vertically for a well or wells intended to store CO2 emissions in Mercer county North Dakota, and the other is also a vertical rig, drilling 5,000 to 10,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track...

The offshore rig count in the Gulf of Mexico was unchanged at twelve offshore rigs this week, with all of this week's Gulf rigs drilling for oil in Louisiana waters....that's the same number of offshore rigs that were active in the Gulf a year ago, when ten Gulf rigs were drilling for oil offshore from Louisiana and two were deployed for oil in Texas waters…since there is not any drilling off our other coasts at this time, nor was there a year ago, those Gulf of Mexico rig counts are equal to the national offshore totals for both years....

In addition to those rigs offshore, we continue to have a water based directional rig, drilling for oil at a depth of over 15,000 feet, inland in the Galveston Bay area, while during the same week of a year ago, there were no such "inland waters" rigs deployed..

The count of active horizontal drilling rigs was up by 5 to 636 horizontal rigs this week, which was also 238 more rigs than the 398 horizontal rigs that were in use in the US on April 16th of last year, but still 53.7% less than the record 1,374 horizontal rigs that were drilling on November 21st of 2014....on the other hand, the vertical rig count was down by one to 26 vertical rigs this week, while those were still up by 4 from the 21 vertical rigs that were operating during the same week a year ago…meanwhile, the directional rig count was unchanged at 32 directional rigs this week, and those were still up by 12 from the 20 directional rig that were in use on April 16th of 2021….

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of April 14th, the second column shows the change in the number of working rigs between last week’s count (April 8th) and this week’s ( April 14th) count, the third column shows last week’s April 8th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 16th of April, 2021...

We'll again start by checking the Rigs by State file at Baker Hughes for the Texas changes in the Permian basin...there we find that three rigs were added to those in Texas Oil District 8, which encompasses the core Permian Delaware, and that two more rigs started drilling in Texas Oil District 8A, which includes the Texas counties in the northern part of the Permian Midland, but that two rigs were removed from Texas Oil District 7C, which encompasses those Texas counties in the southern part of the Permian Midland, at the same time, thus indicating a net increase of three rigs in the Texas Permian...since there was just a two rig increase in the Permian basin nationally, that means that the rig that was pulled out from New Mexico had been drilling in the western Permian Delaware in the southeast corner of that state,...

Elsewhere in Texas, we find that a rig was added in Texas Oil District 2, but that a rig was pulled out of Texas Oil District 3, in the only evidence of activity in the Eagle Ford districts (1 thru 4) in that state...but since the Eagle Ford shale rig count was up by three oil rigs, that means there were at least two other rigs pulled out of those four districts targeting other basins that Baker Hughes doesn't track, to offset and thus mask evidence of those Eagle Ford increases...the North America Rotary Rig Count Pivot Table (XLS) provides county level details, should you want to know exactly what those changes were... meanwhile, another rig was added in Texas Oil District 5, which accounts for the natural gas rig increase in the Barnett Shale near Dallas-FtWorth...

In other rig changes around the country, there was an oil rig added to Oklahoma's Cana Woodford, and an oil rig increase on Alaska's North Slope (as indicated by the Pivot Table), while the inland waters rig that had been targeting oil at a depth of between 10,000 and 15,000 feet in St. Mary Parish, Louisiana was removed...for rigs targeting natural gas formations, there was a natural gas rig addition in the Haynesville shale, offset by the removal of a Haynesville shale oil rig, thus netting no net change in the Haynesville count, while at the same time two rigs targeting natural gas were added in West Virginia's Marcellus, which were offset by the removal of two natural gas rigs from Pennsylvania's Marcellus, thus also netting no net change in the Marcellus...

+++++++++++++++++++++++++++++++++++++++++

Canfield fire chief, officials discuss concerns over plans to build school near ethane pipeline --- There's a pipeline that's been running through parts of the Valley for eight years, but now some parents and residents in Canfield are now sharing their concerns about the pipeline after Canfield Local School District's announcement to build its new K-8 school compound on a property that contains an eight-inch Highly Volatile Liquid (HVL) pipeline. The transmission line runs across the former 300-acre Red Gate Farm at the corner of Leffingwell and Palmyra Roads, which was annexed into the city of Canfield in 2017. This location for the proposed school site was recently announced as part of a development agreement that provided the district with 100 acres for the new school compound. The concern from residents is based on what flows through the pipeline – ethane – a colorless, odorless gas that is used in the making of plastics. According to the Chemical Safety Information from the World Health Organization, ethane is listed as a highly volatile liquid and an extremely flammable gas, which if released, can displace oxygen, can produce a vapor cloud, and large fireball combustion. Ethane is listed as a hazardous substance by the U.S. Department of Transportation, American Conference of Governmental Industrial Hygienists, and National Fire Protection Association, which rates substances as fire and/or explosive hazards.The pipeline is part of the Mariner West pipeline, a 400-mile ethane pipeline that starts near Pittsburgh and runs through part of Columbiana County and across Mahoning County and continues on to Ontario.In February, the Canfield Local School District shared its vision for the location of the K-8 compound with the public, which shows the proposed building approximately 200 feet from the existing Mariner West pipeline. On April 5, Canfield Fire Chief Don Hutchinson sent a letter to Canfield Local Schools Superintendent Joe Knoll, after speaking with the US. Department of Transportation, the federal agency that regulates pipelines in the U.S. In the letter, Hutchinson wrote “my review of the regulations suggest that placement of the school and related facilities would be in a 'high consequence area' and … “The proposed placement of the school facilities has raised a significant safety concern for me, as it should for the school administration.”According to Chief Hutchinson, he has been speaking with the operator of the ethane pipeline that runs through Canfield and the township and said an immediate evacuation for “an isolated leak is 330 feet in all directions” would be needed, which coincides with the DOT Office of Pipeline Safety distance for High Consequence Areas, based on product and size piping and the pounds per square inch for 300 feet. Richard Kuprewicz, president of Accufacts, Inc. out of Redmond, WA., specializes in investigations on pipelines for safety, construction, and risk management, recommends an evacuation radius of at least a half-mile, or 2,640 feet if a vapor cloud were to form from a leak, crack or rupture. Kuprewicz said an 8-inch ethane pipeline leak could cause damage to nearby buildings, but rupture would be more destructive.Canfield Local Schools Superintendent Joe Knoll said that the Canfield Local Board of Education and his office have been spending the last few months reviewing pipeline data and having discussions with the pipeline operator and the local fire department. “There are a lot of safety measures that the pipeline operators have in place,” Knoll said, “Which is good for us in a school setting.”

Oil and gas production expected to increase in Guernsey County - Industry experts expect to see an increase in oil and gas production in the Utica Shale region including Guernsey County this year due to a rising demand resulting from global issues and domestic usage. Guernsey County currently has 300 Utica shale well permits and the most active producers in the county are Ascent Resources with 130 permits, Southwestern Energy with 69 and Utica Resources with 31. The Ohio Department of Natural Resources reports 24 wells — 23 productive and 1 exploratory — were drilled in Guernsey County in 2019, the latest year for which statistics are available. The average well depth was 19,918 feet with an estimated footage drilled of 478,029. The most recent horizontal shale production statistics for Guernsey County from 2019 totaled 13,556,178 barrels of oil and 91,078,704 Mcf of gas. "The industry in Guernsey County is strong, and it's active," said Mike Chadsey of the Ohio Oil & Gas Association after a recent roundtable discussion attended by Ohio Secretary of State Frank LaRose at the Cambridge Country Club. "It's because what's happening globally. "Some of the opportunities and challenges happening right now are allowing us to put (drilling) units together...get leases together and go out and drill to lift that commodity out of the ground. You will see increased activity here in Guernsey County this year, and beyond this year." There are 12 drilling rigs currently in operation in the Utica region across southeast Ohio. According to the Ohio Department of Natural Resources, more than 275,000 gas wells had been drilled statewide as of 2019 with 2.6 trillion cubic feet of natural gas production. The most recent statistics available also show 55,921 oil wells have produced 27 million barrels of crude oil. "I think it's strong," said LaRose of Ohio's oil and gas industry "Ohio has done smart things to be a welcoming state when it comes to energy, and there's good reason for that. All you need to do is look to Europe right now." "Shutting off Russia's oil supply, you are going to have to make that up somewhere and that's where you are seeing some renewed interest in the western part of the Utica shale formation because it's more rich in oil deposits," said George Brown of OOGEEP. "The great thing about Guernsey County is the entire natural gas ecosystem that goes along with it (oil)." Ohio is home to four oil refineries, which can produce nearly 600,000 barrels of crude oil daily, according to the Ohio Oil & Gas Energy Education Program. That's enough oil to produce 11.4 millions gallons of gasoline per day. The rate at which oil and gas production will increase in Guernsey County this year will depend on several variables, according to local officials. "It will probably depended producer to producer based on what their plans are...their access to capital and what their drilling units look like, but I would say we will see increased activity this year," said Chadsey. "Our people can't turn on a dime. You do have to get a permit, get your hands on a rig, a crew and all that stuff, so it will probably be a slow ramp up but I think we will continue to see more activity and excitement about that activity here in Guernsey County." The county continues to be on the western edge of the Utica shale play in what is referred to as the oil window. Brown said there are two-overlaying issues that will slow production in Guernsey and other counties nearby when it come to oil and gas. "One is the certainty in the planning that needs to go into the preparation process for exploration," he said. "It takes time. It can take up to a year, if not more, to get a rig in place and get it in the process of exploration. An atmosphere that is more encouraging of domestic, made in Ohio energy is important. "And two, building out the critical energy infrastructure to get that product to meet its market. There are currently five pipeline proposals that have either been canceled or opposed that would haven taken the gas and oil coming from Ohio and other parts of the basin to end users either on the east coast of the United State or down south to meet the needs.

One Less Way for Ohio Landowners to Challenge Royalty Severances - The National Law Review - On February 15, 2022, the Ohio Supreme Court issued a significant decision in Peppertree Farms, L.L.C. v. Thonen establishing that, unless expressly stated otherwise, an oil and gas royalty interest retained in a deed executed prior to 1925 is not limited to the lifetime of the grantor. In so holding, the Ohio Supreme Court cut off one of the only grounds, other than the Dormant Minerals Act and Marketable Title Act, for landowners to quiet title and eliminate past oil and gas severances. Ohio follows a legal tradition under which the default rules of English “common law” were adopted and then adapted by statute to form the basis of our legal system. At common law, a conveyance of real property had to include “words of inheritance” (i.e., an express statement that the royalty interest would last in perpetuity and be inheritable) or the interest being conveyed would be limited to the lifetime of the grantee (a life estate). Additional complications arose when a grantor sought to retain an interest by deed. If the grantor was retaining a right which had already been conveyed to him in perpetuity, then the retention qualified as a “technical exception” of a pre-existing right and additional words of inheritance were not required. However, if the grantor was creating and then retaining a new right, the retention qualified as a “technical reservation” and was limited to a life estate. As new modes of production and corresponding property rights were discovered, it became unclear exactly what rights pre-existed a severance and the whole system of distinctions fell apart. In 1925, the General Assembly passed a law establishing that all future conveyances of real property were presumed perpetual unless stated otherwise. While eliminating this issue as to future deeds, the General Assembly did not settle the issue as to deeds executed before 1925 or clarify whether the retention of an oil and gas royalty was a “technical exception” or “technical reservation.” In the Peppertree Farms case, Plaintiffs Peppertree Farms, Jay Moore and Amy Moore (collectively, “Peppertree”) sought to quiet title to certain lands in Monroe County, Ohio, against a severed oil and gas royalty interest (the “Royalty Interest”) originally retained by the grantor under a 1921 deed. In addition to a claim for extinguished under Ohio’s Marketable Title Act, Peppertree asserted that the Royalty Interest did not include words of inheritance and was therefore a newly created right which terminated upon the death of the grantor under the 1921 deed. Conversely, the defendant royalty owners (“Royalty Owners”) argued that the Royalty Interest was a pre-existing right which the grantor already held, and therefore could retain, in perpetuity without words of inheritance. While Peppertree was able to convince both the trial and appellate court that the Royalty Interest was a newly created interest which was limited to a life estate, it was unsuccessful with the Ohio Supreme Court. Reasoning that a royalty was nothing more than the retention of part of the right to receive the proceeds of oil and gas production, the Court ultimately found that the Royalty Interest was a “technical exception” which survived the lifetime of the grantor. As a result, Peppertree was limited to its claims for extinguishment under the Marketable Title Act and Ohio surface owners lost another means to challenge ancient royalty reservations.

Fighting Off A Petrochemical Future in the Ohio River Valley - - It was 2007, and the fracking industry was just beginning to take hold in southwest Pennsylvania. The then-fledgling industry was not really on Vanessa Lynch’s radar; between raising a daughter and working full-time as a therapist, she had her hands full. Things got even busier when she had her son in April 2009 and he began suffering from frightening wheezing spells when he was 6 months old, requiring periodic medical attention. “Honestly, I really had very little understanding of what was going on in the region,” she says.Just before her daughter was set to start kindergarten, Lynch and her family moved half an hour away to Indiana Township to be close to a good school and have more space to play outside. The neighborhood had everything the growing family could hope for, with a park to play soccer and softball and a creek for summertime wading.A couple of years later, however, she learned via a neighbor’s Facebook post that the fracking industry had quietly placed a gas drilling site in her community, just above the local park. Infuriated and inspired to act, in 2018, Lynch joined up with the local chapter of the national environmental advocacy group Moms Clean Air Force, where she now works as a part-time organizer.Lynch and her fellow organizers were not able to shut down the well pad, but they did win more protective ordinances for the township, shielding approximately 85% of its land from future drilling.Now, though, there’s another threat lurking at Lynch’s door: a plastics manufacturing plant that Shell Oil is constructing just an hour away, on the banks of the Ohio River.Shell’s ethane-cracker plant, which it began building in 2017, is set to open later this year, but the company has not yet announced a firm date and did not respond to a request for comment. The first facility of its kind in Appalachia, it will use extreme heat to “crack” ethane, a byproduct of fracked gas, into ethylene, a building block for manufacturing plastic.The facility will produce more than 1 million tons of plastic pellets per year, which will be used to make products ranging from phone cases to auto parts. As it does, the facility will spew hundreds of tons of dangerous compounds into the air while also emitting planet-heating pollution. And it will be fed by the fracked gas from thousands of wells peppered across Appalachian communities—communities like Lynch’s.

Amid Hopes and Fears, a Plastics Boom in Appalachia Is On Hold - Yale E360 - Retired and newly married, Karen Gdula was asleep when, just before 5 a.m., an explosion shook her rural western Pennsylvania home. The roar was so loud that some of her neighbors thought it was a plane crash. But when she and her husband saw a fireball stretching above the tops of the towering pine trees across the street, they knew exactly what had happened. The Revolution Pipeline, running right behind Ivy Lane in Center Township, about 25 miles northwest of Pittsburgh, had come into service only days before, carrying gas from the fracking wells that are everywhere in the region. No one was hurt, but the explosion flattened a home three doors down from Gdula’s and toppled six giant electrical transmission towers. Now, Revolution is back in service, and another pipeline has come to Ivy Lane, too. It’s called Line N, and it feeds gas to the vast, $6 billion petrochemical plant Shell is building five miles away in Monaca, right on the Ohio River. That plant, called an “ethane cracker,” will soon turn ethane — a byproduct of fracking — into 1.6 million tons of raw plastic a year.Five years ago, the flood of ethane coming from the Ohio River Valley’s fracking wells got the plastic industry — petrochemical firms that are often subsidiaries of big fossil fuel producers — dreaming about a new generation of massive plants in the region. Companies envisioned building as many as four more ethane crackers like Shell’s in Appalachia, and state and local officials from both parties embraced the idea.That vision is now foundering. Obstacles including global overproduction of plastic, local opposition to pipelines that feed such facilities, and public concern about the tidal wave of waste choking oceans and landscapes mean that even the region’s second proposed ethane cracker may never materialize. Additional plants look even less likely. The question mark over the industry’s once-grand hopes for Appalachia reflects larger doubts about its plans for dramatically Driving oil and gas companies’ plastic production ambitions is the understanding that action on climate change may soon reduce demand for their fuels. Plastic is central to their hopes of keeping profits flowing, so they’ve been pouring money into building new plants and expanding old ones, on track to double 2016 global plastic production levels by 2036. Fracking has made the United States a major player in this international buildout. The American Chemistry Council, an industry association, says companies are investing more than $200 billion in U.S. chemical projects using fracked ingredients. Most of that growth has happened on the Gulf Coast, the country’s long-standing petrochemical hub.

Gas company to explore State Game Lands in Tioga County — The Pennsylvania Board of Game Commissioners recently approved an agreement that will allow a Texas-based energy company to develop oil and gas interests on State Game Lands in Tioga County.The agreement between the Game Commission and Seneca Resources Company will result in a $730,500 bonus payment, and royalties paid to the commission over the 10-year term of the agreement. That money will be added to the Game Fund, the commission says.Seneca Resources will explore about 409 acres of State Game Lands 313 in Delmar and Chatham townships, according to the agreement.The main tract is located in Delmar Township, less than three miles northwest of Wellsboro. The second tract is just north of Little Marsh. The third tract lies between US 6 and and Marsh Creek.Although the gamelands is in a mostly rural setting, it's right next to a railroad that supplies the local natural gas industry, according to the Game Commission.Seneca Resources, which has an eastern division based in Pittsburgh, operates approximately 900 deep, unconventional Marcellus and Uitca shale wells in Pennsylvania

Public health in Pennsylvania ignored during fracking rush: Report - In a rush to reap the economic benefits of fracking, the Pennsylvania Department of Health (DOH), the state General Assembly and three governors ignored or gave underwhelming responses to public health concerns, according to a new white paperfrom the nonprofit Environmental Health Project.“[I]t is clear that, to date, many members of the General Assembly, the Governor’s Office, and the DOH have failed to make a good faith effort to understand and address the health risks and resulting health impacts of shale gas development,” the paper, entitled "Pennsylvania's Shale Gas Boom: How Policy Decisions Failed to Protect Public Health and What We Can Do to Correct It," states.Environmental Health Project, a health organization focused on how shale gas drilling and its byproducts impact communities, collected health data from Pennsylvania residents living near shale wells, which now number more than 13,000 in permits, to make up for what it describes as inaction by the state.“Since we have been doing this for 10 years, it seemed like time to reflect on the comprehensive narrative on how we got to where we are today,” said EHP Executive Director Alison L. Steele.Research has linked increased risk of infant mortality, low birth rates, depression, and hospitalizations for skin and urinary issues to live near fracking wells. The findings come a year after Environmental Health News’ “Fractured” investigation, which found that Western Pennsylvania families near fracking are exposed to harmful chemicals, and regulations fail to protect communities' mental, physical, and social health. The report traces much of the systematic neglect to Act 13, passed in 2012 under Republican Gov. Tom Corbett. The law established some fundamentals for shale drilling in Pennsylvania. It enabled the state to preempt some local environmental laws and zoning authority in order to establish uniform statewide standards for shale gas well development. Act 13 also created the “impact fee,” an annual per-well fee paid by the operator. Pennsylvania is the only state to tax drill operators in this way; the 33 other oil producing states tax profits. While the fees generated about $150 million to $200 million a year, the report states that, “It has been estimated that a severance tax, either instead of or in addition to an impact fee, would have provided the state with billions of dollars in revenue over the first decade of the shale boom.”

Dr. Oz's First-Class Flip-Flop On Fracking - Mehmet Oz, the celebrity TV surgeon better known as Dr. Oz, used to write and tweet about the health benefits ofcoconut oil,lavender oil,CBD oil,MCT oil, avocado and olive oil.He also appeared to be a strong opponent of fracking, warning his readersinmultiplearticles about the potential health risks associated with one of the more controversial fossil fuel extracting technologies.Hydraulic fracturing, better known as “fracking,” involves pumping a pressurized mixture of water, sand and chemicals into underground rock formations to release oil and natural gas.In 2014, an Ohio man asked Oz and Dr. Mike Roizen, then the chief medical officer at the Cleveland Clinic Wellness Institute, whether it was true that fracking is polluting air and groundwater and threatening public health.Oz and Roizen replied that it was “a fact” that the process pumps “toxic chemicals” deep into the ground.“We wonder how eager the leaders of the natural gas industry would be to drink well water from a farm next to one of their drilling sites,” Oz and Roizen wrote in ahealth and wellnessQ&A, adding that in Pennsylvania, “there are multiple reports of air and water contamination, possibly from hydraulic fracturing sites, causing folks breathing problems, rashes, headaches, nosebleeds, numbness, nausea and vomiting.”But now that Oz is a GOP Senate candidate in Pennsylvania, he is apparently less concerned about fracking’s possible health effects on his potential constituents and more interested in preserving an industry active in the state.“Back off Biden! Give us freedom to frack!” Oz said Wednesday in a rambling TikTokvideo while pumping gas somewhere in the Keystone State.

The climate war we cannot afford to lose - Martins Ferry Times Leader - Dear Editor, Dr. Svitlana Krakovska, a Ukrainian climate scientist and member of the International Panel on Climate Change recently said, “Human induced climate change and the war on Ukraine have the same roots, fossil fuels, and our dependence on them,” Europe’s dependence on fossil fuels from Russia is “funding the war” in Ukraine. Russia, the second largest producer of natural gas, has been accused of using the resource in a geopolitical way against European countries dependent on its gas. Europe views the worsening situation in Ukraine as justification to double up its investments in renewable energy and cut Europe’s demand for natural gas. The IEA and EU leaders want to fast-track permitting for wind and solar projects, revisit decisions to phase out nuclear energy, and double the rate of conversions from natural gas boilers to electric heat pumps in buildings.”However, oil and gas companies in the U.S., along with many politicians including Joe Manchin of West Virginia and Bill Johnson of CD 6 Ohio, are using the war to rationalize more drilling and fracking in the U.S., basically, ignoring the real war at our doorstep; the war for a livable planet. Natural Resource Chair Raul Grijalva (D-Arizona) said in a recent op-ed, “Doubling down on fossil fuels is a false solution that only perpetuates the problems that got us here in the first place.”The newly released UN Climate Report clearly shows we are losing the battle against climate change. UN Secretary General Antonio Gutteras said “the evidence detailed by the Intergovernmental Panel on Climate Change is unlike anything he has ever seen, an “atlas of human suffering and a damning indictment of failed climate leadership.”Make no mistake, we all are witnessing a war; a war waged on our planet by the fossil fuel industry and those who benefit financially from these industries. Like most wars, money is needed to fund this endeavor. Federal taxpayer-funded grants, subsidies, and tax incentives help fuel the climate crisis by providing financial incentives for continued extraction. “Conservative estimates put U.S. direct subsidies to the fossil fuel industry at roughly $20 billion per year, with 20 percent currently allocated to coal and 80 percent to natural gas and crude oil.”Just like a conventional war, propaganda and lies are used to mold public opinion.“The fossil fuel industry has perpetrated a multi-decade, multibillion dollar disinformation propaganda and lobbying campaign to delay climate action by confusing the public and policymakers about the climate crisis and its solutions.”It is difficult to win a war when the cards are stacked against you, but the war for a livable planet is one we cannot afford to lose. It is time to demand renewable energy and stop subsidizing the companies responsible for the destruction of our planet. As Dr. Svitlana Krakovska of Ukraine said, “We will not surrender in Ukraine, and we hope the world will not surrender in building a climate-resilient future.” --Randi Jeannine Pokladnik

New York shows the challenges of phasing out fossil fuels, even in blue states - In December, when the New York City Council voted to ban natural gas use in new buildings, environmentalists in the Big Apple barely stopped to celebrate. Instead, they set their sights on a bigger target: making New York the first state in the country to phase out gas use in new buildings, a significant source of air pollution and planet-warming emissions. But the environmentalists suffered a setback last week, when the New York State Legislature omitted a building electrification measure from the state budget, delivering a victory to industry groups that argued the bill would raise utility bills. While climate activists pledged to keep pushing for the measure, the ongoing battle underscores the challenges that advocates face in seeking to curb fossil fuel use, even in blue states like New York that have set aggressive climate goals. The stakes are high. In 2019, lawmakers approved a landmark bill committing the state to cut its greenhouse gas emissions 40 percent by 2030 and at least 85 percent by 2050. Energy used for heating, cooling and lighting in buildings accounts for about 60 percent of emissions in New York. Dan Zarrilli, the former chief climate policy adviser to former New York City Mayor Bill de Blasio (D), said that New York risks missing its climate targets if new buildings are allowed to use gas appliances such as furnaces and stoves, rather than electric appliances such as heat pumps and induction cooktops. “We can’t keep installing new fossil fuel infrastructure if we hope to meet our goals,” Zarrilli told The Climate 202. “You know, when you’re in a hole, you’ve got to stop digging.” Karen Harbert, president and chief executive of the American Gas Association, a trade group, disagreed. “It would be a mistake to prevent homes and businesses in New York from signing up for natural gas service,” Harbert said in a statement. “I doubt New Yorkers will be happy about their policymakers raising their bills on a whim that will not achieve their environmental goals and forecloses on future emissions reduction opportunities.” New York Gov. Kathy Hochul (D) included a ban on gas use in new construction by 2027 in her executive budget for the next fiscal year. But the measure was absent from the final budget deal announced last week. Alex Beauchamp, Northeast region director for Food & Water Watch, said he thinks that Hochul bears some responsibility for the outcome in addition to State Assembly Speaker Carl Heastie. “Governor Hochul probably shares a part of the blame,” Beauchamp said. “This is clearly a governor who, if she had pushed, could have gotten this done and for whatever reason didn't feel the need to push on it.”

FERC approves MVP waterbody crossings - The Federal Energy Regulatory Commission has approved changes to the way waterbodies will be crossed in certain routes of the Mountain Valley Pipeline.FERC issued an order late Friday that approved, with conditions, MVP's request to use underground trenchless boring methods to cross 183 waterbodies and wetlands at 120 locations instead of an open-cut dry crossings approach to pipeline construction.However, MVP is asking the U.S. Army Corps of Engineers for approval to use open-cut methods to cross five waterbodies, according to the FERC filing. The Army Corps will decide on those requests separately.The FERC order also avoids a wetland and waterbody and allows MVP, when construction resumes, to work 24 hours a day at eight crossings using the trenchless method.The approval was needed because MVP, a 303-mile pipeline through West Virginia and Virginia to carry Marcellus and Utica shale natural gas, was no longer able to use a previous Army Corps of Engineers Nationwide Permit 12 approval that called for open-cut waterbody crossings. That Nationwide Permit 12 had been spiked by the U.S. Circuit Court of Appeals in November 2020, which required MVP to change the method.MVP is being built and will be operated and partially owned by Canonsburg-based Equitrans Midstream Corp. (NYSE: ETRN)."This is another important step forward in MVP's project completion and, as a critical infrastructure project, is essential for our nation's energy security, reliability, and ability to transition to a lower-carbon future," said MVP spokeswoman Natalie Cox.The approval doesn't immediately mean MVP can resume construction. It has, in the past three months, lost two key approvals — also from U.S. Circuit Court of Appeals decisions — and it will need to regain them and a U.S. Army Corp of Engineers go-ahead before construction can begin.A condition on FERC's approval "prohibits Mountain Valley from commencing construction activities associated with the Amendment Project until it receives authorization from the Corps to complete its proposed open-cut crossings."It's not clear how the approval will move the project forward immediately. While the pipeline had been, as late as early January, been expected to be completed by the end of the summer, Equitrans this year announced that it wouldn't happen due to the circuit court rulings. And it has yet to announce a new timeline. "This approval does not allow for new construction on the delayed pipeline, and key outstanding permits from the Forest Service, the FWS (Fish and Wildlife Service), and the Army Corps of Engineers must still be replenished," said Rob Rains, an analyst with Washington Analysis. "After this FERC approval, we maintain that the pipeline will most likely get competed, but we still also believe that there is no quick path forward, and that the project must thread the needle of receiving all its permits and dealing with litigation at the Fourth Circuit Court of Appeals."

After losing several permits, Mountain Valley Pipeline wins one for stream boring - After running into a series of roadblocks this year, Mountain Valley Pipeline has won approval to bore under about 180 streams and wetlands it must cross to complete the natural gas pipeline. In a unanimous order Friday afternoon, the Federal Energy Regulatory Commission authorized what is essentially one piece of the construction that remains unfinished due to adverse court rulings. FERC amended its 2017 certificate – perhaps the most important approval among more than a dozen federal and state permits – to allow Mountain Valley to tunnel below some water bodies, rather than digging a trench along their bottoms to bury a 42-inch diameter pipe using what’s called an open-cut process. Mountain Valley still lacks authorizations from other agencies to ford the remaining streams and wetlands by open cut, and to pass through the Jefferson National Forest. Also unresolved is the project’s impact on endangered species. The pipeline, which cuts through Southwest Virginia, nonetheless applauded FERC’s order. In its 72-page order Friday, FERC found that boring under water bodies would cause less environmental damage than the open-cut method. The commission had initially approved the method in 2017 for nearly 1,000 crossings, but those plans ran into legal challenges from environmental groups. “Today’s order amending Mountain Valley’s certificate will almost certainly represent an improvement over the status quo,” FERC Chairman Richard Glick and member Allison Clements wrote in a concurring opinion. Glick and Clements have previously voiced concerns about FERC “putting the cart before the horse” by approving work on the pipeline before the developer had obtained all of its required permits from other agencies. “Those concerns may be heightened when, as here, the permits and authorizations needed to develop the project have been vacated – several times – by the courts,” the opinion stated. But this case is different, Glick and Clements concluded, for three reasons. First, the amendment will actually reduce environmental damage. Second, no additional land would have to be taken by eminent domain for the “almost entirely constructed” pipeline. And thirdly, they wrote, the 4th U.S. Circuit Court of Appeals struck down a permit for the pipeline to pass through the national forest, in part, because the U.S. Forest Service and the Bureau of Land Management did not first consider FERC’s environmental analysis of boring under streams.