US oil prices rose for the first week in four as US inflation figures came in lower than expected, stoking hopes for an interest rate cut, while major institutional forecasts indicated higher demand and higher oil prices for this summer…after falling 1.9% to $75.53 a barrel last week after OPEC reaffirmed their baseline production cuts through 2025 but decided to let their voluntary cuts lapse later this year, the contract price for the benchmark US light sweet crude for July delivery moved higher in early trading on Monday, after analysts from Goldman Sachs forecast that global oil prices would rise to $86 as transportation demand would push the oil market into a deficit this summer, and settled $2.21 higher at $77.74 a barrel despite a stronger U.S. dollar and expectations that the Fed would leave interest rates higher for longer…oil prices traded slightly lower early Tuesday, as traders awaited reports from OPEC, the International Energy Agency, and the US Fed, but managed to settle 16 cents higher at $77.90 a barrel after OPEC stuck to its robust oil demand forecasts for 2024 and 2025, seeing steady global economic growth ahead…oil prices then rose in after hours trading after the American Petroleum Institute reported a larger than expected drop in U.S. crude inventories last week, then extended those gains in early trading Wednesday as cooler-than-expected consumer prices for May pushed oil prices to a session high of $79.32, but then turned lower after the EIA reported large unexpected increases in crude and gasoline inventories, leaving oil with a 60 cent increase to $78.50 a barrel increase for the session….oil prices moved lower in overseas trading early Thursday, after US data had showed an unexpected build in U.S. crude stockpiles, and the IEA's forecast of a surplus petroleum production of up to eight million barrels per day by 2030 weighed on prices, but reversed to settle 12 cents higher at $78.62 a barrel, supported by an OPEC forecast for demand growth and data showing an easing U.S. labor market and slowing inflation, which stoked hopes for Fed rate cuts, despite recent comments from Fed officials to the contrary…oil prices declined on global markets on Friday, as falling equity markets in Europe and Asia added to growing concerns over global demand for crude, then settled the New York trading session 17 cents lower at $78.45 a barrel, amid uncertainty about the outlook for demand after the jump in crude inventories in the U.S., a drop in U.S. consumer sentiment in the month of June, and a firmer dollar, but still ended with a 3.9% gain for the week…

meanwhile, natural gas prices finished lower for the third time in four weeks, despite hitting a five month high on Tuesday, as the startup of the long delayed Mountain Valley Pipeline was expected to add to the country’s domestic gas glut….after rising 12.8% to a 21 week high of $2.918 per mmBTU last week as forecasts for late June unexpectedly turned hotter, the price of natural gas contracted for July delivery shot up above $3 in early trading Monday on forecasts for record warmth for the second half of June, before falling back to settle 1.2 cents lower at $2.906 per mmBTU on concerns that gas supplies will soon rise with the giant Mountain Valley Pipeline nearing completion….however, natural gas prices surged overnight as the market refocused on the extreme hot weather slated to spread across the country and settled Tuesday’s session 22.3 cents or nearly 8% higher at a 21-week high of $3.129 per mmBTU on a recent drop in output and on forecasts that hotter weather would boost the amount of gas power generators would burn to keep air conditioners humming….however, natural gas futures pulled back early Wednesday as traders weighed the start-up of the long-delayed Mountain Valley Pipeline against record heat forecasts, and settled 8.4 cents lower at $3.045 per mmBTU on expectations that gas supplies would soon rise with the approved startup of the Mountain Valley gas pipeline, and on plans by EQT, the nation's biggest gas producer, to boost their output….natural gas prices opened seven cents lower on Thursday, but then traded above $3 up until the storage report hit the wire, when they dropped to an intraday low of $2.898 as the weekly report included a bearish revision to the prior five weeks, but partly recovered to settle 8.6 cents, or 2.8% lower at $2.959 per mmBTU, on lowered demand forecasts for the next two weeks, expectations that supplies would rise once the MVP enters service, and news that recent increases in prices and demand had prompted EQT to start boosting output….natural gas prices slid again in early trading Friday, as traders appeared to be focused on the bearish revisions in the latest storage data and revised weather forecasts, including a cooler change in the second half of June, leading the July contract to fall 7.8 cents to $2.881 per mmBTU on forecasts for less demand this week and next than previously expected, and on signs the amount of gas flowing to LNG export plants was down a bit, and thus finish 1.3% lower for the week...

The EIA’s natural gas storage report for the week ending June 7th indicated that the amount of working natural gas held in underground storage rose by 74 billion cubic feet to 2,974 billion cubic feet by the end of the week, after gas inventories in the Midwest were revised higher by 6 bcf to 9 bcf over the five-week period from May 3 to May 31, 2024, which left our natural gas supplies 364 billion cubic feet, or 13.9% above the 2,610 billion cubic feet that were in storage on June 7th of last year, and 573 billion cubic feet, or 23.9% more than the five-year average of 2,401 billion cubic feet of natural gas that had typically been in working storage as of the 7th of June over the most recent five years…the 74 billion cubic foot addition to US natural gas working storage for the cited week was in line with the average 74 billion cubic foot addition to storage that was forecast in a Reuters poll of analysts, but was less than the 90 billion cubic feet that were added to natural gas storage during the corresponding first week of June 2023, and also less than the average 89 billion cubic foot injection into natural gas storage that has been typical for the same late spring week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending June 7th indicated that after a big jump in our oil imports and a big decrease in our oil exports, we had surplus oil to add to our stored commercial crude supplies for the fourteenth time in twenty weeks and for the 22nd time in the past 34 weeks, despite a big increase in oil demand that the EIA could not account for….Our imports of crude oil rose by an average of 1,245,000 barrels per day to a 70 month high of 8,304,000 barrels per day, after rising by an average of 289,000 barrels per day over the prior week, while our exports of crude oil fell by 1,313,000 barrels per day to 3,188,000 barrels per day, which when used to offset our imports, meant that the net of our trade of oil worked out to a net import average of 5,116,000 barrels of oil per day during the week ending June 7th, 2,558,000 more barrels per day than the net of our imports minus our exports during the prior week. At the same time, transfers to our oil supply from Alaskan gas liquids, from natural gasoline, from condensate, and from unfinished oils averaged 463,000 barrels per day, while during the same week, production of crude from US wells was 100,000 barrels per day higher at 13,200,000 barrels per day. Hence our daily supply of oil from the net of our international trade in oil, from transfers, and from domestic well production appears to have averaged a rounded total of 18,779,000 barrels per day during the June 7th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 17,047,000 barrels of crude per day during the week ending June 7th, an average of 98,000 fewer barrels per day than the amount of oil that our refineries reported they were processing during the prior week, while over the same period the EIA’s surveys indicated that a net average of 581,000 barrels of oil per day were being added to the supplies of oil stored in the US… So, based on that reported & estimated data, the crude oil figures provided by the EIA for the week ending June 7th appear to indicate that our total working supply of oil from net imports, from transfers, and from oilfield production was 1,151,000 barrels per day more than what was added to storage plus what our oil refineries reported they used during the week……To account for that difference between the apparent supply of oil and the apparent disposition of it, the EIA just plugged a [ -1,151,000 ] barrel per day figure onto line 16 of the weekly U.S. Petroleum Balance Sheet, in order to make the reported data for the supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus indicating there must have been an error or omission of that magnitude in the week’s oil supply & demand figures that we have just transcribed...Moreover, since 1,326.000 barrels of oil supply per day could not be accounted for in the prior week’s EIA data, that means there was a 2,477,000 barrel per day difference between this week's oil balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the changes to supply and demand from that week to this one that are indicated by this week's report are off by that much, rendering the week over week changes we have just cited nonsense.... However, since most oil traders react to these weekly EIA reports as if they were accurate, and since these weekly figures therefore often drive oil pricing (as is obvious to anyone who watches oil prices), and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably reliable by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer….there is also an aging twitter thread from an EIA administrator addressing these ongoing weekly errors, and what they had hoped to do about it)

This week’s average 581,000 barrel per day increase in our overall crude oil inventories came as a rounded average of 533,000 barrels per day were added to our commercially available stocks of crude oil, while an average of 48,000 barrels per day were being added to our Strategic Petroleum Reserve, the twenty-seventh SPR increase in thirty-four weeks, following nearly continuous withdrawals from the SPR over the prior 39 months… Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to 7,199,000 barrels per day last week, which was 11.4% more than the 6,462,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be 100,000 barrels per day higher at 13,200,000 barrels per day because the EIA’s rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day lower at 12,800,000 barrels per day, while Alaska’s oil production was 1,000 barrels per day higher at 425,000 barrels per day, but still added the same 400,000 barrels per day to the EIA’s rounded national total as it did last week…US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 0.8% higher than that of our pre-pandemic production peak, and it's also 36.1% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 95.0% of their capacity while processing those 17,047,000 barrels of crude per day during the week ending June 7th, down from their 95.4% utilization rate of a week earlier, but still among the highest operating rates of the past year, after US refineries had lagged normal operating rates for months after arctic cold in mid January had froze off some operations… the 17,047,000 barrels of oil per day that were refined this week were 2.8% more than the 16,586,000 barrels of crude that were being processed daily during week ending June 9th of 2023, but fractionally less than the 17,064,000 barrels that were being refined during the prepandemic week ending June 7th, 2019, when our refinery utilization rate was at a close to normal 93.2% for early June...

Even with the decrease in the amount of oil being refined this week, gasoline output from our refineries was quite a bit higher, increasing by 602,000 barrels per day to 10,086,000 barrels per day during the week ending June 7th, after our refineries’ gasoline output had decreased by 527,000 barrels per day during the prior week.. This week’s gasoline production was still 0.8% less than the 10,171,000 barrels of gasoline that were being produced daily over week ending June 9th of last year, and 1.8% less than the gasoline production of 10,276,000 barrels per day during the prepandemic week ending June 7th, 2019….at the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 29,000 barrels per day to 5,032,000 barrels per day, after our distillates output had increased by 31,000 barrels per day during the prior week. After eleven production increases in the past sixteen weeks, our distillates output was 0.9% more than the 4,988,000 barrels of distillates that were being produced daily during the week ending June 9th of 2023, but was 4.0% less than the 5,239,000 barrels of distillates that were being produced daily during the week ending June 7th, 2019…

With this week’s increase in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the seventh time in nineteen weeks, increasing by 2,566,000 barrels to 233,512,000 barrels during the week ending June 7th, after our gasoline inventories had increased by 2,102,000 barrels during the prior week. Our gasoline supplies rose again this week because our imports of gasoline rose by 213,000 barrels per day to 912,000 barrels per day, while our exports of gasoline fell by 33,000 barrels per day to 858,000 barrels per day, and while the amount of gasoline supplied to US users fell by 94,000 barrels per day to 9,040,000 barrels per day .…But even after twelve gasoline inventory withdrawals over the past nineteen weeks, our gasoline supplies were still 5.7% above last June 9th’s gasoline inventories of 220,923,000 barrels, while slightly below the five year average of our gasoline supplies for this time of the year…

Even with this week’s decrease in our distillates production, our supplies of distillate fuels rose for the ninth time in twenty-one weeks, increasing by 881,000 barrels to 123,366,000 barrels over the week ending June 7th, after our distillates supplies had increased by 3.197,000 barrels during the prior week. Our distillates supplies increased by less this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, rose by 282,000 barrels per day to 3,649,000 barrels per day, and because our imports of distillates fell by 51,000 barrels per day to 91,000 barrels per day, while our exports of distillates fell by 32,000 barrels per day to 1,348,000 barrels per day .…With 5 inventory increases over the past six weeks, our distillates supplies at the end of the week were 8.4% above the 113,854,000 barrels of distillates that we had in storage on June 9th of 2023, but were still about 7% below the five year average of our distillates inventories for this time of the year…

Finally, even after the big increase in demand for oil that the EIA could not account for, our commercial supplies of crude oil in storage rose for the 14th time in twenty-six weeks, and for the 26th time in the past year, increasing by 3,730,000 barrels over the week, from 455,922,000 barrels on May 31st to 459,652,000 barrels on June 7th, after our commercial crude supplies had increased by 1,233,000 barrels over the prior week… Even with this week’s increase, our commercial crude oil inventories were about 4% below the most recent five-year average of commercial oil supplies for this time of year, while they were still about 29% above the average of our available crude oil stocks as of the first weekend of June over the 5 years at the beginning of the past decade, with the big difference between those comparisons arising because it wasn’t until early 2015 that our oil inventories had first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, then jumped again after February 2021’s winter storm Uri froze off US Gulf Coast refining, but then fell due to higher exports relating to the onset of the Ukraine war, only to jump again following the Christmas 2022 refinery freeze offs, our commercial crude supplies as of this June 7th were 1.6% less than the 467,124,000 barrels of oil left in commercial storage on June 9th of 2023, while they were 9.8% more than the 418,714,000 barrels of oil that we had in storage on June 10th of 2022, but were still 1.5% less than the 466,674,000 barrels of oil we had left in commercial storage on June 11th of 2021, after refinery damage from winter storm Uri left even more crude oil remaining after 2020’s pandemic precautions had left a glut of oil unused at year end…

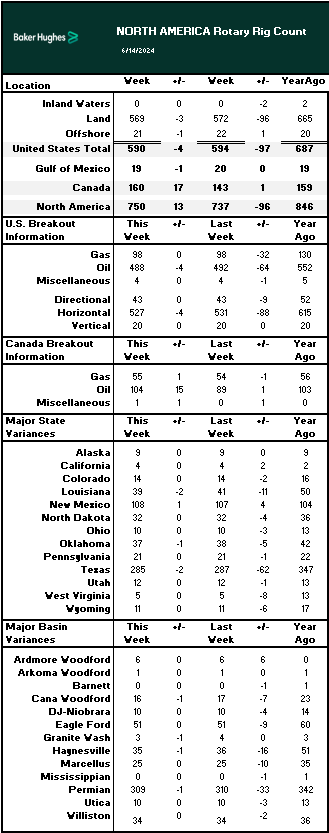

This Week’s Rig Count

In lieu of a detailed report on the rig count, we are again just including a screenshot of the rig count summary from Baker Hughes…in the table below, the first column shows the active rig count as of June 14th, the second column shows the change in the number of working rigs between last week’s count (June 7th) and this week’s (June 14th) count, the third column shows last Friday’s June 7th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting period a year ago, which in this week’s case was the 16th of June, 2023…

+++++++++++++++++++++++++++++++++++++++++++++++++

Tax cuts, interest-free loan program for gas pipelines clear Ohio House committee - – Bipartisan members of an Ohio House committee voted Tuesday to advance legislation that would provide interest-free loans and tax cuts for natural gas pipelines in areas deemed to have insufficient gas infrastructure in place. Should the bill become law, local governments could access $20 million of state funds in interest-free loans to buy easements on property intended for a new gas pipeline. And that pipeline’s developer could exempt up to 75% of its value from its property taxes, providing savings on the scale of millions of dollars.

Ohio committee passes bill to build natural gas pipelines - (WKBN) — The Ohio House Economic and Workforce Development Committee passed a bill to build natural gas pipelines. House Bill 349, also known as EnergizeOhio, creates several incentives to build natural gas pipelines and related infrastructure within locally designated zones. If passed, the loans from the legislation would allow communities to acquire resources within a zone. “Despite the blessings of an abundant supply of natural gas within our great state, communities everywhere are plagued by a lack of access to this resource,” said Rep. Tim Barhorst (R-Fort Loramie). “House Bill 349 will help lower long-term costs for companies wanting to invest in natural gas infrastructure and ensure our communities have a shot for economic development opportunities.” The Department of Development is working on a map of areas that will receive the loans. “The United States is currently the number 1 purchaser of natural gas, but the two largest natural gas companies are owned by Russia and China,” said Rep. Don Jones (R-Freeport). “In addition to providing the necessary infrastructure to aid parts of the state without natural gas, House Bill 349 creates necessary infrastructure to keep Ohio’s natural gas in Ohio and not reliant on natural gas from foreign countries.” A total of $20 million will be appropriated to the EnergizeOhio Program Loan Fund for 2025. The bill awaits a vote by the House.

Martins Ferry Sees No Evidence of Cleanup at Austin Master Serv. - Marcellus Drilling News - We have been tracking and reporting on the drama surrounding Austin Master Services (AMS), a radiological waste management solutions company in Martins Ferry (Belmont County), Ohio, located close to the Ohio River, since the Ohio Attorney General lodged charges against the company back in March (see our AMS stories here). AMS has stored at least 10,000 tons of fracking waste (drill cuttings with low radioactivity) at the facility. The facility is rated and permitted to hold 600 tons. In March, Ohio AG Dave Yost asked the Belmont County Common Pleas Court to block AMS from receiving more waste and order it to clean up and comply with its rating. According to Martins Ferry Mayor John Davies, who addressed the city council last Wednesday, nothing has been done so far.

Majority foreign-owned oil, natural gas producer to frack Ohio state parks - Encino Acquisition Partners, LLC has invested $300 million into extracting oil and natural gas from Ohio state parks and other public lands. EAP received mineral rights for four sites in Ohio State Parks, according to an Ohio Department of Natural Resources news release. This includes three sites in Valley Run Wildlife Area in Carroll County and one site in Zepernick Wildlife Area in Columbiana County. Encino Energy, based out of Houston, Texas, along with the Canada Pension Plan Investment Board, created EAP as a subsidiary in 2017, according to a CPP news release. The CPP holds 98% equity of the company. The CPP is a public pension distributed by the government to over 22 million Canadians, according to its website. The plan has an independent board tasked with managing funds for policyholders. “If someone (is) working in Toronto and they're paying into this pension plan – well, they're financing fracking in Ohio,” Save Ohio Parks Steering Committee Chair Cathy Cowan Becker said. Along with the rights to Ohio state parks, EAP also bought 900,000 acres of oil and gas assets from Chesapeake Energy, which used to be one of the largest natural gas producers in Ohio, in the Ohio Utica Shale region for $2 million in 2018, according to a CPP news release. According to a report from the U.S. Energy Information Administration, the Utica Shale is an expansive oil and natural gas field that covers 115,000 square miles and spans four states from northern New York to northeastern Kentucky and southern Tennessee. Daniel Karney, an economics professor at Ohio University, said EAP is trying to get a return on its investments to grow its capital. ”They think a good way to do that is to invest in generating, purchasing and then producing oil and natural gas,” Karney said. The U.S. remains the world's top destination for foreign direct investment for the 12th consecutive year, according to the U.S Department of Commerce. This is partially due to strong consumer and government expenditure and robust export levels. Karney said individual states can use parks as assets and sell them to make profits. “It's going to be, at this point, something like 18% to the state of Ohio, but that only lasts for as long as the fracking lasts, and you can only frack one place so many times before there's no more gas left,” Becker said. According to an ODNR news release, however, Ohio is only set to receive 12.5% of royalties from EAP. The operation comes after an Ohio judge dismissed a lawsuit from Save Ohio Parks allowing companies to lease public land, according to a previous Post report. The decision opens over 1,000 parcels of land to oil and natural gas companies. Melinda Zemper, Save Ohio Parks steering committee chair, said communities near fracking operations experience negative economic effects. “The eight main counties in Ohio that have been fracked for decades came to the conclusion that they lost population by about 8% and the number of jobs that they had for the community was also down,” Zemper said. She also said farmers can lease mineral rights to their land and make a lot of money. “It's the most money they've ever seen in their lives and are able to take vacations or buy cars or pass their farms on to the next generation,” Zemper said. Becker added fracking poisons the land, so farmers can’t grow or have animals on it.

Chesapeake Transfers Ohio Leases to Hilcorp --Chesapeake Energy Corp. has transferred nearly 1,100 oil and natural gas leases in and around an underground natural gas storage field in Ohio, to privately held Hilcorp Energy Co.According to a report in the Youngstown Business Journal, Columbiana County records show that Chesapeake assigned most of the 1,097 oil and gas leases to the Houston-based operator effective Feb. 15. It was unclear if the deal between the companies, which was negotiated on Jan. 23, amounted to a bona fide sale, a property swap or a farm-in agreement.The transferred leases were for properties in the six northeasternmost townships in Columbiana: Center, Elkrun, Fairfield, Middleton, Salem and Unity, the Journal noted. It also reported that nine drilled wells were also excluded from the deal. Alan Wenger, an attorney with Youngstown, OH-based law firm Harrington, Hoppe & Mitchell, told NGI the leases were in or near the Brinker Storage Field, a 30,000-acre natural gas reserve in northern and central Columbiana County. The field, which was assembled over several decades, is owned by Columbia Gas Transmission."Columbia has all kinds of leases of various vintages that say all kinds of things," Wenger said. "Some of them are storage leases and others are more conventional, production leases. As this play developed, largely after 2009, a lot of the landowners involved in this area knew their properties had leases on them but had no clue as to what they meant. Many of them had never received a royalty check or anything for years because these were ancient leases on properties that got subdivided into lots and the royalties never followed."That's when Chesapeake came to town, Wenger said. "Chesapeake was running around like a chicken [without a head], leasing anything that they could lease in this area. I don't know that [it], frankly, did a very exhaustive title run before signing a lot of these up. They wound up with a lot of leases that ostensibly were for these parcels, but many of them were already arguably held by production, at least by the storage leases that were held by Columbia."Last September, Columbia, a NiSource Inc. subsidiary, formed a joint venture (JV) with Hilcorp to develop the deep rights to the Brinker Storage Field. Four months earlier, NiSource officials said "advanced discussions" about a JV in the Brinker were ongoing, but they did not identify Hilcorp as its negotiating partner (see NGI, May 7, 2012). "I believe Chesapeake was trying to negotiate such a deal with Columbia but wasn't successful in doing so for whatever reason," Wenger said. Many of the leases would have been hard to develop units without joint venturing with others who already held some rights.Wenger said some of the leases held by Columbia were strictly for one specific geological stratum for gas storage and nothing else, which meant landowners were free to sell the deep rights. But he said most of the older leases covered all geological formations. Wenger added that he did not know the collective value of the deep rights leases, if Hilcorp purchased them outright from Chesapeake or if they were transferred between the two companies for holdings elsewhere. More troubling, he said, was that it did not appear that Chesapeake had filed any information about the leases with the U.S. Securities and Exchange Commission (SEC). "I'm not an SEC or a regulatory lawyer, but frankly I don't understand why this would not be reported by Chesapeake," Wenger said, adding that he has searched for records of the assignment in his spare time. "They report assiduously anything that they sell or buy. Maybe they're holding it because they would argue that it's not final yet. But if it were a trade, it should be reported for SEC purposes." Responding to Wenger's comments, Gipson on Friday said Chesapeake "takes the necessary steps to make all required SEC filings."

Newfound Ohio Utica Shale Oil Play Yielding Results -Recent data from the Ohio Department of Natural Resources (ODNR) confirms an emerging Ohio oil play with untapped potential. Traditionally thought of as a natural gas play, new technologies have unlocked oil production in the Utica Shale that continues to grow: 70 percent since 2021 with 40 percent annual growth from 2022 to 2023. The first quarter (Q1) production results from ODNR indicate the state produced 7,227,503 Bbls of oil, continuing its upward trend. If these numbers continue, 2024 will be a record oil year for the state. News of this untapped market continues to raise eyebrows. The Youngstown Business Journal reported on Q1 results, saying: “Columbiana County’s section of the Utica – traditionally known for its high volumes of natural gas and wet gas – has for the past year delivered skyrocketing oil production that is out of character for the northern tier of the play.” (emphasis added)Similarly, Hart Energy reported on EOG Resources investing in the combo play, with EOG chairman and CEO Ezra Yacob recently declaring:“It’s funny, right? When you take the blinders off and you come with a different perspective from different basins, it’s amazing the things that you can uncover….”EOG executives told investors in May that the Utica oil play can “compete with the best plays in America.”Rob Brundrett, the president of the Ohio Oil & Gas Association, also emphasized Ohio’s “holy trinity of hydrocarbons” when speaking at the Hart Energy DUG Appalachia conference:“We’ve got oil, natural gas, natural gas liquids and crude oil. So we have them all right here in the Utica and the state of Ohio.”Ohio’s oil production is centered in a five-county area that’s responsible for 95 percent of the state’s shale oil production, including Harrison, Columbiana, Guernsey, Carroll and Noble counties. Encino Energy had the top five producing oil wells this quarter, with Southwestern Energy, EOG Resources, and Ascent Resources filling out the remaining top ten producing wells. Hart Energy reports that Encino produced 51 percent of Ohio’s total production, followed by Ascent Energy and Infinity Natural Resources as the top producers.

All clear given after officials evacuated downtown Youngstown amid reported natural gas leak - — Officials from the Youngstown Fire Department have given an all clear to return downtown after a reported natural gas leak led to an evacuation on Friday afternoon. In a post on social media, the Youngstown Professional Fire Fighters Local 312 wrote: "Downtown is now reopened and all events scheduled for this evening are a full go."Earlier in the afternoon, fire officials sent out the following advisory: "Please AVOID downtown Youngstown and surrounding areas. Buildings are currently being evacuated for a natural gas leak."According to 21 News WFMJ in Youngstown, a two-block radius from the George Voinovich Government Center was issued a mandatory evacuation. The evacuations included Youngstown City Hall and the Youngstown Police Department. Youngstown State University also issued a "Penguin Alert" ordering the immediate evacuation of the campus. "Employees will be paid the remainder of the day, there is no need to turn in leave. Students should also leave campus, immediately For those living on campus, they should also vacate their living quarters," YSU wrote in a post on its Facebook page. 3News received the following statement from Enbridge Gas Ohio:"Enbridge Gas representatives are onsite in downtown Youngstown actively investigating a reported odor of natural gas."Public safety is the top priority, and the Fire Department has evacuated buildings in a two-block area around the Voinovich Building as a safety precaution."Our trained crews are walking the area and scoping for the presence of natural gas inside and outside buildings in this area."The report of a gas leak comes just over two weeks after a deadly blast inside the Realty Tower building in downtown Youngstown that resulted in the death of a Chase Bank employee.

Continued Concerns with Water Wells Near EQT Frac-Out in Greene Co. -- Marcellus Drilling News ---In July 2022, MDN brought you news of a possible frac-out, or “inadvertent return” that happens when drilling mud pops out of places where it’s not supposed to — places outside the borehole being drilled (see Possible Frac-Out Reported at EQT Well Site in Greene County, PA). A landowner who lives near a well being drilled and fracked by EQT in Greene County complained her water well was fouled by EQT’s drilling and that a nearby abandoned well was releasing fluids and natural gas. According to the PA Dept. of Environmental Protection (DEP), EQT confirmed some of its fluids were “communicating” with the abandoned well. A year later, in August of 2023, the nearby community of New Freeport, where the frac-out happened, said the situation remained unresolved (see Possible Frac-Out Near EQT Pad in Greene County…One Year Later). However, on November 29, 2023, the Pennsylvania Environmental Hearing Board (EHB) accepted a settlement agreement between the PA Dept. of Environmental Protection (DEP) and EQT involving appeals of DEP actions related to the frac-out, settling the matter. Or so it seemed…

Briggs v SWN Rule of Capture/Trespass Court Case Resurrected - In January 2020, the Pennsylvania Supreme Court ruled in THE most consequential lawsuit for Marcellus Shale drilling we’ve seen, a case called Briggs v Southwestern Energy (see HUGE NEWS: PA Supreme Court Keeps ‘Rule of Capture’ for Fracking). The PA Supremes ruled in favor of Southwestern, retaining the “rule of capture” in the Keystone State. Little did we know, but in 2022, the Briggs filed a new lawsuit, call it “Briggs 2,” along the same lines, alleging that Southwestern’s drilling and fracking on a neighboring property has intruded (“trespassed”) under the property line and drained gas from the Briggs property. Here we go again…

7 New Shale Well Permits Issued for PA-OH-WV Jun 3 – 9 ---Marcellus Drilling News --Two weeks ago, 31 new permits were issued to drill in the Marcellus/Utica region. Last week, June 3 – 9, the number dropped (dramatically) by 77% to just seven new permits. And that seems to be the pattern: Way up one week, way down the next. Last week, for the second week in a row, Ohio issued ZERO new shale permits. The top permit receiver for last week was HG Energy, which had five permits for a single pad in Doddridge County, WV. The other two permits were issued in PA: one to CNX in Greene County, and the other to Range Resources in Washington County. CNX RESOURCES | DODDRIDGE COUNTY | GREENE COUNTY (PA) | HG ENERGY | RANGE RESOURCES CORP |WASHINGTON COUNTY

EQT Bringing Back Curtailed Natural Gas Supply; CEO Rice Sees Future Where U.S. Production Triples --EQT Corp., the largest natural gas producer in North America, scaled back output earlier this year in response to low prices amid a mild winter. However, with forecasts for sizzling summer heat domestically and abroad, CEO Toby Rice said the Pittsburgh-based company has started to bring back the 1 Bcf/d curtailed in late February. “We are in the process now,” Rice told NGI Tuesday after presenting at the LDC Gas Forums Northeast in Boston. He described it as an incremental undertaking without a specific timeline. He said EQT could unfurl the retrenchment gradually, with the pace determined in part on prices. Depressed gas prices below $2/MMBtu in February galvanized producers to pull back after U.S. output touched all-time highs around 107 Bcf/d early this year. The lofty production intersected with benign weather and soft heating demand. EQT’s decision followed Chesapeake Energy Corp.’s 15% reduction announcement in February.

CNX Releases 'Radically Transparent' Corporate Sustainability Report - Today, CNX Resources Corp. published its thirteenth annual Corporate Sustainability Report, Radical Transparency, highlighting how the Company's distinct corporate strategy and investment approach continues to deliver material results for all stakeholder groups across the Appalachian region and beyond. "The 160-year legacy of CNX is rooted in being thoughtfully innovative, and that innovative spirit has shaped our unique Tangible, Impactful, Local ESG effort which is summarized in this report," commented CNX Chief Risk Officer Hayley Scott. "This document tells the story of our ongoing strategic journey—a journey that has clearly positioned CNX as a differentiated energy solutions company poised to once again lead an energy renaissance from right here in the heart of Appalachia." CNX's 2023 report outlines the Company's continued dedication to transparency, innovation, environmental stewardship, and community engagement, aligning closely with the standards set forth by prominent international frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the Global Reporting Initiative (GRI) Standards. Core to CNX's updated report is the Company's groundbreaking collaboration with the Commonwealth of Pennsylvania where, in partnership with Governor Josh Shapiro's Administration and the Pennsylvania Department of Environmental Protection (PADEP), the Company is deploying robust environmental monitoring and data collection of its operations in the state. By publicly disclosing the data in real-time via CNXRadicalTransparency.com, all stakeholders can access and better understand the natural gas development process and its critical role in the economy and environment. "Through our commitment to Radical Transparency, we aim to lead the industry into a new era of responsible domestic energy development—one where facts and data prevail over speculation and ideology," Ms. Scott continued. "Through these efforts, we are proving every day that natural gas development is safe and inherently good for the communities where we are privileged to live and operate."

MVP Restoration Work in Jefferson National Forest Begins - Marcellus Drilling News - A major effort by the radical left to block the 303-mile Mountain Valley Pipeline (MVP) from crossing a piddly 3.5 miles of the Jefferson National Forest (JNF) failed. But not for lack of trying. Big Green paid protesters to sit in trees, chain themselves to cars, and all manner of illegal tactics to try and slow or stop progress on building the pipeline through JNF (see our MVP in JNJ stories here). The pipeline itself is now completed, and restoration work is underway in some locations like JNF. In the case of JNF, MVP is removing construction debris and replanting native vegetation.

MVP “Mechanically Complete” – Asks FERC to Begin Flowing TODAY! - Marcellus Drilling News - Is today the day we’ve been waiting and writing about for the past nine years? Possibly! Yesterday, Mountain Valley Pipeline (MVP), the 303-mile, 2 Bcf/d pipeline from Wetzel County, WV, to Pittsylvania County, VA, filed a request with the Federal Energy Regulatory Commission (FERC) to say the pipeline is now mechanically complete, meaning the pipeline is in the ground, covered up, fully tested, and ready to begin operations. MVP asked FERC to allow it to begin flowing gas TODAY, June 11. At best, it’s a 50/50 shot that FERC will allow it to begin operations today. No matter. Whether today, tomorrow, or next week, MVP is done and will begin. WE WON!

Mountain Valley Pipeline is done and ready to go, developers say - After a decade of planning, construction and controversy, developers of the Mountain Valley Pipeline say it’s ready to begin operations. The company asked the Federal Energy Regulatory Commission on Monday to grant authorization by Tuesday that would allow the natural gas pipeline to start service in the coming days. “Mountain Valley confirms that the Project facilities are mechanically complete,” Matthew Eggerding, deputy general counsel for the joint venture, wrote in a letter posted to FERC’s online docket early Monday afternoon. Testing is also completed on all segments of the 303-mile interstate pipeline, including what was required last October by a safety consent order from a federal agency. “The final segments of the Project are currently being purged and packed with natural gas,” Eggerding wrote, referring to a process of venting air from the pipe before gas is introduced. People are also reading… FERC had made no decision by 6 p.m. Monday, according to its online docket. Concerns by opponents – which for years dealt largely with Mountain Valley’s failure to prevent muddy runoff from flowing off construction sites and into nearby forests and streams – have turned more recently to fears about the pipe’s integrity. Questions about whether a protective coating on the pipe’s exterior had been weakened by exposure to the elements intensified May 1, when a segment of the line on Bent Mountain ruptured during pressure testing. “To grant this request on a 24-hour turnaround while reasonable concerns remain about the project’s ability to operate safely will further erode public trust and deliver a final injustice to directly impacted community members who have engaged in this process in good faith,” Russell Chisholm of the Protect Our Water, Heritage, Rights coalition wrote in a letter asking FERC to deny Mountain Valley’s request. The company is still waiting for results from metallurgical testing of the pipe section that ruptured under high-pressure water testing. What caused the pipe to fail has not been determined. Meanwhile, Chisholm wrote, there has not been a full release of results from additional testing that was ordered last October by the U.S. Pipeline and Hazardous Materials Safety Administration. Some details, made available in response to Freedom of Information Act requests, have prompted concerns by the Pipeline Safety Trust, which wrote PHMSA in April about what it called “inadequate information” provided by Mountain Valley. It was not clear Monday how soon the pipeline will begin transporting natural gas, assuming FERC grants the request. “Final preparations are currently underway to begin flowing gas,” company spokeswoman Natalie Cox wrote in response to questions seeking clarification. But Mountain Valley has made an early June start date a high priority. “Multiple shippers have executed agreements to commence transporting volumes using the Project facilities beginning the day after the Project declares in-service, which further heightens the need for prompt authorization to meet market demands,” Eggerding wrote in his letter. Jessica Sims, the Virginia field coordinator of Appalachian Voices, made the following statement: “The community is in the dark about important safety and environmental considerations from the Pipeline and Hazardous Materials Safety Administration and FERC, while Mountain Valley Pipeline pressures FERC to prioritize the company’s sales schedule.” Records from two rounds of tests, performed by Mountain Valley at the direction of PHMSA, have been released to The Roanoke Times under open-record laws. The first report was for tests conducted last year, mostly in West Virginia, where the project originates before passing through the New River and Roanoke valleys to connect with an existing pipeline near the North Carolina line. Those tests showed about 70 “indications,” or possible flaws with the pipe, and a need for about 15 “cutouts,” or the removal and replacement of part of the pipe. The Pipeline Safety Trust, a watchdog group of the industry and its regulators, said Mountain Valley had not adequately explained its criteria for deciding which sections of the pipe needed repairs. Last month, PHMSA released an introduction letter from Mountain Valley’s report on a second period of testing, from January through the end of March. The actual report was withheld. The cover letter showed about 130 potential problem areas, but did not explain what corrective action was taken. Without that information, safety experts said it was difficult to evaluate the overall integrity of the pipeline. Mountain Valley has notified PHMSA “of its full compliance prior to introducing natural gas to the final segments” of the pipe, Eggerding wrote. A PHMSA spokesman could not be reached Monday. A FERC representative said: “This is a pending request, so we cannot comment.”

Mountain Valley pipeline seeks permission to begin operations -Equitrans Midstream Corp. has completed construction of its 303-mile Mountain Valley natural gas pipeline (MVP) and requested US Federal Energy Regulatory Commission permission to put the 2-bcfd system in service. Equitrans described the pipeline as “mechanically complete,” having finished all welding, testing, cleaning, and drying.MVP’s final segments are being purged and filled with natural gas in advance of startup and Equitrans requested that authorization be provided by June 11, 2024. "Multiple shippers have executed agreements to commence transporting volumes using the project facilities beginning the day after the project declares in-service, which further heightens the need for prompt authorization to meet market demands," the company said in its FERC filing. Equitrans initially requested in-service authorization in April 2024, but supplemented its request the following month (OGJ Online, Apr. 24, 2024). MVP (42-in. OD) runs from Wetzel County, WV, to an interconnect with Transcontinental Gas Pipeline Co.at the latter’s Compressor Station 165 in Pittsylvania County, Va. The pipeline was originally scheduled to begin operations in 2018 but has been delayed repeatedly by litigation.

FERC approves startup of Mountain Valley natural gas pipeline - Oil & Gas Journal Equitrans Midstream Corp. was granted approval June 11 by the US Federal Energy Regulatory Commission (FERC) to put its 303-mile, 2 bcfd Mountain Valley natural gas pipeline (MVP) into operation.FERC’s authorization is the final hurdle for the controversial $7.8-billion project designed to move Marcellus and Utica shale gas to Mid-Atlantic markets. The pipeline was originally scheduled to begin flows in 2018 but was repeatedly delayed by litigation involving environmental concerns and landowners.The pipeline was scheduled to start operations in May, but Equitrans delayed the start to run additional safety tests (OGJ Online, Apr. 24, 2024).“We find that Mountain Valley has adequately stabilized the areas disturbed by construction and that restoration and stabilization of the construction work area is proceeding satisfactorily,” Terry Turpin, FERC’s director of the Office of Energy Projects, said in the order. The commission granted authorization based on “Mountain Valley’s recent construction status reports and supplemental filings, our regular compliance monitoring reporting, a staff inspection the week of May 13-17, and our communications with the Department of Transportation’s Pipeline and Hazardous Materials Safety Administration,” Turpin added.The 42-in OD pipeline runs from Wetzel County, WV, to an interconnect with Transcontinental Gas Pipeline Co. at compressor station 165 in Pittsylvania County, Va. “We are pleased with the agencies’ decisions and the related communications regarding in-service authorization for the MVP project,” Natalie Cox, an Equitrans spokeswoman, said in a June 11 statement. “Final preparations are underway to begin commercial operations.”

4th Circus’ Final “Screw You” to MVP in Va. Eminent Domain Case ---Marcellus Drilling News --In a clear case of sour grapes for the U.S. Court of Appeals for the Fourth Circuit (4th Circus clowns) who tried to block the 303-mile Mountain Valley Pipeline (MVP) by rendering arbitrary decisions that caused years of delays for the pipeline, the court flipped the bird to MVP one last time in a decision issued Tuesday of this week (June 11). Three judges from the 4th Circus re-inflated a jury award against MVP for an eminent domain “taking” case in the Bent Mountain, Virginia, area back in May (see 4th Circus Clowns Punish MVP One Last Time via Eminent Domain Case). MVP appealed to the full 4th Circuit to have all judges re-hear the case, called en banc. On Tuesday, the full court refused, allowing the “screw you” decision by the three loser clowns to stand.

Mountain Valley Pipeline goes into service, starts delivering gas in Virginia Mountain Valley Pipeline, the 303-mile vessel that will deliver natural gas from the Appalachian region of West Virginia into Southwest Virginia, officially went into service Friday, after about a decade of steadfast opposition over concerns about environmental and community impacts in the areas in its path. In a news release, the company said the project is now available to deliver natural gas with a capacity of up to 2 billion cubic feet of gas per day. Roanoke Gas said in a separate release Friday it had begun receiving the fossil fuel. Diana Charletta, president and chief executive officer of Equitrans Midstream Corp, the pipeline’s developer, called the day an “important and long-awaited one,” for the country that will allow “greater access to an abundant supply of domestic natural gas for use as an affordable, reliable, and cleaner energy resource.” The project was first announced in 2014 and planned to deliver natural gas from the Marcellus and Utica shale regions into Pittsylvania County, with an anticipated completion date in 2018. But numerous legal challenges led the U.S. Fourth Circuit Court of Appeals to overturn state permits, finding some agencies failed to adequately ensure protections against sediment erosion and harm to endangered fish species, such as the candy darter. In May 2023, however, Democratic West Virginia Sen. Joe Manchin included a measure in a federal stop-gap spending plan, the Fiscal Responsibility Act, that required all state and federal agencies to approve permits necessary for the project to be completed. The measure also prevented any legal challenges until it was completed. With that greenlight, MVP resumed construction in August. The company requested final approval from the Federal Energy Regulatory Commission on Monday, stating that the project was “mechanically complete.” On Tuesday, FERC granted the OK, after consultation with the Pipeline and Hazardous Materials Safety Administration revealed the agency “had no objections if Commission staff were to authorize in-service for the Mountain Valley Pipeline project.” MVP had entered into a consent agreement with PHMSA in October, because of conditions posing “an integrity risk to public safety, property or the environment.” Terry L. Turpin, director of the FERC office that oversees the project stated that “Mountain Valley has adequately stabilized the areas disturbed by construction and that restoration and stabilization of the construction work are proceeding satisfactorily.” The cost of the project, initially stated to be $3.5 billion in 2018, more than doubled to $7.85 billion, according to a news release earlier this year.. Scrutiny of the project, including the safety of coatings on the pipeline that laid out in the elements during years of delay and violations for preventing sediment erosion, increased in recent weeks as requests for the project to come online were submitted. On Wednesday, when the pipeline’s activation was imminent, groups who have been advocating on behalf of indigenous people, other community members and the environment in West and Southwest Virginia raised their concerns and called for continued caution. “I don’t know how else to express how angry, infuriated, grief stricken I am in this moment,” said Russell Chisholm, co-executive director of Protect our Water and Heritage Rights. The pipeline would have “repercussions …for everyone upstream in the fracking fields, and everyone downstream, where the gas is shipped and eventually burned, overheating our planet.” Following a test failure on May 1, Appalachian Voices continuously submitted requests for information on inspection reports, in addition to the March 29 quarterly report that was most recently released, but received no response, said Jessica Sims, the group’s Virginia field coordinator. The lack of response from PHMSA and FERC has left community members in the dark with little legal recourse to take action, Sims added, while condemning Manchin’s intervention at the federal level. “The level of congressional interference with the project was unprecedented and certainly concerning as a reality that could happen again,” Sims said. “We remain deeply disappointed that one pet project was put on an unrelated debt bill and used to pressure members of congress on a matter they should not have been weighing in on in that way. That lack of separation of judicial and legislative powers is deeply concerning,” said Sims.

Encore Energy Adds 3 KY Horizontal Wells to Sales, Drilling 3 More --Marcellus Drilling News - Kentucky is not known as a hotbed of shale drilling activity. The Marcellus/Utica does not extend under the Bluegrass State. However, as we wrote about back in 2017, Kentucky does have the Berea Sandstone, which contains oil deposits (seeFracking Comes to Kentucky – Encore Drills First Horizontal Oil Wells). In 2017, we brought you the news that Encore Energy, headquartered in Bowling Green, was just beginning to drill shale wells looking to extract oil from the Berea. Fast forward to today, and over 100 horizontal wells are permitted, drilled, and/or producing in the Berea in Lawrence County. Encore issued a press release yesterday saying it has just turned another three Berea wells online to sales and is drilling three more.

Ameren Seeks to Build 800-MW Gas-Fired Peaker Near St. Louis, MO - Marcellus Drilling News - Ameren Missouri, a subsidiary of Ameren Corporation, recently filed an application with the Missouri Public Service Commission to build an 800-megawatt, simple-cycle “peaker plant” powered by natural gas to serve as a reliable backup source of energy, ready to use when customers need it most. The Castle Bluff Energy Center is designed to bolster grid reliability, deliver energy on the hottest summer days and the coldest winter nights, and complement the increasing amount of renewable energy generation being added to the grid.

Natural Gas Producer Discipline, Demand Momentum Said to Support Prices Through Summer -Drops in natural gas production, declining storage surpluses and stronger summer weather demand in the Lower 48 and abroad all line up in bulls’ favor. These factors could prop up prices through the cooling season and potentially longer, a cadre of analysts agreed this week.Speaking at the LDC Gas Forums Northeast in Boston, Atmospheric G2 meteorologist James Caron said his firm’s seasonal forecasts call for “very, very warm” weather across most of North America and vast sections of Europe and Asia as well. The outlook mirrors predictions by AccuWeather and the National Weather Service. Such conditions have already settled across parts of all three continents, and he looks for the heat to spread in the back half of June. The sultry temperatures are expected to endure through the summer months, he said, fueling robust domestic cooling demand, strong levels of pipeline exports to Mexico, and increased calls for U.S. shipments of LNG to Europe and Asia.

Golden Pass LNG Navigates EPC Bankruptcy Fallout as Market Scrutinizes Commissioning Timeline --While Golden Pass LNG is holding to previous expectations for commissioning to begin in the first half of 2025, FERC staff said the timelines could be impacted as the lead construction contractor navigates bankruptcy. Zachry Industrial Inc. informed the Texas Workforce Commission that it has laid off about 4,400 workers assigned to the 18 million metric tons/year (mmty) export project southeast of Houston. The San Antonio-based parent company filed for bankruptcy in late May, noting “significant financial strain” from attempts to keep Golden Pass on schedule. Zachry had taken on the role of hiring and coordinating the onsite construction staff at Golden Pass as part of a engineering, procurement and construction (EPC) partnership with Chiyoda Corp. and McDermott.

NextDecade, Saudi Aramco sign 20-yr LNG supply deal (Reuters)—U.S. liquefied natural gas (LNG) provider NextDecade has signed a non-binding agreement with Saudi Aramco to supply 1.2 metric MMtpy of LNG for 20 yr. The deal comes at a time when Aramco is seeking to strengthen its position in the LNG market, which is set to grow globally by 50% by 2030, especially in the U.S., where LNG capacity is set to almost double over the next four years. Aramco said the deal was part of its efforts to expand its "presence in international energy markets." Under the terms, LNG will be supplied from the fourth liquefaction train at NextDecade's Rio Grande LNG Facility at the Port of Brownsville, Texas, USA. Earlier this month, Reuters reported that Aramco was in talks with NextDecade, as well as U.S. firm Tellurian on two separate LNG projects as the Saudi firm seeks to boost its gas trading and production. Aramco and NextDecade said they were in the process of negotiating a binding agreement, effective subject to a positive final investment decision on Train 4, which NextDecade said it expects in the second half of 2024. In May, Abu Dhabi National Oil Company (ADNOC) said it had acquired 11.7% stake in phase 1 of NextDecade's LNG project, which included the first three liquefaction trains, and agreed to a 20-yr supply agreement for the fourth train.

Aramco Inks 20-Year HoA for Rio Grande LNG Supply -Saudi Arabian Oil Co. (Aramco) has signed a non-binding heads of agreement (HoA) with NextDecade Corporation for a 20-year liquefied natural gas sale and purchase agreement (LNG SPA) for offtake from Train 4 at the Rio Grande LNG Facility at the Port of Brownsville, Texas, USA. Under the terms of the HoA, Aramco expects to purchase 1.2 million metric tons per annum (mtpa) of LNG for 20 years on a free on board basis, at a price indexed to Henry Hub, according to a joint news release from the two companies. The HoA was executed through their respective subsidiaries. Aramco and NextDecade are currently in the process of negotiating a binding agreement, according to the release. The binding agreement will still be subject to a positive final investment decision on Train 4. Nasir K. Al-Naimi, Aramco Upstream President, said: "We look forward to finalizing the terms of a long-term LNG offtake agreement with NextDecade, as we explore opportunities to expand our presence in international energy markets. We expect LNG to play an important role in meeting the rising demand for secure and efficient energy”. Matt Schatzman, NextDecade Chairman and CEO, said: “We are pleased to have reached a Heads of Agreement with Aramco for LNG from Train 4, as Aramco seeks to expand its LNG portfolio. We look forward to finalizing the LNG SPA with Aramco and to pursuing other opportunities together”. In May, Abu Dhabi National Oil Co. (ADNOC) announced that it would take a 11.7 percent stake in phase 1 of the Rio Grande LNG project, according to a statement Monday. The deal also gives ADNOC 1.9 million tons a year of LNG supply from the project’s future Train 4, according to an earlier statement. ADNOC’s stake in the first phase of Rio Grande will also give it access to Trains 1 to 3, which are parts of the project. NextDecade Corp., through its subsidiary NextDecade LNG LLC, in January secured a total of $62.5 million for various purposes including the development costs of Train 4 at the Rio Grande LNG facility. NextDecade entered into a credit agreement with MUFG Bank Ltd. as lender and administrative agent that provides for a $50 million senior secured revolving credit facility and a $12.5 million interest term loan. Phase 1 of the Rio Grande LNG project, which consists of the first three liquefaction trains and has a nameplate liquefaction capacity of 17.6 mtpa, has long-term binding LNG sale and purchase agreements with TotalEnergies, Shell NA LNG LLC, ENN LNG Pte. Ltd., Engie SA, ExxonMobil LNG Asia Pacific, Guangdong Energy Group, China Gas Hongda Energy Trading Co., Galp Trading SA, and Itochu Corp. According to the company website, Rio Grande LNG is expected to produce lower carbon intensive LNG. Located on a 984-acre site on the banks of an uncongested deepwater channel, it will be the largest privately funded infrastructure project in Texas. Rio Grande LNG claims to be the first and only U.S. LNG project offering carbon dioxide (CO2) emissions reduction of more than 90 percent via planned carbon capture and storage – capturing and permanently storing more than 5 million metric tonnes of CO2 per year, equivalent to removing more than one million vehicles from the road annually.

Freeport LNG Sues EPC Contractors for Alleged ‘Defects’ in Train Motors --Extended outages at Freeport LNG this year were likely caused by defects in its liquefaction trains’ motors, the company claimed in a lawsuit against three engineering, procurement and construction (EPC) firms. Freeport LNG Development LP is seeking damages from Zachry Industrial Inc., Chiyoda International Corp. and CB&I Inc., which built and installed the Texas facility’s three electric-drive trains, for alleged faulty work. In an April petition filed in a Texas district court, Freeport’s lawyers outlined how crews reportedly found the technical faults in January while doing maintenance work after a system trip on Train 3.

FERC Sends Disagreement Over Calcasieu Pass LNG Documents to Administrative Court -Venture Global LNG Inc. has been tasked with cooperating with long-term offakers of its Calcasieu Pass LNG project to share some private information about the Louisiana export terminal. In a recent ruling, FERC appointed an administrative judge to manage negotiations between the liquefied natural gas exporter and a group of customers seeking information about the 10 million metric ton/year facility. If the parties cannot agree to a plan, the administrative judge could create their own protective order to release information to the customers. “Because Venture Global and customers disagree about the terms of a protective agreement, the Commission finds that the most efficient way for the parties to reach an agreement is with the assistance of an administrative law judge,” Federal Energy Regulatory Commission staff wrote in the order.

NGI’s 1Q2024 Natural Gas Supply and Demand Takeaways --Expectations for North American upstream natural gas capital expenditures in 2024 continue to show a year/year decline in the low- to mid-single digits, with subdued rig counts persisting throughout the year. Eventually, those rigs would need to resume work to account for the in-service of more Lower 48 LNG export capacity next year, and possibly to gear up for the rapid growth in data centers – although it is uncertain as to what that opportunity for incremental gas demand may be. NGI's natural gas prices vs Lower 48 production NGI reviewed some of the first quarter of 2024 earnings calls for players in the major North American oil and natural gas production areas in order to gauge future supply and demand trends. NGI’s Patrick Rau, senior vice president for Research & Analysis, also provided a rundown of the top ten themes of 1Q2024 in the latest episode of Hub & Flow. Baker Hughes Co. (BKR) – Baker Hughes has proclaimed this to be “The Age of Gas.” That’s more of a long-term view, and maybe not quite as apropos a description for 2024, at least not in North America (NA). Both Baker Hughes and SLB Ltd. continue to expect NA activity and spending to be down to the low- to mid-single digits for the rest of this year, primarily because of lower natural gas prices. Thus far in 2024, Lower 48 rigs have fallen to 600 from 622, per Baker Hughes. Even with the recent price rally – which has seen NGI’s daily Henry Hub spot market price index increase from a low of $1.240/MMBtu on March 13 to $2.635 June 3 – rigs are down by six this month.

US Natural Gas Prices Rise To 5-Month Highs On Hot Weather Forecasts - Prompt-month natural gas futures have exceeded $3 per million British thermal units on Monday, marking the highest level since mid-January 2024 and hitting a potential four-day winning streak, spurred by forecasts predicting increased cooling demand due to anticipated warm weather in June. Last week, natural gas prices rose by 12.8%, and are currently eyeing the seventh week of gains out of last eight. “With a blanket of heat stalling over the southern part of the country, market bulls maintained control,” said Jodi Shafto, senior natural gas reporter at Natural Gas Intel. Chart: US Natural Gas Price Have Rallied 95% Since Late April’s Lows NatGasWeather highlighted that much of the country is expected to experience temperatures ranging from the upper 70s and 80s in the Midwest and Northeast to the upper 80s and 90s elsewhere, with extreme heat in California and Texas reaching the mid-100s.The American forecast model predicts significantly above-average temperatures from Monday, June 17 to Monday, June 24."Either way, the pattern is hot enough for stronger-than-normal demand," NatGasWeather said. This trend is anticipated to reduce natural gas storage surpluses to around 450 billion cubic feet (Bcf) or slightly below by the end of the month, according to NatGasWeather.In the week ending May 31, U.S. utilities added 98 Bcf of gas to storage, surpassing market expectations of an 89 Bcf increase. This was the ninth consecutive week of seasonal storage increases, bringing the total stockpiles to 2,893 Bcf. This level is 373 Bcf higher than the same period last year and 581 Bcf, or 25%, above the five-year average of 2,312 Bcf.The weekend GFS lost a few CDDs, although the ECMWF gained a few. Both forecast light to moderate national demand through Thursday but then both are quite hot with the US pattern for the 3rd week of June, just with the EC numerous CDDs hotter compared to the GFS. #natgas pic.twitter.com/d28vw0jcka— NatGasWeather.com (@NatGasWeather) June 9, 2024 Companies involved in the natural gas market outperformed oil-related stocks on Monday.

US natgas prices jump 8% to 21-week high on output drop, hotter weather forecasts (Reuters) -U.S. natural gas futures jumped about 8%to a 21-week high on Tuesday on a drop in output in recent days and forecasts for hotter weather that should boost the amount of gas power generators burn to keep air conditioners humming. That price increase occurred despite forecasts for less demand over the next two weeks than previously expected, expectations gas supplies will soon rise with the giant Mountain Valley Pipeline nearing completion, and the tremendous oversupply of gas still in storage. Analysts said current gas stockpiles were still around 24% above normal levels for this time of year. OLL Mountain Valley said its pipeline from West Virginia to Virginia was "mechanically complete" and being "packed with gas." The company sought permission from the U.S. Federal Energy Regulatory Commission (FERC) to place the project into service by Tuesday, June 11. Analysts predicted FERC would probably authorize the project but not necessarily by Tuesday. Front-month gas futures for July delivery on the New York Mercantile Exchange rose 22.3 cents, or 7.7%, to settle at $3.129 per million British thermal units (mmBtu), its highest close since Jan. 12. In the spot market, next-day gas at the AECO hub in Alberta, Canada fell to 60 cents per mmBtu, its lowest price since October 2022 for a second day in a row. In other news, the U.S. National Hurricane Center said a tropical disturbance in the Gulf of Mexico had a 20% chance of becoming a cyclone over the next seven days as it blows across Florida and into the Atlantic Ocean off the Carolinas. Meteorologists predict this could be a record-setting year for hurricanes and other tropical storms. Financial firm LSEG said gas output in the Lower 48 U.S. states has fallen to an average of 97.8 billion cubic feet per day (bcfd) so far in June, down from 98.1 bcfd in May. That compares with a monthly record of 105.5 bcfd in December 2023. On a daily basis, output was on track to drop by around 2.8 bcfd over the past four days to a preliminary 20-week low of 95.2 bcfd on Tuesday. Traders, however, noted preliminary data is often revised later in the day. Before recent output declines in June, analysts said increases in May were a sign producers were slowly boosting output due to a 47% jump in futures prices in April and May. Output hit a six-week high of 99.5 bcfd on May 24. Overall, U.S. gas production has remained down around 10% so far in 2024 after several energy firms, including EQT and Chesapeake Energy, delayed well completions and cut drilling activities when prices fell in February and March. Meteorologists projected weather across the Lower 48 states would remain mostly hotter than normal through June 26. LSEG forecast gas demand in the Lower 48, including exports, would jump from 94.7 bcfd this week to 98.8 bcfd next week. Those forecasts were lower than LSEG's outlook on Monday. Gas flows to the seven big U.S. LNG export plants have risen to 13.1 bcfd so far in June, up from 12.9 bcfd in May. That, however, remains well below the monthly record high of 14.7 bcfd in December 2023 due to ongoing maintenance at several plants, including Cheniere Energy's LNG.N Sabine Pass, Venture Global's Calcasieu Pass and Cameron LNG's plant in Louisiana.

US natural gas prices fall 3% after Mountain Valley pipe startup approved (Reuters) -U.S. natural gas futures fell about 3% on Wednesday on expectations that supplies will soon rise with the approved startup of the Mountain Valley gas pipe and news about plans by EQT, the nation's biggest gas producer, to boost output. Federal energy regulators approved the startup of the Mountain Valley Pipeline from West Virginia to Virginia late Tuesday. Analysts expect the Mountain Valley startup will allow Appalachian producers to slowly boost output in coming months as other energy firms fix constraints on connecting pipes in Virginia and other states, allowing gas flows on Mountain Valley to reach the pipe's full 2-billion-cubic-feet-per-day(bcfd) capacity. In other news, EQT CEO Toby Rice told Natural Gas Intelligence at the LDC Gas Forums Northeast conference in Boston that EQT started to bring back some of the 1 bcfd of production it started to curtail in February when gas prices dropped. With gas prices rising in April and May, analysts said they sawsigns that EQT and other producers started to boost output again in May. Front-month gas futures NGc1 for July delivery on the New York Mercantile Exchange fell 8.4 cents, or 2.7%, to settle at $3.045 per million British thermal units (mmBtu).On Tuesday, the contract closed at its highest price since Jan. 12. The futures price decline came despite an ongoing drop in output so far in June and forecasts for hotter weather through at least the end of the month that should boost the amount of gas power generators need to burn to keep air conditioners humming. Other factors keeping a lid on futures prices this year include consistently lower spot prices at the U.S. Henry Hub benchmark NG-W-HH-SNL in Louisiana and the oversupply of gas in storage despite six weeks of smaller-than-usualstorage builds. Analysts said current gas stockpiles were still around 24% above normal levels for this time of year. Financial firm LSEG said gas output in the Lower 48 U.S. states fell to an average of 97.7 bcfd so far in June, from 98.1 bcfd in May. That compares with a monthly record of 105.5 bcfd in December 2023. On a daily basis, output was on track to drop by around 2.3 bcfd over the past five days to a preliminary 21-week low of 95.7 bcfd on Wednesday. Traders, however, noted preliminary data is often revised later in the day. Meteorologists projected weather across the Lower 48 states would remain hotter than normal through at least June 27. LSEG forecast gas demand in the Lower 48, including exports, would jump from 95.3 bcfd this week to 98.9 bcfd next week. The forecast for this week was higher than LSEG's outlook on Tuesday. Gas flows to the seven big U.S. LNG export plants rose to 13.1 bcfd so far in June, from 12.9 bcfd in May.

US natgas prices fall 3% on forecasts for lower demand, higher output (Reuters) -U.S. natural gas futures fell about 3% on Thursday on lowered demand forecasts for the next two weeks, expectations supplies will soon rise once the Mountain Valley gas pipeline enters service, and news that recent increases in prices and demand prompted EQT, the nation's biggest gas producer, to start boosting output. Traders said prices were also pressured by upward revisions to past weeks' storage builds in the latest report even though last week's storage build was seasonally small for a fifth straight week. Producers cut output after futures prices dropped to 3-1/2-year lows in February and March. The U.S. Energy Information Administration (EIA) said utilities added 74 billion cubic feet (bcf) of gas into storage during the week ended June 7. But working gas stocks were revised higher for the five-week period from May 3-31 by increasing inventories by 6 bcf to 9 bcf for each week during the period. For the week ended June 7, the stock build was in line with the 74-bcf addition analysts forecast in a Reuters poll. That compares with an increase of 90 bcf in the same week last year and a five-year (2019-2023) average rise of 89 bcf for this time of year. This week's build left stockpiles about 24% above normal for this time of year. Front-month gas futures NGc1 for July delivery on the New York Mercantile Exchange fell 8.6 cents, or 2.8%, to settle at $2.959 per million British thermal units (mmBtu). The futures price decline occurred despite forecasts for hotter weather through at least the end of June that should boost the amount of gas power generators need to burn to keep air conditioners humming. . On a daily basis, output was on track to rise by around 0.4 bcfd over the past two days to a preliminary 96.9 bcfd on Thursday, up from a 20-week low of 96.5 bcfd on Tuesday. Before recent output declines in June, analysts said increases in May were a sign producers were slowly boosting output due to a 47% jump in futures prices in April and May. Output hit a six-week high of 99.5 bcfd on May 24. EQT EQT.N said this week that it started boosting output. Overall, U.S. gas production was still down around 9% so far in 2024 after several energy firms, including EQT and Chesapeake Energy, delayed well completions and cut drilling activities when prices fell in February and March. Chesapeake is on track to become the biggest producer after its merger with Southwestern Energy SWN.N. Meteorologists projected weather across the Lower 48 states would remain hotter than normal through at least June 28. LSEG forecast gas demand in the Lower 48, including exports, would jump from 94.9 bcfd this week to 98.5 bcfd next week. Those forecasts were lower than LSEG's outlook on Wednesday.

Strengthening Natural Gas Prices Seen Driving Production Boost in 2025, EIA says --The U.S. Energy Information Administration (EIA) is projecting a Henry Hub natural gas spot price average of $2.50/MMBtu for 2024, up 13% from the average price the agency modeled last month.In the June release of its Short-Term Energy Outlook (STEO), published Tuesday, EIA said it expects the national benchmark’s average spot prices to climb to $3.30 in December from $2.12 in May, because of the decline in Lower 48 natural gas production. EIA said marketed natural gas production in the United States averaged 110 Bcf/d in May, 3% below the average produced in the first quarter of this year.

US weekly LNG exports reach 26 shipments - US liquefied natural gas (LNG) exports reached 26 shipments in the week ending June 5 and pipeline deliveries to US terminals increased compared to the week before, according to the Energy Information Administration.The agency said in its weekly report that 26 LNG carriers departed the US plants between May 30 and June 5. This is the same number of shipments compared to the week before.Citing shipping data provided by Bloomberg Finance, the EIA said the total capacity of these LNG vessels is 94 Bcf.Average natural gas deliveries to US LNG export terminals increased 0.2 Bcf/d from last week to 13.2 Bcf/d, according to data from S&P Global Commodity Insights.Natural gas deliveries to terminals in South Louisiana increased 7 percent (0.5 Bcf/d) to 8 Bcf/d, while natural gas deliveries to terminals in South Texas decreased 4.5 percent (0.2 Bcf/d) to 4 Bcf/d.The agency said that natural gas deliveries to terminals outside the Gulf Coast averaged 1.2 Bcf/d this week, down from 1.3 Bcf/d the previous week. Cheniere’s Sabine Pass plant shipped eight cargoes and the company’s Corpus Christi facility sent four shipments during the week under review.The Freeport LNG terminal shipped five cargoes, while Venture Global LNG’s Calcasieu Pass facility and Sempra Infrastructure’s Cameron LNG terminal each shipped three cargoes during the period.Also, the Cove Point facility sent two cargoes and the Elba Island facility sent one cargo during the week under review.This report week, the Henry Hub spot price rose 1 cent from $2.21 per million British thermal units (MMBtu) last Wednesday to $2.22/MMBtu this Wednesday.The July 2024 NYMEX contract price increased to $2.757/MMBtu, up 9 cents from last Wednesday to this Wednesday.The price of the 12-month strip averaging July 2024 through June 2025 futures contracts also climbed 9 cents to $3.223/MMBtu, the agency said.The agency said that international natural gas futures were mixed this report week.Bloomberg Finance reported that weekly average front-month futures prices for LNG cargoes in East Asia decreased 2 cents to a weekly average of $11.98/MMBtu.Natural gas futures for delivery at the Dutch TTF increased 14 cents to a weekly average of $11/MMBtu.In the same week last year (week ending June 7, 2023), the prices were $9.25/MMBtu in East Asia and $7.95/MMBtu at TTF, the agency said.