Strategic Petroleum Reserve is at a new 39½ year low; oil and horizontal rigs fell below year ago levels for the first time of the pandemic recovery era; April DUCs down 32nd time in 34 months, DUC well backlog fell to 4.6 months

US oil prices finished higher for the first time in five weeks on hope for a debt ceiling deal, while widespread wildfires impacted Canadian oil production and exports to the US….after falling 1.8% to $70.04 a barrel last week on weak economic reports from the US and China and on the largest jump in US commercial oil supplies since February, the contract price for the benchmark US light sweet crude for June delivery rose slightly in Asian trading after a earlier decline on concerns over the US debt limit, as the possibility that the US would purchase oil for the Strategic Petroleum Reserve offset concerns about the us debt limit, and then moved higher in early US trading after Iran said it had seized another oil tanker in the Persian Gulf, and settled $1.07 higher at 71.11 a barrel, supported by news that wildfires in Alberta, Canada were shutting in large amounts of crude supply, and that flows of northern Iraqi crude to Turkey’s Ceyhan port had yet to resume...oil prices rose again in early Asian trading on Tuesday, as U.S. plans to purchase oil for the Strategic Petroleum Reserve (SPR) lent support, while raging wildfires in Canada fueled supply concerns. then steadied in London trading as concerns over China’s economic recovery offset bullishness around the U.S. plan to start refilling its depleted strategic reserves, but turned south in afternoon trade to settle 25 cents lower at $70.86 a barrel as weaker-than-expected retail sales and industrial production data from China and the US offset a forecast of higher global demand from the International Energy Agency...oil prices continued to trend lower in overnight trading and posted an early low of $70.04 following a late Tuesday report by the American Petroleum Institute of an unexpected big build in crude stocks, then pushed higher in pre-inventory trade Wednesday after that same industry survey showed domestic gasoline and distillate fuel inventories fell for a second week, and advanced further as traders embraced risky assets amid optimism on U.S. debt ceiling talks while awaiting the latest data on U.S. stockpiles….oil prices then slipped lower after the EIA reported an even larger unexpected inventory build, and smaller draws on fuel supplies than the API reported, but rallied again late to finish the session $1.97 higher at $72.83 a barrel after Biden voiced confidence that an agreement on the debt ceiling would soon be reached, easing concerns about a potential default and a cascading impact on the economy and energy demand....however, Wednesday's rally dissipated in Asia on Thusday morning, with prices turning south on the build-up of US oil inventories, and on weak economic data from the US and China, then traded in a narrow range in the New York session as markets awaited the outcome of the debt ceiling negotiations, before settling 97 cents lower at $71.86 a barrel, dragged down by a rallying U.S. dollar index after a better-than-expected reading for unemployment claims raised the odds for further Fed interest rate hikes this summer....oil prices powered higher early Friday after spreading wildfires in Canada's oil-producing region of Alberta shut-in some 250,000 barrels in daily output, but pared those early gains and settled 31 cents lower at $71.55 per barrel, hit by reports that the debt ceiling talks had paused after Republican negotiators walked out the meeting, offsetting recent optimism about an impending deal, but still ended 2.1% higher on the week...

Meanwhile, US natural gas prices finished higher for the fifth week in six, buoyed by prospects for a production pullback and tighter supplies….after rising 6.0% to $2.266 per mmBTU last week after drillers shut down the most natural gas rigs in seven years, the contract price of US natural gas for June delivery opened 9 cents higher on Monday as last week’s decline in active drilling rigs provided the momentum for a bullish start, and traded in a narrow range before settling 10.9 cents higher at $2.375 per mmBTU, as traders shrugged off continued mild weather forecasts and elevated supply data, seizing instead on a the potential decline in future production with fewer rigs in the field...after opening higher, natural gas prices faded on Tuesday after Platts forecast a string of triple-digit injections into our already oversupplied storage but still settled a tenth of a cent higher at $2.376 per mmBTU, still supported by expectations for slowing production...natural gas prices opened higher again on Wednesday, but soon started sliding as traders began betting on a larger than expected inventory increase, and settled 1.1 cents lower at $2.365 per mmBTU...however, with most traders on the wrong side of that bet, natural gas prices jumped about 10% to a nine-week high on Thursday following a smaller-than-expected U.S. injection of gas into storage, and settled 22.7 cents higher at $2.592 per mmBTU, as wildfires kept gas exports from Canada near a 25-month low…natural gas prices held near Thursday's highs on Friday, as a lack of wind power had forced electricity generators to burn more gas this week and settled seven-tenths of a cent lower at $2.585 per mmBTU, but still ended 14.1% higher on the week..

The EIA's natural gas storage report for the week ending May 12th indicated that the amount of working natural gas held in underground storage in the US increased by 99 billion cubic feet to 2,240 billion cubic feet by the end of the week, which left our natural gas supplies 521 billion cubic feet, or 30.3% above the 1,719 billion cubic feet that were in storage on May 12th of last year, and 340 billion cubic feet, or 17.9% more than the five-year average of 1,900 billion cubic feet of natural gas that were in storage as of the 12th of May over the most recent five years…note, however, that the oft quoted national average obscures the fact that gas supplies are 40.6% below normal for this date in the West, while 32.8% and 29.4% above normal in both the East and Midwest regions of the country at the same time....the 99 billion cubic foot injection into US natural gas working storage for the cited week was somewhat less than the 108 billion cubic feet addition to supplies that was expected by industry analysts surveyed by Reuters, but it was more than the 87 billion cubic feet that were added to natural gas storage during the corresponding week of 2022, and also more than the average 91 billion cubic feet addition to natural gas storage that has been typical for the same Spring week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending May 12th showed that after a big jump in our oil imports, an equally big jump in new oil supplies that the EIA could not account for, and another substantial release of oil from the SPR, we had surplus oil to add to our stored commercial crude supplies for the 3rd time in 8 weeks, and for the 23rd time in the past 37 weeks, even as our exports of crude also rose.sharply... Our imports of crude oil rose by an average of 1,306,000 barrels per day to 6,860,000 barrels per day, after falling by an average of 843,000 barrels per day the prior week, while our exports of crude oil rose by an average of 1,434,000 barrels per day to 4,310,000 barrels per day, which combined meant that the net of our trade in oil worked out to a net import average of 2,550,000 barrels of oil per day during the week ending May 12th, 128,000 fewer barrels per day than the net of our imports minus our exports during the prior week. Over the same period, production of crude from US wells was reportedly 100,000 barrels per day lower at 12,200,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have averaged a total of 14,750,000 barrels per day during the May 12th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,990,000 barrels of crude per day during the week ending May 12th, an average of 245,000 more barrels per day than the amount of oil that our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 373,000 barrels of oil per day were being added to the supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures provided by the EIA for the week ending May 12th appear to indicate that our total working supply of oil from net imports and from oilfield production was 1,614,000 barrels per day less than what we added to storage plus what our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a [+1,614,000] barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there was an omission or error of that magnitude in the week’s oil supply & demand figures that we have just transcribed…..Furthermore, since last week’s “unaccounted for crude oil” was at (+771,000) barrels per day, that means there was a 842,000 barrel per day difference between this week's oil balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the changes to supply and demand from that week to this one that are indicated by this week's report are complete nonsense...However, since most oil traders treat these weekly EIA reports as accurate, and since these weekly figures therefore often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably reliable by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….(NB: there is also a more recent twitter thread from an EIA administrator addressing these errors, and what they hope to do about it)

This week's 373,000 barrel per day net increase in our overall crude oil inventories came as an average of 720,000 barrels per day were added to our commercially available stocks of crude oil, while 347,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve at the same time, the seventh straight draw on the SPR this year, wherein government owned oil is being sold into the domestic markets as part of an earlier budget balancing withdrawal mandated by congress, and as a result the 359,586,000 barrels of oil that still remain in our Strategic Petroleum Reserve is now the lowest since September 23rd, 1983, or at a new 39 1/2 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's big SPR releases of last year. However, those Biden administration releases amounted to about 42% of what was left in the SPR when they took office, and that left us with what is now less than a 19 day supply of oil at the current consumption rate.

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,296,000 barrels per day last week, which was 0.3% more than the 6,276,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be 100,000 barrels per day lower at 12,200,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day lower at 11,800,000 barrels per day, while Alaska’s oil production was 37,000 barrels per day lower at 405,000 barrels per day, but still added the same 400,000 barrels per day to the rounded national total as it did last week...US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 6.9% below that of our pre-pandemic production peak, but was 25.8% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 92.0% of their capacity while using those 15,990,000 barrels of crude per day during the week ending May 12th, up from their 91.0% utilization rate during the prior week, and a rate that's on the high side of normal for mid May... The 15,990,000 barrels per day of oil that were refined this week were 0.3% more than the 15,935,000 barrels of crude that were being processed daily during week ending May 13th of 2022, but 4.1% less than the 16,676,000 barrels that were being refined during the prepandemic week ending May 10th, 2019, when our refinery utilization rate was at 90.5%, close to normal for this time of year...

Even with the increase in the amount of oil being refined this week, the gasoline output from our refineries was lower, decreasing by 341,000 barrels per day to 9,482,000 barrels per day during the week ending May 12th, after our gasoline output had increased by 445,000 barrels per day during the prior week. This week’s gasoline production was 1.0% less than the 9,574,000 barrels of gasoline that were being produced daily over the same week of last year, and 4.3% less than the gasoline production of 9,912,000 barrels per day during the prepandemic week ending May 3rd, 2019. On the other hand, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 250,000 barrels per day to 4,856,000 barrels per day, after our distillates output had increased by 30,000 barrels per day during the prior week. Even with that increase, our distillates output was 0.5% less than the 4,880,000 barrels of distillates that were being produced daily during the week ending May 13th of 2022, and 7.8% less than the 5,264,000 barrels of distillates that were being produced daily during the week ending May 10th, 2019...

With this week's decrease in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the eleventh time in thirteen weeks, and for the 42nd time in 64 weeks, decreasing by 1,381,000 barrels to 218,330,000 barrels during the week ending May 12th, after our gasoline inventories had decreased by 3,167,000 barrels during the prior week. Our gasoline supplies fell by less this week because the amount of gasoline supplied to US users fell by 395,000 barrels per day to 8,908,000 barrels per day, even as our imports of gasoline fell by 9,000 barrels per day to 844,000 barrels per day, while our exports of gasoline rose by 179,000 barrels per day to 930,000 barrels per day. After eleven gasoline inventory decreases over the past thirteen weeks, our gasoline supplies were 0.8% below last May 13th's gasoline inventories of 220,189,000 barrels, and about 6% below the five year average of our gasoline supplies for this time of the year…

Meanwhile, with this week's big increase in our distillates production, our supplies of distillate fuels increased for the 2nd time in 10 weeks, rising by 80,000 barrels to 106,233,000 barrels during the week ending May 12th, after our distillates supplies had decreased by 4,170,000 barrels to a six month low during the prior week. Our distillates supplies managed an increase this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, decreased by 299,000 barrels per day to 3,736,000 barrels per day, and because our exports of distillates fell by 42,000 barrels per day to 1,236,000 barrels per day, while our imports of distillates rose by 17,000 barrels per day to 128,000 barrels per day.... Even after 64 inventory withdrawals over the past one hundred and three weeks, our distillate supplies at the end of the week were 2.0% above the 104,029,000 barrels of distillates that we had in storage on May 13th of 2022, but are still about 16% below the five year average of our distillates inventories for this time of the year...

Finally, even with 1.3 million barrels per day of new oil supplies that the EIA could not account for, our commercial supplies of crude oil in storage rose for the 15th time in 21 weeks and for the 28th time in the past year, increasing by 5,040,000 barrels over the week, from 462,584,000 barrels on May 5th to 467,624,000 barrels on May 12th, after our commercial crude supplies had increased by 2,951,000 barrels over the prior week. Even after several large oil supply increases in the weeks following the Christmas refinery freeze offs, our commercial crude oil inventories are still slightly below the most recent five-year average of commercial oil supplies for this time of year, but are around 30% above the average of our available crude oil stocks as of the second weekend of May over the 5 years at the beginning of the past decade, with the apparent disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, then jumped again after February 2021's winter storm Uri froze off US Gulf Coast refining, but then fell in the wake of the Ukraine war, our commercial crude supplies as of this May 12th were 11.1% more than the 420,820,000 barrels of oil we had in commercial storage on May 13th of 2022, but were still 3.8% less than the 486,011,000 barrels of oil that we still had in storage in the wake of winter storm Uri on May 14th of 2021, and 11.1% less than the 526,494,000 barrels of oil we had in commercial storage after the pandemic effects took hold on May 15th of 2020…

This Week's Rig Count

The number of drilling rigs active in the US decreased for the tenth time in the past fourteen weeks during the week ending May 19th, and is now 9.2% below the prepandemic count, despite increasing ninety-nine times over the past 137 weeks... Baker Hughes reported that the total count of rotary rigs drilling in the US fell by 11 rigs to 720 rigs over the past week, which was 8 fewer rigs than the 728 rigs that were in use as of the May 20th report of 2022, and was also 1,209 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business. .

The number of rigs drilling for oil fell by 11 to 575 oil rigs during the past week, after the number of rigs targeting oil had fallen by two rigs during the prior week, and there is now one less oil rig active now than was running a year ago, as they amount to just 35.7% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and while they are now down 15.8% from the prepandemic oil rig count of 683….at the same time, the number of drilling rigs targeting natural gas bearing formations was unchanged at 141 natural gas rigs, which was still down by 9 natural gas rigs from the 150 natural gas rigs that were drilling during the same week a year ago, and as they now amount to just 8.8% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008….

In addition to those rigs specifically targeting oil and natural gas, Baker Hughes shows that four rigs they've labeled as "miscellaneous" are drilling this week: those include a directional rig drilling to between 10,000 and 15,000 feet into a formation in Beaver county Utah, a directional rig drilling to between 5,000 and 10,000 feet on the big island of Hawaii, a directional rig drilling to between 5,000 and 10,000 feet into a formation in Lake county California that Baker Hughes doesn't track, and a directional rig drilling to between 5,000 and 10,000 feet into a formation in Pershing county Nevada, also into a formation unnamed by Baker Hughes. While we haven't seen any details on any of those wells, in the past we've identified various "miscellaneous" rig activity as being for exploration rather than production, for carbon dioxide storage, and for utility scale geothermal projects....Four operating at once is unusual; a year ago, there were two such "miscellaneous" rigs running...

The offshore rig count in the Gulf of Mexico was down by one to 21 rigs this week, with 18 of those rigs drilling for oil in Louisiana's offshore waters, one drilling for natural gas offshore from Vermilion, Louisiana, and two drilling for oil in Texas waters....that Gulf rig count is up by 4 from the 17 Gulf rigs running a year ago, when all 17 Gulf rigs were drilling for oil offshore from Louisiana…however, since there was a rig drilling offshore from Alaska during the same week a year ago, the national total of 21 rigs drilling offshore is up by 3 rigs from the national offshore count of 18 a year ago..

In addition to rigs running offshore, there are still two inland water based deployed this week...one is a vertical rig drilling for natural gas to between 10,000 and 15,000 feet on a lake in Jefferson Parish Louisiana, while the other is a directional rig drilling for oil at a depth of between 10,000 and 15,000 feet through an inland body of water in Lafourche Parish, Louisiana...a year ago, there was just one such rig drilling on inland waters...

The count of active horizontal drilling rigs was down by ten to 650 horizontal rigs this week, which was 14 fewer rigs than the 664 horizontal rigs that were in use in the US on May 20th of last year, and only 47.3% of the record 1,374 horizontal rigs that were drilling on November 21st of 2014…at the same time, the directional rig count was down by 1 to 51 directional rigs this week, but those were up by 12 from the 39 directional rigs that were operating during the same week a year ago....on the other hand, the vertical rig count was unchanged at 19 vertical rigs this week, but those were down by 6 from the 25 vertical rigs that were in use on May 20th of 2022…

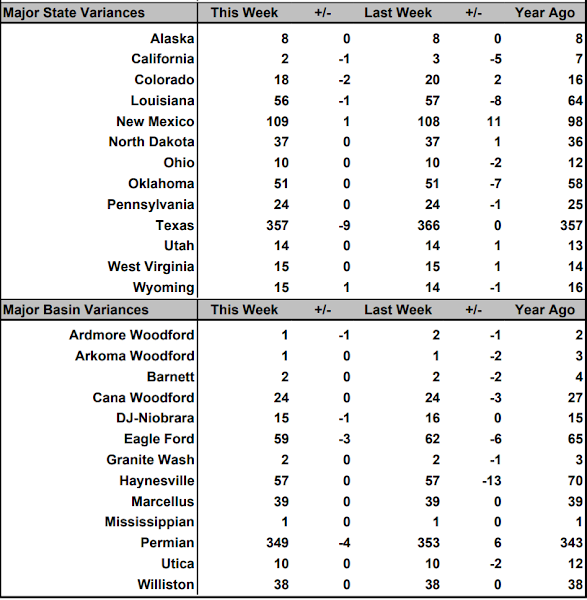

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of May 19th, the second column shows the change in the number of working rigs between last week’s count (May 12th) and this week’s (May 19th) count, the third column shows last week’s May 12th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 20th of May, 2022...

this week we'll start by checking the Rigs by State file at Baker Hughes for the changes in the Texas Permian…there we find that there were five rigs pulled out of Texas Oil District 8, which overlies the core Permian Delaware, and that another rig was pulled out of Texas Oil District 8A, which includes the counties over the northern Permian Midland, while one rig was added in Texas Oil District 7C, which includes the counties over the southern Permian Midland.....since those changes indicate the Texas Permian rig count was down by 5 while the national Permian count was down by four, we can thus conclude the that rig added in New Mexico was set up in the far western Permian Delaware in the southeast corner of that state...meanwhile, in the Texas oil districts that include portions of the Eagle Ford Shale in Texas, which was down by 3 oil rigs this week, we find that three rigs were pulled out of Texas Oil District 1, that two more rigs were pulled out of Texas Oil District 2, and that another rig was pulled out of Texas Oil District 3, while two rigs were added in Texas Oil District 4, with all of those not all necessarily targeting the Eagle Ford...the net loss of four rigs in those four districts, plus the loss of 5 rigs in the Texas Permian thus accounts for this week's nine rig decrease in Texas drilling....

in other states, Colorado saw the removal of two oil rigs that had been drilling in the DJ Niobrara chalk, while Wyoming added a rig targeting that formation in Laramie County....the oil rig pulled from Oklahoma's Ardmore Woodford, meanwhile, must have been offset by the addition of another oil rig elsewhere in the state for the Oklahoma count to remain unchanged...at the same time, Louisiana was down a rig with the removal of an oil rig from the state's offshore waters, and California was down a rig with the removal of a shallow vertical oil rig that had been drilling in Kern county...

oddly enough, after last week had seen the largest drop in drilling for natural gas in over seven years, this week saw no net changes whatsoever among the natural gas rigs, although it's always possible that there were offsetting changes among gas rigs someplace that wouldn't show up in the totals..

DUC well report for April

Monday of the past week saw the release of the EIA's Drilling Productivity Report for May, which included the EIA's April data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions (click tab 3)....that data showed an decrease in uncompleted wells nationally for the 32nd time out of the past 34 months, as both well completions and drilling of new wells fell in April, and remained well below the average pre-pandemic levels...for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 42 wells, falling from a revised 4,905 DUC wells in March to 4,863 DUC wells in April, which was also 8.0% fewer DUCs than the 5,288 wells that had been drilled but remained uncompleted as of the end of April of a year ago...this month's DUC decrease occurred as 1,021 wells were drilled in the 7 regions that this report covers (representing 87% of all U.S. onshore drilling operations) during April, down one from the 1,022 wells that were drilled in March, while 1,063 wells were completed and brought into production by fracking them, down from the 1,075 well completions seen in March , but up by 190 from the 873 completions seen in April of last year....at the April completion rate, the 4,676 drilled but uncompleted wells remaining at the end of the month represents a 4.6 month backlog of wells that have been drilled but are not yet fracked, down from the 4.7 month DUC well backlog of a month ago, but up from the 7 1/2 year low of 4.4 months of six months ago, despite a completion rate that is now about 13% below 2019's pre-pandemic average...

Oil basin DUCS fell in April while natural gas basin DUCs were a bit higher, as three out of the seven basins covered by this report saw DUCs increase....the number of uncompleted wells in the Permian basin of west Texas and New Mexico decreased by 36, from 951 DUC wells at the end of March to 915 DUCs at the end of April, as 474 new wells were drilled into the Permian basin during April, while 510 already drilled wells in the region were being fracked....at the same time, DUC wells in the Bakken of North Dakota were down by 12 to 565 by the end of April, as 79 wells were drilled into the Bakken during April, while 91 of the drilled wells in the Bakken were being fracked.....in addition, DUCs in the Eagle Ford shale of south Texas decreased by 8, from 502 DUC wells at the end of March to 494 DUCs at the end of April, as 110 wells were drilled in the Eagle Ford during March, while 118 of the already drilled Eagle Ford wells were fracked...on the other hand, DUC wells in the Niobrara chalk of the Rockies' front range increased by 7, rising from 702 at the end of March to 709 DUC wells at the end of April, as 117 wells were drilled into the Niobrara chalk during April, while 110 Niobrara wells were completed....at the same time, the number of uncompleted wells remaining in Oklahoma's Anadarko basin increased by 1, rising from 739 at the end of March to 740 DUC wells at the end of April, as 65 wells were drilled into the Anadarko basin during April, while 66 Anadarko wells were completed....

among the natural gas producing regions, the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, decreased by five wells, from 708 DUCs at the end of March to 703 DUCs at the end of April, as 102 new wells were drilled into the Marcellus and Utica shales during the month, while 107 of the already drilled wells in the region were fracked....on the other hand, the uncompleted well inventory in the natural gas producing Haynesville shale of the northern Louisiana-Texas border region rose by 11, from 726 DUCs in March to 737 DUCs by the end of April, as 73 wells were drilled into the Haynesville during April, while just 62 of the already drilled Haynesville wells were fracked during the same period....thus, for the month of April, DUCs in the five major oil-producing basins tracked by this report (ie., the Anadarko, Bakken, Niobrara, Permian, and Eagle Ford) decreased by 46 to 3,423 DUC wells, while the uncompleted well count in the major natural gas basins (the Marcellus, the Utica, and the Haynesville) increased by 4 to 1,440 DUC wells, although as this report notes, once into production, more than half the wells drilled nationally will produce both oil and gas...

+++++++++++++++++++++++++++++++++++++++++++++++++.

Ohio Environmentalists, Oil Companies Battle State Over Dumping of Fracking Wastewater - Ten years ago, Tim Kettler asked local officials to stop spreading liquid waste from fracking on the road near his home in Warsaw, Ohio, because he was worried that the fluid would contaminate a pond where he gets his drinking water. They complied with his request, but the practice continues in many other places across the state, and threatens to taint its groundwater with radioactivity and a cocktail of other contaminants in the residue from natural gas drilling. Water from the pond, downhill from the road where the salty waste was once spread, remains clean and drinkable, but that hasn’t stopped Kettler and other activists in Ohio from campaigning against a practice that has been used for years to de-ice roads in the winter and keep dust down in the summer. They say that high levels of two kinds of radium in the waste, known as produced water, as well as its extreme salinity, is already damaging the environment where the brine is spread and will eventually find its way into underground sources where people get their drinking water. Millions of gallons of produced water from fracking in the region have been pumped into more than 200 underground injection wells—either purpose-built or reused oil and gas wells—as oil and gas production has surged in the Appalachian states, raising fears that the natural environment is being contaminated, and that public water sources are being poisoned. “Putting our water at risk, especially in the area where there are known earthquake faults, just seems pretty wrong-headed,” said Kettler, who owns a wastewater business, and is a member of the Ohio Brine Task Force, an advocacy group that works to stop produced water from fracking from being spread on roads. “The constituents of this wastewater are known to be toxic and radioactive. Putting that on the ground, especially where people use surface water for their domestic water supply, as I do—where runoff is inevitable—is a problem.” Ohio’s Department of Natural Resources says about 22 million barrels of produced water from Ohio sources—924 million gallons—were pumped into injection wells in 2022, and another 12 million barrels—504 million gallons—came from out-of-state sources, including Pennsylvania. Produced water contains dozens of highly toxic chemicals along with naturally occuring poisons like arsenic and radioactive material like radium 226 and 228. It is far saltier than ocean water, which makes it deadly to most plants and freshwater life. Pennsylvania has only 12 active injection wells for fracking waste because it does not have “primacy” over the wells, and so must obtain approval from the U.S. Environmental Protection Agency before issuing permits. By contrast, Ohio has primacy, and so has permitted many more injection wells. There are 234 now operating in Ohio plus “a few” applications pending, the Department of Natural Resources said.

Cleveland U Study: Ohio Utica Shale Investment Tops $100 Billion | Marcellus Drilling News -- JobsOhio, a private, nonprofit corporation that works on behalf of the state to drive job creation and new capital investment in Ohio by attracting business, contracts out economic research to Cleveland State University (CSU) to keep tabs on the Utica Shale industry. JobsOhio released the latest CSU updated report yesterday (full copy below), showing that more than $100 billion has been invested in Ohio across natural gas, natural gas liquids, and petrochemical supply chain industries in just over ten years. Massive!

Ohio's Growing Shale Energy Industry Attracted $2.8 Billion in Direct Investment in First Half of 2022, With Cumulative Investment Surpassing $100 Billion- Total investment in Ohio’s resource-rich shale energy sector was approximately $2.8 billion in the first half of 2022, according to a Cleveland State University (CSU) study. Prepared for JobsOhio, the latest report covers shale investment from January through June 2022 and cumulates total investment from 2011 forward. The study from CSU’s Energy Policy Center at the Maxine Goodman Levin College of Urban Affairs revealed that, with previous investments to date, cumulative oil and gas investment in Ohio through June 2022 is estimated to be $100.6 billion. Of this, $70.8 billion has been in upstream, $21.5 billion in midstream, and $8.3 billion in downstream industries. The study showed that cumulative shale investment steadily rose between 2016 and 2022, particularly with upstream investments. Overall upstream investments increased by about $628 million in the first half of 2022 compared to the second half of 2021, reflecting higher royalty earnings due to higher oil and gas prices and new well development. Indirect downstream investment, such as the development of new manufacturing due to lower energy costs, was not investigated as part of this study. “In just over ten years, more than $100 billion has been invested in Ohio across natural gas, natural gas liquids, and petrochemical supply chain industries. Vital to our growing and diverse economy, this important sector continues to provide high-paying jobs to hard-working Ohioans,” said J.P. Nauseef, JobsOhio president and CEO. “Manufacturers worldwide are now realizing that Ohio is one of the most advantageous states for natural gas and natural gas liquids consumption – that feedstock, combined with our infrastructure, access to end-use markets, and the highly-skilled workforce that calls Ohio home.” “The 30% increase in the number of new wells drilled is responsible for most of the new spending in the first half of 2022,” said Andrew Thomas, Director of the Energy Policy Center at Cleveland State University. “This increase indicates that the upstream industry has largely recovered from the supply chain problems that plagued the industry during the time of COVID.” Upstream activities, such as drilling, roads, and royalties, accounted for nearly $2.8 billion of this total investment. As determined from Ohio Department of Natural Resources Division of Oil and Gas (ODNR) data for shale well drilling, operators drilled 113 new wells during the first and second quarters of 2022, nine fewer than the number drilled in the second half of 2019 – the last pre-COVID study period. Data also indicated that the total volume of gas-equivalent shale production in the first half of 2022 was 2.7% less than overall production in the second half of 2021. Unsurprisingly, mid and downstream investments lag behind the upstream recovery. The first half of 2022 saw midstream investment of $37.1 million, around half the spending for this segment compared to the previous six-month period. Most midstream investment during the Study period ($30.8 million) was for gathering system buildout. Future midstream investment will include Ohio’s share of the $161 million Ohio Valley Connector Expansion project to increase takeaway capacity out of the region, which was actively under development as of March 2023. There were no significant downstream investments during the first half of 2022. However, site work has recently begun on the $1.2 billion natural gas-fired Trumbull Energy Center near Lordstown. Also, construction on a second natural gas-fired power plant in Oregon, OH, is planned to commence in the coming year. Natural gas-based hydrogen projects will present additional downstream opportunities in the next few years. In December 2022, JobsOhio released a study from Shale Crescent USA, a nonprofit focused on promoting the manufacturing advantages created by abundant natural resources available in Ohio, Pennsylvania, and West Virginia, dispels the long-held belief that plastic-based goods are cheaper to import than manufacture locally. The study revealed that the low-cost gas and natural gas liquids flowing from the U.S. Shale Gas Revolution has the potential to turn the $53 billion U.S. plastics importing industry on its head.

26 New Shale Well Permits Issued for PA-OH-WV May 8-14 | Marcellus Drilling News - New shale permits issued for May 8-14 in the Marcellus/Utica rose from the prior week. There were 26 new permits issued last week, up from 20 in the prior week (and 18 the week before that). Last week’s tally included 13 new permits for Pennsylvania, 10 new permits for Ohio, and 3 new permits in West Virginia. Last week the top receiver of new permits was CNX Resources, with 7 permits issued (5 of them in Westmoreland County, PA, and 2 in Greene County, PA). Encino Energy, showing up as EAP Ohio in the report, had the second-highest tally with 5 permits (issued in Harrison County, OH). Antero Resources, CNX Resources, Columbiana County, Encino Energy, Energy Companies, EQT Corp, Fayette County, Greene County (PA), Harrison County, Hilcorp Energy,Marshall County, Noble County, Olympus/Huntley & Huntley, Repsol,Southwestern Energy, Tioga County (PA), Tug Hill Operating, Westmoreland County, Wetzel County

O&G Contributed $143B, 847K Jobs in PA, OH, WV Economies in 2021 -- Marcellus Drilling News - Every so often, the lying left will poke its head up and make the wild claim that the shale industry hasn’t done a darned thing for the jobs or economy in various states–like Pennsylvania, Ohio, and West Virginia (see Heinz Endowments Launches Another Fake ‘Report’ Bashing the M-U). They say, “All those claims of jobs created and economic benefits are just smoke and mirrors.” We say the environmental left is full of (expletive deleted). And we can prove it. Earlier this week, the American Petroleum Institute (API) released a massive new report compiled by PricewaterhouseCoopers (PwC) on the growing economic contributions of America’s natural gas and oil industry in all 50 states, including PA, OH, and WV, in 2021. For those three states (PA, OH, WV) in 2021, the O&G industry (largely shale) collectively contributed over$143 billion to state economies and supported more than 847,000 jobs! Stick that in your bong and smoke it, Big Green.

Upgrades to Eastern Gas Metering Station in Plum Done by Summer --Marcellus Drilling News - Eastern Gas Transmission and Storage (EGTS), a subsidiary of Warren Buffett’s Berkshire Hathaway Energy company, provides natural gas transportation and storage services with one of the largest underground natural gas storage systems in the United States. Essentially EGTS is a pipeline network that connects to other pipelines to flow and store natural gas in six states: Maryland, New York, Ohio, Pennsylvania, Virginia, and West Virginia. An upgrade of an EGTS metering station in Plum (Allegheny County, PA, near Pittsburgh) is currently under construction and due to be complete “by summer.”

Mountain Valley Pipeline gets new permit to build in Appalachian national forest - (AP) — A controversial and long-delayed natural gas pipeline got the green light for construction on national forest land in Virginia and West Virginia after the U.S. Forest Service reissued its approval for a permit, despite past federal appeals court rulings determining developers had “inadequately considered” the project's environmental impact. Monday night's decision will allow the $6.6 billion Mountain Valley Pipeline to be built — for now — across a 3.5-mile (5.6-kilometer) corridor through the Jefferson National Forest. The 303-mile pipeline would transport natural gas that is drilled in Ohio and Pennsylvania across rugged slopes in the Appalachian Mountains. Environmental groups say construction has led to violations of regulations meant to control erosion and sedimentation. Mountain Valley Pipeline LLC, the joint venture behind the project, still has other federal permits it will need approved as it works to complete the pipeline by the end of this year. Environmental advocates like Wild Virginia Conservation Director David Sligh said Tuesday that the Biden administration is favoring fossil fuels even as it “claims to advance environmental justice.” “This is the third time those who should guard our public treasures have failed us,” Sligh said. In previous litigation, the 4th U.S. Court of Appeals has twice vacated U.S. Forest Service decisions allowing for the pipeline in the Jefferson National Forest. Sligh also said the pipeline “remains far from completion,” saying 88 miles of the proposed route is still incomplete in Virginia. That is despite assurances the project is almost finished from developers and pipeline-supporting politicians like U.S. Sen. Joe Manchin, a moderate Democrat from West Virginia who chairs the Senate Energy and Natural Resources Committee. Manchin said Tuesday the natural gas line is “a crucial piece of energy infrastructure” that is good for global supply and American energy security. The fact that the U.S. Forest Service has approved construction three times shows “the review has been exceptionally thorough,” he said in a statement. In a separate decision, the 4th U.S. Circuit Court of Appeals revoked a key water permit last month because it said West Virginia's environmental protection agency didn’t adequately address the pipeline’s history of water quality violations. It also ruled that the agency used the wrong standards to support the decision that in-stream activities would meet state water quality regulations. The permit is required under the federal Clean Water Act. The court noted at least 46 water quality violations and assessed civil penalties totaling roughly $569,000. U.S. Forest Service officials said in the agency's decision Monday that the amended plan will permit the project to move forward while “minimizing environmental impacts to soils, water, scenery and other resources.” The plan contains requirements like one that 85% of soils dedicated to growing vegetation be left in place and that revegetation of the area be completed within five years, with the exception of the construction zone and right-of-way. Jill Gottesman, a top regional director for The Wilderness Society, said in a statement this week that the decision means groups like hers opposing the project will have “no choice but to take this battle back to court.” “The Forest Service has bent to the will of the oil and gas industry, and is placing fossil fuel profits above our environment and public safety,” she said.

Mountain Valley Pipeline gains approval to pass through forest, still faces more hurdles - The U.S. Forest Service has approved Mountain Valley Pipeline’s passage through the Jefferson National Forest through West Virginia and into Virginia.The federal agency issued a record of decision on Monday, approving amendments to its Land and Resource Management Plan to do so. The pipeline project still faces additional regulatory and legal hurdles.“The agency’s decision is a notable step forward in completing this critical infrastructure project, and we expect the Bureau of Land Management to soon issue the project’s right-of-way permit to cross the Jefferson National Forest,” stated Natalie Cox, vice president for communications at Equitrans Midstream Corp., the pipeline’s developer.The decision pleased pipeline project supporters like Senator Joe Manchin, D-W.Va., and received criticism from environmental groups.“The Mountain Valley Pipeline is a crucial piece of energy infrastructure that will help balance global supply and demand while strengthening our energy and national security,” stated Manchin, chairman of the Senate Energy Committee.“The Forest Service has now reviewed and signed-off on this project three separate times, which should provide confidence for everyone, including the courts, that the review has been exceptionally thorough. While I’m pleased with the announcement from the Forest Service, the job isn’t done yet, and I will keep pushing the Administration and all involved to finally complete the last 20 miles of this vital pipeline.” The $6.6 billion pipeline project first got authorization from the Federal Energy Regulatory Commission in 2017, but its completion has been delayed by regulatory hurdles and court challenges.The Mountain Valley Pipeline is a proposed 303.5-mile interstate natural gas pipeline that would cross nine West Virginia counties to transport natural gas to East Coast markets. The pipeline’s developers have said they intend to bring the pipeline into service in the second half of 2023.The developers have said the pipeline’s construction is near completion, but it has faced multiple legal challenges to its permits, such as authorization to construct in the Jefferson National Forest.The 4th U.S. Circuit Court of Appeals has twice knocked down earlier Forest Service approvals for the pipeline, in 2018 and then again last year.

Manchin aims to bring energy infrastructure permitting reform bill to Senate floor for vote by August - Sen. Joe Manchin, D-W.Va., aims to bring bipartisan permitting reform legislation to the Senate floor for a vote by July 31, the tentative start of the chamber’s summer recess, he said Thursday. “That's pretty aggressive. We're going to get it done,” Manchin, chairman of the Senate Energy and Natural Resources Committee, said during a hearing on permitting reform. “We can get together much quicker if we’re all in this, and I think we are. We want this done and everybody wants it done.” Any permitting reforms must apply equally to all energy sources, said Wyoming Sen. John Barrasso, the energy committee’s top Republican. Several permitting reform bills have been introduced in the Senate. They include Manchin’s Building American Energy Security Act, which is similar to a bill he introduced last year, and the SPUR Actand RESTART Act offered separately by Barrasso and Sen. Shelley Moore Capito, R-W.Va., ranking member of the Senate Environment and Public Works Committee. Sen. Tom Carper, D-Del., chairman of the environment committee, plans to introduce a permitting bill, possibly this month. Also, the House in March passed permitting reform legislation that was included in a debt limit bill. “We all need to sit down and negotiate in good faith – putting politics aside – to craft the Bipartisan Permitting Reform Bill,” Manchin said, noting he plans to hold sector-specific energy permitting hearings to inform that effort. White House senior clean energy advisor John Podesta on Wednesday said the Biden administration supports Manchin’s bill. However, there are “yawning gaps” between Republican and Democratic permitting reform priorities, ClearView Energy Partners said in a client note Wednesday. “We do not observe many areas of overlap, and even fewer areas of real consensus between the partisan proposals,” the research firm said. “We think that Podesta’s speech clearly indicates that permitting reform is on the table, but agreeing to terms from such vastly different starting points remains a challenge.” Pioneer Public Affairs, a consulting firm, echoed ClearView’s analysis. “There is substantial – if not overwhelming – agreement that some changes to various permitting processes are needed; however, there is no consensus or general agreement on where to focus to make the biggest difference,” Pioneer said in a memo Wednesday.

Granholm defends support for gas pipeline, citing energy security - Energy Secretary Jennifer Granholm on Thursday defended her support for moving forward with the Mountain Valley Pipeline, an Appalachian natural gas project opposed by environmental activists — including several who disrupted POLITICO’s energy summit in D.C.Granholm endorsed the pipeline in a recent letter to the Federal Energy Regulatory Commission — the federal agency that regulates the nation’s sprawling pipelines — arguing the controversial project is needed for U.S. energy security, but is also crucial to transitioning to a zero-emissions power system. One of pipeline’s big champions is Senate Energy Chair Joe Manchin(D-W.Va.), who provided the crucial vote for President Joe Biden’s climate bill last year.“We know that there is a real desire to have energy security in areas where there’s huge demand for power,” Granholm said during the summit. “We also know that we have got to accelerate investment in clean [energy].”The remarks underscore the Biden administration’s balancing act in meeting its goals of ending carbon pollution from fossil fuels while acknowledging the continued role of the oil and gas industry in the economy.The secretary’s remarks were disrupted by a handful of protesters who rushed toward the stage, shouting variations of “no MVP” and “Granholm, you are killing me.”.In response to a later question on the Biden administration’s support for sending natural gas abroad to help U.S. allies cope with market disruptions from Russia’s invasion of Ukraine, Granholm acknowledged the trade-offs.“To the point of the protesters here, these are really hard decisions,” she said. “We are in this transition. We want to be able to ensure that our allies can turn on the lights.”The secretary said the U.S. has an abundance of natural gas and is going to be “a friend” to its allies, while also working with them to accelerate the transition to clean energy sources.

US NatGas Drilling Collapses At Fastest Rate Since 2016 -According to a new report from Baker Hughes Co., the US natural gas sector is rapidly pulling drilling rigs from the field due to oversupply conditions that have led to a collapse in NatGas prices over a nine-month period. Baker Hughes reported Friday that exploration companies reduced rigs by 16 to 141 this week. This is the most significant weekly decline since February 2016. Nabors Industries Ltd., one of the top providers of rigs to shale drillers, warned last month about the fall in rig orders. The rig provider expects a 9% slide in its US rig leases by the end of June. Its bearish forecast comes as prices once commanded more than $10 per million British thermal units in late August 2022 and have since plunged to $2.25. Bloomberg explained a combination of factors led to the NatGas glut:"The glut developed after a key US gas-export facility was shut by a fire and abnormally mild winter weather gutted heating demand."The good news is that low prices have pushed drillers to curtail production growth. Comstock Resources Inc. and Southwestern Energy Co. have already said drilling in Louisiana's Haynesville Shale region would be reduced. "What's going to suffer the most is the number of drilling rigs," said Angie Gildea, who heads KPMG LLP's US energy, natural resources, and chemicals team. She noted companies "will take lower production growth over having to reduce dividends to shareholders." Meanwhile, Citigroup Inc. analysts warn some exploration companies are shutting down existing wells due to the supply glut and low prices. "We expect further reductions across both natural gas rigs and frac fleets in the Haynesville, while throttling and shut-ins are likely to be needed across all basins by the summer," Citigroup's Paul Diamond wrote in a note to clients. Low NatGas prices plus tighter credit conditions will make it even more challenging for drillers to tap credit lines from big banks. This is the necessary step to correct oversupply conditions.

Natural Gas Futures, Cash Prices Rally on Heels of Rig Count Drop --Natural gas futures traders shrugged off continued mild weather forecasts and elevated supply data, seizing instead on a sharp drop in the weekly rig count to push prices higher for a second day. Following a 7.6-cent gain to close out last week’s trading, the June Nymex gas futures contract on Monday advanced 10.9 cents day/day and settled at $2.375/MMBtu. July followed suit, rising 10.4 cents to $2.542. NGI’s Spot Gas National Avg. jumped 38.5 cents to $2.035, rebounding from losses the prior week. Production held strong at 100 Bcf/d on Monday, according to Bloomberg’s estimate, within 2 Bcf/d of 2023 highs. However, the latest Baker Hughes data showed natural gas-directed rigs dropped by 16 to 141. The BKR data, released Friday and covering the week ended May 12, pointed to a potential pullback in production later this year. This galvanized bullish market sentiment because it is a sign that producers are beginning to move rigs away from gas-focused areas in response to low prices this year, The drop in gas-directed rigs marked the most precipitous decline since 2016 and followed comments during the first quarter 2023 earnings season from several producers that a slowdown loomed. Prices heading into this week were more than 70% lower than the peaks of 2022 in large part because of robust supplies and weak demand through what proved a mostly mild winter. New liquefied natural gas facilities are slated to open over the next few years to support expected long-term global demand for U.S. exports. This, by extension, could bolster prices over the long haul. Producers may be willing to stomach lower prices for longer in order to maintain momentum for the future demand jump. Meanwhile, weather-driven demand in the near-term remains elusive, production is steady and supplies in storage are stout. The combination is expected to result in triple-digit storage injections through the remainder of May and into early next month, There is “the potential the streak extends to five or six weeks without hotter trends in early June,” “Clearly, weather patterns are to the bearish side, and it doesn’t help that the background state remains quite bearish with surpluses at plus-332 Bcf, while forecast to increase to plus-375 Bcf by the end of May.”

US natgas jumps 10% to nine-week high on small storage build, Canada wildfires (Reuters) - U.S. natural gas futures jumped about 10% to a nine-week high on Thursday on a smaller-than-expected U.S. storage build and as wildfires kept gas exports from Canada near a 25-month low. Energy analysts also noted prices extended their gains after breaking through a key level of technical resistance. The U.S. Energy Information Administration (EIA) said utilities added just 99 billion cubic feet (bcf) of gas to storage during the week ended May 12. That, however, was still more than usual for this time of year because mild weather kept demand for the fuel low for both heating and cooling. But it was less than the 108-bcf build analysts had forecast in a Reuters poll and compared with an increase of 87 bcf in the same week last year and a five-year (2018-2022) average increase of 91 bcf. Last week's increase boosted stockpiles to 2.240 trillion cubic feet (tcf), or 17.9% above the five-year average of 1.900 tcf for the time of year. Front-month gas futures for June delivery on the New York Mercantile Exchange rose 22.7 cents, or 9.6%, to settle at $2.592 per million British thermal units (mmBtu), their highest close since March 13. That was also the contract's biggest one-day percentage gain since it jumped about 11% in late April. Data provider Refinitiv said average gas output in the U.S. Lower 48 states held at 101.4 billion cubic feet per day (bcfd) so far in May, matching the monthly record high in April. The amount of gas flowing from Canada to the U.S. dropped to a fresh 25-month low of 6.4 bcfd on Wednesday as wildfires in Alberta caused some producers to shut oil and gas output and pipeline flows over the past couple of weeks. During those two weeks, U.S. gas futures gained about 20% as Canada exported an average of just 7.1 bcfd of gas to the U.S. That is down from an average of 8.4 bcfd since the start of the year and 9.0 bcfd in 2022. About 8% of the gas consumed in the U.S. or exported as liquefied natural gas (LNG) or via pipelines comes from Canada. Meteorologists projected the weather in the U.S. Lower 48 states would switch from near-normal levels from May 18-27 to warmer than normal from May 28-June 2. Refinitiv forecast U.S. gas demand, including exports, would slide from 93.0 bcfd this week to 89.6 bcfd next week. Gas flows to the seven big U.S. LNG export plants fell from a record 14.0 bcfd in April to an average of 12.9 bcfd so far in May due to maintenance work at several plants, including Cameron LNG in Louisiana and Cheniere Energy Inc's Sabine Pass in Louisiana.

US natgas holds near 9-week high on low wind power, Canada wildfires (Reuters) - U.S. natural gas futures held near a nine-week high on Friday after a technical bounce in the prior session and as a lack of wind power this week caused generators to burn more gas to produce electricity. Traders also said prices were supported this week by a drop in gas exports from Canada due to wildfires in Alberta and other western provinces. The amount of U.S. power generated by wind this week was on track to drop to just 7% of the total versus a recent high of 17% during the week ended April 21, according to federal energy data. That means power generators had to burn more gas to produce electricity, and there will be less of the fuel available to go into storage. The amount of power generated by gas was on track to hit 43% this week, up from a recent low of just 37% during the windy week ended April 21. Front-month gas futures for June delivery on the New York Mercantile Exchange fell 0.7 cents, or 0.3%, to settle at $2.585 per million British thermal units (mmBtu). On Thursday, the contract jumped about 10% to settle at its highest since March 13. For the week, the contract gained about 14% this week after rising about 6% last week. That was its biggest weekly percentage increase since early March when it soared about 23%. But all gas prices were not up. In the spot market, mild weather and ample hydropower in the U.S. West pressured next-day gas for Friday at the PG&E Citygate in Northern California to $3.62 per mmBtu, its lowest since April 2021. Over the past couple of weeks the average amount of gas flowing from Canada to the U.S. averaged just 7.1 billion cubic feet per day (bcfd) as wildfires in Alberta and other western provinces caused some producers to shut oil and gas output, according to data provider Refinitiv. That is well below the 8.4-bcfd average amount of gas exported from Canada to the U.S. since the start of the year and 2022's average of 9.0 bcfd. On a daily basis, Canadian gas exports were on track to reach 7.3 bcfd on Friday, up from a 25-month low of 6.4 bcfd on Wednesday. In the U.S., meanwhile, Refinitiv said average gas output in the Lower 48 states held at 101.4 bcfd so far in May, matching April's monthly record. Meteorologists projected the weather in the U.S. Lower 48 states would remain mostly near normal through June 3. Refinitiv forecast U.S. gas demand, including exports, would slide from 93.0 bcfd this week to 89.4 bcfd next week before rising to 90.7 bcfd in two weeks. The forecasts for this week and next were similar to Refinitiv's outlook on Thursday.

Global Natural Gas Demand Projected to Decline Through Remainder of Year, IEA Says - Global natural gas demand is expected to remain flat in 2023 with modest growth in the Asia-Pacific region offset by projected declines in Europe and North America, according to the International Energy Agency (IEA). The world’s natural gas consumption declined 1.5% year/year in 2022, driven largely by a sharp increase in prices after Russia invaded Ukraine and upended trade flows. The decline in demand, IEA said in its latest quarterly gas report, continued into the early months of this year due to favorable weather and “timely policy actions” in response to the energy crisis. “The improved outlook for gas markets in 2023 is no guarantee against future volatility and should not be a distraction from measures to mitigate potential risks,” IEA said.

Shale Drillers Are Auctioning Off Rigs at Bargain Basement Prices --The much-touted second shale boom has lately been getting a reality check as equipment demand declines sharply, a worrying sign that drilling in U.S. shale energy regions is leveling off. The Financial Times has reported that next week, Texas auctioneer Kruse Asset Management will auction off two unused, top-of-the-line drilling rigs valued at $40 million and $30 million when built in 2019 at starting bids of just $12.9M and $2.3M, respectively.“There’s no reason for them to be so cheap, but there’s just no demand,” Dan Kruse, chief executive of Kruse Asset Management, has told the Financial Times.According to Baker Hughes data, U.S. oil and natural gas rig count has declined 6% in the year-to-date to 731 last week, reversing a steady climb since the depths of the pandemic. The current tally is a far cry from the nearly 2,000 rigs that were running around mid-2014 at the peak of the shale boom. Last week, rig count for gas-directed rigs dropped by 16, or 10 per cent--the steepest weekly fall since 2016. Expectations foranother shale boom are getting tamped down due to rising costs as well as limited supplies of labor and equipment that continue to hamstring efforts by U.S. shale producers to quickly ramp up production.Still, a number of experts have predicted that U.S. production will continue growing. A week ago, the Energy Information Administration (EIA) forecast U.S. crude production will rise about 5% in 2023, while fuel demand will increase 1%.

Lower 48 Natural Gas Production Growth Seen Slowing in Latest EIA Modeling - Natural gas production growth from seven key Lower 48 regions will slow — but not stall — from May to June, adding 256 MMcf/d sequentially to crest the 97 Bcf/d mark, updating modeling from the Energy Information Administration (EIA) shows. EIA’s latest projections, published in its Drilling Productivity Report Monday, reflect a reduced sequential natural gas production growth rate when compared to previous modeling from the agency. In the month-earlier period, EIA modeled natural gas production growth of 332 MMcf/d from April to May from the seven plays tracked in the report. The month before that, the DPR had modeled growth of 420 MMcf/d from March to April. EIA’s DPR analyzes production trends in the Anadarko, Appalachia and Permian basins, as well as in the...

U.S. Natural Gas Pipeline Exports to Mexico Dip for First Time in Over a Decade Amid Record Prices - U.S. natural gas gas exports to Mexico via pipeline fell on a year/year basis in 2022 for the first time since 2010, according to the U.S. Department of Energy (DOE). DOE compiles a quarterly report on the North American natural gas trade. Gas flows to Mexico dipped to 5.7 Bcf/d in 2022 from 5.9 Bcf/d in 2021. “Exports to Mexico fell in every month relative to 2021, except for January and February,” DOE researchers said. The average price of gas exports to Mexico increased by 15.7% to $6.26/MMBtu. Nonetheless,“U.S. exports to Mexico have grown substantially in the past 20 years, especially in the past five years,” the DOE team said. “Growing demand for power generation and industrial uses in Mexico and an increase in pipeline capacity has been widely cited as the cause"... © 2023

Markey bill would restore ban on US fossil fuel exports - Sen. Ed Markey (D-Mass.) introduced legislation Thursday that will reimpose a ban on U.S. fossil fuel exports, citing environmental hazards and possible impacts on domestic prices. The measure would “help prioritize American consumers, protect our climate and promote environmental justice and put the United States on a path to self-sufficiency through domestic clean energy production,” Markey said Thursday at a press conference on Capitol Hill, flanked by supporters of the bill from communities in the Rio Grande Valley and the Gulf Coast. Markey disputed the idea that the ban would result in higher prices for American consumers, pointing to International Energy Agency data indicating that increased U.S. exports were accompanied by higher domestic prices for natural gas. “So ordinary families have to pay more on their natural gas bill, because the big oil and gas companies want to sell it overseas, but that leaves less here, which drives up the price for natural gas for people who are trying to heat their homes,” he said. Then-President Obama signed a bill in 2015 lifting a four-decade restriction on U.S. oil exports. Since the Russian invasion of Ukraine last February, U.S. exports of liquefied natural gas (LNG) in particular have surged as European nations end their imports of Russian oil. Reps. Adriano Espaillat (D-N.Y.) and Yvette Clarke (D-N.Y.) introduced corresponding legislation in the House. The bill is likely doomed in the GOP-majority House, but it marks the latest collaboration between Markey and climate-focused House Democrats aimed at promoting aggressive climate action.

Report: US Gulf of Mexico Oil Production Leads on GHG Intensity - The US National Ocean Industries Association (NOIA) has released a study on global oil production emissions that finds that the greenhouse gas intensity of US oil production, particularly in the U.S. Gulf of Mexico, is significantly lower than most other regions around the world. Prepared by ICF, the GHG Emission Intensity of Crude Oil and Condensate Production report, calculates that total US oil production has a carbon intensity 23% lower than the international average outside of the US and Canada. Additionally, the US Gulf of Mexico has a carbon intensity 46% lower than the global average outside of the US and Canada, outperforming other nations like Russia, China, Brazil, Iran, Iraq and Nigeria but not Saudi Arabia. Using the largest crude category from the Gulf of Mexico (API Gravity 37.5), instead of similar crudes from outside the US and Canada, could result in a 50% reduction in the average international carbon intensity. The report includes a sensitivity analysis of global methane emissions, indicating that US production, especially in the Gulf of Mexico, performs much better relative to the global average in terms of emissions intensity even when measured using other methane estimation methodologies. NOIA President Erik Milito says, “The US Gulf of Mexico energy production sets the standard for oil and gas production worldwide. The world needs both climate solutions and a growing amount of energy, and we don't have to choose between the two. Thanks to the remarkable efforts of the women and men producing energy in the Gulf of Mexico, we have an incredible source of reliable and responsibly produced energy. “The Gulf of Mexico produces a massive amount of energy with a remarkably small footprint, and its continued success is critical for our energy security, national security, and energy affordability. This study validates the importance of the US Gulf of Mexico as a source of energy with demonstrably lower carbon intensity barrels.”

US Plans To Buy 3 Million Barrels For SPR Days After It Drained 2.9 Million In One Week - With oil stubbornly the only asset class that is pricing in if not a depression then certainly a deep recession - even as every other asset is already pricing in the inevitable Fed easing in response to said recession - and the price of WTI tumbling as low as $63 at the start of May, the credibility behind the Biden administration's promise to restock the recently drained SPR has become the butt of all jokes. As a reminder, last Fall the White House said the aim was to refill the reserve when prices were at or below about $67-$72 per barrel. Since then oil prices had fallen far below without as much as a squeak from Biden's energy guru, Hunter. But that doesn't mean the pathological liars in the presidency will stop lying about refilling the Strategic Petroleum Reserve; in fact just the opposite... and mere days after the DOE again moved the goalposts to a June "refill", moments ago Bloomberg reported that the US is preparing to buy up to a whopping 3 million barrels of crude oil - or one tanker's worth - to begin refilling its depleted Strategic Petroleum Reserve. After selling more than 200 million barrels from the emergency stockpile last year to curb high energy prices and arrest the collapse of Democratic approval ratings, the Energy Department plans to solicit offers to replenish the reserve, which has fallen to the lowest level since 1983, according to Bloomberg. Which would be believable if only it wasn't one of the most recurring lie dispensed by an admin that views the price of gas like a hawk as if only gas prices will decide if the 80 year old Biden will get reelected. Of course, you will forgive us if we call even more bullshit from the admin that has taken lying to an artform, and which just last week drained 2.9 million barrels of oil from the SPR, long after it was supposed to have restarted refilling it. In addition to direct purchases, the agency has said part of its strategy for refilling the reserve includes a return of oil from previous exchanges, and avoiding “unnecessary sales unrelated to supply disruptions.” The department successfully cancelled some 140 million barrels of oil sales mandated by Congress. Last week, Energy Secretary Jennifer Granholm said the government would repurchase crude oil for the reserve after a congressionally mandated drawdown ends in June. She also claimed that the refill the SPR as soon as maintenance work is completed... or generally just kicking the can to doing anything at all. Case in point: an earlier attempt to refill the reserve, via another 'gargantuan' 3 million barrel-purchase, was canceled by the Energy Department in January, saying the offers it received were either too expensive or didn’t meet other specifications. Both explanations are the kind of pure, unadulterated bullshit one has come to expect from the most corrupt administration in US history, and explains why not only Gulf nations but US energy companies are counting the days until the senile occupant of the White House is once again voted out (only this time the fake mail in ballots won't keep him employed).

Methane Mitigation in Texas Could Create Thousands of Jobs in the Oil and Gas Sector - A new report finds that methane regulations proposed by the Environmental Protection Agency could spur job growth in Texas as oil and gas operators measure, monitor and mitigate the harmful greenhouse gas.While Texas officials argue the methane regulations would kill jobs, the report, published today by the Texas Climate Jobs Project and the Ray Marshall Center at the University of Texas, Austin, found that new federal methane regulations could create between 19,000 and 35,000 jobs in the state. Oil and gas producing regions, including the Permian Basin, would need a significant workforce to detect methane leaks, replace components known to leak the gas and plug abandoned wells. Previous research shows the methane mitigation industry is already growing.In the absence of state methane rules, the EPA’s draft methane rule, first issued in November 2021 and strengthened in a supplemental filing last November, along with a new methane fee under the Inflation Reduction Act, will have a major impact on oil and gas operations in the Lone Star state. The EPA’s methane regulations, to be finalized later this year, would reduce methane emissions 87 percent below 2005 levels by 2030. The Inflation Reduction Act’s first-ever methane fee for large emitters will also start in 2024 at $900 per ton of methane and increase to $1,500 per ton by 2026.Reducing methane emissions is one of the most effective short-term measures to slow the pace of climate change because methane traps about 80 times more heat in the atmosphere over a 20-year period than carbon dioxide.But Texas has been a stubborn opponent of federal methane regulations. In January 2021, shortly after Biden ordered the EPA to develop new methane rules, Gov. Greg Abbott issued an executive order directing state agencies to use every legal avenue to oppose federal action challenging the “strength, vitality, and independence of the energy industry.”

Oneok to Add Refined Products, Crude Oil Transportation Services with $18.8B Magellan Deal - Natural gas midstream company Oneok Inc. on Monday announced that it has agreed to purchase Magellan Midstream Partners LP for $18.8 billion, giving the Tulsa-based firm entry into the transportation of crude oil and refined products.

TC Energy finishes recovering oil from Kansas creek in Keystone spill (Reuters) – TC Energy Corp finished recovering oil from a rural Kansas creek where its Keystone Pipeline spilled 14,000 barrels of oil in December, the company said on Friday.The pipeline operator expects to remain onsite until the third quarter of this year to finish restoring the Mill Creek shoreline, TC Energy said in a statement.

Keystone pipeline owner says recovery of spilled oil into Kansas creek is complete | Nebraska Examiner — A Canadian pipeline company says it has completed the recovery of oil spilled into a Kansas creek following a record leak on the Keystone Pipeline. TC Energy, in a press release Thursday, said it continues to restore the shoreline of Mill Creek as well as adjacent areas affected when the high-pressure, 36-inch pipeline sprang a leak in December, releasing more than 500,000 gallons of crude oil. It was the largest oil pipeline spill in the U.S. in nine years and the largest leak on the 12-year-old Keystone pipeline. The pipeline leak was just across the Nebraska border near Washington, Kansas. The company said it expects to continue its work at the spill site until the third quarter of the year. TC Energy said it employed “sophisticated recovery and water filtration techniques” to collect the oil. The work was done under the oversight of the U.S. Environmental Protection Agency and Kansas Department of Health and Environment. The company has said that a flaw in a weld combined with “inadvertent bending stresses” on an elbow fitting during installation in 2011, combined with the high pressures employed to transport the oil, eventually led to the pipeline failure. Environmental groups have said the Keystone should be shut down because of its design flaws and that it’s only a matter of time before there’s another leak.

Keystone pipeline oil spill result of design and construction issues, operations lapses: report — Pipeline design issues, lapses by its operators and problems caused during its construction led to a massive oil spill on the Keystone pipeline system in northeastern Kansas, according to a report for U.S. government regulators. An engineering consulting firm said in the report that the bend in the Keystone system where the December 2022 spill occurred had been “overstressed” since its installation in December 2010 — likely because construction activity itself altered the land around the pipe. The U.S. Department of Transportation’s Pipelines and Hazardous Materials Safety Administration posted a redacted copy of the report online May 15, about three weeks after it was completed by RSI Pipeline Solutions, based in the Columbus, Ohio, area. The report raised questions about Canada-based TC Energy Ltd.’s oversight of the manufacturing of its pipeline, saying the report’s authors could find no record of a pre-installation inspection of the welds on the Washington County bend. The report concluded that TC Energy underestimated the risks associated with the bend going from its round shape when installed to a more-restricted oval shape within two years and didn’t replace the bend after excavating it in 2013. The company said in February that a faulty weld in the bend caused a crack that grew over time under stress. The spill dumped nearly 13,000 barrels of crude oil — each one enough to fill a standard household bathtub — into a creek running through a rural pasture in Washington County, Kan., about 240 kilometres northwest of Kansas City. It was the largest onshore spill in nearly nine years. “When you have a pipeline that is spilling and having as many problems as Keystone One, it is clearly a red flag that there are bigger issues going on,” said Jane Kleeb, who founded the Bold Nebraska environmental and landowner rights group that helped fight off TC Energy’s plan to build a second pipeline, the Keystone XL. The U.S. Department of Transportation has documented 22 leaks along the Keystone pipeline since it was built in 2010. The one in Washington County was by far the largest. “At what point, does the federal government … step in and say this has reached a point where we need to shut the full line down to do a full review of the pipeline?” Kleeb said. The 4,345-kilometre Keystone system carries heavy crude oil extracted in western Canada to the Gulf Coast and to central Illinois. Concerns that spills could pollute waterways ultimately scuttled TC Energy’s plans to build the Keystone XL across 1,900 kilometres of Montana, South Dakota and Nebraska.