US oil prices rose last week as oil traders refocused on supply and demand fundamentals after the prior week's panic sell-off…after falling 13% to a 15 month low of $66.74 a barrel last week in the wake of the second and third biggest bank failures in US history, the contract price for the benchmark US light sweet crude for April delivery fell over $3 in Asian trading on Monday, on fears that turmoil in the global banking sector would spark a recession that would sap fuel demand, and traded off 1% in early New York trading as a deal in which UBS, Switzerland’s largest bank, agreed to buy Credit Suisse in an attempt to rescue the country’s second biggest bank, failed to ease banking concerns, but rallied late in the session to settle the session 90 cents higher at $67.64 a barrel, supported by a sharp retreat in the U.S. dollar as traders positioned ahead of the two-day Fed policy meeting, when officials were expected to deliver another round of interest rate increases amid still high inflation....oil prices headed higher at the open on the last day of trading for April oil on Tuesday, with increasing demand and disruptions in supply pushing prices higher, then advanced more than 1.5% after Russia announced it would extend its unilateral 500,000 bpd production cut, and finished trading $1.69 or 2.5% higher at $69.33 a barrel, while the more actively traded contract for US oil for May delivery settled $1.85 higher at $69.67 a barrel, as measures to stabilize the banking sector and pledges from major central banks to boost liquidity calmed the fears about the financial system that had been roiling markets...now quoting the price of the May oil contract, oil prices rallied early Wednesday after the EIA reported huge drawdowns of fuel products, and continued on their upward trend despite an unexpected build in crude stocks as the dollar fell to a six-week low ahead of the Fed’s decision on interest rates in the afternoon, and settled $1.23 higher at $70.90 a barrel as the U.S. dollar declined sharply after Fed raised the federal funds rate 25 basis points while acknowledging turmoil in the banking sector could slow the already fragile economy...oil prices started rising for a 4th day on Thursday after Goldman Sachs analysts said they expected higher oil prices 12 months from now, pointing to a forecast demand increase in China to more than 16 million barrels daily over the period, but sold off sharply ahead of the close after U.S. Energy Secretary Jennifer Granholm said that refilling the country’s SPR would be difficult this year and might take several years, and settled 94 cents lower at $69.96 a barrel as fading confidence in the financial system reignited fears that another crisis might be looming...oil prices then plunged by 4% early on Friday as the U.S. dollar rallied and banking stocks in Europe crashed in a sign of renewed pressure on the sector, but recovered to trade modestly higher by midday on the expectation of returning Chinese demand and amid a growing consensus that fears of a banking crisis were overblown, before turning lower again and settling with a 70 cent loss on the day at $69.26 a barrel, paring its weekly gains as fresh signs of stress in the banking sector caused investors to move away from riskier assets ahead of the weekend....oil prices still ended 3.8% higher on the week, while the contract for US oil for May delivery, which ended last week at $66.93 a barrel, finished 3.5% higher...

natural gas prices, on the other hand, finished lower as expectations of coming spring weather more than offset slightly cooler near term forecasts...after falling 3.8% to $2.338 per mmBTU in the widespread market rout following the failed bank takeovers last week, the contract price of US natural gas for April delivery opened higher but quickly traded lower on Monday morning, on expectations that weather driven demand would weaken by the end of the month, and tumbled 11.5 cents or 5% to settle at $2.223 per mmBTU as intensifying stress in the global financial system overwhelmed the bulls seizing upon favorable near-term weather, steady export demand and expectations of a seasonally robust inventory withdrawal...but Monday's action was reversed on Tuesday, as natural gas prices opened lower but quickly moved higher as bulls jumped in on the news of gas production cuts and gas settled with a 12.5 cent gain at $2.348 per mmBTU on short covering after prices hit their lowest in a month...but natural gas prices fell from the open on Wednesday on rising output and declining demand and settled 17.7 cents lower at $2.171 per mmBTU, succumbing to spring weather expectations and stout production levels...natural gas prices crept higher early Thursday and rose to an intraday high of $2.261 soon after Thursday's storage report, which was in line with industry expectations, but faded thereafter to settle 1.7 cents lower at $2.154 per mmBTU on afternoon forecasts for less cold weather and lower heating demand over the next two weeks than was previously expected...natural gas prices then traded up on Friday, boosted by colder forecasts and expectations for back-to-back bullish storage draws relative to historic norms, and settled 6.2 cents higher at $2.226 per mmBTU, but still finshed 5.2% lower for the week...

The EIA's natural gas storage report for the week ending March 17th indicated that the amount of working natural gas held in underground storage in the US fell by 72 billion cubic feet to 1,900 billion cubic feet by the end of the week, which left our natural gas supplies 504 billion cubic feet, or 36.1% above the 1,396 billion cubic feet that were in storage on March 17th of last year, and 351 billion cubic feet, or 22.7% more than the five-year average of 1,549 billion cubic feet of natural gas that were in storage as of the 17th of March over the most recent five years….the 72 billion cubic foot withdrawal from US natural gas working storage for the cited week was a bit less than was expected by analysts surveyed by Reuters, whose average forecast called for a 75 billion cubic feet withdrawal, but it was more than the 55 billion cubic feet that were pulled out of natural gas storage during the corresponding week of 2022, and also much more than the average 45 billion cubic feet of natural gas that have typically been withdrawn from our natural gas storage during the same late winter week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending March 17th showed that the key oil supply and demand metrics were little changed from the prior week, and hence we again had surplus oil to add to our stored commercial crude supplies for the 12th time in 13 weeks, and for the 19th time in the past 29 weeks, on the continued support of 2 million barrels per day of new oil supplies that the EIA could not account for... Our imports of crude oil fell by an average of 45,000 barrels per day to average 6,172,000 barrels per day, after falling by an average of 55,000 barrels per day during the prior week, while our exports of crude oil fell by 95,000 barrels per day to 4,932,000 barrels per day, which combined meant that the net of our trade in oil worked out to a net import average of 1,240,000 barrels of oil per day during the week ending March 17th, 50,000 more barrels per day than the net of our imports minus our exports during the prior week. Over the same period, production of crude from US wells was reportedly 100,000 barrels per day higher at 12,300,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have averaged a total of 13,540,000 barrels per day during the March 17th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,376,000 barrels of crude per day during the week ending March 17th, an average of 21,000 fewer barrels per day than the amount of oil that our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that an average of 160,000 barrels of oil per day were being added to the supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures provided by the EIA for the week ending March 17th appear to indicate that our total working supply of oil from net imports and from oilfield production was 1,996,000 barrels per day less than what was added to storage plus our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a [+1,996,000] barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there was an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed..... However, with most everyone treating these weekly EIA reports as precise, and since these weekly figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….(NB: there is also a more recent twitter thread from an EIA administrator addressing these errors, and what they hope to do about it)

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to an average of 6,217,000 barrels per day last week, which was 0.4% less than the 6,242,000 barrel per day average that we were importing over the same four-week period last year. This week's 160,000 barrel per day increase in our overall crude oil inventories was all added to our commercially available stocks of crude oil, while the amount of oil in our Strategic Petroleum Reserve remained unchanged.. This week’s crude oil production was reported to be 100,000 barrels per day higher at 12,300,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day higher at 11,900,000 barrels per day, while Alaska’s oil production was 3,000 barrels per day lower at 441,000 barrels per day and added 400,000 barrels per day to the the rounded national total, same as Alaska added last week....US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was still 6.1% below that of our pre-pandemic production peak, but was 26.8% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 88.6% of their capacity while using those 15,376,000 barrels of crude per day during the week ending March 17th up from their 88.2% utilization rate during the prior week, as US refineries are now ramping up after completing their seasonal maintenance... The 15,376,000 barrels per day of oil that were refined this week were still 3.2% less than the 15,878,000 barrels of crude that were being processed daily during week ending March 18th of 2022, and 5.1% less than the 16,198,000 barrels that were being refined during the prepandemic week ending March 15th, 2019, when our refinery utilization was 88.9%, also close to normal for mid March ...

With last week's big increase in the amount of oil being refined, the gasoline output from our refineries was finally higher, increasing by 392,000 barrels per day to 9,503,000 barrels per day during the week ending March 17th, after our gasoline output had decreased by 446,000 barrels per day during the prior week. This week’s gasoline production was still 3.1% less than the 9,804,000 barrels of gasoline that were being produced daily over the same week of last year, and 4.3% less than the gasoline production of 9,925,000 barrels per day during the prepandemic week ending March 15th, 2019. Meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 75,000 barrels per day to 4,503,000 barrels per day, after our distillates output had decreased by 97,000 barrels per day during the prior week. Even with this weeks increase, our distillates output was 9.6% less than the 4,979,000 barrels of distillates that were being produced daily during the week ending March 18th of 2022, and 8.5% less than the 4,923,000 barrels of distillates that were being produced daily during the week ending March 15th, 2019...

Even with the big increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the fifth consecutive week and by the most since September 3rd 2021, decreasing by 6,399,000 barrels to 229,598,000 barrels during the week ending March 17th, after our gasoline inventories had decreased by 2,061,000 barrels during the prior week. Our gasoline supplies fell by more this week because the amount of gasoline supplied to US users rose by 366,000 barrels per day to 8,960,000 barrels per day, while our exports of gasoline rose by 1,000 barrels per day to 892,000 barrels per day, and while our imports of gasoline rose by 21,000 barrels per day to 471,000 barrels per day.. Following five straight gasoline inventory decreases, our gasoline supplies were 3.5% below last March 18th's gasoline inventories of 238,043,000 barrels, and about 4% below the five year average of our gasoline supplies for this time of the year…

Likewise, even with the increase in our distillates production, our supplies of distillate fuels decreased for the 7th time in 12 weeks, and by the most since October 7th, falling by 3,313,000 barrels to 119,715,000 barrels during the week ending March 17th, after our distillates supplies had decreased by 2,537,000 barrels during the prior week. Our distillates supplies decreased by more this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, increased by 238,000 barrels per day to 3,974,000 barrels per day, and as our exports of distillates rose by 16,000 barrels per day to 1,225,000 barrels per day, while our imports of distillates rose by 67,000 barrels per day to 222,000 barrels per day.. Even after fifty-eight inventory withdrawals over the past ninety-six weeks, our distillate supplies at the end of the week were 3.8% above the 112,135,000 barrels of distillates that we had in storage on March 18th of 2022, but still about 9% below the five year average of our distillates inventories for this time of the year...

Finally, with nearly two million barrels per day of new oil supplies that could not be accounted for, our commercial supplies of crude oil in storage rose for the 19th time in 29 weeks and for the 30th time in the past year, increasing by 1,117,000 barrels over the week, from 480,063,000 barrels on March 10th to 481,180,000 barrels on March 17th, after our commercial crude supplies had increased by 1,550,000 barrels over the prior week. With several large oil supply increases in the weeks following the Christmas refinery freeze offs, our commercial crude oil inventories are now about 8% above the most recent five-year average of commercial oil supplies for this time of year, and also about 46% above the average of our available crude oil stocks as of the third weekend of March over the 5 years at the beginning of the past decade, with the apparent disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. And even after our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after February 2021's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this March 17th were 16.4% more than the 413,399,000 barrels of oil we had in commercial storage on March 18th of 2022, but 4.3% less than the 502,711,000 barrels of oil that we had in storage in the wake of winter storm Uri on March 19th of 2021, while 5.7% more than the 455,360,000 barrels of oil we had in commercial storage on March 20th of 2020…

This Week's Rig Count

The number of drilling rigs active in the US increased for the second time in six weeks during the week ending March 24th, but were 4.4% below the prepandemic count, despite increasing ninety-seven times over the past 129 weeks... Baker Hughes reported that the total count of rotary rigs drilling in the US rose by 4 to 758 rigs over the past week, which was also 88 more rigs than the 670 rigs that were in use as of the March 25th report of 2022, but was 1,171 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business. .

The number of rigs drilling for oil increased by 4 to 593 oil rigs during the past week, after the number of rigs targeting oil had decreased by 1 during the prior week, and there are still 62 more oil rigs active now than were running a year ago, even as they amount to just 36.9% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and while they are still down 13.2% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations was unchanged at 162 natural gas rigs, which was still up by 25 natural gas rigs from the 137 natural gas rigs that were drilling during the same week a year ago, even as they were still only 10.1% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008….

In addition to those rigs targeting oil and natural gas, Baker Hughes continues to show that three rigs they've labeled as "miscellaneous" are still drilling this week: those include a directional rig drilling to between 5,000 and 10,000 feet on the big island of Hawaii, a directional rig drilling to between 5,000 and 10,000 feet into a formation in Lake county California that Baker Hughes doesn't track, and a directional rig drilling to between 5,000 and 10,000 feet into a formation in Pershing county Nevada, also unnamed by Baker Hughes. While we haven't seen any details on any of those wells, in the past we've identified various "miscellaneous" rig activity as being for exploration rather than production, for carbon dioxide storage, and for utility scale geothermal projects....a year ago, there were two such "miscellaneous" rigs running...

The offshore rig count in the Gulf of Mexico was up by one to 17 rigs this week, with 16 of those rigs drilling for oil in Louisiana's offshore waters, and one drilling for oil in Texas waters….that Gulf rig count is also up by 3 from the 14 Gulf rigs running a year ago, when 13 Gulf rigs were drilling for oil offshore from Louisiana and one was deployed for oil offshore from Texas…in addition to rigs drilling in the Gulf of Mexico, there is also a directional rig drilling for oil at a depth between 10,000 and 15,000 feet, offshore from the Kenai Peninsula Borough of Alaska...hence, we now have a total of 18 rigs drilling offshore, up from the national offshore count of 14 a year ago..

In addition to rigs running offshore, there is also a water based directional rig drilling for oil at a depth greater than 15,000 feet through an inland body of water in Terrebonne Parish, Louisiana this week...a year ago, there were three rigs drilling on inland waters...

The count of active horizontal drilling rigs was unchanged at 692 horizontal rigs this week, which was still 82 more rigs than the 610 horizontal rigs that were in use in the US on March 25th of last year, even as it was just over half of the record 1,374 horizontal rigs that were drilling on November 21st of 2014.....meanwhile, the vertical rig count was up by one to 16 vertical rigs this week, while those were still down by 9 from the 25 vertical rigs that were operating during the same week a year ago…at the same time, the directional rig count was up by 3 to 50 directional rigs this week, and those were also up by 15 from the 35 directional rigs that were in use on March 25th of 2022…

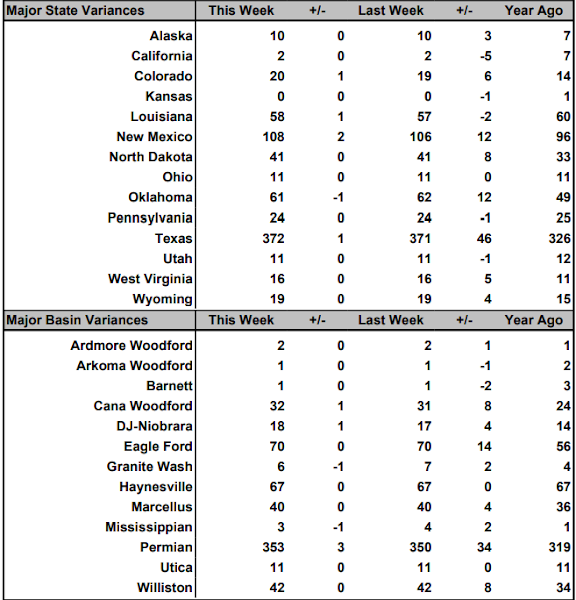

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of March 24th, the second column shows the change in the number of working rigs between last week’s count (March 17th) and this week’s (March 24th) count, the third column shows last week’s March 17th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 18th of March, 2022...

we'll start by checking the Rigs by State file at Baker Hughes for the changes in the Texas Permian...there we find that there were two rigs added in Texas Oil District 8A, which overlies the northern part of the Permian Midland, but that a rig was pulled out of Texas Oil District 7C, which includes a couple counties in the easternmost Permian Midland...since the Texas Permian rig count was thus up by one rig while the national Permian count was up by 3, we can figure that the 2 rigs added in New Mexico were set up to drill in the western Permian Delaware, in the southeast corner of that state....oddly enough, those were the only changes Texas this week, after the state saw 19 rig additions and 14 rig removals last week..

in other states, Oklahoma saw oil rig removals from the Granite Wash basin near the Texas panhandle and from the Mississippian shale along the Kansas border, while a natural gas rig was added in the Cana Woodford in the first natural gas drilling in that basin since September 2019...in Colorado, meanwhile, there was an oil rig added in the DJ Niobrara chalk of the Rockies front range, while in Louisiana, there was an oil rig added in the state's offshore waters...there were also a few changes that aren't evident in the tables above; a natural gas rig was pulled out of a basin that Baker Hughes doesn't track, while there was an oil rig added in a basin that Baker Hughes doesn't track; since there is no imbalance in the changes elsewhere, it's likely those offset each other in the same basin...

DUC well report for February

Monday of last week saw the release of the EIA's Drilling Productivity Report for March, which included the EIA's February data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions (click tab 3)....that data showed an increase in uncompleted wells nationally for the third consecutive month, following 29 consecutive decreases, as both well completions and drilling of new wells decreased in February, despite being well below the average pre-pandemic levels...for the 7 sedimentary regions covered by this report, the total count of DUC wells increased by 21 wells, rising from a revised 4,752 DUC wells in December to 4,773 DUC wells in February, which was still 6.5% fewer DUCs than the 5,105 wells that had been drilled but remained uncompleted as of the end of February of a year ago...this month's DUC increase occurred as 992 wells were drilled in the 7 regions that this report covers (representing 87% of all U.S. onshore drilling operations) during February, down by 15 from the 1,007 wells that were drilled in January, while 971 wells were completed and brought into production by fracking them, down by 1 from the 972 well completions seen in January, but up by 195 from the 776 completions seen in February of last year....at the February completion rate, the 4,773 drilled but uncompleted wells remaining at the end of the month represents a 4.9 month backlog of wells that have been drilled but are not yet fracked, statistically unchanged from the DUC well backlog of a month ago, but up from the 7 1/2 year low of 4.4 months of four months ago, despite a completion rate that is now about 15% below 2019's pre-pandemic average...

Both oil basin DUCS and natural gas basin DUCs rose during February, and only one basin saw DUCs decrease....the number of uncompleted wells in the Niobrara chalk of the Rockies' front range increased by 10, rising from 641 at the end of January to 651 DUC wells at the end of February, as 115 wells were drilled into the Niobrara chalk during February, while 105 Niobrara wells were completed....at the same time, the number of uncompleted wells remaining in Oklahoma's Anadarko basin increased by 4, rising from 732 at the end of January to 736 DUC wells at the end of February, as 75 wells were drilled into the Anadarko basin during February, while 71 Anadarko wells were completed.... meanwhile, DUC wells in the Permian basin of west Texas and New Mexico increased by 2, from 1,042 DUC wells at the end of January to 1,044 DUCs at the end of February, as 435 new wells were drilled into the Permian basin during February, while 433 already drilled wells in the region were being fracked...in addition, DUC wells in the Bakken of North Dakota were up by 1 to 580 by the end of February, as 80 wells were drilled into the Bakken during February, while 79 of the drilled wells in the Bakken were being fracked.....on the other hand, DUCs in the Eagle Ford shale of south Texas decreased by 8, from 434, DUC wells at the end of January to 426 DUCs at the end of February, as 114 wells were drilled in the Eagle Ford during February, while 122 of the already drilled Eagle Ford wells were fracked...

among the natural gas producing regions, the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, increased by one well, from 662 DUCs at the end of January to 663 DUCs at the end of February, as 98 new wells were drilled into the Marcellus and Utica shales during the month, while 97 of the already drilled wells in the region were fracked....at the same time, the uncompleted well inventory in the natural gas producing Haynesville shale of the northern Louisiana-Texas border region rose by 11, from 662 DUCs in January to 673 DUCs by the end of February, as 75 wells were drilled into the Haynesville during February, while just 64 of the already drilled Haynesville wells were fracked during the same period....thus, for the month of February, DUCs in the five major oil-producing basins tracked by this report (ie., the Anadarko, Bakken, Niobrara, Permian, and Eagle Ford) increased by nine to 3,437 DUC wells, while the uncompleted well count in the major natural gas basins (the Marcellus, the Utica, and the Haynesville) was up by twelve to 1,336 DUC wells, although as this report notes, once into production, more than half the wells drilled nationally will produce both oil and gas...

+++++++++++++++++++++++++++++++++++++++++++++++++.

Drilling in state parks: Republicans hope it can fuel a tax cut, but environmentalists fear the worst - cleveland.com – Ohio Senate President Matt Huffman is looking to oil and gas production on public lands, including state parks and state forests, to help replace lost state revenue that would result from income tax cuts that the legislature is eyeing.Huffman, a Lima Republican, said at the Ohio Oil and Gas Association’s annual conference March 9 that production leases on state lands could be a “great revenue generator,” according to Gongwer News Service, which covers the Statehouse and sent a reporter to the conference.But it’s unclear how much of a dent new drilling leases would put in the billion-dollar hole that would be left by the most recent tax-cut proposal before state lawmakers.Republicans who control the legislature have discussed eliminating Ohio’s income taxes, and a bill in the Ohio House would flatten the tax by most drastically cutting rates of wealthy taxpayers and modestly cutting middle-income tax rates. A spokesman for Huffman said Wednesday that the Senate is considering its own tax-cut proposals for the state’s two-year operating budget.Already, though, the Ohio Department of Natural Resources is accepting lease applications for oil and gas drilling in state-owned oil and gas reserves. The Plain Dealer / cleveland.com has requested from ODNR all the leases that have been submitted.Oil and gas development on state property is expected to soon begin after over a decade of debate on the issue among Republicans, Democrats, environmentalists and the oil and gas industry. Lawmakers passed a bill in the waning hours of the two-year legislative session last year that paved the way for drilling on public lands.“If the state can responsibly add to the revenue of the state and we can lower the tax burden, that makes Ohio a much more competitive state,” Huffman told the oilmen on March 9. “And so we should do this in earnest. We should do it responsibly. Kick it into a gear where it actually makes sense and, you know, it can be a great benefit to us.” But environmental groups have objected to drilling on state property, saying the noise, traffic and air pollution will interfere with the solace Ohioans seek when they camp, hike, kayak and participate in other recreation in state parks and forests. It’s not realistic to depend on oil and gas as a replacement revenue for reduced income taxes, said Nathan Johnson, the Ohio Environmental Council’s public lands director. The amount of money the state could earn from oil and gas are uncertain, according to the nonpartisan Legislative Service Commission, when weighing the fiscal impacts of an oil-and-gas bill last year. The industry also doesn’t yet have any estimates about how much it will drill in coming years, as leasing is still in the early stages.Royalties, or the portion that the state would receive from a lease, is one-eighth of the oil and gas produced, Ohio law states. This is a common rate, though some states demand royalties as high as 25%. Oil and gas companies expect to tap mostly subsurface minerals owned by the state. They set up on private property, then access the state minerals underground through vertical and horizontal drilling, said Mike Chadsey, director of public relations for the Ohio Oil and Gas Association. State law prohibits companies from using state-owned surface land for oil and gas development “unless the state agency, in its sole discretion, chooses to negotiate and execute a written surface use agreement.”

How hazardous is Ohio Senate President Matt Huffman’s plan to drill under state parks? Today in Ohio - cleveland.com (podcast transcript)) - Ohio Senate President Matt Huffman is looking to oil and gas production under state parks and forest to help offset possible income tax cuts. We’re talking about possible environmental issues on Today in Ohio. Listen online here. Editor Chris Quinn hosts our daily half-hour news podcast, with impact editor Leila Atassi, editorial board member Lisa Garvin and content director Laura Johnston.Here’s what we’re asking about today: Are environmentalist’s fears misplaced about Ohio Senate President Matt Huffman’s plan for oil and gas drilling on state lands?

- [00:00:00] Chris: First day of spring, and we’re still digging out from one of our biggest snowstorms, interesting weather all winter long. It’s today in Ohio. The news podcast discussion from cleveland.com and the plane dealer. I’m Chris Quinn, here with Lisa Garbin, Laura Johnston and Leila Tassi for another rip snorting conversation.Let’s go. Our environmentalist fears misplaced about Ohio Senate President Matt Huffman’s, plan for oil. Gas drilling on state lands, or I read this story and I’m trying to figure out, is this devastating to the state lands and state parks? Is the reaction people are having more strong than is warranted? What’s going on…

- [00:00:42] Laura: here? Well, the folks who want to be able to do this and remember the green energy bill that we’ve. Talked about at length on this podcast. The NA natural gas is green energy. That included the ability to drill on state parks, and they’d always had that. And it’s drilling under the state parks.

- To be clear, [00:01:00] they, they say that the machinery will not be on the actual park. It’s not like they’ll be an oil rig next to your campsite, but they would be accessing the oil and gas reserves underneath it. And what that bill did was it changed from shall. To ca basically can so that no longer did the OD n r have to go through a long process to say, okay, maybe you can, maybe you can’t, uh, drill, but you are allowed to. Now I think it’s from May to shell, that’s the verb change. And so they say, this is, this is perfectly fine. It’ll be perfectly safe, no problem, but hey, let’s use this to offset the tax cuts we wanna give to the wealthiest Ohioans. And that’s where the issue, well, I mean, I think separately we can talk about the environmental impact and what that’s gonna be like because we don’t actually know, and I think. It’s worth sounding alarm about some of our most pristine, natural spaces in this entire state. But do we wanna start drilling underneath state parks just so we can give rich people a big a, a [00:02:00] big tax cut? It just seems like Ohio’s priorities are so messed up here. It’s like trying to solve a labor shortage on the backs of 14 year

- [00:02:07] Chris: olds. All right. Let, let, let, there’s three things going on here and I, let’s take ‘em individually. One, the story shows how you’re never going to solve a budget issue with this, that, I mean, there are multiple people in the story and saying that’s a ridiculous, ridiculous idea. So Matt Huffman saying he’s gonna solve a budget problem with this, that’s bogus.Two. The, let’s put aside that Ohio is terrible at green energy. It is the, that they haven’t repealed HB six completely, the corrupt, filthy law because it did away with important green energy standards. And yes, you’re right. The governor has signed the bill saying, NA natural gas is green energy, which is.In the extreme, and they’re all trying to stand by it, and we’ll forever be talking about it. It makes Ohio look like chumps [00:03:00] on the issue of drilling on the parks and state lands. I guess I wasn’t aware before that they would never actually have the equipment on the state lands that it would come from private lands and drill down at an angle into the parks.Given all of the. Controversy we had about oil in the past couple of years. Is it a terrible thing to try and extract whatever the the value is from under those parks if you don’t in any way damage the parks, but

- [00:03:32] Laura: how? I don’t know that you can say that. I don’t think you can promise we’re not damaging the parks because you don’t know the long-term consequences.All the fracking, we’ve, I mean, we’ve been talking about fracking now for 15 years, and the fact is we don’t know what they put underground. To do the fracking when they’re injecting all of that liquid into the earth to try to get the minerals out. They don’t, it’s trade secret. They don’t have to tell you.We don’t know the long-term implications of the water and I, I just think it’s really [00:04:00] risky just to say, we’ll make some money on it.

Snodgrass is right to appeal valuation of Nexus pipeline | Editorial - Morning Journal - Lorain County Auditor Craig Snodgrass made the right move March 13 appealing to the Ohio Supreme Court to challenge the most recent and final decision of the Ohio Board of Tax Appeals regarding the valuation of the Nexus pipeline system. After lengthy consideration and input from multiple stakeholders in Lorain County and throughout Ohio, Snodgrass decided to appeal.Nexus Gas Transmission is an approximately 256-mile, 36-inch pipeline running through 12 Ohio counties and into a portion of Michigan.Snodgrass is well within his right to appeal.And he has a supporter in Lorain County Commissioner Michelle Hung, who does not see a down side to taking the appeal to the Supreme Court to rule on this matter.The value was $1.6 billion and the tax commissioner has settled on a value of $950 million, leaving a shortfall to Lorain County of approximately $4 million per year, every year.Obviously, that’s not sitting well with Snodgrass and Hung, especially because the ruling would not be a one-time loss.The higher the value of the gas line, the more money schools and other government agencies receive in funding from tax money collected in those areas where the gas line operates.Hung believes that with the shortfall, area schools and children will suffer the effects of less money.And she has a point that residents don’t have high-priced lobbyists working for them, and the people look to their elected officials to make sure this is a good deal for the schools and children’s future.Hung doesn’t want school districts going to voters to support a levy because corporate businesses aren’t paying their fair share.The two sides, however, had worked out a settlement agreement valuing the pipeline at $950 million for tax year 2019, $946 million in tax year 2020; $934 million in tax year 2021 and the estimated value of $901 million for 2022.Snodgrass firmly believes that under the Board of Tax Appeals decision, his office was wrongfully deprived of a statutory right-of-appeal and the ability to challenge the “true value” of the Nexus pipeline system for not only tax year 2019, but in 2020, 2021 and every year thereafter.Snodgrass feels it’s an obligation to file the appeal, because if not, the Board of Tax Appeals’ ruling would cost Lorain County, and its political subdivision, approximately $15.7 million for tax years 2019-2022, and significant more in personal property tax revenue thereafter.Snodgrass also noted he not only is filing the appeal on behalf of Lorain County residents, but for other county auditors across the state.

Living Near Fracking Tied to Increase in Hospitalizations in Seniors -- Older adults living near fracking sites could have a high risk for poor cardiovascular outcomes, according to a study published in the March issue of The Lancet Planetary Health. see Abstract/Full TextKevin S. Trickey, from the University of Chicago, and colleagues assessed the effects of unconventional natural gas development (UNGD) on population health in local communities. The analysis included Medicare claims (2002 to 2015) in Pennsylvania ZIP codes with fracking and neighboring New York communities without fracking.The researchers found that Pennsylvania ZIP codes that started UNGD in 2008 to 2010 were associated with more hospitalizations for cardiovascular diseases in 2012 to 2015 than would be expected in the absence of UNGD. In 2015, there were an additional 11.8, 21.6, and 20.4 hospitalizations for acute myocardial infarction, heart failure, and ischemic heart disease, respectively, per 1,000 Medicare beneficiaries. Even as UNGD growth slowed, hospitalizations increased and persisted in sensitivity analyses."Although we can't point to one specific part of fracking operations as the culprit, folks living near fracking sites could be affected by exposure to things like air or water pollution that often come with fracking activity," Trickey said in a statement. "Our study connects nearby fracking activity to real, serious human health outcomes, suggesting it's not just a matter of economics or environmental sustainability -- but that policymakers and residents alike should start prioritizing the health of citizens, whether drilling new wells or plugging old ones."

New York nears deal to ban gas stoves in new homes - — New York state lawmakers are poised to enact the nation’s first legislative ban on gas and fossil fuel appliances in most new buildings, including single-family homes.Despite outcry from Republicans nationwide about states and the federal government looking to ban gas stoves, New York appears set to move forward with the proposal in the state budget due March 31.The reason a deal looks imminent is because Gov. Kathy Hochul and fellow Democrats in both chambers of the state Legislature have endorsed proposals to prohibit fossil fuel furnaces, water heaters, clothes dryers and gas stoves in most new construction.New York would be the first to take this step through legislative action; California and Washington have done so through building codes. An agreement has not been finalized to ensure passage, but the new restrictions are included in all three plans being discussed in Albany.Supporters see the potential law as a national model that they hope can spur similar action by other states and the federal government to limit fossil fuel use in buildings, which are a major source of greenhouse gas emissions contributing to climate change.“All eyes are on us and a lot of other states are looking to what New York does,” said Pat McClellan, policy director at the New York League of Conservation Voters. “If we prove it can be done and we have the political will to do this, it’s going to open the floodgates for other states to take action.”Republicans across the nation have stoked anger about proposals targeting gas stoves after a federal official said the Consumer Product Safety Commission should consider a ban. In Florida, Republican Gov. Ron DeSantis urged lawmakers to approve a tax exemption for gas stoves and declared federal officials aren’t “taking our gas stoves away from us.”

Republicans Introduce Bills To Prevent Biden Administration From Banning Gas Stoves - Two House Energy and Commerce Committee Republicans announced on March 20 they are introducing legislation to prevent the Biden administration from banning gas stoves.The legislation was introduced by Reps. Kelly Armstrong (R-N.D.) and Debbie Lesko, (R-Ariz.) in response to the Biden administration’s two-pronged push to ban gas stoves, and might go to the House floor for a vote later this year.Lesko introduced H.R. 1640, also known as the Save Our Gas Stoves Act, while Armstrong introduced H.R. 1615, the Gas Stove Protection and Freedom Act. Both bills are currently in committee. The pieces of legislation would prohibit the Consumer Product Safety Commission (CPSC) from using federal funding to implement any regulation that would classify gas stoves as a prohibited dangerous product under current law.The bills also prohibit the CPSC from enforcing any consumer product safety standards that would prohibit the use of gas stoves or impose regulations that would raise gas stove prices. In a press release announcing the legislation, Armstrong emphasized his frustration with the administration’s attempts to ban the stoves.“Inflation is hurting everyone. We have a crisis at our Southern Border. North Dakotans are worried about being able to provide for their families. What is the Biden administration focused on? Controlling the kind of stove Americans use,” Armstrong said.

Fossil Fuel Executives See a ‘Golden Age’ for Gas, If They Can Brand It as ‘Clean’ - Natural gas has long been subject to a war of words. Once it was a “bridge fuel” that would straddle the gap from fossil energy to renewable sources. More recently, climate activists have sought to highlight that gas pollutes, too, by stripping “natural” from its name and calling it fossil- or methane gas. The industry is pushing back, and gas executives displayed their latest linguistic counteroffensive at an industry conference this month in Houston. “It’s time for us to stop tiptoeing about the value of natural gas,” said Octávio Simões, chief executive of Tellurian, which is struggling to finance its multi-billion dollar plan to export liquified natural gas, or LNG. “It’s time for us to say it is an incredible fuel, and we’re not afraid to burn it in our kitchens,” he added, drawing cheers from the otherwise subdued crowd. Gas’s fortunes have fallen over the last decade as emerging science revealed that its production and transport releases large volumes of methane, the fuel’s primary component and a potent greenhouse gas. Some estimates indicate these leaks have wiped away much or even most of the gains the United States appeared to make in cutting climate pollution by replacing coal with gas as a fuel for power plants. When burned, gas releases about half as much carbon dioxide as coal, but methane traps about 85 times more heat than CO2 over a 20-year period. Other science has shown that gas stoves emit harmful chemicals that can collect in people’s homes.“We lost the narrative on the value of natural gas,” Simões said.Toby Rice, who leads EQT, the country’s largest gas producer, was sitting next to Simões and has been at the forefront of an effort to win back that narrative. During the panel, Rice called his company’s product the “cleanest energy in the world,” despite the fact that gas emits 20 percent of global carbon dioxide emissions.Fossil fuel executives were broadcasting the same message as Rice and Simões throughout the conference, CERAWeek by S&P Global, one of the energy industry’s largest annual gatherings.

U.S. Natural Gas Demand Outpaced Supply in 2022, Says FERC - U.S. LNG exports rose by 8.6% year/year to average 10.6 Bcf/d in 2022, with demand growth driven by European markets seeking a substitute for Russian supply, according to FERC. Coincidentally, the figure for net exports of natural gas overall – including liquefied natural gas and pipeline exports – also was 10.6 Bcf/d, up slightly from 10.5 Bcf/d in 2021, the Federal Energy Regulatory Commission said in its 2022 State of the Market report. “Tight LNG supplies contributed to increasing international prices, which reached record levels, incentivizing U.S. LNG exports,” researchers said. “The approval and expansion of multiple LNG export facilities in 2022 increased LNG liquefaction capacity to serve the growing international LNG demand to higher-priced regions.” Domestically, natural gas prices increased in 2022 versus 2021 at nearly all major hubs, the FERC team noted. The Henry Hub national benchmark averaged $6.38/MMbtu for the year, up from $3.82 in 2021. “This was the highest average spot price at Henry Hub since 2008, and the largest absolute year-over-year average price increase since 2005,” researchers said. FERC researchers explained that “natural gas demand growth outpaced gains in natural gas production,” boosting prices. “In 2022, natural gas demand was driven by increased domestic natural gas consumption and LNG exports. Although production did not keep pace with demand, it continued the growth trend seen in the last decade.” Production highs were especially noticeable in the Permian Basin and Haynesville Shale, they added. This was due to pipeline infrastructure expansions in both regions. By contrast, the Marcellus and Utica shales in Appalachia each saw year/year production declines, a trend “likely in part disincentivized by limited takeaway capacity additions.” More than 40% of incremental pipeline capacity additions over the last five years have occurred in the South Central region. The region accounted for 58% of capacity additions in 2022, researchers said. Natural gas storage inventories, meanwhile, trended downward for the year as a whole, although they have since returned to levels above the five-year historical average.

Chilly Winter, Hot Summer Fuel All-Time U.S. Natural Gas Demand in 2022 - Strong peaks in the winter and summer drove U.S. natural gas consumption to an all-time high last year, averaging 88.5 Bcf/d, according to the Energy Information Administration (EIA). The federal agency said natural gas consumption peaked last year in January and July. EIA noted that natural gas peaks twice a year in the United States, driven by the residential and commercial sectors during the winter and the electric power sector during the summer. In winter, the most natural gas is consumed in January or February when demand for space heating peaks. In summer, the most natural gas is consumed typically in July or August to meet air-conditioning demand. In January 2022, the combined residential and commercial sectors consumed 9% more natural gas than in January 2021, according to EIA. Notably, the electric power sector consumed 10% more year/year, and even reached a record in January 2022 that pushed overall natural gas consumption to a monthly record high in records dating back to 1949. Strong demand continued in the summer, with last year’s being the third-warmest on record in the Lower 48, according to EIA. This led to strong demand for air conditioning and resulted in new daily records for electricity generation in July. “As a result, more natural gas was consumed in the electric power sector, pushing consumption in July to be the highest for the summer,” EIA analysts Katy Fleury and Kristen Tsai. Overall, the pace of the increase in natural gas demand at 5% year/year (4.5 Bcf/d) was the second-fastest annual growth since 2013, EIA said. What’s more, natural gas consumption in the United States set monthly records in nine of 12 months in 2022.

Cold Snap, Bullish Storage Expectations Fail to Send Natural Gas Futures Higher; Spot Prices Steady - Natural gas futures probed higher early Monday, with bulls seizing upon favorable near-term weather, steady export demand and market expectations for a seasonally robust inventory withdrawal. But intensifying stress in the global financial system ultimately curbed the momentum and left futures in the red as markets closed.The April Nymex gas futures contract settled at $2.223/MMBtu, down 11.5 cents day/day. May also fell 11.5 cents to close at $2.331.NGI’s Spot Gas National Avg. slipped 2.0 cents to $2.530 ahead of a break from cold weather.Monday futures trading extended losses from Friday. The prompt month lost 4% last week.NatGasWeather said American and European weather models heading into Monday trading agreed on the timing of swings in national demand the next two weeks, “starting with strong demand to open the week after frosty weather systems swept across” the country over the weekend. This, the firm said, supported prices early Monday.Both models also showed another chilly weather system racing across the northern United States March 27-29 for “a modest bump in national demand” before more spring-like temperatures arrive.

US natgas prices bounce off 1-month low to end 5% higher on short covering (Reuters) - U.S. natural gas futures rebounded more than 5% on Tuesday on short covering after prices hit their lowest in a month. Front-month gas futures for April delivery settled 12.5 cents higher, or up 5.6%, at $2.348 per million British thermal units (mmBtu) after hitting a fresh low since Feb. 23 earlier. Traders' attempt to push towards $2.00 mmBtu resulted in short covering because there were not enough bearish factors to justify that slide, said Robert DiDona of Energy Ventures Analysis, adding that demand was "relatively stable." "We'll find some bid side interest here in short-term given the weather outlook ... and what should be better LNG demand in the upcoming weeks." Oil prices rose, settling up more than 2% and extending a recovery from a 15-month low hit the previous day, as the rescue of Credit Suisse allayed concerns of a banking crisis that would hurt economic growth and cut fuel demand. Analysts said gas production declined earlier this year due in part to a price slump of 40% in January and 35% in December that persuaded several energy firms to reduce the number of rigs they were using to drill for gas. In addition, extreme cold in early February and late December cut gas output by freezing some oil and gas wells in several producing basins. Overall milder winter weather this year, however, has prompted utilities to leave more gas in storage than usual. Gas stockpiles were about 24% above their five-year average (2018-2022) during the week ended March 10 and were expected to end about 16% above normal during the colder-than-normal week ended March 17, according to federal data and analysts' estimates. "We still see significant price support further down the curve with Europe likely to be a strong buyer later in the summer amidst some tank topping ahead of the winter as Russian supply availability will be negligible in relation to past years," analysts at energy consulting firm Ritterbusch and Associates said in a note. "So, by and large, we still see some near-term price softening but will be looking to approach the long side by week's end depending upon the market's response to the EIA storage."

US natgas futures drop 8% as output rises, demand declines (Reuters) - U.S. natural gas futures fell about 8% on Wednesday, erasing the prior session's 6% gain, as output continues to rise while demand declines with the coming of seasonally milder, spring-like weather. That price decline came even as the amount of gas flowing to liquefied natural gas (LNG) export plants was on track to hit a record high this week after Freeport LNG's plant in Texas exited an eight-month outage in February. Prices also dropped despite forecasts for cooler weather and higher heating demand next week than previously expected. Traders, however, noted that slightly colder weather in late March has much less of an impact on heating demand as colder weather in late January. Temperatures in the U.S. Lower 48 states will average around 49.2 degrees Fahrenheit (9.6 Celsius) over the next two weeks versus a 30-year average of 50.6 degrees F for this time of the year, according to data provider Refinitiv. Front-month gas futures for April delivery fell 17.7 cents, or 7.5%, to settle at $2.171 per million British thermal units (mmBtu), their lowest since hitting a 29-month closing low of $2.073 on Feb. 21. The gas market has been extremely volatile in recent weeks as traders bet on the latest weather forecasts - Wednesday's decline was only the biggest percentage drop since early March. Freeport LNG's export plant was on track to pull in about 1.2 billion cubic feet per day (bcfd) of gas on Wednesday, down from 1.5 bcfd on Tuesday, according to Refinitiv data. Freeport LNG said on March 8 that it anticipated feedgas flows would rise and fall as the plant returns to full production over the "next few weeks." Total gas flows to all seven of the big U.S. LNG export plants rose to an average of 13.1 bcfd so far in March from 12.8 bcfd in February. That would top the monthly record of 12.9 bcfd in March 2022, before the Freeport LNG facility shut. The seven big U.S. LNG export plants, including Freeport LNG, can turn about 13.8 bcfd of gas into LNG. Refinitiv said average gas output in the U.S. Lower 48 states rose to 98.6 bcfd so far in March from 98.2 bcfd in February. That compares with a monthly record of 99.9 bcfd in November 2022. Analysts said production declined earlier this year due in part to gas price declines of 40% in January and 35% in December that persuaded several energy firms to reduce the number of rigs they were using to drill for gas. In addition, extreme cold in early February and late December cut gas output by freezing some oil and gas wells in several producing basins. Meteorologists projected the weather in the Lower 48 states would remain mostly colder-than-normal through April 6 after a couple of warmer-than-normal days on March 22-23. Refinitiv forecast U.S. gas demand, including exports, would slide from 115.0 bcfd this week to 109.1 bcfd next week. The forecast for next week was higher than Refinitiv's outlook on Tuesday.

Seasonally Steep Storage Pull Not Enough to Bolster Natural Gas Futures, Cash Prices - Natural gas futures flipped positive early Thursday after a government inventory report proved bullish relative to recent years. However, it ultimately was not enough to ease festering supply/demand imbalance concerns. The April Nymex gas futures contract lost 1.7 cents day/day and settled at $2.154/MMBtu. May fell 2.4 cents to $2.283. A day earlier, both shed more than 17 cents. NGI’s Spot Gas National Avg. on Tuesday fell 19.5 cents to $2.105. Cash prices have declined throughout the week. The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 72 Bcf natural gas from storage for the week ended March 17. Prior to the report, polls showed draw expectations in the 70s Bcf. NGI modeled a 76 Bcf withdrawal. The East and Midwest regions led with withdrawals of 36 Bcf and 29 Bcf, respectively, according to EIA. The South Central posted a pull of 6 Bcf. Mountain region stocks declined by 3 Bcf, while Pacific inventories were flat. From a price perspective, the net result compared bullishly with a pull of 55 Bcf a year earlier and a five-year average decline of 45 Bcf. The decrease lowered inventories to 1,900 Bcf and reflected above-average demand for the covered period – the final week of winter – when a cold snap enveloped several regions of the Lower 48. Winter weather extended into the start of the current week, and the next EIA print could again prove relatively steep. Early estimates for the week ending March 24 submitted to Reuters ranged from pulls of 38 Bcf to 76 Bcf, with an average decrease of 55 Bcf. The projections compare with an increase of 15 Bcf a year earlier and a five-year average decline of 17 Bcf. Still, stocks remained well above the year-earlier level of 1,396 Bcf and the five-year average of 1,549 Bcf. This followed a weeks-long stretch of relatively mild winter that spanned most of January through early March. Production also has hovered around 100 Bcf/d – close to record levels – and it held just shy of the century mark in estimates on Thursday.

Natural Gas Futures, Spot Prices Find Path Forward as Forecasts Tilt Colder - Natural gas futures forged ahead Friday, boosted by colder forecasts and expectations for back-to-back bullish storage prints relative to historic norms. The April Nymex gas futures contract settled at $2.216/MMBtu, up 6.2 cents day/day. May rose 7.8 cents to $2.361. NGI’s Spot Gas National Avg. gained 18.0 cents to $2.285. NatGasWeather said weather data, while inconsistent through most of the past week, flipped back colder heading into trading Friday. The European weather model added several heating degree days for the next two weeks. This, the firm said, advertised a cooler-than-normal pattern heading into April and provided a bump for futures. That noted, price movement was modest as cool temperatures in late March and early April rarely translate into robust demand. At the same time, high temperatures across the South are projected to range from the 60s to the 80s – shoulder season conditions that tend to minimize both heating and cooling demand. Friday’s prompt month close was notably below the previous week’s finish at $2.338. EBW Analytics Group’s Eli Rubin, senior analyst, said bulls also have in their favor Freeport LNG’s gradual return to full service. The liquefied natural gas export facility, knocked out of commission last year after a fire, recently drew 1 Bcf/d of gas from domestic supplies, adding to demand. However, the plant’s efforts to build back to capacity of nearly 2.4 Bcf/d have been slowed by complications. “Demand expectations have been parried by news concerning damage to one train at Freeport LNG during the long-awaited startup,” Rubin said Friday.

Lower 48 Oil and Natural Gas Permitting Rises, but Not Everywhere - Nearly 3,000 permits were issued in February to explore for U.S. oil and gas, a slight increase from January but down nearly 9% from a year ago, according to state and federal data. Evercore ISI, which tracks oil and gas permitting data, said 2,929 permits gained approval in February, up by 211 or 8% from January and 51.7% more than in February 2021. However, permitting fell from February 2022 by 8.8%.“Major losses were reported in the Powder River Basin,” analysts said, down by 68 from January or 26% month/month (m/m). Permitting also declined in smaller plays, off by 18% m/m or by 68. Permitting rose, though, in the Marcellus Shale, up by 199 or 151%, as well as in the Permian Basin, up by 70 from January or 6% higher m/m. Also seeing permitting gains from January were the Denver-Julesburg/Niobrara, up by 62 permits, and the Eagle Ford Shale, up by 46.The Permian held a 41% share of all issued permits, followed by the Eagle Ford with 11%, small basins at 8% and the Marcellus with a 7% share. When permits are issued, it usually takes three to six months to begin development onshore. By state, Texas led the way in permitting, up by 9% m/m or 112 to reach 1,385. Pennsylvania followed with 148 permits, up by 90 or 155% m/m. Colorado recorded 153 permits in February, which was 74 more than in January or 94% higher. Louisiana saw permits reach 102 in February, up by 41 or 67% higher m/m.“These gains offset major declines in issued permits in California to only 12,” said Evercore analysts. That was a 162 decline from January, or down by 93% m/m. Wyoming also saw a sharp decline to 229 permits issued, off by 71 or 24% lower m/m.During January, upstream oil and natural gas employment in Texas rose by 13.7% year/year to a total of 198,100 jobs, according to the Texas Independent Producers and Royalty Owners Association (TIPRO). The figure was up by 1,700 jobs from December 2022, the group said, citing data from the U.S. Bureau of Labor Statistics.Demand for workers remains strong, TIPRO said. It cited 12,478 active unique job postings in the Texas oil and gas industry in January. These included 5,313 new job postings added during the month by companies.

U.S. Natural Gas Production, LNG Exports Expected to Grow Through 2050, EIA Forecasts - U.S. natural gas production and LNG exports are likely to grow between now and 2050 with domestic gas consumption dropping only slightly, according to the Energy Information Administration (EIA).All of the scenarios modeled in EIA’s latest Annual Energy Outlook (AEO) released last Thursday show the United States remaining a net exporter of natural gas and petroleum products through mid-century, driven by rising international demand.On the homefront, meanwhile, “Despite the shift toward renewable sources and batteries in electricity generation, domestic natural gas consumption remains relatively stable – ending recent growth in most cases,” researchers said. “Natural gas production, however, in some cases continues to grow in response to international demand for liquefied natural gas, supported by associated natural gas produced along with crude oil.”The AEO Reference Case shows annual LNG exports totaling 9.98 Tcf by 2050, up from 3.96 Tcf recorded in 2022.“With growth in more market based-LNG, the strength of the relationship between international natural gas prices and oil prices has eroded,” researchers said. “However, we expect that future oil prices will still affect additional LNG export capacity and overall export levels. “When the Brent price is high relative to the U.S. Henry Hub price, like in the High Oil Price case, building more LNG export capacity and exporting LNG are more economical than when the Brent price is lower relative to Henry Hub.”Lower 48 onshore and offshore dry gas production, meanwhile, totals 41.68 Tcf in 2050 in the Reference Case, up from 36.1 Tcf in 2022.Lower 48 natural gas consumption by the residential, commercial, industrial, transport and power generation segments totals 26.2 Tcf by 2050 in the Reference Case, versus 28.8 Tcf in 2022.

TC Eyes Haynesville Natural Gas as North America Growth Driver - As TC Energy Corp. plans to continue investing billions to expand North American natural gas pipeline capacity through the decade, CEO Francois Poirier said political momentum for permitting reform and an appreciation for infrastructure could pave the way for expansions and greenfield projects to boost LNG exports. On the sidelines of the CERAWeek by S&P Global Conference in Houston, Poirier told NGI that the Calgary-based midstream giant expects to see regulatory support for more infrastructure. Currently, around 75-80% of TC’s investments are connected to natural gas businesses. While other energy executives and some regulators at the conference emphasized a need for permitting reforms and more dialogue on the importance of natural gas projects, Poirier said he believed attitudes already were changing, particularly after the invasion of Ukraine. The volatility in Europe helped strike a “balance” between the focus on sustainability and energy security, he added. “It’s no accident, in my view, that in the United States, both parties are voicing support for reforming the permitting process,” Poirier said. “There is debate around the right way to do that, of course, but both sides acknowledge that it needs to improve because I think it’s a recognition of the understanding that the infrastructure is part of that supply chain of getting natural gas around the world.” Poirier said while some projects have faced increased opposition, some operators have finished substantial projects by working with stakeholders and regulators. Last year, TC placed $6 billion worth of infrastructure online and plans to launch a similar amount of infrastructure this year. Through the decade, Poirier said TC aims to boost North American takeaway capacity from a current level of 14 Bcf/d to 21 Bcf/d, a 50% increase. TC expects to hike capital expenditures by roughly 30% year/year this year, mostly focused on gas pipeline expansions. At the center of those expansions is the Gulf Coast, where Poirier said a combination of mostly brownfield expansions and some strategic newbuilds could help TC grow its U.S. market share by 5% to 35% at the end of the decade. Last year, TC sanctioned the Gillis Access Project, a 1.5 Bcf/d greenfield system in Louisiana to move more gas from the Haynesville Shale to the coast. Gillis is the “beginning of a header system,” the CEO said, to unlock growth, along with upgrades on the ANR system, as liquefied natural gas demand continues to expand. “When we look at our system, it’s possible that if we wanted to exceed that 35% market share in the United States and the growth in capacity transpires in the way I described, we would have to be looking at…certainly segments of greenfield projects,” Poirier said. “The key is looking at where expansions need to take place.” While some reforms may help pave the way for projects in the Gulf Coast, Poirier said, there are still limits to creating more infrastructure on the West Coast. For years, project developers and western producers have advocated for LNG exports from the western United States to help support regional production and forge a swift trade route to Asian markets. Instead, the route for more North American gas to Asian markets will likely have to come from developing projects in Canada and Mexico. “I think both Canada and Mexico have recognized an opportunity on the West Coast of the continent that the United States probably can’t capture,” Poirier said. TC is targeting mechanical completion of its Coastal GasLink project in Western Canada by the end of the year, which would link the Shell plc-led LNG Canada and possibly other facilities to feed gas from the Montney Shale. The company reported in February that crews working on the roughly 416-mile, 2.1 Bcf/d pipeline were progressing on schedule, but warned of inflationary impacts further ballooning the cost of completion.

Sempra Launches Port Arthur LNG Project -- Sempra today announced that its 70%-owned subsidiary, Sempra Infrastructure Partners reached a positive final investment decision (FID) for the development, construction and operation of the Port Arthur LNG Phase 1 project in Jefferson County, Texas. Sempra Infrastructure closed its joint venture with an affiliate of ConocoPhillips (NYSE: COP), as well as announced an agreement to sell an indirect, non-controlling interest in the project to an infrastructure fund managed by KKR. Additionally, Sempra Infrastructure announced the closing of the project's $6.8 billion non-recourse debt financing and the issuance of the final notice to proceed under the project's engineering, procurement and construction agreement. "With strong customers, top-tier equity sponsors in ConocoPhillips and KKR and a world class contractor in Bechtel, this project has the potential to become one of America's most significant energy infrastructure investments over time, while creating jobs and spurring continued economic growth across Texas and the Gulf Coast region." "Sempra's selection of Port Arthur as the location for a new natural gas liquefication and export terminal is a strategic decision that will cement Texas' position as the energy capital of the world," said Texas Gov. Greg Abbott. "With a highly skilled workforce and business-friendly climate, and as a national leader in LNG exports, Texas is the prime location to expand LNG operations to unleash the United States' full economic potential in such a critical industry. Expanding LNG is imperative to American energy security, and the State of Texas looks forward to working alongside Sempra to advance this mission and bring more jobs and greater opportunities to hardworking Texans."

Sempra will build $13B LNG facility in Port Arthur - Sempra said Monday that it will move ahead with construction of a $13 billion liquefied natural gas facility in East Texas, becoming the second company to reach a final investment decision on a Gulf Coast LNG facility in as many weeks. Sempra Infrastructure, a subsidiary of the San Diego-based energy conglomerate, also said it closed its joint venture with Houston-based ConocoPhillips, which agreed to buy more than a third of the Port Arthur LNG project's annual production and a 30 percent stake in the development. KKR, which owns 20 percent of Sempra Infrastructure, also agreed to buy a non-controlling interest in the project, the companies said. Port Arthur LNG picked up speed in the race to build export terminals late last year, announcing a wave of deals with buyers of the super-cooled gas. It aims to launch the 13.5-million-metric-ton facility in 2027. The Monday announcement follows one last week from Venture Global, which said it would begin to construct its $21 billion phase 2 at its Plaquemines facility in Louisiana. "With strong customers, top-tier equity sponsors in ConocoPhillips and KKR and a world class contractor in Bechtel, this project has the potential to become one of America's most significant energy infrastructure investments over time, while creating jobs and spurring continued economic growth across Texas and the Gulf Coast region," Sempra CEO Jeffrey W. Martin said in a statement. LNG from the Gulf Coast has played a key role in replacing natural gas in Western Europe, which sought new suppliers after Russia invaded Ukraine.

Spurred by Permian, ExxonMobil Ramps U.S. Refinery Expansion Near Houston - The largest U.S. refinery expansion in more than a decade has ramped up southeast of Houston at ExxonMobil’s Beaumont refining complex. The $2 billion project, considered one of the largest in the world, bumped up capacity for transportation fuels by 250,000 b/d, to total 630,000 b/d-plus. The last big refinery expansion was in 2012. “ExxonMobil maintained its commitment to the Beaumont expansion even through the lows of the pandemic, knowing consumer demand would return and new capacity would be critical in the post-pandemic economic recovery,” said President Karen McKee of ExxonMobil Product Solutions. “The new crude unit enables us to produce even more transportation fuels at a time when demand is surging. This expansion is the equivalent of a medium-sized refinery and is a key part of our plans to provide society with reliable, affordable energy products.” The refinery is connected to pipelines from ExxonMobil’s Permian Basin operations. Permian crude is processed at the Beaumont refinery, where the company manufactures finished products, including diesel, gasoline and jet fuel. With the completion of the Wink-to-Webster crude line, which moves Permian oil to markets near Houston, as well as Beaumont pipelines, the new crude unit is positioned to further capitalize on segregated crude from the Permian Delaware sub-basin, where most of ExxonMobil’s production is underway. As Permian oil output grew, construction on the Beaumont expansion began in 2019, involving 1,700 contractors. More than 50 full-time employees work at the expanded operations. ExxonMobil’s integrated operations in Beaumont also include chemical, lubricants and polyethylene production. More than 2,000 people work for ExxonMobil in the Beaumont area, with operations accounting for around one in every seven jobs in the region. Meanwhile, Calgary-based affiliate Imperial Oil Ltd. in January agreed to invest about $560 million to construct what could be the largest renewable diesel facility in Canada. The project at Imperial’s Strathcona refinery is expected to produce 20,000 b/d of renewable diesel, primarily from locally sourced feedstocks.

U.S. Oil Production Returns to 2023 Peak Level; Demand Rises Despite Fresh Worries --Domestic crude production climbed back to the high mark of the pandemic era as U.S. consumption of petroleum products increased and mounting Chinese demand fueled global growth expectations.American exploration and production (E&P) firms boosted output by 100,000 b/d to 12.3 million b/d for the week ended March 17, according to the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report on Wednesday.The print matched the 2023 peak and the production pinnacle since the onset of coronavirus outbreaks in early 2020. E&Ps posted a record 13.1 million b/d of output in March of that year, just prior to public health officials declaring the global pandemic. The latest EIA result also far exceeded the year-earlier level of 11.6 million b/d.Demand, meanwhile, increased 5% week/week, driven by gains in consumption of gasoline and distillate fuels. Crude exports, however, declined modestly, allowing inventories for the March 17 period, excluding those in the Strategic Petroleum Reserve, to increase by 1.1 million bbl from the previous week. At 481.2 million bbl, stocks were 8% above the five-year average at the close of last week.While the latest week of data pointed to a spring pickup in domestic demand, consumption has proven relatively light so far this year. This developed alongside a slowing economy and forecasts for a potential recession in 2023.Such concerns were amplified over the past two weeks by the failures of Silicon Valley Bank in California and Signature Bank in New York – meltdowns that exposed weaknesses in the banking system. Following failures, other banks tend to pull back on lending. In turn, businesses and consumers, unable to get credit, slow their investments and spending. Against such a backdrop, the economy historically has stalled, as analysts at RBC Capital Markets noted.However, while recession risk is elevated, they do not see reason for panic in the financial system – in the United States or globally. That’s because the analysts view the recent failures as isolated, the result of overconcentration in the technology sector in Silicon Valley Bank’s case and cryptocurrency in Signature’s.