oil prices settle at a new seven year high, oil supplies fall to new 10 year low with SPR at a 19 year low; total oil & products supplies at 7 1/2 year low after across the board inventory draw; global oil shortage at 440,000 barrels per day in January as OPEC’s output falls 749,000 barrels per day short; 2021 shortage revised to 1.5 million barrels per day; US drilling rigs jump most in 48 months

oil prices rose for an eighth straight week and established a fourth consecutive 7 year high after the White House advised that a Russian invasion of Ukraine was imminent.. after rising 6.3% to $92.31 a barrel last week following OPEC's decision to limit their March production increase and on fears of production well freeze-offs, the contract price for US light sweet crude for March delivery opened 49 cents lower on Monday as progress in the Iran nuclear talks raised the specter that up to 2 million barrels per day of their supplies could return to the global oil market, and settled 99 cents lower at $91.32 a barrel as the prospect of an Iran deal offset bullish sentiment on rising consumption across industrialized countries and ongoing supply constraints from the OPEC+ alliance... oil extended Monday's losses into early trading Tuesday, as fears of easing geopolitical risks increased with the partial lifting of Iranian sanctions on civilian nuclear projects ahead of multinational talks in Vienna, and continued to tumble to settle $1.96, or more than 2% lower at $89.36 a barrel, amid a one-two punch of easing geopolitical tensions across the Ukraine-Russian border and reported progress in Iranian nuclear talks in Vienna....oil prices stabilized early Wedneday after Tuesday night's API report of across-the-board inventory draws, and then surged to over $90 after the weekly EIA report also showed across-the-board draws from U.S. stockpiles, and that US refiners had boosted crude throughputs to meet stronger fuel demand, before settling with a modest 30 cent gain to $89.66 a barrel as the prospect of increased supply from Iran and the US kept pressure on the market...oil prices jumped more than $2 early Thursday as traders weighed the possibility of an aggressive Fed response to new data showing annual inflation at a 40 year high, but settled just 22 cents higher at $89.88 a barrel as the inflation increase was also seen sapping US growth.. oil prices then spiked to nearly $95 a barrel Friday, after US National Security Adviser Jake Sullivan told a White House media briefing that a Russian attack on Ukraine could happen by next week and would likely begin with an air assault, before prices backtracked but still settled with a gain of $3.22 at $93.10 a barrel after the International Energy Agency raised its 2022 demand forecast and expects global demand to expand by 3.2 million barrels per day (bpd) this year, reaching an all-time record 100.6 million bpd....with that big Friday gain, US crude prices managed a 0.9% increase on the week and settled at another 7 year closing high..

on the other hand, natural gas prices finished lower for a second week as temperature forecasts continued to moderate throughout the week...after falling 1.4% to $4.572 per mmBTU last week as traders looked past the ongoing winter storm to warmer forecasts ahead, the contract price of natural gas for March delivery opened 4% lower on Monday and tumbled 34 cents, or more than 7% to $4.232 per mmBTU, as output recovered from last week's freeze-offs and on forecasts for lower heating demand over the next two weeks than was previously expected...natural gas prices rose as much as 15 cents early Tuesday as weather models showed a shot of chilly air hitting the eastern half of the country this weekend through early next week, but ultimately just settled 1.6 cents higher at $4.248 per mmBTU....natural gas prices headed south on rising temperatures and waning supply concerns on Wednesday and settled 23.9 cents or more than 5% lower at a two week low of $4.009 per mmBTU, and then fell 5.0 cents more to a three week low on Thursday despite a massive storage draw last week that was much bigger than usual for a fourth week in a row...natural gas prices slipped again on Friday, edging down 1.8 cents to another 3 week low of $3.941 per mmBTU, as a steadily warming February forecast proved too much for bulls to overcome and thus finished 13.8% lower on the week...

The EIA's natural gas storage report for the week ending February 4th indicated that the amount of working natural gas held in underground storage in the US fell by 222 billion cubic feet to 2,101 billion cubic feet by the end of the week, which left our gas supplies 441 billion cubic feet, or 17.3% below the 2,542 billion cubic feet that were in storage on February 4th of last year, and 215 billion cubic feet, or 9.3% below the five-year average of 2,316 billion cubic feet of natural gas that have been in storage as of the 4th of February over the most recent five years....the 222 billion cubic foot withdrawal from US natural gas working storage for the cited week was close to the average forecast for a 221 billion cubic foot withdrawal expected by an S&P Global Platts survey of analysts, but was more than the 174 billion cubic feet that were pulled from natural gas storage during the corresponding week of 2021, and also quite a bit more than the average withdrawal of 150 billion cubic feet of natural gas that have typically been pulled out natural gas storage during the same week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending February 4th indicated that after a drop in our oil imports, a jump in our oil exports, and an increase in our refining, we again had to pull oil out of our stored commercial crude supplies for the ninth time in 11 weeks and for the 25th time in the past thirty-seven weeks….our imports of crude oil fell by an average of 696,000 barrels per day to an average of 6,389,000 barrels per day, after rising by an average of 849,000 barrels per day during the prior week, while our exports of crude oil rose by an average of 724,000 barrels per day to an average of 3,100,000 barrels per day during the week, which together meant that our effective trade in oil worked out to a net import average of 3,289,000 barrels of per day during the week ending February 4th, 1,420,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude oil from US wells was reportedly 100,000 barrels per day higher at 11,600,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 14,889,000 barrels per day during the cited reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,577,000 barrels of crude per day during the week ending February 4th, an average of 328,000 more barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net of 879,000 barrels of oil per day were being pulled out the supplies of oil stored in the US….so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from net imports, from storage, and from oilfield production was 191,000 barrels per day more than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (-191,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet to make the reported data for the daily supply of oil and the consumption of it balance out, essentially a balance sheet fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been a error or omission of that magnitude in this week’s oil supply & demand figures that we have just transcribed...however, since last week’s EIA fudge factor was at (-1,377,000) barrels per day, that means there was still a 1,185,000 barrel per day difference between this week's balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the week over week supply and demand changes indicated by this week's report are completely worthless.....however, since most everyone treats these weekly EIA reports as gospel and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 879,000 barrel per day decrease in our overall crude oil inventories left our total oil supplies at 997,902,000 barrels, the lowest since December 12th, 2011, and therefore at a new 10 year low...this week's oil inventory decrease came as 679,000 barrels per day were being pulled out of our commercially available stocks of crude oil, while 200,000 more barrels per day of oil were being pulled out of our Strategic Petroleum Reserve, part of the first installment of Biden's plan to release 50 million barrels from the SPR to incentivize US gasoline consumption....including the drawdowns from the Strategic Petroleum Reserve under such politically motivated programs, a total of 68,634,000 barrels have been removed from the Strategic Petroleum Reserve over the past 18 months, and as a result the 587,515,000 barrels of oil left in our Strategic Petroleum Reserve is now the lowest since October 4th, 2002, or at yet another new 19 year low, as repeated tapping of our emergency supplies for political reasons or to “pay for” other programs had already drained those supplies considerably over the past dozen years...based on an estimated prepandemic consumption level of around 18 million barrels per day, the US will have roughly 30 1/2 days of oil supply left in the Strategic Petroleum Reserve when the Biden program is complete...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,614,000 barrels per day last week, which was 12.7% more than the 5,868,000 barrel per day average that we were importing over the same four-week period last year….this week’s crude oil production was reported to be 100,000 barrels per day higher at 11,600,000 barrels per day even though the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 11,100,000 barrels per day, because Alaska’s oil production was 12,000 barrels per day higher at 456,000 barrels per day and therefore added 100,000 barrels per day to the rounded national production total (by the EIA's math)...US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 11.5% below that of our pre-pandemic production peak, but 37.6% above the interim low of 8,428,000 barrels per day that US oil production had fallen to during the last week of June of 2016...

US oil refineries were operating at 88.2% of their capacity while using those 15,577,000 barrels of crude per day during the week ending February 4th, up from a utilization rate of 86.7% the prior week, but a bit lower than the historical utilization rate for early February refinery operations…the 15,577,000 barrels per day of oil that were refined this week were 5.3% more barrels than the 14,793,000 barrels of crude that were being processed daily during the pandemic impacted week ending February 5th of 2021, but still 2.8% less than the 16,020,000 barrels of crude that were being processed daily during the week ending February 7th, 2020, when US refineries were operating at what was then also a below normal 87.5% of capacity...

With the big increase in oil being refined this week, gasoline output from our refineries was also much higher, increasing by 740,000 barrels per day to 8,650,000 barrels per day during the week ending February 4th, after our gasoline output had decreased by 267,000 barrels per day over the prior week.…this week’s gasoline production was 8.5% more than the 8,656,000 barrels of gasoline that were being produced daily over the same week of last year, and 1.6% more than the gasoline production of 9,241,000 barrels per day during the week ending February 7th, 2020....at the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 97,000 barrels per day to 4,699,000 barrels per day, after our distillates output had decreased by 148,000 barrels per day over the prior week…after that increase, our distillates output was fractionally more than the 4,660,000 barrels of distillates that were being produced daily during the week ending February 5th of 2021, but 2.9% less than the 4,837,000 barrels of distillates that were being produced daily during the week ending January 31st, 2020...

Even with the increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the third time in the past 11 weeks, decreasing by 1,644,000 barrels to 248,393,000 barrels during the week ending February 4th, after our gasoline inventories had increased by a near record 27,378,000 barrels over the prior five weeks....our gasoline supplies decreased this week because the amount of gasoline supplied to US users increased by 900,000 barrels per day to 9,126,000 barrels per day, even as our imports of gasoline rose by 81,000 barrels per day to 514,000 barrels per day, and as our exports of gasoline fell by 334,000 barrels per day to 306,000 barrels per day…after this week's decrease, our gasoline supplies were 3.1% lower than last February 5th's gasoline inventories of 256,412,000 barrels, and are now about 3% below the five year average of our gasoline supplies for this time of the year…

Meanwhile, despite this week's increase in our distillates production, our supplies of distillate fuels decreased for the seventeenth time in twenty-four weeks, falling by 930,000 barrels to 121,814,000 barrels during the week ending February 4th, after our distillates supplies had decreased by 2,410,000 barrels during the prior week….our distillates supplies fell again this week even though the amount of distillates supplied to US markets, an indicator of our domestic demand, fell by 373,000 barrels per day to 4,296,000 barrels per day, because our exports of distillates rose by 449,000 barrels per day to 976,000 barrels per day, while our imports of distillates rose by 190,000 barrels per day to 440,000 barrels per day....after thirty inventory decreases over the past forty-four weeks, our distillate supplies at the end of the week were 24.4% below the 161,106,000 barrels of distillates that we had in storage on February 5th of 2021, and about 19% below the five year average of distillates inventories for this time of the year…

Meanwhile, drop in our oil imports, a jump in our oil exports, and an increase in our refining, our commercial supplies of crude oil in storage fell for the 18th time in 27 weeks and for the 34th time in the past year, decreasing by 4,756,000 barrels over the week, from 415,143,000 barrels on January 28th to a 39 month low of 410,387,000 barrels on February 4th, after our commercial crude supplies had decreased by 1,047,000 barrels over the prior week…after this week’s decrease, our commercial crude oil inventories fell to about 11% below the most recent five-year average of crude oil supplies for this time of year, but were still about 28% above the average of our crude oil stocks as of first weekend of February over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels....since our crude oil inventories had jumped to record highs during the Covid lockdowns of spring 2020 and remained elevated for most of a year after that, our commercial crude oil supplies as of this February 4th were 12.5% less than the 469,014,000 barrels of oil we had in commercial storage on February 5th of 2021, and are now 7.2% less than the 442,468,000 barrels of oil that we had in storage on February 7th of 2020, and also 8.9% less than the 450,840,000 barrels of oil we had in commercial storage on February 8th of 2019…

Finally, with our inventory of crude oil and our supplies of all products made from oil all near multi year lows, we are continuing to track the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR....the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 9,449,000 barrels this week, from 1,767,813,000 barrels on January 28th to1,758,364,000 barrels on February 4th....that leaves our total supplies of oil & its products now at the lowest since May 30th, 2014, or at a fresh seven and a half year low, despite the recent near record increase in gasoline inventories....

OPEC's January Oil Market Report

Thursday of the past week saw the release of OPEC's February Oil Market Report, which includes details on OPEC & global oil data for January, and hence it gives us a picture of the global oil supply & demand situation for the sixth month after 'OPEC+' agreed to increase their output by 400,000 barrels per day each month from the previously agreed to July level, which was in turn part of the fifth production quota policy reset that they've made over the past twenty months, all in response to the pandemic-related slowdown and subsequent irregular recovery....with US Omicron infections apparently subsiding at the time of this report, we need to again caution that the global oil demand estimates made by OPEC herein, while the eventual global course of the Covid-19 pandemic still remains uncertain, should be considered as having a much larger margin of error than we'd expect from this report during stable and hence more predictable periods..

the first table from this monthly report that we'll review is from the page numbered 46 of this month's report (pdf page 56), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC uses an average of estimates from six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures...

As we can see on the bottom line of the above table, OPEC's oil output increased by 64,000 barrels per day to 27,981,000 barrels per day during January, up from their revised December production total which averaged 27,918,000 barrels per day....however, that December output figure was originally reported as 27,882,000 barrels per day, which therefore means that OPEC's December production was revised 36,000 barrels per day higher with this report, and hence OPEC's January production was, in effect, a 100,000 barrel per day increase from the previously reported OPEC production figure (for your reference, here is the table of the official December OPEC output figures as reported a month ago, before this month's revision)...

According to the agreement reached between OPEC and the other oil producers at their Ministerial Meeting on July 18th, 2021, the oil producers party to that agreement were to raise their output by a total of 400,000 barrels per day each month through December, which was subsequently renewed to include another 400,000 barrel per day production increase in January,and which would include an increase of 254,000 barrels per day from the OPEC members listed above ...but as we can see from the above table, OPEC's increase of 64,000 barrels per day was far short of that...the apparent reasons for their production shortfall in January were the 51,000 barrel per day decrease in Venezuela's output, the 45,000 barrel per day decrease in Libya's output, the 27,000 barrel per day decrease in Iraq's output, and to a lesser extent the production decreases by Congo and Gabon...while we knew that Libyan production has frequently been disrupted by episodes of civil strife and that Iraq's output was interrupted by an explosion on a key export pipeline to Turkey, it turns out that Venezuela was unable to meet their quota because a shipment of Iranian condensate, which it uses to blend its extra-heavy crude, did not arrive in January, forcing a production shutdown....

Recall that the original 2020 oil producer's agreement was to cut oil production by 9.7 million barrels per day from an October 2018 baseline for just two months early in the pandemic, during May and June of 2020, but that initial 9.7 million bpd production cut agreement was extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020....then, in a subsequent meeting in July of that year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August 2020 and subsequent months, which thus became the agreement that governed OPEC's output for the rest of 2020...the OPEC+ agreement for their January 2021 production, which was later extended to include February and March and then April's output, was to further ease their supply cuts by 500,000 barrels per day to a cut of 7.2 million barrels per day from that original 2018 baseline...then, during a difficult meeting on April 1st of last year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher each month by a pre-set amount over the following three months, thus extending their joint output cut agreement through July....production levels for August and the following months of this year were to be determined by a July 1st OPEC meeting, but that meeting was adjourned on July 2nd due to a dispute between the UAE and the Saudis over the 2018 reference production levels, and a subsequent attempt to restart that meeting on July 5th was called off....so it wasn't until July 18th 2021 that a tentative compromise addressing August's output quotas was worked out, allowing oil producers in aggregate to increase their production by 400,000 barrels per day in August, and again by that amount in each of the following months, and also to boost reference production levels for the UAE, the Saudis, Iraq and Kuwait beginning in April 2022....OPEC and other producers then agreed to increase their production in January 2022 by a further 400,000 barrels per day in a meeting concluded on the 2nd of December, 2021, and reaffirmed their intention to continue that policy with another 400,000 barrel per day increase in February at a meeting concluded January 4, 2022, and then agreed to stick to that 400,000 bpd oil output increase in March, despite pressure from the US to raise output more quickly, at a meeting on February 2nd, a little over a week ago...

Hence OPEC arrived at the production quotas for August 2021 through March of this year by repeatedly readjusting the original 23%, or 9.7 million barrel per day production cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day output reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was actually raised to an 8.2 million barrel per day oil output reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during February, March, and then later during April of last year....under the agreement prior to the current one, OPEC's production cut in April 2021 was set at 4,564,000 barrels per day below the October 2018 baseline, which was lowered to a cut of 3,650,000 barrels per day from the baseline with the prior comprehensive agreement, which thus set the July production quota for the "OPEC 10" at 23,033,000 barrels per day, with war torn Libya and US sanctioned producers Iran and Venezuela exempt from the production cuts imposed by thiat agreement....for OPEC and the other producers to increase their output by 400,000 barrels per day from that July 2021 level, each producer would be allowed to initially increase their production by just over 1% per month...for the ten members of OPEC who agreed to impose production cuts on themselves, that would mean their August output quota would be roughly 23,277,000 barrels per day, then 23,531,000 barrels per day in September, then roughly 23,786,000 barrels per day in October, then 24,041,000 barrels per day in November, then 24,296,000 barrels per day in December, and finally to 24,551,000 barrels per day in January ...therefore, the 23,802,000 barrels those 10 OPEC members actually produced in January were 749,000 barrels per day short of what they were expected to produce during the month, with Nigeria, Angola, and the Saudis accounting for most of this month's shortfall....

The next graphic from this month's report that we'll look at shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from February 2020 to January 2022, and it comes from page 47 (pdf page 57) of OPEC's February Oil Market Report....on this graph, the cerulean blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

Including this month's modest 64,000 barrel per day increase in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate indicates that total global liquids production increased by a rounded 710,000 barrels per day to average 98.69 million barrels per day in January, a reported increase which came after December's total global output figure was apparently revised down by 530,000 barrels per day from the 98.51 million barrels per day of global oil output that was estimated for December a month ago, as non-OPEC oil production rose by a rounded 650,000 barrels per day in January after that downward revision, with 80,000 barrels per day of the increase coming from OECD countries, primarily Norway and the UK, while non-OECD countries increased their output by 530,000 barrels per day, predominantly driven by production increases from Russia, Ecuador and Brazil... note that the graph above now shows a decline in December's global production, whereas a month ago OPEC had reported an 650,000 barrels per day global production increase for the month

After that increase in January's global output, the 98.69 million barrels of oil per day that were produced globally during the month were 5.10 million barrels per day, or 5.4 more than the revised 93.59 million barrels of oil per day that were being produced globally in January a year ago, which was the initial month that OPEC and their allied producers agreed to reduce their output cuts by 500,000 barrels per day from the 7.7 million barrels per day production cut that they applied to the last 5 months of 2020 (see the February 2021 OPEC report (online pdf) for the originally reported January 2021 details)...with this month's relatively small increase in OPEC's output, their January oil production of 27,981,000 barrels per day amounted to 28.4% of what was produced globally during the month, down from their 28.5% revised share of the global total in December....OPEC's January 2021 production was reported at 25,496,000 barrels per day, which means that the 13 OPEC members who were part of OPEC last year produced 2,485,000 barrels per day, or 9.7% more barrels per day of oil this January than what they produced a year earlier, when they accounted for 27.4% of global output...

Even after the increases in OPEC's and global oil output that we've seen in this report, the amount of oil being produced globally during the month still fell a bit short of the expected global demand, as this next table from the OPEC report will show us....

The above table came from page 27 of the February Oil Market Report (pdf page 37), and it shows regional and total oil demand estimates in millions of barrels per day for 2021 in the first column, and then OPEC's estimate of oil demand by region and globally quarterly over 2022 over the rest of the table...on the "Total world" line in the second column, we've circled in blue the figure that's relevant for January, which is their estimate of global oil demand during the first quarter of 2022....OPEC is estimating that during the 1st quarter of this year, all oil consuming regions of the globe will be using an average of 99.13 million barrels of oil per day, and that oil consumers will be using 100.80 barrels per day over the entire year, now indicating a level of demand above that of 2019, when global demand averaged 99.98 million barrels per day....but as OPEC showed us in the oil supply section of this report and the summary supply graph above, OPEC and the rest of the world's oil producers were only producing 98.69 million barrels million barrels per day during January, which would imply that there was a modest shortage of around 440,000 barrels per day in global oil production in January when compared to the demand estimated for the month..

Also note on the table above that we've circled in green a small upward revision of 10,000 barrels per day to the demand figure for last year...a separate table on page 26 of tths months Oil Market Report indicates that was due to a 20,000 barrels per day upward revision to the demand figure for the fourth quarter of 2021, and a 30,000 barrels per day upward revision to the demand figure for the third quarter of 2021, which thus means that the supply shortfalls or surpluses that we previously reported for those quarters of last year would need to be revised....a month ago we estimated that there was a shortage of around 1,240,000 barrels per day in global oil production in December, based on the figures that were published at that time...however, as we saw earlier, December's global output figure was revised down by 530,000 barrels per day from those figures, while global demand for the 4th quarter of 2021 has now been revised 20,000 barrels per day higher, so with those revised figures, we now find that global oil production in December was running roughly 1,790,000 barrels per day short of demand...

In addition to figuring the December oil shortage that's indicated by this report, the upward revision of 20,000 barrels per day to 4th quarter demand we've noted above means that the 1,890,000 barrels per day global oil output shortage we had previously figured for November would now be revised to an oil shortage of 1,910,000 barrels per day...likewise, the upward revision of 20,000 barrels per day to 4th quarter demand noted above means that the 2,350,000 barrels per day global oil output shortage we had previously figured for October would now be revised to an oil shortage of 2,370,000 barrels per day...

As we previously mentioned, there was also a upward revision of 30,000 barrels per day to the third quarter's demand....that means that the 1,600,000 barrels per day global oil output shortage we had previously figured for September would now be revised to a shortage of 1,630,000 barrels per day....in like manner, the 30,000 barrels per day upward revision to 3rd quarter demand means that the shortage of 2,110,000 barrels per day we had previously figured for August would now be revised to a shortage of 2,140,000 barrels per day, and that the shortage of 1,690,000 barrels per day barrels per day we had previously figured for July would have to be revised to a shortage of 1,720,000 barrels per day...

After those revisions to our oil shortage estimates for the last 6 months of 2021, we should also go back and revise our estimate of the oil supply shortage for all last year...a month ago, we had listed our revised estimates for each month of last year based on the 12 monthly oil market reports that OPEC released over the year, and the monthly revisions to the supply and demand figures therein, and we found that the world was short 527,910,000 barrels of oil in 2021, which worked out to a shortage of 1,446,300 barrels of oil per day...with January's revisions, we now find that the world was short 548,940,000 barrels of oil in 2021, which works out to a shortage of 1,503,950 barrels of oil per day....despite that, we're still far from running out, because the quantities of oil being produced globally during the pandemic of 2020 still averaged over 3 million barrels per day more than anyone wanted....

This Week's Rig Count

The number of drilling rigs running in the US increased for the 62nd time over the past 73 weeks during the week ending February 11th, and by the most since February 9th 2018, but were still 19.9% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US increased by twenty-two to 635 rigs this past week, which was also 238 more rigs than the pandemic hit 397 rigs that were in use as of the February 12th report of 2021, but was still 1,294 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil was up by 19 to 516 oil rigs during this week, after they had increased by 2 oil rigs during the prior week, and there are now 210 more oil rigs active now than were running a year ago, even as they still amount to just 32.1% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014….at the same time, the number of drilling rigs targeting natural gas bearing formations was up by 2 to 118 natural gas rigs, which was also up by 28 natural gas rigs from the 90 natural gas rigs that were drilling during the same week a year ago, but still only 7.3% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…this week also saw the startup of a new rig drilling vertically in Mercer county North Dakota that Baker Hughes has classified as 'miscellaneous', which i'm told is for a well intended to store CO2 emissions from an area ethanol plant....that lone 'miscellaneous' rig thus matches to the 'miscellaneous' rig count of 1 a year ago

The Gulf of Mexico rig count was unchanged at 16 rigs this week, with fifteen of this week's Gulf rigs drilling for oil in Louisiana waters and another rig drilling for oil in Alaminos Canyon, offshore from Texas....that's down from the 17 Gulf rigs that were active in the Gulf a year ago, when 15 Gulf rigs were drilling for oil offshore from Louisiana and two were deployed for oil in Texas waters…since there is not any drilling off our other coasts at this time, nor was there a year ago, those Gulf rig counts are equal to the national offshore totals for both years....

In addition to those rigs offshore, we also have 2 water based rigs drilling inland; one is a horizontal rig targeting oil at a depth of between 5000 and 10,000 feet, drilling from an inland body of water in Plaquemines Parish, Louisiana, near the mouth of the Mississippi, and the other is a directional rig drilling for oil at a depth of over 15,000 feet in the Galveston Bay area... this week's inland waters rig count of two is up by one from the single inland waters rigs that was deployed a year ago..

The count of active horizontal drilling rigs was up by 19 to 574 horizontal rigs this week, which was also 218 more rigs than the 356 horizontal rigs that were in use in the US on February 12th of last year, but still 58.2% less than the record 1,374 horizontal rigs that were drilling on November 21st of 2014....at the same time, the vertical rig count was up by 4 rigs to 28 vertical rigs this week, which was also up by 5 from the 23 vertical rigs that were operating during the same week a year ago…on the other hand, the directional rig count was down by 1 to 33 directional rigs this week, but those were still up by 15 from the 18 directional rigs that were in use on February 12th of 2021….

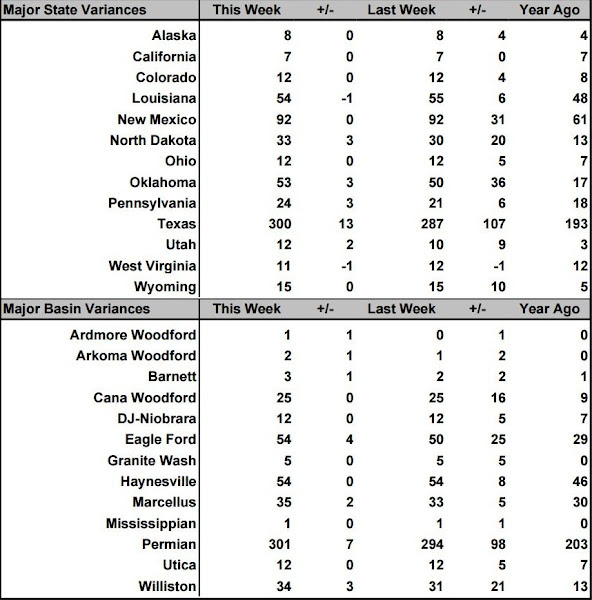

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of February 11th, the second column shows the change in the number of working rigs between last week’s count (February 4th) and this week’s (February 11th) count, the third column shows last week’s February 4th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 12th of February, 2021...

with a 22 rig increase, we may not find details on all of them, but we'll start by checking the Rigs by State file at Baker Hughes for changes in Texas, where we find that two rigs were added in Texas Oil District 8, which encompasses the core Permian Delaware, that four rigs were added in Texas Oil District 7C, which includes the counties of the southern Permian Midland, and that two more rigs were added in Texas Oil District 7B, which includes a couple counties in the far eastern Permian Midland...since that adds up to eight new rigs and the Permian rig count was only up by seven, and since there were no changes evident in New Mexico, that means that one of those rigs in the Permian basin region of Texas was not targeting the Permian..

elsewhere in Texas, there were two rigs added in Texas Oil District 1, another rig added in Texas Oil District 2, yet another rig added in Texas Oil District 3, and also a rig added in Texas Oil District 4 at the same time, any four of which would account for the 4 rig increase in the Eagle Ford shale...since the Eagle Ford saw a natural gas rig pulled out this week while 5 oil rigs were added, that means one of those districts had an offsetting change which doesn't show up in the totals..

meanwhile, the three rigs added in North Dakota were all in the Williston basin, but as we mentioned earlier, one was drilling a well for carbon capture & storage... in Oklahoma, oil rigs added to the Arkoma Woodford and the Ardmore Woodford account for 2 of the state's 3 rig increase, while another rig was added elsewhere in the state targeting a basin that Baker Hughes doesn't track...there were also two rigs added in Utah targeting oil in the Uintah basin, which Baker Hughes doesn't track, and a rig pulled out from southern Louisiana, also from a basin which Baker Hughes doesn't track...

for rigs targeting natural gas, there were three added in Pennsylvania's Marcellus, while a natural gas rig was removed from West Virginia's Marcellus at the same time...there was also a natural gas rig added in a basin not identified by Baker Hughes, while a natural gas was pulled out of the Eagle Ford, where 7 gas rigs and 47 oil rigs remain active..

+++++++++++++++++++++++++++++++

Northeast Ohio injection well operator asks state board to allow more powerful earthquakes before required shutdown - cleveland.com — A company that ran a wastewater injection drilling well in Northeast Ohio wants a state board to change certain parameters it was ordered to follow to resume operations, including allowing for more powerful earthquakes before it must shut down. AWMS Water Solutions of Warren is asking the Oil and Gas Commission to amend an order from the Ohio Department of Natural Resources’ Oil and Gas Resources Division for a well on a 5-acre site in Weathersfield Township in Trumbull County, about 70 miles southeast of Cleveland.

Utica Shale Academy to fall short of funding expectations — The latest funding formula will leave the Utica Shale Academy about $120,000 short of expectations in this fiscal year. “We have to keep an eye on spending,” said Robert Barrett, fiscal officer. “We are trying to evolve this program into something that is worthwhile for these kids so that they have a career that they can go into when they graduate.” Barrett said after analyzing the latest school funding figures for the U.S.A., which emphasizes career training and assistance for students needing to recover credits in order to graduate, he has determined the latest funding formula does not take into account the growth the school has seen in the last couple years. The school funding formula for the state is basing numbers on the number of students involved in career tech during the fiscal year 2020, instead of the current enrollment figures in 2022. Barrett said the school only had six to eight kids involved in career tech at that time, but now there are about 70.Barrett said he has questioned if there will be a correction for the school’s growth and told there is not one planned for this fiscal year. During Monday’s meeting, the U.S.A. board approved a resolution to join the GRADS Coalition, which provides schools dropout prevention and recovery schools a voice in Columbus. The school will break ground on an outdoor welding lab in the next few weeks, a steel building that will have lean-to bays of the side where students will be able to learn to weld outside in the elements. Plans are also approved now for the indoor welding lab planned for the basement of the Utica Shale Academy school housed in the Hutson Building. Watson also talked about future equity grants for next year with the continued symbiotic relationship with Southern Local and the potential partnership in the works with someone in the northern part of the county, but declined to further name the organization.

Boone Co. residents concerned after vandalism causes oil leak into river --An act of vandalism is causing oil to spill into the Pond Fork River in Boone County. Firefighters say the tank that was vandalized help up to 5,000 gallons of oil inside and it is currently unknown how much oil escaped from the tank. G.W. Davis lives at the mouth of Jack Branch Road less that a mile from the transformer substation. “I had no idea they had anything with oil or whatever,” said Davis. He said he did not know there was oil in the tanks of an old transformer substation. Saturday he grew concerned when he saw fire trucks driving by in the afternoon, but said he did not know what they were doing. Boone County firefighters said they went up to check the substation owned by Lexington Coal Company after a person came forward and said they could see oil sheen on the Pond Fork River. Firefighters said they found out the station had been vandalized. The gate to a 5,000 gallon oil tank had been cut and the valve to the tank had been turned to let oil leak out. “There is always shady people coming in and out of here plus they can come in from another way besides this way,” said Davis. The West Virginia Department of Environmental Protection was called out to investigate. Officials with the DEP said the tank contained mineral oil inside and when it was vandalized that oil spilled into a sediment pond nearby. Firefighters say the oil also leaked into the Pond Fork River. A spokesperson with the DEP said no sheen or residue was visible and no fishkill had been observed

Unclear who is investigating oil leak and vandalism; community activist speaks out - Oil sits on top of the areas where the water pools on the Pond Fork River.Maria Gunnoe is the director of a non-profit, Mother Jones Community Foundation, with a long list of awards for community activism in West Virginia. She has been capturing the oil leak the only way she can which is on video.“I have seen a very clear sheen of oil and oil substance I’ll call it, on the river and it has a very pungent smell to it,” said Gunnoe.Boone County firefighters, including the Van Fire Department, said they got a call from a concerned person Saturday afternoon when they also saw the sheen on the river. “It’s everywhere that I know, from Bull Creek up in and through Madison. Every place that the water slows down, this is puddling up,” said Gunnoe.Firefighters traced the leakage back to this transformer substation in the Jack’s Branch area.They found the gate to the station cut open and the valve on a 5,000-gallon oil tank turned on and with oil flowing straight out with very little left.The West Virginia Department of Environmental Protection said the act of vandalism released mineral oil from the tank. While looking out at the rainbow colored ripples, Gunnoe thinks of the kids she teaches to fish in these waters.“Then I hear that it is mineral oil, it’s only mineral oil, and everything should be fine. I don’t agree with that and I would like full disclosure on it because our kids recreate in this water. We fish, we eat the fish, and we need to know,” said Gunnoe.Boone County dispatch said no law enforcement was ever dispatched to the call, although EMS, fire, emergency management and the WV DEP were called out.WSAZ followed up with both the Boone County Sheriff’s Office and the West Virginia State Police. Neither said they are part of any investigation. Gunnoe lives five miles from where the spill happened. With her experience, she said this is one of the worst spills she has seen. “That substation is not well secured, so anyone can go up in there. Anyone could have got into it and done the damage that has been done to our stream,” said Gunnoe. The DEP said the Madison Fire Department put mats down at the substation to contain the oil near the tank.

State could develop natural gas property tax rule - — A bill considered by the House Finance Committee on Monday afternoon would give the State Tax Department another try at developing a rule for determining tax assessments for natural gas-producing property in West Virginia. The committee recommended House Bill 4162 for passage, authorizing the State Tax Department to promulgate a legislative rule relating to valuation of property that produces oil, natural gas, and natural gas liquids. It also states the legislative rule previously filed by the State Tax Department is not authorized. HB 4162 comes nearly one month since the West Virginia Legislature’s Rule-Making Review Committee moved to not approve an earlier legislative rule submitted by the State Tax Department last summer regarding assessments of natural-gas producing property. House Bill 2581, passed during the 2021 legislative session, required the State Tax Commissioner to develop a revised methodology to value oil and natural gas properties based on the fair market value based on a yield capitalization model applied to gross royalty payments for royalty interest to net proceeds once royalties and annual operating costs are subtracted from gross receipts. Instead, the emergency rule and the draft rule developed by the State Tax Department lowered the capitalization rate, eliminated the use of a three-year weighting, and left it up to the State Tax Department to use its own reasonable standard, which is undefined in the rule itself instead of the actual revenues and expenses of the producer. By not approving the agency-submitted rule in January, the emergency rule submitted by the State Tax Department remains in place for tax year 2022. Both the emergency rule and the final rule proved to be unpopular with lawmakers, county assessors, and representatives of the natural gas industry. The original version of last year’s HB 2581 would have resulted in a $9.1 million property tax revenue loss to county governments and county school systems, with $7 million of that cost hitting eight counties in the Northern Panhandle and North Central West Virginia.

Federal Court Rejects Mountain Valley Pipeline Permit - A federal court in Virginia has struck down a proposed permit for the Mountain Valley Pipeline, siding with environmental groups who said the project would threaten endangered wildlife and habitat.The pipeline would run more than 300 miles, transporting natural gas through eleven counties in West Virginia and neighboring states. The decision is the second rejection by a federal court over permitting for the pipeline's construction.Cindy Rank, chair of the extractive industries committee for the West Virginia Highlands Conservancy, one of several groups behind a lawsuit against the pipeline, said it would cross many of the state's headwater streams, both large and small."And the impact on both of those is going to be a tremendous amount of sedimentation," Rank explained. "Both from the construction sites on either side of the stream if you're going to drill under; and the actual in-stream degradation as you're blocking up one side and digging up another side to put that pipeline down."High levels of sediment can disrupt ecosystems, harm fish, and increase algae blooms. The interstate pipeline would be owned and operated by Mountain Valley Pipeline, LLC, a joint venture between several energy companies, and regulated by the Federal Energy Regulatory Commission. On its website, the company said it has provided funding to preserve land and remains dedicated to ongoing environmental preservation efforts.Rank argued a decision last December by the West Virginia Department of Environmental Protection (DEP) to issue awater quality certification failed to consider the pipeline's potentially harmful impacts to wildlife and the environment."Because we believe that certification is based on fallacies," Rank asserted. "DEP did not consider everything they needed to consider, before determining that this would not violate water-quality standards."She believes it would be a mistake to tie West Virginia into more fossil fuels, at a time when the nation is focused on creating a sustainable renewable-energy infrastructure."But now is the time to make those changes," Rank contended. "To solar, to wind, to other options that don't have as big a carbon footprint. And in fact these permits are supposed to take that kind of future impact into account." According to the Center for Biological Diversity, the pipeline has been required to pay millions of dollars in fines for more than 350 water-quality related violations in Virginia and West Virginia.

Future of Mountain Valley Pipeline clouded by court decisions -- For four years now, the half-mile hike from David Seriff’s front door to a ridgetop has offered the same vista: a 125-foot-wide trough plowed up one side of the mountain and down the other. Along the route, segments of an unfinished natural gas pipeline lie in a state of suspended animation. A federal appeals court recently rejected two government permits that are needed to complete a massive infrastructure project that opponents say is an environmental train wreck. On Friday morning, as he stood on the windswept ridge, Seriff’s outlook had not changed. “I think it’s another nail in the coffin,” he said of the 4th U.S. Circuit Court of Appeals’ Jan. 25 reversal of a permit allowing the pipeline to pass through the Jefferson National Forest, which abuts his home north of Blacksburg. A second ruling last Thursday invalidated a finding that endangered species would not be jeopardized. “But we haven’t killed the beast.” If the complex regulatory and legal proceedings that have enveloped the 303-mile pipeline since 2018 could be reduced to a simple baseball analogy, Mountain Valley has two strikes against it. Three sets of key permits — the U.S. Forest Service’s approval for the buried pipe to cut through 3.5 miles of public woodlands, the U.S. Fish and Wildlife Service’s finding that it would not destroy the habitats of endangered species, and the U.S. Army Corps of Engineers’ green light for Mountain Valley to cross streams and wetlands — have each been struck down twice by the Fourth Circuit. Mountain Valley is still swinging, though. “With total project work nearly 94% complete, Mountain Valley remains committed to meeting Americans’ energy needs and completing this pipeline,” company spokeswoman Natalie Cox wrote in an email Friday. “The MVP has undergone an unprecedented level of review, and rigorous analysis has repeatedly demonstrated that this project can in fact be built safely and responsibly. “ If the pipeline is to survive, government agencies must again rewrite permits to satisfy the Fourth Circuit — which has been perhaps the biggest challenge for developers since they first announced the project nearly a decade ago. “MVP is now highly unlikely to enter service in 2022, in our view, and the in-service date could be pushed into 2024 depending on how the court’s concerns are addressed,” Height Capital Markets, an investment banking firm that has followed the project, said in a written commentary last week. Of the two most recent decisions, the reversal of a biological opinion that found no jeopardy to two endangered fish — the Roanoke logperch and the candy darter — was seen as the more troubling for Mountain Valley. In its “non-legal expert” reading, Height said the Fourth Circuit appears to have extended the scope of the Endangered Species Act “to include a standard that would be difficult for most new infrastructure projects to meet.” Judge James Wynn wrote in a unanimous opinion from a three-judge panel that the Fish and Wildlife Service failed to adequately consider two things: the environmental baseline of the two imperiled fish and the cumulative effects of future events, such as climate change. “We recognize that this decision will further delay the completion of an already mostly finished pipeline, but the Endangered Species Act’s directive to federal agencies could not be clearer: halt and reverse the trend toward species extinction, whatever the cost,” the 40-page opinion concluded.

EQT Considers Selling More Shares in MVP Sponsor as Uncertainty Plagues Project -EQT Corp. now expects the Mountain Valley Pipeline (MVP) to come online in 2023, which could help narrow its natural gas price differentials and ease Appalachian takeaway constraints, but management acknowledged Thursday that the “specter of timing” continues to loom over the project. EQT has capacity booked on the system and a stake in MVP’s lead sponsor Equitrans Midstream Corp, which expects the project to start up this summer. Equitrans is reviewing that timeline after a federal appeals court last week vacated MVP’s Endangered Species Act authorizations and set back construction further. The 303-mile, 2 Bcf/d system would move more Appalachian natural gas from West Virginia to the Southeast. EQT’s fourth quarter investor presentation assumes a mid-2023 start-up for MVP.The pipeline has been dogged by regulatory delays. EQT CFO David Khani said during a call on Thursday to discuss year-end results that the company sold some of its shares in Equitrans during the fourth quarter and would consider selling more as the stock has declined. “We’ll be thoughtful in when we want to sell them again,” he said. EQT, the nation’s largest natural gas producer, reported higher average realized prices for 2021 of $2.50/Mcfe, up from $2.37 in the prior year. Those gains were offset by wider differentials, however, as pipeline constraints in the Northeast have dented the realizations of Appalachian producers. CEO Toby Rice said high energy prices in New England are the direct result of takeaway issues in Appalachia. He also cautioned that a rapid energy transition and resistance to natural gas projects in places like Europe have led to higher energy costs as well.. “It’s relevant to the people in the southeast United State. You need to understand there is a pipeline that is going to allow you to benefit from low cost, reliable, clean energy, and this is something that people need to be aware of, because what’s happening in Europe, what’s happening in New England, starts with the things right now happening to MVP.” Rice said his team has been working to get a stronger grip on what they can control. EQT reported steep losses on hedges last year as prices crept upward. However, Rice said the company has started implementing an updated hedging strategy that “provides downside protection, while leaving large-to-upside exposure to higher natural gas prices.” CFO David Khani noted that the company has paid off more debt, allowing it to “switch from a defensive hedging strategy with nearly all swaps to a more balanced approach” for 2023. The company has about 65% of its production volumes hedged for 2022 and another 42% hedged next year. EQT has layered on an overall floor of $3/Dth and a ceiling of $5/Dth in 2023. Management also guided for 2022 capital expenditures (capex) of $1.3-1.45 billion to produce between 1.95-2.05 Tcfe. Guidance was higher than last year’s capex of $1.1 billion and above Wall Street consensus. Inflationary pressures and incremental spending for a new well design are likely to push spending higher this year. Management said the company would phase in a “next generation” well design in 2022 that’s been under development for the past year. Preliminary results from those wells are expected by the end of the year. EQT produced 527 Bcfe in the fourth quarter across its Marcellus and Utica shale assets in Ohio, Pennsylvania and West Virginia. That’s up from 401 Bcfe in 4Q2020. Full year production was 1.9 Tcfe, up from 1.5 Tcfe in 2020. Rising volumes were the result of EQT’s acquisition of Alta Resources Development LLC and Appalachian assets it purchased from Chevron Corp.

Big Oil Has a Plan to Turn Appalachia Into Hydrogen Country - - The fossil fuel industry has a new plan for Appalachia: Blue hydrogen. An alliance between some of the largest corporations in the energy business—Shell, General Electric Gas Power, EQT Corporation, Equinor, Mitsubishi, US Steel and Marathon Petroleum—announced in a press release late last week their plan to create a “hydrogen industrial hub” in Ohio, Pennsylvania, and West Virginia. Their plan is to work with local stakeholders in the process, creating “a national model for sustainable energy and production systems.” The companies are putting their faith in an element that’s gained traction as an energy form in recent months, as the bipartisan infrastructure bill includes billions of dollars to build out clean hydrogen energy development. Hydrogen is also the most abundant element in the universe, existing in water, alcohols, and the like. Producing hydrogen as an energy source requires separating H atoms from other elements in the molecules where it naturally occurs (so, removing the H from H2O, for example). This is most commonly done commercially using steam to separate hydrogen from methane in natural gas; the finished product is referred to as ‘blue hydrogen,’ because it is emissions-free when burned, but is made with polluting sources of energy. Matt Kelso, manager of data and technology at the non-profit environmental watchdog FracTracker Alliance told Motherboard he sees the investment in hydrogen as “an extension of the existing polluting industries, by the exact same companies that are polluting our air, land, and water today.” “It is an excuse to keep drilling, obfuscated under a new identity, in an environment where there is increasing awareness of the damages that oil and gas extraction has caused to the region,” said Kelso, who lives in Pittsburgh, near southwest Pennsylvania’s oil and gas hub. The plan will capitalize on the region’s natural gas stores, largely trapped in the Marcellus Shale geologic formation, … Actual job numbers paled in comparison to those promised. A 2021 economic analysis by the non-profit think tank Ohio River Valley Institute found that jobs in Appalachian fracking counties climbed by merely 1.6 percent in the 2010s, compared to the 450,000 jobs that industry estimates from the early 2010s laid out. It also led to an oversupply of natural gas that the industry is now trying to offload (most notably by pushing plastics). The companies are positioning the move as an environmentally-sound one, or a way to achieve “aggressive net zero carbon goals,” . In fact, the fossil fuel industry more broadly has rallied around using carbon capture and sequestration as a technique to eliminate emissions from steam-methane reforming in the hydrogen production process. These emissions are substantial. An August, 2021 report out of Cornell and Stanford Universities found that the carbon footprint that comes with creating blue hydrogen is 20 percent larger than that of burning natural gas and coal for heat and 60 percent greater than burning diesel oil for the same purpose.Thus, carbon capture and storage—in which carbon dioxide is collected at the source of emissions and shot underground into stores—is essential to the fossil fuel companies’ plan if it is to be ‘net zero.’ But CCS comes with its own set of risks; pipelines carrying captured carbon have, in the past,exploded, and in the Marcellus Shale, where oil and gas wells, manyabandoned, dot the landscape, shooting it underground could prove geologically risky — pressure from two wells interacting could lead to explosions.)

‘There’s no closure’: 12 years after deadly Kleen Energy plant explosion, lawsuits drag on --On a snow-covered morning in February 2010, workers at the Kleen Energy plant under construction in Middletown were attempting to clear any remaining debris from the network of pipes by using the force of roughly 480,000 gallons of natural gas — enough to fill more than five Olympic swimming pools. What exactly caused the cloud of gas to ignite was never determined, though investigators would later point to several possible sources. The resulting explosion killed six workers and injured more than 50, while leading to new national standards that called on companies to stop the use of flammable natural gas in so-called “gas blows.” But as friends and family members of the victims along with the survivors marked the 12-year anniversary of the explosion on Monday, some are still engaged in a drawn-out legal battle seeking to hold the operators of the plant responsible for the disaster. “They’ve accepted no responsibility,” said Paula Dobratz, whose husband Raymond was among those killed in the powerful blast. “Think of how long they’ve had to fight also with their attorneys for 12 years to make sure that the rest of the people that have cases against them get nothing and still have to wait,” Dobratz said. “There’s no closure.” In the years following the explosion, New Haven attorney Joel Faxon has represented the Dobratz family along with roughly a dozen injured workers in a series of lawsuits related to the disaster. Most of their claims, Faxon said Monday, have proceeded through the courts as part “test cases” brought on the behalf of two injured workers. In December, the Connecticut Supreme Court dismissed the latest part of that effort, finding that the plant's operator, Kleen Energy Systems, lacked sufficient control over the independent contractor in charge of construction to be held liable for the explosion. The court’s decision follows its own earlier ruling in 2016, finding that the contractor, O&G Industries of Torrington, had already paid worker’s compensation benefits and was immune from having to pay further damages. The decisions have left the victims and their families with just two pending claims against Kleen Energy related to the inherent dangers of using flammable gas to clean piping equipment, Flaxon said.

New gas plant for electrical co-ops draws fire, highlights bumpy path to renewable energy -The natural gas-fired Magnolia Power Generating Station proposed for Iberville Parish would be an important cog in a plan by five rural Louisiana electrical cooperatives to provide reliable, cheap electricity through 2045, backers say. Its critics have concerns. State utility regulators recently gave their nod to thegroundbreaking 20-year power plan for the co-ops' 119,000 customers that, in addition to Magnolia Power, would count on renewable energy in a big way. Under the new deal, more than a third of the power would come from renewable sources, but local environmental groups say the plan isn't doing enough with renewables given the grave threat that global climate change poses for south Louisiana. Building a new $750 million fossil fuel-reliant power plant, these critics say, would contradict the central goal of Gov. John Bel Edwards' climate task force — net zero carbon emissions by 2050 — by permitting a new greenhouse gas emissions source and potentially locking in those emissions through 2045. Though the financial backers of the plant say it could be switched to hydrogen fuel that they argue would be carbon-free, these critics say the details of when and how that switch would happen are vague and not included in regulatory filings. "We're saying they should go all renewable, and, if they've got to go with this natural gas plant, they need to really seriously talk about reducing emissions from the plant and ... give us details about this idea that they're going to go 100% hydrogen, a fuel that no place in the world is currently doing 50%," said Darryl Malek-Wiley, a senior organizing representative for the Sierra Club in New Orleans. "It's a test plant, and we don't know what that involves." Under Edwards, Louisiana has proposed a rarity for the Deep South: a plan to cut the state's fossil fuel emissions either by eliminating those sources, offsetting them or storing them underground in a bid to slow global climate change. A scientific consensus has concluded that emissions from burning fossil fuels is sending more heat-trapping gases into the atmosphere. The gases are raising overall global temperatures and setting off dynamic changes to the climate, ice caps and glaciers that are inducing sea level rise, according to the United Nations Intergovernmental Panel on Climate Change. Much of south Louisiana could see 1.5 feet of sea level rise by 2050 and, in the worst case, up to 7 feet by 2100, the IPCC found.

Gas pipeline constraints showing along East Coast, manufacturers say - Limited capacity on natural gas pipelines is driving up gas prices for U.S. manufacturers, making it tougher to compete with low-cost manufactures abroad, the trade group Industrial Energy Consumers of America said in a letter to members of Congress Wednesday.The group, which represents U.S. manufacturing and industrial firms, said pipeline companies were putting strict limits on gas flows to maintain system stability. They said increased demand from natural gas-fired power plants and liquefied natural gas export facilities, centered along the Texas and Louisiana Gulf Coast, had resulted in less available pipeline capacity for manufacturing. "New pipeline capacity is not getting built," said Paul Cicio, president of IECA. "Inadequate pipeline capacity impacts existing manufacturing facilities and is detrimental to new investments and job creation." In his letter, Cicio specifically cited the use of what are known as operational flow orders along the Transco pipeline, which runs along the Gulf and Atlantic coastlines between Houston and New York. He said gas prices where the pipeline runs through Virginia and North Carolina averaged $11.37 per million British thermal units in January - more than double the U.S. benchmark Henry Hub - and at one point exceeded $21."We've seen some cold weather over the last several weeks, from Boston all the way down to Atlanta, and demand has been really high," said Scott Hallam, senior vice president at Williams Co., which operates Transco. "We're seeing differences in pricing regionally. Henry Hub is trading around $4 but you get to New York it's $10 to $15. In Boston it's $30. That's the challenging consuming sectors like manufacturing face." Under an operational flow order, buyers and sellers must tell pipeline companies nearly exactly how much gas they are transporting. If they're wrong, they must pay a steep financial penalty that can far exceed the cost of the gas they're buying.

The natural gas industry is ready for a net-zero future — as long as it still includes pipelines -Every minute, a new customer is hooked up to the natural gas system, says Karen Harbert, president of the American Gas Association, or AGA, the primary trade association for U.S. gas utilities. Today, that’s a major problem for the climate. Leaks are common throughout the natural gas system, from wells, pipelines, and appliances, and they release the powerful greenhouse gas methane into the atmosphere. When natural gas is ultimately burned in a heater or stove, carbon dioxide is emitted. All told, residential and commercial use of gas was responsible for about 10 percent of U.S. emissions in 2019. In colder parts of the country that rely primarily on natural gas heating, it makes up a much larger portion of emissions.But at a press conference on Tuesday, Harbert told reporters that the natural gas system can grow by 24 percent over the next three decades while at the same time becoming cleaner, and eventually not contribute to climate change at all. That’s the key finding of the AGA’s new “Net-Zero Emissions Opportunities for Gas Utilities” report.The report comes as many cities and states with climate goals are passing policies and creating incentives to staunch the tide of new natural gas users by encouraging people to install appliances that can run on clean electricity, like heat pumps and induction stoves. The shift threatens gas utilities’ bottom line, and the industry is pushing for solutions that utilize their existing infrastructure. The AGA report outlines four potential pathways that gas utilities could follow to zero out their emissions by 2050. All four would require a radical transformation of the industry, with the amount of energy supplied by fossil natural gas dropping from 12 quadrillion British thermal units today down to 1 quadrillion or less by mid-century. All the pathways feature a similar set of solutions but vary in how much they rely on each one. The AGA is proposing that utilities reduce their energy demand through energy efficiency programs; repurpose the existing pipeline system to deliver alternative gases that have a lower (but not zero) carbon footprint, like biogas or a blend of natural gas and hydrogen; build new pipelines in select areas that can carry pure hydrogen; and ramp up leak detection and pipe replacement programs to reduce methane emissions. The AGA also sees carbon capture playing a role to cut emissions from natural gas use in the industrial sector and in the production of hydrogen. All four of the industry group’s pathways rely on carbon capture and carbon offsets to eliminate the last 8 to 14 percent of gas utilities’ current emissions.

U.S. natgas drops over 7% on less cold forecasts, rising output (Reuters) - U.S. natural gas futures fell over 7% to a near two-week low on Monday, keeping volatility at record highs for a third day in a row, as output slowly recovers from last week's freezing weather and on forecasts for less cold and lower heating demand over the next two weeks than previously expected. Over the past month, trade in gas futures was the most volatile on record due in part to worries that Winter Storm Landon, which battered the eastern half of the country last week, would cut output and boost heating demand like last February's Winter Storm Uri. But Landon - with just one day below freezing in the West Texas Permian basin - was much weaker than Uri, which froze West Texas for eight days in a row. Uri killed more than 200 people in Texas, caused power and gas prices to soar to record highs in many parts of the country and left millions of homes and businesses without heat and power for days after gas pipes and power plants froze, cutting as much as 17.4 billion cubic feet per day (bcfd) of gas output. Front-month gas futures for March delivery on the New York Mercantile Exchange (NYMEX) fell 34.0 cents, or 7.4%, to settle at $4.232 per million British thermal units, their lowest close since Jan. 25. During a period of record volatility for NYMEX futures ahead of Landon, U.S. speculators last week boosted their net long futures and options positions on the NYMEX and Intercontinental Exchanges to the highest since October 2021 by cutting their NYMEX shorts by the most in a week since February 2021, Data provider Refinitiv said output in the U.S. Lower 48 states fell from a record 97.3 bcfd in December to 93.9 bcfd in January and 89.9 bcfd so far in February after wells in several regions froze, including the Permian in Texas and New Mexico, the Bakken in North Dakota and the Appalachia in Pennsylvania, West Virginia and Ohio. With less cold expected, Refinitiv projected average U.S. gas demand, including exports, would drop from 130.3 bcfd this week to 119.8 bcfd next week. Those forecasts were lower than Refinitiv's outlook on Friday. The amount of gas flowing to U.S. liquefied natural gas (LNG) export plants was on track to rise from a monthly record of 12.4 bcfd in January to 12.7 bcfd in February as liquefaction trains at Venture Global LNG's Calcasieu Pass export plant in Louisiana enter service. A vessel arrived near Calcasieu on Monday and may be the first to pick up LNG from the plant.

U.S. natgas falls over 5% to 2-wk low on rising output, less cold (Reuters) - U.S. natural gas futures fell over 5% to a two-week low on Wednesday as output slowly increased after weeks of reductions from freezing wells and on forecasts for slightly less cold weather and lower heating demand than expected in the next two weeks. After weeks of near record volatility, front-month gas futures for March delivery fell 23.9 cents to settle at $4.009 per million British thermal units (mmBtu), their lowest close since Jan. 21. The American Public Power Association (APPA) industry trade group said it asked the U.S. Commodity Futures Trading Commission (CFTC) to investigate natural gas trading activity on Jan. 27 when prices spiked by a record 46%. In the spot market, frigid weather and high heating demand in the U.S. Northeast have kept next-day power and gas prices in New York and New England at or near their highest levels since January 2018. Those high prices have made it economic for the region's power generators to burn lots of expensive oil and liquefied natural gas (LNG) this winter. Data provider Refinitiv said output in the U.S. Lower 48 states fell from a record 97.3 billion cubic feet per day (bcfd) in December to 93.9 bcfd in January and 90.8 bcfd in February after wells in several producing regions froze, including the Permian in Texas and New Mexico, the Bakken in North Dakota and the Appalachia in Pennsylvania, West Virginia and Ohio. Output has been rising almost daily since it dropped to 86.3 bcfd during a winter storm on Feb. 4, its lowest since February 2021. With the cold weather moderating, Refinitiv projected average U.S. gas demand, including exports, would drop from 130.0 bcfd this week to 122.6 bcfd next week. The forecast for this week was lower than Refinitiv's outlook on Tuesday. Traders said demand for U.S. LNG would remain strong so long as global gas prices keep trading well above U.S. futures as utilities around the world scramble for cargoes to meet surging demand in Asia and replenish low inventories in Europe - especially with the threat that Russia could invade Ukraine and cut gas supplies to Europe. Russia provides 35%-40% of Europe's gas supplies, totaling about 16.3 bcfd in 2021, according to analysts and U.S. energy data. Gas futures traded around $25 per mmBtu in Europe and Asia, compared with just $4 in the United States. But no matter how high global prices rise, the United States only has capacity to turn about 12.4 bcfd of gas into LNG. The rest of the gas flowing to LNG facilities is used to run plant equipment.