Strategic Petroleum Reserve approaching a 19 year low; oil + products supplies drop to an 83 month low; total oil product demand sets a record high, led by distillates demand at 18+ year high; global oil shortage at 1,210,000 barrels per day in November as OPEC output falls 563,000 barrels per day short of quota; demand revisions now indicate oil shortage for all of 2021

oil prices ended lower for the seventh time in eight weeks this week as the rapid spread of the Omicron virus variant began to impact oil demand.. after rising 8.2% to $71.67 a barrel last week on hopes that Omicron would not be as detrimental to demand as initially feared, the contract price for US light sweet crude for January delivery opened higher on Monday and rose almost 2% in early trading after OPEC raised their forecast for world oil demand for the first quarter of 2022, but then began falling as new doubts emerged about the effectiveness of vaccines against Omicron variant to settled 38 cents lower at $71.29 a barrel...oil prices continued falling on Tuesday, reaching a low of $69.51 a barrel by late morning, after the International Energy Agency (IEA) said the Omicron coronavirus variant was set to dent global demand recovery, before staging a partial recovery and ending off 56 cents at $70.73 a barrel, even as record producer prices reinforced expectations of a faster stimulus withdrawal by the Fed, thus supporting the US dollar...oil prices moved lower overnight and extended their decline into Wednesday, sliding to $69.39 as Omicron-driven demand fears, reinforced by ugly Chinese retail and industrial output data, coincided with US shale and OPEC+ supply surplus anxiety. but rebounded back to above $70 after the EIA reported across the board inventory declines and the largest crude draw since early September, and settled with a gain of 14 cents at $70.87 a barrel...oil prices followed equity markets higher on Thursday, after the Fed signaled the end of its ultra-easy monetary policy earlier than was previously expected, and settled with a gain of $1.51 at $72.38 a barrel, supported by record U.S.demand data and falling crude stockpiles, even as the spread of the Omicron coronavirus variant threatened to put a brake on consumption worldwide...but oil prices completely reversed those gains on Friday, falling $1.52 to $70.86 a barrel, triggered by growing concerns that a rapid spread of the COVID omicron variant across several major oil-consuming economies would lead to an avalanche of quarantine closures this winter, and thus finished the week 1.1% lower, their seventh weekly decline in eight weeks, for prices based on the front month contract...

meanwhile, natural gas prices finished lower for the third straight week on continued mild temperature forecasts, and are now down by more than 33% since Thanksgiving...after falling 5% to $3.925 per mmBTU last week on a dearth of forecasts for sustained heating demand, the contract price of natural gas for January delivery opened higher on Monday on a chillier weekend forecast and rose by more than 4% in early trading, only to tank by afternoon as subsequent weather data backed off the cold forecast and sent the gas contract price tumbling to settle 13.1 cents lower at $3.794 per mmBTU, despite an 11% jump in European gas prices that was expected to keep our LNG exports near record highs....warm weather continued to pressure gas prices on Tuesday, despite a huge day over day decline in production, as they fell another 4.7 cents to $3.747 per mmBTU, but they recovered to close 5.5 cents higher at $3.802 per mmBTU on Wednesday on forecasts for slightly cooler weather over the next two weeks than was previously expected...however, natural gas prices slipped 3.6 cents to $3.766 per mmBTU on Thursday on a midday forecast for milder weather than expected over the next two weeks, and on expectations for a smaller-than-usual weekly storage withdrawal in the week to come due to the warm weather, and then tumbled another 7.6 cents, or 2% to $3.690 per mmBTU on Friday, the lowest close since Decemer 6th and down 6.0% on the week, on forecasts for even milder weather through the end of December...

The EIA's natural gas storage report for the week ending December 10th indicated that the amount of working natural gas held in underground storage in the US fell by 88 billion cubic feet to 3,417 billion cubic feet by the end of the week, which left our gas supplies 326 billion cubic feet, or 8.7% below the 3,743 billion cubic feet that were in storage on December 10th of last year, and 64 billion cubic feet, or 1.8% below the five-year average of 3,481 billion cubic feet of natural gas that have been in storage as of the 10th of December over the most recent years...the 88 billion cubic foot withdrawal from US natural gas working storage this week was equal to the average forecast for a 88 billion cubic foot withdrawal from a S&P Global Platts' survey of analysts, but was much less than the 118 billion cubic feet that were pulled from natural gas storage during the corresponding week of 2020, and was also less than the average withdrawal of 114 billion cubic feet of natural gas that have typically been pulled out natural gas storage during the same week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending December 10th showed that after a near record jump in our oil exports, we needed to pull oil out of our stored commercial crude supplies for the fifth time in twelve weeks and for the twenty-fifth time in the past thirty-seven weeks….our imports of crude oil fell by an average of 28,000 barrels per day to an average of 6,471,000 barrels per day, after falling by an average of 105,000 barrels per day during the prior week, while our exports of crude oil rose by an average of 1,375,000 barrels per day to an average of 3,645,000 barrels per day during the week, which together meant that our effective trade in oil worked out to a net import average of 2,826,000 barrels of per day during the week ending December 10th, 1,403,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude oil from US wells was reportedly unchanged at 11,700,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 14,103,000 barrels per day during the cited reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,670,000 barrels of crude per day during the week ending December 10th, an average of 115,000 fewer barrels per day than the amount of oil that our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net of 933,000 barrels of oil per day were being pulled out the supplies of oil stored in the US….so based on that reported & estimated data, this week’s crude oil figures from the EIA appear to indicate that our total working supply of oil from net imports, from storage, and from oilfield production was 210,000 barrels per day less than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just plunked a (+210,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet to make the reported data for the daily supply of oil and the consumption of it balance out, essentially a balance sheet fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been a error or omission of that magnitude in this week’s oil supply & demand figures that we have just transcribed...moreover, since last week’s EIA fudge factor was at (-420,000) barrels per day, that means there was a 630,000 barrel per day difference in the EIA's crude oil balance sheet error from a week ago, and hence the week over week supply and demand changes indicated by this week's report are fairly useless....however, since most everyone treats these weekly EIA reports as gospel and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 933,000 barrel per day decrease in our crude oil inventories came as 655,000 barrels per day were being pulled out of our commercially available stocks of crude oil, while 279,000 barrels per day of oil were pulled out of our Strategic Petroleum Reserve, part of the first installment from Biden's plan to release 50 million barrels from the SPR, in order to incentive continued use of US gas guzzlers; however, most of that oil is expected to go to China and India, so how it would impact US prices is unclear...including the drawdowns from the Strategic Petroleum Reserve under such politically motivated programs, a total of 57,232,000 barrels have been removed from the Strategic Petroleum Reserve over the past 18 months, and as a result the amount of oil in our Strategic Petroleum Reserve has fallen to an 227 month low of 598,917,000 barrels per day, or the lowest since December 27, 2002, as repeated tapping of our emergency supplies for political expediency or to “pay for” other programs had already drained those supplies over the past dozen years...based on an estimated prepandemic consumption level of 18 million barrels per day, the US will have roughly 30 1/2 days of oil supply left in the Strategic Petroleum Reserve when the Biden program is complete..

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,502,000 barrels per day last week, which was 15.4% more than the 5,633,000 barrel per day average that we were importing over the same four-week period last year….this week’s crude oil production was reported to be unchanged at 11,700,000 barrels per day even though the EIA's rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day higher at 11,300,000 barrels per day, because Alaska’s oil production was 5,000 barrels per day lower at 449,000 barrels per day and subtracted 100,000 barrels per day from the reported rounded national production total (by the EIA's math)...US crude oil production had hit a pre-pandemic record high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was still 10.7% below that of our pre-pandemic production peak, but 38.8% above the interim low of 8,428,000 barrels per day that US oil production had fallen to during the last week of June of 2016...

US oil refineries were operating at 89.8% of their capacity while using those 15,670,000 barrels of crude per day during the week ending December 10th, unchanged from the prior week, but still a bit lower than normal utilization for early December refinery operations… the 15,670,000 barrels per day of oil that were refined this week were 10.5% more barrels than the 14,183,000 barrels of crude that were being processed daily during the pandemic impacted week ending December 11th of last year, but 5.4% less than the 16,562,000 barrels of crude that were being processed daily during the week ending December 13th, 2019, when US refineries were operating at what was then also a less than seasonal 90.6% of capacity...

Even with the decrease in oil being refined this week, the gasoline output from our refineries was quite a bit higher, increasing by 479,000 barrels per day to 10,042,000 barrels per day during the week ending December 10th, after our gasoline output had decreased by 86,000 barrels per day over the prior week.…this week’s gasoline production was also 17.8% more than the 8,522,000 barrels of gasoline that were being produced daily over the same week of last year, and 2.1% more than the gasoline production of 9,840,000 barrels per day during the week ending December 13th, 2019….on the other hand, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 105,000 barrels per day to 4,812,000 barrels per day, after our distillates output had increased by 45,000 barrels per day over the prior week…after that decrease, our distillates output was still 4.5% more than the 4,604,000 barrels of distillates that were being produced daily during the week ending December 11th, 2020, but 5.1% less than the 5,072,000 barrels of distillates that were being produced daily during the week ending December 13th, 2019..

Even with the big jump in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the eighth time in ten weeks, and for the twentieth time in thirty-four weeks, decreasing by 719,000 barrels to 218,585,000 barrels during the week ending December 10th, after our gasoline inventories had increased by 3,882,000 barrels over the prior week...our gasoline supplies decreased this week because the amount of gasoline supplied to US users increased by 509,000 barrels per day to 9,472,000 barrels per day, and as our imports of gasoline fell by 59,000 barrels per day to 499,000 barrels per day, while our exports of gasoline fell by 171,000 barrels per day to 621,000 barrels per day…after this week’s inventory decrease, our gasoline supplies were 8.5% lower than last December 11th's gasoline inventories of 238,879,000 barrels, and about 6% below the five year average of our gasoline supplies for this time of the year…

With the decrease in our distillates production, our supplies of distillate fuels decreased for the twelfth time in sixteen weeks and for the 24th time in 36 weeks, falling by 2,852,000 barrels to 123,758,000 barrels during the week ending December 10th, after our distillates supplies had increased by 2,733,000 barrels during the prior week….our distillates supplies fell this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, jumped by a record 1,318,000 barrels per day to a 18 1/2 year high of 4,896,000 barrels per day, even as our exports of distillates fell by 445,000 barrels per day to 773,000 barrels per day, and as our imports of distillates rose by 181,000 barrels per day to 450,000 barrels per day....after twenty-five inventory decreases over the past thirty-six weeks, our distillate supplies at the end of the week were 18.2% below the 151,259,000 barrels of distillates that we had in storage on December 11th, 2020, and about 9% below the five year average of distillates stocks for this time of the year…

Meanwhile, with the big jump in our oil exports, our commercial supplies of crude oil in storage fell for the 19th time in the past twenty-nine weeks and for the 34th time in the past year, and by the most in 14 weeks, decreasing by 4,584,000 barrels over the week, from 432,870,000 barrels on December 3rd to 428,286,000 barrels on December 10th, after our commercial crude supplies had decreased by 241,000 barrels over the prior week…after this week’s decrease, our commercial crude oil inventories slipped to around 7% below the most recent five-year average of crude oil supplies for this time of year, but were still about 24% above the average of our crude oil stocks as of the second weekend of December over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels....since our crude oil inventories had jumped to record highs during the Covid lockdowns of last spring and remained elevated for most of the year after that, our commercial crude oil supplies as of this December 10th were 14.4% less than the 500,096,000 barrels of oil we had in commercial storage on December 11th of 2020, and are now 4.2% less than the 446,833,000 barrels of oil that we had in storage on December 13th of 2019, and 3.0% less than the 441,457,000 barrels of oil we had in commercial storage on December 14th of 2018…

Finally, with our inventory of crude oil and our supplies of all products made from oil all near multi year lows, we are continuing to track the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR....the EIA's data shows that total oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 17,816,000 barrels this week, from 1,827,222,000 barrels on December 3rd to 1,809,406,000 barrels on November 10th and is now at the lowest level since January 2nd, 2015, or at an 83 month low...coincidental with that near seven year low in oil and oil product supplies, implied demand based on product supplied of all petroleum products rose to a record high of 23,191,000 barrels per day during the week ending December 10th, beating the previous record that was set during week ending August 27th of this year, when total demand had topped out at 22,820,000 barrels per day...

OPEC's December Oil Market Report

Monday of this week saw the release of OPEC's December Oil Market Report, which includes OPEC & global oil data for November, and hence it gives us a picture of the global oil supply & demand situation for the fourth month after 'OPEC+' agreed to increase their output by 400,000 barrels per day monthly from the previously agreed to July level, which was part of the fifth production quota policy reset that they've made over the past year and a half, all in response to the pandemic-related slowdown and subsequent irregular recovery...again, we'll caution that the oil demand estimates made by OPEC herein, while the course of the Covid-19 pandemic still remains uncertain in most countries around the globe, should be considered as having a much larger margin of error than we'd expect from this report during stable and hence more predictable periods..

the first table from this monthly report that we'll review is from the page numbered 47 of this month's report (pdf page 59), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC uses an average of estimates from six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures...

As we can see on the bottom line of the above table, OPEC's oil output increased by 285,000 barrels per day to 27,717,000 barrels per day during November, up from their revised October production total averaging 27,432,000 barrels per day....however, that October output figure was originally reported as 27,453,000 barrels per day, which therefore means that OPEC's October production was revised 21,000 barrels per day lower with this report, and hence OPEC's November production was, in effect, a 264,000 barrel per day increase from the previously reported OPEC production figure (for your reference, here is the table of the official October OPEC output figures as reported a month ago, before this month's revision)...

According to the agreement reached between OPEC and the other oil producers at their Ministerial Meeting on July 18th, the oil producers party to that agreement were to raise their output by a total of 400,000 barrels per day each month through November, which would include an increase of 254,000 barrels per day from the OPEC members listed above...so as we can see from the above table, OPEC's increase of 285,000 barrels per day was a bit more than that...however, since OPEC's production was already 588,000 barrels per day short of their quota in October, the 31,000 extra barrels per day they produced in November is pretty inconsequential, especially since those OPEC members who saw larger than allotted increases in November were already lagging their quotas..

Recall that last year's original oil producer's agreement was to cut oil production by 9.7 million barrels per day from an October 2018 baseline for just two months early in the pandemic, during May and June of last year, but that initial 9.7 million bpd production cut agreement had been extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020....then, in a subsequent meeting in July of last year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August 2020 and subsequent months, which thus became the agreement that governed OPEC's output for the rest of 2020...the OPEC+ agreement for this January's production, which was later extended to include February and March and then April's output, was to further ease their supply cuts by 500,000 barrels per day to a cut of 7.2 million barrels per day from that original baseline...then, during a difficult meeting on April 1st of this year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher each month by a set amount over the next three months, taking their joint output cut agreement through July....production levels for August and the following months of this year were to be determined by a July 1st OPEC meeting, but that meeting was adjourned on July 2nd due to a dispute between the UAE and the Saudis over reference production levels, and a subsequent attempt to restart that meeting on July 5th was called off....so it wasn't until July 18th that a tentative compromise addressing August quotas was worked out, allowing oil producers in aggregate to increase their production by 400,000 barrels per day in August and again by that amount in each of the following months, and boosting reference production levels for the UAE, the Saudis, Iraq and Kuwait beginning in April 2022...OPEC and other producers then agreed to increase their production in January 2022 by a further incremental 400,000 barrels per day in a meeting concluded on the 2nd of December, two weeks ago...

OPEC arrived at the production quotas for August through November of this year by repeatedly adjusting the original 23%, or 9.7 million barrel per day production cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day output reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was actually raised to an 8.2 million barrel per day oil output reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during February, March, and then later during April of this year....under the prior agreement, OPEC's production cut in April was at 4,564,000 barrels per day from the October 2018 baseline, which was lowered to a cut of 3,650,000 barrels per day from the baseline with the latest comprehensive agreement, which thus set the July production quota for the "OPEC 10" at 23,033,000 barrels per day, with war torn Libya and US sanctioned producers Iran and Venezuela exempt from the production cuts imposed by this agreement....for OPEC and the other producers to increase their output by 400,000 barrels per day from that July level, each producer would be allowed to increase their production by just over 1% per month...for the ten members of OPEC who agreed to impose cuts on themselves, that would mean their August output quota would be roughly 23,277,000 barrels per day, then 23,531,000 barrels per day in September, then roughly 23,786,000 barrels per day in October, and then 24,041,000 barrels per day in November....therefore, the 23,478,000 barrels those 10 OPEC members produced in November were still 563,000 barrels per day short of what they were expected to produce, with Nigeria, Angola and the Saudis accounting for the most of this month's shortfall..

The next graphic from this month's report that we'll highlight has the months mislabelled, but it still correctly shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from December 2019 to November 2021, and it comes from page 48 (pdf page 60) of OPEC's December Monthly Oil Market Report....on this graph, the cerulean blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

Including this month's 285,000 barrel per day increase in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate indicates that total global liquids production increased by a rounded 880,000 barrels per day to average 98.28 million barrels per day in November, a reported increase which came after October's total global output figure was apparently revised down by 160,000 barrels per day from the 97.56 million barrels per day of global oil output that was estimated for October a month ago, as non-OPEC oil production rose by a rounded 590,000 barrels per day in November after that revision, with most the increase coming from non-OECD countries, predominantly in Latin America, even as European OECD countries increased their output by 90,000 barrels per day...

After that increase in November's global output, the 98.28 million barrels of oil per day that were produced globally during the month were 5.93 million barrels per day, or 6.4% more than the revised 92.35 million barrels of oil per day that were being produced globally in November a year ago, which was the fourth month after OPEC and other producers agreed to reduce their output cuts from 9.7 million barrels per day to 7.7 million barrels per day (see the December 2020 OPEC report (online pdf) for the originally reported November 2020 details)...with this month's increase in OPEC's output, their November oil production of 27,717,000 barrels per day amounted to 28.2% of what was produced globally during the month, unchanged from their share of the global total in October....OPEC's November 2020 production was reported at 25,109,000 barrels per day, which means that the 13 OPEC members who were part of OPEC last year produced 2,608,000 barrels per day, or 10.4% more barrels per day of oil this November than what they produced a year earlier, when they accounted for 27.1% of global output...

Even after the increases in OPEC's and global oil output that we've seen in this report, the amount of oil being produced globally during the month again fell short of the expected global demand, as this next table from the OPEC report will show us..

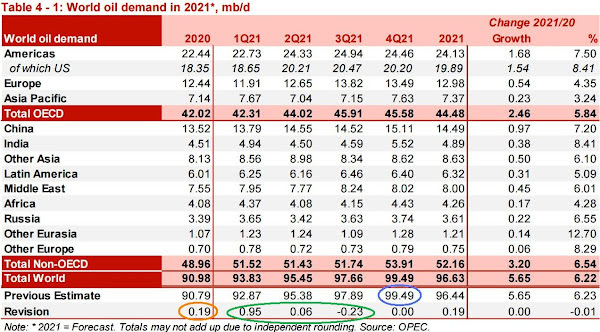

The above table came from page 25 of the OPEC December Oil Market Report (pdf page 37), and it shows regional and total oil demand estimates in millions of barrels per day for 2020 in the first column, and then OPEC's estimate of oil demand by region and globally, quarterly over 2021 over the rest of the table...on the "Total world" line in the fifth column, we've circled in blue the figure that's relevant for November, which is their estimate of global oil demand during the fourth quarter of 2021... OPEC is estimating that during the 4th quarter of this year, all oil consuming regions of the globe have been using an average of 99.49 million barrels of oil per day, which was unrevised from their estimate for the 4th quarter a month ago, still reflecting a bit of coronavirus related demand destruction compared to 2019, when global demand averaged over 101 million barrels per day during second half of the year....but as OPEC showed us in the oil supply section of this report and the summary supply graph above, OPEC and the rest of the world's oil producers were only producing 98.28 million barrels per day during November, which would imply that there was a shortage of around 1,210,000 barrels per day in global oil production in November when compared to the demand estimated for the month...

in addition to figuring that November oil shortage implied by this report, the downward revision of 160,000 barrels per day to October's global oil output that's implied in this report means that the 1,930,000 barrels per day global oil output shortage we had previously figured for October would now be revised to an oil shortage of 2,090,000 barrels per day....

Note on the table above that we've circled in green a downward revision of 230,000 barrels per day to the third quarter's demand....that means that the 2,070,000 barrels per day global oil output shortage we had previously figured for September would now be revised to a shortage of 1,840,000 barrels per day....in like manner, 230,000 barrels per day downward revision to 3rd quarter demand means that the shortage of 2,580,000 barrels per day we had previously figured for August would now be revised to a shortage of 2,350,000 barrels per day, and that the shortage of 2,160,000 barrels per day barrels per day we had previously figured for July would have to be revised to a shortage of 1,930,000 barrels per day...

On the other hand, you can see in green that we've also circled a modest upward revision of 60,000 barrels per day to the second quarter's demand, a quarter when there was also a shortage of oil being produced globally.... based on that upward revision to demand, our previous estimate that there was a shortage of 680,000 barrels per day in June would now be revised to a 740,000 barrels per day shortage, the oil shortage of 2,010,000 barrels per day that we had previously figured for May would have to be revised to a shortage of 2.070,000 barrels per day, and that the 2,360,000 barrels per day global oil output shortage we should have figured for April would have to be revised to a shortage of 2,420,000 barrels per day...

Also note that in green that we have circled a significant upward revision of 950,000 barrels per day to OPEC's previous estimate of first quarter demand, during a period when supply and demand seemed to be closer to being in balance....for March, that means that the global oil output surplus of 140,000 barrels per day we had previously figured for March would now be revised to a shortage of 810,000 barrels per day... similarly, the upward revision to first quarter demand means that the 870,000 barrels per day global oil output shortage we had previously figured for February would now be revised to a shortage of 1,820,000 barrels per day, and that the global oil output surplus of 350,000 barrels per day we had previously figured for January would now be revised to a shortage of 600,000 barrels per day, in light of that 950,000 barrel per day upward revision to first quarter demand...

You might also note that we have also circled a 190,000 barrel per day upward revision to 2020's demand circled in orange....while we're not inclined to go back and recompute the figures for each month of last year in light of that revision, suffice it to say that the quantities of oil being produced globally during the pandemic of 2020 averaged over 3 million barrels per day more than anyone wanted, and that an average 190,000 barrels per day upward revision to global demand during that period would be a drop in the bucket in comparison...

This Week's Rig Count

The number of drilling rigs active in the US increased for the 55th time during the past 65 weeks during the week ending December 17th, but still remained 27% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs running in the US increased by three to 579 rigs this past week, which was also 233 more rigs than the pandemic hit 346 rigs that were in use as of the December 18th report of 2020, but was also still 1,350 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global oil market in an attempt to put US shale out of business….

The number of rigs drilling for oil increased by 4 to 475 oil rigs during this week, after they had increased by 4 rigs during the prior week, and there are now 212 more oil rigs active now than were running a year ago, even as they still amount to just 29.5% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014….at the same time, the number of drilling rigs targeting natural gas bearing formations fell by 1 to 104 natural gas rigs, which was still up by 23 natural gas rigs from the 81 natural gas rigs that were drilling during the same week a year ago, but still only 6.5% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008….note that last year's rig count also included a rig that Baker Hughes had classified as "miscellaneous', while there are no such "miscellaneous' rigs deployed this week...

The Gulf of Mexico rig count was up by one rig to 15 rigs this week, with thirteen of this week's Gulf rigs drilling for oil in Louisiana waters and two more drilling for oil in Alaminos Canyon, offshore from Texas...that's now one less than the count of 16 rigs that were active in the Gulf a year ago, when 13 Gulf rigs were drilling for oil offshore from Louisiana and three deployed for oil in Texas waters…looking at the well records in the Gulf, it appears that most of those rigs appear to be directional, targeting oil at depths greater than 15,000 feet, and include five targeting the Mississippi Canyon and three targeting oil under the Green Canyon...since there is now no drilling off our other coasts, nor was there a year ago, the Gulf rig count is equal to the national offshore totals..

In addition to those rigs offshore, we continue to have one water based rig drilling for oil inland in the Galveston Bay area; the directional rig that had been targeting oil from an inland body of water in Plaquemines Parish, Louisiana, near the mouth of the Mississippi was shut down this week, and hence the inland waters rig count of one is now down from two a year ago..

The count of active horizontal drilling rigs was unchanged at 521 horizontal rigs this week, which was still 213 more than the 308 horizontal rigs that were in use in the US on December 18th of last year, but also 62.1% less than the record 1,374 horizontal rigs that were deployed on November 21st of 2014...meanwhile, the directional rig count was up by one to 31 directional rigs this week, and those were also up by 11 from the 21 directional rigs that were operating during the same week a year ago….in addition, the vertical rig count was up by 2 to 26 vertical rigs this week, and those were up by 9 from the 17 vertical rigs that were in use on December 18th of 2020….

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of December 17th, the second column shows the change in the number of working rigs between last week’s count (December 10th) and this week’s (December 17th) count, the third column shows last week’s December 10th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 18th of December, 2020...

with Texas up three rigs and the Permian up two, we'll start by checking the Rigs by State file at Baker Hughes for changes in the Texas Permian basin...there we find that four rigs were added in Texas Oil District 8, which is the core Permian Delaware, but that a rig was pulled out of Texas Oil District 8A, which covers the southern counties in the Permian Midland....since the Texas Permian rig count was thus up by 3 and the national rig count was just up by two, that means that the rig that was removed from New Mexico had been deployed in the western Permian Delaware...

elsewhere in Texas, two rigs were added in Texas Oil District 1, but a rig was pulled out of Texas Oil District 2, and another rig was pulled out of Texas Oil District 4, all districts where drilling is primarily into the Eagle Ford shale...however, since the Eagle Ford rig count was changed, we can't easily tell if all or even none of those changes involved the Eagle Ford...that can be determined by tediously checking the individual well records in the North America Rotary Rig Count Pivot Table (Feb 2011 - Current), if anyone needs to know..

in other states, we find that two oil rigs were added in Oklahoma, including one in the Arkoma Woodford and another in a basin that Baker Hughes doesn't track...in Louisiana, there was an oil rig added offshore, and another oil rig added in the Haynesville shale in the northwest, one of just two oil rigs in that natural gas basin, while the inland waters rig that had been drilling for oil near the mouth of the Mississippi in Plaquemines Parish was removed...meanwhile, an oil rig was pulled out of a basin that Baker Hughes doesn't track in California...

all the changes among natural gas rigs were in Marcellus shale this week; the Marcellus shale rig count was down by one as two natural gas rigs that had been drilling in West Virginia's Marcellus were pulled out, while a natural gas rig was added in Pennsylvania's Marcellus...

+++++++++++++++++++++++++++++++++++

WALMART DONATES TO UTICA SHALE - Walmart Distribution Center #7017, Wintersville, donated $2,500 to the Utica Shale Academy. The Utica Shale Academy (USA) is a dropout prevention and recovery school serving students in Columbiana, Carroll, Harrison, Jefferson and Mahoning counties. USA provides individual instruction, as well as various career pathways for students, including over 25 Ohio Industry Recognized Credentials.

Utica Shale Academy hopes to secure more grants – With many parts of the Utica Shale Academy’s new equipment and programming coming through grants in the past, the USA board voted on Tuesday to increase the number of hours for the person seeking grants on their behalf. Superintendent Bill Watson recommended to the board to increase the number of hours the USA will pay the career specialist, a grant writer from the Jefferson County Educational Service Center, from 20 hours to 40. Because the board contracts through the ESC, the ESC is responsible for the benefits for the position. The USA currently pays $25,000 for the services and expects that could double. Watson said he believes with other funding sources coming to the schools, there could be less competition for some of the grants this year. He hopes the USA will be applying for up to 50 grants, even though many will be smaller. During Tuesday’s meeting, the board voted to accept a $600 Best Practice Grant from the ESC. Additionally, Watson announced the USA has received a $2,500 donation from Walmart in Wintersville, which will be used for smart tech to help with interventions. The board also approved the creation of a stipend for a dean of discipline position, which will allow Carter Hill to be paid an additional $5,000 to handle discipline concerns at the school whenever Watson is out of the school doing other duties such as recruiting for the school. The USA currently has 94 students enrolled and another eight students in progress to enroll. He also said due to the large amount of growth in the programs, he would like the board to think about possible expansion into Harrison or Carrolton Counties in the future.

Utica Shale Pumped Up Promises to Valley Landowners - – Mel Cadle scopes out the well pad that was constructed on his North Jackson farm nearly 10 years ago. The site, dominated by six large, green storage tanks, is unkempt, strewn with weeds, and sits back on a 20-acre plot he owns along Blott Road. Cadle once envisioned years of lucrative royalties streaming directly into his bank account from oil and gas pumped from the two wells drilled on his property. “It didn’t work out like it was supposed to for me,” the 87 year-old Cadle says. “I don’t have any income from these wells. I lost five acres for nothing.” Cadle personifies a complicated legacy of the oil and gas industry 10 years after energy companies descended on eastern Ohio in search of reserves trapped in the Utica/Point Pleasant shale formation. The development of hydraulic fracturing and horizontal drilling made it possible – and profitable – for exploration companies to tap into tight shale formations 6,000 feet deep and extend laterals thousands of feet across these thin strata. The expectations of long-standing economic benefits to the region were enormous. Energy companies touted investments in the billions of dollars for drilling programs, leasehold contracts, processors, pipelines and support services to the industry. Companies supporting the oil and gas supply chain would also relocate, augmenting further job growth in the region. For some, drilling the Utica meant up-front lease signing bonuses between $1,000 and $6,000 an acre, and many believed the big payoff would come in the form of monthly royalty checks. Early in the play, it was estimated that landowners with a producing Utica well pad on their property could reap as much as $1,000 per acre, per month. For many landowners, though, the promise of sustained wealth remains just that. In Cadle’s case, complications arose because of a lease he purchased in 2008 on the 20 acres where the well pad sits. When he purchased the property, he was under the impression that all of the mineral rights were included. Instead the rights to the Consol wells, now owned by Northwood Energy Corp., remain in the hands of a family trust from the previous owners. “I was so looking forward to getting a well drilled there and then getting rich,” Cadle says. “I bent over backwards to get those wells drilled.” Instead, the only income derived from his land today is through farming soybeans and corn.

FERC Floats $40M Pipeline Penalty Against Energy Transfer - Law360-- The Federal Energy Regulatory Commission on Thursday proposed a $40 million penalty against Energy Transfer Partners LP for allegedly cutting corners during the construction of its Rover gas pipeline, which led to a 2017 spill in Ohio. At its monthly open meeting — the first to feature recently confirmed commissioner Willie Phillips — FERC hit Energy Transfer with a show cause order directing the pipeline giant to respond to enforcement staff allegations that it intentionally and regularly used diesel fuel and other toxic and unapproved substances during the horizontal directional drilling of Ohio's Tuscarawas River along the pipeline's route. Traces of diesel….

FERC seeks answers on Energy Transfer pipeline violations - The US Federal Energy Regulatory Commission (FERC) on December 16 asked midstream company Energy Transfer Partners to explain why it should not have to pay a $40mn penalty for violations during the construction of its Rover natural gas pipeline. In a letter to Energy Transfer Partners and its Rover Pipeline subsidiary, FERC asked why it should avoid blame for “intentionally” including diesel, “other toxic substances and unapproved additives” into drilling mud during operations for pipeline construction in Ohio.FERC alleged that shortly after that drilling began in April 2017 under the Tuscarawas River in Ohio, there was a “large, inadvertent release” of 2mn gallons of contaminated drilling mud that migrated to a nearby protected wetland. Testing carried out by Ohio’s Environmental Protection Agency found the leaked fluid had characteristics similar to diesel fuel.FERC asked “Rover to show cause why it should not be assessed a civil penalty” in the amount of $40mn.The Rover pipeline extends 711 miles, carrying gas from the Appalachia shale basin to Midwest outlets.Alexis Daniels, a spokesperson for Energy Transfer, told the Reuters news agency that the company learned after the fact that “a rogue employee of an independent subcontractor has admitted under oath to have committed this act on his own volition and then tried to hide it.” Parties involved have 30 days to reply to FERC’s letter.

Regulators' endless devotion to fracking industry will cost Ohioans in money, health - Columbus Dispatch – by Leatra Harper - The Ohio Department of Natural Resources Division of Oil and Gas Resource Management has once again demonstrated its complete fealty to the fracking industry. It has done so by its continuing failure to propose rules to appropriately protect the environment and public health from the consequences of the irresponsible handling, processing and disposal of toxic, radioactive frack waste. Instead of addressing the serious issues arising from the disastrous federal failure to regulate through the “Halliburton Loophole,” thereby falsely classifying frack waste as “non-hazardous,” the division fails to address the problems this entails, although it has seen enough of the serious issues the lack of regulation has caused. Even the courts have not demanded the agency do needed rulemaking, and our citizen’s case lost on standing only – not on the merits. We even appealed to the U.S. Environmental Protection Agency to revoke primacy because the agency was not properly protecting citizens from the harms of the lack of regulation. Without recourse, we waited over 8 years for the division to propose rules that would effectively address the mishandling and toxic releases from frack waste processing and disposal. The agency obviously has no intention to deal with this serious issue as evidenced by its most recent attempt at rulemaking by proffering totally inadequate rules with public review and comment closed in only 30 days ending Nov. 29, just after a holiday. The very little time to engage, educate and formulate responses to the substantial deficiencies in the proposed rules substantiates our continued experience that the agency does not genuinely want public input to counter its support of the fracking industry by allowing cheap disposal of its massive amounts of toxic waste. To be most expeditious in the flawed process, the division combined the review and commenting process for two totally different waste handling/disposal schemes, Class II injection wells and Surface Waste Processing Facilities, into one. Frack waste facilities are handling millions of tons of frack waste with inadequate traceability of where the resultant concentrations of toxic chemicals and radionuclides go to assure proper disposal and accountability for those generating the waste. Historically, both types of facilities lack adequate monitoring and oversight, which will not be addressed in the proposed regulations. This ruse of rulemaking process is just another example of industry capture of the Ohio Department of Natural Resources. Our elected representatives are letting this happen, and Ohio taxpayers will pick up the bill, just as we are paying already to remediate leaking frack waste injection wells and cap abandoned wells. In addition to the lack of adequate bonding and severance taxes assessed the fracking industry, Ohio is giving the industry another massive subsidy in the completely inadequate rules proposed by the Division of Oil and Gas Resource Management. Ohioans will pay with their health and tax dollars for the continuing designation of the state as the cheap dumping ground for frack waste generated within the state and imported from other states, solving the industry’s biggest problem at our expense.

Utica/Marcellus Gas Production Expected to Increase in January - - – Oil and gas production from the Utica and Marcellus shale formations is expected to increase in January, according to data from the U.S. Energy Information Administration. The EIA’s Drilling Productivity Report shows that natural gas output stands to increase 78 million cubic feet per day by next month in the Appalachia region, which includes eastern Ohio’s Utica play and the Marcellus shale in Pennsylvania and West Virginia. This week, Hilcorp Energy Co. filed applications with the Ohio Department of Natural Resources for permits to deepen three of its wells in Fairfield Township in Columbiana County. So far this year, Hilcorp Energy Co. has been awarded 14 permits from ODNR to drill new wells in Columbiana County and one permit to deepen an existing well. EAP Ohio has been awarded seven permits for new wells in the county, and five permits to deepen existing wells. There were no new well permits issued in either Mahoning or Trumbull counties this year. Oil in the Appalachia region is expected to tick upward by 1,000 barrels per day next month, according to EIA. The agency reports that gas production is anticipated to increase in six of the seven shale plays across the country. The Permian Basin in Texas stands to post the greatest increase at 115 million cubic feet per day in January, while the Anadarko play in Oklahoma is projected to see production drop by 31 million cubic feet per day.

Where does Ohio rank in natural gas production? See the top 10 states - cleveland.com- Ohio has become a major producer of natural gas over the past decade with the advent of horizontal fracking, a technique that allows for greater access to reserves. The state’s natural gas output has increased more than 30-fold from 2010 to 2020, said Mike Chadsey, director of public relations for the Ohio Oil and Gas Association, and most of that can be attributed to ramped up production from the Utica shale reserve in the eastern part of the state.

Pa. releases final rule to cut methane leaks from existing oil and gas well sites Pennsylvania regulators have released a long-awaited final draft of rules to cut releases of smog-forming and climate warming air pollution from the state’s existing oil and natural gas well sites, but they will still not require companies to find and fix leaks at tens of thousands of low-producing wells. The rules are a last piece of the methane-reduction strategy that Gov. Tom Wolf announced nearly six years ago to cut down on emissions of the potent greenhouse gas from new and old sites across Pennsylvania’s oil and gas production industry. They are expected to take effect by the middle of next year. Scientists attribute about a third of the planet’s warming from greenhouse gases today to human-caused emissions of methane, which traps more than 80 times as much heat as carbon dioxide over 20 years. In the U.S., about a third of methane emissions come from the oil and gas industry. The new state rules will require some well owners to perform leak searches four times a year and upgrade equipment already in the field to cut down on pollution from controllers, pumps, compressors and tanks. In total, the rules are expected to reduce emissions of a smog-forming group of chemicals called volatile organic compounds by nearly 12,000 tons per year and methane emissions by about 214,000 tons per year — more than doubling the impact that was expected when the first draft of the rules was published two years ago. Mark Hammond, director of the Department of Environmental Protection’s air quality bureau, said the major driver for that improvement was better data that state regulators gathered by looking at Pennsylvania facilities to assess the rules’ impact, rather than relying on national estimates. The department made modest changes to the proposal after receiving comments from roughly 36,000 people and groups.

Massive aid on way to plug pollution from oil, gas wells - For decades, Pennsylvania has barely made a dent in stopping pollution from hundreds of thousands of abandoned or orphaned oil and gas wells. Now, the state may soon receive nearly $400 million to tackle one of its most insidious legacy pollution problems. “It’s a game changer,” said Kurt Klapkowski, director of Pennsylvania’s Bureau of Oil & Gas Planning and Program Management. He was referring to the $1.2 trillion Infrastructure Investment and Jobs Act that was passed by Congress on Nov. 5 and signed into law by President Joe Biden on Nov. 15. In addition to Pennsylvania's $400 million cut of federal dollars, the state will add matching funds for some projects. Climate change and pressure to throw a lifeline to communities that long survived on fossil fuel extraction provided a strong tailwind for bipartisan support. The legislation will deliver $4.7 billion nationwide, over the coming decade, to end the ongoing pollution of air, water and soil from abandoned oil and gas wells that pepper the country. Pennsylvania will get the most of any state from that big new pie to plug old wells, which emit methane and other pollutants that threaten public health and the environment. To put the funding increase in perspective, consider that Pennsylvania’s Office of Oil and Gas Management has spent a total of $37 million over the last three decades to plug 300 wells — most of them to rectify emergency situations like contaminated water, houses blowing up or methane gas filling up a church. In contrast, the state Department of Environmental Protection is lining up a batch of 500 wells to plug with just the first $25 million infusion of federal money from the U.S. Department of the Interior. Much of the pollution comes in the form of escaping methane from abandoned natural gas wells. Methane is a more potent greenhouse gas than carbon dioxide in the short term — 86 times more effective at trapping heat in the atmosphere when measured over a 20-year period. Methane is the second-most abundant greenhouse gas, and the process of oil and gas extraction is its largest source. Gas wells emit methane at a much higher rate than oil wells. In 2016, Stanford University researcher Mary Kang studied 88 abandoned wells in the state and found that 90% were leaking methane. A 2016 paper published in the Proceedings of the Academy of Natural Sciences estimated that abandoned wells were leaking 40,000–70,000 metric tons of methane a year, representing 5–8% of Pennsylvania’s total human-caused methane emissions. Other sources include hydraulic fracturing (fracking) for natural gas, livestock, fertilizers, industrial processes, wastewater treatment plants and landfills.

Pa. shale gas permits plunge to 13-year low as drillers keep focus on cash flow -- Pennsylvania shale gas drillers pulled just 34 permits for wells in November, the lowest number in 13 years, continuing their trend of keeping production low despite rising market prices for their product. The last time the state issued so few permits was in November 2008 just before the fracking boom brought a massive surge of development to the Marcellus Shale that peaked in December 2010 with 402 permits issued in a single month. The first unconventional well targeting the Marcellus Shale was drilled in 2004 by Range Resources Corp. November's total was about 53% less than the previous month's count, according to state Department of Environmental Protection data, and 38% less than in November 2020. The five largest exploration and production companies in Pennsylvania — EQT Corp., Chesapeake Energy Corp., Coterra Energy Inc., Range and Southwestern Energy Co. — spent another month keeping drilling and spending to a minimum and accumulating cash thanks to higher commodity prices. EQT pulled seven permits to drill, a decrease from 11 permits a year ago. National Fuel Gas Co.'s upstream unit, Seneca Resources Corp., pulled two permits in November. Four of the five top-producing counties in Pennsylvania — Susquehanna, Bradford and Lycoming in the northeast part of the state and Washington in the southwest — were among the most active counties for permitting in November, with seven permits each in Lycoming and Washington. Clarion, a county northeast of Pittsburgh that had no drilling activity in 2020, had three permits, bringing its year-to-date total to eight.

EIA DPR 12-2021: M-U Gas Production Still Lower than One Year Ago | Marcellus Drilling News Six of the seven largest shale plays in the U.S. will see an increase in natural gas production in January according to the latest monthly Drilling Productivity Report (DPR) issued by the U.S. Energy Information Administration (EIA). The Marcellus/Utica, collectively lumped together as “Appalachia” in the report, will see an increase of 78 MMcf/d (million cubic feet per day) in production next month. The M-U’s chief rival, the Haynesville, continues to see big growth, with an increase of 104 MMcf/d next month. The oil-based Permian will see an increase in natgas production of 115 MMcf/d due to associated gas coming out of the ground along with oil. The Permian’s oil production is set to hit a new all-time high this month, in December, and hit (for the first time ever) 5 million barrels of production per day in January.The cumulative increase in natural gas production across all plays is estimated to be a big 341 MMcf/d next month–roughly one-third of a billion cubic feet!M-U gas production was, last month, forecast to hit 35.6 MMcf/d in December (see EIA DPR: Shale NatGas & Oil Production Flirt with Record Highs). It didn’t happen. The EIA number crunchers were way off. Production is now recast to be 34.8 MMcf/d this month. EIA predicts production in the M-U for January will be 34.9 MMcf/d. We are still well below last December’s 35.6 MMcf/d. Below are the three charts the EIA doesn’t include in the official PDF of the report (for whatever reason). We think these are the three best charts they issue each month.Below is the one chart we obsess over each month–our favorite chart produced by EIA. It shows estimates for total production in the coming month. We also like the following chart which shows drilled but uncompleted (DUC) numbers. Notice the story the chart below tells: New drilling in all plays has slowed down and producers are finishing already-drilled wells at a faster clip. Sooner or later we’ll run out of DUCs to complete. The full December DPR (with estimates for January):

A pipeline runs through it: Stream crossings by the Mountain Valley Pipeline - an overcast October afternoon, clouds cloaked the top of Poor Mountain as a construction crew worked to string a natural gas pipeline across the highest point in the Roanoke Valley. At 3,720 feet above sea level, this is one of the places where concerns about the Mountain Valley Pipeline begin. When it rains, dirt unearthed by clearing land and digging a trench for the pipe turns to mud and silt. The sediment is washed downhill, channeled by a 125-foot-wide strip cut into the mountain. Some of it reaches the streams and wetlands below. Although much of the controversial project is completed, Mountain Valley still needs state and federal approval to cross the remaining water bodies, either by digging through or boring under them. If the State Water Control Board grants a permit when it meets Tuesday, opponents say it will replicate a known harm. “MVP has shown an inability to construct without violating water quality standards, so crossing streams in the remaining steepest portions of the route will inevitably bring more sediment pollution and harm to water resources,” said Jessica Sims, state field coordinator for Appalachian Voices, one of the groups fighting the pipeline. At public hearings in September, many speakers pointed to the company’s environmental record — more than 300 violations of sediment and erosion control regulations since work began in 2018 — in urging the board to deny the permit.

Pipeline opponents hold ‘violation vigil’ in Richmond - Opponents of the Mountain Valley Pipeline held a ‘Violation Vigil’ Saturday in advance of a key hearing in Richmond next week. The event at the Dogwood Dell amphitheater highlighted more than 300 water quality violations along the path of the pipeline in Virginia. “My violation is number 48,” one of the participants said during the event. “It happened on January 22nd 2019 in Franklin County.” Tuesday, the State Water Control Board will consider a key permit that would allow MVP to cross more than 200 streams and wetlands in the Commonwealth. “And we must understand that when we fight this fight against the pipelines or environmental injustice, we’re fighting against lives being destroyed,” said keynote speaker Rev. William Barber II, Chair of the National Poor People’s Campaign. " We’re fighting against communities being disrupted,” he said. Friday, a spokesperson for the Mountain Valley Pipeline said crews have successfully completed multiple crossings. In a written statement, Natalie Cox said completing construction and fully restoring the remainder of the right-of-way represents the best outcome for the environment, landowners and communities along the route. Following is the complete statement from MVP: Mountain Valley appreciates the Virginia DEQ staff’s diligence in performing a comprehensive review of the MVP project’s remaining waterbody and wetland crossings in Virginia. Total project work on the Mountain Valley Pipeline is nearly 94 percent complete, including more than half of the right-of-way fully restored; and crews have previously and successfully completed multiple crossings using both open-cut and trenchless crossing methods. Mountain Valley believes that completing construction and fully restoring the remainder of the right-of-way remains the best outcome for the environment, affected landowners, and communities along the route, as well as the homes and businesses – in Virginia and across the eastern United States – that need greater and more reliable access to affordable natural gas.

Hundreds rally in Va. in opposition to natural gas pipeline (AP) — Hundreds of opponents of a natural gas pipeline rallied on Saturday in Virginia’s capital in advance of an upcoming key regulatory decision. The Virginia State Water Control Board is expected to vote Tuesday on whether to allow construction of portions of the Mountain Valley Pipeline in wetlands and across over 200 Virginia waterways, the Richmond Times-Dispatch reported. The Rev. William Barber, a North Carolina-based civil rights leader, told the crowd at Byrd Park that projects like the proposed pipeline are “an abusive sin” that would harm the poor. The planned 303-mile (488-kilometer) mile pipeline will take natural gas drilled from the Marcellus and Utica shale formations and transport it through West Virginia and Virginia. A 75-mile extension into central North Carolina is also proposed. Barber, who is now the head of the national Repairers of the Breach movement among other roles, pointed out how developers of the Atlantic Coast Pipeline cancelled the project in 2020 following fierce opposition by environmental groups and residents along parts of the line’s path. “We had to fight against one pipeline,” Barber said. “They should have learned by now, Virginians aren’t having this stuff. West Virginians aren’t having it. North Carolinians aren’t having it. They must not know who we are, but they’ll learn.” Mountain Valley Pipeline spokesperson Natalie Cox called Barber’s message that the project is sinful “an uninformed and unproductive comment.” The pipeline, Cox added, is “designed to provide reliable, affordable, clean-burning natural gas to homes and businesses in Virginia and throughout the eastern United States.” The proposed North Carolina extension took a hit earlier this month when Virginia’s State Air Pollution Control Board voted against a permit for a gas compressor station located in a county that borders North Carolina.

State panel approves stream-crossing permit for Mountain Valley Pipeline — The Mountain Valley Pipeline made it across troubled waters Tuesday. In a 3-2 vote, the State Water Control Board granted a permit for the natural gas pipeline to cross about 150 streams and wetlands in Southwest Virginia, surmounting one of the beleaguered project’s most protracted struggles. Although a similar permit from West Virginia and federal approval is still required, Mountain Valley expressed confidence that it will complete construction “in a way that protects natural resources and meets public demand for reliable, affordable and lower-carbon energy.” About 94% of the pipeline is finished, spokeswoman Natalie Cox wrote in an email Tuesday, and “the remaining waterbody crossings can be completed successfully and without adverse impacts to sensitive resources.” However, the Virginia Department of Environmental Quality has already cited the joint venture of five energy companies building the pipeline with nearly 400 violations of erosion and sediment control regulations. Opponents argue that the true number is much higher — and will only increase if stream crossings are allowed to resume after earlier permits were struck down by the courts. In recommending approval for a company that it has cited repeatedly since work began in 2018, DEQ said most of Mountain Valley’s failures to adequately control muddy runoff from construction sites did not ultimately lead to sediment reaching water bodies.

Virginia board approves stream-crossing permit for gas pipeline - A Virginia board has granted a waterbody crossing permit for the Mountain Valley Pipeline. The State Water Control Board voted 3-2 on Tuesday to grant a permit for the natural gas pipeline to cross about 150 streams and wetlands in southwest Virginia, The Roanoke Times reported. The pipeline still needs a similar permit from West Virginia and federal approval. The planned 303-mile (488-kilometer) pipeline will take natural gas drilled from the Marcellus and Utica shale formations and transport it through West Virginia and Virginia. The project has faced legal challenges from environmental groups. A 75-mile (121-kilometer) extension into central North Carolina also has been proposed. The Virginia Department of Environmental Quality has cited the joint venture building the pipeline with nearly 400 violations. Opponents argue that the true number is higher and will increase if crossings resume. In its recommendation for approval, the department said most failures to control runoff did not lead to sediment reaching water bodies. David Sligh, conservation director for Wild Virginia, called the decision "heartbreaking." “Yet another public agency that’s supposed to protect us and our natural treasures has failed to live up to the standards we have a right to expect,” Sligh said in a statement.

Mountain Valley Pipeline stream-crossing permit approved by Virginia regulators - Virginia Mercury - A divided Virginia State Water Control Board approved a necessary stream-crossing permit for the embattled Mountain Valley Pipeline Tuesday despite opponents’ hopes that its record of environmental violations would tank it.The board voted 3-2 to issue a Virginia Water Protection Permit to MVP, with board members Paula Jasinksi and Ryan Seiger dissenting. Board chair Heather Wood and member Jillian Cohen were absent. “The facts show that remaining waterbody crossings can be completed successfully and without adverse impacts to sensitive resources as the project team has proposed,” Mountain Valley spokesperson Natalie Cox wrote in a statement. “In fact, Mountain Valley already has successfully performed multiple crossings of waterbodies and wetlands in Virginia, without adverse impacts to water quality.” The approval came as a blow to pipeline opponents, who have long argued that there is no need for the natural gas the project will supply and that it will continue to cause environmental degradation along its 107-mile path through Giles, Craig, Montgomery, Roanoke, Franklin and Pittsylvania counties. “We’re fighting against communities being disrupted. We’re fighting against monies being diverted to fossil fuel companies that ought to be put in health care and put in the creation of green jobs,” civil rights leader the Rev. William J. Barber II said in a fiery speech at an anti-pipeline rally Saturday in Richmond. Opponents have particularly pointed to Virginia Attorney General Mark Herring’s 2018 lawsuit against Mountain Valley over violations related to erosion and sedimentation. The suit was settled in 2019 with Mountain Valley agreeing to pay a $2.15 million penalty and submit to third-party environmental monitoring. “While there were a number of violations … we’re told by our [erosion and sedimentation] folks that these violations are not ongoing and regular and that they’re being addressed shortly after they’re identified,” Dave Davis, director of the Department of Environmental Quality’s Office of Wetlands and Stream Protection, told the board Tuesday. Furthermore, he added, state regulations outline “nine reasons to deny a VWP permit, but not one of those is to deny a permit based on past violations of” erosion and sediment limits. However, the nonprofit Wild Virginia, which has fought the project since its inception, said its own analysis of Virginia Department of Environmental Quality inspection reports has shown that Mountain Valley has violated environmental rules more than 1,500 times during its existence. “The DEQ has consistently failed to acknowledge the magnitude of these problems or take effective action to stop them,” the group said in a statement. “DEQ’s description of MVP’s record of violations to the board was inaccurate and woefully incomplete.” Tuesday’s approval of the Virginia Water Protection permit was the latest chapter in Mountain Valley’s long and twisting road to getting — and keeping — water-crossing approvals….

D.C. Circuit eminent domain battle may hit FERC gas projects - Federal judges yesterday considered the path for landowners to pursue an unusual, sweeping challenge to takings for natural gas pipelines. Homeowners located along the route of the Mountain Valley pipeline appeared before the U.S. Court of Appeals for the District of Columbia Circuit after filing a legal challenge alleging that it is unconstitutional for the Federal Energy Regulatory Commission to delegate its eminent domain authority to pipeline developers. Yesterday’s D.C. Circuit arguments turned on a narrow procedural question, but a lawyer for the landowners said a broad ruling in favor of her clients could potentially void FERC certificates for natural gas projects across the country. "If enabling legislation is unconstitutional, then all decisions are set aside," said Mia Yugo, a lawyer at the firm Hafemann Magee Thomas. She argued that a judge of a lower court had wrongfully dismissed her clients’ challenge. The legislation at issue in the case is the Natural Gas Act, which extends the federal government’s authority to condemn private land for public use to private entities that have secured from FERC certificates of public convenience and necessity. FERC has in recent years issued a spate of certificates to natural gas pipelines like Mountain Valley. Opponents of those projects have argued that building a large network of gas pipelines is neither necessary nor in the public’s interest. Yugo’s clients had originally brought their case in the U.S. District Court for the District of Columbia but hit a roadblock last year when a judge of that court said the case should land instead before the D.C. Circuit, which gets the first bite at lawsuits over FERC certificates. Judge Cornelia Pillard said yesterday that the D.C. Circuit also has the power to address constitutional questions. The judge, an Obama appointee, asked Yugo whether the court could sidestep the constitutional question by ordering a reconsideration of the Mountain Valley route, which would put a new set of landowners in the pipeline’s path. Those newly affected homeowners might not raise the same concerns as Yugo’s clients, said Pillard. Yugo replied that such a decision would remove her clients’ ability to bring their lawsuit at all. Judge Justin Walker, a Trump appointee, asked whether the landowners hoped to modify Mountain Valley’s FERC certificate if they were allowed to pursue their challenge in district court. Yugo replied that her clients want the courts to invalidate the "entire scheme" of pipeline condemnations under the nondelegation doctrine, which says Congress cannot hand off its legislative powers to federal agencies. Conservative jurists have expressed interest in reviving the long-dormant nondelegation doctrine in other contexts, such as a looming Supreme Court battle over EPA’s authority to regulate climate change under the Clean Air Act.

FERC cracks down on pipelines - The Federal Energy Regulatory Commission toughened its stance on alleged violations associated with natural gas pipelines yesterday, saying enforcement has been too lax in the past and that stricter policies may be needed. "We are being more aggressive and ensuring that those conditions are actually being enforced," FERC Chair Richard Glick told reporters after the agency’s open meeting yesterday. "Under previous leadership, the commission did not adequately enforce its conditions." Yesterday’s meeting showcased the sharp divisions among commissioners about the agency’s oversight of natural gas projects. In contrast to Glick’s get-tough rhetoric, Republican members of the panel warned that putting up obstacles to pipeline development can lead to problems, such as potential gas outages this winter in the Northeast. "We’re going to have to face the reality that the need for gas-fired generation is not going to go away next month, next year, in the short term. It is not,” said Republican Commissioner Mark Christie. “We’re going to have to deal with that and be willing to build the transportation facilities to get the gas to the generators so we can keep the lights on.” Commissioner Allison Clements, a Democrat on the panel, said the agency’s moves "illustrate the profound challenges" facing natural gas projects and signal the need for broader policy changes. She and fellow Democrat Glick reiterated their support for changing how the agency assesses proposed new natural gas pipelines, a process outlined in its certificate policy statement. "To address the challenges ahead, we need to stop debating whether change is necessary and take the forward-looking steps required to meet our statutory obligations," Clements said. The meeting was the first with Willie Phillips, a fellow Democrat who was sworn in this month as FERC’s fifth commissioner. Phillips could give Glick and Clements the votes they need to revise the pipeline policy statement and add "greater emphasis on environmental impacts" into FERC’s review processes, ClearView Energy Partners said in a note Dec. 3. Phillips, for his part, did not vote on any of the items yesterday, but he said he looked forward to getting up to speed while prioritizing electric reliability and affordability.

About half of U.S. oil pipeline space is empty after boom time building spree (Reuters) - About half of U.S. oil pipeline space is sitting unused, heating up competition for barrels in higher-output areas like the Permian Basin in Texas. Overall U.S. pipeline capacity utilization is at around 50%, compared with a range of 60% to 70% headed into early 2020 before the coronavirus pandemic hit, according to consultancy Wood Mackenzie. Pipelines overall are now half-full, as production, which surged to 13 million barrels per day in early 2020 to make the United States the top oil producer, has averaged just 11 million bpd in 2021. Oil and gas shippers often find themselves building pipelines amid a production boom only to find there is too much capacity when downturns occur. Numerous pipelines were built in the Permian in Texas and New Mexico - the largest U.S. oilfield - to export locales while production surged between 2017 and 2020. Some pipeline operators in areas like the Permian Basin have responded by cutting pre-pandemic shipping rates, as the U.S. oil industry has been slow to recover from the coronavirus outbreak. Generally, basins that are overbuilt, like the Permian, have lower uncommitted shipping rates than before the pandemic, but basins with less pipeline capacity have managed to raise rates, because there are fewer shipping options, said Ryan Saxton, head of oil data at Wood Mackenzie. During the pandemic, companies began offering discounted rates to committed shippers as an incentive, said Jesse Mercer, senior director of oil markets at Enverus. As production continues to return, companies are likely to wind down those offers, he said. The best-performing pipeline in the Permian right now at around 94% utilization, is Phillips 66's Gray Oak Pipeline, Saxton said. The uncommitted tariff rate to ship on Gray Oak is about $2.97 per barrel, he said, compared with the more than $4.00-per-barrel on the BridgeTex, another Permian pipeline. BridgeTex, a joint venture from Magellan Midstream Partners LP, is at around 70% utilization, Saxton said. The 440,000-bpd line delivers crude to Magellan's terminal in East Houston. BridgeTex volumes in the third quarter 2021 fell to just over 315,000 bpd, about 5% below volumes in 2020 due to a decrease in uncommitted shipments in the quarter and unfavorable pricing differentials, Magellan said in its most recent earnings call. North Dakota's Bakken production is lagging pre-pandemic levels, and Energy Transfer LP's Dakota Access Pipeline, which can carry about 570,000 bpd out of the region, is at about 77% of utilization, compared with nearly full utilization before the pandemic, Saxton said. However, Dakota Access' uncommitted tariff rate is $6.64 per barrel, above the around $6.28 per barrel before the pandemic, Saxton said. There are fewer pipes out of the Bakken than in the Permian. Energy Transfer declined to comment for this article.