oil prices rose for the 4th week in a row in trading that was largely focused on the US sanctions imposed on Iranian oil and the subsequent ability or inability of other oil producers to replace their exports...after rising 3.5% to $73.25 a barrel on the threat to Iran last week, the benchmark US crude contracts for November delivery rose $2.05 on Monday to $75.30 a barrel, the highest level since November 2014, as North American oil demand was secured by the resolution of the US, Canada and Mexico trade dispute while Chinese cuts of Iranian oil heightened fears of a global supply crunch...after trading as high as $75.91 on Tuesday, oil prices slipped back to close 7 cents lower at $75.23 a barrel ahead of data releases expected to show an increase in U.S. crude inventories...however, even after the reported inventory increases, US crude rose 1.6% to 4-year high of $76.41 on Wednesday, despite the biggest weekly jump in U.S. crude supplies in more than a year...however, with international crude at its most technically overbought level since February 2012 and US crude the most overbought since January*, profit taking set in and oil prices tumbled $2.08 to $74.33 a barrel on Thursday, after news broke on an agreement between Saudi Arabia and Russia to increase production to replace Iranian production as US sanctions took effect...oil prices then steadied on Friday, with US crude prices, supported by US jobs data, holding onto a one cent increase at $74.34 a barrel, while the global benchmark Brent crude for December delivery fell 42 cents to settle at $84.16 a barrel, still up 1.4% on the week, while US crude ended with a gain of 1.3% for the week...

* (note that speculators had accumulated long positions, or bets on a further increase in prices, amounting to almost 1.2 billion barrels of oil...that is more than 100 times daily US oil production of 11.1 million barrels per day)

natural gas prices were also higher this week, driven by abnormal weather patterns and the now widespread understanding that we would be heading into winter with our natural gas supplies at or near a 15 year low...natural gas prices were initially 8.6 cents higher at $3.094 per mmBTU on Monday, as shifting weather forecasts projected to leave cooling demand nearly unchanged through early October, which would leave current storage deficits relatively intact through the so-called "shoulder season", or that period each spring and fall when there is usually neither large demand for heating nor for cooling...that prospect carried prices 7.2 cents higher on Tuesday and 6.4 cents more on Wednesday, until the EIA reported a larger than expected injection of natural gas into storage which sent prices tumbling 6.5 cents on Thursday...another smaller decline of 2.2 cents on Friday then left natural gas prices at $3.143 per mmBTU at the end of trading for the week, still 4.5% higher than last Friday's close..

this week's natural gas storage report from the EIA for week ending September 28th indicated that natural gas in storage in the US rose by 98 billion cubic feet to 2,866 billion cubic feet during that week, which left our gas supplies 638 billion cubic feet, or 18.2% below the 3,502 billion cubic feet that were in storage on September 29th of last year, and 607 billion cubic feet, or 17.5% below the five-year average of 3,473 billion cubic feet of natural gas that are typically in storage after the fourth week of September....this week's 98 billion cubic feet increase in natural gas supplies was more than double the 46 billion cubic feet that was added to natural gas storage last week, was somewhat more than the median forecast 88 billion cubic feet from a Reuters poll of natural gas traders, and also was well above the 84 billion cubic foot average of natural gas that have typically been added to storage during the fourth week of September in recent years, but was still only the 3rd above average inventory increase in the past thirteen weeks...natural gas storage facilities in the Midwest saw a 36 billion cubic feet increase this week, reducing their supply deficit to 14.1% below normal, while supplies in the East increased by 34 billion cubic feet and are now only 10.0% below normal for this time of year...meanwhile, the South Central region saw a 22 billion cubic feet increase in their supplies, as their natural gas storage deficit decreased to 25.4% below their five-year average, while just 3 billion cubic feet cubic feet of gas were added to storage in the Pacific region, where natural gas supplies remain 21.8% below normal for this time of year....

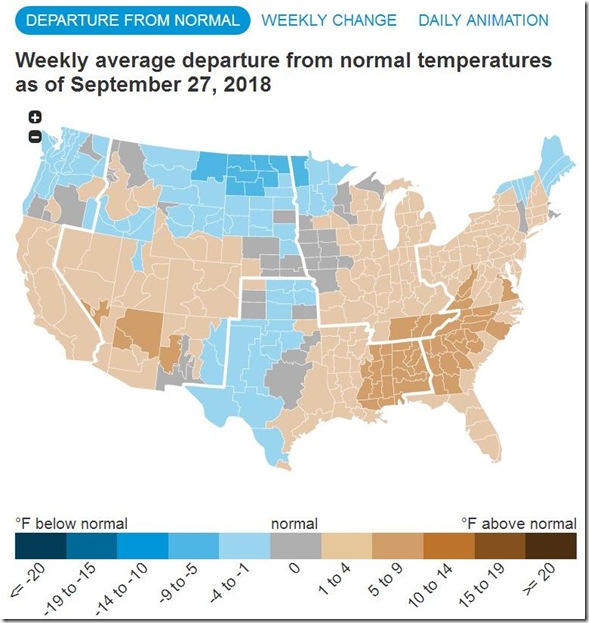

since we have just seen the amount of natural gas added to storage in the continental US swing from 46 billion cubic feet in one week to 98 billion cubic feet in the next, it seems it would be an appropriate time to look at some pictures captured from the EIA's natural gas storage dashboard which will help show how that could happen...we will start with a US map showing how much the temperatures in each geographical area of the 48 states varied from normal during the week ending September 20:

again, this map comes from the EIA's natural gas storage dashboard, an EIA website with dozens of interactive graphics tracking various facets and factors influencing US natural gas supplies, which is updated with the most recent data on Thursday of each week...from the legend underneath this map, we can see that most of the US saw temperatures above normal during the cited week, with a broad swath from the central Rockies through the deep South and Great Lakes all the way east to Maine showing temperatures 5 to 9 degrees above normal...for the middle week in September, that means that most of the country saw cooling demand closer to what one would expect in late August than in mid-September, and hence with the associated utility burn, less natural gas than normal was left to be added to winter supplies...

the next map shows how much the temperatures in each area varied from normal during the week ending September 27th:

here we see that only a handful of states saw temperatures as much as 5 degrees greater than normal during the week ending September 27th, with most of the country seeing temperatures between 4 degrees below normal and 4 degrees above normal...as you know, normal for the last week of September doesnt involve much heating or cooling for most of the country, and hence there was more natural gas left to be added to winter supplies..

next we'll include a map showing how much temperatures changed between the week ending September 20 and the week ending September 27 across the various regions of the US:

as you can see, most of the country except for the already cooler Pacific coast states was cooler during the week ending September 27th than the prior week, with almost half the country seeing temperatures 5 to 9 degrees cooler, with the broad Midwest section and the Northeast seeing temperatures 10 to 14 degrees cooler, and with parts of a few central states seeing temperatures 15 to 19 degrees cooler...hence, we went from a week of summer like air conditioning demand to almost none at all...that change, then, is what accounted for the swing from 46 billion cubic feet of surplus gas during the week ending September 21st to 98 billion cubic feet of surplus during the week ending September 28th..

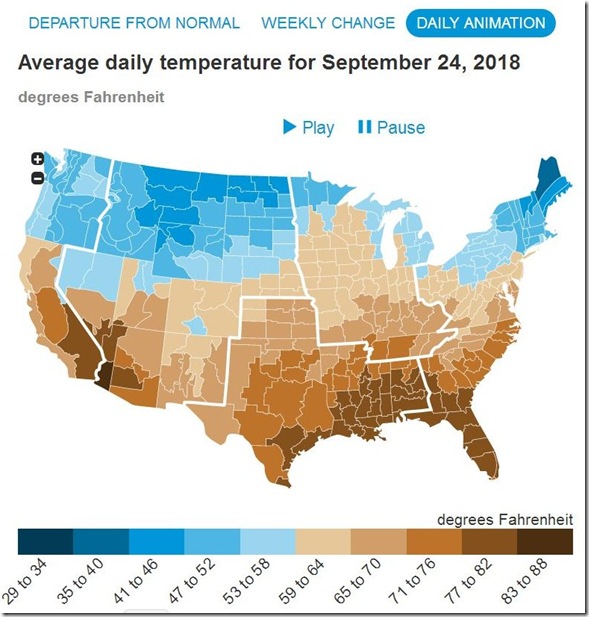

lastly, since all the maps we've shown so far only show a relative change in temperature, we'll include one that shows the actual temperatures on September 24th across the lower 48 states:

the above map was taken from the interactive daily animation feature on the national temperature graphic on the EIA's natural gas storage dashboard, which i paused on September 24th so as to take a picture...as the heading indicates, it shows the average daily temperature for each location on the map, as indicated by the legend below the map...the EIA computes the average daily temperature by adding the high temperature for the day to the low for the day and dividing it by 2; thus, if the afternoon high was 75 degrees at your location while the nighttime low was 65, your average for that date shown above would be 70 degrees (the national weather service also reports daily averages taking temperatures each hour)...of course, this is only one day from the two week period covered, so if you want to see the rest, go to the EIA's natural gas storage dashboard and run the animation yourself...

The Latest US Oil Data from the EIA

this week's US oil data from the US Energy Information Administration, covering the week ending September 28th, showed that because of much lower oil exports coupled with higher oil imports, we were able to add oil to our commercial crude supplies for the second time in seven weeks... our imports of crude oil rosel by an average of 163,000 barrels per day to an average of 7,965,000 barrels per day, after falling by an average of 222,000 barrels per day the prior week, while our exports of crude oil fell by an average of 917,000 barrels per day to an average of 1,723,000 barrels per day during the week, which meant that our effective trade in oil worked out to a net import average of 6,242,000 barrels of per day during the week ending September 28th, 1,080,000 more barrels per day than the net of our imports minus exports during the prior week...over the same period, field production of crude oil from US wells was reportedly unchanged at 11,100,000 barrels per day, which means that our daily supply of oil from the net of our trade in oil and from wells totaled an average of 17,362,000 barrels per day during the reporting week...

meanwhile, US oil refineries were using 16,591,000 barrels of crude per day during the week ending September 28th, 77,000 barrels per day more than the amount of oil they used during the prior week, while over the same period 1,139,000 barrels of oil per day were reportedly being added to the oil that's in storage in the US....hence, this week's crude oil figures from the EIA would seem to indicate that our total working supply of oil from net imports and from oilfield production was 388,000 fewer barrels per day than what refineries reported they used during the week plus what oil was added to storage....to account for that disparity between the supply of oil and the consumption of it, the EIA needed to insert a (+388,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet to make the reported data for the daily supply of oil and the consumption of it balance out, essentially a fudge factor that is labeled in their footnotes as "unaccounted for crude oil"...(for more on how this weekly oil data is gathered, and the possible reasons for that "unaccounted for" oil, see this EIA explainer)....

further details from the weekly Petroleum Status Report (pdf) show that the 4 week average of our oil imports rose to an average of 7,846,000 barrels per day, now 10.2% more than the 7,122,000 barrel per day average that we were importing over the same four-week period last year....the 1,139,000 barrel per day increase in our total crude inventories was all added to our commercially available stocks of crude oil, while the amount of oil in our Strategic Petroleum Reserve still remained unchanged, even as a sale of 11 million barrels from those reserves to Exxon et al closed four weeks ago....this week's crude oil production was reported as being unchanged at 11,100,000 barrels per day because the rounded output from wells in the lower 48 states remained at 10,600,000 barrels per day, so the 10,000 barrels per day increase in oil output from Alaska was not enough to raise the national total, which is now being rounded to the nearest 100,000 barrels per day....last year's US crude oil production for the week ending September 29th was at 9,561,000 barrels per day, so this week's rounded oil production figure was 16.1% above that of a year ago, and 31.7% more than the interim low of 8,428,000 barrels per day that US oil production fell to during the last week of June of 2016...

meanwhile, US oil refineries were operating at 90.4% of their capacity in using 16,591,000 barrels of crude per day during the week ending September 28th, unchanged from the prior week, thus maintaining a refinery utilization rate higher than in any previous September over the past 14 years....the 16,591,000 barrels per day of oil that were refined this week were again at a seasonal high, for the 17th out of the past 18 weeks, 3.5% higher than the 16,029,000 barrels of crude per day that were processed during the week ending September 29th 2017, when US refineries were operating at 88.1% of capacity....

with the increase in the amount of oil being refined this week, gasoline output from our refineries was likewise higher, increasing by 118,000 barrels per day to 9,950,000 barrels per day during the week ending September 28th, after our refineries' gasoline output had decreased by 432,000 barrels per day during the week ending September 21st...as a result, our gasoline production during the week was 1.0% higher than the 9,853,000 barrels of gasoline that were being produced daily during the same week last year...meanwhile, our refineries' production of distillate fuels (diesel fuel and heat oil) increased by 34,000 barrels per day to 5,029,000 barrels per day, after that output had fallen by 462,000 barrels per day the prior week....even so, this week's distillates production was still 2.0% higher than the 4,929,000 barrels of distillates per day that were being produced during the week ending September 29th 2017, as refineries continue to catch up with this summer's distillates shortfall....

even with the increase in our gasoline production, our supply of gasoline in storage at the end of the week still fell by 459,000 barrels to 235,680,000 barrels by September 28th, the 18th decrease in the past 32 weeks, encompassing the spring and summer periods of higher consumption when gasoline supplies usually trend lower....our supplies of gasoline fell this week primarily because the amount of gasoline supplied to US markets rose by 115,000 barrels per day to 9,102,000 barrels per day, after falling by 547,000 barrels per day the prior week, and because our imports of gasoline fell by 150,000 barrels per day to 713,000 barrels per day, while our exports of gasoline fell by 145,000 barrels per day to 816,000 barrels per day....but this week's decrease notwithstanding, our gasoline inventories are again at a seasonal high, 7.4% higher than last September 29th's level of 218,936,000 barrels, and roughly 8.8% above the 10 year average of our gasoline supplies for this time of the year...

meanwhile, even with a small increase in our distillates production, our supplies of distillate fuels were somewhat lower, decreasing by 1,750,000 barrels to 136,131,000 barrels during the week ending September 28th, their second decrease after 8 weeks of increases...our distillates supplies decreased even though the amount of distillates supplied to US markets, a proxy for our domestic demand, fell by 414,000 barrels per day to 3,877,000 barrels per day, because our exports of distillates rose by 416,000 barrels per day to 1,564,000 barrels per day, while our imports of distillates rose by 38,000 barrels per day to 162,000 barrels per day....even after this week's decrease, however, our distillate supplies were fractionally higher than the 135,439,000 barrels that we had stored on September 29th, 2017, while they remained roughly 4.9% below the 10 year average of distillates stocks for this time of the year...

finally, with the drop in our oil exports, our commercial supplies of crude oil increased for the 18th time in 2018 and by the most since March 2017, as they jumped by 7,975,000 barrels during the week, from 395,989,000 barrels on September 21st 403,964,000 barrels on September 28th...that increase brought our crude oil inventories back up to the five-year average of crude oil supplies for this time of year, and to a level roughly 19.9% above the 10 year average of crude oil stocks for the end of September, because it wasn't early 2015 that our oil inventories first rose above 400 million barrels...but since our crude oil inventories had been falling through most of the past year and a half, our oil supplies as of September 28th were still 13.1% below the 470,986,000 barrels of oil we had stored on September 29th of 2017, 13,9% below the 469,108,000 barrels of oil that we had in storage on September 30th of 2016, and 5.8% below the 429,028,000 barrels of oil we had in storage on October 2nd of 2015...

This Week's Rig Count

US well drilling rig activity slowed a bit for the second time in 3 weeks during the week ending October 5th, and remains slower than it was at the end of May, as the steady increases in drilling for oil we saw with higher oil prices during the first part of this year have stalled, with the backlog of uncompleted oil wells increasing monthly while oil futures' prices remained in backwardation....Baker Hughes reported that the total count of rotary rigs running in the US decreased by 2 rigs to 1052 rigs over the week ending on Friday, which was still 116 more rigs than the 936 rigs that were in use as of the October 6th report of 2017, but was down from the shale era high of 1929 drilling rigs that were deployed on November 21st of 2014, the week before OPEC began their attempt to flood the global oil market...

the count of rigs drilling for oil was down by two rigs to 861 rigs this week, the third decrease in a row, which was still 113 more oil rigs than were running a year ago, while it was well below the recent high of 1609 rigs that were drilling for oil on October 10, 2014...at the same time, the number of drilling rigs targeting natural gas formations was unchanged at 189 rigs, which was two more than the 187 natural gas rigs that were drilling a year ago, but way down from the modern high of 1,606 natural gas rigs that were deployed on August 29th, 2008...in addition, two rigs that are categorized as "miscellaneous" continue to drill this week, up from the one such "miscellaneous" rig that was deployed a year ago...

offshore drilling in the Gulf of Mexico increased by 4 rigs to 22 rigs, now the same number of Gulf of Mexico rigs that were active a year ago...in addition, another rig continues to drill offshore from Alaska this week, so the total national offshore count has risen to 23 rigs, up from last year's total of 22 offshore rigs, as a year ago there was no offshore drilling other than in the Gulf...meanwhile, 2 of the rigs that had been drilling through bodies of water in southern Louisiana were shut down this week, cutting the inland waters rig count down to three, still up from the single rig drilling through inland waters a year ago...

the count of active horizontal drilling rigs was down by 3 rigs to 919 horizontal rigs this week, which was still 127 more horizontal rigs than the 792 horizontal rigs that were in use in the US on October 6th of last year, but down from the record of 1372 horizontal rigs that were deployed on November 21st of 2014...in addition, the directional rig count was also down by 3 rigs to 66 directional rigs this week, which was also down from the 79 directional rigs that were in use during the same week of last year....on the other hand, the vertical rig count was up by 4 rigs to 67 vertical rigs this week, which was also up from the 65 vertical rigs that were operating on October 6th of 2017...

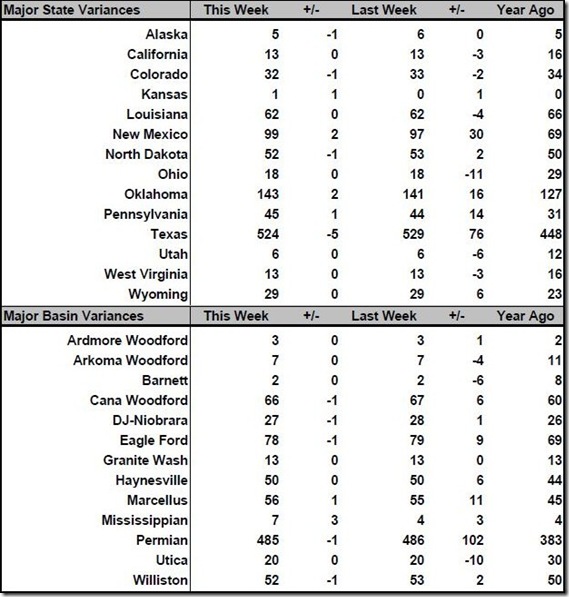

the details on this week's changes in drilling activity by state and by shale basin are included in our screenshot below of that part of the rig count summary pdf from Baker Hughes that shows those changes...the first table below shows weekly and year over year rig count changes for the major producing states, and the second table shows the weekly and year over year rig count changes for the major US geological oil and gas basins...in both tables, the first column shows the active rig count as of October 5th, the second column shows the change in the number of working rigs between last week's count (September 28th) and this week's (October 5th) count, the third column shows last week's September 28th active rig count, the 4th column shows the change between the number of rigs running on Friday and those on the equivalent weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was on Friday the 6th of October, 2017...

despite the 5 rig drop in Texas and the overall decrease in the Permian, drilling in the core Permian Texas Oil District 8, indicated as the Delaware basin, actually increased by 3 rigs to 330 rigs this week, as 6 Midland basin rigs in Texas Oil District 7C were shut down at the same time...since the overall Permian rig count was only down 1 rig, that would suggest a there was 2 rig increase in the Permian Delaware basin on the New Mexico side of the state line...the 3 rig increase in the Mississippian Lime seems to include one rig in Kansas and two rigs in Oklahoma, with another Oklahoma rig increase offsetting the Cana Woodford decrease not shown...natural gas rigs, meanwhile, netted no change, because the increase in Pennsylvania's Marcellus was offset by the shutdown of a natural gas rig in the Eagle Ford of south Texas, where 9 natural gas rigs and 69 oil rigs continue to drill...

++++++++++++++++++++++++++++++++++

FirstEnergy Solutions can retire 4,004 MW of fossil generation without reliability impact: PJM -- Retirement of FirstEnergy Solutions' 4,004 MW of coal and diesel generating units in Ohio and Pennsylvania by June 2021 and June 2022 will not adversely impact reliability, PJM Interconnection said Monday in revealing the results of a new study. PJM completed its 30-day reliability analysis of the units Friday, according to an emailed statement. While the report is not public, it will be discussed at an October 11 Transmission Expansion Advisory Committee meeting and the presentation slides will be posted to the grid operator's website October 8, spokesman Jeff Shields confirmed in an email Monday."The planned deactivations can proceed as scheduled without compromising reliability in the PJM transmission grid, according to the study," the statement said. "Any potential reliability impacts will be addressed by a combination of already planned baseline transmission upgrades and the completion of new baseline upgrades."Akron, Ohio-based FES, formerly a subsidiary of FirstEnergy, has said it will continue normal operations at the facilities until the announced retirement dates. FES announced the power-plant retirements in an August 29 statement.In March, FES said it would deactivate three nuclear power plants with combined capacity of 4,001 MW between May 2020 and October 2021, which brings the total potential deactivations to roughly 8,000 MW of coal-fired, oil-fired and nuclear generation.On March 29, FES sent a letter asking Energy Secretary Rick Perry to issue an emergency order directing PJM to take steps to forestall nuclear and coal-fired retirements. Two days later, FES and FENOC, the FirstEnergy Nuclear Operating Company, and six other subsidiaries filed for bankruptcy. The Trump administration is considering policy action to prevent the retirement of coal and nuclear plants that have been challenged by historically low wholesale power prices pulled down by abundant low-priced natural gas. These market dynamics have made it more economical over the past few years in multiple US markets to run natural gas-fired plants and other power generation resources than coal oil or nuclear plants.

Four Permits Issued in Ohio's Utica – The Ohio Department of Natural Resources issued four permits for horizontal wells in eastern Ohio’s Utica shale during the week ended Sept. 22, the agency reported. Eclipse Resources obtained three permits for horizontal wells in Monroe County, while XTO Energy secured a single permit for a new well in Belmont County, according to ODNR. There were 18 active oil and gas rigs operating in the Utica during the week, ODNR reported. As of Sept. 22, ODNR has issued 2,889 permits in Ohio’s Utica and 2,421 of those wells are drilled. Of that number, 2,205 wells are in production. There were no new permits issued in the northern tier of the Utica, which encompasses Mahoning, Trumbull and Columbiana counties. Nor were there new permits issued to energy companies in neighboring Lawrence and Mercer counties in western Pennsylvania, according to the Pennsylvania Department of Environmental Protection.

Ohio shale gas production spikes as driller Ascent pushes expansion - Utica Shale gas from three counties and five producers led Ohio's 50% year-on-year increase in production to 6.4 Bcf/d in the second quarter.The three counties -- Jefferson, Monroe and Belmont -- all directly across the Ohio River from West Virginia, accounted for 75% of the total second-quarter production reported to the Ohio Department of Natural Resources by Wednesday. Likewise, the state's top five producers, led by Ascent Resources, accounted for 75% of the state's shale gas production.Jefferson County wells, which tripled production from the 2017 second quarter, are split almost exactly in half between two drillers, Ascent and Chesapeake Energy. Ascent was formed around a core of the same executives who pioneered the Utica play for Chesapeake and is now backed by private equity investors First Reserve Management and Energy & Minerals Group. Ascent more than doubled production in a year and continued to widen its lead over rival Gulfport Energy as Ohio's top Utica Shale producer by volume. The company looks to expand in the play, having struck deals to buy $1.5 billion of Utica wells and leases from Hess and CNX Resources as the second quarter was ending. Gulfport, the state's previous production leader, increased production 17% compared with the same period of 2017. Gulfport is in the process of milking its Utica dry gas operations, which do not require much new spending, for cash to fund what it says are higher-margin oily wells in the Woodford Shale of Oklahoma's SCOOP play.Gulfport is cutting back from two drilling rigs to one in the Utica after operating as many as six rigs in Ohio and will turn its attention to completing the 50 to 60 Utica wells it has drilled but not yet fracked and placed online."At current crude oil and natural gas prices, the SCOOP offers higher returns (71% for Woodford wet gas) than the Utica (57% Utica dry gas east) and commands a higher allocation of capital," Judging by the number of drilling permits pulled by Ohio's producers, the three river counties can expect a mild slackening of activity as drillers start to chase wetter wells with higher proportions on NGLs in interior counties such as Harrison and Guernsey as gas prices stay flat and NGL prices increase.

ODNR Issues 14 Permits in Utica Shale – The Ohio Department of Natural Resources last week issued 14 new permits for horizontal wells in eastern Ohio’s Utica shale to two energy companies. Ascent Resources, fast becoming the most aggressive oil and gas exploration company in the Utica, secured 10 of the 14 new permits, according to the latest update from ODNR dated Sept. 29. Seven of the permits are for wells in Jefferson County, while three are targeted for Belmont County, according to the agency. ODNR approved four permits for Triad Hunter LLC, which plans to drill new wells in Monroe County. The rig count in the Utica remained unchanged at 18 from the previous week. As of Sept. 29, ODNR had issued 2,892 permits in the Utica, of which 2,420 are drilled and 2,029 are in production. There were no new well permits issued in Mahoning, Trumbull or Columbiana counties during the week. Nor were there new permits issued in neighboring Lawrence and Mercer counties in western Pennsylvania, according to the Pennsylvania Department of Environmental Protection.

Organizers make last-ditch effort to get anti-fracking initiative on ballot - The Columbus Dispatch - The Ohio Supreme Court is being asked to reconsider whether a proposal to ban oil and natural gas extraction and waste disposal in Columbus should go on the Nov. 6 ballot.Last month, the Franklin County Board of Elections denied the environmental group Columbus Community Bill of Rights' effort to get the measure on the ballot, questioning its legality. The group filed a complaint with the Ohio Supreme Court, which ruled with the Board of Elections."(The Board of Elections members) are limited to counting signatures and making sure the forms are filled out right. They're not allowed to consider the substance of the proposal," said Terry Lodge, a Toledo-based attorney who is representing the Community Environmental Legal Defense Fund. Last week, in a last-ditch effort, the group filed its motion for reconsideration with the state Supreme Court."They're looking for every reason to keep us off the ballot. This is our only recourse," said Carolyn Harding, a co-organizer for Columbus Community Bill of Rights.Meanwhile, the clock is ticking. Military and overseas absentee voting began Sept. 22. Early in-person voting and absentee voting will begin Oct. 10. With each passing day, there’s less time to launch a public-awareness campaign about the issue, Lodge said."The group is sort of in suspended animation," he said. "They don’t know whether to campaign or put up signs or what."The proposed ballot initiative would make it illegal to drill for oil and natural gas in Columbus, as well as store or dump drilling waste in the city or transport waste across the city. A "bill of rights" also would assert that residents should have clean water, air and soil that are free from fracking waste in central Ohio. The Ohio Department of Natural Resources regulates oil and natural gas exploration and operation at the state level.The Ohio Supreme Court can uphold its initial ruling or decide to place the measure on the ballot, but there’s no timeline for that to happen. If history is any indication, the court could rule in favor of the group, but just days shy of Election Day:

'Regulatory issues’ delay opening of Sunoco’s Mariner East 2 pipeline - The Mariner East 2 pipeline, previously scheduled to be in operation by the end of September, is delayed again.Sunoco said it is still working to overcome “regulatory issues.” The company missed its own target of starting to operate the troubled natural gas liquids pipeline by the end of September.“ME2 is not in service at this time due to regulatory issues we continue to work through. These issues have slowed our construction in a few areas along the route. We will put the line in service once it is mechanically complete,” Vicki Granado, a spokeswoman for Sunoco’s parent, Energy Transfer Partners said in a statement.Granado did not specify the issues, but Nils Hagen-Frederiksen, a spokesman for Pennsylvania’s Public Utility Commission, said there are “numerous ongoing matters” regarding the project that are before the PUC and have yet to be resolved. They are:

- A PUC injunction that blocks construction at two sites in Chester County’s West Whiteland Township;

- A complaint to the PUC by state Sen. Andy Dinniman (D-Chester) and others, seeking to stop construction in West Whiteland;

- An investigation into the June spill of 33,000 gallons of gasoline into Darby Creek near Philadelphia from an existing ETP pipeline that the company plans to use temporarily as part of ME2 while the new pipeline is being completed;

- An investigation into a strike on a section of ME2 by a water contractor at Middletown, Delaware County, in May;

- A joint federal-state investigation into “allegations concerning weld inspections.”

In late August, the PUC said it was looking into reports of “improper” weld inspections. At the federal level, the Pipeline and Hazardous Material Safety Administration said it too was investigating concerns about welds, but said it was focused on how weld x-rays had been taken rather than on the welds themselves.

Zinke talks LNG exports, pipeline constraints, offshore wind in Pa. visit - Interior Secretary Ryan Zinke stopped in Pittsburgh on Friday to say that natural gas from places like Pennsylvania plays a key role in helping the United States deal with foreign adversaries. If an energy-rich nation like Russia or Iran were to act aggressively toward the United States, he said having an abundance of natural gas would help counter that move. “We can make sure their energy does not go to markets if we need to, and place great economic leverage,” he said. The U.S. can do that because it’s the world’s largest producer of oil and natural gas, he said. Zinke said he foresees the United States helping supply places like Japan and South Korea that rely on energy imports. “I think the big gun is probably liquid natural gas because the market overseas is liquid natural gas, and the U.S. has a lot of it,” he said. Liquefied natural gas terminals such as Maryland’s Cove Point recently began shipping Marcellus Shale gas to Asian nations. The CEO of pipeline developer Williams, who also spoke at the conference, said Pennsylvania continues to be constrained by a lack of pipelines that can carry gas out of the state. “The problem is you’ve got to get it where there is new market,” Alan Armstrong said. “Most of the new market is developing in the southeast states and in the Gulf Coast.” Work on several new liquefied natural gas export terminals is underway in Texas and Georgia. The company ran into an obstacle constructing its Constitution Pipeline, which would carry Marcellus Shale gas north out of Pennsylvania. New York denied the project a key permit in 2016. Williams challenged that decision, but the U.S. Supreme Court this year opted to leave in place a lower court ruling that sided with New York. Zinke added that other states have blocked energy-related infrastructure projects, including Washington, which has held up proposals to build a coal export and an oil-by-rail facility. “We’re going to have to have a discussion on whether a state has the right to diminish the economic livelihood of another state, of an adjacent state,” he said.

After the gas explosions, a community looks for alternatives to natural gas - Nearly 9,000 households in eastern Massachusetts have had to make do without natural gas since mid-September, when an aging natural gas pipeline failed and set off a series of explosions and fires across the cities of Lawrence, Andover and North Andover.Residents who relied on gas to heat their homes and cook their food won't have service again until mid-November at the earliest, according to Columbia Gas of Massachusetts. The company has 48 miles of pipeline to replace, and industry experts question whether it can meet even that timeline.Environmental advocates say it's time to completely rethink the communities' energy systems. They are calling for a "green new deal" that would shift thousands of homes off natural gas and onto electric heating.Columbia Gas has offered to reimburse "reasonable costs" for residents who lost gas service and want to permanently shift to another heating source. Some area residents, rocked by damage to dozens of homes and the death of one person from the gas explosions, have expressed concerns about ever returning to natural gas.But environmentalists will have to work quickly. Columbia's offer to pay residents to cut ties with natural gas could also result in households moving backward—to high-polluting fuel oil. "The choice is open to the customer whether they want to go back to the 19th century or go into the 21st century,"

Orphan Wells: States Wrestle With Soaring Costs For Oil & Gas Industry Mess - On a recent rainy Monday, William Suan treks down a muddy hill on the backside of his property. Hidden in the wooded thicket is a three-foot-tall rusted tube jutting out of the ground. A soft bubbling sound emanates from the well. “See the gas bubbling out of it?” he said. “Sometimes there’s oil. There’s where they had one of those pads to soak up the oil last time I complained about it.”Having enough resources to plug old, inactive wells is a challenge not unique to West Virginia. Across the country, many state regulators have few resources to deal with an ever expanding list of abandoned wells. “The states are pretty good at regulating wells that are being explored, are being fracked, are in production, but they kind of lose interest once that happens,” said Alan Krupnick, a senior fellow with the nonpartisan environmental think tank, Resources For the Future. “There’s not enough attention being paid to reducing the risk from these abandoned wells.” Across the Ohio Valley, thousands of oil and gas wells sit idle. An analysis of state data by the Ohio Valley ReSource estimates more than 8,000 oil and gas wells are considered “orphan.” Definitions of orphan and abandoned wells vary by state, but in general, orphan wells lack an operator or company that can pay to plug them. That responsibility then falls to state regulators who are frequently struggling to keep up with demand and scrambling to find money to clean up the mess.

Mountain Valley Pipeline is Damaging & Very Expensive - Mountain Valley Pipeline never sufficiently showed that it would face harm without access to landowners’ properties, lawyers for those landowners told the 4th Circuit Court of Appeals in Richmond, Virginia, on Tuesday.They also said that, as court battles over the pipeline continue to play out, the landowners are facing irreparable harm. Oral arguments were available on audio recording Wednesday.The case challenges the preliminary injunctions issued by three district judges that granted Mountain Valley Pipeline immediate possession in condemnation proceedings. It’s the first of five pipeline hearings playing out in Richmond this week. On Friday, a panel of judges will hear arguments in two cases challenging permits issued to the Mountain Valley Pipeline, and two challenging the Atlantic Coast Pipeline.On Tuesday, though, lawyers challenged the injunction granted to developers, and their ability to take property without immediately compensating landowners. “You’d better believe losing possession is important to these landowners,” Christopher Johns, a lawyer for the landowners, said. “It’s substantive to them, and it makes a difference to them.” Allowing early possession through a preliminary injunction through condemnation under the Natural Gas Act is far-reaching and unconstitutional, Johns argued. And Mountain Valley Pipeline’s claims of irreparable harm without access to land were only possible, not inevitable, said Derek Teaney, an Appalachian Mountain Advocates lawyer.Mountain Valley Pipeline had said it would face economic loss and lose its Federal Energy Regulatory Commission certificate without speedy access to properties, Teaney said. The project would span 300 miles from Northern West Virginia to Southwest Virginia.Initial plans said the project would cost $3.7 billion and be completed by the end of 2018. But after a panel of judges on the 4th Circuit said the federal government had skirted rules when it approved the pipeline, and FERC halted the project. Developers say that halt pushed completion into 2019 and caused the price of the project to climb to $4.6 billion.

Mountain Valley Pipeline Construction Permit Revoked by Federal Court - Communities along the 300-mile proposed route for the Mountain Valley Pipeline (MVP) heard some good news this week. On Tuesday, the Fourth Circuit Court of Appeals unanimously voted to vacate a permit required by the Clean Water Act, which was previously issued by the U.S. Army Corps of Engineers. The ruling stated the Army Corps lacked the authority to substitute one type of construction for another for the natural gas pipeline, which would crisscross rivers and other sensitive aquatic ecosystems hundreds of times between northern West Virginia and southern Virginia.The case—brought by the Sierra Club, the West Virginia Rivers Coalition, and other citizen organizations—does not kill the project outright, but it is a significant roadblock.MVP is one of two pipelines (the other is the Atlantic Coast Pipeline) that have drummed up fierce public backlash across the region. Concerned residents have been peacefully protesting the projects for months, sometimes among the trees they would be helping to save.The Trump administration hastily approved both pipelines late last year, ignoring the serious risks a spill would pose to the region's watersheds, such as the Chesapeake Bay. Between the two projects, more than315 acres of critical wetlands are at stake, many of which drain into Virginia's Great Dismal Swamp National Wildlife Refuge. The extra sediment that construction would kick up would also harm fish and other aquatic life. Tuesday's decision isn't the first time the Fourth Circuit Court of Appeals has pushed back against the Trump administration's fast-track approval process for environmentally questionable projects. It also pulled a key permit for the Atlantic Coast Pipeline in May after finding that the U.S. Fish and Wildlife Service failed to set clear and adequate limits on its threats to the environment and endangered species.

Troubled $4.6B Pipe Hits New Snag on Surprise Ruling - -- A $4.6 billion shale gas pipeline that’s already been delayed by about a year is facing yet another setback after a court unexpectedly vacated a key permit. A U.S. appeals court voided a federal authorization for the Mountain Valley project, which will be operated by EQT Midstream Partners LP and is designed to carry natural gas from the Marcellus basin in Appalachia -- America’s biggest reservoir of the fuel -- to Southeast markets. Other eastern U.S. projects, including Dominion Energy Inc.’s Atlantic Coast pipeline, have faced similar woes. The conduits would join several built in the region over the past few years as Marcellus drillers seek outlets for abundant shale supply. In the case of Mountain Valley, the court sided with environmental groups in a ruling Tuesday, saying the Army Corps of Engineers isn’t allowed to substitute a construction method for the pipeline to get around West Virginia’s requirement that work at stream crossings be completed in 72 hours. The decision is “a huge blow to the project,” said Brandon Barnes, an analyst at Bloomberg Intelligence in Washington. It also comes as a shock to policy and legal analysts because the court had lifted a previous stay involving the same permit, said Christi Tezak, managing director at ClearView Energy Partners. The Aug. 29 decision to lift the original stay, put in place in late June, looked "encouraging" for Mountain Valley and the Corps, she said. Shares of EQT Midstream fell as much as 2 percent in New York on Wednesday. The Pittsburgh-based company is “disappointed” with the decision and is in the process of figuring out whether it can continue with construction that doesn’t include stream and wetland crossings along the affected portion of the pipeline route, spokeswoman Natalie Cox said in an emailed statement. The developer expects to apply for a new Army Corps permit once West Virginia’s proposed water-crossing modifications are considered. Mountain Valley anticipates receiving a new permit early in 2019, allowing it to maintain is target of being fully in-service in the fourth quarter of next year, Cox said.

MVP hopes for new permit in early 2019, after 4th Circuit action strikes W.Va. authorization— After a federal appeals court struck a general permit for West Virginia water crossings for the Mountain Valley Pipeline, the project developer said it expects to secure a new permit from the US Army Corps of Engineers early in 2019. An order Tuesday by the 4th US Circuit Court of Appeals struck the general permit for stream and water crossings that was in place for 160 miles of pipeline in West Virginia. Environmentalists who prevailed in the case were quick to argue work must stop on the full route. "Because the MVP certificate from [FERC] specifies that all necessary permits must be in place before the project can proceed anywhere, MVP must also halt work along its entire route," Sierra Club said in a statement late Tuesday. The case at issue involved a dispute over whether the US Army Corps of Engineers had authority to issue a general permit, known as Nationwide 12, rather than an individual stream-by-stream permit, for the pipeline in West Virginia. Sierra Club and other environmental groups argued the general permit failed to meet a state standard that all crossings must be able to be completed in within 72 hours. They argued the Corps improperly imposed one condition requiring the use of a "dry cut" method for constructing four river crossings in the state. The court, in a brief order, concluded the Corps lacked authority to substitute the dry-cut method and vacated in its entirety the Corps' verification of the pipeline's compliance with the permit. It cited regulation stating that if any part of a project requires an individual permit, the nationwide permit does not apply. Each of the four river crossings using the method are expected to take four-to-six months to complete, the court said. A continued legal battle is likely over whether MVP has authority to use a general permit for the route, or must pursue an individual permit, which requires more extensive analysis of individual water crossings. Sierra Club has argued in September 13 comments to West Virginia regulators that it believes legal authority is lacking for the modification that would allow use of the general permit. ClearView Energy Partners predicted the environmental groups would return to FERC promptly with a renewed request to stop work, and suggested FERC would grant that within days in a manner similar to its August stop-work order, in this case, halting all incomplete water crossings. Nonetheless, MVP's extension of its in-service date to the fourth quarter of 2019 should be enough time for West Virginia or MVP to change the route to cross rivers using a horizontal directional drilling method, they said.

US approves part of TransCanada Mountaineer natgas pipe for service (Reuters) - U.S. federal energy regulators on Friday approved a request by TransCanada Corp's Columbia Gas Transmission unit to put part of its $3 billion Mountaineer XPress natural gas pipeline project into service in West Virginia. Mountaineer is one of several pipelines designed to connect growing output in the Marcellus and Utica shale basins in Pennsylvania, West Virginia and Ohio with customers in other parts of the United States and Canada. Specifically, the U.S. Federal Energy Regulatory Commission (FERC) approved Columbia's request to put Mountaineer's Elk River compressor station into service. One billion cubic feet is enough gas to power about 5 million U.S. homes for a day. New pipelines built to remove gas from the Marcellus and Utica basins have enabled shale drillers to boost output in the Appalachia region to a forecast record high of around 29.4 bcfd in October from 24.2 bcfd during the same month a year ago. That represents about 36 percent of the nation's total dry gas output of 81.1 bcfd expected on average in 2018. A decade ago, the Appalachia region produced just 1.6 bcfd, or 3 percent of the country's total production in 2008. In other news, TransCanada said on Friday that it placed the first Western phase of its WB XPress project into service. The Western phase is designed to move about 0.76 bcfd of gas from producers in Appalachia to consumers in the Gulf Coast. The company said it plans to finish the second Eastern phase of the $900 million project by the end of the year. TransCanada also said it plans to finish its $600 million Gulf XPress project by the end of the year. Gulf XPress is designed to move 0.88 bcfd of gas from Appalachia to the U.S. South.

US approves part of TransCanada WB XPress natgas pipe for service (Reuters) - U.S. federal energy regulators on Thursday approved a request by TransCanada Corp's Columbia Gas Transmission unit to put part of its WB XPress natural gas pipeline project into service in West Virginia. WB XPress is one of several pipelines designed to connect growing output in the Marcellus and Utica shale basins in Pennsylvania, West Virginia and Ohio with customers in other parts of the United States and Canada. The U.S. Federal Energy Regulatory Commission (FERC) said in a filing approving the startup of the $900 million project that Columbia has "adequately stabilized the areas disturbed by construction and that restoration is proceeding satisfactorily." One billion cubic feet is enough gas to power about 5 million U.S. homes for a day. New pipelines built to remove gas from the Marcellus and Utica basins have enabled shale drillers to boost output in the Appalachia region to a forecast record high of around 29.4 bcfd in October 2018 from 24.2 bcfd during the same month a year earlier. That represents about 36 percent of the nation's total dry gas output of 81.1 bcfd expected on average in 2018. A decade ago, the Appalachia region produced just 1.6 bcfd, or 3 percent of the country's total production in 2008.

WB XPress Project’s Western Build Placed Into Service -- TransCanada today announced it has placed the Western Build of its WB XPress (WBX) project into service. “WB XPress provides an attractive outlet for our producer customers, creating significant new takeaway capacity in Appalachia,” said Stan Chapman, executive vice president & president, U.S. Natural Gas Pipelines. “We are pleased to deliver on the first phase of this project and look forward to placing the Eastern Build in-service later this year.” The Western Build of WBX is designed to move approximately 760 million cubic feet of natural gas per day to a delivery point on Tennessee Gas Pipeline’s Broad Run System for transportation to the Gulf Coast. Highlights of the project include construction of the Elk River Compressor Station in Clendenin, West Virginia, along with associated pipeline and facilities. WBX is an approximate US$900 million investment, upgrading and enhancing an existing TransCanada pipeline system that has been safely serving customers for over 60 years. The project includes two new compressor stations, 30 miles (48 kilometres) of greenfield pipeline and modifications to seven existing pipelines, allowing an additional 1.3 billion cubic feet of natural gas to flow through the system per day. The project is part of TransCanada’s $28 billion near-term growth portfolio that includes US$8 billion in natural gas pipelines in the United States.

US approves Williams' Atlantic Sunrise natgas pipe for service (Reuters) - U.S. federal energy regulators on Thursday approved a request by Williams Cos Inc’s Transcontinental Gas Pipe Line Co (Transco) unit to put the Atlantic Sunrise natural gas pipeline from Pennsylvania to South Carolina into service. Atlantic Sunrise is one of several pipelines designed to connect growing output in the Marcellus and Utica shale basins in Pennsylvania, West Virginia and Ohio with customers in other parts of the United States and Canada. The U.S. Federal Energy Regulatory Commission (FERC) said in a filing approving the startup of the nearly $3 billion project that Transco has “adequately stabilized the areas disturbed by construction and that restoration is proceeding satisfactorily.” The 1.7 billion-cubic-feet-per-day (bcfd) Atlantic Sunrise project includes about 198 miles (319 km) of new pipe located mostly in Pennsylvania, two new compressor stations and compressor station modifications in five states. One billion cubic feet is enough gas to power about 5 million U.S. homes for a day. Cabot Oil & Gas Corp has secured about 1 bcfd of transport capacity on Atlantic Sunrise. New pipelines built to remove gas from the Marcellus and Utica basins have enabled shale drillers to boost output in the Appalachia region to a forecast record high of around 29.4 bcfd in October 2018 from 24.2 bcfd during the same month a year earlier. That represents about 36 percent of the nation’s total dry gas output of 81.1 bcfd expected on average in 2018. A decade ago, the Appalachia region produced just 1.6 bcfd, which was only 3 percent of the nation’s total production in 2008. Williams said it started laying new pipe in Pennsylvania in September 2017. FERC authorized construction of the project in February 2017.

FERC Issues Trio of Orders to Advance Appalachian Gas Pipeline Projects -- FERC on Friday issued letter orders to advance a trio of natural gas pipeline projects in the Appalachian Basin.The Federal Energy Regulatory Commission granted Columbia Gas Transmission LLC (CGT), a TransCanada Corp. affiliate, permission to enter the Elk River Compressor Station into service to support its Mountaineer XPress Project [CP16-357]. Elk River, in Kanawha County, WV, was constructed as part of CGT's WB XPress Project [CP16-38], and was given authorization by the Commission to enter service for the latter project on Thursday.FERC approved a CGT request to increase the initial monthly incremental recourse reservation rate on Mountaineer XPress last August, and issued a certificate of public convenience and necessity for the project in January. It is expected to enter service late this year.Mountaineer XPress would add 164.5 miles of 36-inch diameter pipe and six miles of 24-inch diameter pipe to expand CGT's system. It would add about 2.7 Bcf/d of capacity to the Columbia Gas system and is designed to allow additional volumes of Marcellus and Utica shale gas to reach markets in the Midwest, Northeast, South and Gulf Coast.In a second letter order, FERC approved a variance request by Rover Pipeline LLC for 0.3 acres of temporary workspace in Monroe County, OH, to repair an off-right-of-way slip and to retrieve sediments associated with the Rover Pipeline Project [CP15-93]. The workspace is along the 42-inch diameter Seneca Lateral.Last month, Rover asked for FERC authorization to start service on two final supply laterals, Sherwood and CGT, to support the 3.25 Bcf/d Appalachian takeaway project. FERC gave authorization for two additional Rover laterals, Burgettstown and Majorsville, to enter service last August. FERC also approved, in a third letter order, a request by Dominion Energy Transmission Inc. to use 0.24 acres in Doddridge County, WV, as additional temporary workspace for truck turn-arounds at its 1.5 million Dth/d Supply Header Project (SHP) [CP15-555]. SHP includes about 37.5 miles of pipeline looping and modifications to existing compressor stations in West Virginia and Pennsylvania, and is related to work on the embattled Atlantic Coast Pipeline.

US Forest Service seeks 'streamlined' oil and gas permit process - A public comment period ends Oct. 15 for a plan by the U.S. Forest Service to accelerate the permitting process for oil and gas development in the 44 national forests where drilling is authorized, and West Virginia’s Monongahela National Forest is among them.The Forest Service announced earlier this month that it is planning to revise “outdated and inefficient regulations for oil and gas resources” on national forest lands.“This is one of many efforts that our agency is undertaking to focus on our priority of regulatory reform,” Interim Forest Service Chief Vicki Christiansen said in the announcement. “Our goal is to make our processes as simple and efficient as possible while ensuring a sustainable environment for future generations.”About 60 active gas wells, most of them storage wells, are currently found in the Mon. None of the wells were horizontally drilled, as is common in Marcellus Shale production areas. The plan to “update, clarify and streamline internal processes related to environmental review and permitting,” as it is described in the Federal Register, was undertaken to clear a backlog of nearly 2,000 pending Expressions of Interest to acquire oil and gas leases. The pending leases involve nearly 2 million acres of national forest lands. The proposed streamlining would make possible “quicker leasing decisions” for oil and gas developers who, under existing rules, sometimes wait five to 10 years for final leasing decisions to be made, according to the Forest Service’s notice in the Federal Register. The rule changes would “promote domestic oil and gas production by allowing industry to begin production more quickly.”

Great Lakes 'At Risk' From Plan to Replace Aging Enbridge Pipelines, Environmentalists Argue - The state of Michigan and Canadian pipeline company Enbridge announced a deal Wednesday to replace controversial aging pipelines that environmental groups worried put Lakes Michigan and Huron at risk for anoil spill, The Detroit Free Press reported. Under the new plan, the existing 65-year-old pipelines, which are part of Enbridge's Line 5 carrying oil and liquefied natural gas between Wisconsin and Ontario, will be replaced with a new pipeline in a tunnel to be drilled into the bedrock beneath the Straits of Mackinac connecting Lakes Huron and Michigan, The Associated Press reported. The project will take seven to 10 years to complete and cost as much as $500 million. Enbridge will foot the bill.Michigan Governor Rick Snyder called the proposal "a common-sense solution" to the problem posed by the aging pipelines, saying that it would resolve "nearly every risk" of an oil spill in the Straits of Mackinac.But environmental groups, who have long opposed the pipeline, disagreed that the new plan was any sort of solution."Today, Governor Snyder cemented his disastrous legacy for the Great Lakes and the people of Michigan," Michigan organizer for Clean Water Action Sean McBearty told The Detroit Free Press. "As his administration comes to a close, he announced a last-minute deal with Enbridge Energy that will succeed in keeping the Great Lakes at risk from a massive Line 5 oil spill for the foreseeable future."Mike Shriberg of the National Wildlife Federation also told The Associated Press that the plan would leave the body of water vulnerable to spills for many years, and David Holtz of Oil and Water Don't Mix said that Michigan's own studies showed there were better ways to provide the state with energy. Enbridge said it would take measures to reduce the risk of an oil spill from the older pipelines during construction, including (a) conducting underwater investigations, (b) placing cameras in the straits to keep track of ship movements and enforce a no-anchor zone, and (c) making Enbridge staff available to manually shut down the pipeline during high-wave days if electric mechanisms fail.

Washington rolls back safety rules inspired by Deepwater Horizon disaster - NYTimes — The Trump administration has completed its plan to roll back major offshore-drilling safety regulations that were put in place after the Deepwater Horizon oil rig disaster in 2010 that killed 11 people and caused the worst oil spill in American history.The Interior Department’s Bureau of Safety and Environmental Enforcement, which was established after the spill in the Gulf of Mexico and regulates offshore oil and gas drilling, has finalized a proposal for loosening the regulations as part of President Trump’s efforts to ease restrictions on fossil fuel companies and encourage domestic energy production.The rules “created potentially unduly burdensome requirements for oil and natural gas production operators on the Outer Continental Shelf, without meaningfully increasing safety of the workers or protection of the environment,” says the new 176-page rule, which is scheduled in the coming days to be published in the Federal Register, before becoming the administration’s final policy.“This rule supports the administration’s objective of facilitating energy dominance by encouraging increased domestic oil and gas production and reducing unnecessary burdens on stakeholders, while ensuring safety and environmental protection,” the new rule says.Among the changes, the new rule removes a requirement for independent verification of safety measures and equipment used on offshore platforms.It also removes a requirement that oil companies design their equipment to function in “most extreme” scenarios involving weather, high heat, strong winds or high pressure from within the undersea oil wells, which was a key factor in the deadly 2010 blowout.And it removes a requirement that professional engineers certify the safety of the design of some pieces of offshore drilling equipment for new wells. The new rule appears to reflect many of the requests made by the oil industry, including the American Petroleum Institute, which lobbies on behalf of oil companies.

Ryan Zinke to the oil and gas industry: “Our government should work for you” -- Interior Secretary Ryan Zinke let the mask slip this week, turning the subtext of his term in office into the headline as he spoke to a friendly audience.On Tuesday, Zinke gave the keynote address at the Louisiana Oil and Gas Association’s fall meeting in Lafayette, Louisiana. He told the conference over lunch “our government should work for you,” according to organizers: You can debate what Zinke meant by “work for you,” but many heard it as a pledge of allegiance to the industry. And according to the Louisiana Oil and Gas Association, the industry members in the room were thrilled with the pledge, giving Zinke a standing ovation. (An organizer told me none of the speeches at the event were recorded.) However, environmental activists and some lawmakers were appalled by the statement. But Zinke has said pretty much the same thing before. In March, he told an energy industry conference: “Interior should not be in the business of being an adversary. We should be in the business of being a partner.” For the record, the Interior Department’s job is to manage about 75 percent of federal public land, which amounts to about one-fifth of the total area of the United States. This means conservation, preserving culture, and facilitating recreation. It also entails leasing rights to mining, drilling, grazing, and logging. However, it does not mean that the agency needs to advance the fossil fuel industry’s interests, certainly not at the expense of the environment.

Trump likely to make pipeline push next year, aide says -- President Trump is likely to make a renewed push to permit and build oil and natural gas pipelines next year, his top economic adviser said Thursday. Larry Kudlow said a new pipeline push would be both a continuation of Trump’s aggressive energy deregulation streak and his ongoing infrastructure agenda. “We need infrastructure, including pipelines,” Kudlow said at an Economic Club of Washington event. “We need east to west, we need west to east.” Kudlow said the need for pipeline is especially strong in the natural gas industry, where drillers, thanks to the boom in fracking and horizontal drilling, are producing more gas than there is pipeline capacity to carry. He said an executive from an unnamed energy company that drills in the Permian Basin in Texas and New Mexico came to the White House Wednesday and spoke with both him and Trump. “He’s got more than he knows what to do with. They’re burning it off, flaring,” Kudlow said of the unnamed executive. Kudlow indicated that Trump’s push is likely to include federal actions to override states that have blocked pipelines.

Climate Emissions From Gulf Coast’s New Petrochemical, Oil and Gas Projects Same as 29 New Coal Power Plants - In the last six years, officials in Texas and Louisiana issued permits allowing 74 petrochemical, oil, and gas projects to pump as much climate-warming pollution into the atmosphere as running 29 coal-fired power plants around the clock, according to numbers released September 26 by the nonprofit watchdog Environmental Integrity Project.And construction appears to be speeding up, with over 40 percent of those projects permitted between 2016 and mid-2018. The 31 most recent projects combined will add 50 million tons of greenhouse gases — equal to 11 new coal-fired power plants — to the world’s atmosphere in a year, the watchdog adds. Environmentalists pointed to the risks that climate change poses to Gulf Coast states, where these projects are being built, and noted that the greenhouse effect has already led to sea level rise and a higher risk of extreme storms.“Louisiana is already sinking into the Gulf of Mexico, and yet our state government is permitting more of the emissions that cause flooding and storms,” Anne Rolfes, Founding Director of the Louisiana Bucket Brigade, said in a statement accompanying the numbers. “It’s mind boggling.” The most recent projects tallied by the group include seven Liquefied Natural Gas (LNG) plants or terminals, 15 chemical and plastic resin plants, five petroleum refineries, and two natural gas processing plants, as well as a fertilizer manufacturer and hydrogen plant, all in Texas and Louisiana. The count does not include plants outside the Gulf Coast, like the Marcellus shale region of Pennsylvania, Ohio, and West Virginia, where a glut of natural gas liquids (NGLs) like ethane, a petrochemical feedstock produced by many shale wells, is attracting attention from plastics and chemical manufacturers. The Marcellus region now produces 27 billion cubic feet of natural gas a day, roughly a third of total U.S. output. Another report, issued last week by Food and Water Watch, called attention to $35.8 billion worth of petrochemical and plastics projects in central Appalachia, including the Appalachia Development Group’s $10 billion NGL storage hub proposed in West Virginia.

Crude oil entering Gulf Coast refineries has become lighter as imports have declined - The density of crude oil processed by U.S. Gulf Coast refineries has become lighter since 2008 as refineries moved away from heavier imported crude oil to lighter crude oil produced in Texas. The Gulf Coast is home to most of the nation’s petroleum refineries, and these refineries tend to run a diverse mix of crude oils that, similar to the national average, has become lighter since 2008. API gravity is a measure of crude oil density that refiners consider when making decisions about the types of crude oil to process. Crude oil with a higher API gravity is lighter, or less dense. Small changes in the API gravity of the combination of crude oils that a refiner processes, called the crude slate, can affect the profitability of the refinery and the shares of petroleum products produced.Between 1985 and 2008, crude oil inputs to refineries in the Gulf Coast (defined as Petroleum Administration for Defense District 3) were getting heavier, from an API gravity of 34.1 degrees in 1985 to their heaviest at 29.5 degrees in 2008. At about the same time, imported crude oil processed in the Gulf Coast was increasing from 1.4 million barrels per day (b/d) in 1985 to its highest level of 5.8 million b/d in 2004. That trend reversed between 2008 and 2017, when the API gravity of crude oil inputs to refineries in the Gulf Coast increased to 32.0 degrees and imported crude oil processed in the region decreased to 3.1 million b/d. Most imports of crude oil to the Gulf Coast region are relatively heavy, as crude oils less than 27 degrees API accounted for 46% of the region’s imports in 2009 and 71% of regional imports in 2017. Relatively lighter crude oil imports accounted for 21% of imports in 2009 but had virtually disappeared by 2017.

The experienced, deep-pocketed team behind the Golden Pass LNG project - It’s crunch time in the race to advance the next-round of liquefaction/LNG export projects along the U.S. Gulf Coast to a Final Investment Decision (FID). And if we’re to assume that only a small number of these multibillion-dollar projects will get their financial go-aheads, it would seem eminently reasonable to put a win-place-or-show bet on a joint venture that includes the world’s leading LNG producer (by far) and one of the largest U.S. natural gas producers — oh, and the partners have very fat wallets too. Size and money aren’t everything, of course, but as we discuss in today’s blog, the team behind the Golden Pass LNG project plans to build its liquefaction trains at the site of an existing LNG import terminal with strong interconnections with coastal pipelines already in place.2019 will be a pivotal year for the second wave of U.S. LNG export projects. Global demand for LNG continues to rise, and LNG marketers and customers — acutely aware of how much it takes to build new liquefaction capacity — are eager to line up the incremental LNG supply they will need in the early to mid-2020s. Want proof? Royal Dutch Shell, the lead partner in the LNG Canada project, on Tuesday (October 2) announced a FID on the 14-million-metric-tonnes-per-annum (MMtpa) liquefaction/export terminal in Kitimat, BC. (The project’s other partners are Petronas, PetroChina, Mitsubishi and Korea Gas.)Today, we look at Golden Pass LNG, a joint effort by three global energy powerhouses — Qatar Petroleum, ExxonMobil and ConocoPhillips — to expand their existing LNG import terminal (photo above, magenta diamond in Figure 1) on the Sabine-Neches Waterway near Sabine Pass, TX, into a liquefaction/LNG export facility. Much like Austin’s East Sixth Street is a mecca for live music and New Orleans’ Bourbon Street is a hub of late-night debauchery, the greater Sabine Pass area (on the border of Louisiana and Texas) already has drawn more than its share of liquefaction/LNG export facilities (Sabine Pass LNG, Cameron LNG and a number of second wave contenders, including Venture Global’s Calcasieu Pass), and for good reason. There’s easy, deep-water access to the Gulf of Mexico and large tracts of waterfront land, but just as important, there are few places on the planet with as many long-haul gas pipelines nearby to deliver large volumes of U.S.-sourced natural gas.

Hi-Crush Temporarily Idles One Sand Plant on 'Temporary Softness in Completions - Hi-Crush Partners LP said Wednesday it temporarily has shuttered dry sand plant operations at the Whitehall, WI, facility given “softness” in U.S. completions activity. Whitehall’s wet sand plant remains operational, and Hi-Crush still is selling inventory from on-site storage to meet northern white customer demand for hydraulic fracture (frack) and completions activity. Wet and dry plants also remain operational at the Wyeville, Augusta and Blair sand mines in Wisconsin, as well as the Kermit sand mine in Winkler County, TX, which serves Permian Basin producers. “Our strategic decision to temporarily idle Whitehall’s dry plant was driven by recent, temporary softness in completions activity and frack sand demand,” said CFO Laura C. Fulton. “This reduced level of expected activity is reflected in our updated guidance for sales volumes of 2.8 to 3.0 million tons for the third quarter we previously communicated.” The Kermit facility “continues to run above its nameplate capacity and we anticipate strong demand for northern white and our in-basin Permian sand in 2019 and beyond,” Fulton said.

Select Sands Halting Independence Expansion Project Due to Softer Demand for Northern White Silica Fracking Sand - -- Select Sands Corp. has announced that it will be halting its previously announced Independence expansion project due to a period of softer demand for Northern White silica/fracking sand.The expansion project will be under regular review and progress will resume once demand reaches appropriate levels. The Company will remain fully operational during the interim period, with a nameplate capacity of 600,000 tons per year of premium Northern White silica. Zig Vitols, President and CEO, commented: "We feel it is prudent to coincide the timing of the expansion project and its completion with increased basin activity and proppant demand. Select Sands is committed to adding new business and pursuing opportunities to generate value for shareholders."

Power to the Permian- Spotty at Best, Outrun by Shale Boom - America’s fastest-growing source of energy has a power problem. The Permian Basin, which produces almost 4 million barrels of oil a day, has expanded so quickly that suppliers of the electricity needed to keep wells running are struggling to keep up. The Delaware portion alone consumed the equivalent of 350 megawatts this summer, tripling the load from 2015. That’s enough to power about 280,000 U.S. homes. And providers say the draw is likely to triple again by 2022. While providers are rushing to build new power lines, it takes three to six years to get them up and working. In the meantime, drillers are bemoaning the reliability of the system and desperately seeking alternatives, exploring the use of solar and natural gas to fuel power-generating gear on-site. The electrical grid in West Texas “was not set up to withstand that much power going through it," "Plain and simple, you have reliability challenges." Power is just one more oilfield complication in a region struggling to deal with extraordinary growth over an incredibly short period of time. Worker and pipeline shortages are major concerns, along with the growing levels of water and sand needed for fracking. Meanwhile, highways initially designed for minimal use are gridlocked in the day and deadly at night. Conventional drilling with vertical wells in the region reached an apex in 1973, producing about 763 million barrels for the year. Output then steadily declined, falling to 309 million barrels in 2006. Then fracking hit. The iconic 40-horsepower “nodding donkeys” that power vertical wells draw about 30 kilowatts each. Shale wells developed using fracking can run horizontally for miles. To lift oil out, companies now depend on electric submersible pumps that individually draw about 300 kilowatts

Permian Needs $300B in CAPEX for Growth through 2023 -A new report by consulting firm Arthur D. Little finds that U.S. independents will need to adjust their business models to keep up with forecasted growth in the Permian.While production in the Permian Basin has been abundant, U.S. independent operators will need to look at new ways of doing business to position themselves for long-term value, according to a report released Oct. 2 by consulting firm Arthur D. Little.Data in the report forecasts Permian activity through the next five years to:

- Rise by up to 3 million barrels of oil equivalent per day

- Possibly produce up to 5.4 billion barrels of oil equivalent per day

- Have a need for up to 41,000 new wells (mostly unconventional) to be drilled to meet production outlook

- Require more than $300 billion in capital expenditures (CAPEX) to keep pace with growth projections

In turn, independents will need to “comprehend and exploit global markets,” the report states, while suggesting partnership opportunities for U.S. independents as refineries in Mexico, Latin America and China.Independents will also need to collaborate.The report called the demands on infrastructure “tremendous,” citing trucking, roads, water usage, power consumption, sand to frack wells and community services like housing, schools and hospitals.Additionally, about one million barrels per day in production growth are at risk due to the inability of the local infrastructure to support daily operations, according to the report.Pioneer Natural Resources’ effort to potentially pool power generation to benefit both the operator’s community and local towns and ranches was an example mentioned in the report of the type of collaboration needed. Still, the biggest challenge remains the amount of capital needed.

No Relief Likely in Permian Takeaway Before Late 2019, Energy Execs Tell Dallas Fed - Oil and natural gas sector activity continued its momentum during the third quarter across Texas, northern Louisiana and southern New Mexico, according to a survey of energy executives, but many are concerned that it’s going to take awhile before any relief in pipeline constraints in the Permian Basin.The Federal Reserve Bank of Dallas, which covers the Eleventh District, published its 3Q2018 energy survey on Monday, comparing activity to the second quarter. Data were collected Sept. 12–20, and 171 energy firms responded to the survey. Of the respondents, 110 were exploration and production (E&P) firms and 61 were oilfield services (OFS) firms.The business activity index, considered the broadest measure of conditions facing the region’s energy firms, dipped “very slightly” to 43.3 from 44.5, but it remained near the highest level since the survey began.The OFS business activity index also declined to 45.9 from 54.2 in 2Q2018, “suggesting a slight deceleration in growth.” Meanwhile, the business activity index for E&Ps rose sequentially to 41.8 from 37.2.Positive readings in the survey generally indicate expansion, while readings below zero generally indicate contraction. “All indexes in the latest survey reflected expansion on a quarterly basis,” Dallas Fed researchers said.Oil and gas production increased for the eighth quarter in a row, according to E&P executives. The oil production index moved down to 34.8 from 39.0 in the second quarter, suggesting crude production “rose at a slightly slower pace relative to last quarter.” However, the natural gas production index edged up sequentially to 35.5 from 33.4, “its highest level since the survey began. This suggests gas production rose at a slightly faster pace relative to last quarter.”

West Texas ex-senator Uresti and businessman Bates charged in fracking Ponzi scheme --The bad news for former West Texas Senator Carlos Uresti and San Antonio businessman Stanley Bates just keeps coming.The U.S. Securities and Exchange Commission officially charged the two men Friday with securities fraud in an alleged $11 million oil and gas fracking Ponzi scheme. The SEC will not have difficulty serving the federal complaint on either man. In June, Uresti was sentenced to 12 years in federal prison after being found guilty of 11 counts of fraud and money laundering. In August, Bates was arrested by FBI officials after he agreed to plead guilty to eight counts of defrauding investors. In an 18-page complaint filed in the U.S. District Court for the Western District of Texas, the SEC’s Fort Worth Regional Office said Uresti and Bates raised $11.2 million from investors for a company they owned called Fourwinds Logistics Laredo. Fourwinds’ business plan called for the company to buy and sell sand used in hydraulic fracking to extract oil and gas from shale rock. The SEC claims that Bates used a significant portion of the $11 million to pay for prostitutes, drugs, models to work in his office, his mother’s housing costs, child support payments, his son’s fraternity dues, designer shoes for his girlfriend and a Ferrari. He listed these charges as investor relations expenses or corporate housing. “Bates misrepresented his background and experience, overstated the profitability and safety of the investments and failed to disclose his misuse of investor funds to make Ponzi payments to earlier investors and to make extravagant office and personal expenditures,” the SEC complaint states. “Bates also provided investors with a doctored bank statement showing FWLL had $18.8 million in the bank, when in reality FWLL had less than $100,000.”