oil prices rose for a 2nd straight week, after falling each of the prior seven weeks, as Houthi attacks in the Red Sea shut down the Suez trade route and forced hundreds of ships to circumvent Africa to reach their destination…after bouncing off a 6 month low to eke out a 0.3% gain at $71.43 a barrel last week after trader sentiment turned bullish on signs that the Fed would pivot to lower interest rates, the contract price for the benchmark US light sweet crude for January delivery opened higher on Monday, triggered by a disruption of shipping through the Red Sea following a series of attacks by Houthi rebels on commercial vessels in the region, and settled $1.04 higher at $72.47 a barrel after BP became the latest company to announce it was halting oil shipments through the Red Sea due to the “deteriorating security situation for shipping.”…after trading lower early Tuesday after the U.S. announced the creation of a task force to safeguard Red Sea commerce from attacks by the militants, the rally resumed during Tuesday's afternoon session, amid reports that shipping companies would continue to avoid transit through the Red Sea and instead send vessels around the southern tip of Africa, as trading in the January oil contract expired 94 cents higher at $73.44 a barrel….the rally continued into early Wednesday with markets quoting the contract price for the US oil benchmark for February delivery, which rose to a high of $75.37 ahead of the release of the EIA’s weekly petroleum stock report, but pared gains ffollowing the release to settle the session just 28 cents higher at $74.22 a barrel, after the EIA reported total oil and petroleum product supplies unexpectedly jumped by 9.5 million barrels and domestic oil production rose to a new record high….however, oil prices fell early on Thursday as traders reacted to cracks in OPEC’s unity following the news that Angola was leaving OPEC, but cut their sharp losses and settled 33 cents lower at $73.89 a barrel after Baker Hughes (BKR) reported a third straight weekly decline in the number of active U.S. rigs drilling for oil and as traders realized Angola couldn’t even pump their reduced OPEC quota…oil prices rose as much as 1% early Friday as tensions persisted in the Middle East following Houthi attacks on ships in the Red Sea, but edged lower during Friday's afternoon session and settled down 33 cents at $73.56 per barrel on concerns of further fracturing within the OPEC+ alliance after Angola abandoned the quota system to pursue private investments to expand its oil industry…oil prices still finished 3.0% higher on the week, while the February oil contract, which had closed last week at $71.78 a barrel, ended with a 2.5% gain…

Meanwhile, natural gas prices finished higher for the first time in seven weeks on colder forecasts and a bigger than expected withdrawal of gas from storage...after settling 3.5% lower at $2.491 per mmBTU last week after hitting a life-of contract low at $2.235 per mmBTU on warm winter forecasts last Tuesday, the contract price for natural gas for January delivery opened 8 cents higher on Monday, as additional heating demand was added to the forecast for the end of the month, but settled just 1.2 cents higher at $2.503 per mmBTU, as weather and fundamental outlooks suggested the upside movement would be short lived….natural gas prices followed through on that sentiment on Tuesday after heating demand vanished from the short-term forecast, and settled 1.1 cents lower at 2.492 per mmBTU, then shed another 4.5 cents to settle at $2.447 per mmBTU on Wednesday after opening 8 cents lower on the revised forecast….however, after trading in a narrow range early Thursday, natural gas prices spiked to over $2.60 per mmBTU after the EIA reported a larger than expected withdrawal of gas from storage, then traded mostly sideways to finish the day 12.5 cents higher at $2.572 per mmBTU, boosted by forecasts for colder weather and higher heating demand in early January than had been expected, and as a record amount of gas continued to flow to LNG export plants…natural gas prices held to the upside on Friday, as traders looked to forecasts calling for colder winter weather, and settled with a 3.8 cent gain to $2.610 per mmBTU on the session, and thus ended 4.8% higher for the week

The EIA's natural gas storage report for the week ending December 15th indicated that the amount of working natural gas held in underground storage in the US fell by 87 billion cubic feet to 3,577 billion cubic feet by the end of the week, which still left our natural gas supplies 240 billion cubic feet, or 7.6% above the 3,337 billion cubic feet that were in storage on December 15th of last year, and 280 billion cubic feet, or 8.5% more than the five-year average of 3,297 billion cubic feet of natural gas that were in working storage as of the 15th of December over the most recent five years…the 87 billion cubic foot withdrawal from US natural gas working storage for the cited week was more than the average 80 billion cubic feet withdrawal from supplies that was forecast by analysts polled by Reuters, and more than the 82 billion cubic feet that were pulled from natural gas storage during the corresponding mid December week of 2022, but less than the average 107 billion cubic feet withdrawal from natural gas storage that has been typical for the same early winter week over the past 5 years

The Latest US Oil Supply and Disposition Data from the EIA

The US oil data from the US Energy Information Administration for the week ending December 15th appeared to show that even after an increase in our oil exports and a significant jump in our refinery throughput, we had surplus oil to add to our stored commercial crude supplies, for the seventh time in nine weeks, and for the 10th time in the past 23 weeks, as oil that the EIA could not account for shifted from the demand side to the supply side of the oil balance sheet...Our imports of crude oil rose by an average of 233,000 barrels per day to average 6,750,000 barrels per day, after our oil imports had dropped by an average of 991,000 barrels per day the prior week, while our exports of crude oil rose by 350,000 barrels per day to average 4,121,000 barrels per day, which combined meant that the net of our trade in oil worked out to a net import average of 2,629,000 barrels of oil per day during the week ending December 15th, 117,000 fewer barrels per day than the net of our imports minus our exports during the prior week. At the same time, transfers to our oil supply from Alaskan gas liquids, natural gasoline, condensate, and unfinished oils averaged 692,000 barrels per day, while during the same period, production of crude from US wells was 200,000 barrels per day higher at a record high of 13,300,000 barrels per day. Hence our daily supply of oil from the net of our international trade in oil, from transfers, and from domestic well production appears to have averaged a total of 16,621,000 barrels per day during the December 15th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,500,000 barrels of crude per day during the week ending December 15th, an average of 403,000 more barrels per day than the amount of oil that our refineries were processing during the prior week, while over the same period the EIA’s surveys indicated that a rounded average of 505,000 barrels of oil per day were being added to the supplies of oil stored in the US... So, based on that reported & estimated data, the crude oil figures provided by the EIA for the week ending December 15th appear to indicate that our total working supply of oil from net imports, from transfers, and from oilfield production was 385,000 barrels per day less than what what was added to storage plus what our oil refineries reported they used during the week. To account for that difference between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a [ +385,000] barrel per day figure onto line 16 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there was an error in the week’s oil supply & demand figures that we have just transcribed.... Moreover, since 1,046,000 barrels of oil demand per day could not be unaccounted for in last week’s data, that means there was a 1,431,000 barrel per day difference between this week's oil balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the changes to supply and demand from that week to this one that are indicated by this week's report are off by that much, and therefore useless... However, since most oil traders react to these weekly EIA reports as if they were accurate, and since these weekly figures therefore often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably reliable by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….(note there is also an aging twitter thread from an EIA administrator addressing these errors, and what they had hoped to do about it…the errors have since gotten larger; Reuters recently addressed that issue here..)

This week's rounded average of 505,000 barrel per day increase in our overall crude oil inventories came as 416,000 barrels per day were added to our commercially available stocks of crude oil, while 90,000 barrels per day were being added to our Strategic Petroleum Reserve, the third SPR increase in ten weeks and the largest since September. Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to 6,652,000 barrels per day last week, which was 7.6% more than the 6,184,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be 200,000 barrels per day higher at a record high of 13,300,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 200,000 barrels per day higher at 12,900,000 barrels per day, while Alaska’s oil production was 4,000 barrels per day lower at 431,000 barrels per day but still added the same 400,000 barrels per day to the EIA's rounded national total as it did last week...US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure is now 1.5% above that of our pre-pandemic production peak, and 37.1% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 92.4% of their capacity while processing those 16,500,000 barrels of crude per day during the week ending December 15th, up from their utilization rate of 90.2% last week, and now a near normal utilization rate for mid December.. the 16,500,000 barrels per day of oil that were refined this week were 3.3% more than the 15,976,000 barrels of crude that were being processed daily during week ending December 16th of 2022, but 0.4% less than the 16,562,000 barrels that were being refined during the prepandemic week ending December 13th, 2019, when our refinery utilization rate was at 90.6%..

With the big increase in the amount of oil being refined this week, gasoline output from our refineries was also higher, increasing by 496,000 barrels per day to 10,038,000 barrels per day during the week ending December 15th, after our refineries' gasoline output had increased by 25,000 barrels per day during the prior week. This week’s gasoline production was 5.1% more than the 9,552,000 barrels of gasoline that were being produced daily over the same week of last year, and 2.0% more than the gasoline production of 9,840,000 barrels per day during the prepandemic week ending December 13th, 2019....on the other hand, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 115,000 barrels per day to 4,873,000 barrels per day, after our distillates output had decreased by 83,000 barrels per day during the prior week. With those decreases, our distillates output was 4.5% less than the 5,102,000 barrels of distillates that were being produced daily during the week ending December 16th of 2022, and 3.9% less than the 2,072,000 barrels of distillates that were being produced daily during the week ending December 13th, 2019..

With this week's increase in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the 7th time in nine weeks and for the 17th time in forty-three weeks, increasing by 2,710,000 barrels to 226,723,000 barrels during the week ending December 15th, after our gasoline inventories had increased by 409,000 barrels during the prior week. Our gasoline supplies rose by more this week because the amount of gasoline supplied to US users fell by 104,000 barrels per day to 8,859,000 barrels per day, and even though our exports of gasoline rose by 62,000 barrels per day to a twelve month high of 1,193,000 barrels per day while our imports of gasoline fell by 178,000 barrels per day to 537,000 barrels per day.…So even after twenty-six gasoline inventory withdrawals over the past forty-three weeks, our gasoline supplies were still 0.3% above than last December 16th's gasoline inventories of 226,113,000 barrels, and only 2% below the five year average of our gasoline supplies for this time of the year…

Even with this week's decrease in our distillates production, our supplies of distillate fuels rose for the fourth time in twelve weeks, increasing by 1,485,000 barrels to 115,024,000 barrels over the week ending December 15th, after our distillates supplies had increased by 1,848,000 barrels during the prior week. Our distillates supplies rose again this week because our imports of distillates rose by 20,000 barrels per day to 225,000 barrels per day and because our exports of distillates fell by 145,000 barrels per day to 1,063,000 barrels per day, and while the amount of distillates supplied to US markets, an indicator of our domestic demand, rose by 53,000 barrels per day to 3,823,000 barrels per day....With 23 inventory decreases over the past forty-one weeks, our distillates supplies at the end of the week were still 4.1% below the 119,929,000 barrels of distillates that we had in storage on December 16th of 2022, and about 10% below the five year average of our distillates inventories for this time of the year...

Finally, even with our our oil exports higher and with a significant increase in refinery demand for oil, our commercial supplies of crude oil in storage rose for the 16th time in twenty-six weeks and for the 25th time in the past year, increasing by 2,909,000 barrels over the week, from 440,773,000 barrels on December 8th to 443,682,000 barrels on December 15th, after our commercial crude supplies had decreased by 4,258,000 barrels over the prior week... With that increase, our commercial crude oil inventories were still about 1% below the most recent five-year average of commercial oil supplies for this time of year, but were also about 32% above the average of our available crude oil stocks as of the 3rd weekend of December over the 5 years at the beginning of the past decade, with the big difference between those comparisons arising because it wasn’t until early 2015 that our oil inventories had first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, then jumped again after February 2021's winter storm Uri froze off US Gulf Coast refining, but then fell in the wake of the Ukraine war, only to jump again following the Christmas 2022 refinery freeze offs, our commercial crude supplies as of this December 15th were 6.1% more than the 418,234,000 barrels of oil in commercial storage on December 16th of 2022, and 4.7% more than the 423,571,000 barrels of oil that we still had in storage on December 17th of 2021, but still 11.2% less than the 499,534,000 barrels of oil we had in commercial storage on December 18th of 2020, after early pandemic precautions had left a lot of oil unused…

This Week's Rig Count

Note that this week's rig count was released on Thursday, December 21st, instead of Friday, apparently due to Christmas on the following Monday, and hence only covers changes to rigs over the six days from last Friday to Thursday; the comparisons to year ago rig counts also include a holiday shortened 6 day period ending Thursday, December 22nd, 2022....in lieu of details on the rig count, we are again just including below a screenshot of the rig count summary from Baker Hughes...in the table below, the first column shows the active rig count as of December 21st, the second column shows the change in the number of working rigs between last week’s count (December 15th) and this week’s ( December 21st) count, the third column shows last week’s December 15th active rig count, the 4th column shows the change between the number of rigs running on Thursday and the number running on the Thursday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting period a year ago, which in this week’s case was the 22nd of December, 2022...

DUC well report for November

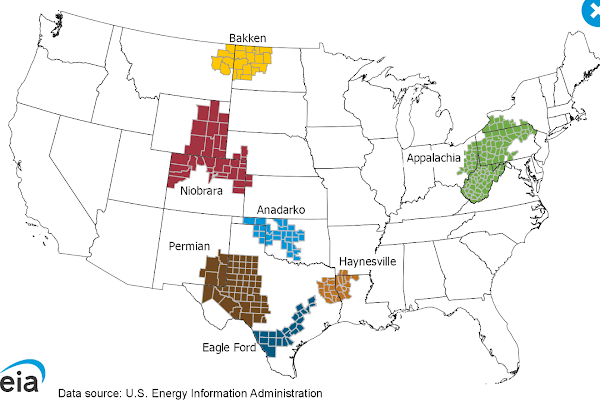

Monday of this week saw the release of the EIA's Drilling Productivity Report for December, which included the EIA's November data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions (click tab 3)....that data showed a decrease in uncompleted wells nationally for the 38th time out of the past 41 months, as both drilling of new wells and completions of drilled wells fell in November and hence remained well below the average pre-pandemic levels....for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 83 wells, falling from a revised 4,498 DUC wells in October to 4,415 DUC wells in November, which was also 15.1% fewer DUCs than the 5,198 wells that had been drilled but remained uncompleted as of the end of November of a year ago...this month's DUC decrease occurred as 854 wells were drilled in the seven regions that this report covers (representing 87% of all U.S. onshore drilling operations) during November, down by 5 from the 859 wells that were drilled in October, while 937 wells were completed and brought into production by fracking them, down from the 952 well completions seen in October, and down from the 947 completions seen in November of last year....at the November completion rate, the 4,415 drilled but uncompleted wells remaining at the end of the month represents a 4.7 month backlog of wells that have been drilled but are not yet fracked, down from the 4.8 month from the DUC well backlog of a month ago, while still up from the 7 1/2 year low of 4.6 months in January, on a completion rate that is roughly 20% below 2019's pre-pandemic average...

the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, decreased by 3 wells, from 764 DUCs at the end of October to 761 DUCs at the end of November, as 77 new wells were drilled into the Marcellus and Utica shales during the month, while 80 of the already drilled wells in the region were fracked...

+++++++++++++++++++++++++++++++++++++++++++++++++.

Ohio HB 201 Adds Fee to Utility Bills to Upgrade NatGas Pipes| Marcellus Drilling News - Ohio House Bill (HB) 201 was recently passed by both the state House and Senate and now sits on the desk of Gov. Mike DeWine (a somewhat swampy Republican, although far superior to governors like Kathy Hochul and Josh Shapiro). HB 201 started life as a bill to block the Buckeye State from following California’s lead in adopting emissions that are stricter than national regulations and call for the phaseout of the internal combustible engine by 2035. Somewhere along the way, the bill added an additional measure allowing the state’s natural gas utilities to recover the costs of installing new pipelines by tacking a fee on utility bills. It is the pipeline amendment that has the radicals going nuts in the state.

Your natural gas bill could go up if DeWine signs bill for pipeline upgrades - Cincinnati Enquirer - Ohioans could pay more on their natural gas bills if Gov. Mike DeWine signs a bill that passed swiftly through the GOP-controlled state Legislature.Last-minute changes to House Bill 201 would allow natural gas companies to charge customers for more infrastructure upgrades, extensions and planning costs, including proposed projects that might never be built."In other words, this will not be the bridge to nowhere. This will be the pipe to nowhere," Sen. Kent Smith, D-Euclid, said.But Sen. Rob McColley, R-Napoleon, contended that the change is needed to bring new jobs to Ohio. "If we are competing across state lines for economic development projects, that in many cases are going to bring hundreds if not thousands of jobs for the state of Ohio, we need to remain competitive for those projects," he said.DeWine seems to agree. “We have a great natural advantage with natural gas in Ohio," the Republican governor told reporters Friday while not expressly saying whether he'd sign the bill. "Making sure it is in the right spots and gets to the right spots is vitally important.” The charges would be limited to $1.50 per month for customers, but utilities could collect those fees for years to come. Currently, the state's four largest gas companies charge less than the $1.50 monthly cap, according to Ohio's Legislative Budget Office.How much could that cost Ohio's 3.7 million gas customers? It's hard to say without knowing what projects will be built in the future.Sen. Niraj Antani, R-Miamisburg, called the expanded fees a "massive tax increase on consumers." Ohio's Legislative Budget Office estimated the new charges "are likely to be minimal."The Ohio Consumers’ Counsel and Ohio Manufacturers' Association oppose the new charges, saying they will hurt customers and the state's economy. "As Ohioans have less money to spend on other goods and services (such as going to a restaurant, buying clothing, etc.), Ohio’s economy will suffer, not prosper. And consumers will suffer," Ohio Consumers’ Counsel Maureen Willis wrote in a letter to lawmakers. DeWine previously vetoed a proposal that would have allowed electric companies to charge for planning, developing and building utility infrastructure for big projects. That money would have come from the All Ohio Future Fund, money earmarked for megaprojects, rather than customers' bills. At the time, DeWine said the change would put too much power in utilities' hands. Now, DeWine says access to utilities is important as the state attracts companies to sites. “If you look to the future, this is one of the ingredients that we have to have for us to grow," DeWine said. Lt. Gov. Jon Husted also emphasized the importance of having sites ready to go. "We lose deals when utilities are not in place because we can’t act fast enough to get them there,” he said.

Court Orders Ohio Drillers to Produce Documents in Royalty Dispute -Marcellus Drilling News - Back in the summer of 2020, MDN told you about a lawsuit brought by an Ohio rights owner called TERA, an organization that appears to own the royalty rights for a number of leases with wells in Belmont County, OH, drilled by different producers, suing the producers for drilling into the Point Pleasant shale layer when the lease only mentions the Utica layer (see OH Landowners Sue Rice, Ascent, XTO, Gulfport for Drilling Too Deep). That lawsuit continues to grind on. Last week, a judge ruled the drillers being sued must produce certain documents sought by the plaintiff (rights owner).

PTT Working on Plan to Build Petchem Plant…in Thailand, Not Ohio -- Marcellus Drilling News -- This is your friendly (somewhat snarky) semi-annual reminder from MDN that the PTT ethane cracker project in Ohio is dead (see Facing Reality – PTT Ohio Cracker Plant Project is Dead). We periodically look for signs of life in the project, and it has been a flat line for YEARS. Nothing. Local and state leaders in Ohio sometimes pop their heads up to tell us to have hope; it will still happen. BUNKUM. Earlier today, PTT Global Chemical Public Company, the parent that would build an ethane cracker in Belmont County, OH, announced a deal with Mitsubishi Heavy Industries “to explore the utilization of hydrogen, ammonia and CCS technology to develop a large-scale petrochemical plant to achieve Net Zero.” However, the location of the plant will be in Thailand, PTT’s home country, and NOT in Ohio. We’ve pointed out for years that PTT has all sorts of money to work on big, multi-billion-dollar petrochemical plant projects elsewhere, but apparently there is not enough money for the Belmont ethane cracker. Why?

Western Pa. natural gas co. begins self-reporting air quality data as part of Shapiro partnership - A western Pennsylvania natural gas company is now publishing real-time air quality data at two of its well sites as part of a collaboration between the company and Gov. Josh Shapiro’s administration. On Monday, CNX Resources Corp., a Pittsburgh-based natural gas company with shale operations across Pennsylvania, Ohio and West Virginia, began publishing air quality data from two well sites — one in Washington County and the other in Greene County. The Shapiro administration is celebrating the move as a “historic collaboration,” noting in a statement on Monday that the public-private partnership will “help to provide fact-based, comprehensive health information for Pennsylvanians” by allowing communities near well sites to access air quality data in real-time. “My Administration is setting a new standard for Pennsylvania natural gas to be produced in a responsible, sustainable way and showing how we can bring people together to get things done,” Shapiro said. “We’re going to follow through on our commitment to reduce pollution and ensure the health and safety of our communities while maintaining Pennsylvania’s proud energy legacy and our Commonwealth’s critical role in the nation’s energy economy.”The online data, which also disclosed all the chemicals and additives used in hydraulic fracturing and drilling at those sites, is currently only available for the two sites, but the administration said the company plans to expand the program to well sites across the Commonwealth. The administration and CNX did not provide a timeline for when the expansion would be completed. However, not everyone is celebrating the news. Environmental advocates have previously expressed concern over allowing a company to essentially self-report. Advocates are equally concerned that the voluntary move lacks any real enforcement from state entities, such as the Pennsylvania Department of Environmental Protection (DEP). In Monday’s announcement, the administration reports that it has directed the DEP to “take immediate action to pursue formal rulemakings and policy changes mirroring the collaboration, including:

- New requirements for the disclosure of chemicals used in drilling,

- Improved control of methane emissions aligned with the EPA’s recently announced performance standards for emission sources in the oil and natural gas sector,

- Stronger drilling waste protections, including inspection of secondary containment,

- And corrosion protections for gathering lines that transport natural gas.

Earlier this year, the University of Pittsburgh published research that showed links between the proximity of gas industry operations and the occurrence of certain health problems in residents living near fracking operations, including cancers and worsening cases of asthma. In 1971, Pennsylvania became the first state to enshrine the right of its residents “to clean air, pure water, and to the preservation of the natural, scenic, historic and esthetic values of the environment” into the state constitution, a mantra that has been at oddswith the oil and natural gas industries in the five decades since.

Gas company in Pennsylvania begins posting real-time air quality data - CNX Resources Corporation, a leading natural gas producer in Canonsburg, Pennsylvania, began posting real-time emissions facts and data on its new website, Pennsylvania Gov. Josh Shapiro announced Monday.The new website is part of a joint commitment made by CNX and Shapiro’s administration in November to provide greater transparency to the public. Officials said the website aims to provide a comprehensive health response regarding natural gas development in Pennsylvania by publicly disclosing all chemicals the company plans to use in drilling and hydraulic fracturing before it starts breaking ground on future gas wells.“My Administration is setting a new standard for Pennsylvania natural gas to be produced in a responsible, sustainable way,” Shapiro said in a press release. “We’re going to follow through on our commitment to reduce pollution and ensure the health and safety of our communities, while maintaining Pennsylvania’s proud energy legacy and our Commonwealth’s critical role in the nation’s energy economy.”The Pennsylvania Department of Environmental Protection is set to conduct an independent study of two future natural gas wells at sites proposed by CNX. The department plans to measure emissions and provide information on the chemicals being used and resulting air emissions at both locations before, during and after project development.In the official commitment, Shapiro directs the environmental agency to pursue policy changes, such as new requirements for the disclosure of chemicals used in drilling and improved control of methane emissions aligned with the EPA’s performance standards. The governor also urged for stronger drilling waste protections, including inspection of secondary containment and corrosion protections for gathering lines that transport natural gas.CNX’s website dedicated to public disclosure comes three years after the 43rd Statewide Investigating Grand Jury in 2020, when Shapiro was serving as state attorney general. It found that the state government failed to protect residents during a 10-year period of increased fracking throughout Pennsylvania. The grand jury’s report included recommendations to hold the natural gas industry accountable and prioritize public health and safety, including greater public health and safety disclosures. CNX said its transparency and real-time data collection will begin with a well pad in Washington County called NV110, but the company plans to expand the monitoring program to its operations across Pennsylvania.

Pennsylvania environmental groups hold press conferences on fracking— A group of 10 environmental groups in Pennsylvania held two news conferences on Monday.They were held to ask Governor Shapiro to take action on fracking, which is the process of extracting natural gas. The groups point to health threats they say the process poses to people and the environment.They spoke on the steps of the State Capitol and at the Department of Environmental Protection in Pittsburgh. “It really protects communities and people in Pennsylvania to push it further back away from people. You know with something that’s bad you need to get away from it. The further you’re away from it the better you are,” Lois Bower-Bjonson said.They spoke against fracking operations close to homes and schools, which they said exposes people to unsafe levels of pollution.

SRBC Approves Water Withdrawals for 7 PA Shale-Related Projects - Marcellus Drilling News - The highly functional and responsible Susquehanna River Basin Commission (SRBC), unlike its completely dysfunctional and irresponsible cousin, the Delaware River Basin Commission (DRBC), continues to support the shale energy industry by approving water withdrawals for responsible and safe shale drilling. Last Thursday, the SRBC approved 19 new water withdrawal requests within the basin, six of them for water used in drilling and fracking shale wells in Pennsylvania (and one for a gas-fired power plant). The Marcellus/Utica shale drillers receiving a green light from SRBC included EQT, Pennsylvania General Energy, Repsol (two requests), and Seneca Resources (two requests).

PA Shale Water/Wastewater Company Expands to Texas Permian | Marcellus Drilling News -- It’s been a few years since we reported on Keystone Clearwater Solutions, a company that provides water services (clean water for fracking and wastewater hauling) for shale drillers in the Marcellus/Utica. At last check, in 2021, the company purchased the operations of competitor ECM Energy Services, based in PA, further expanding Keystone’s operations in the Keystone State (see Keystone Clearwater Buys ECM Energy’s PA Water Transport Biz). We’re happy to report Keystone is expanding to the Texas Permian oil play.

35 New Shale Well Permits Issued for PA-OH-WV Dec 11-17 | Marcellus Drilling News - New shale permits issued for Dec 11 – 17 in the Marcellus/Utica continued the trend up over the previous week. There were 35 new permits issued last week versus 27 issued two weeks ago. Last week’s permit tally included 17 new permits in Pennsylvania, 13 new permits in Ohio, and 5 new permits in West Virginia. The company receiving the most permits last week was Ascent Resources with 8 new permits in two different counties: Guernsey and Belmont counties in OH. Antero was second highest with 5 new permits in Ritchie and Doddridge counties in WV. ANTERO RESOURCES | APEX ENERGY | ARMSTRONG COUNTY | ASCENT RESOURCES | BELMONT COUNTY | CENTRE COUNTY | DODDRIDGE COUNTY | EQT CORP | GREENE COUNTY (PA) | GUERNSEY COUNTY | GULFPORT ENERGY | MONROE COUNTY | RANGE RESOURCES CORP | RITCHIE COUNTY | SENECA RESOURCES | SNYDER BROTHERS | SOUTHWESTERN ENERGY |SUSQUEHANNA COUNTY | TIOGA COUNTY (PA) | WASHINGTON COUNTY | | WESTMORELAND COUNTY |XPR RESOURCES

EIA Dec DPR: Another Big Production Drop Coming in M-U, Haynesville -Marcellus Drilling News - The latest monthly U.S. Energy Information Administration (EIA) Drilling Productivity Report (DPR) for December, issued Monday (below), shows EIA believes shale gas production across the seven major plays tracked in the monthly DPR for January will *decrease* production from the prior month of December. This is the sixth month in a row that EIA has predicted shale gas production will decrease for the combined seven plays. EIA says combined natgas production will slide by 200 MMcf/d (million cubic feet per day). The Marcellus/Utica, called “Appalachia” in the report, is predicted to decrease by 135 MMcf/d in January compared with December, the biggest decrease in gas production for any of the seven plays.

FERC Grants MVP Request to Double Transportation Rates The 303-mile Mountain Valley Pipeline (MVP) project will be completed and go online sometime in the first quarter of 2024 (see Equitrans Admits the Obvious – MVP Won’t be Online Until 2024). In September of this year, MVP filed a request with the Federal Energy Regulatory Commission (FERC) to amend its original certificate (that established the rates it could charge) to increase the rates it charges for new customers (not existing/already contracted customers). Earlier this week, FERC granted MVP’s request to raise rates. When Equitrans began to build MVP, the company estimated it would cost around $3.7 billion to build. Then Big Green got involved and attempted to bury the project under a blizzard of lawsuits (some financed with foreign money). Groups like the odious Appalachian Voices repeatedly sued and delayed the completion ofMVP. It took an actual Act of Congress to force finish the pipeline, the FiscalResponsibility Act (FRA) signed on June 3rd by President Biden. The new estimated cost to build, following years of delays and multiple lawsuits(paying lawyers’ confiscatory rates), is now $7.2 billion — essentially double the original cost. The original rate MVP was authorized to charge was $29.5967 per dekatherm (Dth) per month to reserve capacity and $0.0035 per Dth used. In September, MVP requested the rate be raised to $53.4208 per Dth per month to reserve capacity and $0.0231 per Dth used. It makes sense MVP would ask for a doubling of the rate given it cost twice as much to build.

FERC Approves MVP Southgate Request for 3-Yr Extension to Build - In July of this year, the Democrat Governor of North Carolina, Roy Cooper, sent a letter to the Federal Energy Regulatory Commission (FERC) asking the four commissioners to deny Mountain Valley Pipeline’s (MVP) request for a time extension to build the MVP Southgate expansion project into his state (see NC Leftist Gov. Cooper Asks FERC to Deny MVP Southgate More Time). A month later, 28 Democrats in the U.S. House did the same thing (see 28 U.S. House Democrats Ask FERC to Reject MVP Southgate Project). We’re happy to report FERC ignored them all and yesterday granted the Southgate project a three-year extension to build. Equitrans Midstream, the builder of MVP, proposed to extend the 303-mile pipeline by an extra 75 miles from the current MVP terminus in Pittsylvania County, VA, to Alamance County, NC, to provide natural gas for heating and electric generation, calling it Southgate. It appeared that Equitrans had given up on the Southgate project in October 2022 when it asked a court to cancel all outstanding eminent domain lawsuits against some 70 North Carolina residents who had refused to lease their land for the pipeline (see Equitrans Signals Giving Up on MVP Southgate – Pulls Eminent Domain). However, the company asked the court to dismiss the lawsuits “without prejudice,” meaning it could revive and refile its claims later. Then the earth literally moved. Congress passed the Fiscal Responsibility Act (FRA), and on June 3, President Biden signed it into law. The FRA provides for completing the 303-mile MVP. Not long after the FRA became law, Equitrans reactivated the Southgate project and asked FERC for three more years to build it (see Equitrans Asks FERC for Extra 3 Years to Build MVP Southgate to NC). Yesterday, FERC did just that. Perhaps the biggest surprise is that FERC Commissioner Allison Clements, a Big Green sock puppet, voted in favor of the time extension.

Chicago’s Natural Gas Pipeline Project Halted | PBS (video) The Illinois Commerce Commission’s decision to suspend a gas pipe replacement program comes as environmentalists and consumer advocates are calling for the government to invest in and transition to cleaner, renewable energy, instead of fueling money into aging energy infrastructure projects. Transcript

We Must Have More Natural Gas Pipelines To Avoid Freezing - With the dead of winter approaching, it is appropriate to reflect on last year’s gas well freeze offs Winter Storm Elliott, which occurred over Christmas and caused millions of people to lose power across the eastern United States. It followed Winter Storm Uri, which happened in Texas a year earlier. Natural gas, 40% of this country’s energy portfolio, is the primary fuel for winter heating. Some of the most progressive states, like California, with the largest renewable energy portfolios, rely on natural gas. The winter storms have taught us that waiting several years for new infrastructure to develop jeopardizes energy reliability and economic security. According to the Interstate Natural Gas Association of America, the current political environment makes delivering fuel to natural gas customers taxing. "The United States needs more natural gas pipeline capacity to maintain a resilient system that affords homes and the power grid access to multiple sources of this critical fuel," the trade group said in a prepared statement. The United States Energy Association tackled this subject during its monthly virtual press briefing in which I took part. The experts responsible for delivering dependable heat and electricity to customers agreed that more infrastructure is required. The natural gas trade group said the country must have 24,000 miles of new gas pipelines by 2035, but we are planning for much less. To that end, the North American Electric Reliability Corp. cautioned that half of this country and parts of Canada could go cold this winter because of inadequate natural gas pipeline infrastructure. Indeed, NERC and the Federal Energy Regulatory Commission issued a joint statement about the potential loss of the Everett Marine Terminal in New England and its consequences for the reliability and affordability of the region’s energy supplies. “Winter Storm Elliot caused blackouts in nine states,” said Jim Matheson,” the National Rural Electric Cooperative Association chief executive during the press briefing. “We do need more pipeline capacity. In this country, specific regions are constricted, and it’s difficult to build new pipelines in this day and age.” How Will Policymakers Respond? With that, the National Economic Research Associates issued a report concluding that this country has sufficient natural gas resources to feed the domestic population and export to fuel-hungry Europe and Asia. Prices would also remain “relatively low” — $3 to $4 per million Btus. However, the researchers added that a lack of new pipeline capacity presents a “material impediment” for the industry to maintain reliability and inexpensive fuel. The report points to the Northeast, which has quick access to the Marcellus and Utica Shale Basins but has limited pipeline capacity. Several pipeline operators have canceled their projects because of regulatory and permitting hurdles. According to the U.S. Energy Information Administration, 3 million miles of existing natural gas pipelines exist in the United States, delivering 27.6 trillion cubic feet of natural gas to about 77.7 million consumers. Gas producers say that as many as 62,000 miles of new pipelines are needed by 2050 to fuel electric generators and feed the chemical and manufacturing processes. “My natural gas plants are paperweights if I don’t have the fuel to run to them,” said Rudy Garza, chief executive of CPS Energy in San Antonio, Texas, during the event. “From a policy perspective, gas suppliers must be held to account the same as electric and gas utilities are. Utilities have the same predicament,” he added, noting that they already optimize natural gas storage units and diversify suppliers. Extreme weather has become the "new normal," and this winter, the Mid-Atlantic, New England, or the Midwest could suffer. Texas teaches us that it is unwise to rely on one energy source. When Texas froze in February 2021, its infrastructure failed — specifically, the natural gas supplies and the pipelines to transport it. The state also learned that it must winterize its wind turbines. As for Texas, about 52% of its electricity comes from natural gas while 23% comes from renewables, the U.S. Energy Department says. Coal supplies 17%, and nuclear makes up 8%. The state is also uncommon because its grid system is insulated, making it unable to get new supplies from other areas of the country. Pablo Vegas, chief executive of the Electric Reliability Council of Texas (ERCOT), said Texas’ challenge is to gear up for economic growth. Transmission system operators, like ERCOT, want to work with utilities to deploy demand response — automatically controlling thermostats and asking residential and small business users to shift their energy usage. Industrial customers use demand response. “We are focused on weatherization and inspecting our power plants and transmission lines,” says Vegas. “And we make sure we have firm fuel supply — part of a structured program that ERCOT does for the summer and winter.” Getting energy infrastructure built in the United States is an exhausting task. Lawsuits abound, which for the environmental movement is often intended to preserve ecological integrity. Judges are walking a delicate line, complicated by concerns over leaking methane and the effects of climate change. Courts do not make sweeping decisions that apply to every project. If anything, though, they are trying to facilitate productivity and growth while protecting the air, land, and water — issues that are not mutually exclusive. Winter storms can wreak havoc, with Uri and Elliott providing the proof. The Federal Reserve Bank of Dallas said Uri — a four-day event that left 4.5 million without heat — cost the Texas economy as much as $130 billion. The question before policymakers is how to defend against those events. The answer invariably requires a mixed response given the surge in demand: building more pipelines while diversifying fuel sources. That’s a lofty goal: Expanding any kind of energy infrastructure requires regulatory support and legal backing, adding years to the process.

US weekly LNG exports reach 28 cargoes - US liquefaction plants shipped 28 liquefied natural gas (LNG) cargoes in the week ending December 13, while natural gas deliveries to these terminals increased by 3.9 percent compared to the week before.The US EIA said in its weekly report, citing shipping data provided by Bloomberg Finance, that the total capacity of these 28 vessels is 105 Bcf.During the week from November 30 to December 6, 29 vessels with a capacity of 105 Bcf departed the US plants. Average natural gas deliveries to US LNG export terminals during December 7-13 rose by 0.5 Bcf/d week over week, averaging 14.6 Bcf/d, according to data from S&P Global Commodity Insights. Natural gas deliveries to terminals in South Louisiana increased by 7.5 percent (0.6 Bcf/d) to 9.2 Bcf/d, while natural gas deliveries to terminals in South Texas decreased by 2.4 percent (0.1 Bcf/d) to 4.2 Bcf/d. The agency said that natural gas deliveries to terminals outside the Gulf Coast were essentially unchanged at 1.2 Bcf/d. Cheniere’s Sabine Pass plant shipped nine cargoes and the company’s Corpus Christi facility sent four shipments during the period under review. The Freeport LNG terminal, Sempra Infrastructure’s Cameron LNG terminal, and Venture Global’s Calcasieu Pass each shipped four cargoes during the week under review. Also, the Cove Point LNG terminal shipped two cargoes and the Elba Island LNG facility sent one cargo.This report week, the Henry Hub spot price decreased 40 cents from $2.73 per million British thermal units (MMBtu) last Wednesday to $2.33/MMBtu this Wednesday, the agency said.Moreover, the price of the January 2024 NYMEX contract decreased 23.4 cents, from $2.569/MMBtu last Wednesday to $2.335/MMBtu this Wednesday.According to the agency, the price of the 12-month strip averaging January 2024 through December 2024 futures contracts declined 18.3 cents to $2.563/MMBtu.The agency said that international natural gas futures decreased this report week.Bloomberg Finance reported that weekly average front-month futures prices for LNG cargoes in East Asia decreased 33 cents to a weekly average of $15.77/MMBtu.Natural gas futures for delivery at the Dutch TTF decreased $1.18 to a weekly average of $11.73/MMBtu.In the same week last year (week ending December 14, 2022), the prices were $33.46/MMBtu in East Asia and $42.46/MMBtu at TTF, the EIA said.

Despite Export Strength, South Central Natural Gas Storage Enters Winter at Robust Levels, Pressuring Prices - Demand for American LNG is holding strong, but South Central natural gas storage remains elevated and, according to the latest government inventory data, the surplus of supplies relative to the five-year average continues to swell. The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 16 Bcf from South Central storage during the week ended Dec. 15. This included an 11 Bcf pull from nonsalt facilities and 5 Bcf draw from salt caverns. Still, it proved seasonally modest and left underground supplies in the region 8% ahead of the five-year average. A week earlier, EIA printed a nonsalt draw of 11 Bcf but a salt injection of 2 Bcf, putting supplies 7% above the South Central five-year average at the time. Analysts point to record levels of production...

Conservation Groups Take Aim at Driftwood LNG Pipeline Projects in Latest DC Circuit Arguments - Environmental groups are continuing to pressure LNG export facility and pipeline developers through federal appeals courts as lawsuits seeking to repeal authorizations stack up. In the latest of a series of filings to the U.S. Court of Appeals for the District of Columbia Circuit, Healthy Gulf and the Sierra Club requested FERC’s approval of two pipelines to feed the Driftwood liquefied natural gas project in Louisiana be vacated (No. 23-01226). In the brief filed Tuesday, lawyers for the groups accused the Federal Energy Regulatory Commission of violating federal law by refusing to consider the impact or amount of greenhouse gas emissions from construction of Tellurian Inc.’s Driftwood Line 200 and Line 300 pipeline projects.

Europe continues to be main destination for US LNG cargoes - LNG Prime -- France was the top destination for US liquefied natural gas (LNG) supplies in October as Europe continues to receive the majority of volumes produced at US liquefaction plants, according to the Department of Energy’s newest monthly report.The DOE report shows that US terminals shipped 53.6 Bcf of LNG to France in October, 49.8 Bcf to Spain, 49.7 Bcf to the Netherlands, 28.8 Bcf to the United Kingdom, and 28.2 Bcf to South Korea.These five countries took 54.7 percent of total US LNG exports in October.Prior to this, the Netherlands was the top destination for US LNG supplies for five months in a row.The Netherlands was the number one destination for US LNG supplies during January-October this year and the country is followed by France, the UK, Japan, Spain, South Korea, Germany, Italy, India, and China, the DOE data shows. The US exported in total 384.4 Bcf of LNG in October to 28 countries, up by 24.1 percent compared to the same month last year and a rise of 10.9 percent from the prior month, the DOE report shows.Europe received 259.7 Bcf, or 67.6 percent, of these volumes, Asia received 101.8 Bcf, or 26.5 percent, and Latin America/Caribbean received 22.9 Bcf, or 6 percent.US terminals shipped 124 LNG cargoes in October.Cheniere’s Sabine Pass plant sent 39 cargoes and its Corpus Christi terminal shipped 19 cargoes, while the Freeport LNG terminal shipped 22 cargoes and Sempra’s Cameron LNG plant sent 21 shipments during October.In addition, Venture Global’s Calcasieu plant sent 15 cargoes, Elba Island LNG sent 4 cargoes, and Cove Point LNG dispatched 4 shipments. According to DOE’s report, the average price by export terminal reached 6.81/MMBtu in October and 7.36/MMBtu in the January-October period.Moreover, the report said that in the period from February 2016 through October 2023, the US exported 5384 cargoes or 17,128 Bcf to 41 countries.The DOE data shows that South Korea remains the top destination for US LNG with 561 cargoes, followed by Japan with 438 cargoes, France with 419 cargoes, the UK with 408 cargoes, and Spain with 412 cargoes.Besides these five countries, the Netherlands, China, India, Turkey, and Brazil are in the top ten as well.

Democrats revolt against Biden plan for expanded gas exports - The Biden administration’s plans for increased natural gas exports are causing a revolt within the Democratic Party. Despite the boom in renewables reducing domestic demand for fossil fuels, the administration is backing the gas industry’s plans to sell fuel at higher prices abroad, believing they will lead to less production of climate-warming chemicals like carbon dioxide by displacing dirtier-burning coal. The fossil fuel industry is making a broader transition to gas, which it is seeking to pitch as a climate-friendly fuel — and the Biden administration has so far allowed it to more than double the number of export facilities to ship gas abroad in its pressurized and liquified form (LNG). But gas is itself a planet-heating chemical, and Democrats argue that the administration’s policies have done little to address a big problem for the climate: The U.S. fossil fuel industry plans to increase oil and gas production for decades. Democratic senators, led by Ed Markey (Mass.), have called on the administration to stop investing in gas plants abroad, noting that the administration has already spent $1.8 billion on overseas fossil fuel plants this year alone, along with voting at the World Bank to direct $400 million in new gas financing to poorer countries. “The United States can’t preach temperance from a bar stool, and right now, America is drunk on oil and gas production and exports,” Markey wrote Wednesday. In addition, 32 Democratic members of Congress urged the administration in November to begin planning for the end of fossil fuels. At the United Nations climate conference (COP28) that concluded this week, the administration unveiled a new plan to cut leaks from methane production, the predominant component in gas, in an effort to reduce one of the most serious sources of harmful pollution. But in focusing only on leaks from transporting the fuel — something the industry already has incentives to do — the Biden administration is “ducking the hard issue” on climate change, Rep. Sean Casten (D-Ill.) told The Hill. That issue: the production of planet-warming fuels themselves.

Howard Energy Touts South Texas Natural Gas Expansions, Record Throughput as LNG Demand Taking Off - Howard Energy Partners (HEP) completed about $800 million worth of growth projects and achieved record natural gas throughput on its assets during 2023, the company said Wednesday. San Antonio, TX-based HEP owns energy infrastructure assets in Texas, New Mexico, Oklahoma, Pennsylvania and Mexico. The newly completed projects include “new major pipelines and processing facilities in the most active oil and gas producing basins in the United States and new storage and logistics facilities for renewable diesel on the Texas Gulf Coast,” management said. “The company also achieved record volumes in 2023, with current average natural gas throughput of over 2.5 Bcf/d and current average terminalling throughput of more than 160,000 b/d, representing a 7% and 25% increase...

Japan's Tokyo Gas to buy US gas producer for $2.7 billion - LNG Prime -- A unit of Japan’s city gas supplier and LNG importer, Tokyo Gas, has agreed to buy Texas-based natural gas producer Rockcliff Energy from private equity firm Quantum Energy Partners for $2.7 billion.Tokyo Gas America decided to acquire all shares of Rockcliff Energy II through its ownership interest in TG Natural Resources (TGNR), according to a statement by Tokyo Gas.TGNR is a unit of Tokyo Gas America in which the firm has a 79 percent stake while a unit of Castleton Commodities International holds the rest.Tokyo Gas has been expanding its upstream business in the US through TGNR, which became its subsidiary in 2020. Rockcliff’s main business is upstream development in Texas and Louisiana targeting Haynesville shale and Cotton Valley formations. Tokyo Gas said it is expanding its shale gas business as demand for gas is expected to increase in the US due to the construction of new LNG export terminals. Also, TGNR has been seeking to acquire “superior” assets around its existing assets in Texas and Louisiana.“With this acquisition, the outcome from TGNR will become the base of overseas earnings,” Tokyo Gas said. As a result of this acquisition, the production volume of gas and natural gas liquids held by TGNR will increase by about 4 times from some 330 million cubic feet per day (9.3 million m3/day, gas equivalent) to 1,300 million cubic feet per day (37 million m3/day, gas equivalent), it said. In the US, Tokyo Gas is working with its partners Osaka Gas, Toho Gas, Mitsubishi, and also Sempra Infrastructure to produce e-methane in Texas or Louisiana, liquefy it at Sempra’s Cameron LNG facility, and transport it to Japan. E-methane is a synthetic gas produced from renewable hydrogen and carbon dioxide and can be transported via the existing gas infrastructure, including the LNG supply chain.

US natgas jumps 5% on cold forecasts, bigger-than expected storage decrease - (Reuters) - U.S. natural gas futures jumped about 5% to a one-week high on Thursday on a bigger-than-expected storage withdrawal, forecasts for colder weather and higher heating demand in early January than previously expected and as a record amount of gas continued to flow to liquefied natural gas (LNG) export plants. The U.S. Energy Information Administration (EIA) said utilities pulled 87 billion cubic feet (bcf) of gas from storage during the week ended Dec. 15. That was higher than the 80-bcf withdrawal analysts forecast in a Reuters poll and compares with a decrease of 82 bcf in the same week last year and a five-year (2018-2022) average decline of 107 bcf. Last week's decrease cut stockpiles to 3.577 trillion cubic feet (tcf), which was still 8.5% above the five-year average of 3.297 tcf for the time of year. Analysts said last week's withdrawal was smaller than usual for this time of year because warmer-than-normal weather kept heating demand low. Front-month gas futures for January delivery on the New York Mercantile Exchange rose 12.5 cents, or 5.1%, to settle at $2.572 per million British thermal units (mmBtu), their highest close since Dec. 8. It was the biggest one-day percentage gain since Nov. 11 when prices jumped 5.4%. "If incoming cold prompts speculators to close a massive short position, price gains are possible. Nonetheless, significant U.S. storage surpluses suggest any price increase may prove fleeting unless cold weather can be sustained," analysts at energy consulting firm EBW Analytics said in a note. With the front-month down for six weeks in a row, speculators last week boosted their net short futures and options positions on the New York Mercantile and Intercontinental Exchanges to the most since February, according to the U.S. Commodity Futures Trading Commission's Commitments of Traders report. Record production and ample supplies of gas in storage have weighed on gas prices for weeks, prompting some traders to forecast that futures for this winter (November-March) have already peaked at $3.608 per mmBtu on Nov. 1. Looking ahead, analysts project U.S. gas prices will rise in coming years as new LNG export plants enter service in the U.S., Canada and Mexico to meet rising global demand of the fuel. But expected delays at Exxon Mobil/QatarEnergy's Golden Pass LNG export plant in Texas and Venture Global LNG's Plaquemines in Louisiana have caused some analysts to reduce their forecasts for U.S. gas demand and prices in 2024. Financial firm LSEG said average gas output in the lower 48 U.S. states rose to 108.6 billion cubic feet per day (bcfd) so far in December from a record 108.3 bcfd in November. Meteorologists projected the weather would remain warmer than normal through Dec. 31 before turning near-normal to colder than normal from Jan. 1-5. LSEG forecast U.S. gas demand in the Lower 48 states, including exports, would drop from 126.2 bcfd this week to 120.8 bcfd next week as many businesses and government offices shut for the Christmas holiday. Those forecasts were higher than LSEG's outlook on Wednesday. Gas flows to the seven big U.S. LNG export plants rose to an average of 14.6 bcfd so far in December, up from a record 14.3 bcfd in November.

Biden Govt Sets Only Three Fossil Fuel Leases for 2024-29 - The Biden administration has cut the number of lease sales in the United States outer continental shelf (OCS) from the previously proposed 47 to just three in the final oil and gas leasing program for 2024–29. The Department of the Interior (DOI) said the reduction is needed to meet offshore wind area sales required by the Inflation Reduction Act (IRA). An IRA provision prioritizing fossil fuels requires that total acres offered in offshore oil and gas lease sales in the year till the issuance of any lease for offshore wind development must reach 60 million acres. The final program still needs to be reviewed by Congress within 60 days. A five-year oil and gas auction plan is required by Section 18 of the OCS Lands Act. “The [final] Program schedules three oil and gas lease sales in the Gulf of Mexico Program Area in 2025, 2027 and 2029”, the DOI said in a recent press release. “These three lease sales are the minimum number that will enable the Interior Department’s offshore wind energy program to continue issuing leases in a way that will ensure continued progress towards the Administration’s goal of 30 gigawatts of offshore wind by 2030”. The official memorandum on the decision noted the department had the option to hold no lease sale at all in the next five years but that such a course would not meet the country’s energy needs. The DOI did decide to hold no auction next year for offshore oil and gas licenses, the first no-lease year since 1966 according to the American Petroleum Institute (API), which opposed the decision. The decision “could threaten to increase reliance on foreign energy sources”, the lobby group said in a statement. “Demand for affordable, reliable energy is only growing, yet the administration is choosing to limit future production in a region that plays a critical role in powering our nation and supplies among the lowest carbon-intensive barrels in the world”, said the statement on the API website. Production on the US Gulf of Mexico alone accounts for 15 percent of national petroleum output and five percent of US dry gas production, according to the country’s Energy Information Administration (EIA). “Over 47 percent of total U.S. petroleum refining capacity is located along the Gulf coast, as well as 51 percent of total U.S. natural gas processing plant capacity”, the EIA states on its website. The API went on to cite an industry report that claimed the carbon intensity of oil production in the Gulf of Mexico was 46 percent lower than the international average outside the US and Canada. The report, released May 16, was prepared by the ICF consulting company for the National Ocean Industries Association. “Constrained production in this basin could be replaced by higher carbon intensity barrels from elsewhere in the world”, said the statement by the API, which counts a membership of about 600 companies. “This program is a step in the wrong direction for U.S. energy security and will only make it harder to meet growing energy demand over the long-term”, the API added.

Biden admin approves smallest offshore oil program in history - The Biden administration approved the smallest offshore oil program in U.S. history Friday, a move that’s already provoked both outrage from Republicans and disappointment from climate activists who had urged the president to take more dramatic action. Over the next five years, the Interior Department will hold just three oil auctions of drilling rights in the Gulf of Mexico, where most of the nation’s oil and gas production occurs. The agency first announced its plans for the next five years of offshore drilling in September. That makes the previously scheduled oil sale, taking place next week in the Gulf, the last opportunity for oil companies to buy leases in the nation’s waters until 2025. The shrunken program is the latest example of the White House’s efforts to curtail the nation’s fossil fuels footprint on public lands and waters, despite mandates to allow some development of the nation’s large stores of crude oil and natural gas. Climate activists had urged President Joe Biden to zero out oil sales in the five-year plan, consistent with his promise during the presidential campaign of 2020 to retire the nation’s drilling program. Oil supporters, however, demanded a return to previous norms with multiple oil auctions held every year. Interior rewrites the schedule for offshore oil and gas leases every five years. Recent five-year programs have included at least two auctions annually in the Gulf of Mexico and some sales in Alaska. But Interior’s offshore oil programs historically could include dozens of sales. The Biden administration allowed the last offshore oil program to end in 2022 without a replacement. A previous proposal floated by the Trump administration would have included 47 auctions over a five-year period. Interior said Friday that its three-sale schedule is the minimum required to comply with the Inflation Reduction Act. West Virginia Sen. Joe Manchin, a conservative Democrat who supports fossil fuels, included a provision in the 2022 climate-focused law that would prohibit new offshore wind leasing — a cornerstone in Biden’s decarbonization push — unless Interior holds an offshore oil sale of at least 60 million acres in the prior year. The five-year program announced Friday includes an oil sale every other year, in 2025, 2027 and 2029, allowing Interior ample time to conduct new offshore wind auctions. “These three lease sales are the minimum number that will enable the Interior Department’s offshore wind energy program to continue issuing leases in a way that will ensure continued progress towards the Administration’s goal of 30 gigawatts of offshore wind by 2030,” the department said Friday.

Biden administration auctions off 1.7M acres for Gulf drilling in last offshore oil lease sale until 2025 --The Biden administration has auctioned off the rights to drill for oil and gas on 1.7 million acres in the Gulf of Mexico in what will be the last offshore drilling auction it holds until 2025. Companies will pay a total of more than $380 million for the rights to drill on 311 tracts in the Gulf. Twenty-six companies submitted bids. The auction is expected to be the last chance for companies to bid for the rights to drill offshore until at least 2025, as the Biden administration recently finalized a plan with the fewest offshore oil and gas lease sales ever put forward in an agency five-year plan.That plan, finalized last week and covering 2024-29, offers up three chances to bid for the rights to drill offshore.The oil and gas industry was supportive of Wednesday’s sale but said more auctions should be held in the years ahead.“Although today’s congressionally mandated lease sale is a positive step … the lack of any offshore sales in the year ahead is a prime example of the administration’s failure to implement a long-term energy strategy,” said a written statement from Holly Hopkins, vice president of upstream policy at the American Petroleum Institute, an oil lobby group.“We urge the administration to reconsider its shortsighted approach and plan today for tomorrow’s energy demand,” Hopkins added. The recent sale was mandated by the Inflation Reduction Act — Democrats’ climate, tax and health care bill. However, it follows a contentious recent court battle in which environmental advocates sought to shrink the sale and add stipulations to protect the Rice’s Whale.The Rice’s Whale is one of the most endangered whales in the world, with likely fewer than 100 remaining, and can be found in the Gulf.After environmentalists and the Biden administration agreed to certain restrictions for the sale and leases that aimed to protect the whale, Chevron, the American Petroleum Institute and the state of Louisiana filed a lawsuit..Ultimately, the plaintiffs prevailed, and the sale was held without the removal of acres or the restriction of ship activity, which environmentalists had called for.“The oil industry and its allies know the Rice’s whale could go extinct if they keep expanding Gulf drilling, but they’ve pushed aggressively to prioritize their profits and hold this sale anyway,” Kristen Monsell, oceans legal director at the Center for Biological Diversity, said in a written statement. “Perpetual leasing, new fossil fuel export projects and oil spills are creating a hellish situation for marine life and Gulf communities,” she said, adding that the Biden administration should “phase out offshore drilling altogether.”

Gulf of Mexico Auction Draws Most High Bids in Years as E&Ps Step Up Competition - Interest in the final oil and natural gas auction in the Gulf of Mexico for the year – and potentially the only one until 2025 – was strong on Wednesday, with the highest bid total since 2015. Following a series of delays because of lawsuits, the Interior Department’s Bureau of Ocean Energy Management (BOEM) held Lease Sale 261. The auction offered almost 13,500 unleased blocks on nearly 73 million acres in the Western, Central and Eastern Planning Areas of the Outer Continental Shelf (OCS). Twenty-six exploration and production (E&P) companies submitted 352 bids totaling $442 million. High bids totaled more than $382 million for 311 tracts, with offered blocks drawing an average 1.13 bids each.

Dallas Fed Energy Survey - -- Activity in the oil and gas sector was essentially unchanged in fourth quarter 2023, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index, the survey’s broadest measure of conditions energy firms in the Eleventh District face, remained positive but slipped from 10.9 in the third quarter to 3.6 in the fourth quarter. The business activity index was 7.5 for E&P firms versus -4.2 for services firms, suggesting activity slightly grew for E&P firms, but declined slightly for service firms. Oil production increased but at a significantly slower pace compared with the prior quarter, according to executives at E&P firms. The oil production index remained positive but fell from 26.5 in the third quarter to 5.3 in the fourth. Meanwhile, the natural gas production index edged up from 15.4 to 17.9.Among oilfield services firms the input cost index remained positive, but slipped from 33.4 to 21.3. Among E&P firms, the finding and development costs index rose from 18.3 to 24.4. Meanwhile, the lease operating expenses index moved down from 25.6 to 22.6.Oilfield services firms reported modest deterioration in nearly all indicators. The equipment utilization index moved down from -4.2 in the third quarter to -8.4 in the fourth quarter. The operating margin index was relatively unchanged at -32.0. The index of prices received for services turned negative and fell from 2.1 to -6.2.The aggregate employment index was relatively unchanged at 4.2 in the fourth quarter. The aggregate employee hours index remained positive but fell from 9.6 in the third quarter to 2.8 in the fourth quarter. Meanwhile, the aggregate wages and benefits index edged down from 24.5 to 21.2.The company outlook index turned negative in the fourth quarter and plunged 48 points to -12.4, suggesting some pessimism among firms. The company outlook for E&P firms changed more drastically, as the company outlook index for these firms fell sharply from 46.8 to -9.0. The overall outlook uncertainty index jumped 39 points to 46.1, suggesting mounting uncertainty.On average, respondents expect a West Texas Intermediate (WTI) oil price of $78 per barrel at year-end 2024; responses ranged from $51 to $110 per barrel. Survey participants expect a Henry Hub natural gas price of $3.09 per million British thermal units (MMBtu) at year-end. For reference, WTI spot prices averaged $69.77 per barrel during the survey collection period, and Henry Hub spot prices averaged $2.48 per MMBtu.

As Shale Runs Dry, EOR Companies Respond with Solutions - The reservoir wells of the shale revolution, once gushing like geysers, are beginning to run dry.“Since [the shale revolution], there’s been about 100,000 horizontal shale wells drilled and put in production, [increasing] our production by about 6 million barrels a day,” Robert Downey, CEO of Shale Ingenuity, told Hart Energy. “But today, about a third of those wells are now producing less than 10 barrels a day because they come on like gangbusters and then they have a really steep decline. Pretty much all the wells drilled prior to 2015 are [almost] depleted.”According to a Texas Bureau of Economic Geology study, the estimated typical oil recovery is about 6% of the oil in place, or as Downey explains, “you drill this horizontal well, spend $7 million on it and produce for 10 years. And by the time the well is pretty much producing nothing, you’ve recovered a whopping 6% of the oil.”The Williston and Permian basins and the Eagle Ford Shale hold a combined 3.1 trillion barrels of oil. A 6% recovery at full development leaves 2.9 trillion barrels of oil in place, which is 77 times the proved reserves of the U.S. Getting that remaining 94% of oil is the challenge for oil and gas companies today.SuperEOR is Shale Ingenuity’s solution to the shale wells running dry. The SuperEOR process is similar to huff and puff injection, as it involves injecting a solvent into the reservoir, which expands into a gas and drives the oil out of the rock. However, the solvent has a specific composition, making this process more sustainable than other EOR methods. That’s because the solvent is able to be recovered from the rock and reused multiple times.“It’s much different than if you just injected natural gas or CO2 [into the well], because with natural gas or CO2, you have to get the bottom of pressure up to 3,000 [psi] or 4,000 psi to get those gases to go into solution. Our solvent goes into solution at 700 psi,” Downey said. “Once you inject it, it forces all this oil through the pores. It expands to a gas and it flows up the wellbore and you recover it on the surface, condense it back into a liquid state, store it on location and then reinject it.”When using SuperEOR for a core test, over 90% of the oil was able to be recovered out of the core, said Downey. The recovery process is also quick and efficient, as only five days to 10 days of solvent injection can lead to between 10 and 20 days of flowback.“If you were injecting gas, you’d be injecting for one month to two months and then flowing back for three or four months, but our cycles are fast and the recovery is much greater. So, instead of getting maybe 10% to 40% more oil, we can get 300% to 500% more oil,” Downey said.Another sustainable EOR solution is actually an OOR, or organic oil recovery solution.California-based Titan Oil Recovery uses a specialized EOR process that takes advantage of indigenous microbes that have adapted to the environment over millions of years in order to extract oil from mature reservoirs.Titan activates the biology and ecology of oil reservoirs by working with specific species of microbes that can physically deform oil, turning them into micro oil droplets. This allows the trapped oil in reservoirs to escape and be recovered. The technology has a low carbon footprint and can also reduce hydrogen sulfide production in oil fields.

Fed methane emissions rule could have big impact in ND - New federal regulations that will require the oil and gas industry to get more active in tamping down on climate-warming methane emissions could uniquely affect North Dakota. The federal Environmental Protection Agency this month released a long-anticipated list of regulations that aim to reduce 80% of methane pollution from U.S. oil and gas production. The sector is the country's second-largest contributor of methane emissions behind agriculture. The rule will prevent 58 million tons of methane emissions between next year and 2038. That is equivalent to the annual emissions of over 360 million gas-powered cars, according to an EPA calculator. Methane is the primary component of natural gas. Its warming impact is 28 times stronger than CO2 over the course of a century, according to EPA. The Bakken oilfields in western North Dakota are primarily home to oil wells where natural gas is a byproduct. When the associated gas from an oil well cannot be captured, or used on site due to a lack of infrastructure capacity, it is wastefully flared. One part of the regulations will eliminate routine flaring on new wells over the next two years. Many existing wells will also have to phase out flaring, though there will be some exceptions. The purpose of flaring is to convert gas to less-potent CO2, but methane still gets released at varying degrees depending on the strength of the flare. The practice also releases health-harming volatile organic compounds such as benzene into the air, according to EPA. North Dakota has seen large cuts in flaring over the past few years due to an increased buildout of gathering lines and processing facilities. Gas capture percentages statewide trended in the low 80s five years ago but have climbed to the middle 90s this year. The number hit 95% this September, according to the most recent report from regulators. Figures lag by two months. The state's gas capture goal of 91% has been in place since 2020. But officials have warned that flaring could climb again as producers move beyond the Bakken oil field's core area. Dakota Resource Council Executive Director Scott Skokos said the federal rule was "a long time coming." "This will make (producers) think infrastructure first, wells second," he said. But some worry the new regulations will curtail production in a state whose economy is heavily reliant on oil. Of North Dakota's 18,538 producing wells, 1,383 have no access to gas-gathering infrastructure, according to the Department of Mineral Resources, the agency that oversees the petroleum industry in the state. Mineral Resources said the flaring rule could cause a loss of 45,000 barrels of oil a day. North Dakota produced an average of 1.27 million barrels a day in September. Brady Pelton, vice president of the North Dakota Petroleum Council, a trade group representing over 500 oil and gas producers, said he believes the rule will constrain production. "The gas-to-oil ratio in the Williston Basin is only increasing, and will increase in the future ... if (the gas) has nowhere to go, it has to be flared and if it can't be flared, production will cease," he said. The ratio rises as reservoirs age due to drops in pressure, bringing more gas to the surface.