US oil supplies at a 19 year low; Strategic Petroleum Reserve at a 37½ year low after record SPR withdrawal; gasoline supplies at 42 week low; distillates demand at a 21 month low; global oil surplus at 1,630,000 barrels per day in August, even as OPEC output is 1,411,000 barrels per day short of quota..

oil prices fell for a third straight week as an elevated US inflation reading presaged a large Fed interest rate hike next week...after falling just 0.1% to $86.79 a barrel over last week as lockdowns in China and a big build of US crude inventories were offset by a modest OPEC production cut and Russian threats to oil supplies, the contract price for the benchmark US light sweet crude for October delivery moved higher in Asian trading on Monday as the U.S. dollar weakened against other currencies and traders bet that inflation was at or near its peak, then rose in New York as Iranian nuclear talks appeared to hit obstacles and as an embargo on Russian oil shipments loomed, and settled 99 cents higher at $87.78 a barrel as oil supply concerns mounted heading into winter after the EIA reported a record draw from the Strategic Petroleum Reserve...after rising early Tuesday as the dollar strengthened ahead of the US inflation report, oil prices reversed and gave back half of Monday's gain, falling 47 cents to $87.31 a barrel, as a stronger-than-expected reading on inflation strengthened the dollar and increased the likelihood of higher interest rates, which would dull the demand for oil....but oil prices steadied in late trading despite an American Petroleum Institute report of another big build of US crude inventories, as chatter that the Biden administration would buy crude at $80/bbl to refill the SPR sent prices rebounding....however, oil prices softened in early trading Wednesday after the International Energy Agency raised its global demand outlook for the remainder of the year, citing soaring oil use for power generation and gas-to-oil switching across large economies in Asia and the European Union. but rallied late to settle $1.17 higher at $88.48 a barrel, buoyed in part by a report from Bloomberg that said the Biden administration might consider refilling the nation's Strategic Petroleum Reserve when crude prices dip below $80 a barrel... oil prices edged upwards in early Asian trade on Thursday, as supply concerns and a looming rail stoppage in the US supported markets, but then tumbled $3.38 or nearly 4% to a one-week low of $85.10 a barrel on a tentative agreement to avert a rail strike, and on expectations for weaker global demand and continued U.S. dollar strength ahead of a potentially large interest rate increase...oil prices moved mixed early Friday amid persistent fears that higher interest rates from the Fed would push the U.S. economy into a recession, denting demand growth for oil and petroleum products and settled the session a penny higher at $85.11 a barrel as a spill at Iraq's Basra oil terminal appeared likely to constrain crude supply, but still finished down 1.9% from the prior week, as mounting evidence of an economic slowdown overshadowed supply-risk concerns...

Meanwhile, natural gas prices finished lower for a fourth straight week on a bearish storage report and on the belief that a railroad strike had been averted....after falling 9.0% to $7.996 per mmBTU last week on record production and on moderating weather forecasts, the contract price of US natural gas for October delivery advanced for a third consecutive session on Monday, propelled by festering worries about the inadequacy of gas stored for winter. and settled 25.3 cents higher at $8.249 per mmBTU, buoyed by technical trading and slightly lower production estimates for the week...natural gas prices edged higher again on Tuesday on worries that a possible railroad strike would disrupt coal supplies to power plants, which would force generators to burn more gas to produce electricity, and settled 3.5 cents higher at $8.284 per mmBTU...the October gas contract price rose for a fifth straight day on Wednesday, boosted by late-season heat, domestic storage concerns and a robust global demand for U.S. LNG exports, and spiked 83.0 cents or 10% on the day to settle at $9.114 per mmBTU, the highest price in two weeks...however, natural gas prices reversed course on Thursday and tumbled 79 cents, or 9%, to $8.324 per mmBTU, on a bigger-than-expected increase in inventories and on reports of a deal that would avert a rail strike....natural gas prices continued falling on Friday as gasfield output held near a record high and as global gas prices slumped and settled down 56.0 cents on the day at $7.764 per mmBTU, and thus ended 2.9% lower on the week...

The EIA's natural gas storage report for the week ending September 9th indicated that the amount of working natural gas held in underground storage in the US rose by 77 billion cubic feet to 2,771 billion cubic feet by the end of the week, which left our gas supplies 223 billion cubic feet, or 7.4% below the 2,916 billion cubic feet that were in storage on September 9th of last year, and 354 billion cubic feet, or 11.3% below the five-year average of 3,125 billion cubic feet of natural gas that were in storage as of the 9th of September over the most recent five years....the 77 billion cubic foot injection into US natural gas working storage for the cited week was on the high side of forecasts from analysts that called for an injection between 62 and 80 billion cubic feet, but was close to the 78 billion cubic feet that were added to natural gas storage during the corresponding week of 2021, while a bit less than the average injection of 82 billion cubic feet of natural gas that had typically been added to our natural gas storage during the same week over the past 5 years....

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending September 9th showed that despite a big drop in our oil imports, a record draw of oil from our SPR meant we had unused oil left to add to our stored commercial crude supplies for the 2nd time time in 5 weeks, and for the 18th time in the past 42 weeks....Our imports of crude oil fell by an average of 988,000 barrels per day to average 5,792,000 barrels per day, after rising by an average of 824,000 barrels per day during the prior week, while our exports of crude oil rose by 82,000 barrels per day to average 3,515,000 barrels per day, which meant that the net of our trade in oil worked out to an import average of 2,277,000 barrels of oil per day during the week ending September 9th, 1,070,000 fewer barrels per day than the net of our imports minus our exports during the prior week. Over the same period, production of crude from US wells was reportedly unchanged at 12,100,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 14,377,000 barrels per day during the September 9th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,022,000 barrels of crude per day during the week ending September 9th, an average of 94,000 more barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 853,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures from the EIA for the week ending September 9th appear to indicate that our total working supply of oil from net imports, from oilfield production, and from storage was 792,000 barrels per day less than what our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+792,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed... however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 853,000 barrel per day decrease in our overall crude oil inventories left our oil supplies at 863,690,000 barrels at the end of the week, which is our lowest total oil inventory level since April 11th, 2003, and therefore at a new 19 year low.….Our oil inventories decreased this week as 349,000 barrels per day were being added to our commercially available stocks of crude oil while a record 1,202,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve. That draw on the SPR was another installment of the emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump" (sic), that was intended to supply 1,000,000 barrels of oil per day to commercial interests over a six month period up to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising, at least up until then, and was apparently up by 864,000 barrels per day from two weeks ago because the administration is now attempting to use the Strategic Petroleum Reserve to manipulate prices on a weekly basis....Including the administration's initial 50,000,000 million barrel SPR release earlier this year, their subsequent 30,000,000 barrel release, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 222,092,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 26 months, and as a result the 434,057,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since October 26th, 1984, or at a 37 1/2 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's SPR releases. Now the total 180,000,000 barrel drawdown expected during the current six month release program to November will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,340,000 barrels per day last week, which was 4.6% more than the 6,064,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be unchanged at 12,100,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 11,700,000 barrels per day, while Alaska’s oil production was 4,000 barrels per day higher at 434,000 barrels per day but had no impact on the final rounded national total. US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 7.6% below that of our pre-pandemic production peak, but was 24.7% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021...

US oil refineries were operating at 91.5% of their capacity while using those 16,022,000 barrels of crude per day during the week ending September 9th, up from their 90.9% utilization rate during the prior week, but a refinery utilization rate that's a bit below the normal range for the week after Labor Day. The 16,022,000 barrels per day of oil that were refined this week were 11.4% more than the 14,387,000 barrels of crude that were being processed daily during week ending September 10th of 2021 (after Hurricane Ida), but 4.1% less than the 16,707,000 barrels that were being refined during the prepandemic week ending September 13th, 2019, when our refinery utilization was at 91.2%, also on the low side of the normal range for early September...

Despite the increase in the amount of oil being refined this week, the gasoline output from our refineries was lower, decreasing by 399,000 barrels per day to 9,453,000 barrels per day during the week ending September 9th, after our gasoline output had increased by 74,000 barrels per day during the prior week. This week’s gasoline production was still 2.0% more than the 9,271,000 barrels of gasoline that were being produced daily over the same week of last year, and virtually matched the gasoline production of 9,451,000 barrels per day during the week ending September 13th, 2019, ie, during the year before the pandemic impacted US gasoline output. At the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 12,000 barrels per day to 5,019,000 barrels per day, after our distillates output had increased by 112,000 barrels per day during the prior week. With that increase, our distillates output was 6.7% more than the hurricane impacted 4,706,000 barrels of distillates that were being produced daily during the week ending September 10th of 2021, but 1.8% less than the 5,109,000 barrels of distillates that were being produced daily during the week ending September 13th 2019...

With the decrease in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the 6th time in 8 weeks; and for the 25th time out of the past thirty-two weeks, decreasing by 1,768,000 barrels to a 42 week low of 213,040,000 barrels during the week ending September 9th, after our gasoline inventories had increased by 333,000 barrels during the prior week. Our gasoline supplies fell this week even though the amount of gasoline supplied to US users fell by 233,000 barrels per day to 8,494,000 barrels per day, because our imports of gasoline fell by 509,000 barrels per day to 522,000 barrels per day, while our exports of gasoline fell by 106,000 barrels per day to 1,070,000 barrels per day. but even after 25 gasoline inventory drawdowns over the past 32 weeks, our gasoline supplies were just 2.3% lower than last September 10th's gasoline inventories of 218,142,000 barrels, and about only 2% below the five year average of our gasoline supplies for this time of the year…

Even after the decrease in our distillates production, our supplies of distillate fuels increased for the 11th time in 17 weeks and for the 21st time in the past year, rising by 4.219,000 barrels to 116,020,000 barrels during the week ending September 9th, after our distillates supplies had increased by 95,000 barrels during the prior week. Our distillates supplies rose by their most this year this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, decreased by 492,000 barrels per day to a 21 month low of 3,132,000 barrels per day, and because our exports of distillates fell by 156,000 barrels per day to 1,409,000 barrels per day, while our imports of distillates fell by 47,000 barrels per day to 125,000 barrels per day.. But after forty-eight inventory withdrawals over the past seventy-three weeks, our distillate supplies at the end of the week were 12.0% below the 133,586,000 barrels of distillates that we had in storage on September 10th of 2021, and about 21% below the five year average of distillates inventories, for this time of the year...

Meanwhile, with the record withdrawal of crude from the SPR, our commercial supplies of crude oil in storage rose for the 11th time in 21 weeks and for the 22nd time in the past year, increasing by 2,442,000 barrels over the week, from 427,191,000 barrels on September 2nd to 429,633,000 barrels on September 9th, after our commercial crude supplies had increased by 8.845,000 barrels over the prior week. After those increases, our commercial crude oil inventories were about 2% below the most recent five-year average of crude oil supplies for this time of year, and about 28% above the average of our crude oil stocks as of the second weekend of September over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. And even though our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this September 9th were 2.9% more than the 417,445,000 barrels of oil we had in commercial storage on September 10th of 2021, and were 13.4% less than the 496,045,000 barrels of oil that we had in storage on September 11th of 2020, and 3.0% more than the 417,126,000 barrels of oil we had in commercial storage on September 13th of 2019…

Lastly, with our inventories of crude oil and our supplies of all products made from oil near multi-year lows over the most recent months, we are continuing to watch the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR. With the increases we've already noted, the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 2,943,000 barrels this week, from 1,667,619,000 barrels on September 2nd to 1,664,676,000 barrels on September 9th, after our total inventories had risen by 3,680,000 barrels during the prior week. That left our total liquids inventories down by 123,757,814,000 barrels over the first 34 weeks of this year, and less than a million barrels from a 13 1/2 year low...

OPEC's Report on Global Oil for August

Tuesday of this week saw the release of OPEC's September Oil Market Report, which includes the details on OPEC's & global oil data for August, and hence it gives us a picture of the global oil supply & demand situation after China had briefly reopened their cities after their most restrictive Covid lockdowns, while oil supplies from Russia continued to be constrained by Western sanctions, and while at the same time OPEC and aligned oil producers agreed to increase their output by the usual 400,000+* barrels per day for a thirteenth consecutive month, ie the 13th such increase from the previously agreed to July 2021 level, and to also increment that increase with half of the 400,000+ bpd production increase they had originally scheduled for September...that September was the sixth production and last quota policy reset that they had made over the past twenty-eight months, all by way of responding to the pandemic-related demand slowdown and subsequent irregular recovery, and with August's production increase, the cartel's output should be back to the level it was at before the Covid production cuts began....note that with the course and impact of the Ukraine war and the future course of the Covid pandemic largely unknown, the demand projections made in this report will have a much greater degree of uncertainty than they would have during normal, more stable times..

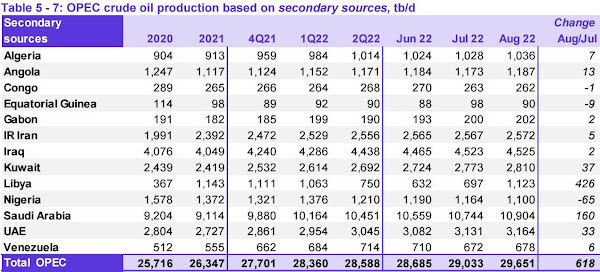

The first table from this month's report that we'll review is from the page numbered 50 of this month's report (pdf page 60), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC has used an average of production estimates by six "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA) and the industry newsletter Petroleum Intelligence Weekly, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures....as of the June report, the consultancy Wood Mackenzie and the research and intelligence firm Rystad Energy were also added to OPEC's secondary sources.....

As we can see on the bottom line of the above table, OPEC's oil output increased by 618,000 barrels per day to 29,651,000 barrels per day during July, up from their revised June production total that averaged 28,482,000 barrels per day....however, that July output figure was originally reported as 28,896,000 barrels per day, which therefore means that OPEC's June production was revised 137,000 barrels per day higher with this report, and hence OPEC's July production was, in effect, 788,000 barrels per day higher than the previously reported OPEC production figure (for your reference, here is a copy of the table of the official June OPEC output figures as reported a month ago, before this month's revision)...

According to the agreement reached between OPEC and the other oil producers at their Ministerial Meeting on July 18th, 2021, the oil producers party to that agreement were to raise their output by a total of 400,000 barrels per day each month through December 2021, (later bumped up to 432,000 bpd) which was subsequently renewed at monthly meetings to include further 400,000+ barrel per day production increases in January, February, March, April, May, & June of 2022, and which would indicate an increase of 254,000 barrels per day each month from the OPEC members listed above, (later bumped up to 286,000 barrels per day) with the rest of the current 432,000 barrel per day cartel increase to supplied by other aligned oil producers. including Russia...with the OPEC agreement reached on June 3rd, they agreed to further increase their output for July and August each by half of the 432,000 barrels per day they had scheduled as an increase in September...hence, the August production increase for the extended cartel was to expected to be 648,000 barrels per day, with 429,000 barrels of that coming from OPEC...hence, OPEC's actual August increase of 618,000 barrels per day was considerably more than the increase they had commited to....however, the 426,000 barrel per day production increase in Libya, coming after a cessation of hostilities between waring factions, was the sole reason that OPEC managed to beet their quota for the month, and several other OPEC members continued to be well short of what they were expected to produce, as we'll see in the next table...

The adjacent table was originally included as a downloadable attachment to the press release following the 30th OPEC and non-OPEC Ministerial Meeting on June 30, 2022, which set OPEC's and other aligned oil producers' production quotas for August... since war torn Libya and US sanctioned producers Iran and Venezuela were exempt from the production cuts imposed by the joint agreement that governs the output of the other OPEC producers, they are not shown in this list, and OPEC's quota excluding them is aggregated under the total listed for the 'OPEC 10', which you can see was expected to be at 26,689,000 barrels per day in August....therefore, the 25,278,000 barrels those 10 OPEC members actually produced in August were 1,411,000 barrels per day short of what they were expected to produce during the month, with Nigeria and Angola accounting for a large part of this month's shortfall, while only Kuwait and Gabon were able to produce what was expected of them...

+ + +

* Recall that the original 2020 oil producer's agreement was to jointly cut their oil production by 23%, or by 9.7 million barrels per day, from an October 2018 baseline for just two months early in the pandemic, during May and June of 2020, but that initial 9.7 million bpd production cut agreement was extended to include July 2020 at a meeting between OPEC and other producers on June 6th, 2020....then, in a subsequent meeting in early July of that year, OPEC and the other oil producers agreed to ease their deep supply cuts by 2 million barrels per day to 7.7 million barrels per day for August 2020 and subsequent months, which thus became the agreement that governed OPEC's output for the rest of 2020...the OPEC+ agreement for their January 2021 production, which was later extended to include February and March and then April's output, was to further ease their supply cuts by 500,000 barrels per day to a reduction of 7.2 million barrels per day from that original October 2018 baseline...then, during a meeting on April 1st of last year, OPEC and the other oil producers that are aligned with them agreed to incrementally adjust their oil production higher for the following three months by a pre-set amount for each country, thus extending their joint output cut agreement through July 2021....production levels for August and the following months of last year were to be determined by a July 1st OPEC meeting, but that meeting was adjourned on July 2nd due to a dispute between the UAE and the Saudis over the 2018 reference production levels on which the cuts are based, and a subsequent attempt to restart that meeting on July 5th was called off....so it wasn't until July 18th 2021 that a tentative compromise addressing August 2021's output quotas was worked out, allowing oil producers in aggregate to increase their production by 400,000 barrels per day in August, and again by that amount in each of the following months, and also to boost reference production levels for the UAE, the Saudis, Iraq and Kuwait beginning in April 2022, and which made the cartel's effective monthly production increase 432,000 barrels per day since that time....OPEC and other producers then agreed to increase their production in January 2022 by a further 400,000 barrels per day in a meeting concluded on the 2nd of December, 2021, and reaffirmed their intention to continue that policy with another 400,000 barrel per day increase in February at a meeting concluded January 4, 2022, and then agreed to stick to that 400,000 bpd oil output increase in March, despite pressure from the US to raise output more quickly, at a meeting on February 2nd....then, at a meeting on March 2nd, OPEC and its oil-producing allies, which included Russia, decided to hold their production increase at that level thru April in an OPEC+ meeting that only lasted 13 minutes, their shortest meeting ever...then on March 31, OPEC and aligned producers agreed to reaffirm the decisions of the prior Ministerial meetings and again limit their production increase for May to the agreed 400,000 barrels per day despite the Russian shortfall, because "the current [oil market]volatility is not caused by fundamentals, but by ongoing geopolitical developments"...following that, in an OPEC and non-OPEC Ministerial Meeting held on May 5th, they again "reaffirmed, reconfirmed, and reinterated" the decision of the July 18th 2021 meeting to increase production by 432,000 barrels per day in June...however, in a meeting held on June 2nd,they agreed to bring forward the 432,000 barrel per day increase they had already scheduled for September, with that increase to be split evenly between July and August...hence, the production quota increase for both July and August was set at 648,000 barrels per day, which would then leave each member's production back at the October 2018 baseline...

Hence OPEC arrived at the production quotas for August 2021 through July & Augst of this year after repeatedly readjusting the original 23%, or 9.7 million barrel per day production cut from the October 2018 baseline that they first agreed to for May and June 2020, first to a 7.7 million barrel per day output reduction from the baseline for the remainder of 2020, then to a 7.2 million barrel per day production cut from the baseline for the first four months of this year, which was subsequently raised to an 8.2 million barrel per day oil output reduction after the Saudis unilaterally committed to cut their own production by a million barrels per day during the Covid surge of February, March, and then later during April of last year....under the agreement prior to the July 18th 2021 pact affecting the recent months since then, OPEC's production cut in April 2021 was set at 4,564,000 barrels per day below the October 2018 baseline, which was lowered to a cut of 3,650,000 barrels per day from the baseline with the subsequent comprehensive agreement, which thus set the July 2021 production quota for the "OPEC 10" at 23,033,000 barrels per day, with war torn Libya and US sanctioned producers Iran and Venezuela exempt from the production cuts imposed by that agreement....for OPEC and the other producers to increase their output by 400,000 barrels per day from that July 2021 level, each producer would be need to initially increase their production by just over 1% per month since that time...for OPEC alone, that meant a 254,000 barrel per day increase for each month from July 2021 to April 2022, at which time the incremental 32,000 barrels per day adjustment they arrived at in July 2021 kicked in....adding together those monthly quota increases since last July, when the quota was at 23,033,000 barrels per day, and then adding the 216,000 barrel per day brought forward from September's increase to July's and August's quotas, is how they arrived at the 26,689,000 barrels per day quota for OPEC for August that you see on the table above..

The next graphic from this month's report that we'll look at shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from September 2020 to August 2022, and it comes from page 51 (pdf page 51) of OPEC's September Oil Market Report....on this graph, the cerulean blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

After this month's 618,000 barrel per day increase in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate is that total global liquids production increased by a rounded 1,300,000 barrels per day to average 101.3 million barrels per day in August, a reported increase which came after July's total global output figure was apparently revised down by 600,000 barrels per day from the 100.6 million barrels per day of global oil output that was estimated for July a month ago, as non-OPEC oil production rose by a rounded 700,000 barrels per day in August after that downward revision, with 500,000 barrels per day of August's production growth coming from the OECD Americas, the OECD Europe, and "Other Eurasia", while oil production in Russia and in some other countries declined...

After that 1.3 million barrel per day increase in August's global output, the 101.3 million barrels of oil per day that were produced globally during the month were 5.98 million barrels per day, or 6.3% more than the revised 95.32 million barrels per day that were being produced globally in August a year ago, which was the third month after OPEC and their allied producers began their program of monthly production increases from the 7.2 million barrels per day production cut that had governed their output over the first four months of last year (see the September 2021 OPEC report (online pdf) for the originally reported August 2021 details)...with this month's increase in OPEC's output fairly large compared to the modest global increase, their August oil production of 29,651,000 barrels per day amounted to 29.3% of what was produced globally during the month, up from their revised 29.1% share of the global total in July, which had originally been reported at 28.7%, before this month's large revisions....OPEC's August 2021 production was reported at 26,762,000 barrels per day, which means that the 13 OPEC members who were part of OPEC last year produced 2,889,000 barrels per day, or 10.8% more barrels per day of oil this August than what they produced last August, when they accounted for 28.0% of global output...

With the increases in both OPECs and global oil output that we've seen in this report, the amount of oil being produced globally during the month was significantly more than the expected global demand, as this next table from the OPEC report will show us....

The above table came from page 27 of the August Oil Market Report (pdf page 37), and it shows regional and total oil demand estimates in millions of barrels per day for 2021 in the first column, and then OPEC's estimate of oil demand by region and globally quarterly over 2022 over the rest of the table...on the "Total world" line in the fourth column, we've circled in blue the figure that's relevant for August, which is their estimate of global oil demand during the third quarter of 2022....OPEC is estimating that during the 3rd quarter of this year, all oil consuming regions of the globe have used an average of 99.67 million barrels of oil per day, which is an downward revision of 260,000 barrels per day from their estimate 99.93 million barrels per day for 3rd quarter demand of a month ago (that revision is circled in green)...but as OPEC showed us in the oil supply section of this report and the summary supply graph above, OPEC and the rest of the world's oil producers were producing 101.3 million barrels per day during July, which would imply that there was a surplus of around 1,630,000 barrels per day of global oil production in August, when compared to the demand estimated for the month...

In addition to figuring that September oil surplus implied by this report, the downward revision of 600,000 barrels per day to July's global oil output that's implied in this report, combined with the 260,000 barrels per day downward revision to 3rd quarter demand that we've circled in green, means that the 670,000 barrels per day global oil output surplus we had previously figured for July would now be revised to a surplus of 330,000 barrels per day....

However, note that in green we have circled an upward revision of 70,000 barrels per day to OPEC's previous estimates of second quarter demand...based on that upward revision to demand, our previous estimate that there was a surplus of 350,000 barrels per day in June would now be revised to a 280,000 barrels per day surplus, while the oil shortage of 60,000 barrels per day that we had previously figured for May would have to be revised to a shortage of 130,000 barrels per day, and finally, that the 340,000 barrels per day global oil output surplus we had previously figured for April would have to be revised to a surplus of 270,000 barrels per day...

This Week's Rig Count

The number of drilling rigs running in the US rose for the second time in seven weeks, and for the 83rd time over the past 103 weeks during the week ending September 16th, but they're still 3.8% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US increased by 4 to 763 rigs this past week, which was also 251 more rigs than the 512 rigs that were in use as of the September 10th report of 2021, but was 1,166 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil increased by 8 to 599 oil rigs during the past week, after the number of rigs targeting oil had decreased by 5 during the prior week, and there are now 188 more oil rigs active now than were running a year ago, even as they amount to just 37.2% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are still down 12.3% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations decreased by 4 to 162 natural gas rigs, which was still up by 62 natural gas rigs from the 100 natural gas rigs that were drilling during the same week a year ago, even as they were only 10.1% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008….other than those rigs targeting oil and natural gas, Baker Hughes reports that two "miscellaneous" rigs continued drilling this week: a directional rig drilling to between 5,000 and 10,000 feet on the big island of Hawaii, and a vertical rig drilling more than 15,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track....a year ago, there were was only one such "miscellaneous" rig running...

The offshore rig count in the Gulf of Mexico was up by one to 14 rigs this week, with all of this week's Gulf rigs drilling for oil in Louisiana's offshore waters....that's in contrast to a year ago, when only 6 Gulf rigs had restarted in the wake of Hurricane Ida...in addition to rigs drilling in the Gulf, we still have an offshore directional rigs drilling to between 5,000 and 10,000 feet for natural gas in the Cook Inlet of Alaska, while a year ago, there were two rigs drilling offshore from Alaska...

In addition to rigs running offshore, there are now four water based rigs drilling through inland bodies of water this week; the one added this week is a directional rig drilling to between 10,000 and 15,000 feet, inland in Galveston Bay. Texas; legacy inland waters rigs include a directional rig drilling for oil to between 5,000 and 10,000 feet in Cameron Parish, Louisiana; a directional rig targeting oil at a depth greater than 15,000 feet drilling through a lake on Grand Isle, Louisiana, and a directional rig drilling for oil in Terrebonne Parish, Louisiana, also at a depth greater than 15,000 feet...a year ago, there were was just one rig drilling on inland waters...

The count of active horizontal drilling rigs was up by 3 to 695 horizontal rigs this week, which was also 229 more rigs than the 466 horizontal rigs that were in use in the US on September 17th of last year, but just over half of the record 1,374 horizontal rigs that were drilling on November 21st of 2014....at the same time, the directional rig count was up by 2 to 45 directional rigs this week, and those were up by 28 from the 17 directional rigs that were operating during the same week a year ago…on the other hand, the vertical rig count was down by 1 to 23 vertical rigs this week, which was also down by 6 from the 29 vertical rigs that were in use on September 17th of 2021….

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of September 16th, the second column shows the change in the number of working rigs between last week’s count (September 9th) and this week’s (September 16th) count, the third column shows last week’s September 9th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 17th of September, 2021...

checking first the Rigs by State file at Baker Hughes for the changes in Texas Permian, we find that there were two oil rigs added in Texas Oil District 8, which covers the core Permian Delaware, and that there were three oil rigs added in Texas Oil District 8A, which covers the northernmost counties of the Permian Midland, but that there was an oil rig pulled out of Texas Oil District 7C, which includes the southernmost counties of the Permian Midland...hence, those changes indicate a 4 rig increase in the Texas Permian, and since the national Permian basin count was just up by 3 rigs, we can conclude that the rig pulled out of New Mexico had been drilling in the far west Permian Delaware....elsewhere in Texas, there was a rig added Texas Oil District 2, which would account for one of the two oil rigs added in the Eagle Ford shale, while there was a rig pulled out of Texas Oil District 4, which would account for the natural gas rig pulled out of the Eagle Ford....however, the Eagle Ford saw an increase of two oil rigs, which means a rig was pulled out of a basin not tracked by Baker Hughes in the same Texas oil district the other Eagle Ford oil rig was added in...in addition, there was a natural gas rig pulled out of the Barnett shale in Texas Oil District 5, while there was an oil rig added in the Barnett in Texas Oil District 9...note that the Texas rig count was up by 5 with the inland waters rig addition in Galveston Bay.....

in other states, the Louisiana rig count was up by one with the rig addition in the adjacent Gulf of Mexico, the North Dakota rig count was down by one with the removal of an oil rig from the Williston basin, and the Oklahoma count remained unchanged despite the addition of two oil rigs in the Cana Woodford because two rigs were concurrently pulled out of basins that Baker Hughes doesn't track at the same time...Oklahoma also saw a natural gas rig pulled out of the Arkoma Woodford, while an oil rig was added in that basin at the same time, thus leaving the Arkoma Woodford unchanged...the last natural gas rig removal we haven't accounted for came out of a basin not tracked by Baker Hughes, which could have also been one of those pulled out elsewhere in Oklahoma...

+++++++++++++++++++++++++++++++++++++

Ohio Spars With Company Over Tax Break for Fracking Equipment -Bloomberg Tax - Stingray Pressure Pumping LLC and the Ohio tax commissioner are going head to head at the state’s high court in opposing briefs over which pieces of the company’s hydraulic fracturing equipment are exempt from sales and use tax. Tax Commissioner Jeffrey A. McClain assessed over $3.6 million in tax, interest, and penalties on 60 pieces of equipment Stingray bought for its fracking operations. The commissioner later canceled half of the assessments, finding the pieces of equipment they covered fell under the state’s exemption for equipment used “directly” in the production of oil and gas.

Fracking Equipment Taxable, Ohio Agency Tells State Justices – Law360 - An Ohio-based hydraulic fracturing company owes sales and tax on equipment purchased and not used directly in oil and gas production, the state Department of Taxation told the state Supreme Court...

Utica Shale Academy Donation -This past June, the EQT Foundation, the philanthropic extension of EQT Corporation, the nation’s largest natural gas producer, awarded the Utica Shale Academy a $25,000 grant to be used for the school’s heavy equipment operator and maintenance program. The academy, located in Salineville, provides a unique and vigorous learning environment through a specialized academic program which responds to employers’ and industries’ current and emerging and changing global workforce needs and expectations through business/school partnerships. “We are impressed with the work and dedication of the students and faculty at the Utica Shale Academy as they train the next generation of employees who will help to fuel and grow the energy industry here in Appalachia,”said Ellen Rossi, president of the EQT Foundation.

30 New Shale Well Permits Issued for PA-OH-WV Sep 5-11 | Marcellus Drilling News - Last week the three states with active Marcellus/Utica drilling, Pennsylvania, Ohio, and West Virginia, issued a collective 30 new drilling permits, down from the 40 permits issued the week before. PA roared back to life by issuing 21 of the 30 permits, with OH issuing just three and WV issuing six. Armstrong County, Ascent Resources, Butler County, CNX Resources, Coterra Energy (Cabot O&G), Elk County, Guernsey County, Indiana County,INR, Jefferson County (OH), Monongalia County, Ohio County, PennEnergy Resources, Seneca Resources, Snyder Brothers, Southwestern Energy, Susquehanna County,Utica Resource Operating, XTO

The dangers of Westmoreland’s proposed method of disposing of liquid landfill waste - I’m a science journalist and four years ago, I fell down the oil-field radioactivity rabbit hole. Here in Pennsylvania, a landfill applying for a permit with the state’s Department of Environmental Protection to evaporate liquid landfill runoff — called leachate — could create airborne radioactive material over people downwind. Every day across the nation, about 2.8 billion gallons of oil field brine are produced with toxic levels of salt, heavy metals, and the radioactive element radium. In Pennsylvania, levels have been recorded at up to 5,700 times EPA’s safe drinking water limit. Sludge that forms on the bottom of tanks and trucks that hold brine can be even richer in radium and can also contain exceptional amounts of radioactive lead. And with every Marcellus well, crushed rock and dirt called drill cuttings are bored out of black shale — a type of geologic formation the U.S. Geologic Survey reported in 1960 was so rich in uranium they thought about mining it, with the oil “considered as a possibly important byproduct.” All this waste must be handled, transported, and disposed of. My reporting has documented problems at every step. Brine is pumped deep underground at facilities called injection wells, which causes earthquakes. In Ohio, these wells are leaking. Sludge and drill cuttings are taken to treatment facilities where it’s often the task of improperly trained and inappropriately protected workers to mix in materials like lime in an attempt to solidify the material and lower the radioactive signature. If the radiation levels in the sludge decrease enough, the waste can be trucked to the same local landfills that handle household trash instead of being shipped by rail to radioactive waste disposal sites out west — a more expensive but safer option. At Westmoreland Sanitary in Belle Vernon, Pa., the Department of Environmental Protection told me from 2013 through 2017, 276,416 tons of oil-field waste were disposed. The landfill has also taken more than 200 tons of oil-field waste from an Ohio facility. An investigation I published last month revealed that workers are being dangerously exposed to radioactive sludge; I also found that railcars, which were being routed across the country to a disposal facility in the Utah desert, arrived at their destination leaking material. Costs of proper disposal are high and oversight is lax. A 1980 congressional exemption labeled oil-field waste nonhazardous despite many known hazards. As a result, the industry has regularly resorted to risky disposal measures, including disposing of oil-field brine at sewage treatment plants and spreading drilling waste on farm fields, a practice common in Oklahoma and Texas. For landfills that accept oil field waste, one big problem is leachate. For years, liquid landfill waste from Westmoreland flowed through a sewer pipe and into Belle Vernon’s sewage-treatment plant. In 2019, I met the plant’s superintendent, Guy Kruppa. He told me the stuff was so toxic that it was ruining his plant’s ability to treat sewage. Not only that, but it was also sending contaminants into the Monongahela River, a drinking water source. That same year, a judge ordered the landfill to halt the practice. The Department of Environmental Protection told me about 17 truckloads of leachate a day was instead being shipped to other sewage plants, an option that the agency said, “is not a preferred situation.” Last month, the Pittsburgh Tribune-Review reported that leachate had leaked into a local stream and the landfill didn’t immediately phone the Department of Environmental Protection or emergency management officials, as required by law. Liquid landfill waste clearly remains an issue, but we have two constantly moving bodies of fluids on this planet: water and air. If you can’t use water to carry away your waste for free, why not try the air? A leachate evaporator is a gas-fired boiler that will cook away the liquid landfill waste. A pair of treatment systems will remove 99% of the radioactivity, according to Westmoreland, relying in part on a device called a mist eliminator. But the science of precisely how this will be done is not clear and was not well explained during a hearing in early September. Yet, it’s of utmost importance, because the agency admits radium is the main radioactive element “of concern in the landfill leachate proposed for evaporation” and has found radium at levels dozens of times EPA’s safe drinking water limit at similar landfills.

Pennsylvania is just the latest sacrifice zone for the plastics industry - Sierra Club - DURING THE SUMMER OF 2018, two of the largest cranes in the world towered over the Ohio River. The bright-red monoliths were brought in by the multinational oil and gas company Shell to build an approximately 800-acre petrochemical complex in Potter Township, Pennsylvania—a community of about 500 people. In the months that followed, the construction project would require remediating a brownfield, rerouting a highway, and constructing an office building, a laboratory, a fracked-gas power plant, and a rail system for more than 3,000 freight cars. Five years after construction began at the site, Shell's complex, which is one of the biggest state-of-the-art ethane cracker plants in the world, is set to open. An important component of gas and a byproduct of oil refinery operations, ethane is an odorless hydrocarbon that, when heated to an extremely high temperature to "crack" its molecules apart, produces ethylene; three reactors combine ethylene with catalysts to create polyethylene; and a 2,204-ton, 285-foot-tall "quench tower" cools down the cracked gas and removes pollutants. That final product is then turned into virgin plastic pellets. Estimates suggest that a plant the size of the Potter Township petrochemical complex would use ethane from as many as 1,000 fracking wells. It is expected to emit up to 2.25 million tons of climate-warming gases annually, equivalent to approximately 430,000 extra cars on the road. It will also emit 159 tons of particulate matter pollution, 522 tons of volatile organic compounds, and more than 40 tons of other hazardous air pollutants. Exposure to these emissions is linked to brain, liver, and kidney issues; cardiovascular and respiratory disease; miscarriages and birth defects; and childhood leukemia and cancer. Some residents fear that the plant could turn the region into a sacrifice zone: a new "Cancer Alley" in Beaver County, Pennsylvania."I'm worried about what this means for our air, which is already very polluted, and for our drinking water," said Terrie Baumgardner, a retired English professor and a member of the Beaver County Marcellus Awareness Community, the main local advocacy group that fought the plant. Baumgardner, who is also an outreach coordinator at the Philadelphia-based nonprofit environmental advocacy group Clean Air Council, lives near the ethane cracker. In addition to sharing an airshed with the plant, she is one of the approximately 5 million people whose drinking water comes from the Ohio River watershed. When Shell initially proposed the petrochemical plant in 2012, she and other community advocates tried their best to stop it. And the plant's negative impact will go far beyond Pennsylvania. Shell's ethane cracker relies on a dense network of fracking wells, pipelines, and storage hubs. It's one of the first US ethane crackers to be built outside the Gulf of Mexico, and one of five such facilities proposed throughout Appalachia's Ohio River Valley, which stretches through parts of Ohio, Indiana, Kentucky, Pennsylvania, and West Virginia. If the project is profitable, more like it will follow—dramatically expanding the global market for fossil fuels at a time when the planet is approaching the tipping point of the climate crisis. For the residents who live nearby, Shell's big bet on plastic represents a new chapter in the same story that's plagued the region for decades: An extractive industry moves in, exports natural resources at a tremendous profit—most of which flow to outsiders—and leaves poverty, pollution, and illness in its wake. First came the loggers, oil barons, and coal tycoons. Then there were the steel magnates and the fracking moguls.

PA Stubbornly Continues to Try and Grab Hydrogen Hub for Itself | Marcellus Drilling News - Pennsylvania is stubbornly continuing to pursue a $2 billion hydrogen hub (part of the Biden infrastructure bill) on its own, without partnering with other Marcellus/Utica states. As we continue to point out, doing the application process alone jeopardizes attracting the project to our region. Yesterday the Pennsylvania House Environmental Resources and Energy Committee held a public hearing on hydrogen’s potential as an energy source. The opening presenter, Richard DiClaudio, president and CEO of the Energy Innovation Center Institute in Pittsburgh, made the case that hydrogen and the hydrogen hub is important to the future of southwestern PA.

Lancaster Sisters of the Corn Still Trying to $hake Down Williams | Marcellus Drilling News - The Catholic nuns of Lancaster County’s Adorers of the Blood of Christ are still, all these years later, trying to shake down Williams for more money because of a pipeline that runs underneath a cornfield owned by the sisters (hence our nickname for them). Using lawyers from Big Green groups, the nuns are arguing their “religious beliefs” were offended by the pipeline because it flows a nasty, filthy fossil fuel that causes global warming. Even though the sisters own and operate a home heated by natural gas at the same location! Williams should be suing the nuns, not the other way around.

Manchin deal might not save Mountain Valley pipeline - The Mountain Valley pipeline may never be finished — even if Sen. Joe Manchin’s permitting revamp becomes law.Legislation from the West Virginia Democrat could give a boost to the beleaguered project by steering legal challenges to a different court. But regulatory experts caution that the proposal, as described by Manchin, won’t guarantee the project gets completed.“It doesn’t necessarily direct an outcome,” said Ted Boling, a former longtime career federal official who served as associate director at the White House Council on Environmental Quality (CEQ) under former President Donald Trump. Boling is now a partner at Perkins Coie LLP.The Mountain Valley pipeline, or MVP, is intended to carry natural gas more than 300 miles from northern West Virginia to southern Virginia. Approved in 2017, it is years behind schedule after environmental groups successfully challenged many of its federal permits in court. Manchin wants to free the project from the legal thicket. But Manchin’s initial plan didn’t appear to free it from all legal challenges.By contrast, the Republican permitting proposal rolled out Monday would direct an outcome. Announced by West Virginia Republican Sen. Shelley Moore Capito, it says Mountain Valley’s new permits would not be “subject to judicial review.”And “judicial review” is what has stymied MVP. In particular, the project has been slowed by the reviews of a three-judge panel at the 4th U.S. Circuit Court of Appeals. The delays have caused some investors to question whether the pipeline can be completed.Unlike Capito, Manchin has not released specific legislative language for his proposal. When he announced his agreement on permitting last month with Senate Majority Leader Chuck Schumer (D-N.Y.), the summary he releasedhad two basic elements related to MVP.First, his plan would direct agencies to “take all necessary actions” to issue new permits for the pipeline. And it would give all jurisdiction on any further litigation to a different court: the U.S. Court of Appeals for the District of Columbia Circuit.The order to the agencies wouldn’t ensure the permits could survive court challenges. And while the D.C. Circuit might be more favorable, analysts said directing future challenges there implies that there will be more legal battles.MVP has a poor record before three judges at the 4th Circuit who have been hearing cases on the project. They have canceled the project’s federal permits, saying the underlying federal reviews have not complied with environmental laws. Attorneys for Mountain Valley’s developers have pleaded in court filings unsuccessfully for a new slate of judges.In January, the 4th Circuit vacated approvals from the Forest Service and Bureau of Land Management that would have allowed the pipeline to cross 3.5 miles of the Jefferson National Forest (Energywire, Jan. 26). The two agencies are working together on a new environmental review. The same three judges — Chief Judge Roger Gregory, Judge James Wynn and Judge Stephanie Thacker — are expected to handle cases over the pipeline’s state water certifications. The D.C. Circuit has been more favorable at times. It upheld FERC’s 2017 approval of the project and rejected challenges to the agency’s approval for an extension of time to complete the project. But in another pipeline case, the court ruled against the Dakota Access pipeline last year, requiring a new environmental review of the project. However, in that same case, the court overturned a district judge’s order to shut down the pipeline and drain it of oil (Energywire, Feb. 23). And D.C. Circuit judges grilled FERC in April about its handling of Mountain Valley, asking why the agency had not done more to review the “profoundly changed circumstances” after state officials found numerous environmental violations.

Fatal Tetco Incident in 2019 Said Combination of Pipeline Defect, Degraded System - A manufacturing defect, a degraded coating and an ineffective corrosion prevention system contributed to a fatal explosion and fire on Enbridge Inc.’s Texas Eastern Transmission (Tetco) natural gas pipeline near Danville, KY, the National Transportation Safety Board (NTSB) said Wednesday. The August 2019 Tetco Line 15 rupture and subsequent fire caused one death and sent six people to the hospital. NTSB noted the incident burned about 30 acres of land, destroyed five homes and damaged 14 other residences. The accident also raised market concerns about potential limits on Appalachian Basin gas flows reaching the Gulf Coast. Investigators concluded “that the combination of a pre-existing manufacturing defect – known as a hard spot – together with a degraded pipeline coating and ineffective cathodic protection, led to hydrogen-induced cracking at the outer surface of the pipe.” Cathodic protection, aka CP, is an electrochemical method for controlling corrosion of pipelines and other metal surfaces. According to NTSB, Enbridge’s integrity management program contributed to the accident by failing to accurately assess the 30-inch diameter pipeline’s condition or estimating the risk from interacting threats. NTSB said its accident report concluded that “Enbridge underestimated the risk posed by hard spots because its processes and procedures were inconsistent” with Pipeline and Hazardous Materials Safety Administration (PHMSA) guidance, as well as “industry knowledge of hard spot threat interaction.” To compensate for increased external corrosion, Enbridge and previous owners of the system increased CP voltages on the affected pipeline segment, noted investigators. NTSB’s report recommended six safety measures, with three directed to Enbridge and three to PHMSA, tied to evaluating gas flow change risks, in-line inspection data analysis limitations, threat assessments and threat interactions, and training and requalification practices.

Manufacturers push regulators for more natural gas pipelines -Manufacturers told lawmakers Friday that federal agencies should have a responsibility to secure reliable and affordable access to natural gas, mainly through a dramatic growth in pipeline infrastructure.A letter released Friday envisions an industry-oriented course correction at the Federal Energy Regulatory Commission and the North American Electric Reliability Corp. — one that sees the agencies turn from slow-walking regulators to active proponents of new infrastructure.“For decades, the current system has worked well. When pipeline capacity was needed, pipeline companies filed permits to the FERC and for the most part, the pipelines were approved and built without much delay,” wrote Paul Cicio, CEO of Industrial Energy Consumers of America.“That is no longer the case.”The letter argues a transformation is necessary because of the dire energy situation U.S. manufacturers find themselves in.Manufacturers, which have long used natural gas for fuel and as a raw material, have been particularly slammed by the rising costs and have to compete with utilities and LNG export facilities for the fuel.IECA is particularly concerned over natural gas prices heading into winter, when increased demand from utilities and export facilities for heating and power generation may strain existing pipeline capacity even further and skyrocket what they see as already untenable prices.FERC and NERC, Cicio argues, have an obligation to step in and ensure adequate pipeline capacity to fulfill the national imperatives of reliable energy and electricity.“The FERC’s responsibility needs to shift from being a regulator of pipeline permits to having responsibility to ensure that the pipelines that are needed will get built to secure our nation’s reliability,” wrote Cicio.He also said FERC should coordinate with power generators to potentially keep nuclear power plants or even coal-fired power plants online until more natural gas is available to all ratepayers.U.S. manufacturers have been sounding the alarm on natural gas infrastructure since February and have also called for gas export bans to shore up domestic supply (Energywire, July 28)Senate Energy and Natural Resources Chair Joe Manchin’s yet-to-be-released permitting reform package would in theory help natural gas infrastructure projects get quick regulatory authorization and hasten construction times (E&E Daily, Sept. 9). However, there is still stringent opposition from environmentalists and some Democrats to new natural gas projects. On Thursday, activists from Indigenous and front-line communities rallied in a Capitol Hill park and called on lawmakers to oppose permitting reforms and new natural gas projects.

Revealed: rightwing US lobbyists help craft slew of anti-protest fossil fuel bills - Republican-led legislatures have passed anti-protest laws drafted by an extreme-right corporate lobbying group in a third of all American states since 2018, as part of a backlash against Indigenous communities and environmentalists opposing fossil fuel projects, new research has found.The American Legislative Exchange Council (Alec) helped draft legislation criminalizing grassroots protests against pipelines, gas terminals and other oil and gas expansion projects in 24 states, under the guise of protecting critical infrastructure.Alec, which is funded by rightwing state lawmakers, corporate sponsors and trade groups, and wealthy ideologues, creates model legislation on a range of conservative issues such as gun control, abortion, education funding and environmental regulations.The laws were passed in 17 Republican-controlled states, including Oklahoma, North and South Dakota, Kansas, West Virginia and Indiana, where protesters now face up to 10 years in prison and million-dollar fines, according to a new report from the non-profit Climate Cabinet.The anti-protest bills, which were rolled out in response to the success of mostly Indigenous-led campaigns slowing down fossil-fuel infrastructure projects, have used intentionally vague language to create a chilling effect on free speech and assembly – both constitutionally protected rights, according to the report Critical Infrastructure Laws: A Threat to Protest & the Planet.“Indigenous-led demonstrations opposing fossil-fuel projects have been one of the most successful and effective forms of climate action to date … in an affront to the protected freedoms of our constitution, state legislatures have found a new legislative mechanism to oppress frontline communities and cause further harm and destruction to our planet,” said Jonathon Borja, co-author of the report.The first so-called critical infrastructure bills originated in Oklahoma in 2018, where the Republican state representative Scott Biggs referenced North Dakota’s Dakota Access pipeline (DAPL) protests and acknowledged that some anti-pipeline demonstrations had succeeded. “[The bill] is a preventative measure … to make sure that doesn’t happen here.”Other states followed after Alec created a model bill for lawmakers to copy. So far, the bills have not passed in any states where Democrats hold a majority in at least one legislative chamber, though some Democrats have voted in favor of them.In most of the bills, protesters, like those who participated in the DAPL demonstrations, could now face felony charges, while those charged with “aiding” protests could face harsh fines.

U.S. natgas futures rebound in choppy trade despite bearish outlook - U.S. natural gas futures rose in choppy trading on Monday, buoyed by technicals and slightly lower production estimates for the week, although elevated overall output and lower consumption forecasts clouded the outlook. Front-month gas futures NGc1 for October delivery rose 28.6 cents, or 3.6%, to $8.28 per million British thermal units (mmBtu) by 11:17 a.m. EDT (1517 GMT), reversing some declines from earlier in the session. The contract fell about 9% last week, its biggest weekly loss since late June and the first time it fell for three weeks in a row since early July. Data provider Refinitiv projected average gas output in the U.S. Lower 48 states at 98.9 billion cubic feet per day (bcfd) for the current week, slightly lower than the 99.3 bcfd in the prior week. But this was well above the five-year average of 87 bcfd. However, some analysts said there did not seem to be any clear fundamental driver at this point for the current uptick, although a break above technical resistance seemed to trigger fresh buying. So far this year, gas futures were up about 124% as higher prices in Europe and Asia keep demand for U.S. LNG exports strong. Global gas prices have soared due to supply disruptions and sanctions linked to Russia’s Feb. 24 invasion of Ukraine. The rise in gas futures, meanwhile, came despite the ongoing outage at the Freeport liquefied natural gas (LNG) export plant in Texas, which has left more gas in the United States for utilities to inject into stockpiles for next winter. Dutch wholesale gas prices, meanwhile, fell on comfortable supply and storage levels while prompt British prices rose in expectation of higher demand over the weekend. Last week, gas speculators increased net short positions by 27,316 contracts to 49,387 on the New York Mercantile and Intercontinental Exchanges, according to the U.S. Commodity Futures Trading Commission’s Commitments of Traders report. .

Natural Gas Futures Extend Win Streak Amid Lingering Domestic, Global Supply Concerns - Natural gas futures on Monday advanced for a third consecutive session, propelled by festering worries about winter storage inadequacy. The October Nymex gas futures contract jumped 25.3 cents day/day and settled at $8.249/MMBtu. November rose 24.3 cents to $8.287. NGI’s Spot Gas National Avg. followed suit, gaining 18.5 cents to $7.620.“The storage situation is definitely not going away – unless we start to get a lot bigger injections over the next few weeks,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI. The U.S. Energy Information Administration (EIA) last Thursday reported an injection of54 Bcf natural gas into storage for the week ended Sept. 2.The result fell short of the five-year average build of 65 Bcf and left stocks well below historic norms. Working gas in storage rose to 2,694 Bcf, according to EIA. However, stocks were 222 Bcf lower than a year earlier and 349 Bcf below the five-year average.Saal noted that production rose notably in recent weeks to meet both strong domestic demand and elevated calls from Europe and Asia for U.S. exports. At the same time, he said, cooling demand is fading as fall weather emerges in northern regions.“Even so, we may need to see even more production increases,” Saal said. “Overall demand is going to stay high because the growth in LNG is real and looks likely to last” into next year and beyond.

U.S. natgas futures edges up on threat of railroad strike (Reuters) - U.S. natural gas futures edged up to a fresh a one-week high on Tuesday on worries a possible railroad strike could threaten coal supplies to power plants, which could force generators to burn more gas to produce electricity. The White House made contingency plans seeking to ensure deliveries of critical goods in the event of a shutdown of the U.S. rail system while again pressing railroads and unions to reach a deal to avoid a work stoppage affecting freight and passenger service. "Market players ... fixated on the potential for U.S. coal supplies to be threatened amid a looming strike by the U.S. railroad union workers later this week," analysts said, noting the market ignored several bearish factors. Those bearish factors included record output, forecasts for lower demand next week than previously expected and the ongoing outage at the Freeport liquefied natural gas (LNG) export plant in Texas, which has left more gas in the United States for utilities to inject into stockpiles for next winter. Front-month gas futures rose 3.5 cents, or 0.4%, to settle at $8.284 per million British thermal units (mmBtu), their highest close since Sept. 2 for a second day in a row. That also put the contract up for a fourth day in a row for the first time since May. So far this year, gas futures are up about 123% as higher prices in Europe and Asia keep demand for U.S. LNG exports strong. Global gas prices have soared due to supply disruptions and sanctions linked to Russia's Feb. 24 invasion of Ukraine. Gas was trading around $56 per mmBtu in Europe and $53 in Asia. Data provider Refinitiv said average gas output in the U.S. Lower 48 states have risen to 93.1 bcfd so far in September from a record 98.0 bcfd in August. With the coming of cooler autumn weather, Refinitiv projected average U.S. gas demand, including exports, would slip from 93.1 bcfd this week to 92.7 bcfd next week. The forecast for next week was lower than Refinitiv's outlook on Monday.

Natural Gas Prices Surge Wednesday Across Futures, Cash Markets - Boosted by late-season heat, domestic storage concerns and robust global demand, natural gas futures on Wednesday rallied for a fifth-straight session. The October Nymex gas futures contract spiked 83.0 cents day/day and settled at $9.114/MMBtu, marking its biggest jump in the latest bull run. November gained 83.3 cents to $9.167. NGI’s Spot Gas National Avg. rose 28.0 cents to $8.155, extending its rally to three days amid a reemergence of summer warmth in the nation’s midsection. The natural gas market has been moving “from strength to strength,” analysts at Evercore ISI said Wednesday They noted robust demand for U.S. LNG exports – hovering near capacity – as Europe scrambles to ward off an energy crisis hastened by Russia’s war in Ukraine. Russia, long a key supplier of gas to the continent, has cut off the bulk of its pipeline deliveries to countries throughout Europe. Asian countries are now ramping up calls for liquefied natural gas as they move with haste to fortify supplies ahead of winter. What’s more, the Evercore team noted, coal-to-gas switching in the power sector continues to mount as the United States steadily retires coal plants. And, of course, seemingly endless summer heat continues to scorch much of the country into mid-September. Markets as far north as the Dakotas are forecast to endure highs in the 90s this week, keeping air conditioners cranking at the level once reserved for brief bouts from July to early August. “We must acknowledge the strong support for both higher LNG send-outs” and “even more significantly a hot summer,” the Evercore analysts added. Rystad Energy’s Zongqiang Luo, senior analyst, expects both continued strong domestic gas consumption and enduring demand for LNG. He, too, noted fallout from Russia’s actions and expectations that Europe will need as much American LNG as it can get to ensure adequate supplies for the coming winter. “Months of geopolitical wrangling have left the European gas market whiplashed, with volatile prices stemming from lack of supply, potential market intervention, and wider uncertainty,” Luo said. “In the view of most experts and policymakers,” the European gas market “is broken. But how it should be supported or fixed is an ongoing conversation with no clear resolution in sight.” NatGasWeather noted that a threatened rail strike in the United States may also have boosted bullish sentiment in the market. More notably, forecasts continue to show persistent heat. “The overnight data maintained unseasonably strong upper high pressure expanding to rule much of the U.S. next week, Sept. 18-22, resulting in widespread above normal temperatures,” NatGasWeather said Wednesday.

Natural Gas Futures Plummet After Negotiators Avert Railway Strike, EIA Prints Bearish Storage Print - Natural gas futures snapped a five-day rally and plunged in Thursday trading. The October Nymex gas futures contract fell 79.0 cents day/day and settled at $8.324/MMBtu after officials said a railway strike had been avoided and the latest government inventory report proved bearish. The prompt month had jumped 83.0 cents on Wednesday, the biggest gain in the multi-day rally. The November contract also dropped Thursday, shedding 79.5 cents to $8.372. NGI’s Spot Gas National Avg. followed suit and fell 49.0 cents to $7.665. The sell-off came amid reports Thursday that an agreement had been reached to avert a rail workers strike. “Disrupted freight rail lines could have snarled supply chains and cost the U.S. economy an estimated $2 billion per day,” “In the energy sector, disrupted freight coal transportation could have further strained precariously low coal inventories, leading coal operators to conserve scarce supplies, reduce coal generation, and increase the call on power sector gas demand.” However, President Biden on Thursday announced a tentative agreement to avert a walkout, alleviating coal delivery concerns and worries about economic fallout. The U.S. Energy Information Administration’s (EIA) latest storage report, meanwhile, furthered the case for bears. EIA printed an injection of 77 Bcf natural gas into storage for the week ended Sept. 9. The build kept inventories below average levels, but analysts on the online energy platform Enelyst said it reflected mounting production levels that could help narrow deficits as the market moves into shoulder season. Production early this month reached record levels above 100 Bcf/d, according to Bloomberg estimates, and output continued to hold near that level Thursday. The print also eclipsed market expectations. Prior to the EIA report, major polls found analysts expecting a slightly bullish result relative to the five-year average, with median estimates in the low 70s Bcf. The build in the comparable week of 2021 was 78 Bcf and the five-year average was 82 Bcf, according to EIA. The 77 Bcf injection for last week lifted inventories to 2,771 Bcf, though stocks remained below the year-earlier level of 2,994 Bcf and the five-year average of 3,125 Bcf. Looking ahead, however, analysts on Enelyst were looking for a build with next week’s print as high as the low 100s, citing the production increase. If that proves to be the case, it would mark only the second triple-digit increase of the current injection season and could put the market on track for adequate supplies ahead of winter.