largest jump in commercial oil inventories in 25 weeks, but 740,000 barrels per day were unaccounted for; distillates inventories at a 45 week low

US oil prices finished higher for the third time in four weeks after Israel stepped up its attacks on Gaza and the capital cities of Lebanon, Syria and Iran…,after falling 8.4% to $69.22 a barrel last week, the biggest weekly drop in a year, on a slew of weak economic data from China, and after Israel agreed not to target Iranian oil facilities, the contract price for the benchmark US light sweet crude for November delivery rose over 2% in early trading on Monday, after Chinese banks adopted extra stimulus measures in a bid to spur economic growth, and retraced some of the previous week’s losses amid the continuing geopolitical tension in the Middle East, and settled $1.34 higher at $70.56 a barrel as ongoing fighting in the Middle East and the expected Israeli retaliation on Iran kept markets worried about supply from the region….the expiring November oil contract extended its gains in early trading Tuesday, supported by the economic stimulus measures announced in China, and expired $1.53 higher at $72.09 a barrel as escalating conflict in the Middle East overshadowed hopes for a ceasefire, and traders focused on tightening supply conditions, while the more actively traded contract for the benchmark US light sweet crude for December delivery, which became the front-month contract at the close, rose $1.70, or 2.4%, to settle at $71.74 a barrel….with markets now quoting the December oil contract price, oil prices slid in overnight trading after the American Petroleum Institute reported US crude inventory unexpectedly rose by 1.6 million barrels, then fell further in Wednesday morning trading after the EIA reported a 5.5 million barrel increase, the largest crude inventory jump since April, and went on to settle 97 cents lower at $70.77 a barrel, as traders factored in continuing conflict in the Middle East…oil prices rose on global markets early on Thursday, spurred by ongoing concerns about supply disruptions particularly related to geopolitical tensions in the Middle East, then rallied to a high of $72.34 early in New York on the risk of wider conflict in the Middle East after Israel launched strikes on the Syrian capital Damascus, but turned south on reports that the U.S. and Israel would try to restart talks on a possible ceasefire in Gaza, and settled 58 cents lower at $70.19 a barrel….oil prices rose from there in Asian trading on Friday, as persistent concerns over a worsening Middle East conflict kept a risk premium largely in play, and rebounded further during the New York session, as geopolitical tensions in the Middle East triggered concerns over supply of crude oil, and settled $1.59 higher at $71.78 a barrel as Israel began to bomb Iran amid increasing uncertainty ahead of the approaching US election…oil prices thus finished 3.7% higher for the week, while the December oil contract, which had settled the prior week at $68.69 a barrel, ended 4.5% higher…

meanwhile, natural gas prices rose for the first time in four weeks on cooler forecasts and lower field production…after falling 14.2% to $2.258 per mmBTU last week on forecasts for a warm Autumn and hence a delayed start to the winter heating season, the price of the benchmark contract for natural gas for November delivery opened up 2 cents on Monday, but remained weak in early trading, as overnight forecasts had removed additional demand from the forecast, then climbed about 2% in afternoon trading to settle 5.4 cents higher at $2.312 per mmBTU on lower production so far this month and on forecasts for cooler weather and more heating demand next week than was earlier expected….natural gas prices opened 2 cents lower on Tuesday but rose to an intraday high of $2.375 by 10:15AM, as those with short positions took profits against weak weather forecasts, but rolling bouts of selling gradually dragged prices lower to settle down one-tenth of a cent at $2.311 per mmBTU, as forecasts for warmer-than-normal weather and low heating demand through early November and a drop in feedgas to LNG export plants were offset by a reduction in well output so far this month…natural gas prices opened 2 cents higher on Wednesday but drifted lower throughout the morning, as historically bearish short-term forecasts pushed prices to an intraday low of $2.286 by 1:25 PM, but rallied late to settle 3.1 cents higher at $2.342 per mmBTU despite fundamentals that continued to push against the upside…natural gas prices opened 9 cents higher on Thursday on a supportive shift in overnight forecasts, and rallied about 8% on short covering after pulling back on a bearish storage report to settle 18.0 cents higher, on rising prices for natural gas in global markets that should boost the value of U.S. LNG exports… natural gas traded lower early Friday, as traders weighed Thursday's bearish storage report against technical indicators leaning in favor of the bulls, but rallied after noon to settle 3.8 cents higher at $2.560 per mmBTU, with the late gains driven by traders squaring their positions ahead of the contract’s expiration early next week, leaving the contract price 13.4% higher on the week…

The EIA’s natural gas storage report for the week ending October 18th indicated that the amount of working natural gas held in underground storage rose by 80 billion cubic feet to 3,785 billion cubic feet by the end of that week, which left our natural gas supplies 106 billion cubic feet, or 2.9% above the 3,679 billion cubic feet that were in storage on October 18th of last year, and 167 billion cubic feet, or 4.6% more than the five-year average of 3,618 billion cubic feet of natural gas that had typically been in working storage as of the 18th of October over the most recent five years….the 80 billion cubic foot injection into US natural gas storage for the cited week was much larger than the 60 billion cubic foot addition to storage that analysts had forecast in a Reuters poll, but it was close to the 81 billion cubic feet that were added to natural gas storage during the corresponding week in October of 2023, and also fairly close to the average 76 billion cubic foot injection into natural gas storage that had been typical for the same early autumn week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA Largest Crude Inventory Jump Since April

US oil data from the US Energy Information Administration for the week ending October 18th indicated that after a big increase in our oil imports and an increase in oil supplies that the EIA could not account for, we had surplus oil to add to our stored commercial crude supplies for the fifth time in seventeen weeks, and for the 21st time in the past 46 weeks...Our imports of crude oil rose by an average of 902,000 barrels per day to 6,431,000 barrels per day, after falling by an average of 710,000 barrels per day to a seven month low over the prior week, while our exports of crude oil fell by an average of 11,000 barrels per day to 4,112,000 barrels per day, which, when used to offset our imports, meant that the net of our trade of oil worked out to a net import average of 2,319,000 barrels of oil per day during the week ending October 18th, 913,000 more barrels per day than the net of our imports minus our exports during the prior week. At the same time, transfers to our oil supplies from Alaskan gas liquids, from natural gasoline, from condensate, and from unfinished oils averaged 416,000 barrels per day, while during the same week, production of crude from US wells was unchanged at a record high of 13,500,000 barrels per day. Hence our daily supply of oil from the net of our international trade in oil, from transfers, and from domestic well production appears to have averaged a total of 16,235,000 barrels per day during the October 18th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,084,000 barrels of crude per day during the week ending October 18th, an average of 329,000 more barrels per day than the amount of oil that our refineries reported they were processing during the prior week, while over the same period the EIA’s surveys indicated that a net average of 891,000 barrels of oil per day were being added to the supplies of oil stored in the US… So, based on that reported & estimated data, the crude oil figures provided by the EIA appear to indicate that our total working supply of oil from net imports, from transfers, and from oilfield production during the week ending October 18th averaged a rounded 740,000 barrels per day less than what what was added to storage plus what our oil refineries reported they used during the week. To account for that difference between the apparent supply of oil and the apparent disposition of it, the EIA just plugged a [+740,000 ] barrel per day figure onto line 16 of the weekly U.S. Petroleum Balance Sheet, in order to make the reported data for the supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus indicating there must have been an error or omission of that size in the week’s oil supply & demand figures that we have just transcribed… However, since most oil traders react to these weekly EIA reports as if they were accurate, and since these weekly figures therefore often drive oil pricing and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it’s published, and just as it’s watched & believed to be reasonably reliable by most everyone in the industry…(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil supply, see this EIA explainer….there is also an old twitter thread from an EIA administrator addressing these ongoing weekly errors, and what they had hoped to do about it)

This week’s net average 891,000 barrel per day increase in our overall crude oil inventories came as an average of 782,000 barrels per day were being added to our commercially available stocks of crude oil, while an average of 109,000 barrels per day were being added to our Strategic Petroleum Reserve, the forty-fifth SPR increase in the past fifty-two weeks, following nearly continuous SPR withdrawals over the 39 months prior to that… Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports slipped to 6,206,000 barrels per day last week, which was 1.3% more than the 6,124,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be unchanged at a record high of 13,500,000 barrels per day because the EIA’s rounded estimate of the output from wells in the lower 48 states was unchanged at 13,100,000 barrels per day, while Alaska’s oil production was 5,000 barrels per day lower at 426,000 barrels per day, but still added the same 400,000 barrels per day to the EIA’s rounded national total as it did every week this year….US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 3.1% higher than that of our pre-pandemic production peak, and was also 39.2% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 89.5% of their capacity while processing those 16,084,000 barrels of crude per day during the week ending October 18th, up from from their 87.7% utilization rate of a week earlier, but not an unusual utilization fluctuation during early Autumn, when refineries typically schedule maintenance and seasonally change fuel blends…the 16,084,000 barrels of oil per day that were refined this week were 5.9% more than the 15,189,000 barrels of crude that were being processed daily during week ending October 20th of 2023, and 1.4% more than the 15,865,000 barrels that were being refined during the prepandemic week ending October 18th, 2019, a week when our refinery utilization rate was at a prepandemic below normal 85.2% for early October…

With the increase in the amount of oil being refined this week, gasoline output from our refineries was also higher, increasing by 666,000 barrels per day to 9,954,000 barrels per day during the week ending October 18th, after our refineries’ gasoline output had decreased by 941,000 barrels per day during the prior week.. This week’s gasoline production was 1.3% more than the 9,824,000 barrels of gasoline that were being produced daily over week ending October 20th of last year, but was 1.4% less than the gasoline production of 10,098,000 barrels per day during the prepandemic week ending October 18th, 2019….at the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 257,000 barrels per day to 5,011,000 barrels per day, after our distillates output had decreased by 234,000 barrels per day during the prior week. After twenty-three production increases in the past thirty-four weeks, our distillates output was 5.9% more than the 4,733,000 barrels of distillates that were being produced daily during the week ending October 20th of 2023, and 5.2% more than the 4,765,000 barrels of distillates that were being produced daily during the pre-pandemic week ending October 18th, 2019…

With this week’s increase in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the seventh time in seventeen weeks, increasing by 878,000 barrels to 213,575,000 barrels during the week ending October 18th, after our gasoline inventories had decreased by 2,201,000 barrels to a 99 week low during the prior week. Our gasoline supplies rose this week even though the amount of gasoline supplied to US users rose by 218,000 barrels per day to 8,838,000 barrels per day, and as our imports of gasoline fell by 12,000 barrels per day to 514,000 barrels per day, while our exports of gasoline fell by 13,000 barrels per day to 886,000 barrels per day.…After twenty-three gasoline inventory withdrawals over the past thirty-eight weeks, our gasoline supplies were 4.4% below last October 20th’s gasoline inventories of 223,457,000 barrels, and were about 3% below the five year average of our gasoline supplies for this time of the year…

Despite this week’s increase in our distillates production, our supplies of distillate fuels fell for the 5th consecutive week and for the 23rd time in the past thirty-nine weeks, decreasing by 1,140,000 barrels to a forty-five week low of 113,839,000 barrels over the week ending October 18th, after our distillates supplies had decreased by 3,534,000 barrels during the prior week. Our distillates supplies fell by less this week because the amount of distillates supplied to US markets, an indicator of domestic demand, fell by 81,000 barrels per day to 4,131,000 barrels per day, and even as our imports of distillates fell by 27,000 barrels per day to 105,000 barrels per day, and as our exports of distillates fell by 31,000 barrels per day to 1,148,000 barrels per day....Even after 23 inventory withdrawals over the past 39 weeks, our distillates supplies at the end of the week were 1.6% above the 112,087,000 barrels of distillates that we had in storage on October 20th of 2023, while they are now about 9% below the five year average of our distillates inventories for this time of the year…

Finally, with the decrease in our oil imports and the increase in our oil exports, our commercial supplies of crude oil in storage rose for the 10th time in twenty-six weeks, and for the 25th time over the past year, increasing by 5,474,000 barrels over the week, from 420,550,000 barrels on October 11th to 426,024,000 barrels on October 18th, the largest inventory jump since April, after our commercial crude supplies had decreased by 2,191,000 barrels over the prior week… Even with this week’s big increase, our commercial crude oil inventories remained about 4% below the most recent five-year average of commercial oil supplies for this time of year, but were about 26% above the average of our available crude oil stocks as of the third weekend of October over the 5 years at the beginning of the past decade, with the big difference between those comparisons arising because it wasn’t until early 2015 that our oil inventories had first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns in the Spring of 2020, then jumped again after February 2021’s winter storm Uri froze off US Gulf Coast refining, but then fell sharply due to higher exports relating to the onset of the Ukraine war, only to jump again following the Christmas 2022 refinery freeze offs, our commercial crude supplies have somewhat levelled off since, and as of this October 18th were 1.2% more than the 421,120,000 barrels of oil left in commercial storage on October 20th of 2023, while 3.2% less than the 439,945,000 barrels of oil that we had in storage on October 21st of 2022, and 0.1% less than the 426,544,000 barrels of oil we had left in commercial storage on October 15th of 2021…

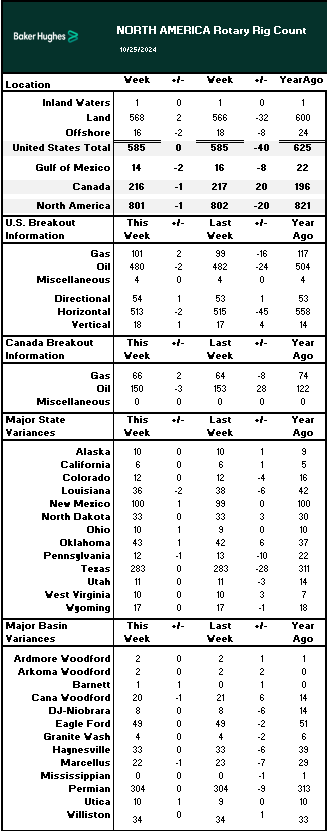

This Week’s Rig Count

Once again, we are including below a screenshot of the rig count summary from Baker Hughes…in the table below, the first column shows the active rig count as of October 25th, the second column shows the change in the number of working rigs between last week’s count (October 18th) and this week’s (October 25th) count, the third column shows last Friday’s October 18th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting period a year ago, which in this week’s case was the 27th of October, 2023…

++++++++++++++++++++++++++++++++++++++++++++++++

Ohio Delays Decision on More Fracking Under Salt Fork State Park - The Ohio Oil & Gas Land Management Commission (OGLMC) met yesterday to consider whether to allow fracking under (not on) two Ohio state-owned lands, including the Leesville Wildlife Area in Carroll County and Salt Fork State Park in Guernsey County. Commissioners approved moving forward to the next step with Leesville, which is to accept bids. They also voted to delay a decision on more fracking under Salt Fork State Park.

Ohio opens state wildlife area for fracking; defers ruling on drilling expansion in state park - cleveland.com By Jake Zuckerman, A state panel on Monday approved an industry application to open about 62 acres of a preserved wildlife area in Carroll County for oil and gas drilling. The decision from the Oil and Gas Land Management Commission triggers a competitive bidding process through which the state will select the “highest and best” bid for mineral rights to access oil or gas reserves under Leesville Wildlife Area in eastern Ohio.

Sixty-two acres of land at Ohio's Leesville Wildlife Area are one step closer to being fracked • Ohio Capital Journal --About 62 acres of Leesville Wildlife Area were approved to move forward to bidding for fracking during Monday’s seven minuteOhio Oil and Gas Land Management meeting.This is about 15% of the total land in Leesville Wildlife Area, which is located in Carroll County. “The commission did not consider any ‘highest and best’ bids for the leasing of mineral rights at this meeting, only nominations were considered,” Ohio Department of Natural Resources spokesperson Karina Cheung said in an email. “According to statute, all nominations and bids remain anonymous until the ‘highest and best’ bidder is announced.”The new OGLMC Chair Theresa White decided to hold off on making a decision about 884 acres of land at Salt Fork State Park in Guernsey County. “Going through the comments and the documents submitted for these nominations, I wonder if we might hold off on making determinations on these nominations,” White said. “There were over 360 total comments submitted on these and I would appreciate some more time to weigh the pros and cons before making a decision. … I would like to request that we delay action on these nominations until our next meeting.”The two other commissioners who were present at the meeting — Jim McGregor and Stephen Buehrer — agreed to wait until the commission’s next meeting. The next meeting has not been scheduled yet. Anti-fracking advocates at Monday’s meeting were surprised White and the commissioners decided to delay the Salt Fork decision. “I see that as a positive,” Melinda Zemper, with Save Ohio Parks, said after Monday’s meeting. “We don’t know why, but we’re just going to continue trying to educate the people of Ohio about the irrevocable effects that fracking will have on our environment and people’s health and our natural resources. So we’ll be back at the next meeting and beyond.” Jenny Morgan, also with Save Ohio Parks, was not as optimistic. “Every time they hold off, they just come back and vote yes,” she said after the meeting. “So it didn’t mean anything to me, really. It just means they’ll come back and they’ll vote it in because it just seems like they have the ear of the industry. They haven’t listened to the public.”There were more than 1,400 fracking incidents associated with oil and gas wells in Ohio between 2018 and September 2023, according to FracTracker Alliance — a nonprofit that collects data on fracking pipelines. About 10% of those incidents were reported as fires or explosions.During that same time period, there were 56 total incidents in Guernsey County (where Salt Fork is located), according to FracTracker. Before Monday’s brief meeting, several Save Ohio Parks volunteers took turns speaking outside the Ohio Department of Public Safety building (where the OGLMC’s meetings are held). “Folks commonly say they love taking their kids or grandkids to our state parks, so why on Earth would anyone want to damage these cherished spaces?” Save Ohio Parks volunteer Shannon Flanders asked. “And how will the animals, plants, lakes, and woods survive such harm? … It is absurd to allow out-of-state oil and gas companies to disrupt the outdoor, natural sanctuaries we love in Ohio.” Cathy Cowan Becker read comments that were submitted to ODNR about the acres of land in question at Leesville Wildlife Area and Salt Fork State Park.“As a frequent boater on Leesville Lake and a year round resident of Carroll County, I am firmly opposed to fracking this wildlife area,” Cowan read from a comment that was submitted.

Encino Looks to Expand Drilling Under & Around Leesville Lake, OH - - Marcellus Drilling News - Encino Energy wants to establish new oil and gas wells on Leesville Lake lands owned by the Muskingum Watershed Conservancy District (MWCD) in Carroll County. The conservancy district’s board of directors is expected to consider a lease agreement with the company’s Ohio affiliate at its meeting tomorrow. The left is apoplectic. The MWCD manages over 54,000 acres of land in Ohio. Over the past decade, the MWCD has leased over half of that land for shale drilling. This isn’t the conservancy’s first rodeo with shale drillers. Encino is one of four operators the MWCD has leased with and is the largest of the four that leases MWCD-owned acreage.

EIA: Utica Shale Gas Production Dropped 10% First 9 Mos. of 2024 - Marcellus Drilling News - The U.S. Energy Information Administration (EIA) reports that U.S. natural gas production from shale and tight formations declined by about 1% from January through September 2024 compared to the same period in 2023. Most of the decline comes from two shale plays—the Haynesville in Louisiana and Texas (down 12%) and the Utica Shale in Ohio, Pennsylvania, and West Virginia (down 10%). Although the EIA’s analysis (below) is excellent and instructive, it misses one important detail about the decrease in Utica Shale gas production

OH Lawmakers Asked to Waive Competitive Bids to Plug Orphaned Wells -- Marcellus Drilling News - The Ohio Department of Natural Resources (ODNR) asked a panel of lawmakers called the Ohio Controlling Board to waive the need for competitive bidding for $11.2 million in contracts to plug orphaned oil and gas wells around the state. Yesterday, the Controlling Board approved the request. The contracts were awarded to two companies: Next LVL Energy (owned by Diversified Energy) will receive $7 million, and CSR Services will receive $4.2 million

Ohio Oil and Gas Association opposes Issue 1 - Energy and Policy Institute - -The Ohio Oil and Gas Association has come out in opposition to Issue 1, the ballot initiative that aims to depoliticize how voting districts are drawn in Ohio and end partisan gerrymandering. “During its September meeting, OOGA’s Board of Trustees voted to OPPOSE Issue 1,” an Ohio Oil and Gas Association (OOGA)document posted with the group’s online 2024 election guide said.OOGA’s Board of Trustees includes more than forty individuals representing companies involved in the oil and gas industry, including Ariel Corporation, Blackrock Resources, CNX Resources, Enbridge, Energy Transfer, EOG Resources, EQT Corporation, Gulfport Energy, Knox Energy, and Southwestern Energy, which merged with Chesapeake Energy earlier this year. “VOTE NO on Issue 1,” a banner positioned at the top of OOGA’s online election guide now says. OOGA’s opposition to Issue 1 puts the oil and gas industry association at odds with a majority pof Ohio voters who plan to vote “Yes” on Issue 1, according to polling done by Bowling Green University in September. Partisan gerrymandering has enabled one-party rule by Republicans in Columbus. Republican state lawmakers have used their supermajorities in the Ohio House and Senate to enact controversial laws backed by OOGA and its members. Republican lawmakers passed House Bill 201 last year with support from OOGA. The new law allows gas utilities to charge Ohio customers millions of dollars annually to fund what H.B. 201 opponents like state senator Kent Smith, a Democrat, call pipelines to nowhere. In 2022, Republicans pushed through state legislation, House Bill 507, backed by OOGA to open up state parks to fracking for oil and gas. H.B. 507 also redefined methane gas, a fossil fuel, as “green energy” in Ohio. The move was backed by The Empowerment Alliance (TEA), a project of Republican megadonor couple Karen Buchwald Wright and Tom Rastin, whose family owns Ariel Corp. OOGA honored Buchwald Wright earlier this year with its Patriot Award. The OOGA document detailing the industry group’s opposition to Issue 1 links to the website of Ohio Works for more information. Ohio Works is a 501(c)(4) organization and ballot issue PAC that spent more than $1.7 million in September opposing Issue 1 and Democratic presidential candidate Kamala Harris, according toFederal Elections Commission (FEC) filings. The Energy and Policy Institute emailed a spokesperson for OOGA to ask if the industry group or its PAC has contributed any money to Ohio Works, which has yet to disclose any of its donors in campaign finance filings with the FEC and Ohio Secretary of State. OOGA had not responded at the time this blog was published. Ohio Works’ website lists OOGA as a “NO ON 1 TEAM” member.

What Harris and Trump have said about fracking and the environment - Ohio Capital Journal -- Vice President Kamala Harris and former President Donald Trump both say they don’t want to get rid of fracking, but that’s about where their similarities seem to end when it comes to their stance on the environment. Harris flip-flopped on her position of fracking. When she ran for president in 2019 she said she wanted to ban fracking, but changed her tune when she became President Joe Biden’s running mate. Now, she’s saying she would not ban fracking if elected president. “Let’s talk about fracking because we’re here in Pennsylvania,” Harris said during last month’s presidential debate in Philadelphia. “I made that very clear in 2020 I will not ban fracking. I have not banned fracking as vice president of the United States. … My position is that we have got to invest in diverse sources of energy so we reduce our reliance on foreign oil.”Pennsylvania is a key swing state in this year’s election and is one of the country’s largest producers of natural gas. Trump, who has been quick to point out Harris’ change in her stance on fracking, says he wants to increase fracking leases on federal lands. “We will drill, baby, drill,” Trump said over the summer at the Republican National Convention. Despite changing her stance on fracking, Save Ohio Parks doesn’t think that will hurt Harris. “I think I see that personally as a way to moderate her stances,” said Melinda Zemper, a volunteer with Save Ohio Parks. “Harris has been supportive of clean energy in the past, so we see her as more malleable in the terms of creating energy policy that is aggressive enough to allow us to have our children and grandchildren exist on a livable planet.” Fracking has been documented in over 30 states, according to the Center for Biological Diversity. Vermont, New York, Maryland, Washington and California all ban fracking, according to the Center for Biological Diversity. According to a recent Pew Research Center survey, 44% of Americans support more fracking for oil and gas in the United States and 53% are against it. The United States is producing more oil and natural gas than ever before and way more than any other country. Drilling companies can frack in Ohio State Parks and the Ohio Oil and Gas Land Management Commission has granted the mineral rights to many oil and gas companies so they can frack under land owned by the Ohio Department of Natural Resources and the Ohio Department of Transportation. There were more than 1,400 fracking incidents associated with oil and gas wells in Ohio between 2018 and September 2023, according to FracTracker Alliance — a nonprofit that collects data on fracking pipelines. About 10% of those incidents were reported as fires or explosions.“What ends up happening is you end up taking places like Appalachia, eastern part of Ohio, southeastern part of Ohio, and you make it like, frankly, a sacrifice zone in the name of resource colonization,” said Ted Auch, Fractracker Alliance Midwest Program Director. “We did this with coal, we do it with steel, we do it with timber, and now we’re doing with oil and gas.” Presidents do not have the ability to ban fracking without support from Congress. A president can, however, impact fracking on federal land, Auch said.“The way that I looked at it is like the Democrats talk a big game, end up doing very little in terms of pushing the needle on a renewable future, and they they are more polite and discreet about how they go about business, while the Republicans say the quiet part out loud, but at the end of the day, both parties are beholden to fossil fuel industry to varying degrees,” he said.

14 New Shale Well Permits Issued for PA-OH-WV Oct 14 – 20 - Marcellus Drilling News - For the week of Oct 14 - 20, there were 14 permits issued to drill Marcellus/Utica wells, up from 10 permits issued the prior week. The Keystone State (PA) had just four new permits (down from six the previous week), with three going to Southwestern Energy (now Expand Energy) in Susquehanna County and one for Seneca Resources in Lycoming County. The Buckeye State (OH) had seven new permits, with six going to Encino Energy (EAP) for two pads in Carroll County. The other OH permit was for Ascent Resources in Harrison County. The Mountain State (WV) issued three new permits, with all three going to Southwestern Energy (now Expand Energy) in Marshall County. ASCENT RESOURCES | CARROLL COUNTY | ENCINO ENERGY | HARRISON COUNTY | LYCOMING COUNTY | MARSHALL COUNTY | SENECA RESOURCES | SOUTHWESTERN ENERGY | SUSQUEHANNA COUNTY

PA Rig Count Stays Down, M-U @ 32; National Count Drops 1 @ 585 - Marcellus Drilling News - Two weeks ago, Pennsylvania lost two rigs, down to just 13 active rigs, the lowest PA's rig count has been since July 2016 (see PA Craters, Drops 2 Rigs, M-U @ 32; National Rig Count Adds 1 @ 586). That’s the lowest rig count for PA in more than eight years. Last week, PA and the other two Marcellus/Utica states, OH and WV, remained constant in their rig counts (13, nine, and ten, respectively). The national rig count collectively lost one rig last week and now stands at 585.

Range Resources marks 20th anniversary of first Marcellus Shale well - Pittsburgh Business Times -- Range Resources Corp. executives, employees and community members on Wednesday marked the 20th anniversary of a single 8,470-foot well in Mount Pleasant Township, Washington County, that spawned the American shale gas revolution. Range is one of the state's biggest natural gas producers, and it exclusively produces in southwestern Pennsylvania where it also has a big community presence and a regional headquarters at Southpointe. Range under a different name had a long history in conventional oil and gas drilling in Appalachia before October 2004, when geologist Bill Zagorski and the Range team found success in unlocking a reservoir of natural gas two miles under Mount Pleasant above a family farm. The company's success — and others like it in Pennsylvania, West Virginia and eastern Ohio — not only discovered how to bring to the surface oil, gas and other liquids from the Marcellus and Utica shales but they transformed the region into the biggest natural gas field in the United States with an estimate of more than 96.5 trillion cubic feet of natural gas in the Marcellus alone. And Pennsylvania, thanks to Range and others, have helped the United States become energy independent, something it wasn't in 2004 when the Renz well was drilled.

Murrysville Rejects Antis’ Petition to Cancel Leases Under Parks - - Marcellus Drilling News - Last December, Murrysville (PA) Council members voted to lease land for shale drilling under two town parks—Duff Park and Murrysville Community Park (see Murrysville, PA to Vote in Dec. on Plan to Drill Under Two Parks). Murrysville is located in Westmoreland County, in the southwestern part of the state. Olympus Energy pitched proposals to lease under both parks, using their adjacent leased acreage (on private land) to set up rigs to drill under the parks, which the council approved. The council also approved a lease last year with Apex Energy to drill and frack under Kovalczik Park. Last week, so-called environmental group Protect PT presented a petition to the council asking them to rescind the leases for drilling under the three parks.

PA Oil & Gas Weekly Compliance Dashboard - October 5 to 18 - Conventional Well Owners Issued 767 Violations For Abandoning Their Wells - So Far, More Than Double Number In 2019; Leaking Gas Storage Area Wells -From October 5 to 18, DEP’s Oil and Gas Compliance Database shows oil and gas inspectors filed 1,474 inspection entries, along with inspection reports from previous weeks. So far this year, DEP took these actions as of October 4--

- -- NOVs Issued In Last Week: 27 conventional, 13 unconventional

- -- Year To Date - NOVs Issued: 6,264 conventional and 791 unconventional

- -- Enforcements 2024: 398 conventional and 101 unconventional (orders, agreements)

- -- Inspections Last Week: 313 conventional and 318 unconventional

- -- Year To Date - Inspections: 13,117 conventional and 18,768 unconventional

- -- Wells Drilled Last Week: 4 conventional and 9 unconventional

- -- Year To Date Wells Drilled: 131 conventional and 235 unconventional

On October 3, 2024, DEP did follow-up inspections of 2 conventional wells-- GE Klayer 2 and Rahl & Burnwell 524-- serving the Eastern Gas Transmission & Storage Inc. North Summit Gas Storage Reservoir in Wharton Township, Fayette County and found them abandoned, not plugged and leaking gas. The original violations for abandonment were issued on August 16, 2024 and the well owner failed to permanently plug the wells and stop the gas leaks. DEP’s inspection reports [example] requested the well owner to again submit a plan by November 10, 2024 on how the wells will be brought into compliance. On October 11, 2024, DEP inspected the WK Stewart 1 conventional well owned by Big Sand Drilling Co Inc. in Lower Burrell City, Westmoreland County and found it to be abandoned and not plugged with a faint odor of gas.The owner also failed to submit production, waste generation and well integrity reports for at least five years.DEP’s inspection report requested the owner to submit a plan by October 31, 2024 on how the well will be brought into compliance.On October 15 & 16, 2024, DEP inspected 3 conventional oil and gas wells-- Detwiler Unit 1, James Noel 1, Walker 1616-- in Addison Township, Somerset County owned by Oil & Gas MGMT Inc. and found them all to be abandoned and not plugged.The original violations for abandonment were issued on or about November 14, 2023 and the well owner failed to do anything in response to the violations.DEP’s inspection reports [example] continued the abandonment violations and others for failure to submit annual production and waste reports and requested the well owner to submit a plan by October 25, 2024 on how the wells will be brought into compliance.On October 8, 2024, DEP did a follow-up inspection of the Allshouse 3492 conventional gas well owned by Diversified Prod LLC in Knox Township, Jefferson County and found the abandoned well was in the process of being plugged.DEP inspected the well on October 2 as part of a stray gas investigation and had issued violations related to abandonment on May 6, 2024. Read more here.DEP’s inspection report noted the plugging operation found the well casing was compromised by holes in multiple locations.DEP said the violations related to abandonment will be continued until the job is done. DEP also inspected at least 18 other conventional oil and gas wells with Unknown owners to confirm their coordinates and evaluate them for consideration under the federal conventional oil and gas well plugging program. So far in 2024, DEP issued 767 new or continued violations to conventional oil and gas well owners for abandoning and not plugging their wells.So far in 2024, 26 violations were issued or continued to 10 shale gas well owners [Diversified Prod LLC; Big Dog Energy LLC follow-up; Big Dog Energy LLC; EQT Production Co.; Diversified Prod LLC; Chesapeake Appalachia LLC, Atlas Resources, LLC; Atlas Resources, LLC (follow-up inspection)’ Repsol Oil & Gas, EQT Chap LLC; M4 Energy; M4 Energy (follow-up inspection); EQT (Rice Drilling B LLC); and Roulette Oil & Gas LLC; Roulette Oil & Gas LLC (follow-up inspection)] for abandoning wells and not plugging wells.On October 17, 2024, DEP reported sample results confirmed a spill of shale gas wastewater occurred at the Donna shale gas well pad in Terry Township, Bradford County owned by Chesapeake Appalachia, LLC.DEP found the spill on September 30 during a routine inspection.DEP’s inspection report includes additional violations related to the spill, and for failing to notify DEP. Because an unknown quantity of wastewater was released, DEP recommended Chesapeake remediate the area under the Act 2 Land Recycling Program.DEP again requested the well pad owner to submit a plan by November 8, 2024 on how the pad will be brought into compliance.On October 17, 2024, DEP reported sample results confirmed a spill of shale gas wastewater occurred at the Tract 726D shale gas well pad in Plunketts Creek Township, Lycoming County owned by PA General Energy Co LLC.The spills were discovered during a routine DEP inspection on October 3.Because an unknown quantity of wastewater was released, DEP recommended PA General Energy remediate the area under the Act 2 Land Recycling Program.DEP’s inspection report again requested the well pad owner to submit a plan by November 8, 2024 on how the pad will be brought into compliance.On October 7, 2024, DEP did a routine inspection of the Bowers 408 shale gas well pad in Jackson Township, Tioga County owned by Repsol Oil & Gas USA LLC and found a build up of wastewater in secondary containment around the waste storage tanks.Elevated levels of conductivity were also found outside the containment indicating there may be a leak. A Repsol representative contacted DEP the following day and said the wastewater had been removed from a well cellar and that it had been constructed of corrugated metal that deteriorated over time. DEP’s inspection report requested the well owner to submit a plan by October 24, 2024 on how the well pad will be brought into compliance.So far in 2024, DEP received or acted on 228 Act 2 Land Recycling notices and reports related to oil and gas facility site cleanups. Read more here.On October 1, 2024, DEP and a representative of EPA’s Underground Injection Control Program inspected the Green Glen Corp 4 conventional well being used as an observation well for the Povlik #1 underground oil and gas wastewater injection well owned by Danken-Sammer LLC in Huston Township, Clearfield County.The inspection found the Green Glen Corp 4 well was leaking gas and had increasing fluid levels indicating casing and/or cementing failures.DEP’s inspection report included violations related to failure to notify DEP of casing/cementing defects and failure to correct the problems. The well owner was requested to submit a plan by October 25, 2024 on how the well will be brought into compliance.DEP returned to the well on October 7, 2024 to take a sample of the gas for molecular and isotopic analysis to see if it matches gas from the Povlik #1 wastewater injection well. [DEP inspection report] On October 1, 2024, DEP inspected 7 conventional gas wells used as gas injection wells to service the Donegal Gas Storage Reservoir in Donegal Township, Washington County owned by Columbia Gas Transmission LLC and found them to be leaking gas.The wells included Columbia Gas 4078, Daisy Defrance 0, Stanley Buick L4077, Stanley Buick UX 3, Montgomery 1, Martin L3702 and Patterson L4079. DEP’s inspection reports [example] include multiple violations for leaking gas and request the well owner to submit a plan by November 2, 2024 to bring the wells into compliance.On October 6, 8 & 17, 2024, DEP inspected 6 more conventional gas wells used as gas injection wells to service the Donegal Gas Storage Reservoir in Donegal Township, Washington County owned by Columbia Gas Transmission LLC and found them all to be leaking gas.The wells included Patterson L3555, Grcich ET UX 0, DeFrance L4074, WS Main 4757; Daisy DeFrance 2 and Stanley Buick UX 0. DEP’s inspection reports [example] requested the well owner to submit plans by between November 9 and 17 (depending on the inspection date) for bringing the wells into compliance.These inspections continue DEP’s compliance review of Columbia’s Donegal Gas Reservoir which in the last several weeks found multiple abandoned and leaking gas wells. Read more here.On October 15, 2024, DEP’s Compliance Reporting Database shows a $1,000 penalty was assessed against BJS, LLC for failing to keep emergency contacting postings at three conventional well sites in the City of Warren up-to-date.On October 2, 2024, DEP was called to the site of three conventional wells in Warren after a lawnmower damaged a gas pipeline causing a leak. Read more here.The Warren Fire Department said incorrect information on emergency contact postings on the wells delayed a response to the incident.On October 8, 2024, DEP inspected the C&K Coal 13 conventional well in Boggs Township, Centre County owned by Capital Oil & Gas Inc. in response to a notification by the Capital well tender and the property owner of a wastewater spill.DEP found evidence of a spill and what “appeared to be a bullet hole” in the wastewater storage tank that caused the release of wastewater. DEP’s inspection report included violations for the spill and requested the well owner to submit a plan by October 28, 2024 on how the well site will be brought into compliance. On October 11, 2024, DEP inspected a surface water pipeline in Ward Township, Tioga County in response to a notification from Repsol Oil & Gas USA LLC the pipeline ruptured on October 10 and released an estimated 18,900 gallons of what the company was fresh water from an impoundment on DCNR State Forest land.The water washed out an area immediately at the site of the rupture, flowed into a roadside ditch and then into a culvert and across the lawn of a residence. DEP’s inspection report said conductivity measures confirmed it was fresh water and no violations were issued.

Environmental, Health Groups Submit Petition To Environmental Quality Board For More Protective Setbacks From Shale Gas Wells For Schools, Daycares, Hospitals, Buildings, Drinking Water Wells, Surface Water - On October 22, the Clean Air Council and Environmental Integrity Project filed a 358-page rulemaking petition with the Environmental Quality Board asking it to increase minimum setback distances from fracking wells. Setbacks, also referred to as protective buffers and no-drill zones in the context of fracking, are mandatory distances that fracking wells must abide by to keep them separated from homes, schools, hospitals, drinking water wells, and surface water. Pennsylvania’s current fracking well location requirements—which include a waivable 500-foot setback distance from buildings and a 1,000-foot setback distance from water supply extraction points—are woefully insufficient to protect public health and the environment from the numerous dangers of fracking, according to the petition..Clean Air Council, Environmental Integrity Project, and a coalition of environmental and public health organizations - called Protective Buffers PA - are calling for the following research-informed setbacks from any new unconventional shale gas well:

- -- 3,281 feet from any building;

- -- 3,281 feet from any drinking water well;

- -- 5,280 feet from any building serving vulnerable populations (e.g., schools, daycare centers, hospitals); and

- -- 750 feet from any surface water of the Commonwealth.

“The gas industry has dangerously encroached on our daily lives over the last twenty years.” said Alex Bomstein, Clean Air Council Executive Director. “Now, nearly 1.5 million Pennsylvanians live within a half mile of fracking. The harm that fracking inflicts on communities is unacceptable and no one deserves to live with fracking in their backyard.”“The research is clear that too many Pennsylvanians have suffered a decline in their health, quality of life, and property values as a result of oil and gas companies fracking too close to buildings, wells, and waters,” said Lisa Hallowell, Senior Attorney with the Environmental Integrity Project. “Pennsylvania agencies have a constitutional duty to heed the overwhelming evidence and require minimum setbacks to protect the Commonwealth’s residents and natural resources from further peril.”“20 years of fracking in Pennsylvania has spawned 20 years of research showing convincingly that living and working near fracking increases the risk of developing health problems,” said Ned Ketyer, MD, President of Physicians for Social Responsibility Pennsylvania. “And the closer you are to fracking the higher the risk. Increasing buffers from the present to at least 2500 feet from homes and 5000 feet from schools, hospitals, and other public buildings is a small but necessary step to protect the health of Pennsylvanians living near fracking.”“Living a little over 500 feet from Range Resources Augustine well pad has, for the past 4 years, caused many issues for my family of five,” said Michele Stonewark, Cecil Township, Washington County. “We’ve suffered health issues including headaches, nausea, and bloody noses, sleepless nights due to noise and vibrations and increased stress and anxiety that compounds all of the other issues. There are days we can not go outside due to awful diesel and chemical smells and my children are forced to stay indoors. All the while, the landowners of the pad, are the furthest away from the threat we live with every day. The importance of setbacks is an issue that I will fight with all of my being, not just for my family's health but for the health of all families in this Commonwealth.” “We have 12 well pads and one compressor station planned for our residential community and thousands of residents have already been harmed,” said Gillian Graber, impacted resident and Executive Director of Protect PT, Westmoreland County. “After a decade of working to protect my community, I am tired of waiting for our government agencies, Governor Shapiro, and our legislators to act in the best interest for Pennsylvanians. That is why we need to force the issue with this rulemaking petition to protect us from a toxic industry whose sole motivation is to make money as quickly and cheaply as possible.”When Governor Shapiro was Attorney General, the primary recommendation of the 43rd Statewide Investigating Grand Jury’s report on fracking was to enact a 2,500 foot no-drill zone between fracking and homes, as well as a 5,000 foot no-drill zone for schools and hospitals. [Read more here.]In the fall of 2023, Governor Shapiro instructed the Department of Environmental Protection to implement some of the Grand Jury recommendations for better protecting Pennsylvania residents from oil and gas operations, but this notably did not include setbacks. Instead of asking the DEP to develop greater setbacks for the oil and gas industry, he announced a partnership with CNX - a gas company with a history of environmental violations - that included a promise to adhere to voluntary, unenforceable setbacks from homes and schools at distances well below those recommended by the Grand Jury, according to the groups. [Read more here.]Fracking contaminates groundwater (used for public and private drinking water supplies) and also pollutes surface water, impacting headwater streams and other ecosystems. Furthermore, spills often occur in watersheds linked to drinking water sources, according to the groups.Dozens of peer-reviewed scientific studies show that a person’s proximity to fracking wells is associated with severe human health risks and a wide range of ailments, including increased cancer rates, increased hospitalization rates, and higher rates of respiratory, neurological, dermatological, and muscular symptoms. Vulnerable populations are particularly susceptible—numerous studies have shown that proximity to fracking wells harms health for infants and children. In addition to these studies, first-hand accounts of residents living near Pennsylvania fracking wells demonstrate the profound harms of living in close proximity to fracking, the groups said.The petitioners argue in detail-- “Establishing setback requirements as outlined in this Petition would constitute a valid exercise of the EQB’s authority granted by the Oil and Gas Act, the Air Pollution Control Act, and the Clean Streams Law, discussed in this in turn. “Indeed, failing to act on this Petition would violate many statutory obligations imposed on the Board to abate pollution in the state and limit public exposure to environmental harms.”“The EQB is also obligated by the ERA [Environmental Rights Amendment to the state constitution] to advance the Commonwealth’s duties as trustee of Pennsylvania’s public natural resources— a constitutional mandate with which all statutory directives must comport—further necessitating action on this Petition.” Click Here for a copy of the rulemaking petition. DEP must now evaluate the petition to determine if it meets the requirements for the Environmental Quality Board to take action on the issues it raises.DEP must notify the petitioner within 30 days of a petition’s receipt if it meets the requirements, although it has taken much longer for other petitions.Among the specific requirements is a determination of whether the EQB has the statutory authority to take the action requested by the petitioners.

Leftist Enviro Groups Ask PA EQB to Ban Fracking via Bigger Setbacks-- Marcellus Drilling News - Yesterday, the radicalized Clean Air Council and Environmental Integrity Project filed a rulemaking petition with the Pennsylvania Environmental Quality Board (EQB) asking the EQB to increase minimum setback distances from fracked wells. Setbacks, also referred to as protective buffers and no-drill zones in the context of fracking, are mandatory distances that fracked wells must abide by to keep them away from homes, schools, hospitals, drinking water wells, and surface water. PA already has a safe and sufficient setback of 500 feet. The groups want that increased by 650% to 3,281 feet. It would ban approximately 95% of all new shale wells in the state.

Susquehanna River Basin Conditions Trigger Low-Flow Water Use Restrictions At 9 Shale Gas Water Withdrawals In Bradford, Susquehanna, Tioga CountiesOn October 19, the Susquehanna River Basin Commission Hydrologic Conditions Monitor shows low stream flows in some areas have triggered water withdrawal restrictions to water users, including 9 shale gas development water withdrawals.Five more shale gas water withdrawals in Bradford, Tioga and Wyoming counties are approaching water restrictions. Shale gas water withdrawals tend to get hit first with withdrawal restrictions because they are often located on smaller streams.The shale gas water withdrawals impacted so far are-- Bradford County

- -- Repsol Oil & Gas USA, LLC - Fall Brook, Bense - Troy Township

- -- Repsol Oil & Gas USA, LLC - Sugar Creek - West Burlington Township

- -- Repsol Oil & Gas USA, LLC - Wappasening Creek Antisdel - Windham Township

Susquehanna County

- -- BKV Operating, LLC - UNT to Middle Branch - Wyalusing Creek - Forest Lake Township

- -- BKV Operating, LLC - East Branch Wyalusing Creek - Jessup Township

- -- Repsol Oil & Gas USA, LLC - Choconut Creek - Choconut Township

- -- SWN Production Company, LLC - Tunkhannock Creek - Lenox Township

Tioga County

- -- Seneca Resources Company, LLC - Crooked Creek - Middlebury Township

- -- Seneca Resources Company, LLC - Elk Run - Sullivan Township

Water withdrawals with restrictions found on the Hydrologic Conditions Monitor can be looked up on SRBC’s Search for Projects webpage.Contact the Susquehanna River Basin Commission to report suspected violations of these requirements.For more information on programs, training opportunities and upcoming events, visit the Susquehanna River Basin Commission website. Click Here to sign up for SRBC’s newsletter. Follow SRBC on Twitter, visit them on YouTube.

NYC Dem Politicians, Radical Groups Seek to Jail Big Oil Execs - Marcellus Drilling News - What is happening in American politics is shocking. Unfortunately, we are so shocked almost daily that we’re (as a society) becoming numb to it. Never in the history of our country have the members of one political party sought to jail their political opponents. It’s happening now, and the party/movement in question comes from the left. Democrat elected officials in New York City and progressive advocacy groups are pushing New York City’s prosecutors to charge fossil fuel companies AND their executives with crimes for “reckless endangerment” for their supposed role in causing “climate change.” Never mind that the left can’t prove mankind is catastrophically causing global warming (which is what they mean by climate change). They seek to jail people who disagree with them. It’s astonishing.

US shale production may decline for first time since 2000 - U.S. shale gas production is on track for its first annual decrease in nearly 25 years, according to the Energy Department’s statistical arm.Total U.S. shale gas production from January through last month dropped by roughly 1 percent compared to the same time period last year, the U.S. Energy Information Administration said in a research analysis Thursday. The agency attributed the dip in output to low natural gas prices, which prompted production declines in the Haynesville and Utica plays.Natural gas prices at the U.S. benchmark Henry Hub hit record lows in the first half of 2024, “making drilling natural gas wells less profitable, particularly in the Haynesville,” EIA said. Production in the Haynesville play, which covers parts of Texas and Louisiana, decreased by 12 percent during the first nine months of the year. The decrease was 10 percent in the Utica play, which crosses through New York, Ohio, Pennsylvania and West Virginia.

U.S. shale natural gas production has declined so far in 2024 - U.S. EIA - U.S. natural gas production from shale and tight formations, which accounts for 79% of dry natural gas production, decreased slightly in the first nine months of 2024 compared with the same period in 2023. If this trend holds for the remainder of 2024, it would mark the first annual decrease in U.S. shale gas production since we started collecting these data in 2000.Total U.S. shale gas production from January through September 2024 declined by about 1%, to 81.2 billion cubic feet per day (Bcf/d), compared with the same period in 2023, while other U.S. dry natural gas production increased by about 6% to 22.1 Bcf/d. Total U.S. dry natural gas production from January through September 2024 averaged 103.3 Bcf/d, essentially flat compared with the same period in 2023. The decline in shale gas production so far this year has been driven primarily by declines in production in the Haynesville and Utica plays. From January through September 2024, shale gas production decreased by 12% (1.8 Bcf/d) in the Haynesville and by 10% (0.6 Bcf/d) in the Utica compared with the same period in 2023. At the same time, shale gas production in the Permian play grew by 10% (1.6 Bcf/d). Production in the Marcellus play, which leads U.S. shale gas production, remained flat.The Haynesville play in northeastern Texas and northwestern Louisiana is a dry natural gas formation. The Utica and Marcellus plays in theAppalachian Basin produce lease condensate in addition to dry natural gas. In all three plays, natural gas prices mostly drive drilling and developing wells. The U.S. benchmark Henry Hub daily natural gas price has generally declined since August 2022 and reached record lows in the first half of 2024, making drilling natural gas wells less profitable, particularly in the Haynesville. Several operators in the Haynesville and the Appalachian Basin shut in natural gas production in reaction to historically low prices and intend to continue curtailments in the second half of 2024.In contrast, natural gas produced in the Permian play in western Texas and southeastern New Mexico is primarily associated gas from oil wells where drilling and development is driven by the oil price. Natural gas production in the Permian has increased this year along with increasing oil production.Shale natural gas production in the Utica was 5.6 Bcf/d in September, 33% less than the monthly high of 8.3 Bcf/d in December 2019 and 10% less than the average of 6.2 Bcf/d in 2023. At depths of 5,000 feet to 11,000 feet, wells in the Utica, which lies beneath the Marcellus, are slightly more expensive to drill than Marcellus wells because of their depth. Drilling costs of Haynesville wells, at depths of 10,500 feet to 13,500 feet, are even higher. Shale natural gas production in the Haynesville was 13.0 Bcf/d in September 2024, 14% less than the peak in May 2023. The Haynesville is the third-largest shale gas-producing play in the United States, behind the Marcellus and the Permian plays. In 2023, shale natural gas production in the Haynesville averaged 14.6 Bcf/d, accounting for 14% of total U.S. dry natural gas production. The U.S. benchmark Henry Hub natural gas price fell 79% from the August 2022 inflation-adjusted high of $9.39 per million British thermal units (MMBtu) to an average of $1.99/MMBtu in August 2024. So far this year, the price has averaged $2.10/MMBtu compared with an inflation-adjusted average of $6.89/MMBtu in 2022 and $2.62/MMBtu in 2023. As natural gas prices declined, the economics of producing natural gas in the dry gas formations worsened, leading producers to shut in production and drop drilling rigs.Producers tend to increase or decrease the number of drilling rigs in operation as natural gas prices fluctuate. The number of natural gas-directed drilling rigs in the Haynesville, Utica, and Marcellus plays has decreased steadily since the end of 2022, according to data fromBaker Hughes. In the Haynesville, an average of 33 rigs were in operation in September 2024, 53% fewer than in January 2023. The number of rigs operating in the Haynesville in September was the lowest it has been since July 2020. In the Utica, an average of seven rigs were operating in September 2024, fewer than half the number that were operating in January 2023, and in the Marcellus, an average of 25 rigs were in operation, about 36% fewer than in January 2023. Although the productivity of newer wells has improved in recent years, the decline in rig counts has contributed to an overall decrease in production.In our latest Short-Term Energy Outlook, we forecast total U.S. dry natural gas production to average 103.5 Bcf/d in 2024, down slightly from 103.8 Bcf/d in 2023, and to resume modest growth in 2025 at 104.6 Bcf/d.

WV’s Hope Gas Seeks to End “Farm Taps” for 600 Customers - Marcellus Drilling News - It is just coming to light for us now that back in August, Hope Gas, a large local utility company that provides gas service to more than 131,000 residential, industrial, and commercial customers in thirty-seven West Virginia counties, filed a rate case with the state Public Service Commission (PSC) looking to convert customers who use a “farm tap” gas system to either propane fuel or electric heat for their homes. The change would affect around 600 customers, removing them from the ability to use local natural gas.

Kentucky Utilities Want to Build 2 New NatGas Power Plants -- Marcellus Drilling News - Kentucky has seen unprecedented economic growth in recent years like other southern states. Data centers are looking to Kentucky for future expansion. Louisville Gas and Electric Company (LG&E) and Kentucky Utilities Company (KU), both part of PPL Corporation, are forecasting in their Integrated Resource Plan (IRP) the need for additional power generation due to the expected influx of data centers and economic development across their service territories. The companies want to build two new natural gas combined-cycle generation units---one in 2030 and another in 2031.

AES Indiana Committed to Converting Last Coal Plants to NatGas -- Marcellus Drilling News - AES Indiana, formerly known as Indianapolis Power & Light Company, is a utility company providing electric service to the city of Indianapolis. It is a subsidiary and largest utility of AES Corporation. In August, AES Indiana said that it wants to invest $1.1 billion in Pike County, IN, to convert the company’s two remaining coal-fired power plants to run natural gas instead (see AES Indiana Spending $1.1B to Convert Last Coal Plants to NatGas). Unfortunately, the coal lobby has pressured some Republican politicians, including Indiana's Republican candidate for governor, into opposing the plan. However, AES remains committed.

Natural Gas ‘Clear Winner’ as LNG Contracts and Equipment Orders Rising, Says Baker Hughes Chief -An “all-of-the above strategy” will be needed to meet the world’s growing energy consumption, but “in our view,” nothing beats natural gas, Baker Hughes Co. CEO Lorenzo Simonelli said Wednesday. Bar chart showing Baker Hughes' primary energy demand outlook through 2040 with historical comparison. Displays a modest energy growth forecast in Million tons of barrels of oil equivalent. Speaking with investors during the third quarter conference call, Simonelli noted that renewables demand is expanding significantly, providing a pathway to lower emissions. However, solar, wind and other alternatives cannot match the pace of global demand, he said. Meanwhile, oil consumption is flattening. That said, “natural gas is a clear winner,” he said. “This is the age of gas. By 2040, we expect natural gas demand to grow by almost 20%, and global LNG demand to increase at an even faster rate of 75%.”

ExxonMobil, Qatar get 3-yr extension to build their LNG plant in Texas -- Federal regulators on Thursday gave an ExxonMobil and Qatar Energy LNG joint venture a 3-yr extension to finish building their Golden Pass LNG plant, a regulatory document showed. The extension was granted due to delays caused when lead construction contractor Zachry Holdings filed for bankruptcy in March, according to a Federal Energy Regulatory Commision filing. The project, at the Sabine Pass site of a former gas-import terminal that was converted to process natural gas for LNG exports, is one of two large U.S. LNG facilities whose startups were expected to significantly expand supplies from the world's top exporter of the superchilled fuel in the next 12 months. The project's original main contractor, Zachry Holdings filed for Chapter 11 bankruptcy protection, saying the Golden Pass project - known as GPX - was at least $2.4 B over the original budget. Golden Pass is yet to announce a new EPC contractor and has been in negotiations with McDermott International to be the lead contractor on the project.

NextDecade Looks to Avoid Rio Grande LNG ‘Death Spiral’ with DC Circuit Court Rehearing - Rio Grande LNG LLC and Texas LNG Brownsville LLC have requested a rehearing in the U.S. Court of Appeals for the District of Columbia (DC) Circuit over a decision the firms said would derail U.S. project development and create judicial contradictions. The liquefied natural gas export project developers on Monday filed requests seeking a full panel of judges in the DC Circuit to revisit the August order that vacated and remanded FERC authorizations for Rio Grande LNG, the Rio Bravo Pipeline project and Glenfarne Energy Transition LLC’s proposed Texas LNG project (Nos. 23-1175, 23-1222). In Rio Grande LNG’s appeal, lawyers argued that taking the added step of vacating FERC’s authorization of the $18.4 billion LNG project is not supported by federal law and threatens to tank the project despite the likelihood that the Commission would grant its approval of the project for a third time.

Sharp Drop in U.S. Feed Gas Deliveries Stokes Natural Gas Price Volatility — Feed gas deliveries to U.S. LNG export facilities have slipped noticeably this week, largely because of outages at the Cameron and Sabine Pass terminals in Louisiana. Natural Gas Intelligence's (NGI) LNG export flow tracker showing operational export facilities' daily feed gas demand. Overall, deliveries were down 14% on Thursday to 12.4 Bcf/d from week-ago levels, when they hit their highest point of the year at 14.4 Bcf on Oct. 17, according to NGI data. Unplanned maintenance started at the Cameron liquefied natural gas facility over the weekend, and one train is expected to be offline until Friday, Rystad Energy analyst Masanori Odaka said Thursday. It’s unclear why the train is offline. Roughly 250 MMcf/d was impacted Tuesday and Wednesday because of scheduled work on the Columbia Gas Transmission system that helps feed Cameron, according to Wood Mackenzie.

Natural Gas Price Relief Prospects Shrinking as LNG Startups Delayed -The already slim prospects of additional feed gas demand lifting natural gas prices this year could be narrowing as the startup of another U.S. LNG export facility appears at risk of slipping into 2025. Natural Gas Intelligence's (NGI) graph showing all North American operational and under construction LNG export facilities. Graph shows when new export capacity would come online based on market estimates. Global expansions of liquefied natural gas export capacity are limited until 2030, leaving international buyers to hone in on any projects that might be able to help ease supply volatility in the near term. Most of those anticipated projects are sited on the Gulf Coast. However, construction delays have pushed the ramp up of one major project, Golden Pass LNG, to at least the second half of next year. That could limit the chances of added feed gas demand to raise domestic prices.

US natgas prices climb 2% on lower output, higher demand forecasts (Reuters) -U.S. natural gas futures climbed about 2% on Monday on lower output so far this month and forecasts for cooler weather and more heating demand next week than previously expected. Capping gains,meteorologists forecast mostly warmer weather through early November, which should limit gas demand. Front-month gas futures NGc1 for November delivery on the New York Mercantile Exchange rose 5.4 cents, or 2.4%, to settle at $2.312 per million British thermal units (mmBtu). Thefront-month remained intechnically oversold territory for a fourth straight day for the first time since February.On Friday, the contract closed at its lowest since Sept. 10. With gas futures down 22% over the past three weeks, speculators last week cut their net long futures and options positions on the New York Mercantile and Intercontinental Exchanges for a second week in a row to their lowest since April, according to the U.S. Commodity Futures Trading Commission's Commitments of Traders report. Financial group LSEG said average gas output in the Lower 48 U.S. states slipped to 101.5 billion cubic feet per day (bcfd) so far in October, down from 101.8 bcfd in September. That compares with a record 105.5 bcfd in December 2023. Analysts projected energy firms would cut output in calendar 2024 for the first time since 2020 when the COVID-19 pandemic cut demand for the fuel. Prices have remained relatively low since the U.S. Henry Hub benchmark in Louisiana fell to a 32-year low in March after many producers reduced drilling activities. Meteorologists projected temperatures in the Lower 48 states will remain mostly warmer than normal through Nov. 5. Despite those mild forecasts, it will be cooler with more heating demand in early November than this week. The average temperature in the Lower 48 states will drop to around 56 degrees Fahrenheit (13.3 Celsius) by Nov. 5, according to the latest forecasts, down from an average of 63 F now. That, however, is well above the normal average of 51 F in early November. With cooler weather coming, LSEG forecast average gas demand in the Lower 48, including exports, would rise from 96.0 bcfd this week to 100.2 bcfd next week. The forecast for this week was lower than LSEG's outlook on Friday, while its forecast for next week was higher. The amount of gas flowing to the seven big U.S. LNG export plants rose to an average of 13.1 bcfd so far in October, up from 12.7 bcfd in September. That compares with a monthly record high of 14.7 bcfd in December 2023. Gas prices were trading around $13 per mmBtu at the Dutch Title Transfer Facility (TTF) benchmark in Europe and the Japan Korea Marker (JKM) benchmark in Asia JKMc1. NG/EU

U.S. natgas prices jump 8% on cooler weather, higher global gas prices U.S. natural gas futures jumped about 8% to a one-week high on Thursday on forecasts for cooler weather and more heating demand over the next two weeks than previously expected and on rising prices for gas in global markets that should boost the value of U.S. liquefied natural gas (LNG) exports. That price increase came despite a bearish bigger-than-expected weekly storage build that was also bigger than the five-year average for the first time in 15 weeks. Front-month gas futures for November delivery on the New York Mercantile Exchange rose 18.0 cents, or 7.7%, to settle at $2.522 per million British thermal units (MMBtu), their highest close since Oct. 11. The U.S. Energy Information Administration (EIA) said utilities added 80 Bft3 of gas into storage during the week ended Oct. 18. That was much bigger than the 60- Bft3 build analysts forecast in a Reuters poll and compares with an increase of 81 Bft3 in the same week last year and a five-year (2019–2023) average rise of 76 Bft3 for this time of year. Lower injections in recent weeks came because many producers reduced drilling activities this year after average spot monthly prices at the U.S. Henry Hub benchmark in Louisiana fell to a 32-year low in March. Prices have remained relatively low since then. Even though the latest forecasts were for lower temperatures than previously expected in coming weeks, meteorologists still expect the weather in the Lower 48 states to remain warmer than normal through at least Nov. 8. With cooler weather coming, LSEG forecast average gas demand in the Lower 48, including exports, would rise from 95.1 Bft3d this week to 99.4 Bft3d next week. The forecast for this week was lower than LSEG's outlook on Wednesday. The amount of gas flowing to the seven big U.S. liquefied natural gas (LNG) export plants rose to an average of 13.0 Bft3d so far in October, up from 12.7 Bft3d in September. That compares with a monthly record high of 14.7 Bft3d in December 2023. The U.S. became the world's biggest LNG supplier in 2023, ahead of recent leaders Australia and Qatar, as much higher global prices feed demand for more exports due in part to supply disruptions and sanctions linked to Russia's invasion of Ukraine in February 2022. Gas prices climbed to a 10-month high over $13 per MMBtu at the Dutch Title Transfer Facility (TTF) benchmark in Europe and a five-week high near $14 at the Japan Korea Marker (JKM) benchmark in Asia.

US natgas prices climb 2% to 2-week high on lower output, soaring global gas prices (Reuters) -U.S. natural gas futures climbed about2% to a two-week high on Friday on lower output so far this month and a jump in global gas prices that could boost demand for more U.S. liquefied natural gas (LNG) exports. Earlier in the session, U.S. gas futures were down on forecasts for mild weather through early November that should keep U.S. heating demand low and allow utilities to inject more gas into U.S. storage than is usual for this time of year. Front-month gas futures NGc1 for November delivery on the New York Mercantile Exchange rose 3.8 cents, or 1.5%, to settle at $2.560 per million British thermal units (mmBtu), their highest close since Oct. 11 for a second day in a row.That put the front-month up about 13% this week after it fell about 22% over the prior three weeks. Analysts projected utilities were on track to inject more gas into storage this week than normal for a second week in a row for the first time since October 2023. Prior to last week, injections had been smaller than usual for 14 weeks in a row because many producers so far this year have reduced drilling activities after average spot monthly prices at the U.S. Henry Hub NG-W-HH-SNL benchmark in Louisiana fell to a 32-year low in March. Prices have remained relatively low since then. NGAS/POLL HH/GAS Financial group LSEG said average gas output in the Lower 48 U.S. states slipped to 101.5 billion cubic feet per day (bcfd) so far in October, down from 101.8 bcfd in September. That compares with a record 105.5 bcfd in December 2023. With so many firms curtailing drilling activities, analysts have projected that average output in calendar 2024 will decline for the first time since 2020 when the COVID-19 pandemic cut demand for the fuel. The reduction in drilling activities was clear in Pennsylvania where drillers this week cut the number of rigs operating by one to a total of just 12, the lowest since July 2007, according to data from energy services firm Baker Hughes. Meteorologists projected the weather in the Lower 48 states would remain warmer than normal through at least Nov. 9. But even warmer than normal weather in early November is cooler than warmer than normal weather in late October. So, with seasonally cooler weather coming, LSEG forecast average gas demand in the Lower 48, including exports, would rise from 95.4 bcfd this week to 99.2 bcfd next week and 102.4 bcfd in two weeks. The amount of gas flowing to the seven big U.S. liquefied natural gas (LNG) export plants rose to an average of 13.0 bcfd so far in October, up from 12.7 bcfd in September. That compares with a monthly record high of 14.7 bcfd in December 2023. Analysts have noted that overall LNG feedgas will likely remain below record levels for at least a couple more weeks while some firms conduct maintenance on their plants in Louisiana, including Cheniere Energy LNG.N at Sabine and Cameron LNG at Cameron. Gas prices climbed to a 10-month high near $14 per mmBtu at the Dutch Title Transfer Facility (TTF) benchmark in Europe and a six-week high also near $14 at the Japan Korea Marker (JKM) benchmark in Asia JKMc1.

Kinder Morgan Sanctions GCX Pipeline Expansion as LNG, Mexico Exports Seen Driving Natural Gas Demand Surge – -Kinder Morgan Inc. (KMI) is moving ahead with a $455 million, 570 MMcf/d expansion of the Gulf Coast Express (GCX) natural gas pipeline serving the Permian Basin that could be in service by mid-2026, management said Wednesday. The expansion “will enable our customers who have signed long-term throughput agreements to move substantial additional gas” out of the Permian, said Executive Chairman Richard Kinder Wednesday during the Houston-based midstreamer’s third quarter earnings call. The project is designed to increase natural gas deliveries from the Permian to the Agua Dulce hub in South Texas.

Could the U.S. Election Have Ripple Effects on Natural Gas Trade Into Mexico? -The upcoming U.S. election between Vice President Kamala Harris and former President Donald Trump is being watched closely by those involved in the burgeoning natural gas trade that crosses the border. Bar chart showing yearly value of U.S.-Mexico energy trade. The value of all energy trade between the United States and Mexico was $66.5 billion in 2023, according to the U.S. Energy Information Administration (EIA). This was down from $77.8 billion in 2022, adjusted for inflation, principally because of lower fuel prices that offset the increase in the volume of energy trade between the two countries. The U.S. benchmark Henry Hub natural gas price averaged $2.57/MMBtu in 2023, about a 62% drop from the 2022 averages, according to EIA. This year, gas prices also have remained low. NGI’s spot Henry Hub daily natural gas price has averaged $2.124 through Tuesday, according to Daily Historical Data.