oil prices are at a 3 month high; natural gas prices settled at new 3½ year lows four days this week; US refinery utilization rate, refinery throughput, and distillates production all are lowest in 58 weeks, on ongoing Gulf Coast shut-ins; January’s global oil production was 1,520,000 barrels per day below estimated demand.

US oil prices finished higher for the fourth time in five weeks on rising violence in the Middle East and a weaker US dollar…after rising 6.3% to $76.84 a barrel last week after Israel rejected a brokered ceasefire offer from Hamas and resumed attacks on Gaza amid ongoing US strikes against Yemen, Iraq and Syria, the contract price for the benchmark US light sweet crude for March delivery moved lower in Asian trading Sunday, after Iran’s foreign minister reported the Israel-Hamas conflict could be moving closer to a diplomatic solution, then sold off early in the Monday session amid the news that the Israeli military said it had "concluded" a “series of strikes” on southern Gaza, but recovered to settle 8 cents higher at $76.92 a barrel, a sixth straight gain, as traders continued to weigh global demand expectations and prospects for supply disruptions against a backdrop of rising tensions in the Middle East…oil prices continued to move higher in early trading Tuesday after OPEC forecast relatively strong growth in global oil demand in 2024 and 2025, and increased their economic growth forecasts for both years, and settled 95 cents higher at $77.87 a barrel against a backdrop of broader risk-off sentiment after the consumer price index indicated inflation remained elevated, reducing the prospect of imminent interest rate cuts…oil prices extended their gains overnight after the American Petroleum Institute reported big draws from fuel supplies, but then sold off Wednesday morning after the EIA reported a huge increase U.S. crude inventories, and settled $1.23 lower at $76.64 a barrel after the. Congressional intelligence chairman warned of a 'serious national security threat', without providing details, scaring off some oil traders…oil prices began lower for a second day early Thursday after the International Energy Agency warned of slowing demand growth, but reversed those early losses and settled $1.39 higher at $78.03 a barrel after U.S. retail sales data showed consumers spent less than expected last month, weakening the U.S. dollar and thus boosting oil…oil prices slipped in overseas trading early Friday on signs that OPEC+ members were complying with their promised supply cuts, but rallied during the New York session and settled $1.16 higher at a three month high of $79.19 a barrel, and thus ended with a 3.1% gain for the week, after Hezbollah fired dozens of rockets at a northern Israeli town and said they would escalate their retaliation against Israel following the killing of 10 civilians in southern Lebanon

On the other hand, natural gas prices fell for the 5th time in six weeks on an anemic midwinter withdrawal of gas from storage and weather forecasts ppromising more of the same....after falling 11.2% to a 3½ year low of $1.847 per mmBTU last week on weak LNG and heating demand in the face of a building gas supply glut, the contract price for natural gas for March delivery opened 2 cents lower on Monday on extended forecasts for low demand in key markets, and slid to a 7.9 cent loss on the session at $1.768 per mmBTU, as fundamental support continued to evade traders, leaving them little to latch onto…the March contract opened 3 cents lower and fell again early Tuesday, as daily forecasts continue to trend progressively bearish, and again settled 7.9 cents lower at $1.689 per mmBTU, with the market strangled by a healthy supply of natural gas and no significant demand for it….natural gas prices opened another 4 cents lower on Wednesday on steady production and continued mild forecasts, and slid throughout the day to settle 8.0 cents lower at $1.609 per mmBTU on near-record output, ample amounts of fuel in storage, curtailed LNG demand, and forecasts for warmer weather next week than was previously expected… natural gas prices averaged a penny higher ahead of the storage report early Thursday, but an anemic storage print sent prices lower to settle down 2.8 cents at a fresh 3-1/2-year low of $1.581 per mmBTU on rising, near-record output and a smaller-than-expected storage withdrawal, as warm weather had kept heating demand low….natural gas prices finally managed an upside move of 2.8 cents or almost 2% to $1.609 per mmBTU on Friday, ahead of a three-day weekend, as bargain hunters moved in to buy on news that some producers planned to reduce drilling in 2024, after prices had collapsed to a 3-1/2-year low, but still finished 12.9% lower for the week..

The EIA's natural gas storage report for the week ending February 9th indicated that the amount of working natural gas held in underground storage in the US fell by 49 billion cubic feet to 2,535 billion cubic feet by the end of the week, which left our natural gas supplies 255 billion cubic feet, or 11.2% above the 2,280 billion cubic feet that were in storage on February 9th of last year, and 348 billion cubic feet, or 15.9% more than the five-year average of 2,187 billion cubic feet of natural gas that were typically in working storage as of the 9th of February over the most recent five years…the 49 billion cubic foot withdrawal from US natural gas working storage for the cited week was significantly less than the 68 billion cubic feet withdrawal from supplies that had been forecast by analysts polled by Reuters, and was less than half of the 117 billion cubic feet that were pulled from natural gas storage during the corresponding first week of February 2023, and was less than a third of the average 149 billion cubic feet withdrawal from natural gas storage that has been typical for the same mid winter week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA -

US oil data from the US Energy Information Administration for the week ending February 9th indicated that even after an increase in our oil exports and a decrease in our oil imports, an increase in oil supplies that could not be accounted for meant we had surplus oil to add to our stored commercial crude supplies for the third consecutive week, and for the 11th time in the past 17 weeks….Our imports of crude oil fell by an average of 437,000 barrels per day to average 6,470,000 barrels per day, after rising by an average of 1,302,000 barrels per day the prior week, while our exports of crude oil rose by 751,000 barrels per day to average 4,347,000 barrels per day, which combined meant that the net of our trade in oil worked out to a net import average of 2,123,000 barrels of oil per day during the week ending February 9th, 1,188,000 fewer barrels per day than the net of our imports minus our exports during the prior week. At the same time, transfers to our oil supply from Alaskan gas liquids, natural gasoline, condensate, and from unfinished oils averaged 479,000 barrels per day, while during the same week, production of crude from US wells remained at a record 13,300,000 barrels per day. Hence our daily supply of oil from the net of our international trade in oil, from transfers, and from domestic well production appears to have averaged a rounded total of 15,902,000 barrels per day during the February 9th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 14,542,000 barrels of crude per day during the week ending February 9th, an average of 297,000 fewer barrels per day than the amount of oil that our refineries reported they were processing during the prior week, while over the same period the EIA’s surveys indicated that a rounded average of 1,823,000 barrels of oil per day were being added to the supplies of oil stored in the US... So, based on that reported & estimated data, the crude oil figures provided by the EIA for the week ending February 9th appear to indicate that our total working supply of oil from net imports, from transfers, and from oilfield production was 464,000 barrels per day less than what was added to storage plus our oil refineries reported they used during the week…To account for that difference between the apparent supply of oil and the apparent disposition of it, the EIA just plugged a rounded [+464,000] barrel per day figure onto line 16 of the weekly U.S. Petroleum Balance Sheet, in order to make the reported data for the supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there was an error or omission of that size in the week’s oil supply & demand figures that we have just transcribed... Moreover, since 1,569,000 barrels of oil demand per day could not be accounted for in last week’s EIA data, that means there was a 2,034,000 barrel per day difference between this week's oil balance sheet error and the EIA's crude oil balance sheet error from a week ago, and hence the changes to supply and demand from that week to this one that are indicated by this week's report are off by that much, and therefore nonsense...however, since most oil traders react to these weekly EIA reports as if they were accurate, and since these weekly figures therefore often drive oil pricing (as is obvious to anyone who watches oil prices), and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably reliable by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….(note there is also an aging twitter thread from an EIA administrator addressing these ongoiing weekly errors, and what they had hoped to do about it)

This week's rounded 1,823,000 barrel per day average increase in our overall crude oil inventories came as 1,717,000 barrels per day were being added to our commercially available stocks of crude oil, while 107,000 barrels per day were being added to our Strategic Petroleum Reserve, the eleventh SPR increase in eighteen weeks. following nearly continuous withdrawals over the prior 39 months... Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to 6,140,000 barrels per day last week, which was 7.2% less than the 6,669,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be unchanged at a record 13,300,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was unchanged at 12,900,000 barrels per day, while Alaska’s oil production was 4,000 barrels per day higher at 439,000 barrels per day but still added the same 400,000 barrels per day to the EIA's rounded national total as it did last week...US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 1.5% above that of our pre-pandemic production peak, and 37.1% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 80.4% of their capacity while processing those 14,542,000 barrels of crude per day during the week ending February 9th, their lowest utilization in 58 weeks, and down from their utilization rate of 92.6% four weeks earlier, apparently due to damage from the arctic cold that penetrated to the Gulf Coast in mid January, as refineries outside of PADD 3 were still operating normally... the 14,542,000 barrels per day of oil that were refined this week were also the least in 58 weeks, 3.2% less than the 15,027,000 barrels of crude that were being processed daily during week ending February 10th of 2023 (after the refinery-freeze-offs following Christmas 2022's winter storm Elliot), and 9.2% less than the 16,020,000 barrels that were being refined during the prepandemic week ending February 7th, 2020, when our refinery utilization rate was also at a lower than normal 88.0%..

Even with the decrease in the amount of oil being refined this week, gasoline output from our refineries was somewhat higher, increasing by 164,000 barrels per day to 9,175,000 barrels per day during the week ending February 9th, after our refineries' gasoline output had decreased by 270,000 barrels per day during the prior week. This week’s gasoline production was 0.9% more than the 9,089,000 barrels of gasoline that were being produced daily over the winter storm impacted week ending February 10th of last year, but 9.0% less than the gasoline production of 9,903,000 barrels per day during the prepandemic week ending February 7th 2020....on the other hand, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 281,000 barrels per day to a 58 week low of 4,076,000 barrels per day, after our distillates output had decreased by 545,000 barrels per day over the prior three weeks. With those decreases, our distillates output was 9.6% less than the 4,509,000 barrels of distillates that were being produced daily during the week ending February 10th of 2023, and 15.7% less than the 4,837,000 barrels of distillates that were being produced daily during the week ending February 7th 2020…outside of last year’s winter storm Elliot, 2021’s winter storm Uri, and 2017’s Hurricane Harvey, refinery throughput and distillates production hasn’t been this low in more than a dozen years

Even with this week's increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the third time in thirteen weeks, decreasing by 3,658,000 barrels to 247,330,000 barrels during the week ending February 9th, after our gasoline inventories had decreased by 3,146,000 barrels during the prior week. Our gasoline supplies fell again this week even though the amount of gasoline supplied to US users fell by 639,000 barrels per day to 8,168,000 barrels per day, because our exports of gasoline rose by 221,000 barrels per day to 968,000 barrels per day, and because our imports of gasoline fell by 100,000 barrels per day to 436,000 barrels per day…But even after thirty-one gasoline inventory withdrawals over the past fifty-two weeks, our gasoline supplies were still 2.2% above than last February 10th's gasoline inventories of 241,922,000 barrels, while about 2% below the five year average of our gasoline supplies for this time of the year…

With this week's decrease in our distillates production, our supplies of distillate fuels fell for the fourth consecutive week, following eight consecutive increases, decreasing by 1,915,000 barrels to 127 574,000 barrels over the week ending February 9th, after our distillates supplies had decreased by 3,221,000 barrels during the prior week. Our distillates supplies fell by less this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, fell by 303,000 barrels per day to 3,514,000 barrels per day, and because our exports of distillates fell by 155,000 barrels per day to 971,000 barrels per day, while our imports of distillates rose by 9,000 barrels per day to 135,000 barrels per day...Even with 27 inventory decreases over the past forty-eight weeks, our distillates supplies at the end of the week were 5.4% above the 119,237,000 barrels of distillates that we had in storage on February 10th of 2023, but were about 7% below the five year average of our distillates inventories for this time of the year...

Finally, after an increase in our oil supplies that the EIA could not account for and absent the unaccounted fo demand, our commercial supplies of crude oil in storage rose for the 13th time in twenty-six weeks and for the 23rd time in the past year, increasing by 12,018,000 barrels over the week, from 427,432,000 barrels on February 2nd to 439,450,000 barrels on February 9th, after our commercial crude supplies had increased by 5,220,000 barrels over the prior week... With this week’s increase, our commercial crude oil inventories rose to about 2% below the most recent five-year average of commercial oil supplies for this time of year, and were more than 34% above the average of our available crude oil stocks as of the second weekend of February over the 5 years at the beginning of the past decade, with the big difference between those comparisons arising because it wasn’t until early 2015 that our oil inventories had first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, then jumped again after February 2021's winter storm Uri froze off US Gulf Coast refining, but then fell in the wake of the Ukraine war, only to jump again following the Christmas 2022 refinery freeze offs, our commercial crude supplies as of this February 9th were 6.8% less than the 471,394,000 barrels of oil left in commercial storage on February 10th of 2023, but 6.8% more than the 411,508,000 barrels of oil that we still had in storage on February 11th of 2022, while still 4.8% less than the 461,757,000 barrels of oil we had in commercial storage on February 12th of 2021, after 2020’s pandemic precautions had left a lot of oil unused…

OPEC's Report on Global Oil for January

Tuesday of this past week saw the release of OPEC's February Oil Market Report, which includes the details on OPEC's & global oil data for January, and hence it gives us a picture of the global oil supply & demand situation as the largest OECD economies outside of the US had slipped into recessions, and as the Chinese manufacturing PMI continued to indicate contraction, following their earlier sharp recovery from the country's restrictive Covid policy, while at the same time oil supplies continued to be impacted by ongoing production cuts from OPEC, their allies, and unilaterally by the Saudis...while January marked the end of the twelve month span that OPEC and aligned oil producers were operating under a 2 million barrel per day production reduction, meant to take roughly 2% of global oil supplies off the market, those cartel wide quotas of 2023 were replaced by "voluntary cuts" totaling 2.2 million barrels by less than half of the cartel's members for the first quarter of 2024, after a November 30th meeting was unable to agree to a cartel wide cut....at the same time, the Saudis extended their unilateral million barrel per day production cut, and a Saudi led cut of an additional 1.16 million barrels per day, which, when combined with a unilateral 500,000 million barrel per day Russian cut, was intended to take 1.66 million barrels per day off the market, were also extended into 2024....

The first table from this month's report that we'll review is from the page numbered 50 of the report (pdf page 60), and it shows oil production in thousands of barrels per day for each of the current OPEC members over the recent years, quarters and months, as the column headings below indicate...for all their official production measurements, OPEC has been using an average of production estimates by as many as eight "secondary sources", namely the International Energy Agency (IEA), the oil-pricing agencies Platts and Argus, the U.S. Energy Information Administration (EIA), the oil consultancy Cambridge Energy Research Associates (CERA), the industry newsletter Petroleum Intelligence Weekly, the energy consultancy Wood Mackenzie and the research and intelligence firm Rystad Energy, as a means of impartially adjudicating whether their output quotas and production cuts are being met, to thereby avert any potential disputes that could arise if each member reported their own figures…

As we can see in the bottom right hand corner of the above table, OPEC's oil output decreased by 350,000 barrels per day to 26,342,000 barrels per day during January, down from their revised December production total that averaged 26,692,000 barrels per day...however that December OPEC output figure was originally reported as 27,700,000 barrels per day, which means that OPEC's December production was revised 8,000 barrels per day lower with this report, and hence OPEC's January production was, in effect, 358,000 barrels per day less than the previously reported OPEC production figure (for your reference, here is a copy of the table of the official December OPEC output figures as reported a month ago, before this month's revision)...

OPEC's twelve remaining members, and twelve other aligned oil producers, were unable to arrive at a cartel wide production cut to replace the 2 million barrel per day cuts of 2023 in which all producers participated, so several of the key members of the cartel agreed to "voluntary cuts" totaling 2.2 million barrels per day for the first quarter of 2024....according to a November 30th press release after that meeting, participants in that voluntary agreement included Saudi Arabia (cutting 1,000 thousand barrels per day); Iraq (223 thousand b/d); United Arab Emirates (163 thousand b/d); Kuwait (135 thousand b/d); Kazakhstan (82 thousand b/d); Algeria (51 thousand b/d); and Oman (42 thousand b/d)...those voluntary cuts would be calculated from the 2024 required production level as per the 35th OPEC Ministerial Meeting held on June 4 2023, and are in addition to the voluntary cuts previously announced in April 2023 and later extended until the end of 2024...the production cuts that OPEC members committed to under the April 2023 agreement included 500,000 barrels per day (bpd) from the Saudis, 211,000 bpd from Iraq, 140,000 bpd from the Emirates, 128,000 bpd from Kuwait, 48,000 barrels per day from Algeria, and 8,000 barrels per day from Gabon...eight months ago, our initial assessment was that only the Saudis managed to hit the additional production cut target in May 2023, and only Algeria joined them in June, indeed, most of the others who announced cuts in April 2023 increased their production over the June through December period, rather than cutting it...hence, the net production reduction at year end remained about half of what had been committed to by the parties to that April 2nd agreement…

looking at January’s production levels in the above table, it appear that Iraq and Kuwait have begun to reduce their production as per the November agreement, while reductions from the other parties has been negligible (the Saudis had already unilaterally cut a million barrels per day for several months prior, so we wouldn’t expect a change from them)…on the other hand, those OPEC members who objected to a continuation of 2023’s reduced quotas have not begun to increase their production to their previous levels (note that Libya’s 162,000 barrel per day output reduction in January was involuntary, after protests had shut down their largest oil field)….war torn Libya as well as US sanctioned producers Iran and Venezuela have been exempt from the production cuts imposed by the joint agreement that has governed the output of the other OPEC producers since May 2020…

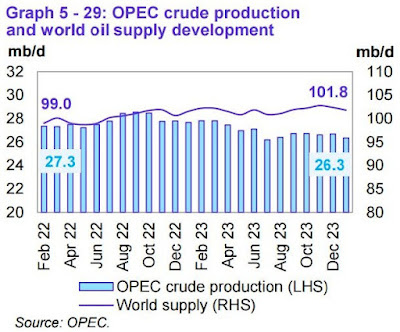

The next graphic from this month's report that we'll look at shows us both OPEC's and worldwide oil production monthly on the same graph, over the period from February 2022 thru January 2024, and it comes from page 51 (pdf page 61) of OPEC's February Oil Market Report....on this graph, the sky blue bars represent OPEC's monthly oil production in millions of barrels per day as shown on the left scale, while the purple line graph represents global oil production in millions of barrels per day, with the metrics for global output shown on the right scale....

Following January's 350,000 barrel per day decrease in OPEC's production from their revised production of a month earlier, OPEC's preliminary estimate is that total global liquids production decreased by a rounded average of 600,000 barrels per day in January to an average of 101.8 million barrels per day in December, after December's total global output figure was apparently revised up by 1,500,000 barrels per day from the 100.9 million barrels per day of global oil output that was reported for December a month ago, as non-OPEC oil production fell by a rounded 200,000 barrels per day in December after that big upward revision, with most of January’s non-OPEC production 'decrease' due to lower oil output from the US and 'other Eurasian countries', which more than offset greater oil production from China, Canada and Brazil...

Even with the large upward revision to December's global oil output, the amount of oil being produced globally during January again fell far short of the expected global demand, as this next table from the OPEC report will show us...

The above table came from page 27 of the February Oil Market Report (pdf page 37), and it shows regional and total oil demand estimates in millions of barrels per day for 2023 in the first column, and then OPEC's forecast of oil demand by region and globally, quarterly over 2024 over the rest of the table…on the "Total world" line in the second column, we've circled in blue the figure that's relevant for January, which is their estimate of global oil demand during the first quarter of 2024….OPEC is estimating that during the 1st quarter of this year, all oil consuming regions of the globe will use an average of 103.32 million barrels of oil per day, which is a rounded 10,000 barrels per day downward revision from their estimate for the first quarter a month ago (as we’ve circled in green), but not enough of a revision to change the rounded projection from their prior forecast....but as OPEC showed us in the oil supply section of this report and the summary global supply graph above, OPEC and the rest of the world's oil producers were only producing 101.8 million barrels per day during January, which would imply that there was a shortage of around 1,520,000 barrels per day of global oil production during January, when compared to the demand estimated for the month...

Note that in addition to figuring the January oil shortage that's indicated by this report, the upward revision of 1,500,000 barrels per day to December's global oil output that's implied in this report means that the 2,280,000 barrels per day global oil output shortage we had previously figured for December would have to be revised to an oil production shortage of 780,000 barrels per day...

Also note that in green we've also circled an upward revision of 40,000 barrels per day to 2024's demand, which also means that the supply surpluses and shortfalls that we previously reported over last year would have to be revised...previously, when OPEC had revised demand for a prior year, they had been including a separate table showing which quarters and how much in each quarter that revision would apply to...since they didn't do that in this month's case, it likely means they've dropped that historical feature, and hence we can't revise our monthly estimates accordingly...we do have the most up-to-date estimates of production shortages (and in few cases surpluses) for all 12 months of 2023 with our post on December's oil supply and demand as per OPEC, so those estimates now need to be adjusted for that 40,000 barrels per day upward revision to 2024's demand...

This Week's Rig Count

In lieu of a detailed report on the rig count, we are again just including below a screenshot of the rig count summary from Baker Hughes...in the table below, the first column shows the active rig count as of February 16th, the second column shows the change in the number of working rigs between last week’s count (February 9th) and this week’s (February 16th) count, the third column shows last week’s February 9th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting period a year ago, which in this week’s case was the 17th of February, 2023...

++++++++++++++++++++++++++++++++++++++

Oil Find Shifts Attention in Utica - Business Journal Daily – More than 10 years into the exploration of the Utica/Point Pleasant shale region, energy companies are just now obtaining a clearer picture of what this formation holds. This is especially important for northeastern Ohio, where surprising discoveries of large volumes of oil are changing the entire nature of the play. The combination of data from legacy horizontal oil and gas wells, advanced technology, and a more in-depth understanding of the geology of the Utica have helped to narrow the search for more productive rock, industry specialists say. This information has also led to more efficient means of drawing out oil and gas molecules that have been sealed underground for millions of years. At the forefront of the rush is Encino Energy, whose Utica subsidiary, EAP Ohio, has emerged as the leading oil producer in the state. Moreover, the company has found productive oil wells in pockets that earlier were thought relegated to natural gas production. “Over the past five years, Encino has grown oil production by 250% and natural gas production by 15%, becoming the largest producer of oil in Ohio,“ says Jackie Stewart, Encino director of external affairs. Encino entered the market in 2018, acquiring most of Chesapeake Energy’s Utica assets in eastern Ohio, including Columbiana County. Through the first nine months of 2023 – the most recent production figures available from the Ohio Department of Natural Resources – the Texas-based energy company reported it’s produced more than 10.35 million barrels of oil from the Utica, more than half of the nearly 20 million barrels produced in the entire state during the period. Columbiana County Oil Boom A major addition this year to the oil assets of Encino is a handful of wells in Columbiana County that have shown promise in the northern tier of the Utica, according to ODNR production records. Drilled in Hanover and Knox townships, eight Encino wells accounted for 728,443 barrels of oil during the first nine months of 2023. Three of those wells, the Sanor 6H, 8H, and 10H in Knox Township, were ranked respectively the 6th-, 7th- and 8th-most productive oil wells in Ohio during the third quarter, ODNR records show. What is unusual is that this section of the Utica is known for its natural gas production, not oil. “There is some shifting where the money’s being invested,” observes Andrew Thomas, executive in residence at the Energy Policy Center of Cleveland State University’s Maxine Goodman Levin School of Urban Affairs. “The focus of drilling has been moving north.” Thomas observes as early as five years ago, energy companies all but ignored prospects for oil in portions of the northern and other parts of the Utica. “Five years ago, that entire oil window had been written off as uncommercial,” he says. “They’re coming back now. We’ve seen a handful of companies drilling in areas that are predominantly oil.” The Energy Policy Center at Cleveland State publishes a Utica shale investment study twice a year and is now compiling data, Thomas says, and analyzing trends for the first half of 2023. “Oil production has been on the rise – about 10% a year – over the last several years,” he observes, driven mostly by higher oil prices and a renewed push into the oil windows. This trend is likely to continue, Thomas says, along with steady volumes of natural gas production. And the Utica should continue to see drilling activity migrate northward from the southern tier, he says. “What caught my eye during the first half of 2023 was that it’s the first time we’ve seen total production from Jefferson County exceed Belmont County as the leader in state for production,” Thomas says. The potential for strong oil production across the Utica has been known for years, says Mike Chadsey, director of public relations for the Ohio Oil and Gas Association. The trick, however, was finding a way to drill for this oil that made economic sense. “There’s a saying in the industry, ‘Oil is where oil was,’ ” Chadsey says. “There’s been oil production in shale and conventional production in Columbiana County and elsewhere such as Tuscarawas and Guernsey counties for a long time now.” The precise extent of the Utica oil play has yet to be determined, Chadsey says. Between 30 and 40 wells in the Utica oil window – some of which are in Columbiana County – should be commissioned by the first quarter of this year. Production results from these wells should present a better indicator of the oil potential in the Utica, he says. “Each well is a data point,” Chadsey says. “The most telling will be the first quarter of 2024, when a lot of these wells come online and production is reported.” As of now, Chadsey says, there’s not enough information to project with certainty the course of oil production in Columbiana County. “We have an indication. We’ll know more in the first and second quarters of 2024,” he says. Nevertheless, the early results are encouraging for the industry, Chadsey says. “Everything we have heard – they’re cautiously optimistic if not downright excited about the opportunities in Columbiana County,” he says.

Gassy Northern Utica in Ohio Turns Oily Thanks to Encino Energy | Marcellus Drilling News - Encino Energy purchased Chesapeake Energy’s Ohio oil and gas assets (including Utica Shale assets) in 2018 for $2 billion (see Encino Takes Over from Chesapeake in Ohio Utica; Big Plans). A few months later, Encino CEO Hardy Murchison and COO Ray Walker (formerly of Range Resources) told attendees at a conference they would do oil drilling in the state differently and better than Chesapeake (see Encino Says They’ll Do it Better in the Utica than Chesapeake Did). They did! By June of last year, Encino had become the biggest oil producer in the state, having “cracked the code” on oil drilling in Ohio (see Oil Prod. in Northern Utica Comes Alive – Encino Cracks Oil Code). Encino is now turning parts of northern Utica, places like Columbiana County that are known for producing mostly natural gas, into oil-producing zones.

PA DEP Finally OKs Use of Big Sewickley Creek Water for Fracking - Marcellus Drilling News -- In 2021, PennEnergy Resources made a request to the Pennsylvania Dept. of Environmental Protection (DEP) to withdraw up to 3 million gallons of water a day from Big Sewickley Creek and one of its tributaries for shale fracking (see Dem PA Lawmaker Wants to Block Use of Creek Water for Fracking). In March 2022, PennEnergy reapplied for a permit to draw water, but this time, the request was cut in half to just 1.5 million gallons of water a day (see PennEnergy Reapplies to Use SWPA Creek Water for Fracking Ops). In July 2022, the application was finally christened as complete and ready for an official review (see PennEnergy Creek Water Request Now “Complete” – PA DEP Reviewing). And that’s where it’s been, hanging in limbo since then. Until yesterday, when the DEP notified those commenting on the application that it had been approved. Finally!

Record High NGL Exports from Marcus Hook, ET Expanding Facility - Marcellus Drilling News -- Pipeline giant Energy Transfer (ET), owner of the Mariner East Pipeline system, the Marcus Hook NGL terminal, and the Rover pipeline in the Marcellus/Utica region, issued its fourth quarter and full-year 2023 update yesterday. Net income for 4Q23 was $1.57 billion, up 9% from 4Q22’s $1.44 billion. However, net income for 2023 was $5.29 billion, down 10% from 2022’s $5.87 billion. ET is a big company with assets in many oil and gas regions of the U.S. Of interest for us were the comments about the Marcus Hook NGL terminal and its exports.

EQT Not Ready to Curb Production Further as it Jockeys for Natural Gas Rebound - Despite crashing prices, executives at EQT Corp. said the U.S. natural gas market is not as oversupplied as most think, suggesting the stage is being set for a rebound. Henry Hub has traded below $2/MMBtu for seven straight sessions. The contract hasn’t been this low since June 2020 during the Covid-19 pandemic. NGI’s Weekly Spot National Avg. price has also been under pressure for four weeks in a row, weighed down by near record production and mild winter weather. But CFO Jeremy Knop pointed to a “prominent data vendor” that lowered its year-to-date supply estimates this week, suggesting fundamentals aren’t as bad as they seem.

Low Gas Price May Cause EQT to Shut-in Production, Curtail Drilling - Marcellus Drilling News - - EQT Corporation, the largest natural gas producer in the U.S. (100% focused on the Marcellus/Utica) released its fourth quarter and full-year 2023 update yesterday. According to CEO Toby Rice, 2023 was a big year for the company which “set multiple drilling world records” and achieved its highest completion efficiency pace ever. Last year, EQT closed on the purchase of Tug Hill and XcL Midstream, adding major assets to the company’s portfolio. In 2023, EQT signed 2.5 million tons per annum (MTPA) of LNG export agreements to export roughly 5% of EQT’s total natural gas production. The company produced 2,016 billion cubic feet equivalent (Bcfe) in 2023, which works out as 5.52 Bcfe per day. As for 2024, Rice says his company is ready and quite willing to throttle back on production and do less drilling than previously planned…if the price of natural gas stays low.

NFG Quarterly Update – Seneca M-U Production Up Big 11% | Marcellus Drilling News - National Fuel Gas Company (NFG), headquartered in Buffalo, NY, is the parent company for Marcellus/Utica driller Seneca Resources and the parent of midstream company NFG Midstream (and subsidiary Empire Pipeline). Last week, NFG issued its latest quarterly update. During the quarter (considered the company’s first quarter), Seneca produced 100.8 Bcf (billion cubic feet) of natural gas, an increase of 10.2 Bcf, or 11%, from the prior year, mainly due to production from new Marcellus and Utica wells in Seneca’s Eastern Development Area (EDA).

Webb, Lupardo lead legislative effort to ban carbon dioxide fracking - Pipe Dream - State lawmakers recently introduced a bill to ban the use of carbon dioxide (CO2) to drill and extract natural gas and oil resources. The bill, proposed by State Sen. Lea Webb and Assemblywoman Donna Lupardo in late January, would close a loophole in the Climate Leadership and Community Protection Act, New York state’s nation-leading climate law banning fracking operations. While the state prohibits using water to frack natural gas, companies have used CO2 as an alternative method. The bill comes alongside efforts from Southern Tier CO2 to Clean Energy Solutions, a Texas-based company, to convince Southern Tier landowners to lease their land to extract gas by injecting supercritical carbon dioxide into the Marcellus shale formation since fall 2023. Offers went to landowners with over 30 acres of land in Broome, Tioga and Chemung counties. The company plans to utilize CO2 to extract methane gas from the Marcellus and Utica shales, in a method more environmentally friendly than hydraulic fracking. “The technique relies heavily on the unique properties of carbon dioxide when in its supercritical phase and the affinity of shale, especially shale containing elevated levels of organic content, to absorb carbon dioxide while desorbing methane gas preferentially,” their website says. In November, Webb and Lupardo sent a letter to Basil Seggos, the New York State Department of Environmental Conservation’s commissioner, to investigate Southern Tier Solutions and its proposed method to use carbon dioxide to extract fossil fuels. In the letter, Lupardo claimed that residents came to her with concerns about the impact CO2 fracking could have on the community. “This process uses directional drilling that first bores vertically deep underground to reach the Marcellus or Utica shale layer and then uses directional drilling to slowly bend the drill path sideways to drill parallel to the plane of the shale layer and try to stay roughly centered between top of the layer and bottom of the layer as they drill approximately horizontally within the shale layer for perhaps a mile or two,” Valdi Weiderpass, the Sierra Club’s Susquehanna Group chair, wrote in an email. “This process is akin high volume hydraulic fracturing, also nicknamed ‘fracking’, except this proposal would be using CO2, so environmentalists refer to it as CO2 ‘fracking.’” Environmentalist groups argue that CO2 fracking poses a great risk to the environment. According to Sandra Steingraber, a senior scientist with Science and Environmental Health Network, a nonprofit, any form of extraction requires industrializing the landscape, resulting in numerous environmental problems, including habitat destruction, soil erosion and destroyed wildlife. Steingraber also said that CO2 fracking would cause more problems because of liquified CO2’s toxicity, leaving local water supplies at risk of being contaminated and becoming harmful to humans.

Bill That Would Ban New Fracking Method Advances in Assembly - A new bill (S.8357/A.8866) that would ban the use of carbon dioxide for fracking and gas extraction has been introduced in the Legislature following reports that homeowners in New York’s Southern Tier are being asked to lease their land by a fracking company. Southern Tier CO2 to Clean Energy Solutions, or Southern Tier Solutions, a Texas-based natural gas production company, started sending letters to residents last summer according to Assemblywoman Lupardo, D–Endwell, one of the bill’s co-sponsors. After learning that more than 6,000 residents received letters from the company, Lupardo and Senator Lea Webb, D–Binghamton, the Senate bill sponsor, sent a letter to the DEC in November requesting information about the company. The DEC responded in December, writing that the company had not reached out to the agency about the projects, and that if they were to receive permit applications from Southern Tier Solutions, there would be a “thorough review” to “ensure the agency’s decision is protective of public health and the environment.” “Our community has been through a lot when it comes to promises made about drilling in the Marcellus and Utica shale,” Assemblywoman Lupardo said. “In 2021 we permanently banned fracking with water, five years after it was initially banned by Executive Order. We now need to make sure that carbon dioxide is prohibited from being used in gas or oil extraction as well, by adding three words to our existing law. “We cannot allow a company with an unproven track record to move forward with this environmentally risky process.” While hydraulic fracking has been banned in New York since 2021 — and halted since 2014 via executive order — current law makes no mention of the use of CO2 for fuel extraction, a process that has been described as “experimental, dangerous and threatening to our water, health and climate,” by Food and Water Watch, an environmental group opposed to fracking. “It’s like conducting a chemistry experiment below our feet,” said Dr. Sandra Steingraber, a biologist who has extensively researched fracking and its effects, during a press conference. Dr. Steingraber stressed there is a lack of in-depth understanding about the interactions between CO2 and the shale formations Southern Tier Solutions is looking to drill into. Other risks associated with CO2 fracking include the creation of waste, leakage, habitat destruction, soil erosion, species die-offs, and increased risk of earthquakes, according to Steingraber and others who oppose the process. “Southern Tier Solutions doesn’t have adequate answers for questions about safety and contamination risks,” said Valdi Weiderpass, a chemical engineer and chair of the the Sierra Club’s Susquehanna Group. “The process of drilling and pressurizing CO2 and extracting gas releases countless chemicals and pollutants that can harm our food, water, air and bodies.” Supporters of the bill have also expressed concern about the possibility of CO2 pipes rupturing and causing public health issues. On Feb. 22, 2020 in Satartia, Mississippi, a pipe carrying CO2 ruptured and led to a mass poisoning that hospitalized 45 people. A first responder likened the affected area to a scene from a zombie apocalypse. “Pressurized CO2 transportation and ground injection poses severe health and environmental threats,” said Assemblywoman Anna Kelles, D–Ithaca, the bill’s prime sponsor. “Pressurized CO2 is highly caustic when in the presence of the smallest amount of water. Assemblywoman Anna Kelles “To use this CO2 for oil and gas extraction it must be transported through a spiderweb of thousands of miles of pipelines across the country, risking pipe corrosion and ruptures,” she said The bill S.8357/A.8866 would amend the current law banning state fracking to include just three more words: “and carbon dioxide.” The bill’s sponsors are attempting to pass it as part of the budget to avoid the issue being pushed off. “The sooner the better,” said Lupardo. The Assembly bull has advanced to a third reading and is ready for a floor vote. The Senate bill is currently in the Environmental Conservation Committee.Antero 4Q – Production Up 6%, Profits Down 87%, 21 New Wells | Marcellus Drilling News Antero Resources, which is 100% focused on the Marcellus/Utica with over 500,000 net acres under lease (and the largest M-U driller in West Virginia), issued its fourth quarter and full-year 2023 update yesterday. The company reports net production averaged 3.4 billion cubic feet equivalent per day (Bcfe/d) during 4Q23, an increase of 6% year-over-year. Production for the full year 2023 averaged 3.4 Bcfe/d as well. Of the company’s 2023 production, liquids (NGLs) averaged 193 thousand barrels per day (MBbl/d), an increase of 14% from 2022. Natural gas production averaged 2.2 Bcf/d, up 2% from 2022. The company made $95 million in 4Q23 versus a profit of $730 million in 4Q22 — down a big 87% year over year. For 2023, Antero made $243 million versus $1.9 billion in 2022, down 87% year over year.

Desperate Antis Ask Va. Regulators to Block Work on 99% Done MVP - Marcellus Drilling News - Last Thursday, 29 far-left nutball groups wrote Mike Rolband, Director of the Virginia Department of Environmental Quality (DEQ), demanding that he issue a stop work order for the 99% completed Mountain Valley Pipeline (MVP) due to “repeated and widespread violations and damage to waterbodies and private property.” This isn’t the first time these groups have demanded regulators intervene to block MVP based on flimsy grounds. The 29 radical groups include Wild Virginia, The Wilderness Society, Virginia League of Conservation Voters, West Virginia Rivers Association, Chesapeake Climate Action Network, and others (most of them obscure, one-person “groups” pretending to be bigger than they are).

Southwest Virginia landowners' Mountain Valley Pipeline lawsuit dismissed again - A three-judge panel of a federal appeals court has again dismissed a lawsuit from six Southwest Virginia landowners who say their land was improperly seized to build the Mountain Valley Pipeline. Cletus and Beverly Bohon of Montgomery County, Wendell and Mary Flora of Franklin County, and Aimee and Matt Hamm of Roanoke County argue that Congress erroneously delegated eminent domain power to the Federal Energy Regulatory Commission, which in 2017 authorized pipeline developers to use that power to take land for the 303-mile natural gas project. The judges on Tuesday reaffirmed their June 2022 agreement with a district court’s ruling that dismissed the lawsuit against FERC and Mountain Valley, stating that under federal law the district court lacks jurisdiction to hear the landowners’ lawsuit filed in 2020 because the appeals court already took up a related case filed in 2018. “In other words, the Bohons’ suit came too late,” wrote judges Cornelia Pillard, Robert Wilkins and Justin Walker of the U.S. Court of Appeals for the D.C. Circuit. Mia Yugo, an attorney with the Roanoke-based law firm Yugo Collins who represents the landowners, said they will appeal to the U.S. Supreme Court a second time. The high court already sent the case back to the D.C. Circuit once, in April, after the landowners appealed the previous dismissal. Yugo said Tuesday’s ruling failed to address the challenge to FERC’s authority and said recent Supreme Court rulings in other cases confirm the landowners’ position that such a challenge must be decided by trial in district court. “Private property is the bedrock of liberty,” Yugo said in a statement. “This case presents a critical issue for the country. The Landowners are entitled to their day in court and that should have already happened.” A FERC spokesperson declined to comment Wednesday, saying the agency doesn’t comment on matters before the courts. Mountain Valley Pipeline spokesperson Natalie Cox said in an email that Mountain Valley is pleased with the outcome of the court decision. The pipeline is planned to run from West Virginia through six Virginia counties, ending at a compressor station in Pittsylvania County. Equitrans Midstream, the company that owns a majority stake in the joint venture, says the pipeline is scheduled to be operational this quarter. The project was first announced in 2014 and initially was scheduled to be complete in 2018 with a price tag of $3.5 billion. It has been delayed by years of legal and permitting challenges as its cost estimate has more than doubled to $7.2 billion. Supporters say the pipeline will help transport natural gas from Appalachian shale deposits to mid- and south Atlantic U.S. markets, meeting a need for domestic energy. Opponents have said the project is unnecessary, unsafe and harmful to the environment. Lawsuits focusing on the pipeline’s impact on federally protected endangered species and national forests were dismissed in August. Judges cited legislation from this past summer that kept the U.S. from hitting its debt ceiling and also included a provision approving the pipeline’s remaining outstanding permits and shielding those permits from further legal challenges. In October, the landowners filed an emergency injunction to have construction work on their land stopped while their case was pending. The same three-judge panel denied that request. The Richmond-based 4th Circuit U.S. Court of Appeals is scheduled to hear oral arguments later this year in a related case regarding compensating the Bohons for the land seized by eminent domain.

MVP Gauges Support for Southgate Natural Gas Extension as Mainline Shows Heartbeat - Mountain Valley Pipeline LLC (MVP) is conducting an open season for natural gas deliveries along its revamped Southgate extension planned for 550,000 Dth/d capacity. The non-binding open season runs through Friday (Feb. 16) and is for firm transportation service in Rockingham County, NC. MVP said it is targeting an in-service date of mid-2028. After years of regulatory setbacks, MVP in December scaled back the Southgate project to run 31 miles from its mainline terminus in Virginia into North Carolina, from an original 75 miles. The redesign upped the planned firm capacity to 550,000 Dth/d from a previous 375,000 Dth/d.

U.S. NatGas Production Nears All-Time High Again – No Slowdown - Marcellus Drilling News - - U.S. natural gas production in the Lower 48 states is once again very close to all-time high levels, contrary to the blatherings of groups like the International Energy Association (IEA), which continues its meme that both oil and natgas either already have or will soon peak in demand. That’s just not happening here at home. Natural gas production is up to nearly 104.5 Bcf/d (billion cubic feet per day) over the last week, not far off from the all-time highs of nearly 105.7 Bcf/d recorded in December, according to data from S&P Global Commodity Insights.

Certified natural gas is ‘dangerous greenwashing scheme’, US senators say -- Certified natural gas – or methane gas that is purportedly produced in a low-emissions manner – is a “dangerous greenwashing scheme”, a group of progressive senators wrote in a letter to federal regulators on Monday. The letter, addressed to Federal Trade Commission chair, Lina Khan, comes as the agency prepares to release its updated Green Guides, which clarify when companies’ marketing claims around sustainability violate federal laws barring consumer deception, giving regulators stronger legal cases against polluters. Those guidelines should “crack down” on claims made by gas certification programs, the lawmakers, led by Massachusetts’s Ed Markey, wrote. “The reality is that gas certification schemes allow the oil and gas industry to justify the continued expansion of methane gas use and undermine efforts towards a just transition to renewables,” says the letter, which was also signed by the senators Jeff Merkley, Sheldon Whitehouse, Elizabeth Warren, Richard Blumenthal, Bernie Sanders and Cory Booker. The gas sector has long branded itself as climate-friendly, noting that when burned, the fuel generates less planet-heating carbon dioxide than other fossil fuels. But gas – called “natural gas” by fossil fuel interests – is made of methane, a greenhouse gas 80 times more planet-heating than carbon dioxide in the short term. Some research even indicates the fuel is worse for the climate than coal.Amid increasing public concern about gas usage and the climate crisis, a new industry of third-party gas “certifiers” has cropped up. These companies develop standards that they use to proclaim that certain producers are reducing emissions from their fracking wells, pipelines and storage facilities, and therefore generating gas sustainably.The companies can then deem certain gas “certified”, “responsibly produced” or “differentiated”, allowing producers to sell it at a premium. Utilities in New York, Vermont, New Jersey, Michigan and Virginia have purchased certified natural gas and plan to pass on the additional costs to customers, the non-profit watchdog organization Revolving Door Project found last year.“Those same consumers are still exposed to hazardous air pollution from burning gas in their homes, and combusting that gas is still contributing to the climate crisis,” said Hannah Story Brown, senior researcher at Revolving Door Project.Gas certifiers’ standards have not appeared to stand up to closer scrutiny. In 2022, for instance, the environmental non-profits Earthworks and Oil Change International spent seven months auditing sensor technologies used by Project Canary, an industry leader among gas certifiers. The groups concluded in a report released last year that the company was consistently failing to detect methane leaks during drilling, fracking, flaring and venting. (Project Canary has said in response that the report contains “inaccurate and misleading claims”.)This lack of robustness, the lawmakers write, comes as no surprise. “The gas companies’ profits depend on the monitoring companies certifying their gas, and the monitoring companies’ profits depend on willing industry customers,” they said. “Thus, there is no incentive to ensure the accuracy of emissions measurements.”

D.C. Circuit grills FERC in LNG export fight - A pair of Biden-appointed judges signaled Monday that the Federal Energy Regulatory Commission may need to take a closer look at climate and air quality impacts of the liquefied natural gas export terminals the agency approves. The remarks from judges of the U.S. Court of Appeals for the District of Columbia Circuit came during oral arguments over FERC’s certification of a Louisiana LNG project. The hearing occurred just two weeks after the Biden administration announced that a separate agency — the Department of Energy — would pause new LNG export approvals to better account for climate impacts when deciding whether the projects are in the public interest. Two D.C. Circuit judges questioned how that analysis was playing out at FERC, which approves siting and construction of new LNG facilities. The court has previously required FERC to beef up its consideration of greenhouse gas emissions from the energy projects it oversees. Advertisement “I don’t know why [FERC] would be so reluctant to find significance. It seems easier than litigation like this,” said Judge Florence Pan. Pan, a Biden appointee, pressed FERC attorney Susanna Chu to explain how high a project’s emissions had to be to prompt the agency to explore other alternatives. “I think the bottom line is there is no line that you would think greenhouse gas emissions are significant,” said Pan, after some back and forth. The arguments Monday centered on environmental groups’ challenge against FERC’s approval of Commonwealth LNG. The project is slated to be one of about a half-dozen proposed and existing LNG export facilities in southwest Louisiana, including the massive planned CP2 LNG terminal. Pan said that Commonwealth LNG’s emissions are 36 times higher than FERC’s proposed threshold for considering a project’s emissions “significant.” Chu said that FERC has withdrawn that policy. “Why isn’t this project significant under any proposal that you might adopt?” Pan said. Judge Brad Garcia also drilled down on how FERC accounts for cumulative air quality effects of building a project in an area that is expected to host several other LNG terminals. FERC had found that the levels of air pollution from nitrogen dioxide would not be significant, said Chu Even if the emissions from one facility are incremental, said Garcia, a Biden appointee, “why is that relevant to the total level [of emissions], which is what cumulative impacts analysis is asking [FERC] to talk about?” Later in the hearing, he asked John Longstreth, a partner at the firm K&L Gates representing Commonwealth LNG, why FERC would not consider emissions significant if they were counted alongside pollution from other facilities. “It literally does not compute in my head,” Garcia said. The judge also asked Chu to explain why FERC’s determination that Commonwealth LNG was in the public interest was not a basis for sending the analysis back to the agency to offer a better explanation. Chu responded that the Natural Gas Act presumes that LNG exports to free-trade-agreement nations are in the public interest, and DOE has already authorized the shipments. FERC “felt it was on firm ground on approving [the project], because it was required to do so,” she said.

Coalition of states criticize Biden's natural gas export freeze – A coalition of about two dozen state attorneys general sent a letter to President Joe Biden Tuesday blasting the president's recent decision to freeze the approval of new export sites for liquefied natural gas. Biden announced the freeze last month, citing climate change concerns. The attorneys general called on Biden to end the pause, saying it will hurt the economy, national security, and violated federal law. "Your administration's planned 'pause' – which we might more accurately call a series of constructive denials – of most American LNG exports is unlawful for several reasons," the letter said. The attorneys general goes on to lay out those reasons, saying the Department of Energy does not have legal authority to writ large deny the export permits. The letter also points out the agency did not go through the standard rulemaking procedure, a lengthy process that allows input from stakeholders. "Generally, agency legislative rules must go through the APA's notice-and-comments procedures," the letter said. "And the pause here is a substantive rule required to go through that process. The pause effectively commands the Department to stop performing its obligations under the NGA to approve export applications and does not leave the agency free to exercise discretion unless it chooses to disobey the policy. "That's the exact type of substantive rule that needs to go through notice and comment because it modifies substantial rights," the letter adds. The letter comes the same day that House Energy and Commerce Chair Rep. Cathy McMorris-Rodgers, R-Wash., held a hearing Tuesday on the export pause. "The administration has made its intentions clear," she said at the hearing. "This is not a 'pause,' as they've claimed. This is a ban. The administration is ignoring the fact that natural gas continues to create millions of new jobs, bring manufacturing back to the U.S., and revitalize communities across the country. The natural gas industry supports millions of jobs and brings tens of billions of dollars to the U.S. economy. "In 2022, in Pennsylvania alone, the natural gas industry supported $41.4 billion in economic activity, and shale gas development supported over 120,000 jobs," Rodgers added. Over the weekend, about 150 House Republicans sent a letter to Biden criticizing the gas freeze. The letter argues that administrations from the left and right have supported gas exports. Energy exports have become increasingly important given the global conflicts with Russia and Ukraine and in the Middle East, two of the world's most important energy export areas. Some House Democrats have also attacked Biden's decision, but the White House has stood by it, pointing out that the U.S. is already the world leader in these exports and that those exports are expected to significantly grow in the coming years. "We also must adequately guard against risks to the health of our communities, especially frontline communities in the United States who disproportionately shoulder the burden of pollution from new export facilities," the White House said in a statement. "The pause, which is subject to exception for unanticipated and immediate national security emergencies, will provide the time to integrate these critical considerations."

Future of US LNG hangs in balance as White House weighs geopolitical, environmental interests— The first shipment of U.S. liquefied natural gas left Cheniere Energy’s Sabine Pass export terminal in Louisiana almost eight years ago, ushering in a new age of American energy exportsto allies around the globe and generating tens of billions of dollars a year for the U.S. economy.But with climate change now gaining bandwidth in global leaders’ minds, the greenhouse gas emissions produced by LNG, while in some respects markedly less than coal, are driving a tense assessment within the Biden administration about whether building more LNG terminals is in the world’s best interests, while they put a pause on permitting.At the center of that debate is the network of American allies now dependent on U.S. LNG, for whom a reduction in American supply could have far-reaching implications beyond climate change, affecting the economic relationships around which so much diplomacy is built.“The climate concerns are real, and they deserve a serious, hard look, but there’s other geopolitical and market considerations we need to take into account,” said Ben Cahill, a fellow at the Center for Strategic and International Studies, a Washington think tank. “The fact is, gas demand is going to be with us for a long time and there will be multiple suppliers vying to meet that market demand.”The United States exported more than 88 million tons of LNG last year, surpassing Qatar and Australia to become the world’s largest supplier. And with multiple terminals under construction along the Gulf Coast, the sector is expected to grow exponentially in the decades ahead, with research company Wood Mackenzie projecting LNG exports from the U.S. and Mexico to reach a capacity of 238 million metric tons per year by 2050, accounting for 30% of global supply.But in a note to clients last week, the company warned that while a short-term pause on U.S. LNG permitting was unlikely to have much impact on global energy markets a sustained interruption could “have lasting implications on the global LNG market and could affect how buyers perceive US LNG."“While we expect existing LNG buyers to wait in the short term, these and other potential new buyers could start to look at competing projects outside of the U.S., such as those in Canada, Australia and particularly Qatar, as alternative supply sources,” wrote Giles Farrer, head of gas research at Wood Mackenzie.

Rockefellers, Bloomberg Behind Campaign to Block LNG Exports - Marcellus Drilling News -- So-called “charities” (really nothing of the sort) controlled by Rockefeller family billionaires and charities controlled by billionaire Mike Bloomberg provided millions of dollars in recent years to environmental groups that are campaigning against fossil-fuel projects, including LNG terminals that have been proposed on the Gulf Coast, according to insiders. So says an article recently published in the Wall Street Journal. Frankly, we’re not surprised. Nobody should be surprised that billionaire Democrats are funding these anti-fossil fuel crusades. What everyone SHOULD be surprised by is that the billionaires’ charities are tax-exempt and that they are funding tax-exempt nonprofits to engage in overtly political activities — activities that violate the IRS tax code for nonprofits. Why are ANY of the participants in this scheme tax-exempt?

The unlikely coalition behind Biden’s liquefied natural gas pivot - Environmental activists and community organizers on the Gulf Coast have spent years pressuring the Biden administration to halt the construction of terminals that export liquefied natural gas, or LNG. As U.S. production of natural gas skyrocketed over the past few decades, energy companies began building massive coastal facilities to liquefy the fossil fuel and transport it by ship to Europe, Asia and elsewhere. In response, activists staged protests, organized sit-ins, wrote to members of Congress and broadly made the issue Biden’s “next big climate test.”When the administration announced that it would pause its approval of new LNG terminals late last month, the climate movement and its allies were largely credited with the victory. Bill McKibben, the renowned founder of 350.org (and a former Grist board member), began his blog post about the news by saying, “Um, I think we all just won.” The decision reportedly came about after senior administration officials, including White House climate advisor Ali Zaidi, learned that young activists on TikTok were drawing millions of views elevating LNG as a major climate issue. As if to prove the president was listening, the White House has collected dozens of quotes from climate advocates praising the decision. (In some ways, the activists’ celebration belies the reality that the climate impact of constricting LNG exports is far from certain, and the devil is in the details: While a broader buildout certainly has the potential to promote unnecessary fossil fuel use, it may also speed other countries’ transition away from other, more harmful fossil fuels like coal.) But a broader, less-climate-concerned coalition, representing thousands of manufacturers, chemical companies and consumer advocates, has also been quietly pushing for the pause — and stands to benefit if Biden curbs LNG exports. The more American natural gas that’s available to be shipped overseas, they argue, the more unpredictable the price of the fuel will be stateside. If, for example, an unexpected gas shortage in another country means U.S. gas companies can make more money selling their product overseas than they can at home, prices will rise as the supply is stretched thin. This volatility would hurt not only households that heat and power their homes with natural gas but also the profit margins of big companies that rely on the fuel.“LNG exports put pressure on domestic markets, which…results in higher energy costs,” said Mark Wolfe, executive director of the National Energy Assistance Directors Association, an organization representing state officials who administer federal energy assistance programs that help low-income households pay energy bills. “There’s an impact on families that are benefiting from these lower prices. That needs to be taken into account.”Wolfe said that average home heating prices have risen more than 16 percent since March2020, driven in large part by higher natural-gas prices. (Hotter summers also mean utilities need more fuel to power a grid stretched thin by air conditioning in the summer and therefore have less natural gas for heating in the winter.) The result is that 1 out of 6 households nationwide are behind on their energy bills. “If the administration wants to approve these facilities, they should do it in the context of saying, ‘How do we help families pay their bills?’” Wolfe added. It’s not just cash-strapped families that might benefit if LNG exports are limited: The Industrial Energy Consumers of America, or IECA, a trade group representing more than 11,000manufacturing facilities nationwide, has also been arguing against LNG exports. IECA’s members include fertilizer companies, aluminum smelters and glass manufacturers, among others. These industries are heavily dependent on natural gas either as feedstock for production or to fuel their operations. As natural-gas prices rose in 2022, heavy industries that require large amounts of natural gas or electricity — such as fertilizer production and aluminum smelting — saw their costs skyrocket. That year, multiple steel mills, as well as the country’s second-largest aluminum smelter,paused operations in the face of unsustainable costs.Paul Cicio, IECA’s president, has been imploring the federal government to curb natural-gas exports since the Obama administration. The last three presidential administrations “have just ignored consumers’ interests,”

House Votes to Reverse Biden’s Pause on New LNG Exports – The U.S. House of Representatives passed a Republican-sponsored bill on Thursday to reverse the Biden administration’s pause on authorizing new LNG exports. The bill would strip the Department of Energy’s role for determining whether LNG projects are in the public interest and give the Federal Energy Regulatory Commission exclusive authority to approve projects and export licenses. The Biden administration temporarily suspended new project authorizations last month while DOE reviews policies for approving more exports. The legislation faces an uphill battle in the Senate, where lawmakers passed a Ukraine aid bill on Tuesday without any amendments, despite calls from Republicans to tack on measures that would have reversed...

New Study Questions LNG as a “Bridge Fuel” in Decarbonization - For years, the petroleum industry has been trying to push liquefied natural gas as a clean energy source, or at least a cleaner energy source than other fossil fuels, touting its role as a stepping stone or ‘bridge fuel’ between higher-emissions fuels and clean energy in the decarbonization transition. But recent research shows that LNG may not always be cleaner than coal, the dirtiest fossil fuel.The debate over whether LNG is in reality a cleaner alternative to other fossil fuels has been reengaged in recent months as the Biden administration has announced that it will pause approvals of new licenses to export liquefied natural gas. Last Friday, President Joe Biden announced that during this freeze the United States Department of Energy will review and assess whether the nation’s considerable LNG exports are “undermining domestic energy security, raising consumer costs and damaging the environment.”This pause will have widespread implications for global energy markets, as the United States was the single biggest exporter of liquefied natural gas in the world in 2023. According to LSEG data, full year exports from the U.S. rose 14.7% to 88.9 million metric tons (MT), but from 77.5 million metric tons in 2022.As the Biden administration’s decision to pause new approvals makes waves around global energy markets, it’s also caused a major resurgence of the natural gas debate in scientific circles. We now know that natural gas is much more harmful for the environment than initially thought, but there is widespread disagreement about to what extent, and whether pausing exports is actually the right move for the environment.In December 2023, 170 climate scientists signed onto a letter petitioning President Joe Biden to reject all plans to build more LNG export terminals going forward, and especially along the Gulf of Mexico. Their argument was based on the finding that, in stark contrast to the dominant energy transition narrative, liquefied gas is actually “at least 24 percent worse for the climate than coal.” This figure comes from a forthcoming Cornell University study (which has not yet been peer reviewed).The issue is not really the consumption of the natural gas itself, but emissions associated with the life cycle of liquefied natural gas production. The Cornell University figure comes from figuring in the carbon dioxide emissions that result from the liquefying process, which requires chilling natural gas to extremely cold temperatures, an energy-intensive ordeal.Another major issue is the methane that is released during the extraction of natural gas. Methane is an extremely potent greenhouse gas. While it breaks up much more quickly in the atmosphere than carbon dioxide, it is 80 times more potent at warming than CO2 over a 20-year period. And peer–reviewed studies (like this one, this one, and this one) are increasingly indicating that natural gas produces much, much more methane over its life cycle than previously thought.But other experts contend that these figures, while peer-reviewed, are politically motivated and the figures are inflated or skewed to tell a certain narrative that’s not necessarily consistent with reality. “It’s just extremely frustrating to even deal with claims like this, because we talk about settled science,” says Dan Byers, vice president of policy at the U.S. Chamber of Commerce, where he works on environmental issues in a recent Scientific American report. “The notion that, you know, LNG and natural gas reduce emissions by displacing coal is completely well established. So it feels like we’ve got like a flat earth situation going on with these claims.”A recent op-ed in the Wall Street Journal goes as far as to contend that the Biden administration’s new LNG export pause will actually harm the environment more than it helps. In the op-ed Chris Barnard, president of the American Conservation Coalition, argues that if the United States takes a step back from meeting global energy demands, other energy powers including Russia and China will only be too happy to fill those shoes. He argues that the result will be a more volatile geopolitical landscape as well as an increase of more carbon-intensive energy sources on the market.As usual, the truth probably lies somewhere in the middle. But the one thing that’s certain is that regardless of whether coal or LNG is cleaner, clean energy buildout will always be the cleanest. Of course, LNG will continue to have a role in stabilizing, and yes, bridging a smooth energy transition. But the quicker we can move away from it, the better.

Chesapeake seals LNG deal with Delfin and Gunvor - US shale gas producer Chesapeake Energy has entered into an offtake deal with Delfin Midstream, the US developer of a floating LNG export project in the Gulf of Mexico, to supply LNG to Geneva-based trader Gunvor. Chesapeake said in a statement on Tuesday that the LNG export deal includes executed sales and purchase agreements for long-term liquefaction offtake. Under the SPA, Chesapeake will buy about 0.5 million tonnes per annum (mtpa) of LNG from Delfin at a Henry Hub price with a targeted start date in 2028. The firm will then deliver LNG to Gunvor on an free on board (FOB) basis with the sales price linked to the Japan Korea Marker (JKM) for a period of 20 years, it said. These volumes will represent 0.5 mtpa of the previously announced up to 2 mtpa heads of agreement with Gunvor, Delfin said. Also, these volumes will add to the SPA Gunvor signed with Delfin in November last year for up to 1 mtpa. Delfin plans to install up to four self-propelled FLNG vessels that could produce up to 13.3 mtpa of LNG or 1.7 billion cubic feet per day of natural gas as part of its Delfin LNG project. The firm also aims to install two FLNG units under the Avocet LNG project. Delfin said in November it had secured commercial agreements for LNG sales and liquefaction services and the firm was “in the final phase towards FID on its first three FLNG vessels”. Kalpesh Patel, co-head of LNG trading and a member of Gunvor’s executive committee, said the new deal “represents an important step in finalizing the 0.5 mtpa out of our total of 2 mtpa arrangement with Chesapeake, while expanding our existing cooperation with Delfin.” “We continue to provide reliable and competitive logistics services to our partners by utilizing our fleet consisting of vessels procured via term charters and equity ownership,” he said.