US gasoline production at a 35 month low, gasoline supplies at 35 month high; gasoline demand at a 54 week low, distillates production at a 55 week low, after Gulf Coast refineries freeze; DUC well backlog unchanged at 4.7 months.

US oil prices rose for a fifth time in seven weeks following Ukrainian drone attacks on Russian Baltic Sea fuel exports, Houthi missile attacks on shipping in the Red Sea, and a larger than expected draw from US crude supplies…after rising 1% to $73.41 per barrel last week on escalating Mideast violence and on cold weather damage to US production and refining, the contract price for the benchmark US light sweet crude for February delivery rose more than 2% at the start of trading on Monday in reaction to a drone attack on a Russian fuel port in the Gulf of Finland, impacting their crude and petroleum products flows to Asia, and held on to those early gains in spite of news that production at Libya's Sharara oilfield had resumed to settle $1.78, or 2.4% higher at $75.19 a barrel as trading in the February oil contract expired, while the more active March oil contract settled up $1.51 at $74.76 a barrel…with markets now quoting the contract price for the US benchmark crude for March delivery, oil prices pulled back in early trading Tuesday despite a fresh series of joint U.S. and U.K. strikes against Houthi targets in Yemen, and finished 39 cents lower at $74.37 a barrel as traders focused on rebounding crude output from frozen fields in North Dakota and on rising supplies from Libya and Norway, rather than risks to supply posed by conflicts in Europe and the Middle East…oil prices traded lower in on a softer US dollar early Wednesday, despite an American Petroleum Institute report that US commercial oil supplies had tumbled by more than four times what had been expected, then rallied to a high of $75.83 after an EIA report confirmed a larger than expected draw from US crude stocks of over 9 million barrels, and held on to half its gains to settle 72 cents higher at at $75.09 a barrel, as the EIA report also showed that US oil production had dropped a million barrels barrels per day due to the arctic air outbreak…US oil prices continued higher early Thursday, supported by the larger than expected draw from crude stocks and by news of a Chinese cut in reserve requirements for banks intended to spur growth, then rallied to finish $2.27 or 3% higher at $77.36 a barrel after Houthi militants in Yemen claimed they had hit a U.S. warship in the Bab el-Mandeb Strait….after an early consolidation, oil prices rallied again Friday, propelled by stronger-than-expected macroeconomic data in the US and signs of deeper fiscal stimulus in China that boosted expectations for demand gains, and settled 65 cents higher at an eight week high of $78.01 a barrel as economic stimulus from China, stronger-than-expected 4Q GDP growth in the U.S., cooling U.S. inflation data, ongoing geopolitical risks, and the larger-than-expected drop in U.S. commercial crude supplies combined to wedge prices higher….oil prices thus finished the week 6.3% higher, while the March oil contract, which had closed the prior week at $73.25, settled with a 6.5% gain at a 13 week high...

Meanwhile, natural gas prices rose for the 5th time out of six weeks, on a near record withdrawal of gas from storage and on forecasts for slightly cooler weather heading into February…after falling 24% to $2.519 per mmBTU last week, the largest price drop in 3 years, on forecasts for a national warming trend and a lower than expected withdrawal of gas from storage, the contract price for natural gas for February delivery opened 15 cents lower on Monday, knocked down over the weekend by a bearish adjustment to weather forecasts to close out the month, and struggled back to close 10.0 cents lower at $24.19 per mmBTU, as forecasts had doubled down on warmer weather into February…natural gas prices were down another 8 cents at the open on Tuesday, as a mild temperature outlook stretching into early February continued to put pressure on prices, but mounted a steady ascent throughout the day to settle 3.1 cents higher at $2.450 per mmBTU, as traders awaited the expected report of massive pull of gas from storage on Thursday….prices opened at $2.595 on Wednesday, nearly fifteen cents above Tuesday’s closing price, following a modest bullish shift in forecasts overnight, and held those gains to settle 19.1 cents higher at $2.641 per mmBTU, as traders eyed a potentially record-challenging storage report following the widespread arctic weather outbreak last week…natural gas prices open eleven cents higher on Thursday, but the rally quickly gave way to selling as the storage withdrawal met expectations, and gas prices settled 7.0 cents lower $2.571 per mmBTU, as a near record draw of gas from storage failed to boost prices…February natural gas prices slid nearly 15 cents early Friday on an outage of a Freeport Texas LNG export train, but rallied in thin volumes towards the contract expiration to settle 14.1 cents higher at $2.712 per mmBTU on forecasts for higher demand in two weeks when the weather turns slightly cooler…trading in February natural gas prices thus finished this week's trading 7.7% higher, while the March natrual gas contract, which will be the basis for trading next week, actually ended 3.4% lower at $2.17 per mmBtu...

The EIA's natural gas storage report for the week ending January 19th indicated that the amount of working natural gas held in underground storage in the US fell by 326 billion cubic feet to 2,856 billion cubic feet by the end of the week, which still left our natural gas supplies 110 billion cubic feet, or 4.0% above the 2,746 billion cubic feet that were in storage on January 19th of last year, and 142 billion cubic feet, or 5.2% more than the five-year average of 2,714 billion cubic feet of natural gas that were typically in working storage as of the 19th of January over the most recent five years…the 326 billion cubic foot withdrawal from US natural gas working storage for the cited week was close to the average 321 billion cubic feet withdrawal from supplies that had been forecast by analysts polled by Reuters, but was more than triple the 86 billion cubic feet that were pulled from natural gas storage during the corresponding third week of January 2023, and was more than double the average 148 billion cubic feet withdrawal from natural gas storage that has been typical for the same early winter week over the past 5 years…

The Latest US Oil Supply and Disposition Data from the EIA -

US oil data from the US Energy Information Administration for the week ending January 19th showed that after a big drop in production from US wells and an even larger drop in our oil imports, we needed to pull oil out of our stored commercial crude supplies for the sixth time in eight weeks, and for the 20th time in the past 32 weeks, even after a big drop in our oil refining….Our imports of crude oil fell by an average of 1,840,000 barrels per day to average 5,580,000 barrels per day, after rising by an average of 1,179,000 barrels per day the prior week, while our exports of crude oil fell by 595,000 barrels per day to average 4,434,000 barrels per day, which combined meant that the net of our trade in oil worked out to a net import average of 1,146,000 barrels of oil per day during the week ending January 19th, 1.245,000 fewer barrels per day than the net of our imports minus our exports during the prior week. At the same time, transfers to our oil supply from Alaskan gas liquids, natural gasoline, condensate, and from unfinished oils averaged 693,000 barrels per day, while during the same week, production of crude from US wells decreased by a rounded 1,000,000 barrels per day to 12,300,000 barrels per day. Hence our daily supply of oil from the net of our international trade in oil, from transfers, and from domestic well production appears to have averaged a rounded total of 14,139,000 barrels per day during the January 19th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 15,276,000 barrels of crude per day during the week ending January 19th, an average of 1,376,000 fewer barrels per day than the amount of oil that our refineries reported they were processing during the prior week, while over the same period the EIA’s surveys indicated that a rounded average of 1,188,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US... So, based on that reported & estimated data, the crude oil figures provided by the EIA for the week ending January 19th appear to indicate that our total working supply of oil from storage, from net imports, from transfers, and from oilfield production was 51,000 barrels per day more than what our oil refineries reported they used during the week…To account for that difference between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a rounded [-50,000] barrel per day figure onto line 16 of the weekly U.S. Petroleum Balance Sheet, in order to make the reported data for the supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there was an error or omission of that size in the week’s oil supply & demand figures that we have just transcribed...

This week's rounded 1,188,000 barrel per day average decrease in our overall crude oil inventories came as 1,319,000 barrels per day were being pulled out of our commercially available stocks of crude oil, while 131,000 barrels per day were being added to our Strategic Petroleum Reserve, the eighth SPR increase in fifteen weeks. following nearly continuous withdrawals over the prior 39 months... Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports fell to 6,534,000 barrels per day last week, which was still 6.3% more than the 6,207,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be 1,000,000 barrels per day lower at 12,300,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was a rounded 1.000,000 barrels per day lower at 11,900,000 barrels per day, while Alaska’s oil production was 8,000 barrels per day lower at 426,000 barrels per day but still added the same 400,000 barrels per day to the EIA's rounded national total as it did last week...US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 6.1% below that of our pre-pandemic production peak, but still 26.8% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021.

US oil refineries were operating at 85.5% of their capacity while processing those 15,276,000 barrels of crude per day during the week ending January 19th, down from their utilization rate of 92.6% the prior week, and a below normal utilization rate for mid January, apparently due to the arctic cold that penetrated to the Gulf Coast ... the 15,276,000 barrels per day of oil that were refined this week were still 2.0% more than the 14,981,000 barrels of crude that were being processed daily during week ending January 20th of 2023 (after the refinery-freeze-offs following the Christmas 2022 blizzard), but 9.4% less than the 16,857,000 barrels that were being refined during the prepandemic week ending January 17th, 2020, when our refinery utilization rate was at 90.5%..

With the big decrease in the amount of oil being refined this week, gasoline output from our refineries was also much lower, decreasing by 1,040,000 barrels per day to a 35 month low of 8,325,000 barrels per day during the week ending January 19th, after our refineries' gasoline output had decreased by 291,000 barrels per day during the prior week. This week’s gasoline production was 5.7% less than the 8,831,000 barrels of gasoline that were being produced daily over the storm impacted week of last year, and 12.7% less than the gasoline production of 9,535,000 barrels per day during the prepandemic week ending January 17th 2020....at the same time, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 402,000 barrels per day to a 55 week low of 4,500,000 barrels per day, after our distillates output had decreased by 265,000 barrels per day during the prior week. Even with this week’s decrease, our distillates output was 2.0% less than the 4,892,000 barrels of distillates that were being produced daily during the week ending January 20th of 2023, and was 9.2% less than the 4,954,000 barrels of distillates that were being produced daily during the week ending January 17th 2020..

Even with this week's decrease in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the 9th time in ten weeks, increasing by 4,912,000 barrels to a 35 month high of 252,977,000 barrels during the week ending January 19th, after our gasoline inventories had increased by 3,082,000 during the prior week. Our gasoline supplies rose this week despite the big drop in production because the amount of gasoline supplied to US users fell by 389,000 barrels per day to a 54 week low of 7,880,000 barrels per day, and because our exports of gasoline fell by 380,000 barrels per day to 717,000 barrels per day, and because our imports of gasoline rose by 79,000 barrels per day to 628,000 barrels per day…Even after twenty-seven gasoline inventory withdrawals over the past forty-eight weeks, our gasoline supplies were 9.0% above than last January 20th's gasoline inventories of 232,022,000 barrels, and about 1% above the five year average of our gasoline supplies for this time of the year…

With this week's decrease in our distillates production, our supplies of distillate fuels fell for the first time in nine weeks, decreasing by 1,417,000 barrels to 133,336,000 barrels over the week ending January 19th, after our distillates supplies had increased by 2,370,000 barrels to a 124 week high during the prior week. Our distillates supplies fell this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, rose by 139,000 barrels per day to 3,784,000 barrels per day, and because our exports of distillates rose by 87,000 barrels per day to 1,120,000 barrels per day, while our imports of distillates rose by 86,000 barrels per day to 201,000 barrels per day...With 24 inventory decreases over the past forty-five weeks, our distillates supplies at the end of the week were 15.7% above the 115,270,000 barrels of distillates that we had in storage on January 20th of 2023, but were still about 4% below the five year average of our distillates inventories for this time of the year...

Finally, after the big drops in our oil production and our imports, our commercial supplies of crude oil in storage fell for the 16th time in twenty-six weeks and for the 29th time in the past year, decreasing by 9.233,000 barrels over the week, from 429,911,000 barrels on January 12th to 420,678,000 barrels on January 19th, after our commercial crude supplies had decreased by 2,492,000 barrels over the prior week... With that big decrease, our commercial crude oil inventories slipped to about 4% below the most recent five-year average of commercial oil supplies for this time of year, but were still about 28% above the average of our available crude oil stocks as of the third weekend of January over the 5 years at the beginning of the past decade, with the big difference between those comparisons arising because it wasn’t until early 2015 that our oil inventories had first topped 400 million barrels. After our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, then jumped again after February 2021's winter storm Uri froze off US Gulf Coast refining, but then fell in the wake of the Ukraine war, only to jump again following the Christmas 2022 refinery freeze offs, our commercial crude supplies as of this January 19th were 6.2% less than the 448,548,000 barrels of oil left in commercial storage on January 20th of 2023, but 1.1 % more than the 416,190,000 barrels of oil that we still had in storage on January 21st of 2022, while still 11.7% less than the 476,653,000 barrels of oil we had in commercial storage on January 22nd of 2021, after 2020’s pandemic precautions had left a lot of oil unused…

This Week's Rig Count

In lieu of a detailed report on the rig count, we are again just including below a screenshot of the rig count summary from Baker Hughes...in the table below, the first column shows the active rig count as of January 26th, the second column shows the change in the number of working rigs between last week’s count (January 19th) and this week’s (January 26th) count, the third column shows last week’s January 19th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting period a year ago, which in this week’s case was the 27th of January, 2023...

DUC well report for December

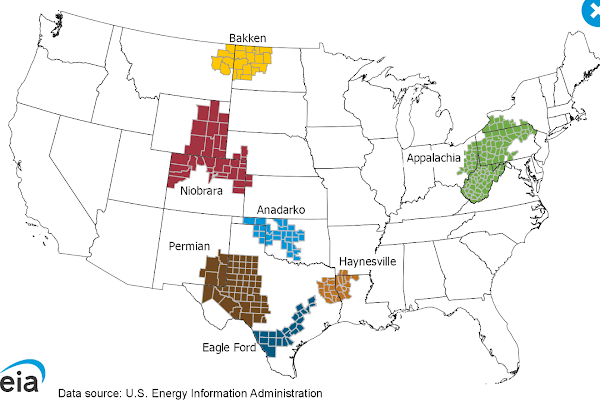

Tuesday of last week saw the release of the EIA's Drilling Productivity Report for January, which included the EIA's December data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions (click tab 3)....that data showed a decrease in uncompleted wells nationally for the 39th time out of the past 42 months, even though drilling of new wells increased in December while completions of drilled wells decreased and hence remained well below the average pre-pandemic levels....for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 64 wells, falling from a revised 4,438 DUC wells in November to 4,374 DUC wells in December, which was also 18.0% fewer DUCs than the 5,337 wells that had been drilled but remained uncompleted as of the end of December of a year ago...this month's DUC decrease occurred as 862 wells were drilled in the seven regions that this report covers (representing 87% of all U.S. onshore drilling operations) during December, up by 9 from the 853 wells that were drilled in November, while 926 wells were completed and brought into production by fracking them, down from the 944 well completions seen in November, but up from the 904 completions seen during the storm impacted December of last year....at the December completion rate, the 4,374 drilled but uncompleted wells remaining at the end of the month represents a 4.7 month backlog of wells that have been drilled but are not yet fracked, same as the DUC well backlog of a month ago, while up from the eight year low of 4.6 months of last January, on a completion rate that is now more than 20% below 2019's pre-pandemic average...

the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, was unchanged from a month earlier at 768 DUC wells at the end of December, as 79 new wells were drilled into the Marcellus and Utica shales during the month, while 79 of the already drilled wells in the region were fracked...

+++++++++++++++++++++++++++++++++++++++++++++++++.

Commission claims court can’t review decisions on drilling under Ohio park and wildlife areas - Ohio Capital Journal -- An Ohio commission is arguing its decisions last fall to allow oil and gas drilling under a state park and two wildlife areas are final and cannot be appealed. Environmental groups challenging the Ohio Oil & Gas Land Management Commission say it failed to follow state law when it approved land parcels for leasing of drilling rights at Salt Fork State Park, Zepernick Wildlife Area and Valley Run Wildlife Area. Among other things, state law says the commission must consider nine factors in reaching its decisions, including environmental impacts, consequences for visitors or users of state lands, public comments or objections, economic issues, and others. State lawyers have filed a motion to dismiss, claiming the court can’t review the decisions because the statute doesn’t expressly provide for judicial review. The plaintiffs seeking to overturn the decisions, though, say the commission’s actions affect their rights and amounted to licensing, which can be appealed under the Ohio Revised Code. “Our courts play a critical role in overseeing agency decisions to make sure agencies do not abuse the discretion and power the law gives them. Our lawsuit asks that the court provide that critical oversight here,” said Megan Hunter, an attorney with Earthjustice, on behalf of the plaintiffs. Those environmental groups are Save Ohio Parks, the Ohio Environmental Council, the Buckeye Environmental Network and Backcountry Hunters and Anglers. “Ohio statute has set up a system where an oil and gas company can hand-select those public lands it wants to lease and ask the commission for permission to move forward with the process for it to do so,” Hunter added. “The law places the commission in a gatekeeping role, making them the ones to determine whether an oil and gas company should be able to lease a particular state park or wildlife area.” And while a winning bidder has to apply for permits to drill, Ohioans generally have no right to appeal permitting decisions, she said. “Therefore, the appeal from the nominations is when there is an opportunity for judicial review of the decision to drill under these state lands.” Commission chair Ryan Richardson admitted that the commission would need to consider the nine statutory criteria in a Nov. 2 affidavit filed in a related case. Yet the commissioners did not discuss all nine factors at the public meeting where they voted to grant the proposals. Nor did they provide any written opinion explaining how they weighed the nine criteria. “This is not the way justice is supposed to happen in Ohio or anywhere else in a democracy,” said Melinda Zemper, a member of Save Ohio Parks.The case is further complicated by the commission’s insistence on moving ahead before the Ohio Attorney General’s office resolves an investigation into claims about allegedly falsified comments that favored fracking under state parks and wildlife areas. “The [commission’s] decision to approve fracking in Ohio parks undermines core principles of good governance, for it occurred despite an ongoing investigation and enormous public pushback,” said Chris Tavenor, associate general counsel and managing director of democracy policy for the Ohio Environmental Council. The decisions also mean Ohio will be a less healthy place to live and have more greenhouse gas emissions, he said. As of 2021, the Energy Information Administration ranked Ohio fifth among states for total carbon dioxide emissions, he noted. The commission’s failure to let citizens testify at its meetings also undermined the trust of Ohio citizens and denied them their rights to participate in the process, said Loraine McCosker, a co-founder and member of Save Ohio Parks. A separate lawsuit challenges the constitutionality of House Bill 507, which jump-started the challenged decisions, but where citizen groups had no chance to testify against its natural gas provisions after they were added through last-minute amendments in late 2022. The appeal doesn’t automatically stay the public bidding period for the drilling rights, which began Jan. 3 and runs through Feb. 4. Spokesperson Andy Chow said the commission does not comment on pending litigation. However, he noted, the commission is currently working to schedule its next meeting to decide on the winning bids. Once companies have secured drilling rights, they would be free to apply for permits to drill wells. Ohio law generally provides up to 21 days for review of those applications, except for urban areas, where a 30-day review period applies. The average review time generally has been running 15 to 18 days, Chow said. So, barring any stay from a court, well construction could start as early as this spring.

Antis Have No Right to Appeal Decision to Drill Under State Parks - Marcellus Drilling News --Anti-fossil fuel fanatics in Ohio (and beyond) still can’t accept that they lost a battle to block drilling under (not on) Ohio state-owned land, including some Ohio state parks. In November, the Ohio Oil & Gas Land Management Commission (OGLMC) met in a public forum and voted to allow shale drilling under three state-owned tracts of land: (1) all 20,000 acres of Salt Fork State Park in Guernsey County, (2) more than 300 acres of Valley Run Wildlife Area in Carroll County, and (3) 66 acres of the Zepernick Wildlife Area in Columbiana County (see OGLMC Votes to Allow Fracking Under Ohio’s Salt Fork State Park). The vote precipitated a panic attack among the environment left. Earthjustice and the Ohio Environmental Council (disgusting leftwing green groups) filed a lawsuit in Franklin County Common Pleas Court appealing the OGLMC’s action (see Big Green Sues to Block Drilling Under (Not On) Ohio State Parks). One teeny, tiny problem for the wackos: The new law that empowers the OGLMC to do the leasing does not contain a provision to appeal their decisions to a court.

OH Supremes Revive Lawsuit Against ODNR for Closing Injection Well - Marcellus Drilling News - Here’s a story we haven’t written about in over three years. American Water Management Services (AWMS) owns a wastewater injection well in Trumbull County that supposedly caused a low-level earthquake (that nobody could feel) in 2014. Actually, there are two injection wells located at the site, both operated by AWMS. They were both “temporarily” shut down by the Ohio Dept. of Natural Resources following the quake nobody could feel (see ODNR Temporarily Shuts Down Injection Wells After Low-Level Quake). ODNR allowed AWMS to reopen one of the injection wells but denied it the right to reopen the second well. AWMS appealed the closure of the second well all the way to the Ohio Supreme Court in 2018.

Ohio Supreme Court finds appeals court in Warren was wrong to dismiss Weathersfield injection well case - An Ohio Supreme Court ruling issued on Wednesday could be a step toward resolving a long legal battle over how much, if any money is owed by the state to the owner of a Trumbull County brine injection well that was ordered closed following an earthquake. Justices on the state’s highest court unanimously ruled that the Eleventh District Court of Appeals, based in Warren, failed to follow earlier instructions from the Ohio Supreme Court in the case filed by AWMS Water Solutions against the Ohio Department of Natural Resources. AWMS has been arguing that ODNR in effect “took” its property when it suspended the operation of one of its injection wells along Route 169 in 2014 following seismic activity near the well site. The well owner argues that it invested $5.6 million into the wells and was unable to reap the profits from its operation. In a 2021 ruling, the appellate court dismissed the case, agreeing with the ODNR’s argument that AWMS had a lease to dispose of waste, and was not considered to be a property qualified for compensation. In Wednesday’s opinion, the Supreme Court states that it had already previously ruled that AWMS did have a property interest in its lease and that the duty of the appeals court was to weigh the evidence to consider how much money, if any, the state owes AWMS. “By deciding the case in this manner, the court ventured beyond the scope of our remand order,” the opinion stated. The opinion stated that it is hard to understand how the appeals court could rule that AWMS did not have an interest that entitled it to compensation without doing the takings analysis that the appeals court was ordered to do. The case is again being sent back to the appeals court where judges have been ordered to weigh the evidence to determine whether the well owner suffered a total taking of the property involved.

Appeals Court Failed to Follow Orders When Reconsidering Wastewater Well Closure - An appeals court failed to follow instructions from the Supreme Court of Ohio when considering the case of a wastewater well operator that was shut down for potentially causing earthquakes in Trumbull County.In a unanimous per curiam opinion, the Supreme Court today stated that the Eleventh District Court of Appeals ignored the high court’s directive to “weigh the parties'evidence ” to determine if the state should compensate AWMS Water Solutions for suspending its permits to operate in Weatherfield Township.In 2014, the Ohio Department of Natural Resources (ODNR) suspended the operation of one of two AWMS wells. The wells were used to inject waste fluid from the oil and natural gas drilling process of hydraulic fracturing, known as fracking. ODNR suspended the operations when seismic activity was recorded near AWMS well #2, which is close to the city of Niles.A protracted legal battle led to a 2020 Supreme Court decision regarding AWMS’claim that the state’s actions amounted to a “taking” of its property under the Fifth Amendment to the U.S. Constitution. AWMS argued that it was entitled to compensation from ODNR for improperly shutting down the wells and hindering the company’s ability to reopen. The Supreme Court did not definitively decide whether AWMS was owed money but remanded the case to the Eleventh District.After conducting a nine-day trial in 2021, and ordering the parties to file additional briefs, the Eleventh Districtdismissed the case, finding that AWMS was not entitled to compensation. AWMS appealed the decision to the Supreme Court, asserting the appellate court made its decision without following the Supreme Court’s directions. In December 2011, AWMS secured a lease from the owner of 5.2 acres of industrial property in Trumbull County. The lease gave the company the exclusive right to operate disposal wells and install, operate, and maintain infrastructure to facilitate waste disposal from oil and gas drillers. About a week after AWMS applied for permits, a 4.0-magnitude earthquake was recorded a few miles from the AWMS property. The event originated near another deep-well injection site and was felt by more than 4,000 people in parts of northeastern Ohio, western Pennsylvania, and Ontario, Canada. After the earthquake, former Ohio Gov. John Kasich imposed a moratorium on well-injection activities. The moratorium delayed the processing of AWMS’ permits, but the company was authorized to use the two wells in July 2013. AWMS then spent $5.6 million to construct the wells and other infrastructure, including tanks and pumps. ODNR authorized the company to begin wastewater injections in March 2014. Four months later, a 1.7-magnitude earthquake was recorded near well #2, and a month later, a 2.1-magnitude quake was recorded in the same area. ODNR ordered AWMS to suspend its operations of both wells, stating the earthquakes were related to the well operations. The agency later allowed well #1 operations to resume, but not well #2. AWMS sought ODNR permission to restart well #2 but was unsuccessful. In 2016, the company sought a writ of mandamus from the Eleventh District. AWMS wanted the appellate court to order ODNR to start a “property appropriation” proceeding, claiming that the state was, in effect, taking the property of the disposal company but not permitting it to operate. The Eleventh District dismissed the case, finding that ODNR regulation of the facility did not constitute a taking. AWMS appealed to the Supreme Court. In 2020, the Supreme Court ruled there was a “genuine issue of material fact” concerning whether the state’s suspension of AWMS’ operation constituted a taking by depriving the company of all economically beneficial uses of its lease. The Supreme Court remanded the case to the Eleventh District with instructions to weigh the evidence related to AWMS’ claim that the state “totally” took all the economic value of well #2 or “partially” took the value. The Supreme Court directed the Eleventh District to use a process set out by the U.S. Supreme Court to determine if AWMS suffered a partial taking.

‘Black Gold: EOG Resources Drills Gushers in Ohio Utica | Marcellus Drilling News - Perhaps our headline is slightly misleading. EOG is not the modern equivalent of Jed Clampett walking along and seeing crude bubbling up out of the ground (as in the fictionalThe Beverly Hillbillies show of the 1960s with the “Ballad of Jed Clampett” that says, “Oil that is, black gold, Texas tea.”). What EOG and other Ohio drillers (like Encino Energy and Ascent Resources) have done is more like rocket science than winning a lottery. The oil has been locked away in the Utica/Point Pleasant shale layer for millennia. Aubrey McClendon, co-founder and former CEO of Chesapeake Energy, was the first to see the vision of freeing oil from the Utica.

Black Gold: Ascent & Encino Drill Oil Gushers in Ohio Utica --Marcellus Drilling News - Yesterday we brought you the latest update on EOG Resources’ oil drilling program in the Utica Shale (see Black Gold: EOG Resources Drills Gushers in Ohio Utica). Today we have details about two more companies and their Utica oil drilling programs: Ascent Resources and Encino Energy. Last summer, we told you that Encino, which picked up Chesapeake Energy’s Ohio O&G assets, including 933,000 Ohio acres with 320,000 net Utica acres and 920 operated and non-operated Ohio Utica wells for $2 billion in 2018 (see Stop Press: Chesapeake Sells ALL of its Ohio Utica Assets for $2B), had finally cracked the code on coaxing oil from the Utica Shale (see Oil Prod. in Northern Utica Comes Alive – Encino Cracks Oil Code). Encino is now Ohio’s top oil producer.

20 New Shale Well Permits Issued for PA-OH-WV Jan 15 – 21 --Marcellus Drilling News - There were 20 new permits issued to drill in the Marcellus/Utica during the week of Jan. 15 – 21, versus 24 permits issued during the prior week. Pennsylvania issued 11 new permits last week. Ohio issued 9 new permits. West Virginia had a big, fat zero new permits last week. Ascent Resources scored the most new permits issued, with 5 permits across two counties, Jefferson and Harrison, in Ohio. Encino Energy (EAP in the list) had the second most new permits issued with 4 permits in Harrison County, OH. ARMSTRONG COUNTY | ASCENT RESOURCES | BRADFORD COUNTY | CHESAPEAKE ENERGY | CNX RESOURCES | ENCINO ENERGY | EQT CORP | EXCO RESOURCES | HARRISON COUNTY | JEFFERSON COUNTY (OH) | LYCOMING COUNTY | SOUTHWESTERN ENERGY | SUSQUEHANNA COUNTY |WASHINGTON COUNTY | WESTMORELAND COUNTY

Utilities plan onsite gas storage to improve reliability; critics warn of costs, safety concerns --As the U.S. electric power system has become more reliant on natural gas plants, it’s also become more vulnerable to gas system failures. During Winter Storm Elliott in 2022, about 18% of the anticipated power supply in the portion of the grid that serves the entire eastern half of the United States, called the Eastern Interconnection, was offline. Of the power plants that failed to perform, 47% were natural-gas fired, according to a joint inquiry by the Federal Energy Regulatory Commission and the North American Electric Reliability Corporation. Natural gas fuel problems accounted for 20% of all generation outages, the report noted.However, in an era when building new gas pipelines, along with other infrastructure, has proven increasingly fraught, some utilities see a solution to gas shortages: adding liquified natural gas storage onsite.Virginia utility giant Dominion Energy is proposing to add liquefied natural gas storage to serve two large power plants it operates near Emporia in southern Virginia. And in South Dakota, Otter Tail Power Company is planning to add gas storage at its Astoria combustion turbine plant in Deuel County. A spokesman for Duke Energy, a large North Carolina-based utility company which was forced to cut power to customers during Elliott last year, said it is “exploring all on-site storage options, including LNG and other alternative fuel storage technologies for future use.” A 2021 study by researchers at Carnegie Mellon University found that storing gas onsite could also yield benefits for electric customers in New England, where gas supply is tight.Some pro-renewable energy analysts, though, are wary about the costs and impacts of adding new gas infrastructure at a time when cutting emissions to mitigate climate change is becoming ever more pressing. There are also safety and environmental concerns. Having backup fuel on site is common at many natural gas power plants, though the go-to option is typically a distillate fuel oil (like diesel), said Michael Caravaggio, director of research and development at the Electric Power Research Institute, an independent nonprofit research organization. The main advantage is ease of storage and management over a long period of time, whereas liquefied natural gas needs to be kept at extremely low temperatures, (about -260 degrees Fahrenheit). That means that adding LNG storage involves either liquefying pipeline gas onsite or transporting LNG in for storage in specialized tanks.“That’s a lot of infrastructure for backup fuel,” Caravaggio said. “The vast majority of the U.S. would likely pencil out with diesel and distillate oil as the onsite backup and that’s what we see currently.”But Bill Swanson, manager of supply operations and planning for Otter Tail Power Company, which has about 133,000 customers in Minnesota, North Dakota and South Dakota, said adding LNG at the company’s 245-megawatt Astoria plant made the most economic sense. Winter Storm Uri in 2021, which sent gas production plummeting, and Elliott last year prompted the company to pursue LNG backup fuel. During Winter Storm Elliott we had a situation where we couldn’t get gas out of the pipeline,” he said.The company explored fuel oil but found it would require modifications to the gas turbine. Burning the oil, he added, also reduces the output of the plant more than 10% and increases emissions.“On an evaluated cost basis, LNG was lower cost,” Swanson said, though when asked he said the total cost of the gas storage project is not public. If Otter Tail had to liquefy the gas onsite instead of trucking it in from a nearby facility, “economics might flow back to fuel oil,” he added.Jeremy Slayton, a spokesman for Richmond-headquartered Dominion Energy, said Elliott, Uri, and the Colonial Pipeline cyberattack in 2021 all underscored the need for backup fuel. The company is proposing to add a 25 million gallon LNG storage facility that will enable its two large combined cycle plants at Brunswick and Greensville to run at full bore for up to four days each. Those plants alone generate enough electricity to power 700,000 of its 2.6 million Virginia customers’ homes.

DTE Gas to recover $49 million in costs from year of skyrocketing prices - – State utility regulators recently approved most of DTE Gas Co.’s requests for its natural gas cost recovery for a past winter’s heating season. The Michigan Public Service Commission (MPSC) signed off on more than $49 million to be recovered with interest. The agency’s decision last week is related to the company’s contracted use of the NEXUS gas pipeline to bring the fossil fuel from Ohio into Michigan during the 2021-2022 fiscal year.

DEC: Heating oil leaked into Byron Lake from nearby Oakdale home - The state Department of Environmental Conservation and Town of Islip hazmat crews responded to an oil spill in Oakdale Friday that seeped into Byron Lake. The DEC says the spill started in the crawlspace of a home earlier in the week. Robert Abrahamson felt something was off when he smelled what he described as diesel coming from a stream behind his Oakdale home. He says he didn’t think anything of it until Thursday. “The smell just got increasingly worse,” he said. "Then we started seeing hazmat trucks, spill response clean ups down by the lake, Byron Lake. And then I said, oh well something's going on. And then late last night, we saw the trucks over here by the creek." The Department Of Environmental Conservation says a petroleum oil spill started at a home on Lincoln Drive Monday. DEC crews arrived at the home Wednesday and told the homeowner to stop a sump pump from pumping out the nearly 140 gallons of oil onto the street. The oil then found its way into a storm drain, into Byron Lake, and possibly the stream behind Abrahamson’s home. "It's actually gotten worse than it's been yesterday," he said. The DEC said the spill didn’t harm wildlife. Citizens Campaign for the Environment executive director Adrienne Esposito says potential impacts of a spill like this could greatly impact the watershed. "It can kill aquatic plants. It can kill hibernating reptiles, such as turtles, fish, and it’s very difficult to remediate at that point,” she said. “The longer you wait to clean it up, the more damage it does, and the more costly it is.” She says the DEC should’ve responded sooner to prevent potential problems further downstream. "The problem here with Byron Lake is that it is a tributary into the South Shore estuary,” said Esposito. “Once the oil flows into the lake, it's a very good chance it's flowing out into the bay."

US weekly LNG exports drop to 27 cargoes - US liquefied natural gas (LNG) exports decreased in the week ending January 17 compared to the week before, according to the Energy Information Administration. The agency said in its weekly natural gas report that 27 LNG carriers departed the US plants between January 11 and 17, one vessel less compared to the week before. Moreover, the total capacity of these LNG vessels is 99 Bcf, the EIA said, citing shipping data provided by Bloomberg Finance. Average natural gas deliveries to US LNG export terminals decreased by 15.4 percent (2.3 Bcf/d) week over week, averaging 12.5 Bcf/d, according to data from S&P Global Commodity Insights. Natural gas deliveries to terminals in South Louisiana decreased by 12.9 percent (1.2 Bcf/d) to 8 Bcf/d, while natural gas deliveries to terminals in South Texas decreased by 18.6 percent (0.8 Bcf/d) to 3.6 Bcf/d. The agency said that natural gas deliveries to terminals outside the Gulf Coast the decreased 28.8 percent (0.3 Bcf/d) to 0.9 Bcf/d. Cheniere’s Sabine Pass plant shipped eight cargoes and the company’s Corpus Christi facility sent four shipments during the period under review. Sempra Infrastructure’s Cameron LNG terminal shipped five LNG cargoes, and the Freeport LNG terminal shipped four cargoes, while Venture Global’s Calcasieu Pass sent three cargoes during the week under review. Also, the Cove Point LNG terminal shipped two cargoes, and the Elba terminal shipped one cargo during the week. This week, Texas and Louisiana experienced a cold snap, which affected operations at Cheniere’s Sabine Pass and Corpus Christi plants as well as the Freeport terminal, according to reports. This report week, the Henry Hub spot price fell 36 cents from $3.23 per million British thermal units (MMBtu) last Wednesday to $2.87/MMBtu this Wednesday, the agency said. The Henry Hub price reached a high of $13.08/MMBtu on Friday last week, the highest daily closing price since February 2021, reflecting a run-up in prices observed across the country that day, it said. Natural gas spot prices fell at most locations in the US this report week, after spiking on Friday ahead of the three-day holiday weekend. Prices were high on Friday in anticipation of increased natural gas consumption because of the weather forecast for well-below-normal temperatures for most of the US over the long weekend, it said. The price of the February 2024 NYMEX contract decreased 16.9 cents, from $3.039/MMBtu last Wednesday to $2.870/MMBtu this Wednesday. According to the agency, the price of the 12-month strip averaging February 2024 through January 2025 futures contracts declined 4.8 cents to $2.960/MMBtu. The agency said that international natural gas futures decreased this report week. Bloomberg Finance reported that weekly average front-month futures prices for LNG cargoes in East Asia fell 93 cents to a weekly average of $10.51/MMBtu. Natural gas futures for delivery at the Dutch TTF decreased 72 cents to a weekly average of $9.62/MMBtu, the first time averaging below $10/MMBtu since mid-summer, the agency said. In the same week last year (week ending January 18, 2023), the prices were $24.85/MMBtu in East Asia and $20.10/MMBtu at TTF, the EIA said. EIA

Port of Corpus Christi says LNG volumes hit record in 2023 - The US Port of Corpus Christi in Texas set a new record in annual tonnage during 2023, including for liquefied natural gas (LNG) volumes. According to a statement released on Thursday, more than 200 million tons of goods moved in 2023 through the Corpus Christi Ship Channel for the first time in its history. The 203 million tons moved in 2023 was an 8.1 percent increase from the prior year, and the new high mark primarily can be attributed to a jump in crude oil exports to 126.1 million tons in 2023, a 12.5 percent increase compared to 2022. Moreover, the port also saw a nearly 13.5 percent increase in agricultural commodities to a little over 2.2 million tons, as well as a slight increase in refined products to 42.5 million tons. A record volume of LNG – 16.3 million tons – moved through the Corpus Christi Ship Channel in 2023, the port said. LNG volumes rose 81.2 percent in 2021, reaching 15.7 million tons. The port previously said that LNG volumes increased 3.5 percent in 2022 compared to the year before. These volumes will grow in the future as Cheniere’s Corpus Christi liquefaction facility is currently undergoing a capacity expansion. The Corpus Christi terminal currently consists of three operational trains with each having a capacity of about 5 million tonnes per annum. Cheniere completed the first train in February 2019 followed by the second in August the same year, while Bechtel handed over operational control of the third train in March 2021. In June 2022, Cheniere took a final investment decision on the Corpus Christi Stage 3 expansion project worth about $8 billion, and Bechtel officially started construction on the project in October the same year. The project includes building seven midscale trains, each with an expected liquefaction capacity of about 1.49 mtpa.

Biden to pause natural gas export approvals as it updates how to assess projects - The Biden administration will pause approvals of some natural gas export facilities as it considers changing how to evaluate them, the administration announced Friday. The current analyses the Energy Department uses to decide whether to authorize exports of liquified natural gas (LNG) do not “adequately account” for factors like domestic energy costs or planet-warming emissions, the White House said in a fact sheet. As a result, the administration is temporarily pausing pending decisions on whether to approve exports to countries with which the U.S. does not have a free trade agreement. The pause will be in effect until the Energy Department can update how it conducts underlying analyses. An administration official told reporters that an update would take a few months, followed by a public comment period before it is final. President Biden, in a written statement, invoked climate change as he discussed the pause. “During this period, we will take a hard look at the impacts of LNG exports on energy costs, America’s energy security, and our environment,” he said. “This pause on new LNG approvals sees the climate crisis for what it is: the existential threat of our time,” he added. The pause only applies to new export projects and is not expected to impact existing exports. There will also be exceptions for emergencies. An administration official told reporters that four projects — two large and two small — currently have applications before the department and would be affected by the pause. A controversial pending project, known as CP2, is not expected to immediately be impacted as its approval is not yet before the Biden administration, the official said. Energy Secretary Jennifer Granholm told reporters on Thursday that the update was coming due to a dramatic increase in U.S. natural gas exports. U.S. capacity to export liquefied natural gas (LNG) has more than tripled since 2018 and is on track to triple again based on projects that are already under construction, she said. “As our exports increase, we must review export applications using the most comprehensive, up-to-date analysis of the economic, environmental and national security considerations,” Granholm added. The announcement comes as progressives and environmental activists have shone a spotlight on the natural gas export projects — lamenting the climate implications of increased fossil fuel shipments. Politically, the move comes as at least some progressives have expressed disappointment in the administration over issues including the war in Gaza. And while Biden has signed significant climate legislation, progressives have also pushed back on his approval of the Willow Project — a major oil project in Alaska.

America faces a looming LNG debacle - Recent news of John Kerry’s departure from the Biden team is a reminder of the baneful influence he and his progressive friends have continued to exert on U.S. energy policy. This month that faction renewed their attacks on fossil fuel by urging the Biden administration to slow down or halt approvals of new liquified natural gas (LNG) export licenses. This initiative should be seen for what it is: an attempt to constrain the free market economy and accelerate the end of the fossil fuel economy. Even more puzzling is that constraining LNG exports would likely increase, not decrease, global carbon emissions.As the United States faces crises in the Middle East, Europe, and Asia, Washington should prioritize economic and energy stability to resist these challenges. Growing U.S. LNG exports has been key to keeping European economies stable, helping Ukraine resist Russian President Vladimir Putin’s aggression, and maintaining stable energy prices in the Pacific Rim.Indeed, last year the United States became the world’s largest LNG exporter, surpassing Qatar and Australia. U.S. exports rose 14.7 percent to a record 88.9 million metric tons (MT), or 8.6 billion cubic feet per day.After the shock of the 1972 Arab Oil Embargo, America spent decades eliminating its dependence on foreign energy suppliers to become the world’s leading energy producer. Energy independence, ample supplies, and lower prices have also been the secret to reenergizing U.S. industrial capacity. Meanwhile, the country’s vast energy resources have provided much-needed stability at home while helping allies, particularly in Europe after Russia’s full-scale invasion of Ukraine in 2022. Despite increasing production, the United States has seen one of the most significant decreases in carbon emissions of any industrialized country, now 17 percent below 2005 levels and falling while the economy continues to grow. A key reason why this occurred is because natural gas has been replacing coal in energy production. More energy and fewer emissions are a testament to American innovation and ingenuity. So America is not the renegade polluter demonized by progressives; it is the bar against which other countries should be judged, lest we forget that emissions from China and India far outpace the rest of the developed world combined. However, the Biden administration is now reviewing how it approves natural gas exports, with some reporting that the administration is planning to curtail or even limit additional applications for new or increased capacity.The theory is that exporting natural gas perpetuates the use of hydrocarbons. If America did not export such energy, other countries would emit less. This theory, however, is flawed. American LNG is not a choice of last resort; it is the world’s first choice, and its absence would undermine allies and increase the cost of goods and commodities. Furthermore, without American LNG, other countries’ emissions would actually increase because they would be forced to utilize fuels like coal or fuel oil that have higher carbon content. The history of the last few years demonstrates this inconvenient truth.

Deep Freeze Forces USA LNG Exporters to Cancel, Delay Cargoes - The recent freeze across Texas and Louisiana disrupted scheduled exports of US liquefied natural gas, temporarily tightening some supply of the heating and power-plant fuel. The Cameron LNG export plant in Louisiana canceled at least one scheduled shipment, according to people familiar with the matter. Several other planned deliveries from Cameron and Cheniere Energy Inc.’s Corpus Christi facility in Texas were also delayed, they said. The Freeport LNG terminal in Texas on Tuesday briefly brought down and restarted one of its three production units, according to a state regulatory filing. Freeport LNG’s loading schedule was also disrupted this week as a result of the weather, according to people familiar with the matter. Export disruptions will likely be short-lived, with warmer weather expected next week. Milder-than-normal temperatures are forecast across most of the US from Jan. 23 to 27, according to the National Oceanic and Atmospheric Administration. The global market impact should also be limited given that gas inventories across Europe and Asia remain high, with the end of winter on the horizon. European gas futures fell to a five-month low on Wednesday. Frigid weather in the US closed ports and reduced domestic gas production, forcing LNG exporters to rearrange schedules for customers. Pipeline gas flows to liquefaction facilities on Wednesday were 45% lower than a week earlier. Cameron LNG did not respond for comment. A spokesperson declined to comment on the plant operations earlier this week. Spokespeople for Cheniere and Freeport also declined to comment.

China’s demand for LNG imports may double over next decade: largest US exporter Cheniere Energy -- China’s demand for liquefied natural gas imports may double over the next decade, an official from America’s largest exporter of the commodity said on Tuesday, as the Asian country faces pressure to lower greenhouse gas emissions. “Everything is in place and heading towards a 130-to-140 million-tonnes market in China alone, as we get towards the mid-30s-to-2040 time frame. Then we actually think it plateaus,” said Anatol Feygin, Cheniere Energy’s executive vice-president and chief commercial officer. In 2023, China’s total LNG import volume reached 71.3 million tonnes, increasing by 12.6 per cent from a year earlier, according to Chinese customs data. However, that was still lower than the record level of 78.9 million tonnes in 2021, as the country has struggled economically after the coronavirus pandemic, seeing diminished energy consumption amid Beijing’s efforts to boost domestic gas production. The world’s second-largest economy views natural gas as a transitional energy source while it shifts from traditional fossil fuels to renewables. Beijing has pledged to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. Natural gas emits almost 50 per cent less carbon dioxide than coal, the major primary energy fuel used in China. “We’re proud to be part of that solution,” Feygin said on Tuesday during an online event organised by the Centre for Strategic and International Studies, a Washington-based think tank. Feygin voiced confidence that China would meet its climate objectives and remain one of the major pillars of global LNG demand growth in the medium-to-longer term, along with South Asia and Southeast Asia. Currently, the country has more than 40 gigawatts of gas-fired power generation under construction, along with growing industry and residential commercial demand, suggesting rising opportunities for US exporters, he added. “So we think that in those economics everybody wins.” The United States has surpassed Russia to become the world’s largest exporter of LNG after the latter was mired in Western sanctions on its energy products following Moscow’s invasion of Ukraine. China, meanwhile, is the world’s top buyer of LNG. Chinese energy firms have signed a record number of long-term contracts over the past few years, mostly with American and Qatari suppliers. In November, China’s Foran Energy Group and Cheniere entered a long-term contract of purchasing around 0.9 million tonnes per annum of LNG for 20 years.

Biden freezes approvals to export U.S. gas, imperiling major projects - The Biden administration on Friday halted the approval of new licenses to export U.S. liquefied natural gas while it scrutinizes how the shipments affect climate change, the economy and national security — a moratorium likely to disrupt plans for billions of dollars in projects. The Energy Department study will build on an existing analysis that underpins the agency’s review of proposals to send more natural gas to European, Asian and other countries that are not U.S. free-trade partners. New exports are now vetted on a case-by-case basis to see whether they are in the public interest — a threshold established by federal law — but government assumptions used in those reviews haven’t been updated since 2018. “We will take a hard look at the impacts of LNG exports on energy costs, America’s energy security and our environment,” President Joe Biden said in a statement. “This pause on new LNG approvals sees the climate crisis for what it is: the existential threat of our time.” Embedded Image The move strikes at the heart of the debate over LNG’s role in the future of energy. While advocates contend it’s crucial for getting developing nations to stop using coal and enabling Europe to power its economy without Russian gas, environmentalists warn that building the enormous infrastructure required to ship LNG ensures it will be burned for generations to come. The administration’s pause comes as environmentalists have seized on projects, including Venture Global LNG Inc.’s CP2 export terminal planned for the Gulf Coast, as a litmus test of the president’s climate change commitment. The review, which won’t affect previously granted authorizations or immediately shake the U.S. status as the world’s top LNG exporter, will be conducted by the Energy Department’s national labs. It could stretch for months before a report is made available for public comment. Senior administration officials who briefed reporters on the plan would not put a firm timeline on the process, saying only that it would be done expeditiously and take some months. “A lot has happened in the past decade since this program was created and we need to have an even greater understanding of the market need, the long-term supply and demand of energy resources, and the environmental factors,” Energy Secretary Jennifer Granholm said. The pause could have implications for more than a dozen proposals now awaiting review at the Energy Department, including ventures planned in Louisiana by Commonwealth LNG and Energy Transfer LP. The issue is politically fraught for Biden — forcing him to balance an array of competing priorities. A months-long review would effectively foreclose decisions on additional LNG exports until after the Nov. 5 presidential election. Environmentalists, such as Bill McKibben, who successfully led the campaign to block the Keystone XL oil pipeline roughly a decade ago, have pressed Biden to shift course on LNG and made clear they are scrutinizing every fossil-fuel project approval under his watch. The halt in permits represents “the first step in stopping these mega-climate bombs,” said Allie Rosenbluth, U.S. program manager for the environmental group Oil Change International. “Stopping LNG exports is a make-or-break issue for his climate record this election.” At the same time, Republicans — including former President Donald Trump — have accused Biden of making a priority of his climate agenda at the expense of domestic jobs and other economic concerns. On Wednesday, Senate Republican leader Mitch McConnell asserted that limiting LNG exports would hinder the U.S. goal of combating Russia’s influence as a global gas supplier. White House National Climate Advisor Ali Zaidi said the government’s existing analysis was outdated and didn’t reflect evolving information about how much methane — the prime ingredient in natural gas — could warm the atmosphere. Earlier studies were completed in 2012, 2015 and 2018. Natural gas burns more cleanly than coal — and oil industry allies argue that’s one reason to bolster exports, not halt them. But environmentalists say methane leaks from wells, pipelines and processing undermine those green credentials and that expanded LNG exports can crowd out investments in emission-free alternatives. LNG advocates excoriated the administration’s decision, saying it would chill development and undercuts US promises to help Europe displace Russian gas after the invasion of Ukraine. “The administration’s decision to freeze review of new LNG terminals is deeply disturbing and raises significant risks around the globe,” said Marty Durbin, president of the U.S. Chamber of Commerce’s Global Energy Institute. “It betrays our allies at a time of geopolitical instability and could slow the energy transition.” Already, 10 North American projects have won the Energy Department’s blessing to export U.S. LNG, but they remain in various stages of development. The U.S. has seven other LNG projects currently operating, and an additional 12 billion cubic feet a day of export capacity still could be constructed just under existing approvals. Four projects will be hardest hit because they have gone through initial permitting and undergone a separate required review by the Federal Energy Regulatory Commission yet are effectively blocked without a final export license from the Energy Department.

Manchin promises to investigate Biden natural gas export freeze -Senate Energy Committee Chair Joe Manchin (D-W.Va.), one of the Biden administration’s most vocal intraparty critics on energy issues, vowed an investigation into the newly announced pause on liquefied natural gas (LNG) export approvals. In a statement Friday morning, Manchin implied the decision to implement the pause was based on political considerations rather than “indisputable facts,” citing LNG production’s economic benefits and the role of American exports in isolating the Russian energy sector after Russia’s invasion of Ukraine. ”I have always said that our first concern must be protecting American consumers and growing American businesses, and we need a safety valve in place to ensure Americans aren’t unnecessarily stuck paying a premium for the abundant resources we’re blessed to have,” Manchin said. “But as the superpower of the world, we also have a responsibility to our allies and trading partners who, in our absence, may have no other choice but to turn to countries that don’t share our values. That’s been made abundantly clear in the last two years as we have been able to step in to replace Russian natural gas to cut off funds for Putin’s bombs and bullets.” Manchin, who is not seeking reelection this year, said he will hold hearings of the energy committee on the decision to “unveil the facts about the true state of play in the markets, this Administration’s motivations, and their implications.” The Biden administration confirmed Friday it will halt export permit approvals while it assesses impacts on emissions and domestic energy costs, saying the current export permitting process does not sufficiently assess these factors. The delay will specifically apply to countries that lack free-trade agreements with the U.S. Existing export projects will not be affected. “During this period, we will take a hard look at the impacts of LNG exports on energy costs, America’s energy security, and our environment,” President Biden said in a statement. “This pause on new LNG approvals sees the climate crisis for what it is: the existential threat of our time.” Manchin has frequently blasted the Biden administration’s energy and environmental policies, sinking the White House’s ambitious Build Back Better climate and infrastructure package earlier in the president’s tenure by withholding his vote. Manchin later voted for the smaller Inflation Reduction Act, but he has been a harsh detractor of its implementation, particularly pertaining to electric vehicles.

Fossil Fuel Speculators—Not Consumers—Would Win Big From LNG Exports: Report -- Belying Big Oil’s claims that vastly expanded U.S. liquefied natural gas exports benefit consumers, a report published Wednesday revealed that fossil fuel speculators and commodity traders would be the main beneficiaries from eight proposed LNG projects, while American consumers and the climate would suffer higher prices and emissions.The report—entitled Methane Madness—was published by Friends of the Earth, Bailout Watch, and Public Citizen and examines how the controversial Calcasieu Pass 2 (CP2) LNG export terminal in Louisiana and seven other proposed projects would harm U.S. consumers while fueling the climate emergency.“Big Oil’s talking points about European energy security are cynical and inaccurate,” said Lukas Ross, climate and energy deputy director at Friends of the Earth.The report found that:

- If built, the eight pending projects will produce the annual equivalent of 113 coal plants in planet-warming emissions;

- More than half of the volume from these pending facilities has been secured by commodity trading firms and Big Oil’s speculative trading arms;

- Four of the five largest purchasers by volume from pending facilities are speculators;

- LNG from these facilities, if they are built, will be sold wherever these so-called “portfolio players” can turn the biggest profit—undercutting industry claims that the expansion is needed for European energy security; and

- The temporary surge in LNG exports to Europe since the outbreak of war in Ukraine is not translating into long-term demand.

“Record LNG exports drive up home heating prices for Americans, and line the pockets of fossil fuel CEOs, and these new planet-wrecking projects are not in the interest of the public,” asserted Public Citizen energy researcher Alan Zibel.“No amount of misleading energy industry lobbying can undo the simple reality that LNG exports force American consumers to pay more in the long run while U.S.-produced gas winds up in Beijing and Berlin,” he added. “The expansion of U.S. LNG export capacity simply empowers Big Oil giants and commodity traders’ ability to earn eye-popping profits.”The new report came as the Biden administration reportedly paused CP2’s approval pending a Department of Energy review of the project’s economic, national security, and climate impacts. While welcoming the news, climate campaigners argued that a pause is not enough.“Now that they have paused, there is only one thing to do: Vow to reject CP2 and all 17 proposed LNG projects, and to phase out ALL fossil fuels,” said 350.org U.S. campaign manager Candice Fortin. “Our frontline partners on the U.S. Gulf Coast have been fighting against oil and gas projects and for their homes and lives for decades. It is past time for the government to listen and stand up to the billionaires who are knowingly promoting toxic energy sources.”

US natural gas prices slide - Markets - US natural gas futures slid about 3% to a five-week low on Tuesday on forecasts for demand to keep dropping and output to keep rising as the weather turns warmer than normal through at least early February. That price drop occurred even though the amount of gas flowing to US liquefied natural gas (LNG) export plants climbed over the past week after it fell to a one-year low during last week’s Arctic freeze. That extreme cold also boosted daily gas demand to a record high and cut output to a one-year low by freezing wells. Front-month gas futures for February delivery on the New York Mercantile Exchange were down 8 cents, or 3.3%, to $2.339 per million British thermal units (mmBtu) at 9:07 a.m. EST (1407 GMT), putting the contract on track for its lowest close since Dec. 13.

U.S. natural gas prices slide 3% on warm forecasts, slow return of LNG feedgas (Reuters) - U.S. natural gas futures slid about 3% on Thursday on forecast for the weather to remain warmer than normal through at least early February and the slow return of U.S. LNG export plants to full service after last week's Arctic freeze. That freeze boosted gas demand to a daily record high and cut both U.S. gas output and LNG feedgas to a one-year low. Traders noted that prices fell despite forecasts for higher demand next week than previously expected, the slow return of output from last week's extreme cold, and a massive withdrawal from storage last week that was in line with estimates. The U.S. Energy Information Administration (EIA) said utilities pulled a much bigger than usual 326 Bcf of gas out of storage during the week ended Jan. 19 due to last week's extreme cold. That was the biggest weekly withdrawal since utilities pulled 338 bcf of gas out of storage during a brutal freeze in February 2021 and the all-time record withdrawal of 359 bcf in January 2018. Last week's withdrawal was close to the 321-bcf decline analysts forecast in a Reuters poll and compares with a decrease of 86 bcf in the same week last year and a five-year (2019-2023) average decline of 148 bcf for this time of year. Front-month gas futures for February delivery on the New York Mercantile Exchange fell 7.0 cents, or 2.7%, to settle at $2.571 per mmBtu. Financial company LSEG said average gas output in the Lower 48 states fell to 103.0 billion cubic feet per day (bcfd) so far in January, down from a monthly record of 108.0 bcfd in December. On a daily basis, U.S. gas output was on track to jump by 13.7 bcfd from Jan. 17-25 to a preliminary 104.2 bcfd on Thursday. That, however, was not enough to make up for the 17.2 bcfd output drop from Jan. 8-16 to a 12-month low of 90.5 bcfd on Jan. 16, due primarily to freeze-offs and other cold weather events. Meteorologists projected temperatures in the Lower 48 states would remain warmer than normal from now through at least Feb. 9. With less frigid temperatures coming, LSEG forecast U.S. gas demand in the Lower 48, including exports, would drop from 144.7 bcfd this week to 125.5 bcfd next week. The forecast for next week was higher than LSEG's outlook on Wednesday. That compares with a daily record demand of 168.4 bcfd on Jan. 16 during the arctic freeze. U.S. pipeline exports to Mexico rose to an average of 5.8 bcfd so far in January, up from 4.7 bcfd in December, but remained well below the monthly record of 7.0 bcfd in August. Analysts expect exports to Mexico to rise in the coming months once U.S.-based New Fortress Energy's LNG export plant in Altamira in Mexico starts pulling in U.S. gas to liquefy for export.

US natgas prices jump 6% ahead of contract expiry, slow output return (Reuters) - U.S. natural gas futures jumped about 6% to a one-week high in volatile trade on Friday ahead of contract expiration on forecasts for higher demand in two weeks when the weather turns slightly cooler and with the slow return of output from last week's Arctic freeze. Traders noted prices fell by over 5% earlier in the session on forecasts for the weather to remain warmer than normal through at least the middle of February and the slow return of U.S. liquefied natural gas (LNG) export plants to full service after last week's extreme cold. Last week's freeze boosted gas demand to a daily record high and cut both U.S. gas output and LNG feedgas to one-year lows. On its second to last day as the front-month, gas futures NGc1 for February delivery on the New York Mercantile Exchange rose 14.1 cents, or 5.5%, to settle at $2.712 per million British thermal units (mmBtu), their highest close since Jan. 17. Futures for March NGH24, which will soon be the front-month, were little changed at around $2.18 per mmBtu. For the week, the front-month gained about 8% after dropping about 24% last week. Financial company LSEG said gas output in the Lower 48 states fell to an average of 103.2 billion cubic feet per day (bcfd) so far in January, down from a monthly record high of 108.0 bcfd in December. On a daily basis, U.S. gas output was on track to jump by 14.6 bcfd from Jan. 17-26 to a preliminary two-week high of 105.1 bcfd on Friday. That, however, was not enough to make up for the 17.2 bcfd output drop from Jan. 8-16 to a 12-month low of 90.5 bcfd on Jan. 16, due primarily to freeze-offs and other cold weather events. Meteorologists projected temperatures in the Lower 48 states would remain warmer than normal from now through at least Feb. 10. The forecasts for the week of Feb. 4, however, were slightly cooler than the outlook for the week of Jan. 28. With the weather expected to turn warmer, LSEG forecast U.S. gas demand in the Lower 48, including exports, would drop from 144.6 bcfd this week to 124.9 5 bcfd next week before rising to 127.8 bcfd in two weeks as the weather turns cooler. The forecast for next week was lower than LSEG's outlook on Thursday. That compares with a daily record demand of 168.4 bcfd on Jan. 16 during the arctic freeze. Gas flows to the seven big U.S. LNG export plants fell to an average of 13.8 bcfd so far in January, down from a monthly record of 14.7 bcfd in December. But on a daily basis, LNG feedgas was on track to rise by about 4.8 bcfd from Jan. 17-26 to a preliminary 14.0 bcfd on Friday after dropping by 5.8 bcfd from Jan. 13-16 to a one-year low of 9.2 bcfd on Jan. 16 during last week's freeze.

Kinder Morgan remains bullish on natural gas demand growth - Kinder Morgan said on Wednesday it continues to have a bullish outlook for natural gas demand banking on higher demand from liquefied natural gas (LNG) export facilities and increased exports to Mexico. The United States was the largest exporter of LNG in 2023, with 8.6 million metric tons leaving the country's terminals in December. The U.S. Energy Information Administration expects North America's LNG export capacity to increase to 24.3 billion cubic feet per day (Bcf/d) by end-2027, partially driven by new plants in Mexico and Canada. "The future for U.S. natural gas is very bright. And that has positive implications both for our existing business and for our ability to expand," chief executive Kimberly Dang said during an investor call. The comments come days after the company reported fourth-quarter results which showed weakness in its natural gas pipeline operations. Kinder Morgan said a rise in natural gas demand has led to increased pipeline utilization, driving new projects for the company. Of its $3 billion project backlog, about $2.2 billion is associated with natural gas. The company has the largest natural gas transmission network in the U.S. and moves about 40% of all natural gas production. Kinder Morgan said the company is also working on a couple of projects to bring more natural gas supply into the short-supplied southeast market.

Remember that foul odor that swept through the Coastal Bend earlier this month? Contaminated soil from the Victoria spill is heading to our region. (news video) — San Patricio County Sheriff Oscar Rivera told 3News trucks carrying contaminated soil from the Victoria spill will be traveling through the Coastal Bend in the coming weeks. "The dirt is headed to a disposal site near Robstown," said the sheriff. "As you recall on January 3, we were flooded with calls about a bad odor on the east part of the county."Sheriff Rivera said TCEQ announced that the odor may be noticed on US 77 as about 50-60 truck loads travel through San Patricio County.