US oil supplies at new 18 year low, Strategic Petroleum Reserve at a 37 year low, DUC wells at an all time low, DUC backlog at 4.4 months, lowest since March 2015

oil prices fell for the fourth time in 5 weeks after the EIA report confirmed weak summertime demand for fuel ...after falling 6.9% to $97.59 a barrel last week as a new Covid outbreak in China threatened demand while rising inflation in the US & Europe bolstered the case for economy-crushing interest rate hikes, the contract price for the benchmark US light sweet crude for August delivery moved higher in early trading on Monday after Saudi officials indicated no additional production would come online following Biden's visit, and settled $5.01, or 5.1% higher, at $102.60 a barrel, boosted by dollar weakness and by indications that the Fed wouldn't raise interest rates by a full percentage point at their coming meeting....however, oil prices fell sharply in early trading on Tuesday as new Covid-19 cases in China jumped and new data showed the euro zone's inflation accelerated to a fresh record high, increasing worries about a possible recession, but reversed higher in afternoon trade Tuesday on a sharp drop in the U.S. dollar index and on a rallying stock market, and finished $1.62 higher at $104.22 a barrel, after a disruption of the Keystone pipeline cut shipments of Canadian oil to US refiners...oil prices slipped lower in overnight trading after the American Petroleum Institute reported increases of crude and gasoline inventories, and then declined on that news in early NYMEX trading on Wednesday, as renewed strength in the U.S. Dollar Index put further pressure on prices, and then extended those losses after the EIA report confirmed those larger-than-expected builds in U.S. crude and gasoline stockpiles and settled $1.96 lower at $102.26 a barrel, as EIA data showed lackluster gasoline demand during the peak summer driving season and as interest rate hikes by central banks fed fears the economy would slow...with trading in the August contract expired on Wednesday and US oil prices quotes referencing the contract for the benchmark US light sweet crude for September delivery on Thursday, prices continued lower in early trading on demand concerns in both the US and China, and tumbled $3.53 to settle at $96.35 a barrel after a European Central Bank rate hike stoked demand worries, while returning oil supply from Libya and the resumption of Russia’s gas flows to Europe eased supply restraints...oil prices eroded further in early morning trading on Friday, with all petroleum contracts on course for hefty losses for the week, after overnight data out of Europe showed manufacturing activity unexpectedly contracted in July, while the return of Libya's oil exports to the global market further weighed on the complex, and settled $1.65 lower at $94.70 a barrel after the European Union said it would allow Russian state-owned companies to ship oil to third countries under an adjustment of sanctions agreed to by member states...oil prices thus finished 3.0% lower on the week, while the September oil contract, which had finished last week priced at $94.57 a barrel, actually finished fractionally higher...

natural gas prices, on the other hand, finished higher for a third consecutive week on record power demand and forecasts for further records...after rising 16.3% to $7.016 per mmBTU last week as record heat across the South led to record natural gas deliveries to the electricity generation sector, the contract price of natural gas for August delivery opened 3% higher and jumped to an intraday high of $7.554 by midday Monday as soaring temperatures baked much of the Lower 48 and forecasts called for heat waves to fester through July and into next month, before settling with a 46.3 cent or 7% gain at $7.479 per mmBTU...but natural gas prices gave up 21.5 cents of that gain on Tuesday to settle at $7.264 per mmBTU, after mid-range heat forecasts eased slightly and a new outlook called for record production on the horizon....however, natural gas prices soared more than 10% to a five-week high on Wednesday, as a brutal heat wave boosted power demand to a record high amid forecasts that next week was expected to be the hottest of the season, as the August gas contract settled 74.3 cents higher at $8.007 per mmBTU....natural gas prices initially surged 35 cents following an anemic storage report on Thursday, but see-sawed to close 7.5 cents or 1% lower at $7.932 per mmBTU on forecasts for less hot weather over the next two weeks than was previously expected, and on the return to partial service of the Russia to Germany Nord Stream gas pipeline...but prices jumped 5% to another 5 week high on Friday on the heels of a solidly bullish storage report and a shift hotter in an already sizzling late-summer weather outlook and settled 36.7 cents higher at $8.299 per mmBTU, and thus finished with a 15.5%, $1.283 gain on the week...

The EIA's natural gas storage report for the week ending July 15th indicated that the amount of working natural gas held in underground storage in the US rose by 32 billion cubic feet to 2,401 billion cubic feet by the end of the week, which left our gas supplies 270 billion cubic feet, or 10.1% below the 2,671 billion cubic feet that were in storage on July 15th of last year, and 328 billion cubic feet, or 12.0% below the five-year average of 2,729 billion cubic feet of natural gas that have been in storage as of the 15th of July over the most recent five years....the 32 billion cubic foot injection into US natural gas working storage for the cited week was well below the average forecast for a 41 billion cubic foot injection from an S&P Global Platts survey of analysts, and much less than the 50 billion cubic feet that were added to natural gas storage during the corresponding week of 2021, and also lower than the average injection of 41 billion cubic feet of natural gas that has typically been added to our natural gas storage during the same week over the past 5 years....

The Latest US Oil Supply and Disposition Data from the EIA

US oil data from the US Energy Information Administration for the week ending July 15th indicated that despite another large oil withdrawal from the SPR and a sizable increase in oil supplies that could not be accounted for, we needed to withdraw oil from our stored commercial crude supplies for the 3rd time in 7 weeks, and for the 20th time over the past 34 weeks, mostly because of a big increase in our oil exports…our imports of crude oil fell by an average of 156,000 barrels per day to an average of 6,519,000 barrels per day, after falling by an average of 164,000 barrels per day during the prior week, while our exports of crude oil rose by 735,000 barrels per day to 3,759,000 barrels per day, which meant that our trade in oil worked out to a net import average of 2,760,000 barrels of oil per day during the week ending July 15th, 891,000 fewer barrels per day than the net of our imports minus our exports during the prior week…over the same period, production of crude from US wells was reportedly 100,000 barrels per day lower at 11,900,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 14,660,000 barrels per day during the July 15th reporting week…

Meanwhile, US oil refineries reported they were processing an average of 16,319,000 barrels of crude per day during the week ending July 15th, an average of 321,000 fewer barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 778,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US....so based on that reported & estimated data, the crude oil figures from the EIA for the week ending July 15th appear to indicate that our total working supply of oil from net imports, from oilfield production, and from storage was 881,000 barrels per day less than what our oil refineries reported they used during the week…to account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+881,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed... however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 778,000 barrel per day decrease in our overall crude oil inventories left our oil supplies at 906,758,000 barrels at the end of the week, our lowest total oil inventory level since February 27th, 2004, and therefore at a new 18 year low….our oil inventory decreased this week as 64,000 barrels per day were being pulled out of our commercially available stocks of crude oil and 714,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve....the draw on the SPR was part of the emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump" (sic), that was expected to supply 1,000,000 barrels of oil per day to commercial interests over a six month period up to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising further at least up until that time...the administration's previous 30,000,000 million barrel release from the SPR to address Russian supply related shortfalls wrapped up in June, and his earlier release of 50 million barrels from the SPR to incentivize US gasoline consumption was completed in May....including those, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 175,998,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 24 months, and as a result the 480,149,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since July 12th, 1985, or at a 37 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's SPR releases....now the total 180,000,000 barrel drawdown expected over the current six month release program to November will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,508,000 barrels per day last week, which was 3.8% more than the 6,400,000 barrel per day average that we were importing over the same four-week period last year….this week’s crude oil production was reported to be 100,000 barrels per day lower at 11,900,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 100,000 barrels per day lower at 11,500,000 barrels per day, while Alaska’s oil production was 3,000 barrels per day higher at 435,000 barrels per day but had no impact on the final rounded national total....US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 9.2% below that of our pre-pandemic production peak, but was 22.7% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021...

US oil refineries were operating at 93.7% of their capacity while using those 16,319,000 barrels of crude per day during the week ending July 15th, down from their 94.9% utilization rate during the prior week, but in line with the historical refinery utilization rates of mid summer…the 16,319,000 barrels per day of oil that were refined this week were 1.9% more than the 16,007,000 barrels of crude that were being processed daily during week ending July 16th of 2021, but 4.2% less than the 17,034,000 barrels that were being refined during the prepandemic week ending July 19th, 2019, when our refinery utilization was at 93.1%, a rate slightly below normal for mid-July...

Even with the decrease in the amount of oil being refined this week, gasoline output from our refineries was still much higher, increasing by 447,000 barrels per day to 9,368,000 barrels per day during the week ending July 15th, after our gasoline output had decreased by 1,425,000 barrels per day during the prior week…this week’s gasoline production was also 2.6% more than the 9,130,000 barrels of gasoline that were being produced daily over the same week of last year, but 7.4% less than our gasoline production of 10,089,000 barrels per day during the week ending July 19th, 2019, ie, during the year before the pandemic impacted US gasoline output....meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 102,000 barrels per day to 9,855,000 barrels per day, after our distillates output had decreased by 246,000 barrels per day during the prior week…even with that decrease, our distillates output was 2.6% more than the 4,902,000 barrels of distillates that were being produced daily during the week ending July 16th of 2021, but 3.6% less than the 5,219,000 barrels of distillates that were being produced daily during the week ending July 19th, 2019...

With the increase in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the fourth time in five weeks.; but for just the fifth time out of the past twenty-four weeks, increasing by 3,489,000 barrels to 228,435,000 barrels during the week ending July 15th, after our gasoline inventories had increased by 5,825,000 barrels during the prior week...our gasoline supplies increased by less this week because the amount of gasoline supplied to US users increased by 459,000 barrels per day to 8,521,000 barrels per day, after domestic gasoline supplied had decreased by a near record 1,351,000 barrels per day during the prior week, and even as our imports of gasoline rose by 150,000 barrels per day to 865,000 barrels per day while our exports of gasoline fell by 34,000 barrels per day to 806,000 barrels per day....but after 19 inventory drawdowns over the past 24 weeks, our gasoline supplies were 3.4% lower than last July 16th's gasoline inventories of 236,414,000 barrels, and about 3% below the five year average of our gasoline supplies for this time of the year…

After the recent decreases in our distillates production, our supplies of distillate fuels decreased for the 3rd time in ten weeks and for the 28th time in forty-six weeks,falling by 1,295,000 barrels to 112,508,000 barrels during the week ending July 15th, after our distillates supplies had increased by 2,668,000 barrels during the prior week….our distillates supplies fell this week even though the amount of distillates supplied to US markets, an indicator of our domestic demand, increased by 329,000 barrels per day to 3,697,000 barrels per day, after distillates demand had fallen by 1,014,000 barrels per day to a one year low the prior week, as our exports of distillates rose by 121,000 barrels per day to 1,642,000 barrels per day while our imports of distillates fell by 15,000 barrels per day to 122,000 barrels per day....but after forty-four inventory withdrawals over the past sixty-six weeks, our distillate supplies at the end of the week were 20.2% below the 141,000,000 barrels of distillates that we had in storage on July 16th of 2021, and still about 23% below the five year average of distillates inventories for this time of the year…

Meanwhile, with this week's increase in our oil exports and decreases in our imports and production, our commercial supplies of crude oil in storage fell for the 6th time in 10 weeks and for the 31st time in the past year, decreasing by 445,000 barrels over the week, from 427,054,000 barrels on July 8th to 426,609,000 barrels on July 15th, after our commercial crude supplies had increased by 3,254,000 barrels over the prior week…after that modest decrease, our commercial crude oil inventories remained about 8% below the most recent five-year average of crude oil supplies for this time of year, but about 25% above the average of our crude oil stocks as of the third weekend of July over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels....since our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this July 15th were still 3.0% less than the 439,687,000 barrels of oil we had in commercial storage on July 16th of 2021, and were 20.5% less than the 536,580,000 barrels of oil that we had in storage on July 17th of 2020, and 4.1% less than the 445,041,000 barrels of oil we had in commercial storage on July 19th of 2019…

Finally, with our inventories of crude oil and our supplies of all products made from oil receently near multi year lows, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR....the EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 3,862,000 barrels this week, from 1,692,658,000 barrels on July 8th to 1,688,796,000 barrels on July 15th, after our total inventories had risen by 14,863,000 barrels during the prior week...that left our total liquids inventories down by 99,637,000 barrels over the first 28 weeks of this year, but still nearly 11 million barrels from a new 13 1/2 year low...

This Week's Rig Count

The number of drilling rigs running in the US increased for the 80th time over the prior 95 weeks during the week ending July 22nd, but still remained 4.4% below the prepandemic rig count....Baker Hughes reported that the total count of rotary rigs drilling in the US increased by 2 to 758 rigs this past week, which was also 267 more rigs than the 491 rigs that were in use as of the July 23rd report of 2021, but was still 1,171 fewer rigs than the shale era high of 1,929 drilling rigs that were deployed on November 21st of 2014, a week before OPEC began to flood the global market with oil in an attempt to put US shale out of business….

The number of rigs drilling for oil was unchanged at 599 oil rigs during the past week, after rigs targeting oil had risen by 2 during the prior week, and there are still 212 more oil rigs active now than were running a year ago, even as they still amount to just 37.2% of the shale era high of 1609 rigs that were drilling for oil on October 10th, 2014, and as they are still down 12.3% from the prepandemic oil rig count….at the same time, the number of drilling rigs targeting natural gas bearing formations increased by 2 to 155 natural gas rigs, which was also up by 51 natural gas rigs from the 104 natural gas rigs that were drilling during the same week a year ago, even as they were still only 9.7% of the modern high of 1,606 rigs targeting natural gas that were deployed on September 7th, 2008…

In addition to rigs targeting oil and natural gas, Baker Hughes continues to report four "miscellaneous" rigs active; including a horizontal rig drilling between 5,000 to 10,000 feet into the Permian basin in Dawson county Texas, and a directional rig drilling between 5,000 to 10,000 feet on the big island of Hawaii, a rig drilling vertically to between 10,000 and 15,000 feet for a well or wells intended to store CO2 emissions in Mercer county North Dakota, and another vertical rig, drilling more than 15,000 feet into a formation in Humboldt county Nevada that Baker Hughes doesn't track...a year ago, there were no such "miscellaneous" rigs running...

The offshore rig count in the Gulf of Mexico was up by 1 to 14 rigs this week, with all of this week's Gulf rigs drilling for oil in Louisiana's offshore waters....that's still 3 less than the 17 offshore rigs that were active in the Gulf a year ago, when 16 Gulf rigs were drilling for oil offshore from Louisiana and one was deployed for oil offshore from Texas.…in addition to rigs drilling in the Gulf, we now have two offshore directional rigs drilling for natural gas in the Cook Inlet of Alaska; one is indicated to be drilling to between 10,000 and 15,000 feet, while the new one is is indicated to be drilling to between 5,000 and 10,000 feet...a year ago, there were no offshore rigs other than those deployed in the Gulf of Mexico....

in addition to rigs running offshore, there are now 4 water based rigs drilling through inland bodies of water....one is a directional rig targeting oil at a depth of 10,000 to 15,000 feet in Cameron parish, Louisiana; others include a directional rig targeting oil at a depth greater than 15,000 feet on Grand Isle, Louisiana, and two directional inland water rigs drilling for oil in Terrebonne Parish, Louisiana, one of which is targeting a formation greater than 15,000 feet in depth, while the other is shown drilling to between 10,000 and 15,000 feet... during the same week of a year ago, there was just one such "inland waters" rig deployed...

The count of active horizontal drilling rigs was up by one to 687 horizontal rigs this week, which was also 248 more rigs than the 439 horizontal rigs that were in use in the US on July 23rd of last year, but just half of the record 1,374 horizontal rigs that were drilling on November 21st of 2014....at the same time, the vertical rig count was up by 1 to 31 vertical rigs this week, and those were also up by 12 from the 19 vertical rigs that were operating during the same week a year ago…on the other hand, the directional rig count was unchanged at 40 directional rigs this week, while those were still up by 7 from the 33 directional rigs that were in use on July 23rd of 2021….

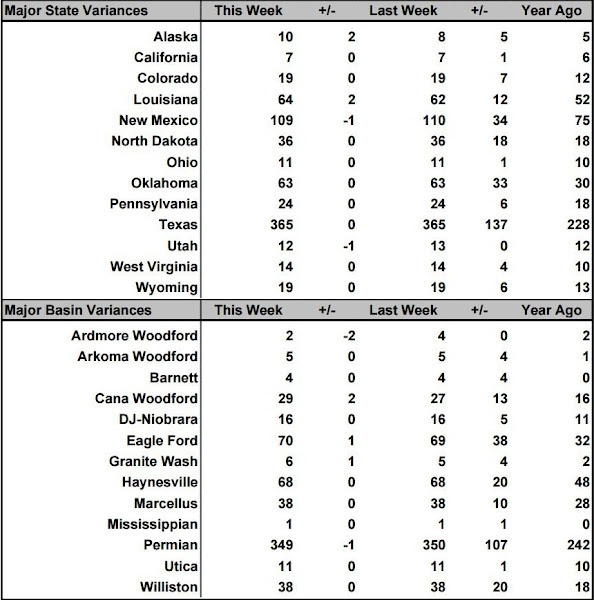

The details on this week’s changes in drilling activity by state and by major shale basin are shown in our screenshot below of that part of the rig count summary pdf from Baker Hughes that gives us those changes…the first table below shows weekly and year over year rig count changes for the major oil & gas producing states, and the table below that shows the weekly and year over year rig count changes for the major US geological oil and gas basins…in both tables, the first column shows the active rig count as of July 22nd, the second column shows the change in the number of working rigs between last week’s count (July 15th) and this week’s (July 22nd) count, the third column shows last week’s July 15th active rig count, the 4th column shows the change between the number of rigs running on Friday and the number running on the Friday before the same weekend of a year ago, and the 5th column shows the number of rigs that were drilling at the end of that reporting week a year ago, which in this week’s case was the 23rd of July, 2021...

the 2 rig increase in Alaska came as an offshore rig was added in the Cook Inlet, another natural gas rig was added in Tyonek of the Athabascan region, and an oil rig was added in Sagavanirktok in the North Slope Borough, while a gas rig was removed from the Kenai peninsula...the 2 rig increase in Louisiana came as an oil rig was added in the state's offshore waters and an inland waters oil rig was added in Cameron parish...

checking the Rigs by State file at Baker Hughes for the changes in Texas, we first find that a rig was added in Texas Oil District 1, which accounts for the oil rig that added in the Eagle Ford shale, and that a rig was added in Texas Oil District 10 of the Texas panhandle, which accounts for the rig added in the Granite Wash basin....at the same time, an oil rig was pulled out Texas Oil District 9, which would have been drilling in a basin that Baker Hughes doesn't track....we also find that an oil rig was pulled out Texas Oil District 8, which covers the core Permian Delaware, but that a natural gas rig was added in Texas Oil District 8A, which includes the northern counties of the Permian Midland...since those indicate no net change in the Permian basin in Texas, we have to conclude that the rig removed from New Mexico had been drilling in the western Permian Delaware for the national Permian count to show a loss of one....the Permian now has two natural gas rigs, one miscellaneous rig, and 346 oil rigs running...the Texas rig count ended unchanged because the inland waters oil rig that had been drilling in Galveston Bay was pulled out at the same time...

meanwhile, the rig that was removed from Utah had been drilling in the Uintah basin, where all of Utah's drilling is taking place, even as it not tracked by Baker Hughes...the two oil rigs that were pulled out of Oklahoma's Ardmore Woodford were offset by two oil rig additions in the state's Cana Woodford, leaving the Oklahoma rig count unchanged...a similar combination of oil rig removals and oil rig additions left the national oil rig count unchanged, while the natural gas rig count was up by two with the net additions in the Permian basin and in the Cook Inlet, and offshore from Alaska....

DUC well report for June

Monday of this week saw the release of the EIA's Drilling Productivity Report for July, which included the EIA's June data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions (shown under the report's tab 3)....that data showed a decrease in uncompleted wells nationally for the 24th consecutive month, as both completions of drilled wells and drilling of new wells increased in June, but remained well below average pre-pandemic levels...for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 26 wells, falling from 4,271 DUC wells in May to 4,245 DUC wells in June, which was the lowest number of US wells left uncompleted on record, and also 31.1% fewer DUCs than the 6,159 wells that had been drilled but remained uncompleted as of the end of June of a year ago...this month's DUC decrease occurred as 938 wells were drilled in the 7 regions that this report covers (representing 87% of all U.S. onshore drilling operations) during June, up from the 909 wells that were drilled in May, while 964 wells were completed and brought into production by fracking them, up by just 3 from the 961 well completions seen in May, but up by 245 from the 716 completions seen in June of last year....at the June completion rate, the 4,245 drilled but uncompleted wells remaining at the end of the month represents a 4.4 month backlog of wells that have been drilled but are not yet fracked, unchanged from the DUC well backlog of a month ago, which is the lowest DUC backlog since March 2015, despite a completion rate that is still more than 15% below 2019's pre-pandemic average...

only the oil producing regions saw a net DUC well decrease during June, since both of the natural gas producing Appalachian and Haynesville shales saw modest DUC well increases....the number of uncompleted wells remaining in the Permian basin of west Texas and New Mexico decreased by 30, from 1,244 DUC wells at the end of May to 1,214 DUCs at the end of June, as 408 new wells were drilled into the Permian basin during June, while 438 already drilled wells in the region were being fracked....in addition, the number of uncompleted wells remaining in Oklahoma's Anadarko basin decreased by 8, falling from 727 at the end of May to 719 DUC wells at the end of June, as 62 wells were drilled into the Anadarko basin during June, while 70 Anadarko wells were completed....meanwhile, there was a decrease of 1 DUC well in the Bakken of North Dakota, where DUC wells fell from 425 at the end of May to a record low of 424 DUCs at the end of June, as 76 wells were drilled into the Bakken during June, while 77 of the drilled wells in the Bakken were being fracked...at the same time, DUCs in the Eagle Ford shale of south Texas also decreased by 1, from 598 DUC wells at the end of May to a record low of 597 DUCs at the end of June, as 110 wells were drilled in the Eagle Ford during June, while 111 already drilled Eagle Ford wells were fracked....on the other hand, DUC wells in the Niobrara chalk of the Rockies' front range increased by 1, riising from 310 at the end of May to 311 DUC wells at the end of June, as 109 wells were drilled into the Niobrara chalk during June, while 108 Niobrara wells were completed....

among the natural gas producing regions, the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, rose by one well, from 526 DUCs at the end of May to 527 DUCs at the end of June, as 98 wells were drilled into the Marcellus and Utica shales during the month, while 97 of the already drilled wells in the region were fracked....at the same time, the uncompleted well inventory in the natural gas producing Haynesville shale of the northern Louisiana-Texas border region rose by 13, from 419 DUCs in May to 432 DUCs by the end of June, as 75 wells were drilled into the Haynesville during June, while 63 of the already drilled Haynesville wells were fracked during the same period....thus, for the month of June, DUCs in the five major oil-producing basins tracked by this report (ie., the Anadarko, Bakken, Niobrara, Permian, and Eagle Ford) decreased by a net total of 39 wells to 3,265 DUC wells, while the uncompleted well count in the major natural gas basins (the Marcellus, the Utica, and the Haynesville) increased by net of 13 wells to 980 wells, although as this report notes, once into production, more than half the wells drilled nationally will produce both oil and gas...

++++++++++++++++++++++++++++++++++++++++

Fracking Co. Tells Ohio Justices Its Equipment Is Exempt – Law360 - A hydraulic fracturing company asked the Ohio Supreme Court to find that its equipment purchases used in oil and gas production were exempt from sales and use tax. Stingray Pressure Pumping LLC asked the Ohio Supreme Court in a brief filed Thursday to reexamine the company's request for sales and use tax exemptions

47 New Shale Well Permits Issued for PA-OH-WV Jul 11-17 | Marcellus Drilling News - For the week of July 11-17, the three Marcellus/Utica states issued 47 permits to drill new shale wells, up 10 from the prior week. Pennsylvania issued the lion’s share with 35 new permits. CNX grabbed seven of those permits in Washington County, and Olympus Energy received six in Westmoreland County. Ohio issued 11 new permits, with four going to Ascent Resources in Jefferson County, and four to Hilcorp Energy in Columbiana County. West Virginia issued a paltry one new permit, which went to Southwestern Energy in Ohio County.tags: Apex Energy, Armstrong County, Ascent Resources, Bradford County, Butler County, Cabot Oil & Gas, Carroll County, Chesapeake Energy, Clarion County, CNX Resources,Columbiana County, Encino Energy, Energy Companies, EOG Resources, Hilcorp Energy, Inflection Energy, Jefferson County (OH), Laurel Mountain Energy, LOLA Energy, Lycoming County, Ohio County, Olympus/Huntley & Huntley, PennEnergy Resources, Range Resources Corp, Southwestern Energy, Susquehanna County, Washington County, Weekly Permits, Westmoreland County, Wyoming County (PA)

A shale well met an abandoned well a mile away. How did it happen? - Pittsburgh Post-Gazette On June 19, Zach Debolt noticed a geyser shooting up 15 feet above the ground on his property in New Freeport, Greene County.That’s how he described it to James Gillin, a township supervisor and his neighbor, when Mr. Gillin ran over to see what was going on. The geyser was gone by that point, but Mr. Gillin could see water rushing underground through a sinkhole that had formed around an old, abandoned gas well.Mr. Gillin called EQT Corp., the Downtown-based natural gas company that was fracking shale wells from a pad more than a mile away. At that moment, EQT was pumping large volumes of water, sand and chemicals through holes in a pipe that extends horizontally for thousands of feet underground. The pressure of that rush of water is intended to create fractures that extend through the Marcellus Shale formation, releasing the gas trapped inside.EQT stopped fracking the Lumber 13H well that day, and the liquid and gas in the abandoned well on Mr. Debolt’s property subsided. The next day, the company notified the Pennsylvania Department of Environmental Protection of a well communication issue — a term that means one well has interacted with another.Since then, the company and the DEP have been investigating exactly what happened.“They’re going to want to know where all this water went,” Mr. Gillin said, referring to the fast-flowing river he saw through the sinkhole.If fluid from a frack job 1.5 miles underground reached an old shallow well 1.2 miles away from the Marcellus Shale well pad, the impact would fall outside the radius that shale drillers must survey before they break ground and beyond the so-called zone of presumption (2,500 feet from the wellbore). That designated area allows landowners to get replacement water from a driller suspected of causing damage to their water supply.It would also raise questions about the complicated geology in southwestern Pennsylvania.Whatever happened underground was enough to momentarily suck all the water from Mr. Gillin’s house and dewater his septic tank, leaving a sludge.Several neighbors believe it may have also impacted their water wells.Tammy Yoders said her son broke out in hives after taking a shower the day of the incident, which they only learned about the next day from a Facebook postThe DEP and EQT came to her house and left with half a dozen bottles of water to sample. EQT supplied the family with several cases of bottled water, which are now long gone, Ms. Yoders said, but they haven’t asked the company for more. Now, they buy drinking water while they wait for the test results. In this small community, rumors started flying immediately, especially since it wasn’t EQT notifying people but their neighbors.Tom Bussoletti was shopping in Waynesburg when he ran into another township supervisor who told him about the well issue, called a “frack out.”Mr. Bussoletti thought about the high-pressure propane line that runs under his property. That line was why he opposed EQT’s Lumber well pad in the first place.He was already on edge about EQT’s trucks parking on top of the line. Finding out about a problem underground was more unwelcome news. That he was hearing about it days later was aggravating. Mr. Bussoletti called around. He heard from his neighbor, Liz Pebley, that the DEP found methane in her water well and suggested it be aerated to get rid of it. “Of course, I tried to light it and it didn’t [light],” she chuckled, figuring that methane would catch on fire. She doesn’t drink well water, Ms. Pebley said, and hasn’t since she lived in West Virginia, where fracking made her more cautious. But she does cook with it. Like the other families, she’s waiting for the results that she says will go to her landlord first.Wendy Saul, whose property is north of Mr. Bussoletti’s, found out about the incident on Facebook from Tammy’s daughter Tonya Yoders, who posted that the DEP was testing water. She, too, is awaiting water results. The DEP said it is investigating several water supply complaints while EQT’s spokesman Bridget McNie said in a statement that “water sampling and well monitoring have shown no other areas of concern at this time.”

Since the ‘frack out,’ it’s oily showers, mysterious smells and thirsty pets for residents of a Southwestern PA town - Frack out in PA town leaves residents questioning water safety. A strange smell wafted across the room as well water began to flow through the hose in Bill Yoders’ garage. The smell wasn’t quite sulfur, and it didn’t smell like gas. But it sure wasn’t plain water either.“That smell was never there before,” he said, adding that the water’s yellow tint was new, too. Since June 19, Yoders said, his two dogs have refused to drink the water. He’s still using the water to shower. “It kind of leaves an oily film on you,” he said. His wife, Tammy, said their 23-year-old son, Loran, broke out in hives after he took a shower at home on that June day. ”He was pure blood red, hives from head to toe,” she said.For a month, the Yoders family and other households in the Greene County hamlet of New Freeport have been living with deep concerns about their water supply. On June 19, some residents became aware, through word of mouth or a township supervisor’s Facebook post, that Pittsburgh-based EQT Corporation had reported a “frack out” at a nearby well drilling site. A frack out — sometimes spelled “frac out” — occurs when fluid pumped into a well to fracture shale formations and release gas instead enters an abandoned well. EQT, in a statement provided to PublicSource, indicated that “water was brought to the surface near an abandoned well” and that it had stopped drilling operations at its well a mile away “out of an abundance of caution.”Residents, meanwhile, are yearning for clarity on the quality of their water. Both the state Department of Environmental Protection [DEP] and Moody and Associates, a subcontractor for EQT, sent representatives to gather water samples for testing. Most residents said they have not yet received test results as of early this week. Independently, Duquesne University microbiology Professor John Stolz went to New Freeport to test the water. Preliminary data and on-site measurements from three private wells, he told PublicSource, were enough for him to conclude: “This water is not potable.” “Folks have to be provided alternative sources of drinking water,” Stolz said. The Yoders said EQT dropped off three cases and five jugs of water to the house after Bill called the corporation. That water is long gone now, they said. “A couple cases of water don’t mean anything,” he said.

CEASRA hosting landfill update -The Citizens’ Environmental Association of the Slippery Rock Area Inc. is hosting a program to share updates about the landfill being proposed by Tri-County Industries Inc.“Our Radioactive Landfill” will be held at 7 p.m. July 29 at the Grove City borough building, 123 W. Main St., Grove City, according to a news release from the organization, which is also known as CEASRA.There will be guest speakers from other parts of Pennsylvania who have experienced the effects of radioactive waste in their communities.CEASRA and community members have voiced concerns for a number of years about TCI’s plans to reopen a landfill on property the company owns in Liberty and Pine townships. As TCI continues to make its way through the rest of the permitting process, CEASRA wants to make residents aware of the potential dangers they believe the landfill presents, like radioactive fracking waste.The presentation will include information from DEP about how Vogel Holding Inc., which owns the TCI property, has dumped radioactive leachate from its Seneca landfill into the Connoquenessing Creek, CEASRA members said.TCI’s permit application for the new landfill notes that the leachate — which is liquid from landfill waste — will be similar to leachate at the Seneca landfill, said Jane Cleary, CEASRA member.Radioactive waste has become a huge problem for Pennsylvania residents, as most landfills are permitted to accept radioactive fracking waste.Dust from the waste can be airborne and inhaled, leading to serious health conditions like bone cancer, especially in children, she said.There is no easy way to remove the radioactivity from the liquid nor the landfill, and Dr. Julie Weatherington-Rice, a soil scientist at Ohio State University, has said that a landfill with fracking waste is a “permanent reactor near your house” with the same cancer-causing radon levels 500 years from now.

Pipeline explosion cause not yet provided - Bradford Era - It has been nearly two weeks since a section of the Tennessee Gas Pipeline (TGP) exploded near Clermont, and little is known about the cause. A representative from Kinder Morgan, the parent company of TGP, stated July 15, “A thorough investigation is underway and will take some time to complete.” On Thursday, Kinder Morgan responded to questions submitted regarding what happened and the process taken in the aftermath. Concerning a reported “release of gas,” Kinder Morgan was asked what kind of gas specifically and how far the release could travel in the air? “Natural gas is the type of gas that we transport in that pipeline, and that is the product that was released,” KM responded. “Natural gas is lighter than air, and many factors determine how it dissipates making it difficult to ascertain how far it travels.” The company was also asked if there was any danger to wildlife or residents in the area from a release of natural gas. “There were no adverse impacts to the residents or wildlife reported from this event,” KM responded. After the blast, KM indicated “the pressure was lowered.” The Era asked what is the difference between the pressure of the line being lowered and the line being completely shut off. KM responded, “During an incident, we shut down and isolate the impacted pipeline segment which was a portion of Line 1 on our Tennessee Gas Pipeline 300 system. We did so during this incident by closing mainline valve 309 and mainline valve 310, which are on either side of the segment that experienced the failure. The impacted segment remains shut down. “Line 2 on our TGP system parallels Line 1, and the operating pressure of that pipeline was lowered, as a precaution, until we determined that it hadn’t sustained any collateral damage as part of the in-service failure on Line 1. This line has resumed normal operations.” KM pointed to its website for further information concerning updated notices. From there, it was found that the company had declared a “Force Majeure” on Main Line Valve 309 and MLV 310, on Line 1, as of July 13 and until further notice. This is classified, on the report, as critical. According to the Wilcox Volunteer Fire Department, a call came in at 5:23 p.m. July 12, with a report of a suspected brush fire with flames “shooting over the trees with large columns of smoke” in the area of the Instanter Boat Launch on the East Branch of the Clarion River Dam. Dispatch reported the caller had heard a “loud roar” as well. However, fire crews could not find anything in the vicinity of the boat launch and the chief canceled additional units who were en route. An hour later, at 6:35 p.m., the Clermont Volunteer Fire Department requested assistance from several departments for a large wildfire and what had been reported as a gas line explosion. As crews began arriving at the Wilcox Clermont Road location, a command post was set up approximately 2 miles down the road. The crews walked the TGP line until they were able to find where the 24-inch line had ruptured. According to reports, this rupture caused the fire that burned approximately 5 acres of surrounding land. TGP lowered the pressure on the pipeline, which helped the crews who were extinguishing flames. One of the first updates received from Kinder Morgan stated, “As of (Tuesday, July 12) evening, Tennessee Gas Pipeline confirmed that there was a natural gas release and fire on a pipeline segment of its 300 system in a rural area of McKean County, Pennsylvania. The company shut down the impacted pipeline segment and worked with local responders to isolate the area. The fire was extinguished later that evening, and there were no injuries from the event. The incident remains under investigation, and the company is working with regulatory agencies as needed.”

New England gas prices top $20 on AGT system restrictions, demand spike - Natural gas prices in New England are up sharply over past several days as strong demand on Algonquin Gas Transmission collides with a planned service outage on the pipeline, prompting the system operator to impose operational flow orders to manage system pressure and deliveries. On July 20, the cash market at Algonquin city-gates surged to nearly $23/MMBtu, more than doubling on the day. At Iroquois Zone 2 spot prices jumped to nearly $21. At both locations, prices are up from weekend settlement levels at under $7/MMBtu, Intercontinental Exchange and Platts data showed. Earlier this week, constraints on Algonquin began lifting spot gas prices at the Boston-area city-gate. Since at least July 16, capacity on Algonquin's J-system delivering into Boston has remained at zero, down from over 250 MMcf/d owing to a planned maintenance outage that could continue to limit deliveries into the metro-area. The transmission outage on the J-system is currently scheduled to conclude July 21 but is subject to change and was previously extended an additional two days earlier this week by the pipeline operator. Over the past several days, the system outage on Algonquin has coincided with a surge in demand. On July 20, Algonquin deliveries to local distribution companies or LDCs edged up to nearly 600 MMcf/d, up from levels under 300 MMcf/d earlier this week. Power plant deliveries have also climbed over the past several days to an average 950 MMcf/d July 19-20, up from about 650 MMcf/d over the weekend, Platts Analytics data shows. Rising LDC and power demand on Algonquin's pipeline has accompanied a recent spike in temperatures with Boston and Hartford, Connecticut, recording highs in the low- to mid-90s Fahrenheit on July 20. Amid rising demand downstream demand, nomination requests on Algonquin have exceeded operational capacity at some locations, resulting in the imposition of some flow restrictions in accordance with capacity priority.

Gas industry drags FERC into tussle over pipeline scheme - Pipeline companies pushed back this week against claims that they are artificially inflating the price of natural gas, urging the Federal Energy Regulatory Commission to allow them to continue a sales practice of bundling gas capacity from nonadjacent sections of pipe.The comments from the Interstate Natural Gas Association of America (INGAA) and multiple pipeline companies are the latest in an ongoing tussle between key segments of the natural gas industry. They come in response to a recent petition from gas utilities, producers, shippers and others accusing the pipeline industry of anticompetitive behavior and asking FERC to step in to address it (Energywire, June 6).To obtain natural gas, gas utilities and other shippers that consume or process the fuel sometimes participate in “open seasons” held by pipelines, in which parties submit bids for capacity on a section of pipe. In recent years, pipelines have increasingly begun to bundle multiple noncontiguous capacity offers into a single bid, forcing shippers to purchase gas that they cannot use, according to the original petition.But in their comments to FERC, pipeline companies argued that the practice enables them to offer lower rates, which ultimately get passed onto residential customers and industrial consumers of gas. They also reminded FERC that it has repeatedly affirmed the use of noncontiguous capacity offers and dismissed past complaints about them.“The Petition is a plain attempt to get yet another bite at the apple and falls far short of offering the substantial evidence needed to justify a drastic departure from a policy that the Commission has applied consistently for decades,” INGAA, a trade group for pipeline companies, wrote in a comment this week to FERC.INGAA argued that FERC has taken the position for years that maximizing the revenue and use of pipeline capacity is good for all parties in the long run. In addition, other protections are already in place to ensure pipelines do not impose monopoly prices, the group said.

From Farmland to Frac Sand - One Monday in June, excavators were tearing into a field in Wedron, Illinois where the nubs of last season’s dried corn stalks were still sticking out of the ground. Behind where the crew worked, strips of earth had been carved out like steps on a wide staircase descending to the bottom of a deep pit. On the far side, fine sand the color of snow was piled in front of soaring, solid walls of sandstone. Picture standing on a ledge looking down into the biggest rock quarry you’ve ever seen. Then, enlarge that image 100 times, whitewash it, and add turquoise blue pools of wastewater. This is silica mining. Fracking, a process used to extract natural gas and petroleum, depends on silica sand, or “frac sand” to produce the fossil fuels. A single fracking site can use millions of pounds of sand. The sand is blasted into wells to keep fissures in the rock open so that oil and gas can be released. In the Midwest, farmland is being irreversibly lost in pursuit of silica sand. Wedron Silica, which is now owned by Ohio-based Covia, has been expanding this particular mine for years and now owns at least 2,500 acres in and around the tiny village. It’s just one of several that Covia owns across LaSalle County, Illinois, 90 miles southwest of Chicago. Here, U.S. Silica, Smart Sand, and other companies are also actively mining. Together, the companies have purchased hundreds of parcels of land and now own more than 9,000 acres in LaSalle, a Civil Eats investigation has found. The majority of those acres are former or current farmland. Silica mining is also prevalent in other parts of Illinois and regions of Wisconsin and Missouri. According to the U.S. Department of Agriculture (USDA), LaSalle County’s farmland acreage dropped 5 percent from 2012 to 2017, to 573,000 acres. But many of the acres still identified as farmland are owned by mining companies and leased to farmers. Across the street from the mining activity in Wedron, for example, Covia owns 600 acres, where tiny corn plants were just starting to green up in neat rows. In 2018, the county approved the company’s application to expand into those farm fields, despite the fact that LaSalle County Soil and Water Conservation District discouraged the decision based on a site assessment score that identified the land as “highly productive.” Digging could start at any time.

US sets course for natural gas production records - US natural gas production will push past 100 billion cubic feet per day by the end of the year as producers scramble to boost output to meet growing global demand for gas, according to a leading market analyst. The US is already the world’s largest gas producer but increased production in major shale plays is helping the nation expand its lead over Russia, Rystad Energy said this week. The primary producing regions will continue to be the Marcellus and Utica shales in the US north-east, the Haynesville shale in Louisiana and the Permian basin in Texas and Louisiana.

Rystad: US natural gas output to top 100 bcfd by end-2022 -US natural gas production is expected to hit a record high of more than 100 bcfd by the end of the year, Rystad Energy analysis shows. Production growth in major US gas-producing basins, in addition to associated gas production in the Permian, will cement the country's position as the world's largest gas producer, stretching its lead over Russia. Within shale gas plays, the Marcellus, Utica, and Haynesville are set to contribute the most. Rystad Energy expects production from the Haynesville alone to grow by 2.6 bcfd this year compared with 2021, pushing annual output to more than 14 bcfd. Production from the basin is forecast to jump next year as well, reaching 17.2 bcfd by end 2023. The company noted, however, that growth in Appalachia basin remains entirely dependent on progress of the proposed Mountain Valley Pipeline, which faces significant legal hurdles. The recent surge in global natural gas prices is pushing US exploration and production companies to increase investment in an effort to take advantage of competitive breakeven costs. A well-documented supply shortage in Europe is pushing up prices on the continent amid efforts to ease reliance on Russian gas. Given the wide US and European price differences, shipping US gas across the Atlantic, even considering the pricey liquefaction process, is economically advantageous. The US-Europe price spread has widened steadily since summer 2020. Russia’s invasion of Ukraine and the ensuing global energy crisis accelerated the disparity. As of July 15, Henry Hub prices were $7/MMbtu, while the TTF stood at $47/MMbtu. Although LNG production capacity constraints remain, with new LNG capacity expected to be added only after 2024, the US’s role in global gas markets should grow for some time to come, said Kristine Vassbotn, Rystad Energy senior analyst. Upstream investments in the Haynesville of $7.4 billion are set to exceed the Marcellus this year for the first time since 2009. Haynesville investments will grow 47% from 2021 to 2022, according to Rystad, followed by the Utica and Marcellus at 26% and 21%, respectively. The increase in investments in 2022 is a combination of increased activity in response to prices, particularly in the Haynesville, and increased well costs due to inflation. The Marcellus has the largest undrilled leased acreage of the three basins at 6.7 million acres. As policymakers seek ways to boost domestic output, the Marcellus has plenty of remaining commercial acreage and inventory to unlock, should takeaway constraints eventually ease in the Northeast. The Haynesville has the least undrilled acreage at 1.8 million acres. In terms of remaining gas reserves, the Marcellus has the most, with close to 380 tcf. The Haynesville follows, with 202 tcf.

LNG exports shoot up in Louisiana, US in 2022 amid booming demand --Led by a trio of Louisiana facilities, the United States’ liquefied natural gas export terminals are exceeding their 2021 pace amid growing demand for LNG in natural gas-starved Europe. Collectively, the seven operating LNG export terminals in the U.S. have pumped out more than 1.7 trillion cubic feet of LNG through May, according to the most recent data available from the Department of Energy. That’s nearly 260 billion more than the nearly 1.5 trillion cubic feet that U.S. terminals moved at the same point last year. Leading the way was Sabine Pass LNG in Cameron Parish, near the Texas border. Sabine Pass LNG has exported nearly 626.9 billion cubic feet through May, a 100 billion-cubic-foot spike compared with its total through the same month in 2021. The facility has accounted for more than a third of U.S. production so far. Sabine Pass LNG’s output nearly doubled the second-place facility, Corpus Christi Liquefaction in Corpus Christi, Texas, which exported 315 billion cubic feet through May. Both facilities are owned by Houston-based Cheniere Energy. Cameron LNG in Hackberry has produced 274 billion cubic feet through May, good enough for fourth in the U.S. rankings. That’s a jump of nearly 29 billion cubic feet from the same point a year ago. All six of the terminals that were in operation last year posted year-over-year gains in May. Venture Global LNG’s Calcasieu Pass facility, near the mouth of the Calcasieu Ship Channel in Cameron Parish, came online in January and has shipped more than 61 billion cubic feet so far this year. In total, U.S. LNG terminals sent more than 351 billion cubic feet of exports in May alone, an 11.5% increase from May 2021 and a 6.4% increase from April of this year.

We Gotta Get Out of This Place - Court Decision Helps Supply Access to LNG Export Facilities - Europe is trying to wean itself off Russian natural gas, and few things would help it more than an expansion of U.S. LNG export capacity. But LNG projects don't just need long-term commitments for their output, they also need pipelines to transport natural gas from the Marcellus/Utica and other distant production areas to their coastal liquefaction plants. And, in case you hadn't noticed, new interstate gas pipelines face a lot of hurdles during the regulatory review process these days — getting a pipeline approved is tougher than snagging a Saturday morning tee time. Which brings us to, of all things, an important court ruling. In today's RBN blog, we discuss the implications of the DC Circuit's decision in City of Oberlin v. FERC. On July 8, the U.S. Court of Appeals for the District of Columbia Circuit (a.k.a. the DC Circuit) updated a decision that could have a significant impact on the supply of feedgas to LNG export facilities. In the case of City of Oberlin, Ohio v. FERC, the DC Circuit reversed an earlier finding that the Federal Energy Regulatory Commission (FERC) had not explained why export volumes on a proposed interstate pipeline project can be used to help justify approval of the new pipe projects. The case involved the city of Oberlin's challenge to FERC's approval of the NEXUS pipeline, carrying natural gas from the Utica Shale in eastern Ohio to the gas hub in Dawn, ON (among other destinations). The project sponsors had included the gas flows to Dawn as support for approval of the pipeline, to help meet the requirements of FERC’s “certificate policy” that a public benefit had to be shown for pipeline construction to be authorized. In what the DC Circuit now refers to as its "Oberlin I" decision, the court, in 2019, found that FERC needed to explain why volumes on NEXUS going to Canada were a benefit to the U.S. public. That decision had been used by LNG opponents, such as Sierra Club, to claim that the same issue affects feedgas pipelines built to serve LNG export terminals. They argued that such pipelines shouldn’t receive certificates to allow construction or the eminent domain rights that automatically go with those certificates if they didn’t show a benefit to the U.S. public. The DC Circuit's decision last month (“Oberlin II”) reversed Oberlin I, finding that FERC has now explained itself well enough and that, yes, natural gas exports can provide public benefits in the U.S. So, does this reversal clear the way for LNG feedgas pipelines to be built without running into legal roadblocks? Well, it pretty much knocks down one potential roadblock, but that’s a start.Two parts of the Natural Gas Act of 1938 (NGA) are involved: Section 3 and Section 7. Section 3 deals with the import and export of natural gas. It’s jointly administered by the Department of Energy (DOE) and FERC. DOE decides whether an export is in the public interest and FERC decides whether to authorize an LNG export terminal. Section 7, in turn, deals with the construction of interstate natural gas pipelines. It's exclusively administered by FERC. One of the most important differences between the two sections is that Section 7 includes a grant of eminent domain (added to the NGA in 1947), so that if a pipeline developer cannot get a landowner to negotiate for right of way, it can petition a court for condemnation. This helps a lot in keeping pipelines straighter and cheaper than they otherwise would be. Section 3, however, does not include an eminent domain provision. Also, a Section 7 pipeline can transport interstate gas for any shipper, not just the LNG terminal. A Section 3 pipeline can’t — it’s just treated as a piece of the terminal. So, for a pipeline needed to feed gas to an LNG export terminal, it’s a big deal whether the pipeline is authorized under Section 3 or Section 7.

‘Super-Hot’ Weather Pattern Spurs on Natural Gas Futures Rally - Natural gas futures flew higher on Monday, building on the prior week’s gains, as soaring temperatures baked much of the Lower 48 and forecasts called for heat waves to fester through July and into next month. The August Nymex contract jumped 46.3 cents day/day and settled at $7.479. September gained 45.6 cents to $7.382.The prompt month advanced 16% last week, including a 41.6-cent gain on Friday.NGI’s Spot Gas National Avg. mounted further momentum of its own, rising $1.145 to $7.745. Hubs throughout the country posted strong gains.Cash prices cruised higher last week, too. NGI’s Weekly Spot Gas National Avg. for the July 11-15 period spiked 88.5 cents to $6.730.“The pattern remains in super-hot mode,” Bespoke Weather Services said Monday, adding its forecast calls for a few record gas-weighted degree days (GWDD) over the next two weeks. That would put the market “on pace for a July that ranks among the top three hottest months on record in terms of total GWDDs. This includes a continuation of blistering heat in places like Texas, where the hottest weather comes the next three days, bringing up the chance for at least one day of 110 in Dallas.“Looking ahead,” the firm added, “we have little reason to think we will not continue to see above normal heat on into at least the first part of the month of August, keeping weather easily on the supportive side.” Bears had previously seized upon the Freeport LNG outage that followed an early June fire. It cut U.S. export capacity by about 2.0 Bcf/d through at least early fall. That gas is now available for domestic consumption.However, “all of this extra heat is really chewing away at the 200-plus Bcf given to the market’s end-of-season storage projections by the Freeport LNG debacle,” Bespoke said. “In fact, just with the forecast we see through the first few days of August, we estimate that weather has negated as much as 85 Bcf. Should heat continue this strongly into the rest of August, prices will continue to move higher, as injections will remain rather low.”The U.S. Energy Information Administration (EIA) most recently printed an injection of 58 Bcf into natural gas storage for the week ended July 8. It lifted working gas in storage to 2,369 Bcf, yet stocks were 319 Bcf below the five-year average. Dry gas production gained 1.0 Bcf/d over the weekend to around 97 Bcf/d, EBW Analytics Group senior analyst Eli Rubin noted. That lifted output to near 2022 highs. “If supply continues to increase, it could adjust the long-term storage outlook and severely slash shortage risk premiums for later this year,” Rubin said. For now, however, “searing heat” is driving markets higher.

U.S. natgas futures slide 3% as output rises, technical resistance (Reuters) - U.S. natural gas futures fell about 3% on Tuesday after failing to break through a key point of technical resistance as overall output continues to rise to record levels and a small, brief decline in gas flowing to liquefied natural gas (LNG) export plants. That price decline came despite a preliminary one-day drop in output on Tuesday, a preliminary increase in LNG feed gas on Tuesday and forecasts for hotter weather and higher air conditioning demand next week than previously expected. Extreme heat has already boosted power demand to record highs in several parts of the country, including Texas and other U.S. Central states, as homes and businesses crank up their air conditioners to escape the weather. Also pressuring gas prices was the ongoing outage at the Freeport liquefied natural gas (LNG) export plant in Texas, which leaves more fuel in the United States for utilities to refill low storage. Freeport, the second-biggest U.S. LNG export plant, was consuming about 2 billion cubic feet per day (bcfd) of gas before it shut on June 8. Freeport LNG has said the facility could return around Oct. 22. Some analysts, however, expect the outage to last longer. Front-month gas futures fell 21.5 cents, or 2.9%, to settle at $7.264 per million British thermal units (mmBtu). On Monday, the contract closed at its highest since June 13. On the technical side, the front-month failed to break above its 50-day moving average for a second day in a row, making that a key level of resistance. So far this year, the front-month is up about 96% as much higher prices in Europe and Asia keep demand for U.S. LNG exports strong, especially since Russia's invasion of Ukraine stoked fears Moscow would cut gas supplies to Europe. Gas was trading around $49 per mmBtu in Europe and $37 in Asia. After the shutdown of Nord Stream 1 for maintenance on July 11, Russian gas exports have held around 1.4 bcfd on the three main lines into Germany: Nord Stream 1 (Russia-Germany), Yamal (Russia-Belarus-Poland-Germany) and the Russia-Ukraine-Slovakia-Czech Republic-Germany route. That is down from an average of 3.7 bcfd in the month before Nord Stream shut and an average of 9.4 bcfd in July 2021. The average amount of gas flowing to U.S. LNG export plants slid to 11.1 bcfd so far in July from 11.2 bcfd in June due to a brief upset at Venture Global LNG's Calcasieu Pass plant in Louisiana on Monday. That was down from 12.5 bcfd in May and a monthly record of 12.9 bcfd in March due to the Freeport outage. Feed gas to Calcasieu was expected to return to 1.5 bcfd on Tuesday after sliding to 0.8 bcfd on Monday. That compares with an average of 1.5 bcfd over the past week.

U.S. natgas futures jump 10% on hotter forecasts, output decline (Reuters) - U.S. natural gas futures jumped about 10% to a five-week high on Wednesday on forecasts for hotter weather over the next two weeks to boost air-conditioner use and gas-fired electrical demand following a recent decline in output. A brutal heat wave has already boosted power demand for air conditioning to record highs in several parts of the country, including Texas. "Power demand reached an all time high ... yesterday," analysts at Gelber & Associates said in a report, noting, "Next week is expected to be the hottest of the season." Power companies were burning lots of gas to produce all that power in part because coal prices were near record highs, making it uneconomic for many generators to switch to coal-fired plants. Gas prices rose despite a drop in feed gas to liquefied natural gas (LNG) export plants due to upsets at a couple facilities in Louisiana and the ongoing outage at Freeport in Texas, which leaves more fuel in the United States. Freeport, the second-biggest U.S. LNG export plant, was consuming about 2 billion cubic feet per day (bcfd) of gas before it shut on June 8. Front-month gas futures rose 74.3 cents, or 10.2%, to settle at $8.007 per million British thermal units (mmBtu), their highest close since June 13. In what has already been an extremely volatile year of trade, Wednesday's gain was only the biggest one-day percentage gain since early July. There have already been 11 days where the front-month has settled up or down over 10% in 2022. So far this year, the front-month was up about 115% as much higher prices in Europe and Asia keep demand for U.S. LNG exports strong, especially since Russia's invasion of Ukraine. Gas was trading around $48 per mmBtu in Europe and $38 in Asia. Data provider Refinitiv said average gas output in the U.S. Lower 48 states rose to 96.1 bcfd so far in July from 95.3 bcfd in June. That compares with a monthly record high of 96.1 bcfd in December 2021. On a daily basis, however, output was on track to drop 2.7 bcfd from a six-month high of 97.3 bcfd on Monday to a preliminary five-week low of 94.6 bcfd on Wednesday. Preliminary data is often revised later in the day. Refinitiv projected average U.S. gas demand including exports would slide from 100.9 bcfd this week to 100.1 bcfd next week as extreme heat starts to ease in some parts of the country. Those forecasts were similar to Refinitiv's outlook on Tuesday. With hot weather blanketing much of the country, next-day power in New England soared to $199 per megawatt hour for Wednesday, its highest since late January.

US working natural gas in storage increases by 32 Bcf on week: EIA | S&P Global Commodity Insights - US natural gas working stocks rose by 32 Bcf during the week ended July 15, undershooting market expectations and providing bullish fodder for US gas futures markets. Storage inventories rose to 2.401 Tcf for the week ended July 15, the US Energy Information Administration reported on July 21. The build was well below an S&P Global Commodity Insights survey of analysts calling for a 44 Bcf net injection, although it was within the wider range of 25-58 Bcf. The weekly injection also was less than the 50 Bcf build reported during the corresponding week in 2021, and below the five-year average draw of 41 Bcf, according to EIA data. As a result, the deficit to both the five-year average and year-ago week widened. Stocks in the most recent reporting week were 270 Bcf, or 10.1%, below the year-ago level of 2.671 Tcf, and 328 Bcf, or 12%, below the five-year average of 2.729 Tcf. The smaller-than-expected build initially galvanized US gas futures July 21, with the session's highs giving way to a more tepid response by the close of trading. The NYMEX Henry Hub August contract surged 35 cents to $8.10/MMBtu in the 10 minutes of trading following the weekly storage report, erasing the pre-storage report pricing weakness observed earlier in the session. The contract had been trading around $7.75/MMBtu in the 30 minutes before the July 21 storage report launched, down around 25 cents from its prior-day rally to $8.007/MMBtu. Prior to July 20, the NYMEX prompt-month contract last settled above $8/MMBtu in mid-June. At close, the August contract settled at $7.932/MMBtu, down 7.50 cents from its prior day's settlement. Ongoing heat wave conditions have spiked power sector demand for gas so far in July, absorbing volumes that might otherwise have flowed into storage. Total US power burn demand has exceeded the five-year average every day since June 18, Platts Analytics data showed. Between July 1-20, 14 days have seen power burn demand outpace the five-year maximum as well. Gas-fired power demand has been especially strong in Texas and the Southeast, which are largely captured in the EIA's South-Central region. The South-Central region saw a 16 Bcf withdrawal from storage for the week ended July 15, the region's first net pull so far this injection season. Withdrawals from salt caverns drove the net decrease in storage, with non-salt storage recording no change from the previous week.

Natural Gas Futures Fly Back Above $8 Amid Relentless Heat, Storage Concerns - Natural gas futures flexed some pricing muscle on Friday on the heels of a solidly bullish storage report and a shift hotter in an already sizzling late-summer weather outlook. The August Nymex gas futures contract gained 36.7 cents day/day and settled at $8.299/MMBtu to close the week. September advanced 38.0 cents to $8.195. NGI’s Spot Gas National Avg. followed suit, rising 1.5 cents to $8.385. Markets on Friday mulled the implications of a seasonally weak inventory build and the prospect of more to come as exceptional cooling demand has come to define the summer of 2022. The U.S. Energy Information Administration on Thursday posted a 32 Bcf injection of gas into underground storage for the week ended July 15. The print fell short of expectations and historic norms. Polls ahead of the EIA report pointed to an increase in the mid- to high-40s Bcf. The actual build compared to the 50 Bcf increase in the comparable week last year and a five-year average injection of 41 Bcf. The injection raised working gas in storage to 2,401 Bcf, though stocks were 328 Bcf below the five-year average. On a weather-adjusted basis, Tudor, Pickering, Holt & Co. (TPH) analysts said the latest EIA report implied the market was about 3 Bcf/d undersupplied. Summer heat remains a “primary driver of price action” for the natural gas market, having pushed power generation demand to an all-time high at 47.5 Bcf/d during the July 17-22 week, roughly 6 Bcf/d above seasonal norms, according to the TPH analysts. Analysts at The Schork Report said the government assessment came in 24% below the most conservative forecast in major polls. About halfway through the storage refill season, they said, the market has covered 45% of last winter’s gas deliveries. The market had anticipated that the Freeport LNG outage – caused by a June fire – would ease supply worries even in the face of prolonged heat. The outage cut export capacity by 2.0 Bcf for the summer – and likely longer – and that gas is now available for domestic use. But utilities are eating through the added supply and still struggling to narrow the storage deficit to the five-year average. Meanwhile, output climbed to around 97 Bcf early in the past week – near a summer high. But producers were not able to sustain that level as maintenance projects interrupted momentum and curbed output to around 95-96 Bcf late in the week. Bespoke Weather Services said widespread high temperatures in the 90s and 100s put this month on track to be one of the three hottest Julys on record. Now, the latest outlooks shifted hotter and put next month on a path to become one of the five hottest Augusts in the firm’s data set. “If this heat does indeed continue throughout August, it is likely that prices still move higher from here, and end-of-season storage projection could fall as low as 3.25 Tcf, with hot weather having eaten away most of what Freeport gave the market,” Bespoke said. “Such a scenario would mean prices could still manage to touch $10.00 yet.” ”

U.S. regulators to inspect shuttered Texas LNG plant in September (Reuters) - The U.S. Federal Energy Regulatory Commission (FERC) will inspect Freeport LNG's shuttered liquefied natural gas (LNG) export plant in Texas in September, the agency said on Tuesday. The plant shut on June 8 because of a fire and was expected to remain out of service until October, Freeport LNG said in an email on Tuesday. Both FERC and the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) said they would not allow the facility to return to service until they approve the restart. The September inspection is a standard annual site inspection. The shutdown of Freeport caused natural gas prices in Europe to jump about 40% in the week after the plant shut because it reduced the volume of available exports from the United States at a time when the world is short on natural gas supply. Europe has been buying U.S. LNG heavily due to reduced flows from Russia following its invasion of Ukraine on Feb. 24 and subsequent sanctions placed on Russia by the United States and its allies. The Freeport shutdown also caused U.S. gas prices to drop because it left more of the fuel in the United States, allowing utilities to quickly rebuild low gas stockpiles. U.S. futures dropped about 44% due in part to the ongoing outage of Freeport from a near 14-year high of $9.66 per million British thermal units (mmBtu) on June 8, the day Freeport shut, to a three-month low of $5.33 on July 5. In addition to the notice about the upcoming Sept. 13-15 inspection, FERC asked Freeport to provide information about the plant, including "any abnormal operating conditions at the facility" and "any changes in the facility design, process equipment, process piping ... that have been made" since the last FERC inspection on June 23-24, 2021.

U.S. Coast Guard Contains Over 1 Mn Gallons From Longest Oil Spill -The U.S. Coast Guard and partner agencies have successfully contained and collected over one million gallons of oil discharged from subsurface oil wells connected to a toppled oil platform in Mississippi Canyon Block 20, some 11 miles offshore Louisiana. The platform collapsed in 2004 due to Hurricane Ivan, and oil continues to leak from the damaged wells making this the longest-running oil spill in U.S. history. Since April 2019, oil has been captured, contained, and removed from the site while a permanent plan to decommission the oil wells effectively and safely at the MC-20 site is being developed. According to the U.S. Coast Guard, 1,016,929 gallons of oil have been collected from the site as of July 12, 2022. A subsea containment system designed, fabricated, installed, and operated by Couvillion Group continues to collect an average of 900 gallons of oil per day with the Coast Guard overseeing continuous oil collection and necessary system maintenance. “The near elimination of the surface sheen and collection and removal of more than one million gallons of oil from the site over the previous three years is a major milestone in the Coast Guard’s efforts to contain the MC-20 oil spill that has affected the waters off the Gulf Coast for years,” said Kelly Denning, the Coast Guard’s Federal On-Scene Coordinator for the incident. “Though the containment system is considered a great success, the federal government is exploring all available response options, including properly decommissioning the impacted wells on site,” Denning added. To remind, a settlement between the United States and Taylor Energy was reached in late December last year in which Taylor Energy agreed to transfer all remaining funds in the Taylor Energy Decommissioning Trust to the United States. This meant that Taylor Energy would pay over $43 million for the settlement and transfer the $432 million decommissioning trust fund in its entirety. The funds will be used to properly decommission the oil wells which were originally connected to the downed platform at the MC-20 site. The terms of the settlement are outlined in the Consent Decree entered by the District Court for the Eastern District of Louisiana on March 17, 2022. The response to the active oil spill continues to be led by the Coast Guard Federal On-Scene Coordinator and is supported by its federal partners, including the Bureau of Safety and Environmental Enforcement and the National Oceanic and Atmospheric Administration. Currently, the Coast Guard is gathering key subsurface data which is intended to support future federal efforts to decommission the MC-20 wells which the Bureau of Safety and Environmental Enforcement and U.S. Coast Guard believe is the necessary step to ultimately bring this incident to a close.