as you know, the EIA was out with new maps of the Utica shale formation, and the Point Pleasant formation directly below it, earlier this week...i found that by copying the original EIA post, the map pictures would still appear, and better yet, clicking the links below the map pictures pops up the maps in separate window, complete with a zoom magnifier, so we can, for all practical purposes, get right down to identifying the characteristics of the formations that underlie our county and those adjacent to it...basically, each of the maps below has two notes below it; one for the sources of the information used in producing the map, followed by a note to "Click to enlarge"...it's that "Click to enlarge" that you'll have to click to get the large version of the map in a separate tab or window;…the large versions of the maps have a magnifier which enables you to zoom in or zoom out, giving a relatively clear picture of all the features on each, and when you zoom in, the otherwise faint county borders become visible...

EIA produces new maps of the Utica Shale play

Source: U.S. Energy Information Administration, based on DrillingInfo, Inc., IHS Inc., the Appalachian Oil and Natural Research Consortium, and U.S. Geological Survey

Note: Click to enlarge.

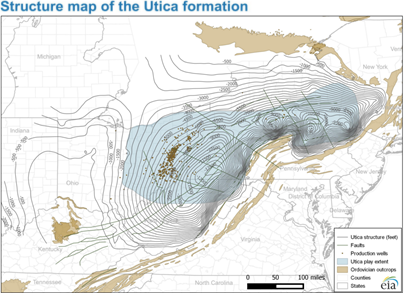

The U.S. Energy Information Administration has produced new maps that show the structure, thickness, and geologic setting of the Utica Shale play and the location of production wells. Production of oil and natural gas from the Utica play has increased since 2011, with more than 1,700 wells drilled as of January 2016. The Utica play includes both the Utica formation and the deeper Point Pleasant formation, each with its own characteristics.

the first map, above, shows several of the geologic features of the northern Appalachian basin, mostly as they relate to the Utica shale, and the targeted area of it, which is shown with the blue shading..some of the oil & gas related literature includes the Point Pleasant formation, directly below the Utica, as part of the Utica, as apparently they can be accessed together in the same drilling / fracking operation...i'm unfamiliar with many of the other geologic features shown above, though the Rome trough, shown in magenta, is another deep formation including the Rogersville shale, occasionally mentioned as a target of drilling in Kentucky and West Virginia....the Ordovician outcrops are apparently areas where features of the same geologic formation that includes the Utica come to the surface...the Utica is a Ordovician era formation named after Utica, New York, where an outcrop of it was first described...and it's my understanding that the nearly parallel faults shown crosshatching most of Pennsylvania are the result of the counter-clockwise rotation of the North American plate as it moves to the WNW, which cracks as it's twisted, much as you would break up an ice cube tray...

The Utica play spans about 60,000 square miles across Ohio, West Virginia, Pennsylvania, and New York. The geologic characteristics of the Utica and Point Pleasant formations, which are discussed in EIA's update, are favorable for the accumulation and production of hydrocarbons.

The Utica map is one of several maps of low-permeability hydrocarbon formations that EIA updated with additional geologic detail. EIA has previously published updated maps of major geological and tectonic features for the Marcellus and Eagle Ford plays. EIA has also provided shapefiles for structure and thickness maps for the following: Marcellus, Eagle Ford, Abo-Yeso, Bone Spring, Delaware, Glorieta-Yeso, Spraberry, Bakken, Three Forks, and Niobrara.

Source: U.S. Energy Information Administration, based on DrillingInfo, Inc., IHS Inc., the Appalachian Oil and Natural Research Consortium, and U.S. Geological Survey

Note: Click to enlarge.

this next map, above, mostly shows the depth of the Utica shale in feet below sea level..note that the Utica is close to the surface in Canada north of New York, and in the area around Cincy...zoom in to our corner of the state, you'll see the Utica is 4,000 ft below sea level at the lake erie shore, in Lake, northern Ashtabula and Geauga counties, and in western Cuyahoga..it then falls to 4,500 ft below sea level in southern Ashtabula and Geauga counties, and to 5000 ft below sea level in Portage and Trumbull counties...to the south, we see that most of the wells drilled thus far in Ohio target the Utica 6,500 to 7,500 below sea level....if you know your own elevation above sea level, you should be able to figure out the depth from where you're at to the Utica....for instance, the Cuyahoga river south of Burton is about 1100 feet above sea level; that would mean that the Utica shale is about 5600 feet below the river...the elevation of Chardon is 1299 feet, while Lake Erie is 571 feet above sea level, so go figure..

Source: U.S. Energy Information Administration, based on DrillingInfo, Inc., IHS Inc., the Appalachian Oil and Natural Research Consortium, and U.S. Geological Survey

Note: Click to enlarge.

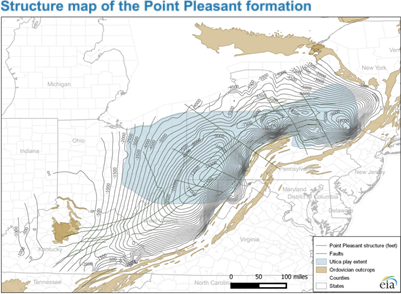

the next map (above) shows the elevation of the top of Point Pleasant formation, which is directly below the Utica, and which you'll note in the EIA notes below is more often targeted by Utica drillers than the Utica itself...unsurprisingly, then, we find top of Point Pleasant is 4,000 ft below sea level at the lake erie shore and in Lake county, and that it's at 4,500 feet below for most of Ashtabula and Geauga counties, and then it drops to 5000 ft below sea level in northwest Portage and Trumbull counties, and to 5500 ft below sea level to the south and east of there..also note both formations are as deep as 12,500 feet below sea level in southwest Pennsylvania, which probably means that it would take an expensive 14,000 foot deep well just to reach it from there...

The Utica is a stacked play that includes both the Utica formation and the underlying Point Pleasant formation. Currently, the deeper Point Pleasant is more often targeted for oil and natural gas drilling because it is more productive. Most of the more productive areas across the Point Pleasant formation footprint are in eastern Ohio and western Pennsylvania. Subsea elevation contour maps representing the top surface of each formation were developed with depth measurements from wells and outcrop data from the U.S. Geological Survey. These maps represent subsea depths and only roughly approximate drilling depth to reach the top of each formation.

The Point Pleasant formation is deepest in the southwest region of Pennsylvania, reaching subsea depths of more than 13,000 feet, and it is shallowest at the junction of Ohio, Indiana, and Kentucky. The Utica formation reaches subsea depths of up to 12,500 feet in a northeast arc though Pennsylvania and is also shallowest at the junction of Ohio, Indiana, and Kentucky. The most productive wells in the Utica formation are found at subsea depths ranging from 5,000 to 11,000 feet.

Structure maps not only provide valuable drilling information, but they also lend insight into the distribution of oil and natural gas throughout the play. Temperature and pressure, which are functions of a formation's depth, are key factors in the amount of oil and natural gas present in the formation.

Source: U.S. Energy Information Administration, based on DrillingInfo, Inc., IHS Inc., the Appalachian Oil and Natural Research Consortium, and U.S. Geological Survey

Note: Click to enlarge.

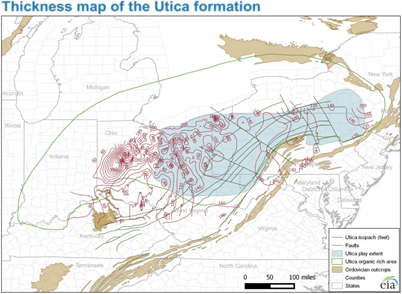

these next two maps show the thickness of each of those stratuses of organic shale, and where each contains rich organic matter, suggesting extractable oil or gas...above we have the thickness of the Utica shale, ranging from just 20 feet thick under the Cincinnati area to 220 feet in extreme northeast Ohio and northwest Pennsylvania...the Utica is over 200 feet thick along the shore of Lake Erie east of Lorain to northern Geauga and Ashtabula, and between 160 and 180 feet in the rest of the region, except for two areas in Ashtabula where it's more than 220 feet... the thickness of the Utica where most Ohio horizontal wells have been drilled & fracked ranges between 100 and 180 feet...the areas with high organic content are enclosed by a green ellipse that includes most of the region....all else being equal, the thickest areas of shale offer the biggest target for fracking...for instance, we know much of the fracking of the Marcellus in Pennsylvania was in areas in the northeast which were 200 to 400 feet thick, and the Ohio thicknesses ranging from 25 to just over 50 feet is the reason there was little drilling of the Marcellus in Ohio...

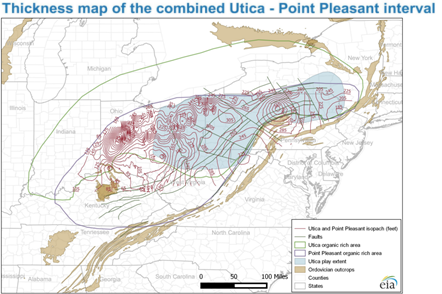

below, we have the thickness map for the Point Pleasant formation (click the link below the map)..here we have a different layout than for the Utica, in that the thickest areas of the Point Pleasant are in Trumbull and Ashtabula county, generally ranging from 110 feet at the east and west borders to 130 feet in the middle of the county, with one area in Ashtabula near the Geauga border as thick as 150 feet...the thickness drops from there as we move west, with the thickness in the southwest corner of Geauga falling to 70 feet, and further thins to two areas of southern Portage county that come in at just 50 feet thick...most of the Utica wells in southeast Ohio are drilled in areas where the Point Pleasant formation is between 70 and 90 feet thick...the organically rich areas of the Point Pleasant on this map are enclosed by the violet circle, again including almost the entire region...

Source: U.S. Energy Information Administration, based on DrillingInfo, Inc., IHS Inc., the Appalachian Oil and Natural Research Consortium, and U.S. Geological Survey

Note: Click to enlarge.

Source: U.S. Energy Information Administration, based on DrillingInfo, Inc., IHS Inc., the Appalachian Oil and Natural Research Consortium, and U.S. Geological Survey

Note: Click to enlarge.

in this last map, the combined thickness of the Utica and Point Pleasant shales is shown, presumably because any well drilled in this area will be targeting both formations at the same time...and here, the thickest areas are in our part of the state, ranging from a thickness of 245 to 265 feet in southern Geauga and eastern Portage county, to over 305 feet in northeast Geauga and at the lake shore...the combined thicknesses then rise to over 345 feet in parts of southern Ashtabula, and generally fall to 305 feet to the north and south of there...most of the horizontally drilled wells in Ohio that target these formations do so where the thickness is between 185 feet and and 245 feet, so our part of the state appears to offer the frackers a richer target than where they're drilling now...

Thickness maps (isopach) for each formation individually and for the Utica play as a whole were developed using observations from wells. The maps also show areas of high organic content, which is a factor in the amount of hydrocarbons in the rock. Like structure maps, isopach maps provide valuable drilling information because thickness of the reservoir is a key factor in determining whether, and where, to drill a well.

The Utica formation is thickest in western Ohio and the northwest corner of Pennsylvania at 200-300 feet and thins to 50 feet or less in southern Ohio and northern Kentucky. The Point Pleasant formation reaches a thickness of more than 200 feet in central Pennsylvania and thins to less than 20 feet in the eastern half of Kentucky. The combined thickness of Utica and Point Pleasant is less than 100 feet in the area where Ohio, West Virginia, and Kentucky meet. The thickness reaches more than 300 feet in northwest and central Pennsylvania, and in northeast and central Ohio. Most producing wells are located where the formation has a thickness of 150 feet or more.

now, i dont know why our area, where the shale play seems to be the thickest, has not yet been targeted for the extensive drilling that the southeast part of the state has...it's possible that the shale in those areas have a higher hydrocarbon content than the shale in our area...it's also possible that they found a rich vein down there and stuck with it, not knowing that other parts of the Utica/Pt Pleasant might be richer...it's even possible that they stayed in poorer areas of the Appalachian foothills because the people there are less likely to fight drilling and fracking than the quasi suburban counties in this part of the state; area frackers are already on record saying they deliberately keep their wells away from the “big houses” of wealthy and potentially influential people...whatever the case, with these maps, it's now known by everyone who's paying attention that these north eastern Ohio counties offer a richer target than most other areas of the state...as we saw two weeks ago, Utica natural gas production growth is poised to overtake Marcellus gas growth this year...now the EIA has confirmed that the Utica will provide the US with most of its new natural gas in the future...and thus these maps tell us that we'll eventually have a fight on our hands to keep that gas from coming out from under us...

The Latest Oil Stats from the EIA

this week's oil balance sheet data showed the largest one week drop in our crude oil production in 10 months, which was almost matched barrel for barrel by an increase in our oil imports...still, despite a modest increase in the oil refined, we still had nearly 2.8 million more barrels of oil left than we could use, and hence set yet another record for the amount of oil we had stored at the end of the week...Wednesday's reports from the Energy Information Administration showed that production of crude oil from US wells fell for the 14th time in the past 15 weeks, but unlike prior weeks this year when the decreases in production were on the order of 0.1 or 0.2% of the aggregate, this week saw a drop of nearly 1.3%, as our output fell by 113,000 barrels per day, from an average of 8,938,000 barrels per day during the week ending April 22nd to an average of 8,825,000 barrels per day during the week ending April 29th....that's now 5.8% below the 9,369,000 barrels per day we were producing during the same week last year, and 8.2% below the 9,610,000 barrel per day peak of our oil production that was hit during the week ending June 10th of last year...

at the same time, our imports of crude oil rose by 110,000 barrels per day, from an average of 7,550,000 barrels per day during the week ending April 22nd, to an average of 7,660,000 barrels per day during the week ending April 29th...that was 17.1% more than the 6,541,000 barrels of oil per day we imported during the week ending May 1st a year ago, but the EIA's weekly Petroleum Status Report (62 pp pdf) reports that the 4 week moving average of our oil imports was still at the 7.8 million barrel per day level, which was 8.4% more than our oil import rate of the same four-week period last year...

as we mentioned earlier, refinery processing of crude oil rose this week, after the odd slowdown last week, as US refineries used 15,986,000 barrels of oil per day during the week ending April 29th, 139,000 barrels per day more than the average of 15,847,000 barrels of oil per day barrels they processed during the week ending April 22nd...the US refinery utilization rate rose to 89.7% of operable capacity last week, up from a 88.1% capacity utilization rate during the week ending April 22nd...that's still below the 93.0% capacity utilization rate of the week ending May 1st last year, when US refineries were using 16,347,000 barrels of crude each day...

with more oil being refined, refinery production of gasoline rose to average 9,811,000 barrels per day during week ending April 29th, up by 303,000 barrels per day from our gasoline output average of 9,507,000 barrels per day during week ending April 22nd...moreover, that output of gasoline was up more than 7.2% from the 9,152,000 barrels of gasoline per day that we produced during the same week last year, a week when gasoline output was unusually depressed....at the same time, our refineries' output of distillate fuels (diesel fuel and heat oil) fell by 33,000 barrels per day to 4,589,000 barrels per day during week ending the 29th, which was 381,000 barrels per day, or 7.7% lower than our distillates production during the same week of 2015...

with that greater output of gasoline, combined with gasoline imports of 946,000 barrels per day, the highest gasoline imports in 8 months, our gasoline inventories rose again, increasing from 241,259,000 barrels on April 22nd to 241,795,000 barrels as of April 29th...hence, our gasoline inventories were 6.1% higher than the 227,852,000 barrels we had stored on May 1st last year, which was at that time the highest gasoline stores for the last week in April in EIA records going back to 1990...hence, our gasoline stores are still categorized by the EIA as "well above the upper limit of the average range" for this time of year...

at the same time, our distillate fuel inventories fell by 1,261,000 barrels to end the week at 156,970,000 barrels, as farm use of diesel fuel continues to be above last year's pace...however, because distillate inventories were already bloated after a warmer than normal winter reduced heat oil consumption, distillate inventories remained 20.0% higher than the 130,773,000 barrels of distillates we had stored at the same time last year, and thus they're also characterized as "well above the upper limit of the average range" for this time of year...

finally, when all was said and done, we ended up with an additional 2,784,000 barrels of surplus crude oil this week, and hence our stocks of crude oil in storage, not counting what's in the government's Strategic Petroleum Reserve, rose once again to a new record of 543,394,000 barrels as of April 29th, up from the record 540,610,000 barrels of oil we had stored as of April 22nd...that was 11.6% higher than the 487,030,000 barrels of oil we had stored as of May 1st, 2015, and 36.7% higher than the 397,576,000 barrels of oil we had stored on May 2nd of 2014....we've now increased our inventories of crude oil by by nearly 61.1 million barrels since the beginning of this year, while setting new records for the amount oil we had in storage in the US in 11 out of the last 12 weeks...

This Week's Rig Counts

we also again set another all time record low for drilling activity in the US, as the rig count fell further below its previous record low for the 9th week in a row......Baker Hughes reported that their total count of drilling rigs running in the US was down by 5 more rigs to 415 rigs as of May 6th, which was also down from the 894 rigs that were working on May 8th of 2015, and down from the recent high of 1929 rigs that were deployed on November 21st of 2014... the count of rigs drilling for oil fell by 4 rigs to 328, which was down from 668 a year earlier, and down from the recent high of 1609 working oil rigs that was reported on October 10, 2014, while the count of drilling rigs targeting natural gas formations fell by 1 to a record low of 86, down from the 221 natural gas rigs that were drilling a year ago, and down from the recent natural gas rig high of 1,606 rigs that was set on August 29th, 2008...

one of the rigs that was shut down this week had been drilling in the Gulf of Mexico, meaning the Gulf rig count fell to 23 and the total offshore count dropped to 24, with the other offshore platform working off the Cook Inlet in Alaska...that was down from 33 rigs in the Gulf of Mexico and 34 total offshore that were in use on May 8th of 2015...there was also a rig removed that had been drilling through an inland lake in southern Louisiana this week, which left the inland waters rig count at 3, up from the 2 rigs deployed drilling on inland waters last year at this time...

a net of 6 horizontal drilling rigs were pulled out this week, leaving the count of rigs drilling horizontally at 318, which was down from the 692 horizontal rigs that were in use on May 8th of 2015, and down from the recent record of 1372 horizontal rigs that were drilling on November 21st of 2014...at the same time, 2 more directional rigs were also stacked, leaving 44 directional rigs still working, which was down from the 88 directional rigs that were in use at the end of the same week a year earlier...however, a net of 3 vertical rigs were added this week, increasing the vertical rig count to 53, which was still down from the 114 vertical rigs that were in use nationally the same week last year...

for the details on which states and which shale basins saw changes in drilling activity this past week, we're again going to include a screenshot of that part of the rig count summary from Baker Hughes, which shows those changes...

the first table above shows weekly and annual rig count changes by state, and the second table shows weekly and annual rig count changes for the major geological oil and gas basins...in both cases, the first column shows this week's active rig count, second column shows the change in the number of working rigs from last week, the third column shows last weeks rig count, the fourth column shows the change in the number of rigs running from the same week a year ago, and the 5th column shows the number of rigs that were drilling at the end of that week a year ago, which in this case was May 8th of 2015...hence, you can thus see that the active rig count in the Eagle Ford shale of South Texas was down by 3 rigs to 37, which was down from the 105 rigs that were working that basin a year ago, while the Permian basin of west Texas saw 5 new rigs added, bringing that total up to 139, which of course was still down from 237 last year at this time..as a result, the top table shows that Texas added 3 rigs, and now have 188 still drilling, which is nonetheless down from the 379 rigs that were working in Texas a year ago... at least this week the Utica saw one of its rigs shut down, leaving just 10 in the basin and hence 10 rigs still working in Ohio, down from 24 last week at this time...the Baker Hughes state count tables do not indicate any change in drilling activity in states not shown above...

Global Drilling Activity During April

Friday also saw the monthly release of the international rig count for April, which unlike the weekly count, is an average of the number of rigs running in each country for the month, rather than the total of those drilling at month end....Baker Hughes reported that an average of 1424 rigs were drilling for oil and natural gas around the globe in April, which was down from 1,551 rigs drilling globally in March and down from the 2,268 rigs that were deployed globally in April of last year...as usual, most of the 127 rigs that were pulled out worldwide during the month had been drilling in North America, where the average number of rigs deployed fell from 566 in March to 478 in April...the US averaged 437 active rigs in April, down from 478 in March, and down from 976 in April of last year, while the Canadian average deployment was 41 rigs, down by more than half from 88 in March, and down from the 90 rigs that were working in Canada a year ago at this time...

the Middle East saw rigs pulled out for the 4th month in a row, after a run of 5 months when their drilling increased, as the region's activity was down by 13 rigs to an April average of 384, which was also down from the 410 rigs deployed in the Middle East a year earlier...however, the region saw an unusual increase of 12 rigs working offshore, bringing the offshore count back up to 54, same as their offshore rig count last April....Iraq accounted for 5 of the net rigs removed from the region, as they were were down to 43 rigs in April from 48 in March, and down from the 53 rigs that were drilling in Iraq a year earlier...the Saudis idled 4 rigs, which left them with 123 still active, which was down from 124 a year earlier...however, the Saudis have been averaging a deployment of 125 rigs throughout 2015 and 2016, an increase from their average of 105 rigs in 2014, when oil prices averaged twice as high, so they’ve been adding rigs as prices fell...other Middle East rig reductions in April were seen in Oman, down 2 rigs to 68, but up from 64 a year ago, and single rig cuts in Kuwait to 40, which was also down from 50 a year earlier, and in Pakistan, where they were down to 23 rigs but up from 22 rigs a year earlier...meanwhile, Qatar added a rig and now has 7, which is still down a rig from the 8 they had deployed last April...

meanwhile, the Latin American countries pulled out another 15 rigs, after pulling out 52 rigs in the first 3 months of the year, as the region averaged 203 rigs in April, including 36 offshore, down from the total of 325 rigs, which included 64 offshore rigs, that were active in Latin America in April of 2015....Brazil saw the largest pullback, as they were down by 9 rigs to 19, which was down from the 43 rigs that were in use in Brazil a year ago...Mexico idled 4 more rigs, after shutting down 12 in March, and they were hence down to just 23 active rigs, from the 67 rigs deployed in Mexico in April last year...in addition, Venezuela, Colombia and Trinidad all cut 2 rigs in April, that left Venezuela with 69 rigs, which was an increase from the 55 they were running a year earlier, left Colombia with just 2 rigs, down from 25 a year earlier, and left Trinidad with 5 rigs working, which was up from the 3 rigs working there a year ago....meanwhile, Argentina, which had cut their active rig count from 101 to 65 in the three months ending February, added 5 rigs in April after adding 3 in March, which brought them back up to 73 rigs, which was still down from the 107 rigs they had deployed last April...also, Venezuela added 2 rigs and now have 71 active, up from 62 in March of 2015...

elsewhere, the Asia-Pacific region had 179 drilling rigs working in April, down from the 183 rigs working the region in March, and down from the 228 rigs working the region a year earlier...both Australia and Indonesia shut down 2 rigs, leaving Australia with 6 rigs, down from 18 rigs a year ago, and leaving Indonesia with 17 rigs, down from 32 rigs in April of 2015...at the same time, the Vietnamese added 2 rigs and hence had 3 working, same as they had a year ago...rigs working on the African continent, meanwhile, fell by 1 from 91 rigs in March to 90 in April , which was down from the 120 rigs working the African continent last year at this time...Nigerian activity dropped by two rigs to 6, which was down from the 9 rigs working in Nigeria a year earlier...both the Ivory Coast and Chad saw their rig count drop from 2 rigs to 1; a year ago, the Ivory Coast had 2 rigs drilling, and Chad had 3...at the same time, single rigs were added in Algeria, Angola, and in Equatorial Guinea, which brought Algeria up to 55 rigs, down from 56 a year earlier, brought Angola up to 9, down from 15 a year earlier, and brought Equatorial Guinea up to 2 rigs, same as they had deployed last April...

lastly, the rig count in Europe fell by 6 rigs to 90 in April, which was down from the 119 rigs working in Europe a year ago at this time...Norwegian drillers idled 2 rigs which left them with 17 running, down from 18 in April a year ago...Romanians also shut down 2 rigs, leaving 4 still working, which was down from 12 in April a year earlier...the Brits idled one rig onshore and 1 offshore; that left them with no drilling on land, same as April a year ago, and 8 offshore, down from 15 platforms a year ago...Germans also cut a rig, leaving 4, which was up from the 3 rigs they were running last April, while the Turks added a rig and now have 29 active, down from 30 rigs last year at this time.....note that Iran, Russia, and China rig counts are not included in Baker Hughes international data, although China's offshore area, with an average of 26 rigs active in April, is included in the Asian rig totals here...

+++++++++++++++++++++++++++++

Feds seek public input on oil-and-gas leasing in Wayne National Forest (AP) — A federal agency is seeking public comments on a draft environmental assessment of proposed oil and gas leasing in Wayne National Forest in southeastern Ohio. The Bureau of Land Management opened a comment period this week. Documents will be available for review until May 29. The environmental report analyzes impacts on about 40,000 acres underlying the forest. The agency says it is assessing a broader area than would be opened to drilling to avoid having to do a separate report on each individual lease request. Oil and gas companies told the bureau that they wanted to drill beneath the forest in 2011. The proposal has seen heated debate that pits supporters of the economic potential of the wells against southeastern Ohio residents and groups concerned about environmental problems.

BLM draft assessment: Leasing to drillers won’t hurt national forest - athensnews.com: A federal agency has issued a preliminary “finding of no significant impact” related to a proposal to lease 18,000 acres in the Wayne National Forest’s Marietta Unit for oil and gas drilling. The finding does not become official until after a draft environmental assessment (EA) issued Thursday by the federal Bureau of Land Management becomes final. The public has 30 days (until May 29) to review and comment on the draft EA. Then pertinent federal officials will have to review that input before finalizing the EA and the related finding of no significant impact. Click here to link to the EA and other pertinent documents.Proposals to lease land in the Wayne National Forest for deep-shale oil and gas drilling (which involves “fracking”) have generated bitter opposition from citizens and environmental groups concerned about the adverse effects on water and other natural resources in the national forest. However, other citizens, including many landowners whose land borders the Marietta Unit of the Wayne forest, support leasing and drilling. They say it will allow them to lease their own private oil and gas rights. Public and private land is intermingled throughout the Wayne National Forest. The EA in question only involves designated acreage on the Wayne’s Marietta Unit for which more than 50 oil-and-gas industry “expressions of interest” have been submitted, but not the Athens or Ironton units of the national forest. In the yet-to-be-signed finding of no significant impact, BLM District Manager Dean Gettinger, states, “Based upon a review of the EA and supporting documents, I have determined that the proposed action (leasing of 18,494 acres in the Wayne’s Marietta Unit) is not a major federal action, and will not significantly affect the quality of the human environment, individually or cumulatively, with other actions in the general area.”

BLM displays shortsighted attitude on forest - Marietta Times -- In response to the BLM's recent "Finding of no significant impact" related to the leasing of 18,494 acres in the Wayne National Forest's Marietta Unit for deep shale oil and gas drilling: there are many of us absolutely appalled at this short-sighted assessment. There are so many ominous - not to mention, scientifically proven - down sides to this. The first real issue is water, on both ends of this potential fracking disaster. First: it takes about 4,000,000 gallons of fresh water to frack just one well. Fact. I attended the BLM so-called presentation at Marietta College back in March. I asked every agent there, "So. My first question is, where is all the fresh water to frack going to come from?" Not one could answer my question. One man did say 'the water source was up to each individual driller." There are no guidelines on this issue. According to Terry Smith of the Athens News, there have, so far, been 50 individual expressions of interest in the Marietta Unit. If each one of those drillers frack even one well each, that is - let me get my calculator - 200,000,000 gallons of fresh, potable water. Taken from where? Wherever the hell a driller wants to get it. You can bet they won't use a public utility spigot. Then on the back side, where is all that now-radioactive, toxic, contaminated waste water going to GO? It will be injected back into the earth, under great pressure in injection wells, where? We know. In Marietta's injection wells up in Harmar, in Devola, Veto, and Waterford, among others, and down in Torch and Coolville. 200,000,000 gallons. Read that again. When that water perks back up everywhere - and you may be assured that sooner or later, it will - does anyone really think the water departments can ever provide safe drinking water again? Not to mention all the private water wells in our area. One other note: SE Ohio has no geological surveys of our aquifers. None.

Local anti-fracking movement continues to grow - athensnews.com: The local people and groups who continue to oppose fracking and injection wells have had mixed success against powerful fossil-fuel interests, federal and state government that are gung-ho about the expansion of fracking wherever there is natural gas. There are also, of course, some Ohio and Athenian businesses and citizens who focus on the prospect of immediate, if not long-term, economic benefits from fracking and/or who are ideologically against additional and effective government regulation when it comes to natural gas and other fossil fuels. Nonetheless, opponents, such as Athens County Fracking Action Network, have done an exemplary job locally on educating the people in the area on the well-documented harms that result from fracking. The voters of Athens City have supported a ban on fracking in the city that remains so far uncontested in the courts. They have supported legal action against the Ohio Department of Natural Resources and other government regulatory agencies for allowing inadequate permitting processes. Most recently, but not for the first time, they have taken a stand against the federal government’s proposal to allow fracking in the Wayne National Forest. They have lobbied elected officials at the city, county and state levels. Organized rallies. Roused and engaged citizens in some of the townships, like Torch, and nearby counties where injection wells are proliferating. The Athens County Bill of Rights Committee is right now undertaking a petition drive to get a provision on the November ballot to ban fracking and injection wells in the entire county.

Toxic brine from oil well spills in Morrow County - Columbus Dispatch -- A truck carrying brine from an oil well was struck by a train in Morrow County on Friday, spilling 3,200 gallons of the toxic waste water. None of the liquid spilled into creeks or affected public water supplies, said John C. Harsch director of the Morrow County Office of Homeland Security and Emergency Management Agency. Still, "there’s liquid all over the place,” Harsch said. “It just splashed everywhere,” said Sgt. Dave Flanagan of the State Highway Patrol’s Mt. Gilead post. “Covered the train, covered everything.” The brine came from a conventional well in Morrow County, not a horizontally fractured “fracking” well, said Eric Heis, an Ohio Department of Natural Resources spokesman. . The waste liquid was headed for disposal in an injection well. The Ohio Environmental Protection Agency was working with a contractor to clean the spill. The brine flowed into a farm field and a ditch, Ohio EPA spokesman James Lee said. He said he didn't think well water was affected. The Fishburn Services truck was heading west on Township Road 75 northeast of Edison about 8 a.m. when it crossed the CSX tracks. A northbound train traveling at 59 mph struck the truck in the tank, Flanagan said. The site is about 50 miles north of Columbus. The driver, James Thompson, 58, of Marengo, was taken by a MedFlight helicopter to OhioHealth Grant Medical Center in Columbus. Flanagan said he didn’t believe the injuries were life-threatening.

Ohio report looks at drilling potential of Devonian shales - From a Monday press release from the Ohio Department of Natural Resources: Posted on 5/2/2016 by Geological Survey in Devonian shale oil oil and gas. A new open-file report released by the ODNR Division of Geological Survey provides an analysis of source rock generative potential and thermal maturity of the Devonian shale interval in eastern Ohio. The interval for this study extends from the top of the Middle Devonian Onondaga Limestone to the base of the Upper Devonian Berea Sandstone. Maps created as part of the study include total ototal organic carbon (TOC), existing hydrocarbons (S1), hydrocarbons generated during pyrolysis (S2), vitrinite reflectance (%Ro), and conodont alteration index (CAI). Open-File Report 2016-3 is available for free download here as a PDF file [file size = 19 MB].

When fracking makes climate sense - Beacon Journal Editorial - Bernie Sanders boasts that he is the one candidate prepared to address climate change in a substantial way. Sanders also supports a ban on hydraulic fracturing in mining for oil and gas. The concept is swell in the ideal. Unfortunately, the country isn’t in position to follow such a course in the short term, not when natural gas accounts for one-third of electricity generation. Add the senator’s opposition to nuclear power and coal, and he has pushed aside roughly 85 percent of the country’s energy sources. How would Sanders replace them? Wind, solar and other renewable energy sources hold much promise. So does energy efficiency. They are not prepared to make up the difference soon, or likely even by the 2030s. This is one of the concerns about the way Sanders discusses an issue that he rightly describes as defining for the next generation. He doesn’t talk squarely about the complications and practicalities at work. No question, hydraulic fracturing, or fracking, involves risks via air pollution, plus water and ground contamination. Especially troubling are leakage of methane (a most potent greenhouse gas) and the toxic liquid injected and flushed at the drilling site. This process must be tightly regulated and adequately taxed, something Ohio still has not accomplished. What Sanders and others let slide too easily is that fracking (done right) produces fuel that burns more cleanly than the coal alternative. Natural gas generates 50 percent to 60 percent less carbon dioxide (the leading greenhouse gas) when burned in new, more efficient power plants. It also produces less soot, mercury, sulfur dioxide and nitrogen oxide.The technology just isn’t there to make a clean break with fossil fuels. And the problem of climate change cannot wait. A transition is required, and the cleaner alternative is natural gas, as long as fracking is well regulated.

Gulfport loses $242 million despite increased production - Gulfport Energy’s Utica Shale production was strong in the first quarter but the company lost $242.3 million. Gulfport has drilled 244 Utica wells in Ohio. It has the second most wells after Chesapeake Energy. The loss equaled $2.17 per share, the company said in a press release ahead of a Thursday conference call with investors. The Oklahoma City-based company had revenue of $157 million during the quarter, but losses dragged its balance sheet into the red. Gulfport’s largest loss, $219.0 million, was from a drop in the future value of production from its oil and natural gas properties. Gulfport’s first quarter production averaged 692.2 million cubic feet equivalent per day, 1 percent above the company’s highest estimate. However, oil and natural gas prices were about half what they were a year ago. The company spent $74.5 million drilling and fracking wells and another $19.7 million on leases. Most of Gulfport’s production was in the Utica, where the company drilled 10 wells and began production from 15 wells during the quarter. The company has three rigs in the Utica and plans to drill up to 24 Utica wells and begin production from as many as 39 wells this year.

Is Shell Chemical finally ready to act on Ohio River cracker? - Shell Chemicals is taking steps that suggest it finally may be ready to pull the trigger on a long-debated petrochemical complex which would include an ethylene plant (steam cracker) and three polyethylene units in the heart of the “wet” Marcellus/Utica natural gas liquids production region. If the $3+ billion project advances to construction soon, it would significantly impact ethane market dynamics, not just in Ohio/Pennsylvania/West Virginia but along the Gulf Coast too. And if it turns out we’re in for extended stagnation in drilling and production, the Shell cracker also may undermine plans to build additional NGL pipeline capacity out of the Marcellus/Utica—or any other cracker there. Today we discuss the likelihood of Shell proceeding with its Beaver County, PA cracker and the effects the project’s development might have. The production of NGLs in the Utica/Marcellus really started taking off in 2011-12, when shale drillers, responding to declining prices for natural gas, began to focus on “wet” gas liquids plays to take advantage of higher prices – thus higher returns. That required the build-out of gas processing and fractionation capacity, which we documented initially in Whoville, the Big New NGL Hub in Marcellus/Utica, and more recently in our Join Together With Demand series and Drill Down Report. As we noted in that report, in 2009, there was only 600 MMcf/d of gas processing capacity in the entire Northeast region, most of it legacy infrastructure dating back decades, and now there is some 7,600 MMcf/d of gas processing capacity—more than 40 new plants built in the past six years, most of them built by MPLX (MarkWest) at eight major processing centers across the region. There are still more gas processing plants on the drawing boards. Similarly, there’s now some 500 Mb/d of fractionation (C3+ or full range) and another 240 Mb/d of de-ethanization capacity. All that production—natural gas, mixed NGLs and “purity” products like ethane, propane, butanes and natural gasoline—has also resulted in the build-out of extensive take-away capacity (pipelines for gas, NGLs and purity products; rail- and barge-loading terminals for NGLs and purity products) as well as the development of local gas-fired power plants to consume Marcellus/Utica gas and—the subject of our blog today—proposals to construct in-region steam crackers to consume locally sourced ethane.

Enbridge predicts $62M in fines, penalties tied to oil spill (AP) — A pipeline company says it expects $62 million in fines and penalties related to a 2010 Michigan oil spill. In a filing Monday with the Securities and Exchange Commission, Enbridge says $55 million represents penalties under federal water law. The Alberta-based company says no final fine or penalty has been ordered yet as negotiations continue with the U.S. government. Enbridge says about 20,000 barrels of oil spilled into the Kalamazoo River system, near Marshall, from a ruptured line in 2010. Enbridge says total costs from the disaster are pegged at $1.2 billion. The company says most of the costs are covered by insurance.

Pennsylvania Town Opposes Fracking, Says Civil Disobedience a Human Right: A Pennsylvania town attempting to stop the use of fracking, a highly toxic and economically-questionable method of oil extraction, has ruled that direct action and civil disobedience is a protected civic duty. Grant Township, a hotbed of fracking prevention and protest, on Tuesday passed an ordinance proclaiming that the use of nonviolent resistance against fossil fuel companies is protected because it is a “sanctioned civil right.” The new ordinance stems from a November 2015 adoption of the country’s first-ever municipal charter, aimed directly at fighting Pennsylvania General Energy Company (PGE) and the Pennsylvania Independent Oil and Gas Association (PIOGA). The charter established a local set of protocols codifying environmental and democratic rights, Common Dreams reports. “If a court does not uphold the people’s right to stop corporate activities threatening the well-being of the community, the ordinance codifies that, ‘any natural person may then enforce the rights and prohibitions of the charter through direct action.’ Further, the ordinance states that any nonviolent direct action to enforce their Charter is protected, ‘prohibit[ing] any private or public actor from bringing criminal charges or filing any civil or other criminal action against those participating in nonviolent direct action,’” a press release from Community Environmental Legal Defense Fund (CELDF), who assisted with drafting the ordinance, said in a press release. The charter has been hailed as "one of the boldest moves to stop the natural gas industry's attacks on our communities, climate and democracy.” "We're tired of being told by corporations and our so-called environmental regulatory agencies that we can't stop this injection well," stated Grant Township Supervisor Stacy Long. "We're being threatened by a corporation with a history of permit violations, and that corporation wants to dump toxic frack wastewater into our Township." "I live here, and I was also elected to protect the health and safety of this Township. I will do whatever it takes to provide our residents with the tools and protections they need to nonviolently resist aggressions like those being proposed by PGE,”

DEP investigates 5 quakes, 1 close to Lowellville - Youngstown Vindicator -- The Pennsylvania Department of Environmental Protection is investigating five micro earthquakes in Lawrence County that occurred last Monday. The quakes – all too small for people to feel – occurred not far from a well pad operated by Hilcorp Energy Co. Subsequently, Houston-based Hilcorp voluntarily halted its nearby fracking operation about noon Monday. The U.S. Geological Survey reports these earthquakes that day in Lawrence County:

- 12:05 a.m.: magnitude 1.9; 1.9 miles northeast of Bessemer, Pa.

- 4:16 a.m.: magnitude 1.7; 0.6 miles west of Oakland, Pa.

- 5:03 a.m.: magnitude 1.8; 1.2 miles east-southeast from Lowellville.

- 10:54 a.m.: magnitude 1.9; 2.5 miles northeast of Bessemer, Pa.

- 10:10 p.m.: magnitude 1.8; 1.9 miles northeast of Bessemer, Pa.

The DEP will meet with Hilcorp to discuss geologic data the company collected from the area during and before drilling. The Pennsylvania Department of Conservation and Natural Resources is investigating the quakes with the DEP. Hilcorp has not returned a request for comment. Hilcorp, doing business as North Beaver NC Development, has four wells on that well pad. The first two wells were fracked in a southeast direction and were completed, according to the department.The second two wells were going in a northwest direction, and fracking was ongoing but near completion.“That time and space correlation suggests that [the earthquakes and the fracking] are related,” said Michael Brudzinski, a professor of seismology in the Department of Geology and Environmental Earth Science at Miami University in Oxford, Ohio. “The operator was very proactive about it. They are cognizant that there’s something to be concerned about.”

Hilcorp Energy responds responsibly to 5 quakes: The Greater Youngstown area certainly is no stranger to adversity tied to hydraulic fracturing for oil and natural gas. Who, after all, could ever forget the rocking New Year’s Eve in 2011 when Youngstown and its environs were jolted by the most powerful of a series of 12 earthquakes that the Ohio Department of Natural Resources later attributed to injection-well operations at D&L Energy?In those and other incidents, the Ohio Department of Natural Resources and other state and federal agencies took charge, ordering shutdowns and initiating full-scale investigations. But in an encouraging sign of growing corporate responsibility, a different response accompanied the immediate aftermath of a series of five earthquakes last week that some believe can be traced to fracking operations in Mahoning Township, Pa., near the Mahoning County line. This time, the company in charge needed no prodding, pushing or shoving from the long arm of the state or federal governments to do the right thing. Houston-based Hilcorp Energy Co., one of the largest privately held oil and natural-gas exploration and production companies in the United States, independently acted to halt all fracking operations just a mere hours after it learned of the quakes. There were five of them that day – all technically described as micro-quakes because of their extremely low magnitude. The company’s decision to act on its own to ensure that worker and public safety would not be compromised reflects its awareness of the amped-up public consciousnesss toward the potential hazards of fracking to the environment and community health. It also reflects the higher standards to which companies drilling for natural gas and oil are being held as state governments – including those in Pennsylvania and Ohio – have enacted increasingly taut regulations to monitor the industry and safeguard public health.

Pipelines drained; feds investigating cause of explosion - Natural gas pipelines were being drained Saturday as authorities try to determine the cause of an explosion in western Pennsylvania that destroyed one home, damaged at least three others and burned a fleeing homeowner. Officials in Westmoreland County said the 30-inch Texas Eastern transmission line burst open around 8:15 a.m. Friday in Salem Township, shooting flames into the sky. Spectra Energy said in a statement Saturday that it is cooperating with an investigation by the federal Pipeline and Hazardous Materials Safety Administration and taking steps to reduce harmful effects on the environment. "We are deeply sorry for the effect this incident has had on the community, and we are committed to taking care of all of those involved," the company said. The injured man, whose home was about 500 yards from the explosion, was taken to the University of Pittsburgh Medical Center-Mercy. An update on his condition wasn't immediately available Saturday. Company spokesman Creighton Welch said the pipeline was one of four parallel lines running through the rural area. One of the other pipelines was out of service, and the remaining two were being drained of natural gas, a process that should be finished by the end of the day, Welch said. Bob Rosatti, chief of the Forbes Road Fire Department in Salem, told the Pittsburgh Post-Gazette that once that work has been done, officials can begin inspecting the pipe that exploded and the three others. Spectra Energy said that the section of pipe where the fire occurred was built in 1981 and that a 2012 inspection found "no areas requiring repair or remediation." Welch said regulations call for the pipelines to be inspected every seven years.

Pennsylvania gas blast reverbs in Massachusetts | Boston Herald: A massive natural gas explosion that rocked western Pennsylvania and left one person badly burned is being pointed to by elected officials and local advocates as evidence of the potential danger of a planned pipeline by the same company in West Roxbury. “The risk here is obvious,” U.S. Rep. Stephen F. Lynch (D-South Boston) said. “I see disaster on the horizon.” The West Roxbury Lateral Pipeline is an offshoot of a larger project by Spectra Energy Corp., a Texas natural gas company, and will wind through Dedham, and West Roxbury, among other towns. An explosion and fire on Spectra’s Texas Eastern pipeline in Pennsylvania Friday disrupted service and left one person with severe burns. “It could happen to us, and the damage, destruction and loss of life could be even more here, because we’re more densely populated,” said Paul Horn, of the Committee to Stop the West Roxbury Pipeline. “We all need to be concerned about this. Lynch and critics of the pipeline have balked at a high-pressure natural gas pipeline running through the narrow residential streets in West Roxbury, as well as its proximity to an active quarry that routinely uses explosives. A metering station is planned across the street from the quarry, while a compression station similar to the one that blew in Pennsylvania is planned for Weymouth. “Common sense and an overriding sense of responsibility for the safety of the public would definitely require us to stop this pipeline,” Lynch said. “You would hope common sense would prevail, but I’m still waiting.”

Corrosion found on Texas Eastern pipeline that exploded Friday: The Texas Eastern pipeline explosion that injured one man, damaged several homes and disrupted natural gas flows to the northeast on Friday involved a pipeline that federal investigators said had corroded in at least two places. The U.S Department of Transportation’s Pipeline and Hazardous Materials Safety Administration cautioned that “the cause of failure is unknown at this time, and the investigation is ongoing,” in a document on Wednesday. A preliminary investigation, however, revealed corrosion along two welds. One was located right where the pipeline ruptured and another was in a section of the pipe excavated after the accident. “The pattern of corrosion indicates a possible flaw in the coating material applied to girth weld joints following construction welding procedures in the field at that time,” the agency wrote. Experts warn that a preliminary finding is often amended or reversed entirely during the cause of an investigation, which could span months or even years. Spectra Energy, which operates the 30-inch diameter pipeline that burst and three others alongside it as part of the Texas Eastern system that stretches some 9,000 miles from the Gulf Coast to New York, has not resumed service at its Delmont Compressor station yet. The compressor was processing some 1.3 billion cubic feet of gas a day before the accident, which is about 7 percent of all the gas produced in the Marcellus Shale daily.

Possibly flawed welds cited in Pennsylvania pipeline blast - Investigators say they’ve found evidence of corrosion on a natural gas pipeline that exploded in western Pennsylvania last week, damaging homes and burning a resident. The federal Pipeline and Hazardous Materials Safety Administration says the cause of the blast remains unknown, but the corrosion indicates a “possible flaw” in the coating material applied to welded joints. The federal agency said Wednesday it has ordered Houston-based Spectra Energy Corp. to take a series of corrective actions. The damaged pipeline and three nearby pipelines are out of service while the probe continues. Three homes were damaged and one was destroyed in the blast. The injured man suffered third-degree burns over 75 percent of his body.

Feds approve plan to build gas pipeline for power plant (AP) — Federal officials have signed off on a plan to build a 34-mile pipeline through five central Pennsylvania counties that will carry natural gas to a power plant being built along the Susquehanna River. Federal energy regulators approved the Sunbury Pipeline Project on Friday. The pipeline would service the power plant being built in Shamokin Dam, about 40 miles north of Harrisburg, and will travel through Lycoming, Montour, Northumberland, Union and Snyder counties. UGI Energy Services Inc. spokesman Kenneth Robinson says they are pleased with the approval. Construction should begin after state environmental regulators issue the necessary permits. The utility says they plan to complete the pipeline in November and have gas available early next year. The more than 1,100-megawatt power plant is scheduled to be completed in early 2018.

Is Fracking For Gas As Dirty As Coal? - Even though coal is much cleaner than ever before, State energy portfolios are eliminating coal, and increasing natural gas, as fast as possible. According to Stephen Moore at The Washington Times, U.S. coal plants have reduced their emissions significantly in the past several decades.” But the shift away from coal is accelerating because of regulations discouraging companies from building new coal-fired plants, and State energy portfolios that dictate an increasing amount of power coming from renewables. Besides China’s new decreasing hunger for coal, another problem with selling coal to China is that no one in America wants that coal going through their backyards, especially along the best routes in the Pacific Northwest. As an example, a proposed coal-export terminal along the Columbia River in southwest Washington State has had nothing but problems getting permitted. According to an environmental impact report released last week by Washington Department of Ecology and Cowlitz County (the host county), the proposed terminal could have “unavoidable, significant impacts on greenhouse gases emissions, vessel traffic and rail safety.” Other concerns include increased water traffic, as 840 ships a year would be added, and a potential for train accidents along rail routes in Cowlitz County and other parts of Washington from the dramatically increased rail traffic that would occur. Opposition also came from unexpected sectors. Steve Charter, a Montana rancher, stated that the Washington coal port is also bad news for his own state of Montana, saying that rail towns would have to deal with traffic delays, diesel exhaust and other consequences.

Map: Here's Where America Gets Much Of Its Natural Gas - The Utica shale play, which spans 60,000 square miles across Ohio, West Virginia, Pennsylvania and New York, will provide America most of its new natural gas, according to a new map published Monday by the U.S. Energy Information Administration (EIA). Production of oil and natural gas from the Utica play has increased since 2011, and companies have drilled more than 1,700 wells as of January 2016, according to the EIA map. The Utica is the center of America’s natural gas boom enabled by hydraulic fracturing, or fracking. America produced 79 billion cubic feet of natural gas each day in 2015, breaking the previous record by 5 percent, according to an EIA report from earlier this month. Much of the natural gas boom has been concentrated around the Utica shale. Together, the states around the Utica accounted for 35 percent of total American natural gas production while the rest of the country saw a modest decline. Ohio alone saw its natural gas production grew 41 percent faster last year than it did in 2014. The development of the Utica shale for natural gas helped America surpass Russia early last year as as the world’s largest and fastest-growing producer natural gas. Today, America’s proven recoverable natural gas reserves are seven times larger than they were in 2014. Rising U.S. natural gas production has made gas the fuel of choice for America’s power plants, which were transitioning to natural gas before 2015. Natural gas provided more electricity than coal for every month between July and October of last year, according to data released in December by EIA.

Natural gas net imports in 2015 at lowest level since 1986 - Today in Energy - U.S. EIA -- U.S natural gas net imports fell to 2.6 billion cubic feet per day (Bcf/d) in 2015, continuing a decline that began in 2007, when net imports of natural gas exceeded 10 Bcf/d. While both U.S. natural gas consumption and production have increased in recent years, natural gas production has grown slightly faster, resulting in a decline in net imports. Increasing domestic production of natural gas has reduced U.S. reliance on imported natural gas and kept U.S. natural gas prices relatively low. Most U.S. imports of natural gas come by pipeline from Canada. A small and declining amount of imported liquefied natural gas (LNG) comes mainly from Trinidad. Most U.S. exports of natural gas are sent by pipeline to Mexico and Canada. The United States also exported LNG and compressed natural gas to several countries, but these volumes were relatively minimal in 2015. EIA's Short-Term Energy Outlook expects that the United States will become a net exporter of natural gas by mid-2017. In recent years, increasing production from shale plays in the United States has resulted in an increase in U.S. natural gas exports. Since 2012, the natural gas pipeline industry has added 3.4 Bcf/d and 0.2 Bcf/d of export capacity to Mexico and Canada, respectively. As a result, U.S. natural gas exports to Mexico grew from 1.3 Bcf/d in 2011 to 2.9 Bcf/d in 2015. U.S. natural gas net imports from Canada have remained relatively stable since 2011.

Analyzing US Natural Gas Consumption in 2016 - Market Realist: US natural gas consumption fell by 1.8% for the week ended April 27, 2016, compared with the previous week. In contrast, natural gas flows to the power plants increased by 0.9% for the same period. This is 5.3% higher than the same period in 2015. Natural gas deliveries to the industrial sector fell by 1.2% for the week ended April 27, 2016, compared with the previous week. Natural gas flows to residential and commercial segments also fell by 4.7% for the same period. Natural gas consumption dropped due to milder-than-normal weather. The EIA (U.S. Energy Information Administration) forecasts that US natural gas consumption could average 76.2 Bcf (billion cubic feet) per day and 77.4 Bcf per day in 2016 and 2017. Natural gas consumption is estimated to rise by 3.9% in the electric power sector in 2016. Then, it could fall by 1.3% in 2017 due to the increase in natural gas prices. . Natural gas consumption would also be driven by the rise in demand from the industrial sector in 2017. New projects coming online in the fertilizer and chemical sectors could also drive the demand. The EIA (U.S. Energy Information Administration) estimates that the US natural gas supply could exceed demand by 3.4 Bcf (billion cubic feet) per day in 2016. Then, it could further increase to 3.73 Bcf per day in 2017. Total US natural gas inventories are 48% higher than their five-year average. The widening supply and demand gap and high inventory could limit the upside potential for natural gas prices. The EIA forecasts that US natural gas prices could average $2.25 per MMBtu (British thermal units in millions) in 2016. Then, it could further increase to $3.11 per MMBtu in 2017. Moody’s Investor Service forecasts that gas prices could average $2.25 per MMBtu and $2.50 per MMBtu in 2016 and 2017. Raymond James, a financial services firm, forecasts that US natural gas prices could average around $2 per MMBtu in 2016.

Natural Gas Prices Rise - WSJ: Natural gas futures rose Tuesday as traders took profits after a sharp price slide Monday. Futures for June delivery settled up 4.4 cents, or 2.2%, to $2.086 a million British thermal units on the New York Mercantile Exchange. Prices dropped 6.2% Monday as weather forecasts indicated minimal need for gas-powered indoor heating in the next two weeks. The natural gas market is already oversupplied, with storage levels 48% above the five-year average for this time of year, due to robust production and sluggish heating demand. “Nat gas demand will be decreasing after Thursday to relatively light levels through next week,” said forecaster NatGasWeather.com in a note Tuesday. Still, many traders and analysts expect natural-gas prices to rise in the coming months as production falls to lower spending on new drilling and demand increases. “Bulls can continue to cite some recent production slippage that is finally seeing translation from the plunge in the rig counts,” said energy-advisory firm Ritterbusch & Associates in a note. “On the other hand, bears can indicate a near record level of storage.” A pipeline explosion on Friday caused a temporary rise in prices, but natural-gas deliveries to power plants appear unaffected, said data provider Genscape Inc.

Natural Gas is Sexy Once Again from a Macro Fundamentals Standpoint (Video) -- The mild winter has Nat Gas stocks at record levels, but the last time this many natural gas rigs went offline in 2012, prices rebounded to the $5 level nicely on a long trending trade. Traders and Investors are trying to anticipate and evaluate the likelihood of this move in Natural Gas happening again.

If You Frack With My Horses, I Will Kill You -- It’s pretty much that simple. And any jury in Texas will acquit me on the grounds of justifiable homicide In fact, I would probably be named Horseman of the Year by the American Quarter Horse Association I can’t think of any more diplomatic or tactful way to put it. The algorithm is quite elementary: You frack with my horses + I kill you = You die. Doesn’t take Cornell grad to figure out. Even a Texas Aggie gets it, mathematically speaking. A number of foals born on the Sayre, Pennsylvania standardbred farm operated by Meadowlands owner Jeff Gural over the last three years have developed an affliction known as dysphagia, which prevents them from swallowing properly. The story was first reported by the Ithaca Journal. Gural said the farm’s water supply is behind the problem and that the water has a high concentration of manganese which may be the result of nearby fracking operations. Over three years, 17 foals born at Gural’s farm have developed the problem and last year 11 of 12 had the issue. Gural estimated his farm has produced 30 foals over the three-year period in question. No mares came down with the disorder. Each affected foal was sent to the Cornell University Equine Hospital, where they were successfully treated. Gural sells most of the horses he breeds at yearling sales and said that each one was 100 percent healthy and over the problem by the time they entered the sales ring. “Everyone wants to know if fracking is a factor and Cornell is doing a study,” Gural said. “I assume that at some point we will get to the bottom of this.” A previous study done by Cornell concluded that “dozens of cases of illness, death and reproductive issues in cows, horses, goats, llamas, chickens, dogs, cats, fish and other wildlife, and humans” could be “the result of exposure to gas drilling operations.”

The Shale Sector Just Got Two Critical Wins – In Two Different States | OilPrice.com: A lot of things are in flux right now for U.S. oil and gas producers, and that includes critical legal frameworks for unconventional development across the country. The regulatory landscape got notably better for E&Ps this past week, with not one but two critical decisions coming down in favour of producers, in two completely separate parts of America. Perhaps the biggest development came Tuesday in the state of Pennsylvania, where the state legislature moved to strike down a controversial set of new rules that would have made surface use for oil and gas drilling more difficult. A group of lawmakers forming Pennsylvania’s House Environmental Resources & Energy Committee voted 19 to 8 to strike down the tougher drilling laws — which had been introduced in April by the state’s Independent Regulatory Review Commission. The move was seen as a big positive for unconventional development in key plays like the Marcellus shale. With the proposed rules mandating more expensive storage solutions for drill fluids — and requiring E&Ps to assess potential impacts on a slate of “public resources” before drilling. And that wasn’t the only bright spot for drillers. With a key court decision Monday coming down in favour of E&Ps — all the way across the country in Colorado. That came from the Colorado Supreme Court, which ruled that the fracking bans implemented by two Colorado cities are illegal because they conflict with state law. Judges in the high-profile case decided that state-level regulatory body Colorado Oil and Gas Conservation Commission has the mandate to promote “efficient and responsible development of oil and gas resources.” With the court saying that municipal bans impeded this function for state regulators.

New England gas pipelines update -- More than 3,000 MW of new, natural gas-fired generating capacity is either under construction in New England or will be soon, but some of the gas pipeline projects that would ease long-standing constraints into and through the six-state region have hit rough patches. Kinder Morgan in mid-April suspended plans for its Northeast Energy Direct project, a “greenfield” pipeline across Massachusetts and southern New Hampshire, and a few days later the state of New York denied the co-developers of the already-delayed Constitution Pipeline—a key link between the Marcellus and New England--a needed water quality permit. The fates of some other major projects in the Northeast are uncertain too. Today, we provide an update on pipelines in the land of Yankees and Red Sox. We’ve written often about gas pipeline constraints to and through New England, a region with less than one-third the area of Texas but nearly 15 million people, the vast majority of whom believe that Fenway Park is heaven on earth. As we said in our Drill Down reports on the subject (Please Come to Boston and 50 Ways to Leave the Marcellus), New England has been adding a lot of new gas-fired generating capacity, but only modest enhancements have been made to the gas pipeline network that serves the region. And, as we blogged about in Polar Vortex Workaround, in the unusually cold winter of 2013-14, the lack of sufficient pipeline capacity to meet demand during periods of very high demand sent natural gas prices soaring as local distribution companies (LDCs) with firm transportation contracts took most of the gas and owners of many gas-fired power plants either scrambled for deliverable, high-priced gas or switched to firing their units with fuel oil.

Residents to weigh in on new Atlantic Coast Pipeline path (AP) — Residents in three western Virginia counties will have a chance to weigh in a proposed new path of the Atlantic Coast Pipeline. The Richmond Times-Dispatch reports that the Federal Energy Regulatory Commission said this week that it will collect comments from the public and agencies on changes to the $5 billion natural gas pipeline proposal. The companies behind the project revised the route in February to avoid sensitive animal habitat in national forests in Virginia and West Virginia. The new route would affect about 249 additional landowners in Highland, August and Bath counties and parts of West Virginia. Federal officials will take public comment on the proposal during hearings in Marlinton, West Virginia, on May 20 and Hot Springs, Virginia, on May 21.

US shale firm's bankruptcy exit shows new chapter just as tough - Reuters - Magnum Hunter Resources Corp and its founder Gary Evans are emblematic for the U.S. shale revolution: it started small, borrowed heavily to snap up land and rivals and then crumbled under the weight of debt when prices crashed. Now, the oil and gas company is among the first casualties of the energy slump to exit bankruptcy and Evans has a message for its peers: even once you are debt-free you cannot take survival for granted if energy prices do not recover soon. With little chance of seeing hundreds of millions of dollars in debt repaid, creditors agreed to convert all of it into shares in a revamped Magnum Hunter. Bankruptcy lawyers say that by eliminating its entire $1 billion debt load, cutting costs by renegotiating contracts with suppliers and moving quickly, Magnum Hunter has already provided a template for other cash-strapped drillers. Now Evans and the new board face a fateful decision. One option is to hunker down and minimize spending and borrowing while waiting for markets to eventually recover. Another is to ramp up drilling to get the company growing again, widening losses until oil and gas prices rise. Evans told Reuters in an interview that even debt-free Magnum Hunter, primarily a gas producer, would need gas prices to rise to $2.50 - $3.00 per million cubic feet equivalent from about $2 now to get the 15 percent return on new wells it normally uses as a target when making spending decisions. Magnum’s new owners appear set to opt for the low-risk, low-cost scenario - the company has told the court it expects to keep posting net losses through 2018 and its oil and gas reserves to shrink about 11 percent over that period.

Bank's Oil Exit Creates New Questions for Energy Lenders | American Banker: Green Bancorp's surprise exit from energy lending has left others in the industry scrambling to make sense of what it means for them. The Houston company said late Thursday that it will purge $277 million of energy loans and other classified assets by the end of this year. The recent downturn in oil — and a dismal outlook for its recovery — was a drag on performance and a distraction for management's dealings with investors. The move makes Green the first Gulf Coast lender to call it quits on the struggling energy sector. Bad loans have taken large bites out of several banks' profits as oil firms struggle to stay afloat. Green's exit creates more uncertainty at a time when most energy lenders have been reassuring investors that they have a handle on oil-related risks. "I think it is a little wait-and-see in terms of what it means for other banks," said Emlen Harmon, an analyst at Jefferies. For others, Green's situation is unique. In the lead-up to the announcement, the $3.7 billion-asset company's stock — for a host of reasons — had been trading at a significant discount to banks of similar size along the Gulf Coast. Exiting the oil business will help Green clean up its books — and potentially return to making acquisitions, some industry observers said. At the same time, Green would be a much easier bank to acquire if it went ahead and did the hard work of purging its balance sheet of questionable energy credits.

Texas’s Toxic Rivers: Fracking Chemicals Seep Into Waterways After Floods - - The floods Texas has experienced recently have inundated oil wells and fracking sites resulting in the flushing of oil and fracking chemicals into local rivers. Emergency management officials in Texas have mobilized the Civil Air Patrol to photograph possible oil spills and leaks around the flood regions where a catastrophe could be in the making. Many environmentalists and residents have expressed concern that recent floods have deluged fracking sites, spreading oil and the chemicals used to turn shale into oil and is now depositing them into waterways and even possibly drinking water. Texas is the home to America’s petroleum industry where companies engage in shale fracturing — more commonly referred to as “fracking” — seen by many ecologists as destructive to the environment, mostly for the industry’s use of harsh chemicals. Photos show oil-sheen as well as plumes flowing from tipped tanks and fracking sites that were inundated with rainwater during March’s flooding of the Sabine River. “That’s a potential disaster,” Dr. Walter Tsou, a former president of the American Public Health Association, told the El Paso Times. “Cattle that drank the fracking fluid actually died an hour after drinking it. There are potential carcinogens that can lead to leukemia, brain cancer and other endocrine disruptors that can affect premature births.” Critics are additionally concerned that the state’s commission will continue to fail to hold oil and gas companies responsible for such incidents given that commissioners receive more than half of their campaign contributions from that industry.

Fracking & Flooding Don’t Mix in Texas — Scores of photographs taken by state emergency-management officials show that when floodwaters rise in Texas, they inundate oil wells and fracking sites, sweeping crude and noxious chemicals into rivers throughout the Lone Star State. Most recently, rainbow sheens and caramel plumes can be seen radiating from tipped tanks and flooded production pads during the March flood of the Sabine River, which forms much of the state’s boundary with Louisiana. Similar scenes are visible in photos from last year’s floods of the Trinity, Red, and Colorado rivers. But despite apparent evidence that spills have been routine in recent floods, Texas’ regulator, the Railroad Commission of Texas, contends that it has responded effectively. Scientists and environmental groups aren’t as confident. “In other areas, cattle that drank the fracking fluid actually died an hour after drinking it. There are potential carcinogens that can lead to leukemia, brain cancer and other endocrine disruptors that can affect premature births.” They worry that as floodwaters rage, harmful substances are swept downstream into the environment — and, possibly, drinking-water supplies — before Railroad Commission inspectors can reach the site of the spills. “They’re looking after the fact at what might have happened,” said Ken Kramer, water resources chairman of the Lone Star Chapter of the Sierra Club. “Because of that, it’s pretty hard to figure out exactly what happened.” It’s hard to draw definite conclusions simply by looking at photographs, but after reviewing a few, one expert said the spills could be deadly.

Fracking foes won't let go in Denton - Watchdog.org: The moment of reckoning has come at different times for the people of Denton, Texas, as they wait in fear for the outcome of an election May 7. For the resident and outside zealots who saw their hopes of a ban on hydraulic fracturing smashed by the Texas Legislature, the reckoning came with a repeal by the City Council of its fracking ban ordinance a month later. For council member Kevin Roden it came with the furious reaction from those same zealots to the zealots to the Renewable Denton Plan, a plan that would have placed Denton in the forefront of American cities turning hard toward renewable energy. For Joey Hawkins, a popular council member who voted against the original fracking ban and for its repeal, it was his recall — driven by those same activists — that voters will decide on election day. And for Pete Kamp and the other community leaders who formed Citizens For Local Governance, the reckoning has come in the realization their effort to deal with what was once a local zoning matter has been hijacked by national and international groups whose underlying message is anarchy. Kamp, who opposes fracking, has nonetheless been working furiously to encourage voters to reject Hawkins’ recall and to vote for at-large incumbents Greg Johnson and Dalton Gregory, who are facing challengers spurred on by the activists.